The Natural Graphite Market size was valued at USD 30.84 billion in 2023 and the total Natural Graphite Market revenue is expected to grow at a CAGR of 5.4 % from 2024 to 2030, reaching nearly USD 44.57 billion. Natural graphite is graphite that is crystalline form of carbon. Natural graphite is an important industrial mineral that finds applications in almost every facet of manufacturing including electronics, atomic energy, hot metal processing, friction, coatings, aerospace, powder metallurgy, etc. The natural graphite market is a growing industry with significant opportunities for growth, driven by the increasing demand for electric vehicles, renewable energy storage systems, and high-temperature materials. The market is highly competitive, with a few dominant players, and is characterized by a high degree of vertical integration.To know about the Research Methodology :- Request Free Sample Report

Scope and Methodology of Natural Graphite Market

The scope of this research is to analyze the global Natural Graphite Market, with a focus on graphite mining, production, and consumption trends, as well as key drivers, challenges, opportunities, and future prospects for the industry. The research covers all types of natural graphite, including flake graphite, amorphous graphite, and vein graphite. The study also examines the various applications of natural graphite, including batteries, refractories, lubricants, and other industrial uses. The research was conducted using a combination of primary and secondary research methods. Primary research involves interviews with key industry experts, including graphite mining companies, graphite processors, equipment suppliers, and end-users. The interviews were conducted through telephone, email, or video conferencing. Secondary research involves collecting data from various sources, including industry reports, company websites, government publications, and academic journals. This report involves forecasting future trends and growth prospects for the natural graphite market based on the analysis of historical data and current trends.Natural Graphite Market Dynamics

Growth in the electric vehicle market: The increasing demand for electric vehicles (EVs) is one of the most significant drivers of the Natural Graphite Market. Natural graphite is a crucial material used in the production of lithium-ion batteries, which are the most common type of batteries used in EVs. The growing demand for EVs is expected to drive the demand for natural graphite in the battery anode segment. Increase in renewable energy storage systems: Renewable energy sources such as wind and solar power require energy storage systems to provide a consistent power supply. Lithium-ion batteries are a popular choice for these energy storage systems, which require large quantities of natural graphite. As the demand for renewable energy sources grows, the demand for natural graphite is also expected to increase. Growth in the steel industry: Natural graphite is widely used in the steel industry as a refractory material. The growth of the steel industry, particularly in developing countries, is expected to drive the demand for Natural Graphite Market in the refractory segment. Expansion of the aerospace industry: The aerospace industry is another significant driver of the natural graphite industry. Natural graphite is used in the production of lightweight composites used in aircraft and spacecraft. The expansion of the aerospace industry, particularly in emerging economies, is expected to drive the demand for natural graphite. Increasing demand for electronics: Natural graphite is used as a conductor and electrode material in electronic devices such as smartphones, tablets, and laptops. The growing demand for electronic devices, particularly in developing countries, is expected to drive the demand for natural graphite in the electronics segment. Growth in the industrial lubricants segment: Natural graphite is used as a dry lubricant in various industrial applications. The growth of the manufacturing sector, particularly in emerging economies, is expected to drive the demand for natural graphite in the industrial lubricants segment. Technological advancements by using Natural Graphite: Advancements in technology such as the development of new battery chemistries and improved processing methods for natural graphite could lead to increased efficiency and lower costs, creating new opportunities for the natural graphite market. Emerging markets for Natural Graphite Market: Emerging markets in Asia, Africa, and Latin America present significant growth opportunities for the Natural Graphite Market, as these regions have a growing demand for natural graphite in applications such as steelmaking, refractories, and energy storage. Environmental concerns: The mining and processing of natural graphite have significant environmental impacts, such as deforestation, soil erosion, and water pollution. These concerns are leading to increased regulations and scrutiny of the industry, which impact production and supply. Volatility in Pricing of Natural Graphite: The price of natural graphite is volatile, driven by factors such as changes in supply and demand, geopolitical events, and currency fluctuations. This creates uncertainty for Natural Graphite Market producers and consumers of natural graphite.Natural Graphite Market Segment Analysis:

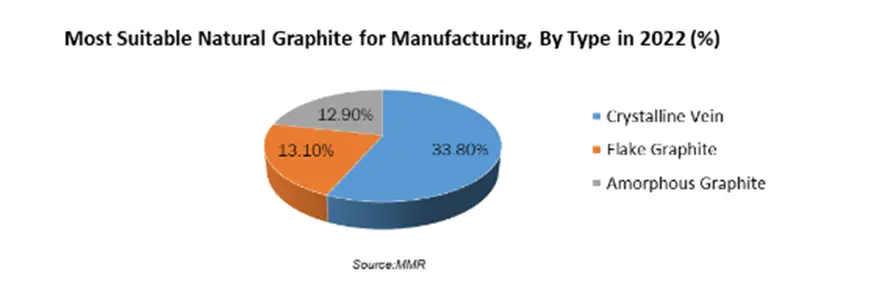

Based on Subtype, Natural graphite is available in three forms, all of which are processed from naturally sourced graphite material. The three forms are amorphous graphite, flake graphite, and crystalline vein graphite. Amorphous graphite is usually formed by contact metamorphism between an anthracite coal seam and a metamorphism agent. Amorphous graphite tends to have a higher ash content than other kinds of natural graphite. In the production of steel, amorphous graphite is included as a carbon raiser for increased strength and durability. In other industries, amorphous graphite is used to make brake linings, clutch materials, gaskets, and pencil lead. Pencil lead is normally made from the lowest-quality amorphous graphite, and this particular use is primarily found in China. Almost any eco-friendly car or truck requires flake graphite to run. Graphite is a key component in the lithium-ion batteries that electric and hybrid cars use, and it’s also found in fuel cells. In fact, fuel cells require more flake graphite than lithium-ion batteries. Flake graphite is also used in vanadium-redox batteries and nuclear reactors.

Regional Analysis of Natural Graphite Market:

The Asia-Pacific region is the largest, accounting for a significant Natural Graphite Market share of the global market. China is the world's largest producer and consumer of natural graphite, with the majority of the products used in the steel, refractory, and battery markets. Other significant markets in the region include Japan, India, and South Korea. The European natural graphite market is the second-largest in the world, with several major producers and consumers of natural graphite located in the region. Germany, France, and the UK are the largest markets in the region, with significant demand for natural graphite in the automotive, aerospace, and energy storage industries. The North American natural graphite market is the third-largest in the world, with the majority of the demand coming from the automotive and energy storage industries. The US is the largest producer and consumer of natural graphite in the region, with Canada and Mexico also significant markets. The rest of the world’s natural graphite market includes regions such as South America, Africa, and the Middle East. The demand for natural graphite in these regions is driven by industries such as steel, refractory, and energy storage. Brazil is the largest market in South America, while countries such as Mozambique and Tanzania are emerging as significant producers of natural graphite in Africa.Competitive Landscape Analysis of Natural Graphite Market: Syrah Resources is a major producer of natural graphite, with mining operations in Mozambique. In 2020, the company signed an agreement with Qingdao Taida-Huarun New Energy Technology Co. Ltd. to supply natural graphite for the production of lithium-ion batteries. Syrah Resources has also recently launched anode material products for the lithium-ion battery market. GrafTech International produces graphite for steel, automotive, and aerospace industries. In 2020, the company announced the acquisition of the U.S. business of C/G Electrodes LLC, a manufacturer of graphite electrodes used in the steel industry. Northern Graphite is a Canadian company that produces natural graphite for use in the battery, lubricant, and refractory markets. In 2021, the company announced a partnership with ProGraphite GmbH to develop a natural graphite anode material for lithium-ion batteries. Mason Graphite is a Canadian mining company that produces natural graphite for use in the battery and refractory markets. In 2021, the company announced a partnership with Bécancour Silicon Inc. to develop a silicon-graphite anode material for lithium-ion batteries. Graphite India is a leading producer of graphite electrodes used in the steel industry. In 2020, the company announced the acquisition of US-based General Graphene Corporation, a manufacturer of graphene products used in a variety of applications, including batteries. Imerys Graphite & Carbon is a leading supplier of natural graphite products used in the refractory, foundry, and battery markets. The company has recently launched a new range of natural graphite products for use in lithium-ion batteries.

Natural Graphite Market Scope: Inquire before buying

Global Natural Graphite Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 30.84 Bn. Forecast Period 2024 to 2030 CAGR: 5.4% Market Size in 2030: US $ 44.57 Bn. Segments Covered: by Application Refractory Foundry Battery Friction Product Lubricant Others by subtype Flake Amorphous Vein Natural Graphite Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Natural Graphite Market Key Players:

North America 1. Northern Graphite (Canada) 2. Alabama Graphite (United States) 3. American Graphite Technologies (United States) 4. Anson Resources (United States) 5. Archer Materials (Canada) 6. Asbury Carbons (New Jersey, U.S.) 7. Eagle Graphite (Canada) Europe 8. Skaland (Norway) 9. AMG (Hauzenberg, Germany) 10. SGL Carbon (Wiesbaden, Germany) Asia Pacific 11. Fangda Carbon (China) 12. BTR New Material (China) 13. EPM Group (Moscow, Russia) 14. Grafitbergbau Kaisersberg GmbH (Kaisersberg, Austria) FAQs: 1. What are the growth drivers for the Natural Graphite Market? Ans. Technological advancements by using Natural Graphite is the major driver for the Market. 2. What is the major Opportunity for the Market growth? Ans. Increasing demand for electronics is expected to be the major Opportunity in the Market. 3. Which country is expected to lead the Market during the forecast period? Ans. North America is expected to lead the Market during the forecast period. 4. What is the projected market size and growth rate of the Natural Graphite Market? Ans. The Market size was valued at USD 30.84 billion in 2023 and the total Natural Graphite Market revenue is expected to grow at a CAGR of 5.4 % from 2024 to 2030, reaching nearly USD 44.57 billion. 5. What segments are covered in the Natural Graphite Market report? Ans. The segments covered in the Market report are by Application, Subtype, and Region.

1. Natural Graphite Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Natural Graphite Market: Dynamics 2.1. Natural Graphite Market Trends by Region 2.1.1. North America Natural Graphite Market Trends 2.1.2. Europe Natural Graphite Market Trends 2.1.3. Asia Pacific Natural Graphite Market Trends 2.1.4. Middle East and Africa Natural Graphite Market Trends 2.1.5. South America Natural Graphite Market Trends 2.2. Natural Graphite Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Natural Graphite Market Drivers 2.2.1.2. North America Natural Graphite Market Restraints 2.2.1.3. North America Natural Graphite Market Opportunities 2.2.1.4. North America Natural Graphite Market Challenges 2.2.2. Europe 2.2.2.1. Europe Natural Graphite Market Drivers 2.2.2.2. Europe Natural Graphite Market Restraints 2.2.2.3. Europe Natural Graphite Market Opportunities 2.2.2.4. Europe Natural Graphite Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Natural Graphite Market Drivers 2.2.3.2. Asia Pacific Natural Graphite Market Restraints 2.2.3.3. Asia Pacific Natural Graphite Market Opportunities 2.2.3.4. Asia Pacific Natural Graphite Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Natural Graphite Market Drivers 2.2.4.2. Middle East and Africa Natural Graphite Market Restraints 2.2.4.3. Middle East and Africa Natural Graphite Market Opportunities 2.2.4.4. Middle East and Africa Natural Graphite Market Challenges 2.2.5. South America 2.2.5.1. South America Natural Graphite Market Drivers 2.2.5.2. South America Natural Graphite Market Restraints 2.2.5.3. South America Natural Graphite Market Opportunities 2.2.5.4. South America Natural Graphite Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Natural Graphite Industry 2.8. Analysis of Government Schemes and Initiatives For Natural Graphite Industry 2.9. Natural Graphite Market Trade Analysis 2.10. The Global Pandemic Impact on Natural Graphite Market 3. Natural Graphite Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Natural Graphite Market Size and Forecast, by Application (2023-2030) 3.1.1. Refractory 3.1.2. Foundry 3.1.3. Battery 3.1.4. Friction Product 3.1.5. Lubricant 3.1.6. Others 3.2. Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 3.2.1. Flake 3.2.2. Amorphous 3.2.3. Vein 3.3. Natural Graphite Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Natural Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Natural Graphite Market Size and Forecast, by Application (2023-2030) 4.1.1. Refractory 4.1.2. Foundry 4.1.3. Battery 4.1.4. Friction Product 4.1.5. Lubricant 4.1.6. Others 4.2. North America Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 4.2.1. Flake 4.2.2. Amorphous 4.2.3. Vein 4.3. North America Natural Graphite Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Natural Graphite Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Refractory 4.3.1.1.2. Foundry 4.3.1.1.3. Battery 4.3.1.1.4. Friction Product 4.3.1.1.5. Lubricant 4.3.1.1.6. Others 4.3.1.2. United States Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 4.3.1.2.1. Flake 4.3.1.2.2. Amorphous 4.3.1.2.3. Vein 4.3.2. Canada 4.3.2.1. Canada Natural Graphite Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Refractory 4.3.2.1.2. Foundry 4.3.2.1.3. Battery 4.3.2.1.4. Friction Product 4.3.2.1.5. Lubricant 4.3.2.1.6. Others 4.3.2.2. Canada Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 4.3.2.2.1. Flake 4.3.2.2.2. Amorphous 4.3.2.2.3. Vein 4.3.3. Mexico 4.3.3.1. Mexico Natural Graphite Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Refractory 4.3.3.1.2. Foundry 4.3.3.1.3. Battery 4.3.3.1.4. Friction Product 4.3.3.1.5. Lubricant 4.3.3.1.6. Others 4.3.3.2. Mexico Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 4.3.3.2.1. Flake 4.3.3.2.2. Amorphous 4.3.3.2.3. Vein 5. Europe Natural Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.2. Europe Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 5.3. Europe Natural Graphite Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 5.3.2. France 5.3.2.1. France Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Natural Graphite Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6. Asia Pacific Natural Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3. Asia Pacific Natural Graphite Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.4. India 6.3.4.1. India Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Natural Graphite Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 7. Middle East and Africa Natural Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Natural Graphite Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 7.3. Middle East and Africa Natural Graphite Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Natural Graphite Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Natural Graphite Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Natural Graphite Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Natural Graphite Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 8. South America Natural Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Natural Graphite Market Size and Forecast, by Application (2023-2030) 8.2. South America Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 8.3. South America Natural Graphite Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Natural Graphite Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Natural Graphite Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Natural Graphite Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Natural Graphite Market Size and Forecast, by Subtype (2023-2030) 9. Global Natural Graphite Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Natural Graphite Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Northern Graphite (Canada) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Alabama Graphite (United States) 10.3. American Graphite Technologies (United States) 10.4. Anson Resources (United States) 10.5. Archer Materials (Canada) 10.6. Asbury Carbons (New Jersey, U.S.) 10.7. Eagle Graphite (Canada) 10.8. Skaland (Norway) 10.9. AMG (Hauzenberg, Germany) 10.10. SGL Carbon (Wiesbaden, Germany) 10.11. Fangda Carbon (China) 10.12. BTR New Material (China) 10.13. EPM Group (Moscow, Russia) 10.14. Grafitbergbau Kaisersberg GmbH (Kaisersberg, Austria) 11. Key Findings 12. Industry Recommendations 13. Natural Graphite Market: Research Methodology 14. Terms and Glossary