The Military Parachute Market size was valued at USD 1431.2 Million in 2022 and is expected to grow by 6.17% from 2023 to 2029, reaching nearly USD 2176.39 Million. A parachute is a tool that uses drag to slow down an object's speed as it falls through the air. It comprises of a canopy made of fabric from which the subject or object is hung. The parachute pilot can fly under a structured "wing" made by the parachute as it overcomes air resistance by shoving air in front of it. Militaries have employed military parachutes to transport troops and supplies into battle. Large military planes frequently use parachutes to drop supplies and cargo over distant military locations. In general, the military uses a variety of parachutes, including square parachutes, ram-air parachutes, and round parachutes. With the defense industry being the primary end-use industry in the market, it is expected that the majority of the sales of military parachutes would be driven by their use in a range of military activities. Additionally, there has been an increase in the use of UAVs for ISR operations, which has been made possible by the growing use of parachutes in processes like recreation. Future growth in military parachute sales is also expected to be fueled by an increase in international conflicts. Technical innovations like the use of lightweight material, followed by the incorporation of GPS systems, drogue chutes, and recovery parachutes, are expected to assist the military parachute market growth across the globe.To know about the Research Methodology :- Request Free Sample Report

Military Parachute Market Market Report Scope:

The report provides an exhaustive analysis of major investment regions, top winning strategies, drivers and opportunities, market size and estimates, competitive landscape, and growing market trends. The market analysis provides information that may be used by market leaders, new entrants, investors, and shareholders to develop long-term plans and strengthen their market positions. The market for the military parachute is analyzed worldwide by Product type, Application, and geographic region. The report uses the tabular and graphical format to provide a thorough examination of segments and their sub-segments. The segmentation can help investors and market participants create strategies based on the top revenue-generating and fastest-growing groups identified in the research. The report examines important market trends for military parachute sales as well as organic and inorganic growth strategies. Many businesses are putting an emphasis on organic growth initiatives, including new launches, product approvals, and others like patents and events. Acquisitions, partnerships, and collaborations were examples of inorganic growth tactics that were observed in the market. These steps have made it possible for market participants to increase their clientele and revenue. With the increasing demand for the military parachute in the worldwide industry, market players in the military parachute market are projected to have attractive growth prospects in the future. Along with their SWOT analyses and market strategies, the profiles of important companies in the military parachute market are also included in the report. The report also focuses on the top companies in the market and provides details on them, including company profiles, products, and services supplied, financial data from the last three years, and significant advancements from the previous five years.Military Parachute Market Dynamics:

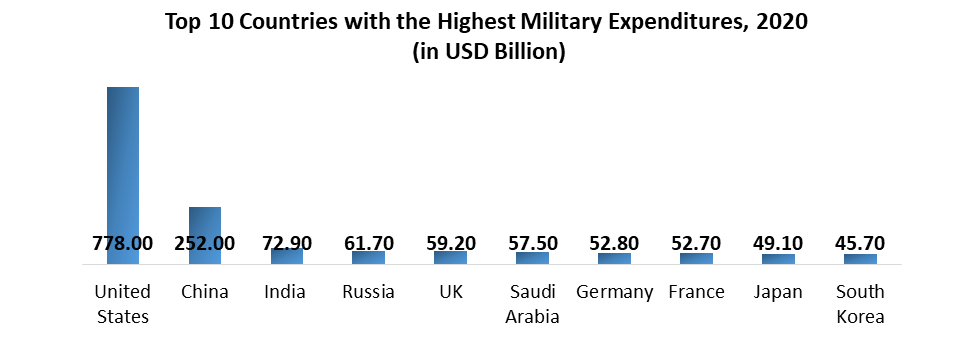

Increasing uses of Parachutes in Military Applications to drive Military Parachute Market Militaries across the world are using military parachutes to drop troops and supplies onto the field of battle. They are utilized more and more frequently in various conflict areas, especially by special forces from wealthy nations. The mechanism of operation of parachutes has also been modified thanks to advances in airborne technology, making them safer and more dependable for military parachutists. Over time, manufacturers have come to accept the idea of safely landing aviators. The UAV parachute recovery technology has also helped the military parachute industry in several non-military sectors. The main use areas are cargo, sports, rescue, recovery, and break chutes, to name a few. For instance, as part of its "Prime Air Programme" program, the e-commerce giant Amazon introduced its new drone in January 2019. The efficient growth of the company's distribution network is the goal of this drone's design. Therefore, it is expected that the military parachute market would be driven by the rise in demand for UAV parachutes in military applications. Rising Territorial Conflicts and Terrorism across the World driving the Military Parachute Market Growth Territorial disputes have been the main cause of war, especially when two governments disagree over specific areas of territory. These conflicts are brought on by a variety of factors, such as competing for limited natural resources, normative issues, and economic and political concerns. Additionally, as terrorists' strength has grown in recent years, terrorist events have dramatically increased. For instance, downtown Baghdad was the target of a devastating double suicide bombing in January 2022. Additionally, the government across the world are spending more funds in the defense sector to overcome rising terrorism and territorial conflict issues. For instance, the U.S. Army and Mills Manufacturing Corp. inked a $249 million deal in July 2019 to deploy human parachute systems for modern warfare scenarios. Additionally, the market for military parachutes is expected to grow globally due to governments' growing security concerns as a result of the escalating territorial wars. These factors are driving the military parachute market growth across the world. Government Regulations and Declining Defense Expenditure to Impact the Military Parachute Market Growth Government regulations restricting the use of military resources for purposes other than defense have made the market for military parachutes less competitive. Additionally, the military parachute market share is expected to be constrained by things like declining defense spending, procedures related to parachute inventory overstocking inside the defense sector's facilities, and stringent regulatory procedures.

Military Parachute Market Segment Analysis:

By Product Type, the Military Parachute Market is segmented into Round type Parachute, Cruciform Parachute, Ribbon and ring/ Annular, and Ram air parachute. The Round type Parachute segment accounted for the largest market share in 2022. Military ejection seats, cargo, and drogue chutes primarily use round parachutes. Additionally, the convenience and cost factor of round type parachute are driving the segment growth. The ram-air parachute segment is expected to expand at the quickest CAGR over the forecast period. In North America, Airborne Systems is a significant producer of ram-air parachutes and is expected to rule the industry.By Application, the Military Parachute Market is segmented into Personnel Parachutes and Cargo Parachutes. The Personnel parachutes segment held the largest market share accounting in 2022. This segment covers a wide range of military activities, including challenging special operations. As a result, it is expected that throughout the forecast years, the personal parachute category would grow at a significant CAGR, followed by the cargo segment.

Military Parachute Market Regional Insights:

North America held the largest market share of the global Military Parachute Market in 2022. Several significant parachute manufacturers may be found in North America, including Airborne Systems, BAE System Plc, and Mills Manufacturing. In addition, the region is the base of operations for a number of important Military Parachute producers, including Spekon, Ballenger International, Safran SA, Butler Parachute Systems Group, Aerodyne Research, LLC, and others. The availability of technologically advanced military parachutes is expected to propel sales growth in North America due to the presence of major players in the region. Europe is expected to grow at a significant growth rate through the forecast period. During the forecast period, it is expected that significant players and research and development initiatives would generate higher profits. The European market is expected to grow at a moderate rate in the near future as a result of increased investment in parachute manufacturing enterprises in this region.Military Parachute Market Scope: Inquiry Before Buying

Military Parachute Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 1431.2 Mn. Forecast Period 2023 to 2029 CAGR: 6.17% Market Size in 2029: US $ 2176.39 Mn. Segments Covered: by Product Type 1. Round-type Parachute 2. Cruciform Parachute 3. Ribbon and ring/ Annular 4. Ram air parachute by Application 1. Personnel Parachutes 2. Cargo Parachutes by Components 1. Canopy 2. Cords 3. Tapes/ Webbings 4. Metal by End User 1. Military 2. Sports 3. Rescue 4. Recovery 5. Break Chutes Military Parachute Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Military Parachute Market, Key Players are

1. CIMSA Ingenieria 2. Cirrus Aircraft 3. Global SDN BHD 4. Mills Manufacturing 5. Safran SA, 6. SPEKON Company 7. VITAL Parachute 8. Aerodyne Research, LLC 9. Airborne systems, Inc. 10. Atair Aerospace 11. Avic Hongguang Airborne Equipment 12. BAE System Plc 13. Ballenger International 14. Butler parachute systems 15. Zodiac Aeospace FAQs: 1. What was the global market size of the Military Parachute Market in 2022? Ans. The Global Military Parachute Market size was valued at USD 1431.2 Million. 2. What is the study period for the Military Parachute Market? Ans. 2017-2029 is the study period for the Military Parachute Market. 3. What is the growth rate of the Market? Ans. The Military Parachute Market is growing at a CAGR of 6.17% over forecast the period. 4. What are the major key players in the Global Market? Ans. The major key players in the Global Market are CIMSA Ingenieria, Cirrus Aircraft, Global SDN BHD, Mills Manufacturing, Safran SA, SPEKON Company, Avic Hongguang Airborne Equipment, and BAE System Plc 5. What is the forecast period for the Market? Ans. The forecast period for the Market is 2023-2029.

1. Global Military Parachute Market: Research Methodology 2. Global Military Parachute Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Military Parachute Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Military Parachute Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Military Parachute Market Segmentation 4.1 Global Military Parachute Market, by Product Type (2022-2029) • Round-type Parachute • Cruciform Parachute • Ribbon and ring/ Annular • Ram air parachute 4.2 Global Military Parachute Market, by Application (2022-2029) • Personnel Parachutes • Cargo Parachutes 4.3 Global Military Parachute Market, by Components (2022-2029) • Canopy • Cords • Tapes/ Webbings • Metal 4.4 Global Military Parachute Market, by End User (2022-2029) • Military • Sports • Rescue • Recovery • Break Chutes 5. North America Military Parachute Market(2022-2029) 5.1 North America Military Parachute Market, by Product Type (2022-2029) • Round-type Parachute • Cruciform Parachute • Ribbon and ring/ Annular • Ram air parachute 5.2 North America Military Parachute Market, by Application (2022-2029) • Personnel Parachutes • Cargo Parachutes 5.3 North America Military Parachute Market, by Components (2022-2029) • Canopy • Cords • Tapes/ Webbings • Metal 5.4 North America Military Parachute Market, by End User (2022-2029) • Military • Sports • Rescue • Recovery • Break Chutes 5.5 North America Military Parachute Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Military Parachute Market (2022-2029) 6.1. European Military Parachute Market, by Product Type (2022-2029) 6.2. European Military Parachute Market, by Application (2022-2029) 6.3. European Military Parachute Market, by Components (2022-2029) 6.4. European Military Parachute Market, by End User (2022-2029) 6.5. European Military Parachute Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Military Parachute Market (2022-2029) 7.1. Asia Pacific Military Parachute Market, by Product Type (2022-2029) 7.2. Asia Pacific Military Parachute Market, by Application (2022-2029) 7.3. Asia Pacific Military Parachute Market, by Components (2022-2029) 7.4. Asia Pacific Military Parachute Market, by End User (2022-2029) 7.5. Asia Pacific Military Parachute Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Military Parachute Market (2022-2029) 8.1 Middle East and Africa Military Parachute Market, by Product Type (2022-2029) 8.2. Middle East and Africa Military Parachute Market, by Application (2022-2029) 8.3. Middle East and Africa Military Parachute Market, by Components (2022-2029) 8.4. Middle East and Africa Military Parachute Market, by End User (2022-2029) 8.5. Middle East and Africa Military Parachute Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Military Parachute Market (2022-2029) 9.1. South America Military Parachute Market, by Product Type (2022-2029) 9.2. South America Military Parachute Market, by Application (2022-2029) 9.3. South America Military Parachute Market, by Components (2022-2029) 9.4. South America Military Parachute Market, by End User (2022-2029) 9.5. South America Military Parachute Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 CIMSA Ingenieria 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Cirrus Aircraft 10.3 Global SDN BHD 10.4 Mills Manufacturing 10.5 Safran SA, 10.6 SPEKON Company 10.7 VITAL Parachute 10.8 Aerodyne Research, LLC 10.9 Airborne systems, Inc. 10.10 Atair Aerospace 10.11 Avic Hongguang Airborne Equipment 10.12 BAE System Plc 10.13 Ballenger International 10.14 Butler parachute systems 10.15 Zodiac Aeospace