The North America Embedded Security Market size was valued at USD 2.9 Billion in 2023 and the total North America Embedded Security Market revenue is expected to grow at a CAGR of 5.1% from 2024 to 2030, reaching nearly USD 4.11 Billion.North America Embedded Security Market Overview

Embedded security is used to protect computer systems that are embedded within several electronic devices and machinery. It is a programmable hardware component with a minimal operating system and software. Embedded systems require to be extremely reliable in process control systems, consumer electronics, aircraft, hybrid cars and other applications. The lifespan of embedded security systems is at least 15 years. With embedded systems being integrated into critical infrastructure and everyday objects, they have been vulnerable to several security attacks and threats. The rise in cybersecurity threats, focus on critical infrastructure protection and growing awareness and adoption of secure coding practices are driving factors for the North America Embedded Security Market growth. The qualitative and quantitative approaches are included in the report to analyze the Market data. To know deeper information on the North America Embedded Security Market penetration, competitive structure, pricing and demand analysis are involved in the report. The report includes historical data, present and future trends, competitive environment of the North America Embedded Security industry.To know about the Research Methodology :- Request Free Sample Report

North America Embedded Security Market Dynamics

Growing Adoption of IoT to Fuel North America Embedded Security Market Growth IoT is experiencing rapid growth, with an expansion of interconnected devices across several industries. These devices including smart home appliances, wearable devices, industrial sensors and connected vehicles, rely on embedded systems to function. There is an increase in the requirement to secure communication and data exchange between them, with the increasing number of IoT devices. Embedded security solutions are used to protect these devices and assure the confidentiality, integrity and availability of IoT networks, which drives North America Embedded Security Market. The proliferation of IoT devices innovates new vulnerabilities and security risks. Many IoT devices have fixed computing power and memory, making them attractive targets for cybercriminals. These devices have anemic security controls, making them inclinable to unauthorized access, data breaches and exploitation. As a result, consumers and organizations are recognizing the requirement for powerful embedded security measures to protect their IoT devices and the sensitive data they handle. IoT devices transmit and collect large amounts of data such as personal and sensitive information. With growing awareness of data privacy concerns, individuals and organizations are demanding embedded security solutions to ensure that their data remains secure. Several industries in North America are leveraging IoT technologies to improve operations, enhance productivity and enable new business models. For instance, IoT devices are used for remote patient monitoring as well as medical device connectivity in the healthcare industry. The industry-specific IoT applications handle critical data and need robust embedded security solutions to protect against cyber threats and boost the North America Embedded Security Market growth. Increasing Demand for secure automotive systems to Boost the North America Embedded Security Market Growth The automotive industry is witnessing significant growth with the increase of autonomous and connected vehicles. The integration of embedded systems in vehicles introduces security vulnerabilities to make secure automotive systems a top priority. This resulted in the there is increasing demand for embedded security solutions to protect against cyber threats and assure the integrity of automotive systems. The automotive industry has become a target for cybercriminals, with the increasing connectivity and digitalization of vehicles. The potential risks involve unauthorized access to vehicle systems, tampering with critical functions and theft of personal data. The requirement for robust security measures in automotive systems is used to prevent such attacks. Embedded security solutions play a vital role in protecting vehicle networks, securing communication channels and detecting cyber threats. North America has established regulatory needs and industry standards to address cybersecurity concerns in the automotive industry, which fuel the North America Embedded Security Market. For instance, the U.S. Department of Transportation has released guidelines on cybersecurity best practices for connected vehicles. In addition, automotive industry standards including ISO 21434 and MISRAC offer guidelines to secure development processes and embedded system security. Compliance with these regulations and standards boosts the adoption of embedded security solutions in the automotive sector. Ensuring the safety of vehicle occupants are critical priorities for automotive manufacturers. Security breaches in automotive systems have been resulting in unauthorized control of critical functions, posing safety risks. Automakers have been securing their vehicles from potential cyber threats, enhancing safety by implementing robust embedded security measures.

North America Embedded Security Market Trend

AI-powered threat detection Cybersecurity threats are becoming sophisticated increases and rapidly evolving. Traditional security solutions struggle to keep up with these dynamic threats. AI-powered threat detection leverages machine learning algorithms to analyze vast amounts of data and identify patterns that indicate vicious activity. By continuously learning from new threat data, AI-powered systems have been adapting and improving their detection abilities to make them more effective in identifying complex threats. Traditional security systems generally rely on predefined rules and signatures to identify known threats. The new and past unseen threats have been simply bypassing these rules. AI-powered threat detection systems have been analyzing real-time data from embedded systems, network traffic and device behavior to identify potential security breaches. Embedded security solutions have been detecting threats in real-time, mitigating the risk of attacks and reducing the impact of security incidents by leveraging AI algorithms. AI-powered threat detection systems have been significantly enhancing the accuracy of identifying security threats. Machine learning algorithms have been analyzing vast datasets and identifying anomalies that have indicated malicious activity. This improved accuracy supports minimizes false positives, which have saving time and resources by reducing the number of unnecessary investigations and increase the demand for Embedded Security, which drives the North America Embedded Security Market growth. Security teams have been prioritizing their efforts to potential security incidents by focusing on genuine threats. North America Embedded Security Market Restraint Cost Implications Integrating robust security measures into embedded systems has involved significant costs. This includes the acquisition of hardware components including secure elements or trusted platform modules (TPMs), which offer secure storage and cryptographic functions. Implementing secure communication protocols, encryption algorithms and authentication mechanisms needs investments in software integration and development. These upfront costs have been a barrier for organizations, especially for those with limited budgets. Ensuring the security of embedded systems needs testing processes and comprehensive development. Implementing secure coding practices, conducting security audits and performing penetration testing all acquire additional costs. Organizations require to invest in security tools, skilled security professionals and infrastructure to identify vulnerabilities efficiently. These expenses have been contributing to the overall cost of implementing robust embedded security measures.North America Embedded Security Market Segment Analysis

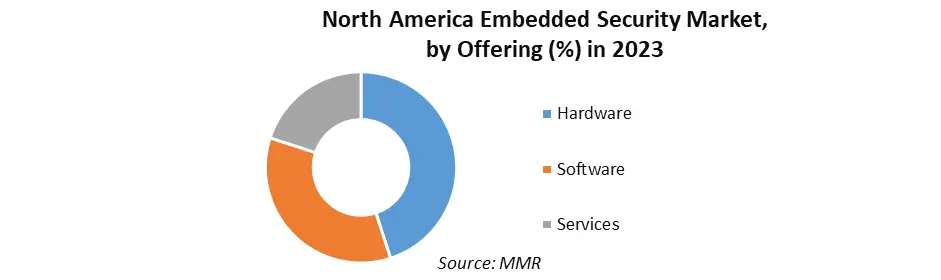

Based on Offering, the market is segmented into Hardware, Software and Services. The Hardware segment held the largest North America Embedded Security Market share in 2023. Hardware components offer physical protection against attacks, tampering and unauthorized access. Secure elements, secure microcontrollers (MCUs), trusted platform modules (TPMs) and hardware security modules (HSMs) are designed to resist physical attacks and provide secure storage for sensitive data. This physical security is especially critical in industries where embedded systems are exposed to several threats including automotive, industrial control systems and critical infrastructure. Hardware components provide dedicated secure storage and management of cryptographic keys. These keys are useful for authentication, encryption, and secure communication in embedded systems. Hardware-based security modules offer tamper-resistant key storage to make it more critical for adversaries to compromise keys. The secure management of keys ensures the integrity and confidentiality of data, making hardware components an important component in overall system security. Hardware-based security solutions have certifications and compliance with industry standards, regulatory needs and security evaluations. Compliance with standards including FIPS 140-2 (Federal Information Processing Standards) provides assurance that the embedded system meets specific security requirements. In industries such as government, defense, and finance, compliance with these certifications is demanding, which fuels the North America Embedded Security Market growth.

North America Embedded Security Market Regional Insights

The United States dominated the North America Embedded Security Market in 2023 and is expected to continue its dominance during the forecast period. The United States faces a significant number of cybersecurity threats across several industries. The escalating sophistication of cyber-attacks has increased awareness among organizations about the importance of implementing robust embedded security measures. The need to protect critical infrastructure, sensitive data and intellectual property from cyber threats boosts the demand for embedded security solutions. The United States has precise regulations and compliance needs for cybersecurity and data privacy. The regulations including the Health Insurance Portability and Accountability Act (HIPAA), the California Consumer Privacy Act (CCPA) and the Payment Card Industry Data Security Standard (PCI DSS) need organizations to implement robust security measures in their embedded systems. The requirement for compliance with these regulations boosts the Embedded Security Market in the United States. In recent years, Data privacy concerns have gained elevation with high-profile data breaches and privacy incidents. The U.S. public and regulatory bodies are growingly focusing on sensitive data. Organizations are investing in embedded security solutions to protect data from unauthorized access and maintain privacy compliance. The research institutions and technology companies driving advancements in embedded systems and security. Technological developments including hardware-based security modules, encryption algorithms, and machine learning-based threat detection are fuelling the growth of the embedded security market. The integration of machine learning (ML) and artificial intelligence (AI) techniques in embedded security solutions boost North America Embedded Security Market growth.North America Embedded Security Market Competitive Landscape The competitive analysis of the Market includes the Market size, growth rate and key trends. The report provides information about the Key companies, such as their size, North America Embedded Security market share, and geographic presence. The report provides such type of competitive landscape of all Key Players to assist new market entrants. The report offers Competitive benchmarking of the North America Embedded Security industry through the Market revenue, share and size of the key players. Some of the key players are Texas Instruments Incorporated (US), Microchip Technology Inc.(US), Qualcomm Incorporated (US), Symantec Corporation(US), IBM Corporation(US), Intel Corporation(US), Hewlett Packard Enterprise Company(US), Cisco Systems Inc. (US), Fortinet Inc. (US), Trustwave Holdings(US), Check Point Software Technologies Ltd. (US), AT&T Inc. (US), Palo Alto Networks Inc. (US), NVIDIA Corporation(US), Maxim Integrated Products, Inc. and Others. The key players developed new technologies and products to achieve increasing consumer demand. For Instance, TI makes embedded systems more affordable with new Arm Cortex -M0+ MCU portfolio: The Company expanding its broad analog and embedded processing semiconductor portfolio by introducing a scalable Arm Cortex -M0+ microcontroller (MCU) portfolio that features a wide range of options such as computing, pinout, memory and integrated analog.

North America Embedded Security Market Scope: Inquire before buying

North America Embedded Security Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.9 Bn. Forecast Period 2024 to 2030 CAGR: 5.1% Market Size in 2030: US $ 4.11 Bn. Segments Covered: by Offering Hardware Software Services by Security Type Authentication and Access Management Payment Content Protection by Application Wearables Smartphones Automotive Smart Identity Cards Industrial Payment Processing And Card Others North America Embedded Security Key Players

1. Texas Instruments Incorporated 2. Microchip Technology Inc. 3. Qualcomm Incorporated 4. Symantec Corporation 5. IBM Corporation 6. Intel Corporation 7. Hewlett Packard Enterprise Company 8. Cisco Systems Inc. 9. Fortinet Inc. 10. Trustwave Holdings 11. Check Point Software Technologies Ltd. 12. AT&T Inc. 13. Palo Alto Networks Inc. 14. NVIDIA Corporation 15. Maxim Integrated Products, Inc. 16. McAfee LLC 17. Trustwave Holdings, Inc. 18. Cypress Semiconductor Corporation FAQs: 1. What are the growth drivers for the North America Embedded Security Market? Ans. The growing adoption of IoT and increasing demand for secure automotive systems are the growth drivers of the North America Embedded Security Market. 2. What is the major restraint for the North America Embedded Security Market growth? Ans. Cost implications are the restraining factor of the market growth. 3. Which country is expected to lead the North America Embedded Security Market during the forecast period? Ans. The United States is expected to lead the North America Embedded Security Market during the forecast period. 4. What is the expected North America Embedded Security Market size by 2030? Ans. The market size is expected to reach USD 4.11 Bn by 2030. 5. What segments are covered in the North America Embedded Security Market report? Ans. The segments covered in the market are Offering, Security Type and Application.

1. North America Embedded Security Market: Research Methodology 2. North America Embedded Security Market: Executive Summary 3. North America Embedded Security Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. North America Embedded Security Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. North America Embedded Security Market: Segmentation (by Value USD and Volume Units) 5.1. North America Embedded Security Market, by offering (2023-2030) 5.1.1 Hardware 5.1.2 Software 5.1.3 Services 5.2. North America Embedded Security Market, by Security Type (2023-2030) 5.2.1 Authentication and Access Management 5.2.2 Payment 5.2.3 Content Protection 5.3. North America Embedded Security Market, by Application (2023-2030) 5.3.1 Wearables 5.3.2 Smartphones 5.3.3 Automotive 5.3.4 Smart Identity Cards 5.3.4 Industrial 5.3.5 Payment Processing And Card 5.3.6 Others 5.4. North America Embedded Security Market, by Country (2023-2030) 5.4.1. United States 5.4.2. Canada 5.4.3. Mexico 6. Company Profile: Key players 6.1. Texas Instruments Incorporated(US) 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Texas Instruments Incorporated(US) 6.3. Microchip Technology Inc.(US) 6.4. Qualcomm Incorporated (US) 6.5. Symantec Corporation(US) 6.6. IBM Corporation(US) 6.7. Intel Corporation(US) 6.8. Hewlett Packard Enterprise Company(US) 6.9. Cisco Systems Inc. (US) 6.10. Fortinet Inc. (US) 6.11. Trustwave Holdings(US) 6.12. Check Point Software Technologies Ltd. (US) 6.13. AT&T Inc. (US) 6.14. Palo Alto Networks Inc. (US) 6.15. NVIDIA Corporation(US) 6.16. Maxim Integrated Products, Inc. (US) 6.17. McAfee LLC(US) 6.18. Trustwave Holdings, Inc. (US) 6.19. Cypress Semiconductor Corporation(US) 7. Key Findings 8. Industry Recommendation