Global Mobility as a Service Market size was valued at USD 4.8 Bn in 2023 and is expected to reach USD 32.95 Bn by 2030, at a CAGR of 31.7 %Overview

Mobility as a Service refers to a comprehensive approach that integrates various transportation services into a single, user-friendly platform. It allows users to plan, book, and pay for multi-modal journeys seamlessly, promoting efficient and sustainable urban mobility. The Mobility as a Service (MaaS) market is witnessing rapid growth as cities embrace smart and sustainable transportation solutions. MaaS platforms consolidate diverse transportation modes like ride-sharing, public transit, and micro-mobility, providing users with streamlined access. Factors such as urbanization, environmental concerns, and the desire for convenient, cost-effective commuting are driving the market. Key players in this evolving landscape include tech firms, traditional transport providers, and startups. As MaaS gains momentum, collaborations and advancements in digital technologies are shaping the future of urban mobility, offering a flexible and interconnected transport ecosystem that enhances accessibility and reduces reliance on private car ownership, thereby contributing to a more sustainable and interconnected urban transportation network.To know about the Research Methodology :- Request Free Sample Report There are several advantages to adopting the MaaS model. It promotes higher vehicle utilization, meaning fewer cars are needed overall, saving valuable parking space. People rent out their vehicles when they're not using them, recovering some costs. With fewer cars on the road, the government focuses on investing in better public transport infrastructure, leading to more frequent and reliable services. Organizations also gain from MaaS, especially those with vehicle fleets. Shifting to a MaaS transport model reduces fleet maintenance risks and costs and Mobility as a Service Market Growth. Fleet assets are better utilized by offering them for public use on weekends and holidays. Organizations provide alternative transportation options for their staff, potentially saving on overall transport costs per individual. Mobility as a Service is a game-changing approach to urban transportation. By providing a comprehensive range of transport choices through a single platform. MaaS benefits individuals by reducing car ownership and cities by easing congestion and promoting efficient public transport infrastructure. Organizations with fleets also use MaaS to optimize asset utilization and offer alternative transportation solutions to their staff.

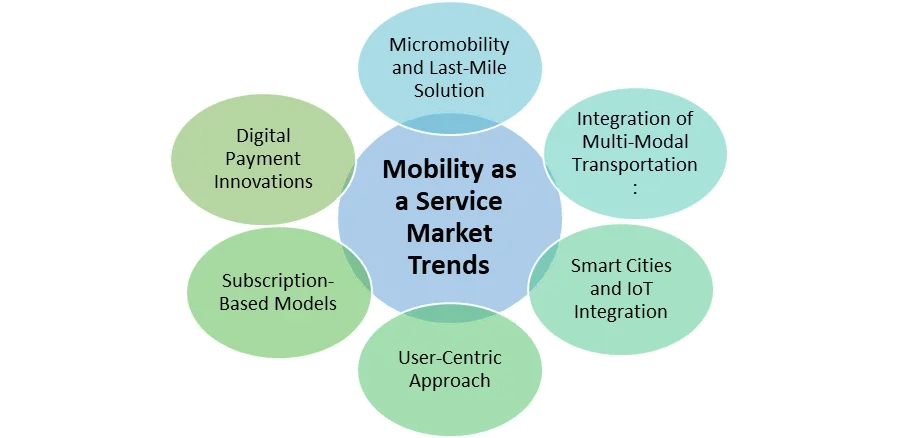

Mobility as a Service Market Dynamics: Drivers, Restraints, Opportunities and Trends

Advancements in Technology Propelled the Rise of Mobility as a Service Platforms Urban population growth leads to higher demand for efficient transportation solutions in cities. MaaS offers a convenient and integrated platform that addresses urban dwellers' mobility needs, making it an attractive option for both residents and visitors. A rapidly expanding metropolis experiences a surge in commuter traffic. This prompts city authorities to collaborate with MaaS providers to offer a comprehensive range of transportation options. This reduces reliance on private cars and promotes sustainable travel choices. Advancements in mobile technology, GPS, and data analytics have paved the way for MaaS platforms. These technological innovations enable real-time trip planning, seamless booking, and integration of various transportation modes within a single app. A tech-savvy MaaS startup harnesses advanced mapping and routing algorithms to optimize multi-modal transportation routes, providing users with efficient and time-saving travel options. A city with ambitious sustainability goals partners with MaaS operators to incentivize eco-friendly transportation options by offering discounts or subsidies to users who choose public transit or bike-sharing. Consumer preferences are evolving, with rising interest in on-demand and personalized services. As a result, such factors are expected to drive the Mobility as a Service Market growth. Mobility as a Service Market trend by providing convenient, user-friendly, and tailored transportation choices. A generation of tech-savvy millennials embraces MaaS platforms as their go-to solution for daily commuting, citing ease of use, cost-effectiveness, and environmental benefits as key factors influencing their choice. Collaboration between public transit agencies, private companies, and MaaS providers creates opportunities for creating comprehensive and integrated transportation networks. A city's public transit authority partners with ride-hailing and bike-sharing companies to integrate their services into the MaaS platform, providing commuters with a seamless and interconnected travel experience. Governments around the world encourage MaaS adoption to address transportation challenges and reduce congestion. Incentives, policy support, and funding initiatives further drive MaaS market growth. The national government introduces tax incentives for MaaS companies. It allocates funding for smart infrastructure development to support transportation mode integration.Investing in Infrastructure Enhancing MaaS Efficiency and Accessibility and Boost the Market MaaS presents an opportunity to leverage vast amounts of data to gain valuable insights into transportation patterns and user preferences. This data-driven approach leads to better service optimization and personalized travel recommendations for users. Regulatory challenges require collaboration between governments, transportation providers, and MaaS operators. By working together, stakeholders create a conducive environment for MaaS growth and ensure fair competition in different transportation modes. As MaaS gains traction, there is an opportunity for increased investment in infrastructure development. This includes expanding public transit networks, creating dedicated bike lanes, and implementing charging stations for electric vehicles. Improved infrastructure will enhance the overall MaaS experience. Consumer behavior challenges addressed through targeted education and awareness campaigns. By highlighting the benefits of MaaS, such as convenience, affordability, and sustainability, more individuals are encouraged to adopt these innovative transportation options. Although integrating diverse transportation modes is complex, successful integration presents an opportunity for a more seamless and efficient travel experience. Collaborative efforts lead to smoother interchanges between different modes, making MaaS an attractive choice for users. Changing Consumer Behavior to Restrain the Adoption of Mobility as a Service and Hinder the Market Growth Mobility as a Service (MaaS) faces significant challenges that hinder its widespread adoption and implementation. One of the primary challenges lies in data management. These systems rely heavily on collecting and processing vast amounts of data from various sources, including transportation providers, users, and third-party platforms. Effectively managing and protecting this data is crucial for user privacy and maintaining system integrity. Regulation poses another complex challenge for Mobility as a Service Market. The transportation industry operates under a myriad of laws and standards, varying across different regions and modes of transport. Navigating this complex regulatory environment is demanding. Ensuring a level playing field for all participants is essential for fair competition and sustainable MaaS growth. MaaS's success depends on physical and digital infrastructure availability and adequacy. This includes reliable public transit networks, well-maintained bike lanes, charging stations for electric vehicles, and robust mobile networks to support seamless connectivity. The absence or inadequacy of such infrastructure in certain areas hinders MaaS systems' efficiency. Changing consumer behavior poses a significant challenge to MaaS adoption. Many users are accustomed to traditional transportation modes and resist shifting to more innovative and unfamiliar services. Consumer preferences and behaviors change over time, making it challenging for MaaS providers to anticipate and cater to evolving needs effectively achieving seamless integration of diverse transportation modes is vital to MaaS's success. Coordinating and collaborating with different transportation providers and stakeholders is complex, given their competing interests and priorities. Effective integration is necessary to create a cohesive and interconnected transportation network. Affordability remains a barrier to MaaS adoption for certain demographics, those with lower incomes or residing in rural areas with limited transportation options. Mobility as a Service must be accessible and cost-effective for all users is essential for equitable and inclusive mobility solutions.

Mobility as a Service Market Segmental Analysis

By Service Type: Based on the Service Type, the Ride-hailing services held the largest Mobility as a Service Market share in 2023. Ride-hailing platforms, such as Uber, Rapido, Ola, and Lyft, have gained widespread popularity in urban areas, offering users the convenience of booking a ride with just a tap on their smartphones. These services provide on-demand transportation options, eliminating private car ownership and promoting more efficient vehicle use. Ride-hailing has been preferred by many commuters due to its ease of use, real-time tracking, and often competitive pricing compared to traditional taxis. Car-sharing is another significant segment of the MaaS market, contributing to improved resource efficiency and reduced congestion. Car-sharing platforms allow users to access shared vehicles for short-term use, promoting a shift from private car ownership to shared mobility. It is possible to book a car when needed, and the vehicle is returned to a designated parking spot once used.Car-sharing services have seen steady growth, especially in urban areas, where individuals find it more economical to use rented cars occasionally rather than owning a private vehicle. Micromobility, including services like bike-sharing and electric scooter-sharing, has seen a surge in popularity and has become an integral part of the MaaS ecosystem. Such factors are influencing the Mobility as a Service market growth. These services provide convenient options for short-distance travel, complementing other modes of transportation. Micromobility solutions are particularly attractive for last-mile connectivity, allowing users to cover the distance between public transit stations and their final destinations. The segment's growth is supported by the increasing availability of electric bikes and scooters, making them more accessible and eco-friendly.

Mobility as a Service Market Regional Analysis

In 2023, Asia Pacific dominated the largest Mobility as a Service Market share in 2023. There is significant traffic congestion and air pollution in the region due to densely populated urban centers. These issues have spurred governments and private entities to explore innovative mobility solutions like MaaS to address the growing demand for efficient transportation. Smartphone adoption and increasing internet penetration in the Asia Pacific have facilitated the rapid uptake of MaaS platforms. The Asia Pacific region has witnessed significant investments in micro-mobility services, particularly bike-sharing and electric scooter-sharing. Companies such as Ola and Mobike in China and Bounce in India have played a pivotal role in popularizing shared micro-mobility options. Asia Pacific has become a hub for multimodal transportation integration through MaaS platforms. North America is also a leading player in the Mobility as a Service Market market, with the United States and Canada driving growth. In North America, Uber and Lyft dominate the ride-hailing segment. These platforms have reshaped urban transportation by providing convenient on-demand ride services to millions of users. North America has seen significant advancements in the car-sharing industry. Car-sharing services like Zipcar and Turo have gained popularity in urban areas where individuals seek alternatives to car ownership. These services contribute to reducing privately-owned vehicles on the road, aligning with MaaS sustainability goals. The diverse and well-connected transportation systems in Europe have embraced MaaS concepts to address urban mobility challenges effectively. Europe's ride-hailing segment is growing steadily, with Uber and Bolt expanding to multiple cities. Car-sharing has gained traction in Europe, with companies like Share Now (formerly Car2Go and DriveNow) and Getaround offering flexible car-sharing options to users in various European cities. These services align with the region's emphasis on sustainable urban mobility solutions. The success of bike-sharing in Europe has inspired the integration of these services into MaaS platforms, enabling users to access shared bicycles boost the Mobility as a Service industry growth in Europe.Mobility as a Service Market Scope: Inquire Before Buying

Global Mobility as a Service Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.8 Bn. Forecast Period 2024 to 2030 CAGR: 31.7% Market Size in 2030: US $ 32.95 Bn. Segments Covered: by Service Type Ride Hailing Car Sharing Micro mobility Bus Sharing Train Services by Solution Type Technology Platforms Payment Engines Navigation Solutions Telecom Connectivity Providers Ticketing Solution Insurance Insurance Services by Transportation Type Public Private by Business Model B2B B2C P2P by Operating System Android iOS Others Mobility as a Service Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina, and the Rest of South America)Mobility as a Service Key Players

North America 1. Addison Lee 2. Lyft Inc. 3. Uber Technologies Inc. Europe: 1. BlaBla Car 2. Cabify 3. Careem 4. Citymapper, Ltd. 5. Communauto Inc., 6. Daimler AG. 7. Easy Taxi 8. Gett 9. Ingogo 10. Meituan (Mobike) 11. Meru Cabs 12. Mobilleo 13. Moovit Inc. 14. Ola Cabs 15. SkedGo Pty Ltd Mobility as a Service Companies in Asia Pacific: 1. ANI Technologies Pvt. Ltd. (Ola Cabs) 2. Beijing Xiaoju Technology Co., Ltd (Didi Chuxing) 3. Gocatch 4. Grab Taxi 5. HINOMARU KOTSU 6. Tranzer 7. Wiwigo Frequently Asked Questions: 1] What is the growth rate of the Global Mobility as a Service Market? Ans. The Global Mobility as a Service Market is growing at a significant rate of 31.7 % during the forecast period. 2] Which region is expected to dominate the Global Mobility as a Service Market? Ans. Asia Pacific region is expected to dominate the Mobility as a Service Market growth potential during the forecast period. 3] What is the expected Global Mobility as a Service Market size by 2030? Ans. The Mobility as a Service Market size is expected to reach USD 32.95 Bn by 2030. 4] Which are the top players in the Global Mobility as a Service Market? Ans. The top players in the market include Addison Lee, Lyft Inc., Uber Technologies Inc. and others. 5] What are the factors driving the Global Mobility as a Service Market growth? Ans. Advancements in technology propelled the rise of mobility as a service platform and are expected to drive market growth. 6] Which country held largest the Mobility as a Service market share in 2023? Ans. China dominated the largest Mobility as a Service market share in 2023 and India, Japan and South Korea are expected to drive the market growth.

1. Mobility as a Service Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Evolution of Mobility as a Services 1.4. Executive Summary 2. Mobility as a Service Market: Dynamics 2.1. Mobility as a Service Market Trends by Region 2.1.1. North America Mobility as a Service Market Trends 2.1.2. Europe Mobility as a Service Market Trends 2.1.3. Asia Pacific Mobility as a Service Market Trends 2.1.4. Middle East and Africa Mobility as a Service Market Trends 2.1.5. South America Mobility as a Service Market Trends 2.2. Mobility as a Service Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Mobility as a Service Market Drivers 2.2.1.2. North America Mobility as a Service Market Restraints 2.2.1.3. North America Mobility as a Service Market Opportunities 2.2.1.4. North America Mobility as a Service Market Challenges 2.2.2. Europe 2.2.2.1. Europe Mobility as a Service Market Drivers 2.2.2.2. Europe Mobility as a Service Market Restraints 2.2.2.3. Europe Mobility as a Service Market Opportunities 2.2.2.4. Europe Mobility as a Service Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Mobility as a Service Market Drivers 2.2.3.2. Asia Pacific Mobility as a Service Market Restraints 2.2.3.3. Asia Pacific Mobility as a Service Market Opportunities 2.2.3.4. Asia Pacific Mobility as a Service Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Mobility as a Service Market Drivers 2.2.4.2. Middle East and Africa Mobility as a Service Market Restraints 2.2.4.3. Middle East and Africa Mobility as a Service Market Opportunities 2.2.4.4. Middle East and Africa Mobility as a Service Market Challenges 2.2.5. South America 2.2.5.1. South America Mobility as a Service Market Drivers 2.2.5.2. South America Mobility as a Service Market Restraints 2.2.5.3. South America Mobility as a Service Market Opportunities 2.2.5.4. South America Mobility as a Service Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For the Mobility as a Service Industry 2.9. The Global Pandemic's Impact on the Mobility as a Service Market 2.10. Mobility as a Service Price Trend Analysis (2021-22) 3. Mobility as a Service Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 3.1. Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 3.1.1. Ride Hailing 3.1.2. Car Sharing 3.1.3. Micro mobility 3.1.4. Bus Sharing 3.1.5. Train Services 3.2. Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 3.2.1. Technology Platforms 3.2.2. Payment Engines 3.2.3. Navigation Solutions 3.2.4. Telecom Connectivity Providers 3.2.5. Ticketing Solution Insurance 3.2.6. Insurance Services 3.3. Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 3.3.1. Public 3.3.2. Private 3.4. Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 3.4.1. B2B 3.4.2. B2C 3.4.3. P2P 3.5. Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 3.5.1. Android 3.5.2. iOS 3.5.3. Others 3.6. Mobility as a Service Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Mobility as a Service Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 4.1. North America Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 4.1.1. Ride Hailing 4.1.2. Car Sharing 4.1.3. Micro mobility 4.1.4. Bus Sharing 4.1.5. Train Services 4.2. North America Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 4.2.1. Technology Platforms 4.2.2. Payment Engines 4.2.3. Navigation Solutions 4.2.4. Telecom Connectivity Providers 4.2.5. Ticketing Solution Insurance 4.2.6. Insurance Services 4.3. North America Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 4.3.1. Public 4.3.2. Private 4.4. North America Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 4.4.1. B2B 4.4.2. B2C 4.4.3. P2P 4.5. North America Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 4.5.1. Android 4.5.2. iOS 4.5.3. Others 4.6. Mobility as a Service Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 4.6.1.1.1. Ride Hailing 4.6.1.1.2. Car Sharing 4.6.1.1.3. Micro mobility 4.6.1.1.4. Bus Sharing 4.6.1.1.5. Train Services 4.6.1.2. United States Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 4.6.1.2.1. Technology Platforms 4.6.1.2.2. Payment Engines 4.6.1.2.3. Navigation Solutions 4.6.1.2.4. Telecom Connectivity Providers 4.6.1.2.5. Ticketing Solution Insurance 4.6.1.2.6. Insurance Services 4.6.1.3. United States Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 4.6.1.3.1. Public 4.6.1.3.2. Private 4.6.1.4. United States Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 4.6.1.4.1. B2B 4.6.1.4.2. B2C 4.6.1.4.3. P2P 4.6.1.5. United States Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 4.6.1.5.1. Android 4.6.1.5.2. iOS 4.6.1.5.3. Others 4.6.2. Canada 4.6.2.1. Canada Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 4.6.2.1.1. Ride Hailing 4.6.2.1.2. Car Sharing 4.6.2.1.3. Micro mobility 4.6.2.1.4. Bus Sharing 4.6.2.1.5. Train Services 4.6.2.2. Canada Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 4.6.2.2.1. Technology Platforms 4.6.2.2.2. Payment Engines 4.6.2.2.3. Navigation Solutions 4.6.2.2.4. Telecom Connectivity Providers 4.6.2.2.5. Ticketing Solution Insurance 4.6.2.2.6. Insurance Services 4.6.2.3. Canada Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 4.6.2.3.1. Public 4.6.2.3.2. Private 4.6.2.4. Canada Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 4.6.2.4.1. B2B 4.6.2.4.2. B2C 4.6.2.4.3. P2P 4.6.2.5. Canada Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 4.6.2.5.1. Android 4.6.2.5.2. iOS 4.6.2.5.3. Others 4.6.3. Mexico 4.6.3.1. Mexico Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 4.6.3.1.1. Ride Hailing 4.6.3.1.2. Car Sharing 4.6.3.1.3. Micro mobility 4.6.3.1.4. Bus Sharing 4.6.3.1.5. Train Services 4.6.3.2. Mexico Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 4.6.3.2.1. Technology Platforms 4.6.3.2.2. Payment Engines 4.6.3.2.3. Navigation Solutions 4.6.3.2.4. Telecom Connectivity Providers 4.6.3.2.5. Ticketing Solution Insurance 4.6.3.2.6. Insurance Services 4.6.3.3. Mexico Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 4.6.3.3.1. Public 4.6.3.3.2. Private 4.6.3.4. Mexico Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 4.6.3.4.1. B2B 4.6.3.4.2. B2C 4.6.3.4.3. P2P 4.6.3.5. Mexico Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 4.6.3.5.1. Android 4.6.3.5.2. iOS 4.6.3.5.3. Others 5. Europe Mobility as a Service Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 5.1. Europe Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.2. Europe Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 5.3. Europe Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.4. Europe Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.5. Europe Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 5.6. Europe Mobility as a Service Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.6.1.2. United Kingdom Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 5.6.1.3. United Kingdom Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.6.1.4. United Kingdom Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.6.1.5. United Kingdom Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 5.6.2. France 5.6.2.1. France Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.6.2.2. France Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 5.6.2.3. France Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.6.2.4. France Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.6.2.5. France Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.6.3.2. Germany Mobility as a Service Market Size and Forecast, by Solution Type(2023-2030) 5.6.3.3. Germany Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.6.3.4. Germany Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.6.3.5. Germany Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.6.4.2. Italy Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 5.6.4.3. Italy Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.6.4.4. Italy Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.6.4.5. Italy Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.6.5.2. Spain Mobility as a Service Market Size and Forecast, by Solution Type(2023-2030) 5.6.5.3. Spain Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.6.5.4. Spain Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.6.5.5. Spain Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 5.6.5.6. 5.6.6. Sweden 5.6.6.1. Sweden Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.6.6.2. Sweden Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 5.6.6.3. Sweden Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.6.6.4. Sweden Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.6.6.5. Sweden Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.6.7.2. Austria Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 5.6.7.3. Austria Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.6.7.4. Austria Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.6.7.5. Austria Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 5.6.8.2. Rest of Europe Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 5.6.8.3. Rest of Europe Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 5.6.8.4. Rest of Europe Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 5.6.8.5. Rest of Europe Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6. Asia Pacific Mobility as a Service Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 6.1. Asia Pacific Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.2. Asia Pacific Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.3. Asia Pacific Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.4. Asia Pacific Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.5. Asia Pacific Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6. Asia Pacific Mobility as a Service Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.1.2. China Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.1.3. China Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.1.4. China Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.1.5. China Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.2.2. S Korea Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.2.3. S Korea Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.2.4. S Korea Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.2.5. S Korea Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.3.2. Japan Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.3.3. Japan Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.3.4. Japan Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.3.5. Japan Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.4. India 6.6.4.1. India Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.4.2. India Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.4.3. India Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.4.4. India Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.4.5. India Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.5.2. Australia Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.5.3. Australia Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.5.4. Australia Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.5.5. Australia Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.6.2. Indonesia Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.6.3. Indonesia Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.6.4. Indonesia Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.6.5. Indonesia Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.7.2. Malaysia Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.7.3. Malaysia Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.7.4. Malaysia Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.7.5. Malaysia Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.8.2. Vietnam Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.8.3. Vietnam Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.8.4. Vietnam Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.8.5. Vietnam Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.9.2. Taiwan Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.9.3. Taiwan Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.9.4. Taiwan Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.9.5. Taiwan Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 6.6.10.2. Rest of Asia Pacific Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 6.6.10.3. Rest of Asia Pacific Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 6.6.10.4. Rest of Asia Pacific Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 6.6.10.5. Rest of Asia Pacific Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 7. Middle East and Africa Mobility as a Service Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn) (2023-2030) 7.1. Middle East and Africa Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 7.2. Middle East and Africa Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 7.3. Middle East and Africa Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 7.4. Middle East and Africa Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 7.5. Middle East and Africa Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 7.6. Middle East and Africa Mobility as a Service Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 7.6.1.2. South Africa Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 7.6.1.3. South Africa Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 7.6.1.4. South Africa Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 7.6.1.5. South Africa Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 7.6.2.2. GCC Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 7.6.2.3. GCC Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 7.6.2.4. GCC Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 7.6.2.5. GCC Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 7.6.3.2. Nigeria Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 7.6.3.3. Nigeria Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 7.6.3.4. Nigeria Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 7.6.3.5. Nigeria Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 7.6.4.2. Rest of ME&A Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 7.6.4.3. Rest of ME&A Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 7.6.4.4. Rest of ME&A Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 7.6.4.5. Rest of ME&A Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 8. South America Mobility as a Service Market Size and Forecast by Segmentation by Segmentation (by Value USD Mn)(2023-2030 8.1. South America Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 8.2. South America Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 8.3. South America Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 8.4. South America Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 8.5. South America Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 8.6. South America Mobility as a Service Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 8.6.1.2. Brazil Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 8.6.1.3. Brazil Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 8.6.1.4. Brazil Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 8.6.1.5. Brazil Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 8.6.2.2. Argentina Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 8.6.2.3. Argentina Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 8.6.2.4. Argentina Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 8.6.2.5. Argentina Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Mobility as a Service Market Size and Forecast, by Service Type (2023-2030) 8.6.3.2. Rest Of South America Mobility as a Service Market Size and Forecast, by Solution Type (2023-2030) 8.6.3.3. Rest Of South America Mobility as a Service Market Size and Forecast, by Transportation Type (2023-2030) 8.6.3.4. Rest Of South America Mobility as a Service Market Size and Forecast, by Business Model (2023-2030) 8.6.3.5. Rest Of South America Mobility as a Service Market Size and Forecast, by Operating System (2023-2030) 9. Global Mobility as a Service Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.4. Leading Mobility as a Service Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Addison Lee 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Lyft Inc. 10.3. Uber Technologies Inc. 10.4. BlaBla Car 10.5. Cabify 10.6. Careem 10.7. Citymapper, Ltd. 10.8. Communauto Inc. 10.9. Daimler AG. 10.10. Easy Taxi 10.11. Gett 10.12. Ingogo 10.13. Meituan (Mobike) 10.14. Meru Cabs 10.15. Mobilleo 10.16. Moovit Inc. 10.17. Ola Cabs 10.18. SkedGo Pty Ltd 10.19. ANI Technologies Pvt. Ltd. (Ola Cabs) 10.20. Beijing Xiaoju Technology Co., Ltd (Didi Chuxing) 10.21. Gocatch 10.22. Grab Taxi 10.23. HINOMARU KOTSU 10.24. Tranzer 10.25. Wiwigo 11. Key Findings 12. Industry Recommendations 13. Mobility as a Service Market: Research Methodology