Mine-Site Technology Adoption Market size was valued at USD 14.3 Billion in 2024 and the total Mine-Site Technology Adoption Market is expected to grow at a CAGR of 14.5 % from 2025 to 2032, reaching nearly USD 42.25 Billion.Mine-Site Technology Adoption Market Overview:

The Mine-site Technology Adoption markets include mining, quarrying, and oil and gas extraction companies. Companies in this sector extract naturally occurring mineral solids, such as coal and metal; liquid minerals, such as crude petroleum; and gases, such as natural gas. The term Mining is used in the broad sense to include quarrying, well operations, beneficiating like crushing, screening, washing, and flotation, and other work performed at a mine site.The sector distinguishes between mine operation and mining support activities. Mine operation includes operating mines, quarries, or oil and gas wells. Mining support activities include performing exploration or other mining services.Mine-site technology Adoption Markets in the Mining sector are classified according to the natural resource mined or to be mined. Industries include companies that develop the mine site, extract the natural resources and those that prepare the mineral mined. Mining is the second-most important and ancient effort of humanity after agriculture. The two industries are ranked as the primary industries of early civilization. Mining is the foremost source of mineral commodities, and all countries find it essential for maintaining and improving their standard of living. In recent years, automated mining has gained importance due to better awareness of the application of advanced technology. Previously, mining activities involved a lot of manual work that posed a risk to personnel who were working in a dangerous environment. A proportion of human resources are required for achieving higher productivity, which involves providing safety equipment and high remuneration that increases the overall production cost. To avoid such high costs and risks to personnel, many companies are implementing automation in their mining processes.The demand for more efficient and economical mining operations is the key driver propelling the growth of the industry. Mining software solutions are being adopted by governments and mining firms to boost productivity, increase safety and lessen environmental impact. Mining software shines in the optimization of mine design, planning, processing of minerals, safety management, and environmental management for mining firms. To enhancemining operations, these solutions are progressively utilizing cutting-edge technologies like automation, artificial intelligence, and blockchain. By enabling the creation of smart nines the integration of these technologies is anticipated to transform the mining sector.To know about the Research Methodology :- Request Free Sample Report

Mine-Site Technology Adoption Market Dynamics:

Mine-Site Technology Adoption Market Drivers:

Rising Focus on Reducing Operating Cost

Constantly fluctuating commodity prices in recent years have put additional pressure on the profit margins of mining companies. Increasing expenses on exploration activities and the need to carry out non-stop production to meet global energy demands have encouraged mining companies to embrace innovative technologies. To maximize productivity gains, companies are directing their investment towards advanced automation technologies, such as AHS for driverless trucks, automated drilling systems (ADS), and real-time monitoring of assets. By using advanced automation technologies for mining, companies are witnessing a significant fall in their operating costs. Thus, mining companies are focusing on deploying automation to reduce operating costs, which will accelerate market growth over the course of the forecast period.Reducing Risks to the Health and Safety of Workers

Some mining operations can take place in extreme environments and distant locations McKinsey and Company. Moving operators to the mine face whether by flying them in, moving them underground, or from shaft to face is time-consuming, expensive, and can be dangerous for workers’ health and safety. Therefore, any technology that can minimize the presence of workers at complex and deep mining operations or remote locations will contribute to improving their safety conditions and hence reduce risks of accidents and lossesa critical concern for mining companies and workers alike.Mine-Site Technology Adoption Market Restraint:

High Initial and Maintenance Costs

The high expenses of purchasing and maintaining automated equipment and solutions can hinder market growth. Aside from the high cost, the necessity for more experienced employees to handle automated systems and sufficient training for automotive engineers can increase the overall cost. Furthermore, even after buying automated equipment, many machines require extensive maintenance. Such factors can adversely impact market expansion, which is projected to impede the fog computing market's growth.Market Opportunity:

Evolution of smart connected mines

Connected mining refers to the application of technology to achieve better productivity and safety as well as reduce operational costs for a mine site. Thus, connected mining, a combination of IT, automation, and instrumentation technologies, is a result of the advancements in the existing technologies present in the mining Deployment. This integrated operations technology makes the process of mine surveying, planning, exploration, extraction, and analysis faster and easier with software providing real-time information, thereby providing a realistic image of the mine environment and the availability of resources.Competitive Landscape:

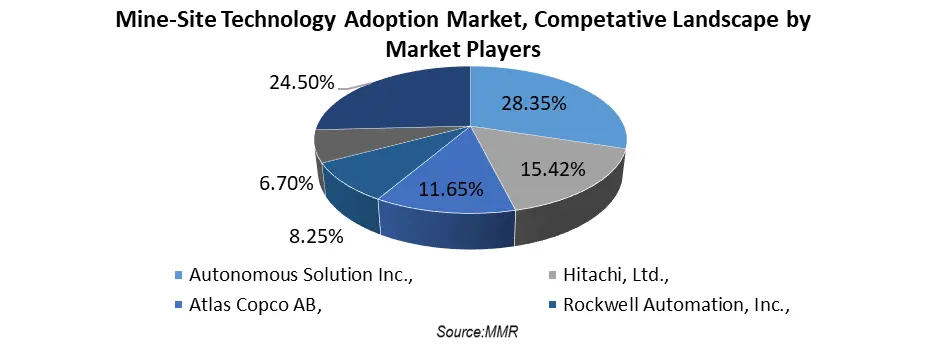

Smart mining technologies market players are focused on expanding their product portfolios by adding new and advanced services and technologies. Retailers in the market are also focusing on mergers, acquisitions, and collaborations to gain a competitive edge in the market. The Mine-Site Technology Adoption Market included key players Atlas Copco AB, Autonomous Solution Inc., Caterpillar, Epiroc AB, Hexagon AB, Hitachi, Ltd., Komatsu Ltd., Liebherr Group, MST (Mine Site Technologies), Rio Tinto, Rockwell Automation, Inc., RPM Global Holdings Ltd., Sandvik AB, SANY Group, Siemens and Trimble Inc. May 23, 2023: Atlas Copco has acquired Maziak Compressor Services Ltd., a UK distributor of air compressors, nitrogen generators, and process cooling equipment as well as related services and support. May 17, 2023 – Hitachi Astemo, Ltd. ("Hitachi Astemo") has developed an autonomous driving technology that helps to safely and smoothly pass by oncoming vehicles on narrow roads and other situations by utilizing 3D sensing results of the surrounding vehicle environment. Hitachi Astemo aims to strengthen its cost competitiveness through the use of 3D sensing data obtained from new stereo cameras with improved cost benefits.

Mine-Site Technology Adoption Market Segment Analysis:

By Mining Type, the Surface mining holds the largest market share in the Global Mine-Site Technology Adoption Market. According to MMR analysis, the segment is further expected to grow at a CAGR of 14.6 % during the forecast period. This dominance is primarily driven by the operational accessibility and scalability that surface mining offers, allowing for smoother integration of advanced equipment such as autonomous haul trucks, excavators, and drilling systems. The open environment of surface mines enhances visibility and safety, making it ideal for deploying GPS tracking Device systems, drone-based mapping, and real-time monitoring technologies. In contrast, underground mining operations often face complex conditions such as limited space, higher safety risks, and ventilation requirements, which slow down technology adoption and increase deployment costs.The market impact of this trend is significant. The high adoption rate of digital and automated technologies in surface mining is accelerating operational efficiency, productivity, and cost reduction for major mining companies. This has also attracted investments in digital mining infrastructure, especially in regions like Australia, South America, and Africa, where large-scale open-pit operations are prevalent. Surface mining is not only shaping the direction of technological innovation but also influencing the strategic decisions of equipment manufacturers, software providers, and mining operators seeking to remain competitive in an increasingly automated mining landscape.

Mine-Site Technology Adoption Market Regional Analysis:

North America has dominated the Mine site technology Adoption Market segment during the forecast period 2025-2032. North America has been a prominent Application in the mining automation market, exhibiting significant growth and adoption of automation technologies in the mining Deployment. The Application is known for its strong technological capabilities and innovation. The Application is home to several leading automation technology providers, research institutions, and mining companies focused on developing and implementing cutting-edge automation solutions in mining operations. Moreover, North America has a substantial mining Deployment, encompassing various minerals, including coal, gold, copper, and iron ore. The Application's rich mineral resources and the demand for these minerals drive the need for efficient and productive mining operations, making it an ideal market for automation technologies, and are also expected to fuel market growth in North America over the forecast period.Mine-Site Technology Adoption Market Scope: Inquire before buying

Mine-Site Technology Adoption Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 14.3 Billion Forecast Period 2025 to 2032 CAGR: 14.5 % Market Size in 2032: USD 42.25 Billion Segments Covered: by Component Solution Services by Deployment Mode Cloud On-premise by Mining Type Surface mining Underground mining by Technology Mine Management Software Predictive Maintenance Drones Autonomous Vehicles Collision Avoidance Others by Application Exploration Processing and Refining Transportation Others Mine-Site Technology Adoption Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)• South America (Brazil, Argentina Rest of South America)Mine-Site Technology Adoption Market Key Players:

Key players in the mine-site technology adoption market are major mining technology and equipment providers. These companies are focusing on integrating advanced technologies like automation, real-time analytics, and remote monitoring. Strategies include expanding their technological portfolios, forming strategic partnerships, and pursuing acquisitions to enhance operational safety and efficiency in mining operations. 1. Anglo American 2. TerraTech Innovations 3. American Mining Systems 4. Sino Mine Automation 5. Advantech Mining Solutions 6. Deutsche Mining Tech 7. BHP 8. Rio Tinto 9. Vale S.A. 10. Glencore 11. Newmont Corporation 12. ArcelorMittal 13. Hindalco Industries 14. Freeport-McMoRan 15. Caterpillar 16. China Minmetals 17. Veracio 18. m4mining 19. Ceibo 20. KMO-Fleet 21. NextAV 22. Seeq 23. Skycatch 24. Celonis 25. Lithium Americas Corp 26. Robex Resources Inc 27. Others Frequently Asked Questions: 1] What segments are covered in the Market report? Ans. The segments covered in the Mine-Site Technology Adoption Market report are based on Components, Deployment Modes, Mining Types, Technology and Applications. 2] Which Application is expected to hold the highest share in the Market? Ans. The North America Application is expected to hold the highest share of the Mine-Site Technology Adoption Market. 3] What is the market size of the Market by 2032? Ans. The market size of the Mine-Site Technology Adoption Market by 2032 is expected to reach USD 42.25 Bn. 4] What is the forecast period for the Market? Ans. The forecast period for the Mine-Site Technology Adoption Market is 2025-2032. 5] What was the market size of the Market in 2024? Ans. The market size of the Mine-Site Technology Adoption Market in 2024 was valued at USD 14.3 Bn.

1. Mine-Site Technology Adoption Market: Market Introduction 1.1. Executive Summary 1.2. Market Size (2024) & Forecast (2025-2032) 1.3. Market Size (Value USD) and Market Share (%) - By Segments, Regions and Country 2. Mine-Site Technology Adoption Market Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Top Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. Technology Integration 2.3.5. Profit Margin (%) 2.3.6. Revenue (2024) 2.3.7. Market Share (%) 2024 2.3.8. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Mine-Site Technology Adoption Market Dynamics 3.1. Mine-Site Technology Adoption Market Trends 3.2. Mine-Site Technology Adoption Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Global Industry 4. Technological Innovation and Advancement 4.1. Automation and Robotics in Mining Operations 4.2. Industrial Internet of Things (IIoT) and Smart Sensors 4.3. Artificial Intelligence (AI) and Machine Learning (ML) 4.4. Predictive Maintenance and Condition Monitoring 4.5. Remote Operations and Control Centers 4.6. Blockchain for Supply Chain Transparency 4.7. Drone Technology for Surveying and Mapping 5. Role and Impact of Technology in Mining 5.1. Enhancing Productivity and Efficiency 5.2. Improving Worker Safety and Health 5.3. Reducing Operational Costs 5.4. Supporting Environmental Compliance and ESG Goals 5.5. Enabling Predictive and Preventive Maintenance 5.6. Increasing Resource Recovery Rates 5.7. Minimizing Equipment Downtime 6. Adoption Barriers and Risk Assessment 6.1. Key Adoption Barriers 6.1.1. Capital Cost Constraints 6.1.2. Integration with Legacy Infrastructure 6.1.3. Workforce Skill Gaps 6.1.4. Connectivity and Infrastructure Limitations 6.1.5. Cybersecurity and Data Risks 6.1.6. Regulatory and Cultural Resistance 6.2. Risk Assessment Matrix 6.2.1. Financial Risk 6.2.2. Operational Disruption 6.2.3. Technology Obsolescence 6.2.4. Cyber Threat Exposure 6.2.5. Vendor Lock-In 7. Regulatory Landscape, By Region 7.1. Overview of Global Mining Regulations 7.2. Regional Compliance Frameworks 7.3. Government Initiatives Promoting Digital Mining 7.4. Mining Permit and Licensing Standards 7.5. ESG (Environmental, Social, Governance) Compliance Requirements 8. Mine-Site Technology Adoption Market: Global Mine-Site Technology Adoption Market Size and Forecast by Segmentation (by Value in USD) (2024-2032) 8.1. Global Mine-Site Technology Adoption Market Size and Forecast, by Component 8.1.1. Solution 8.1.2. Service 8.2. Global Mine-Site Technology Adoption Market Size and Forecast, by Deployment Mode 8.2.1. Cloud 8.2.2. On-premise 8.3. Global Mine-Site Technology Adoption Market Size and Forecast, by Mining Type 8.3.1. Surface mining 8.3.2. Underground mining 8.4. Global Mine-Site Technology Adoption Market Size and Forecast, by Technology 8.4.1. Mine Management Software 8.4.2. Predictive Maintenance 8.4.3. Drones 8.4.4. Autonomous Vehicles 8.4.5. Collision Avoidance 8.4.6. Others 8.5. Global Mine-Site Technology Adoption Market Size and Forecast, by Application 8.5.1. Exploration 8.5.2. Processing and Refining 8.5.3. Transportation 8.5.4. Others 8.6. Global Mine-Site Technology Adoption Market Size and Forecast, by region 8.6.1. North America 8.6.2. Europe 8.6.3. Asia Pacific 8.6.4. Middle East and Africa 8.6.5. South America 9. North America Mine-Site Technology Adoption Market Size and Forecast by Segmentation (by Value in USD) (2024-2032) 9.1. North America Market Size and Forecast, by Component 9.2. North America Market Size and Forecast, by Deployment Mode 9.3. North America Market Size and Forecast, by Mining Type 9.4. North America Market Size and Forecast, by Technology 9.5. North America Market Size and Forecast, by Application 9.6. North America Market Size and Forecast, by Country 9.6.1. United States 9.6.1.1. United States Market Size and Forecast, by Component 9.6.1.2. United States Market Size and Forecast, by Deployment Mode 9.6.1.3. United States Market Size and Forecast, by Mining Type 9.6.1.4. United States Market Size and Forecast, by Technology 9.6.1.5. United States Market Size and Forecast, by Application 9.6.2. Canada 9.6.3. Mexico 10. Europe Mine-Site Technology Adoption Market Size and Forecast by Segmentation (by Value in USD) (2024-2032) 10.1. Europe Market Size and Forecast, by Type 10.2. Europe Market Size and Forecast, by Deployment Mode 10.3. Europe Market Size and Forecast, by Mining Type 10.4. Europe Market Size and Forecast, by Technology 10.5. Europe Market Size and Forecast, by Application 10.6. Europe Market Size and Forecast, by Country 10.6.1. United Kingdome 10.6.2. France 10.6.3. Germany 10.6.4. Italy 10.6.5. Spain 10.6.6. Sweden 10.6.7. Russia 10.6.8. Rest of Europe 11. Asia Pacific Mine-Site Technology Adoption Market Size and Forecast by Segmentation (by Value in USD) (2024-2032) 11.1. Asia Pacific Market Size and Forecast, by Component 11.2. Asia Pacific Market Size and Forecast, by Deployment Mode 11.3. Asia Pacific Market Size and Forecast, by Mining Type 11.4. Asia Pacific Market Size and Forecast, by Technology 11.5. Asia Pacific Market Size and Forecast, by Application 11.6. Asia Pacific Market Size and Forecast, by Country 11.6.1. China 11.6.2. S Korea 11.6.3. Japan 11.6.4. India 11.6.5. Australia 11.6.6. Indonesia 11.6.7. Malaysia 11.6.8. Philippines 11.6.9. Thailand 11.6.10. Vietnam 11.6.11. Rest of Asia Pacific 12. Middle East and Africa Mine-Site Technology Adoption Market Size and Forecast by Segmentation (by Value in USD) (2024-2032) 12.1. Middle East and Africa Market Size and Forecast, by Component 12.2. Middle East and Africa Market Size and Forecast, by Deployment Mode 12.3. Middle East and Africa Market Size and Forecast, by Mining Type 12.4. Middle East and Africa Market Size and Forecast, by Technology 12.5. Middle East and Africa Market Size and Forecast, by Application 12.6. Middle East and Africa Market Size and Forecast, by Country 12.6.1. South Africa 12.6.2. GCC 12.6.3. Egypt 12.6.4. Nigeria 12.6.5. Rest of ME&A 13. South America Mine-Site Technology Adoption Market Size and Forecast by Segmentation (by Value in USD) (2024-2032) 13.1. South America Market Size and Forecast, by Component 13.2. South America Market Size and Forecast, by Deployment Mode 13.3. South America Market Size and Forecast, by Mining Type 13.4. South America Market Size and Forecast, by Technology 13.5. South America Market Size and Forecast, by Application 13.6. South America Market Size and Forecast, by Country 13.6.1. Brazil 13.6.2. Argentina 13.6.3. Colombia 13.6.4. Chile 13.6.5. Rest Of South America 14. Company Profile: Key Players 14.1. Anglo American 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Recent Developments 14.2. TerraTech Innovations 14.3. American Mining Systems 14.4. Sino Mine Automation 14.5. Advantech Mining Solutions 14.6. Deutsche Mining Tech 14.7. BHP 14.8. Rio Tinto 14.9. Vale S.A. 14.10. Glencore 14.11. Newmont Corporation 14.12. ArcelorMittal 14.13. Hindalco Industries 14.14. Freeport-McMoRan 14.15. Caterpillar 14.16. China Minmetals 14.17. Veracio 14.18. m4mining 14.19. Ceibo 14.20. KMO-Fleet 14.21. NextAV 14.22. Seeq 14.23. Skycatch 14.24. Celonis 14.25. Lithium Americas Corp 14.26. Robex Resources Inc 14.27. Others 15. Key Findings 16. Analyst Recommendations 17. Research Methodology