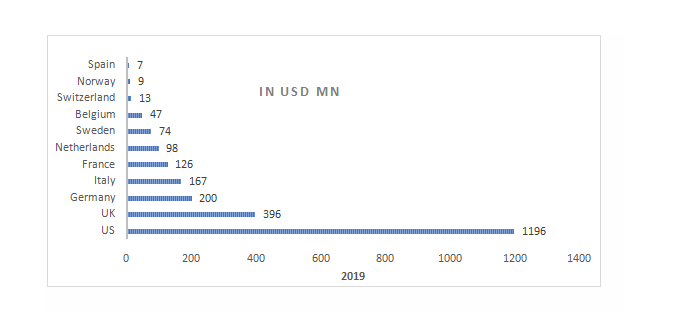

North America Artificial Meat Market size is expected to reach nearly US$ 1197.3 Mn by 2026 with the CAGR of 4.2% during the forecast period.To know about the Research Methodology :- Request Free Sample Report

North America Artificial Meat Market Overview:

Artificial meat is meat made by in vitro cell culture of animal cells. Artificial meat is made using many of the same tissue engineering methods traditionally used in recreating medicine. The application of artificial meat leads it to have some perspective health, environmental, cultural, & economic considerations in comparison to conventional meat. This market is estimated to drive by the factor like increase in global demand for meat substitutes & alternative sources of protein. Rising environmental problems coupled with increasing health concerns are further generating demand for artificial meat products.Global Meat Demand:

This is happening in big part because economies are rising & people can afford more meat. But raising meat takes a great deal of land & water and has a large environmental impact. Put simply, there’s no way to produce sufficient meat for 7.98 Bn people. That’s why there is more need for more choices for producing meat without reducing resources. Some exciting new firms are taking on this challenge. They are producing plant-based alternatives to chicken, ground beef, even eggs, which are made more sustainably, & taste great. Firms such as Beyond Meat & Hampton Creek Foods are testing new ways to use heat & pressure to turn plants into foods that look & taste just like meat & eggs.

Meat Alternative Market Poised for Growth:

As meat consumption is gradually scrutinized for ethical aims & its possible environmental impact, plant-based alternatives to meat are composed to be more than just a flash in the pan. Following the robust IPO of alternative meat producer Beyond Meat, which saw its share price more than double on its 1st trading day in early May, MMR report is forecasting that the global market for animal-free meat alternatives could raise more than tenfold during the forecast period & possibly reach USD 140 Bn by 2029.

The Alternative Protein Boom:

On average, humans slaughter over 70 Bn animals for food every year. This range is only possible as the transformed animal farming from a mostly pastoral, family-owned farming system to a developed system of livestock production. It’s one that has produced a USD 1.5 trillion industry, serving as the backbone for the increase of Big Food & inspiring iconic products, from the Big Mac to the Whopper. But gradually, it’s a system which is under scrutiny for the range of its impact on people & the planet. These worries are driving customers to seek alternatives for the meat & dairy they love & inspiring innovators to meet this market demand over disruption: replicating the taste, texture & flavor of animal proteins with better supply efficiency & without the actual animal. These progresses have challenged the long-held thesis that the only way for the segment to raise (and feed a world of ten Bn people by 2050) is over the expansion of the existing intensive animal production system. For the 1st time since the start of industrial animal farming nearly 60 years ago, substitute proteins whether plant-based or cell-based – show a the feasible path forward to meet global demand for proteins sustainably.Alternative proteins & the food industry:

The rapid growth of the plant-based market has makers, retailers & food brands playing catch-up. New playerssuch as Beyond Meat, Just & Impossible Foods have forced recognized players to modernize, invest &introduce new products to avoid a disruption of their current brands.Oppositions from the traditional meat industry:

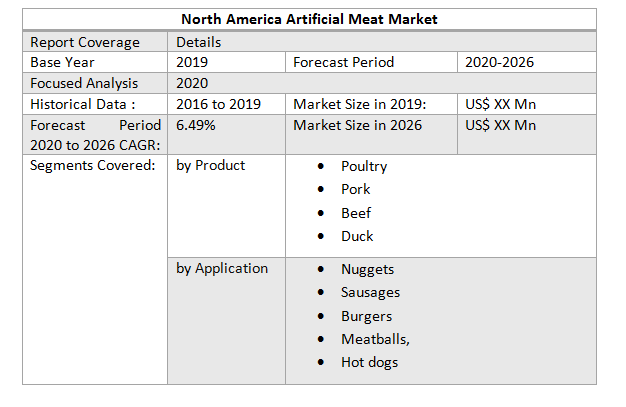

Cattle farmers could also stand in the system of the alternative protein segment, particularly in the United States. The United States Cattlemen’s Association in the year 2019 filed a request asking for the meaning of the terms “beef” & “meat,” in an offer to keep plant-based proteins out of the report. The EU in October rejected applications to ban restaurants & shops from using words like sausage or burger when describing meat alternatives. The report covers Poultry,Pork, Beef, Duck with detailed analysis North America Artificial Meat Market industry with the classifications of the market on the, Product, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it.The report has profiled fifteen key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Products, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the North America Artificial Meat Market: Inquire before buying

North America Artificial Meat Market, by Region

• North America: o US o CanadaNorth America Artificial Meat Market Key Players

• MosaMeat • Just, Inc • SuperMeat • Aleph Farms Ltd • Finless Foods Inc • Integriculture • Balletic Foods • Future Meat Technologies Ltd • Avant Meats Company Limited • Higher Steaks • Appleton Meats • Fork & Goode • Biofood Systems LTD • Mission Barns • BlueNalu, Inc. • Mutable

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: North America Artificial Meat MarketSize, by Market Value (US$ Bn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. North America Artificial Meat MarketAnalysis and Forecast 7. North America Artificial Meat MarketAnalysis and Forecast, by Product 7.1. Introduction and Definition 7.2. Key Findings 7.3. North America Artificial Meat MarketValue Share Analysis, by Product 7.4. North America Artificial Meat MarketSize (US$ Bn) Forecast, by Product 7.5. North America Artificial Meat MarketAnalysis, by Product 7.6. North America Artificial Meat MarketAttractiveness Analysis, by Product 8. North America Artificial Meat MarketAnalysis and Forecast, by Application 8.1. Introduction and Definition 8.2. Key Findings 8.3. North America Artificial Meat MarketValue Share Analysis, by Application 8.4. North America Artificial Meat MarketSize (US$ Bn) Forecast, by Application 8.5. North America Artificial Meat MarketAnalysis, by Application 8.6. North America Artificial Meat MarketAttractiveness Analysis, by Application 9. North-AmericaArtificial Meat MarketAnalysis 9.1. Key Findings 9.2. North-AmericaArtificial Meat MarketOverview 9.3. North-AmericaArtificial Meat MarketValue Share Analysis, by Product 9.4. North-America Artificial Meat MarketForecast, by Product 9.4.1. Poultry 9.4.2. Pork 9.4.3. Beef 9.4.4. Duck 9.5. North-America Artificial Meat MarketForecast, by Application 9.5.1. Nuggets 9.5.2. Sausages 9.5.3. Burgers 9.5.4. Meatballs, 9.5.5. Hot dogs 9.6. North-AmericaArtificial Meat MarketForecast, by Country 9.6.1. US 9.6.2. Canada 9.7. US Artificial Meat MarketForecast, by Product 9.7.1. Poultry 9.7.2. Pork 9.7.3. Beef 9.7.4. Duck 9.8. US Artificial Meat MarketForecast, by Application 9.8.1. Nuggets 9.8.2. Sausages 9.8.3. Burgers 9.8.4. Meatballs, 9.8.5. Hot dogs 9.9. Canada Artificial Meat MarketForecast, by Product 9.9.1. Poultry 9.9.2. Pork 9.9.3. Beef 9.9.4. Duck 9.10. Canada Artificial Meat MarketForecast, by Application 9.10.1. Nuggets 9.10.2. Sausages 9.10.3. Burgers 9.10.4. Meatballs, 9.10.5. Hot dogs 9.11. PEST Analysis 9.12. Key Trends 9.13. Key Developments 10. Company Profiles 10.1. Market Share Analysis, by Company 10.2. Market Share Analysis, by Region 10.3. Market Share Analysis, by Country 10.4. Competition Matrix 10.4.1. Competitive Benchmarking of key players by price, presence, marketshare, End-Use and R&D investment 10.4.2. New Product Launches and Product Enhancements 10.4.3. Market Consolidation 10.4.3.1. M&A by Regions, Investment and End-Use 10.4.3.2. M&A Key Players, Forward Integration and Backward Integration 10.5. Company Profiles: Key Players 10.5.1. MosaMeat 10.5.2. Just, Inc 10.5.3. SuperMeat 10.5.4. Aleph Farms Ltd 10.5.5. Finless Foods Inc 10.5.6. Integriculture 10.5.7. Balletic Foods 10.5.8. Future Meat Technologies Ltd 10.5.9. Avant Meats Company Limited 10.5.10. Higher Steaks 10.5.11. Appleton Meats 10.5.12. Fork & Goode 10.5.13. Biofood Systems LTD 10.5.14. Mission Barns 10.5.15. BlueNalu, Inc. 10.5.16. Mutable