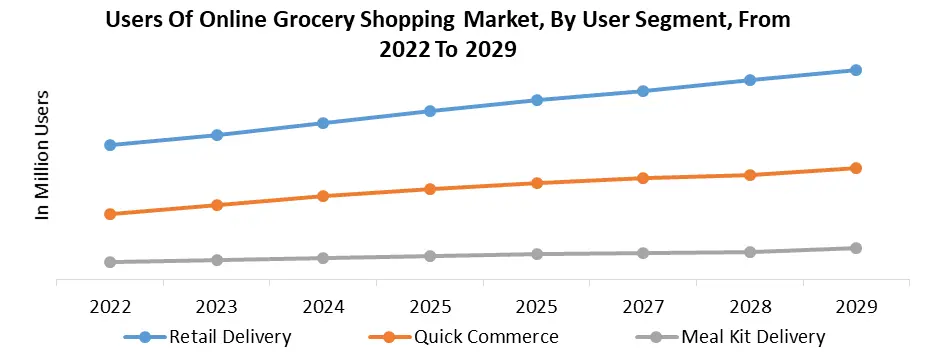

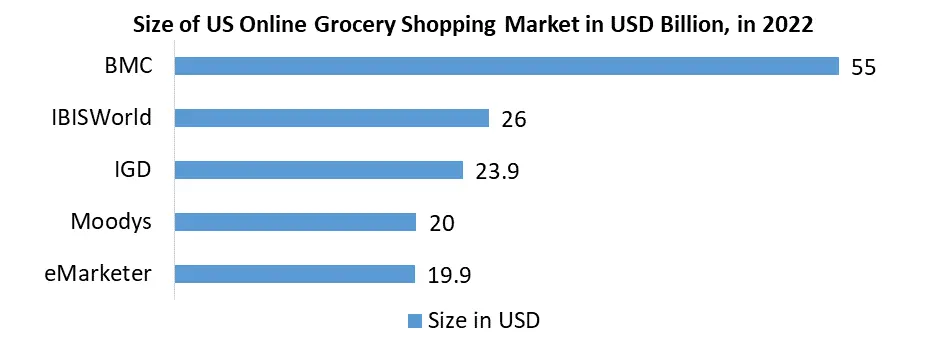

The North America Online Grocery Shopping Market size was valued at USD 98.87 billion in 2022 and the total North America Online Grocery Shopping Market revenue is expected to grow at a CAGR of 26.87 % from 2023 to 2029, reaching nearly USD 523.15 billion. The North America online grocery shopping market has witnessed remarkable growth and transformation, catalyzed by the COVID-19 pandemic and shifting consumer behaviors. This dynamic market has become a crucial component of the region's retail landscape, presenting both challenges and opportunities for businesses. Pandemic-induced lockdowns and safety concerns have prompted a surge in online grocery shopping adoption across North America. Consumers seek the convenience, contactless experience, and wider product selection offered by digital platforms. This seismic shift led traditional retailers and e-commerce giants to enhance their online infrastructure, logistics, and user interfaces. The market is characterized by intense competition among key players. Established retail giants like Walmart and Amazon have been major drivers of the online grocery trend, leveraging their extensive networks and resources. Regional players and startups have also emerged, offering specialized services such as rapid delivery and curated shopping experiences. A significant trend is the growing use of mobile devices for online grocery shopping. Smartphone apps enable consumers to browse, order, and track deliveries seamlessly. Personalized offers, loyalty programs, and tailored recommendations enhance customer engagement and retention. The market's growth trajectory remains promising. Projections indicate sustained expansion, driven by ongoing digital transformation, improving technology, and evolving consumer preferences. As e-commerce becomes increasingly ingrained in daily life, businesses are investing in last-mile delivery solutions, micro-fulfillment centers, and partnerships to streamline operations and ensure timely deliveries. North America Online Grocery Shopping Market Scope and Research Methodology: The North America Online Grocery Shopping Market encompasses the digital retail landscape for purchasing food and household essentials across the United States and Canada. This market study investigates various aspects of online grocery shopping, including consumer behavior, trends, preferences, key players, and market size. It aims to provide insights into the adoption of digital grocery shopping, the factors influencing customer choices, and the competitive dynamics within the industry. Primary research includes surveys, and interviews, and Secondary research involves the analysis of existing reports, market data, and academic literature related to online grocery shopping trends and statistics. Data collected from both primary and secondary sources is analyzed to identify trends and key drivers of the market. The research also examines challenges, opportunities, and the impact of technological advancements. By integrating insights from multiple sources, the study aims to present a comprehensive and accurate overview of the North America online grocery shopping market, providing valuable insights for businesses, policymakers, and researchers in the field.To know about the Research Methodology :- Request Free Sample Report Market Dynamics: Online grocery growth is fueled by busy lifestyles and the desire for effortless shopping: Busy lifestyles and the desire for hassle-free shopping drive North America Online Grocery Shopping Market growth. Consumers can save time by ordering essentials from home, like a working parent choosing to have groceries delivered, avoiding time-consuming trips to physical stores. Advancements in e-commerce platforms, secure payment gateways, and user-friendly mobile apps have made online grocery shopping more accessible and seamless. Consumers can easily navigate and complete transactions. Flexible delivery choices, including same-day or scheduled deliveries, cater to varying preferences. Shoppers can select delivery slots that align with their routines, like students receiving groceries in their dorms. Online platforms offer a broader range of products, from local to international brands, enabling consumers to access a wider selection. This benefits individuals seeking specialty or unique items. AI-driven algorithms provide tailored recommendations and offers based on past purchases, enhancing the shopping experience. A health-conscious shopper receiving recommendations for organic options is a prime example. Subscription models, offering recurring deliveries of staples, create a reliable revenue stream for businesses while offering customers convenience. Secure and swift payment options, including mobile wallets and digital payment platforms, facilitate seamless transactions, especially relevant amid health concerns. Urban dwellers often value time and convenience more, making them inclined to use online grocery services. Young professionals in city centers opting for digital grocery shopping due to their fast-paced lives exemplify this trend. Increased competition has prompted retailers to innovate, resulting in improved services and offerings.

Online platforms reach remote areas, like farming communities, with essential deliveries boosting local economies by spotlighting regional producers: Penetrating rural areas with limited physical store access presents untapped potential. Online platforms provide essentials for remote residents, such as a farming community receiving fresh produce delivered to their doorstep. Tailored services for seniors and individuals with special needs offer a growth avenue. Online platforms provide a user-friendly interface and personalized support, catering to the unique requirements of this demographic. Catering to health-conscious consumers by offering organic, vegan, or allergen-free options drives growth. A platform curating a selection of nutritional products for fitness enthusiasts is a prime example. Showcasing local producers and artisanal goods on online platforms fosters community support and boosts sales. A marketplace offering regional cheeses, jams, and crafts encourages local economies. Green consumers seek eco-friendly packaging and sustainable products. Platforms emphasizing eco-conscious options attract environmentally conscious shoppers, such as those ordering groceries with minimal packaging waste. Offering meal kits and pre-prepared ingredients attracts busy consumers seeking convenience. An online service providing easy-to-cook kits tailored to dietary preferences taps into this trend. Integrating virtual cooking classes with ingredient purchases creates a unique shopping experience. A platform providing live tutorials and ingredient bundles encourages customers to experiment with new recipes. Collaborating with local restaurants or cafes for delivery or hybrid services broadens market reach. Offering customers the option to order their favorite local dishes alongside groceries enhances the overall shopping experience. Expanding online grocery services to cater to businesses, offices, and events offers growth potential for North America Online Grocery Shopping Market. Providing bulk ordering and timely deliveries to corporate clients establishes a reliable revenue stream. Utilizing customer data to personalize offers, improve inventory management, and predict trends enhances competitiveness. Platforms analyze shopping patterns to curate personalized recommendations to create a more engaging shopping journey.

Skepticism about online grocery quality and data security hampers adoption: Some consumers are skeptical about online grocery quality and data security, hindering adoption. Concerns about receiving fresh produce under proper conditions deter shoppers. Limited internet access in rural areas hampers online grocery growth. Communities without reliable internet may face difficulties accessing and using online platforms. Complex logistics for perishables and last-mile deliveries can lead to delays and compromise product quality. Delays in delivering fresh bakery items could lead to dissatisfaction. Online shopping cannot touch, smell, and examine products. Customers may hesitate when they can't assess the freshness of produce. Delivery charges and service fees can discourage budget-conscious consumers. Additional costs could deter them from choosing online over in-store shopping. The process of returning or exchanging products can be cumbersome online. Shoppers may hesitate due to uncertainty about the return process for perishable items. Some shoppers prefer the instant access and gratification of in-store shopping over waiting for online deliveries. Packaging waste from online orders raises environmental concerns. Excessive packaging can deter eco-conscious consumers. Online platforms need a robust tech infrastructure, which may not be universally accessible, affecting potential customers' ability to shop online. Traditional grocery stores enhance their online presence, competing with digital platforms. Established chains offering both in-store and online services may divert online customers. These restraints challenge the growth of the North America online grocery shopping market, highlighting areas that need attention for a more comprehensive and inclusive adoption.

North America Online Grocery Shopping Market Segment Analysis:

Based on End Users, The dominating segment is individuals, as they constitute the largest consumer base and drive the majority of online grocery sales. Their demand for convenience and time-saving options has propelled the growth of online grocery shopping platforms. This segment comprises regular consumers who purchase groceries for personal use. They value the convenience of online shopping, especially during busy schedules. Individuals access a wide range of products and benefit from tailored promotions. A working professional orders weekly groceries online to save time and avoid in-store crowds. This segment includes businesses that procure groceries for resale or distribution to retailers, restaurants, and other establishments. Online platforms offer the efficiency and ease of sourcing products in bulk. A restaurant owner uses online platforms to purchase ingredients for their menu offerings. This miscellaneous segment encompasses any unique end-user categories not covered by the primary segments. It may include organizations or specialized groups with distinct purchasing needs. Non-profit organizations source groceries for community events through online platforms.

North America Online Grocery Shopping Market Regional Insights:

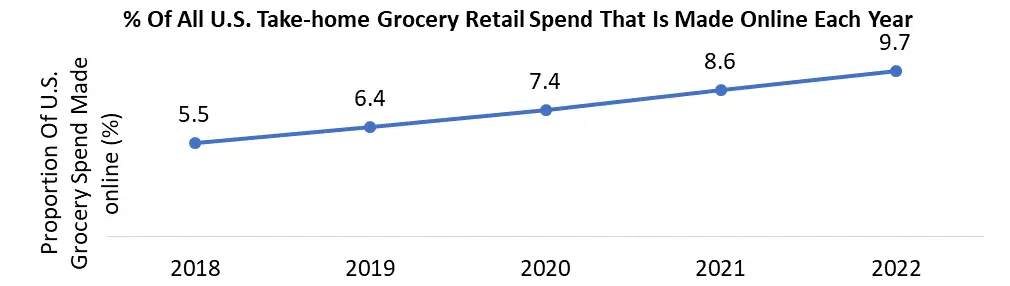

The United States holds the largest shares in North America Online Grocery Shopping Market. Major Key players like Amazon Fresh, Walmart Grocery, and Instacart. Online grocery shopping has become common in urban and suburban areas, with many consumers opting for home delivery or curbside pickup options. There were regional variances in online grocery shopping adoption. Urban areas have higher adoption rates due to convenience and access to delivery services. Rural areas often faced challenges related to delivery infrastructure and tended to rely more on traditional brick-and-mortar stores. The online grocery market saw increased competition, leading to consolidation as more prominent players acquired smaller, specialized companies to expand their offerings and reach. Canada's online grocery market was also expanding, with companies like Walmart Canada and Loblaw's offering online ordering and delivery services. Delivery and fulfillment logistics remain a challenge, especially during peak demand periods or in areas with limited delivery infrastructure. Convenience, time-saving, and access to a wide variety of products are key drivers of online grocery shopping. In Mexico, online grocery shopping has grown steadily, with companies like Walmart, Soriana, and Chedraui offering online ordering and delivery services. The adoption of online grocery shopping was driven by convenience and the desire to avoid crowded stores.

Competitive Landscape

Key Players of the North America Online Grocery Shopping Market profiled in the report 7-Eleven Inc., Ahold Delhaize, Albertsons Companies Inc., ALDI, Amazon Fresh, FreshDirect LLC, Google LLC, Instacart, Jet.com, Kroger Co., Peapod LLC, Postmates Inc., Safeway Grocery Delivery, Shipt, Target Corporation, Vitacost.com Inc., Walmart Inc. This provides huge opportunities to serve many End-users and customers and expand the North America Online Grocery Shopping Market.Walmart Inc., along with Sam's Club, surged ahead of Amazon to become the frontrunner in US digital grocery sales, capturing a substantial 28.9% of the market share within that year. Leveraging its extensive network of over 5,000 retail stores across the nation, Walmart has outlined plans to establish micro-fulfillment centers, strategically adapting to the rapid shift towards digital consumption across all product categories. Securing the second position with a 23.8% market share is Amazon, the sole digitally native retailer within the top five leaders. Although Amazon possesses just over 500 Whole Foods outlets and 18 Amazon Fresh locations, its positioning to meet the growing demand for click-and-collect services is comparatively limited. This constraint could explain the projected stagnation in grocery sales growth until 2023. Kroger follows as a distant third in the realm of grocery e-commerce sales, trailing at slightly over half of Amazon's revenue generation. This gap is expected to persist through 2023, with Kroger's digital grocery sales projected to reach only 53.13% of Amazon's sales. Notably, Kroger gained an early foothold in the digital arena, granting it a significant competitive advantage over traditional grocers. The brand continues to foster innovation through AI-driven fulfillment centers. Occupying a closely contested fourth place are Target and Albertsons, both of which experienced substantial growth during the pandemic. These retailers, with strong physical retail presence, are predicted to exhibit higher year-on-year growth in 2022 compared to Walmart, Amazon, and Kroger. Their growth trajectory is based on a small initial foundation.

North America Online Grocery Shopping Market Scope: Inquire before buying

North America Online Grocery Shopping Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 98.87 Bn. Forecast Period 2023 to 2029 CAGR: 26.87% Market Size in 2029: US $ 523.15 Bn. Segments Covered: by Product Type Fresh Produce Breakfast & Dairy Snacks & Beverages Meat & Seafood Staples & Cooking Essentials Others by Payment Method Online Offline (Cash on Delivery) by End User Individual Distributors Others North America Online Grocery Shopping Market Key Players:

1. 7-Eleven Inc. 2. Ahold Delhaize 3. Albertsons Companies Inc. 4. ALDI 5. Amazon Fresh 6. FreshDirect LLC. 7. Google LLC 8. Instacart 9. Jet.com, 10. Kroger Co. 11. Peapod LLC, 12. Postmates Inc. 13. Safeway Grocery Delivery, 14. Shipt, 15. Target Corporation 16. Vitacost.com Inc., 17. Walmart IncFAQs:

1. What are the growth drivers for the North America Online Grocery Shopping Market? Ans. Online grocery growth is fueled by busy lifestyles and the desire for effortless shopping and is expected to be the major driver for the North America Online Grocery Shopping Market. 2. What are the major restraints for the North America Online Grocery Shopping Market growth? Ans. Skepticism about online grocery quality and data security hampers adoption and is expected to be the major restraints in the North America Online Grocery Shopping Market. 3. Which country is expected to lead the North America Online Grocery Shopping Market during the forecast period? Ans. The United States is expected to lead the North America Online Grocery Shopping Market during the forecast period. 4. What is the projected market size and growth rate of the North America Online Grocery Shopping Market? Ans. The North America Online Grocery Shopping Market size was valued at USD 98.87 billion in 2022 and the total North America Online Grocery Shopping Market revenue is expected to grow at a CAGR of 26.87 % from 2023 to 2029, reaching nearly USD 523.15 billion. 5. What segments are covered in the North America Online Grocery Shopping Market report? Ans. The segments covered in the North America Online Grocery Shopping Market report are by Product Type, Payment Method, End-Users, and Region.

1. North America Online Grocery Shopping Market: Research Methodology 2. North America Online Grocery Shopping Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. North America Online Grocery Shopping Market: Dynamics 3.1 North America Online Grocery Shopping Market Trends by Country 3.2 North America Online Grocery Shopping Market Dynamics 3.2.1 North America North America Online Grocery Shopping Market Drivers 3.2.2 North America North America Online Grocery Shopping Market Restraints 3.2.3 North America North America Online Grocery Shopping Market Opportunities 3.2.4 North America North America Online Grocery Shopping Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Country 3.7 Analysis of Government Schemes and Initiatives For the North America Online Grocery Shopping Industry 3.8 The Pandemic and Redefining of The North America Online Grocery Shopping Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 North America Online Grocery Shopping Trade Analysis (2017-2022) 3.11.1 Import of North America Online Grocery Shopping 3.11.2 Export of North America Online Grocery Shopping 3.12 North America Online Grocery Shopping Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Analysis by Size of Manufacturer 4. North America North America Online Grocery Shopping Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 4.1 North America North America Online Grocery Shopping Market Size and Forecast, By Product Type (2022-2029) 4.1.1 Fresh Product 4.1.2 Breakfast & Dairy 4.1.3 Snacks & Beverages 4.1.4 Meat & Seafood 4.1.5 Staples & Cooking Essentials 4.1.6 Others 4.2 North America North America Online Grocery Shopping Market Size and Forecast, By Payment Method (2022-2029) 4.2.1 Online 4.2.2 Offline (Cash on Delivery) 4.3 North America North America Online Grocery Shopping Market Size and Forecast, By End User (2022-2029) 4.3.1 Individual 4.3.2 Distributors 4.3.3 Other 4.4 North America North America Online Grocery Shopping Market Size and Forecast, by Country (2022-2029) 4.4.1 United States 4.4.1.1 United States North America Online Grocery Shopping Market Size and Forecast, By Product Type (2022-2029) 4.4.1.1.1 Fresh Product 4.4.1.1.2 Breakfast & Dairy 4.4.1.1.3 Snacks & Beverages 4.4.1.1.4 Meat & Seafood 4.4.1.1.5 Staples & Cooking Essentials 4.4.1.1.6 Others 4.4.1.2 United States North America Online Grocery Shopping Market Size and Forecast, By Payment Method (2022-2029) 4.4.1.2.1 Online 4.4.1.2.2 Offline (Cash on Delivery) 4.4.1.3 United States North America Online Grocery Shopping Market Size and Forecast, By End User (2022-2029) 4.4.1.3.1 Individual 4.4.1.3.2 Distributors 4.4.1.3.3 Other 4.4.2 Canada 4.4.2.1 Canada North America Online Grocery Shopping Market Size and Forecast, By Product Type (2022-2029) 4.4.2.1.1 Fresh Product 4.4.2.1.2 Breakfast & Dairy 4.4.2.1.3 Snacks & Beverages 4.4.2.1.4 Meat & Seafood 4.4.2.1.5 Staples & Cooking Essentials 4.4.2.1.6 Others 4.4.2.2 Canada North America Online Grocery Shopping Market Size and Forecast, By Payment Method (2022-2029) 4.4.2.2.1 Online 4.4.2.2.2 Offline (Cash on Delivery) 4.4.2.3 Canada North America Online Grocery Shopping Market Size and Forecast, By End User (2022-2029) 4.4.2.3.1 Individual 4.4.2.3.2 Distributors 4.4.2.3.3 Other 4.4.3 Mexico 4.4.3.1 Mexico North America Online Grocery Shopping Market Size and Forecast, By Product Type (2022-2029) 4.4.3.1.1 Fresh Product 4.4.3.1.2 Breakfast & Dairy 4.4.3.1.3 Snacks & Beverages 4.4.3.1.4 Meat & Seafood 4.4.3.1.5 Staples & Cooking Essentials 4.4.3.1.6 Others 4.4.3.2 Mexico North America Online Grocery Shopping Market Size and Forecast, By Payment Method (2022-2029) 4.4.3.2.1 Online 4.4.3.2.2 Offline (Cash on Delivery) 4.4.3.3 Mexico North America Online Grocery Shopping Market Size and Forecast, By End User (2022-2029) 4.4.3.3.1 Individual 4.4.3.3.2 Distributors 4.4.3.3.3 Other 5. North America North America Online Grocery Shopping Market: Competitive Landscape 5.1 MMR Competition Matrix 5.2 Competitive Landscape 5.3 Key Players Benchmarking 5.3.1 Company Name 5.3.2 Product Segment 5.3.3 End-user Segment 5.3.4 Revenue (2022) 5.3.5 Manufacturing Locations 5.3.6 SKU Details 5.3.7 Production Capacity 5.3.8 Production for 2022 5.4 Market Analysis by Organized Players vs. Unorganized Players 5.4.1 Organized Players 5.4.2 Unorganized Players 5.5 Leading North America Online Grocery Shopping Companies, by market capitalization 5.6 Market Structure 5.6.1 Market Leaders 5.6.2 Market Followers 5.6.3 Emerging Players 5.7 Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1 7-Eleven Inc. 6.1.1 Company Overview 6.1.2 Business Portfolio 6.1.3 Financial Overview 6.1.4 SWOT Analysis 6.1.5 Strategic Analysis 6.1.6 Scale of Operation (small, medium, and large) 6.1.7 Details on Partnership 6.1.8 Regulatory Accreditations and Certifications Received by Them 6.1.9 Awards Received by the Firm 6.1.10 Recent Developments 6.2 Ahold Delhaize 6.3 Albertsons Companies Inc. 6.4 ALDI 6.5 Amazon Fresh 6.6 Fresh Direct LLC. 6.7 Google LLC 6.8 Instacart 6.9 Jet.com, 6.10 Kroger Co. 6.11 Peapod LLC, 6.12 Postmates Inc. 6.13 Safeway Grocery Delivery, 6.14 Shipt, 6.15 Target Corporation 6.16 Vitacost.com Inc., 6.17 Walmart Inc 7. Key Findings 8. Industry Recommendations 9. Terms and Glossary