The North America Military Land Vehicle Market size was valued at USD 1950.68 Million in 2023 and the total Anime revenue is expected to grow at a CAGR of 43.34% from 2024 to 2030, reaching nearly USD 24252.57 Million. The US military has different types of vehicles for defence. Like battle trucks, engineering support vehicles, infantry fighting vehicles, mobile artillery, prime movers, trucks, light tactical vehicles, mine-protected vehicles, armoured personnel carriers, light utility vehicles, and light tactical vehicles. These military vehicles come in different sizes, shapes, and weights, ranging from the heavy 70-plus ton. The military also uses modified commercially available vehicles like pickups, dumping trucks, and tanks. The U.S. military has around 225,000 military vehicles of various types, which drive the North America Military Land Vehicle Market demand during the forecast period. The U.S. military is focused on upgrading its old vehicles and North America Military Land Vehicle Market introducing new capabilities to enhance mobility, firepower and protection in various departments, especially on land. The U.S. has the highest defence market globally, and keeping track of every dollar spent is important thanks to the changing budget environment in Washington. The North America Military Land Vehicle Market covered a detailed analysis of the economic, and political, budget for military vehicles, also market players’ M&A, and JV’s that could affect the programs for military land vehicles in the United States, Canada, Mexico, Central America, and the Caribbean. The report provides detailed insights into defence spending trends, ongoing military programs, future requirements, and the armed forces of each country. The report analyses and study the military capabilities for land vehicles, equipment needs, and inventories of each country in the region. Also, it represents the information in concise segments, covering governmental and political structures, economic and political trends, national and defence budgets, force structures, military planning requirements, recent and future procurements, the security environment, threat assessments, and military postures for North America Military Land Vehicle Market.To know about the Research Methodology :- Request Free Sample Report

North America Military Land Vehicle Market Dynamics:

Electrification is the future for defence vehicles The U.S. military gives great value to its vehicles, which gives a character for their strength and capability. During the recent year of warfare, it is important for ground forces to rapidly navigate the battlefield. At the same time, the automotive industry in the military is undergoing various transformations moving away from conventional internal combustion engines and embracing electric power systems. Major automotive key market players are strategies for developing electric vehicles, with a few even aiming to completely replace internal combustion engines in their line-up, which drives the North America Military Land Vehicle Market demand globally. U.S. Democratic governors have introduced a new bill designed at accelerating the military's adoption of electric non-tactical vehicles. The future Military Vehicle Fleet Electrification Act requires that 75% of the Pentagon's non-tactical vehicle purchases in 2023 be electric or zero-emissions. This move comes as the U.S. defence is recognized as a significant contaminator, having manufactured over 1.2 billion metric tons of greenhouse gas emissions since 2001, greater than emissions of entire countries like Denmark and Portugal. The Pentagon alone accounts for 56% of the government's greenhouse gas emissions. To address these environmental problems, the U.S. military has shown its climate strategy, which tries to find to achieve a 50% reduction in military net greenhouse gas emissions by 2030 compared to 2005. The plan also objects to reaching net zero emissions by 2050, with a specific target of having a fully-electric non-tactical land vehicle fleet by 2035 and fully-electric tactical land vehicles by 2050. The Department of Defense is exploring hybrid and fully-electric technologies for battlefield use, with a focus on hybrid-electric solutions in the near period, which increases demand for the North America Military Land Vehicle Market during the forecast period. For example, to drive the North America Military Land Vehicle Market Allison, a company specializing in transmissions, has made a significant investment in a new electric hybrid cross-drive transmission to meet the requirements of infantry fighting vehicles and main battle tanks. This technology, called eGen Force, features a 220-kW electric motor and offers engine-off mobility, reducing detection and increasing soldier survivability. American Rheinmetall Vehicles has also selected this hybrid transmission for integration into its offering for the Army's Optionally Manned Fighting Vehicle (OMFV) program, which aims to replace ageing Bradley vehicles. Emerging innovation in new military vehicle designs to aid market growth New Technologies Enhance Military Capabilities for Future Wars. Congress and Pentagon market players are focused on developing new military technologies to strengthen U.S. national security and keep up with competitors. The North American military has always trusted advanced technology to stay ahead in battles and protect the country. Advancements in robotics, big data analytics, artificial intelligence, advanced computing and other technologies, are involved in the military land vehicles. These technologies are important for winning future wars. Moreover, the U.S. and Canada are also generating growth to develop these technologies for military land vehicles, which could have a significant impact on international security. Congress needs to prioritize funding and errors to ensure the U.S. remains at the forefront of these advancements. The North America Military Land Vehicle Market is growing due to the military exploring various applications of artificial intelligence, particularly in semi-autonomous and autonomous military vehicles. The US has also developed combat modules for unmanned ground vehicles that may have autonomous target identification capabilities. Swarms of coordinated unmanned vehicles could overwhelm defences, giving an advantage to attackers. On the other hand, directed energy weapons for land vehicles offer a cost-effective way to counter such attacks, favouring defenders. As these emerging technologies continue to evolve, they have the potential to modify the balance between offence and defence in future conflicts in the market.

North America Military Land Vehicle Market Regional Insights:

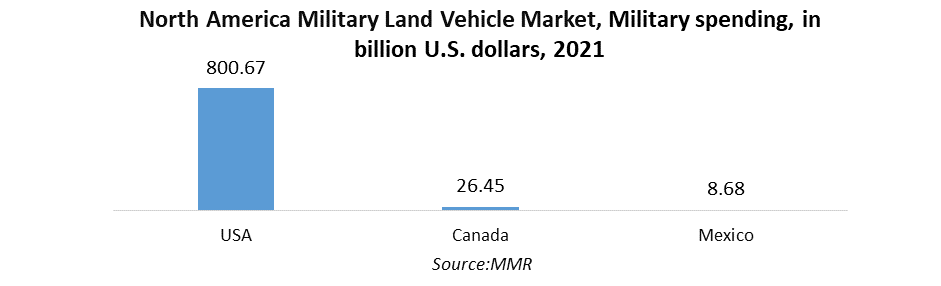

The US held the largest North America Military Land Vehicle Market share in 2023 due to an increased focus on safeguarding soldiers, as well as governments around the world wanting the latest machinery to aid with various emergencies and tactical missions. According to the report, military vehicle OEMs have been making investments in new product developments to meet market needs. The market players introduced new upgrades made in military land vehicles to remain competitive in the market. For example, Iveco Defence introduced Amphibious Combat Vehicles (ACV) to U.S. Military Corporation as a part of an order for new generation vehicles which is awarded in 2018.The company is partnering with BAE Systems to develop an ACV Personnel Carrier variant (ACV-P) for the Marine Corps. Mexico held the third largest market share in North America market. The Mexican manufacturers of military land vehicles are highly focused to manufacture military land vehicles also they are investing in R&D to drive the North American Military Land Vehicle Market during the forecast period. For example, Mexico's TPS Armoring and the USA's TPS Armoring have joined forces to showcase their North America Military Land Vehicle Market globally. At the exhibition, the companies displayed the Epel TPV and the brand-new Black Mamba QRV. The Black Mamba QRV is a quick-reaction vehicle available in different protection levels, with the basic version meeting B6+ or STANAG 1 standards. Weighing 5.6 tons with a 1.32-ton payload, it is constructed on a Ford 250 chassis and powered by a 330 horsepower engine. The vehicle can accommodate up to seven passengers and has a rear flatbed for some transportation capabilities.North America Military Land Vehicle Market Scope: Inquire before buying

North America Military Land Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 1950.68 Million Forecast Period 2024 to 2030 CAGR: 43.34 % Market Size in 2030: USD 24252.57 Million Segments Covered: by Offering 1.Platform 2.Service by Product Type 1.Infantry Fighting Vehicles (IFV) 2.Armored Personnel Carriers (APC) 3.Main Battle Tanks (MBT) 4.Light Multirole Vehicles (LMV) 5.Tactical Trucks by Application 1.Defence and Combat 2.Logistics and Transportation North America Market by Region:

1. North America 1.1.United States 1.2.Canada 1.3. MexicoNorth America Military Land Vehicle Key Players:

1.General Dynamics Land Systems - Sterling Heights, Michigan, USA 2.Oshkosh Corporation - Oshkosh, Wisconsin, USA 3.BAE Systems Inc. - Arlington, Virginia, USA 4.Textron Systems - Providence, Rhode Island, USA 5. AM General - South Bend, Indiana, USA 6.Navistar Defense - Lisle, Illinois, USA 7.Lockheed Martin Corporation - Bethesda, Maryland, USA 8.Rheinmetall Defence - Düsseldorf, Germany (North American division headquarters in Sterling Heights, Michigan, USA) 9.The Boeing Company - Chicago, Illinois, USA 10.Canadian Commercial Corporation (CCC) - Ottawa, Ontario, Canada 11. Raytheon Technologies Corporation - Waltham, Massachusetts, USA 12.Leonardo DRS - Arlington, Virginia, USA 13.Doosan Infracore Defense - West Fargo, North Dakota, USA 14.Mack Defense - Allentown, Pennsylvania, USA 15.Krauss-Maffei Wegmann (KMW) - Munich, Germany (North American division headquarters in Reston, Virginia, USA FAQs: 1. What are the growth drivers for the North America Military Land Vehicle Market? Ans. The increasing prevalence of artificial intelligence and IOT and machine learning expected to be the major driver for the North America market. 2. What is the major restraint for the North America Military Land Vehicle Market growth? Ans. Stringent government regulations are expected to be the major restraining factor for the North America market growth. 3. Which country is expected to lead the North America Military Land Vehicle Market during the forecast period? Ans. U.S. is expected to lead the North America market during the forecast period. 4. What is the projected market size & growth rate of the North America Military Land Vehicle Market? Ans. The North America Military Land Vehicle Market size was valued at USD 1950.68 Million in 2023 and the total Anime revenue is expected to grow at a CAGR of 43.34% from 2024 to 2030, reaching nearly USD 24252.57 Million. 5. What segments are covered in the North America Military Land Vehicle Market report? Ans. The segments covered in the North America market report are Offering, Product type, Application, and Region

1. North America Military Land Vehicle Market: Research Methodology 2. North America Military Land Vehicle Market: Executive Summary 3. North America Military Land Vehicle Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. North America Military Land Vehicle Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.1.1. United States 4.1.1.2. Canada 4.1.1.3. Mexico 4.2. Market Drivers by Region 4.2.1. North America 4.2.1.1. United States 4.2.1.2. Canada 4.2.1.3. Mexico 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.1.1. United States 4.9.1.2. Canada 4.9.1.3. Mexico 5. North America Military Land Vehicle Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. North America Military Land Vehicle Market Size and Forecast, by Offering (2023-2030) 5.1.1. Platform 5.1.2. Service 5.2. North America Military Land Vehicle Market Size and Forecast, by Product Type (2023-2030) 5.2.1. Infantry Fighting Vehicles (IFV) 5.2.2. Armored Personnel Carriers (APC) 5.2.3. Main Battle Tanks (MBT) 5.2.4. Light Multirole Vehicles (LMV) 5.2.5. Tactical Trucks 5.3. North America Military Land Vehicle Market Size and Forecast, by Application (2023-2030) 5.3.1. Defense and Combat 5.3.2. Logistics and Transportation 6. North America North America Military Land Vehicle Market Size and Forecast (by Value USD and Volume Units) 6.1. North America North America Military Land Vehicle Market Size and Forecast, by Offering (2023-2030) 6.1.1. Platform 6.1.2. Service 6.2. North America North America Military Land Vehicle Market Size and Forecast, by Product Type (2023-2030) 6.2.1. Infantry Fighting Vehicles (IFV) 6.2.2. Armored Personnel Carriers (APC) 6.2.3. Main Battle Tanks (MBT) 6.2.4. Light Multirole Vehicles (LMV) 6.2.5. Tactical Trucks 6.3. North America North America Military Land Vehicle Market Size and Forecast, by Application (2023-2030) 6.3.1. Defense and Combat 6.3.2. Logistics and Transportation 6.4. North America North America Military Land Vehicle Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Company Profile: Key players 7.1. General Dynamics Land Systems - Sterling Heights, Michigan, USA. 7.1.1. Company Overview 7.1.2. Financial Overview 7.1.3. Business Portfolio 7.1.4. SWOT Analysis 7.1.5. Business Strategy 7.1.6. Recent Developments 7.2. Oshkosh Corporation - Oshkosh, Wisconsin, USA 7.3. BAE Systems Inc. - Arlington, Virginia, USA 7.4. Textron Systems - Providence, Rhode Island, USA 7.5. AM General - South Bend, Indiana, USA 7.6. Navistar Defense - Lisle, Illinois, USA 7.7. Lockheed Martin Corporation - Bethesda, Maryland, USA 7.8. Rheinmetall Defence - Düsseldorf, Germany (North American division headquarters in Sterling Heights, Michigan, USA) 7.9. The Boeing Company - Chicago, Illinois, USA 7.10. Canadian Commercial Corporation (CCC) - Ottawa, Ontario, Canada 7.11. Raytheon Technologies Corporation - Waltham, Massachusetts, USA 7.12. Leonardo DRS - Arlington, Virginia, USA 7.13. Doosan Infracore Defense - West Fargo, North Dakota, USA 7.14. Mack Defense - Allentown, Pennsylvania, USA 7.15. Krauss-Maffei Wegmann (KMW) - Munich, Germany (North American division headquarters in Reston, Virginia, USA) 8. Key Findings 9. Industry Recommendation