In 2023, the Military Electro-optical and Infrared Systems Market showed strong performance, reaching a value of USD 7.5 billion. Looking ahead, there's an expected 4.1% increase in revenue from 2024 to 2030, expected to reach USD 9.94 billion. This growth presents an appealing opportunity for investors and stakeholders in the Military Electro-optical and Infrared Systems industry.Military Electro-optical and Infrared Systems Market: Overview

Electro-optic infrared (EO/IR) systems are a type of sensor technology that uses a combination of optics and electronics to detect, track, and identify objects and targets in the infrared spectrum. EO/IR systems are used for a variety of purposes, including target acquisition, tracking, and identification. Therefore, it is widely used in the military. The military electro-optical and infrared system enables the soldier to have enhanced vision and work during low light or dark conditions. Electro-optical and Infrared systems comprise devices and components designed to interact between the optical and the electronic state. The Military Electro-optical and Infrared Systems market is primarily driven by the long-range imaging capabilities and image stabilization features of EO/IR systems, crucial for target identification, tracking, and threat assessment across airborne homeland security, combat, patrol, surveillance, reconnaissance, and search and rescue missions. FLIR stands out as a leader in EO/IR technology development, providing to professionals in safeguarding lives and assets. The growing global demand for these systems is growing to enhance national security concerns, with countries allocating significant portions of defense budgets to acquire EO/IR-equipped platforms. Increasing military expenditures, ongoing R&D in advanced infrared imaging technologies, and the pursuit of high-resolution sensors to enhance situational awareness contribute to the positive outlook for the Military Electro-Optical and Infrared Systems Market.To know about the Research Methodology :- Request Free Sample Report Military Electro-optical and Infrared Systems Market: Trends

In the Military Electro-optical and Infrared (EO/IR) Systems Market, key trends include the integration of EO/IR systems with unmanned platforms for enhanced surveillance, continuous advancements in sensor technologies to improve image quality and target identification, a focus on reducing size, weight, and power consumption for airborne applications, the integration of multiple sensors for comprehensive situational awareness, enhanced connectivity for network-centric warfare, heightened attention to cybersecurity, the exploration of hyperspectral and multispectral imaging technologies, and increased global partnerships for technology transfer. These trends collectively underscore the industry's commitment to innovation, interoperability, and addressing evolving defense needs in a rapidly changing landscape. Military Electro-optical and Infrared Systems Market: Dynamics Elevated Threat Landscape and Growing National Security Priorities Drive the market growth Modern conflicts rely more on advanced EO/IR systems. These systems emphasize surveillance and reconnaissance capabilities. They address the evolving complexities of warfare scenarios/IR technology enhances situational awareness and threat detection. Nations prioritize investments in innovative EO/IR solutions. Governments align defense strategies with emerging technologies. The demand for airborne EO/IR systems rises due to global conflicts. Ambitious programs for stealth fighter aircraft drive the need for advanced sensors. Companies collaborate to develop innovative EO/IR solutions. Continuous security challenges boost the Military Electro-optical and Infrared Systems Market growth in this sector. These technologies enhance situational awareness, night vision, and threat detection, addressing the complexities of contemporary warfare scenarios. Nations are recognizing the critical importance of these systems and are increasingly investing in innovative EO/IR solutions to stay ahead of evolving threats in the dynamic geopolitical landscape. This factor significantly boosts the Military Electro-optical and Infrared Systems Market Growth. Germany, Spain, France, and the United Kingdom, governments are prioritizing substantial investments to boost their defense capabilities, creating a burgeoning market for companies specializing in EO/IR technologies. The global increase in conflicts, terrorism, and border disputes particularly drives the demand for advanced airborne EO/IR systems. Which is significantly responsible for driving the growth of the Military Electro-optical and Infrared Systems Market. For instance, Globally, nations are launching ambitious programs to develop next-generation stealth fighter aircraft, necessitating state-of-the-art EO/IR sensors. Companies are actively responding to this demand by collaborating on the development of advanced EO/IR sensors. For example, the United States Air Force's partnership with Lockheed Martin and Collins Aerospace for the U2 Dragon Lady aircraft. Furthermore, the procurement and development of advanced aircraft, as demonstrated by India's acquisition of Mig-29 and Su-30 MKI aircraft, significantly contribute to the growing demand for EO/IR systems.

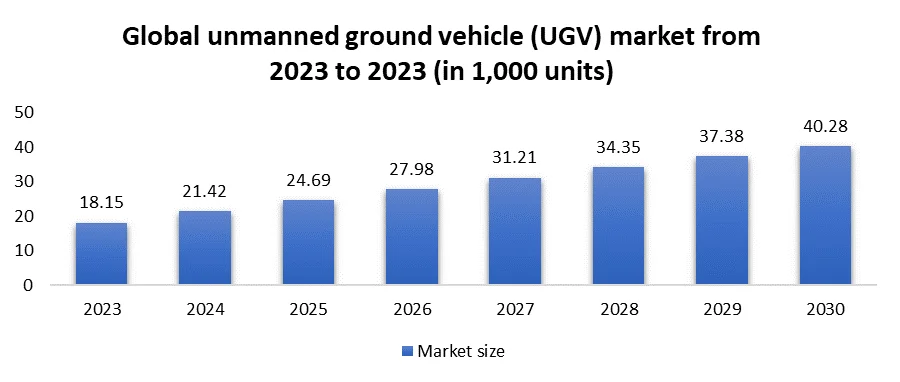

Stagnant product life cycle limits the market growth The Military Electro-optical and Infrared Systems Market faces growth limitations due to a stagnant product life cycle. These systems involve sophisticated technologies, and once developed, they may remain in service for extended periods without significant upgrades or replacements. The lack of innovation and evolution in these systems leads to technological obsolescence, rendering them less competitive and effective compared to emerging technologies. Stagnation in the product life cycle hampers Military Electro-optical and Infrared Systems market growth by discouraging investments in research and development. Companies are hesitant to allocate resources to enhance existing systems and develop new ones when the current offerings seem sufficient. This stagnancy limits the industry's ability to address evolving military threats and challenges as the systems become outdated and less adaptable to changing operational requirements. Also, a static product life cycle diminishes the Military Electro-optical and Infrared Systems Market appeal to potential buyers, as they seek cutting-edge solutions to stay ahead in modern warfare. To overcome these limitations, industry stakeholders must prioritize continuous innovation, research, and development to ensure that Military Electro-optical and Infrared Systems remain technologically advanced and capable of meeting evolving defense needs. Increasing demand from unmanned systems creates lucrative growth opportunities for market growth. Unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs) are important in modern military operations, necessitating advanced EO/IR systems for surveillance, reconnaissance, and targeting. These systems enable real-time data collection and analysis, enhancing situational awareness and mission effectiveness. As military forces globally prioritize the integration of unmanned systems into their arsenals, there is a high need for innovative EO/IR technologies tailored for these platforms. Companies offering innovative, lightweight, and high-performance EO/IR solutions capable of meeting the specific requirements of unmanned systems are poised for substantial Military Electro-optical and Infrared Systems Market growth. The evolving landscape of autonomous military capabilities positions EO/IR system providers at the forefront of addressing critical defense needs, ensuring a Strong and competitive market presence. The global unmanned vehicle market reached the size of some 15,000 units in 2023. It is expected that in 2030, the market will reach a size of over 40,000 units. The Growing market of unmanned vehicles has boosted the demand for Electro-optical and Infrared Systems. This factor significantly escalated the growth of the Military Electro-optical and Infrared Systems Market.

Military Electro-optical and Infrared Systems Market Segment Analysis:

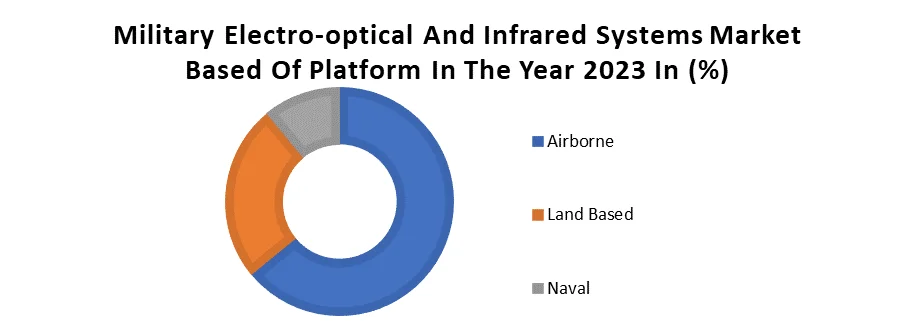

Based On Platform, The Airborne subsegment dominates the platform subsegment of Military Electro-optical and Infrared Systems Market in the year 2023. The dominance of the airborne subsegment in the Military Electro-optical and Infrared Systems (EO/IR) market stems from operational flexibility, strategic advantages, and technological advancements. Airborne platforms, such as aircraft and drones, offer rapid deployment, extensive coverage, and high vantage points for surveillance and reconnaissance. Their quick response capabilities, versatility across various military scenarios, and the ability to support tactical operations contribute to their preference. Additionally, advancements in aviation technology, especially in unmanned aerial vehicles (UAVs), enhance the effectiveness and efficiency of airborne EO/IR systems. This dominance is further underscored by the crucial role these systems play in providing intelligence, monitoring activities, and guiding precision-guided munitions. Overall, the airborne subsegment's adaptability and strategic value make it a prominent choice in modern military operations.

Military Electro-optical and Infrared Systems Market Regional Insights:

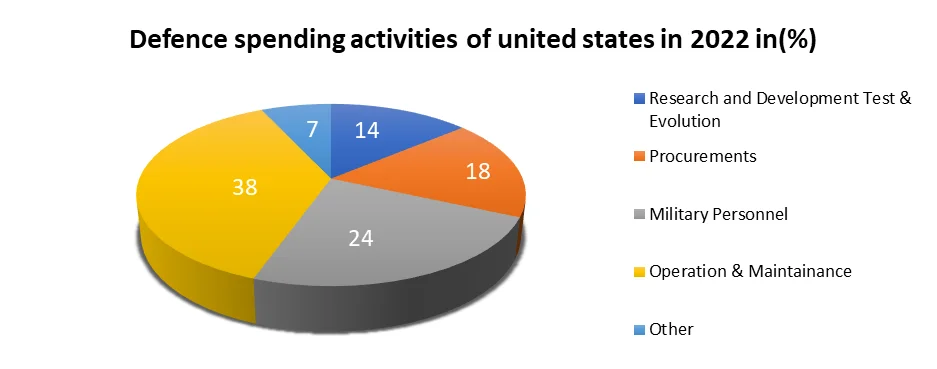

North America dominated the Military Electro-optical and Infrared Systems Market, and this regional stronghold is primarily attributed to the substantial demand from the United States armed forces for EO/IR systems. The evolving dynamics of modern warfare, marked by enhanced capabilities of adversaries, have compelled the United States to escalate its investments in technologically advanced weapon systems. The country's active involvement in global conflicts has further boostecan the procurement of advanced ISR (Intelligence, Surveillance, Reconnaissance) and related systems, substantially elevating the military's situational awareness. In 2023, U.S. defense spending accounted for nearly 40 percent of the world's military expenditures. This increase in defense spending, including a $71 billion rise from 2021 to 2023, was partly driven by military aid sent to support Ukraine in its ongoing conflict. As a result, the United States now surpasses the combined defense spending of the next 10 countries, underscoring its unparalleled commitment to defense expenditure. However, it is worth noting that the Congressional Budget Office foresees a decline in defense spending as a share of the Gross Domestic Product (GDP) over the next decade, from 3.1 percent in 2023 to 2.8 percent in 2033, which is significantly lower than the 50-year average of 4.3 percent of GDP.

Competitive Analysis: Military Electro-Optical and Infrared Systems Market

The Military Electro-Optical and Infrared Systems Market is competitive, characterized by continuous advancements and strategic collaborations. Established players and new entrants vie for market share, driving technological innovation and mutual growth. For Instance, Important advancements include Excelitas Technologies Corp.'s DRAGON-S12 Thermal Attachment Sniper Sight, featuring a 60Hz uncooled thermal sensor for exceptional sensitivity. In May 2022, Israel Aerospace Industries (IAI) secured a contract to supply MiniPOP EO/IR systems to the Philippine Navy, highlighting the market's responsiveness to defense needs. MiniPOP integrates four sensors into a single unit, exemplifying the trend toward integrated solutions. However, the industry faces design challenges, technological limitations, and supply chain risks. Global crises, such as the COVID-19 pandemic, underscore the need for resilience. To stay competitive, companies must prioritize addressing size, weight, and power (SWaP) constraints, particularly in airborne platforms will be pivotal for sustained growth in the dynamic Military Electro-Optical and Infrared Systems Market.Military Electro-optical and Infrared Systems Market Scope: Inquire Before Buying

Global Military Electro-optical and Infrared Systems Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2030 Market Size in 2023: US $ 7.5 Bn. Forecast Period 2024 to 2030 CAGR: 4.1% Market Size in 2030: US $9.94 Bn. Segments Covered: by Cooling Technology Cooled Uncooled by system Laser Targeting Imaging by Imaging Technology Scanning Starring Hyperspectral Multispectral by Application Military Intelligence Surveillance Reconnaissance by Platform Airborne Land Based Naval Military Electro-optical and Infrared Systems Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Military Electro-optical and Infrared Systems Market Key Players:

North America 1. Lockheed Martin Corporation 2. Raytheon Technologies Corporation 3. L3Harris Technologies, Inc. Europe 1. BAE Systems plc 2. Thales Group 3. Leonardo S.p.A Asia Pacific 1. Mitsubishi Electric Corporation 2. Hanwha Corporation 3. Bharat Electronics Limited Middle east and Africa 1. Israel Aerospace Industries (IAI) 2. Aselsan A.Ş. 3. Saudi Arabian Military Industries (SAMI) South America 1. Embraer Defense & Security 2. Tecnobit 3. COTI Frequently Asked Questions: 1] What segments are covered in the Global Military Electro-Optical and Infrared Systems Market report? Ans. The segments covered in the Market report are based on Cooling Technology, system, Imaging Technology, Application, Platform, and Regions. 2] Which region is expected to hold the highest share in the Global Military Electro-Optical and Infrared Systems Market? Ans. The North America region is expected to hold the highest share of the Market. 3] What is the market size of the Global Military Electro-Optical and Infrared Systems Market by 2030? Ans. The market size of the Market by 2030 is expected to reach US$ 9.94 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2024-2030. 5] What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at US$7.5 Bn.

1. Military Electro-optical and Infrared Systems Market: Research Methodology 2. Military Electro-optical and Infrared Systems Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Military Electro-optical and Infrared Systems Market: Dynamics 3.1. Military Electro-optical and Infrared Systems Market Trends by Region 3.2. Military Electro-optical and Infrared Systems Market Dynamics by Region 3.2.1. Military Electro-optical and Infrared Systems Market Drivers 3.2.2. Military Electro-optical and Infrared Systems Market Restraints 3.2.3. Military Electro-optical and Infrared Systems Market Opportunities 3.2.4. Military Electro-optical and Infrared Systems Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. Global 3.5.2. North America 3.5.3. Europe 3.5.4. Asia Pacific 3.5.5. Middle East and Africa 3.5.6. South America 3.6. Analysis of Government Schemes and Initiatives for Military Electro-optical and Infrared Systems Industry 3.7. The Global Pandemic Impact on Military Electro-optical and Infrared Systems Market 4. Military Electro-optical and Infrared Systems Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 4.1.1. Cooled 4.1.2. Uncooled 4.2. Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 4.2.1. Laser 4.2.2. Targeting 4.2.3. Imaging 4.3. Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 4.3.1. Scanning 4.3.2. Starring 4.3.3. Hyperspectral 4.3.4. Multispecral 4.4. Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 4.4.1. Military Intelligence 4.4.2. Surveillance 4.4.3. Reconnaissance 4.5. Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 4.5.1. Airborne 4.5.2. Land Based 4.5.3. Naval 4.6. Military Electro-optical and Infrared Systems Market Size and Forecast, by Region (2023-2030) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Military Electro-optical and Infrared Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 5.1.1. Cooled 5.1.2. Uncooled 5.2. North America Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 5.2.1. Laser 5.2.2. Targeting 5.2.3. Imaging 5.3. North America Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 5.3.1. Scanning 5.3.2. Starring 5.3.3. Hyperspectral 5.3.4. Multispecral 5.4. North America Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 5.4.1. Military Intelligence 5.4.2. Surveillance 5.4.3. Reconnaissance 5.5. North America Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 5.5.1. Airborne 5.5.2. Land Based 5.5.3. Naval 5.6. Military Electro-optical and Infrared Systems Market Size and Forecast, by Country (2023-2030) 5.6.1. United States 5.6.1.1. United States Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 5.6.1.1.1. Cooled 5.6.1.1.2. Uncooled 5.6.1.2. United States Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 5.6.1.2.1. Laser 5.6.1.2.2. Targeting 5.6.1.2.3. Imaging 5.6.1.3. United States Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 5.6.1.3.1. Scanning 5.6.1.3.2. Starring 5.6.1.3.3. Hyperspectral 5.6.1.3.4. Multispecral 5.6.1.4. Training United States Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 5.6.1.4.1. Military Intelligence 5.6.1.4.2. Surveillance 5.6.1.4.3. Reconnaissance 5.6.1.5. United States Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 5.6.1.5.1. Airborne 5.6.1.5.2. Land Based 5.6.1.5.3. Naval 5.6.2. Canada 5.6.2.1. Canada Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 5.6.2.1.1. Cooled 5.6.2.1.2. Uncooled 5.6.2.2. Canada Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 5.6.2.2.1. Laser 5.6.2.2.2. Targeting 5.6.2.2.3. Imaging 5.6.2.3. Canada Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 5.6.2.3.1. Scanning 5.6.2.3.2. Starring 5.6.2.3.3. Hyperspectral 5.6.2.3.4. Multispecral 5.6.2.4. Canada Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 5.6.2.4.1. Military Intelligence 5.6.2.4.2. Surveillance 5.6.2.4.3. Reconnaissance 5.6.2.5. Canada Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 5.6.2.5.1. Airborne 5.6.2.5.2. Land Based 5.6.2.5.3. Naval 5.6.3. Mexico 5.6.3.1. Mexico Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 5.6.3.1.1. Cooled 5.6.3.1.2. Uncooled 5.6.3.2. Mexico Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 5.6.3.2.1. Laser 5.6.3.2.2. Targeting 5.6.3.2.3. Imaging 5.6.3.3. Mexico Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 5.6.3.3.1. Scanning 5.6.3.3.2. Starring 5.6.3.3.3. Hyperspectral 5.6.3.3.4. Multispecral 5.6.3.4. Mexico Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 5.6.3.4.1. Military Intelligence 5.6.3.4.2. Surveillance 5.6.3.4.3. Reconnaissance 5.6.3.5. Mexico Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 5.6.3.5.1. Airborne 5.6.3.5.2. Land Based 5.6.3.5.3. Naval 6. Europe Military Electro-optical and Infrared Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.2. Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.3. Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.4. Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.5. Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 6.6. Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Country (2023-2030) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.6.1.2. United Kingdom Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.6.1.3. United Kingdom Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.6.1.4. United Kingdom Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.6.1.5. United Kingdom Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 6.6.2. France 6.6.2.1. France Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.6.2.2. France Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.6.2.3. France Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.6.2.4. France Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.6.2.5. France Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 6.6.3. Germany 6.6.3.1. Germany Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.6.3.2. Germany Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.6.3.3. Germany Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.6.3.4. Germany Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.6.3.5. Germany Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 6.6.4. Italy 6.6.4.1. Italy Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.6.4.2. Italy Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.6.4.3. Italy Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.6.4.4. Italy Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.6.4.5. Italy Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 6.6.5. Spain 6.6.5.1. Spain Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.6.5.2. Spain Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.6.5.3. Spain Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.6.5.4. Spain Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.6.5.5. Spain Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 6.6.6. Sweden 6.6.6.1. Sweden Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.6.6.2. Sweden Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.6.6.3. Sweden Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.6.6.4. Sweden Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.6.6.5. Sweden Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 6.6.7. Austria 6.6.7.1. Austria Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.6.7.2. Austria Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.6.7.3. Austria Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.6.7.4. Austria Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.6.7.5. Austria Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 6.6.8.2. Rest of Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 6.6.8.3. Rest of Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 6.6.8.4. Rest of Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 6.6.8.5. Rest of Europe Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7. Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.2. Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.3. Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.4. Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.5. Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7.6. Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Country (2023-2030) 7.6.1. China 7.6.1.1. China Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.1.2. China Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.1.3. China Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.1.4. China Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.1.5. China Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.1.6. China Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.2. S Korea 7.6.2.1. S Korea Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.2.2. S Korea Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.2.3. S Korea Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.2.4. S Korea Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.2.5. S Korea Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.3. Japan 7.6.3.1. Japan Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.3.2. Japan Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.3.3. Japan Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.3.4. Japan Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.6.3.5. Japan Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7.6.4. India 7.6.4.1. India Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.4.2. India Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.4.3. India Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.4.4. India Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.6.4.5. India Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7.6.5. Australia 7.6.5.1. Australia Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.5.2. Australia Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.5.3. Australia Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.5.4. Australia Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.6.5.5. Australia Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7.6.6. Indonesia 7.6.6.1. Indonesia Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.6.2. Indonesia Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.6.3. Indonesia Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.6.4. Indonesia Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.6.6.5. Indonesia Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7.6.7. Malaysia 7.6.7.1. Malaysia Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.7.2. Malaysia Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.7.3. Malaysia Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.7.4. Malaysia Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.6.7.5. Malaysia Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7.6.8. Vietnam 7.6.8.1. Vietnam Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.8.2. Vietnam Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.8.3. Vietnam Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.8.4. Vietnam Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.6.8.5. Vietnam Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7.6.9. Taiwan 7.6.9.1. Taiwan Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.9.2. Taiwan Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.9.3. Taiwan Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.9.4. Taiwan Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.6.9.5. Taiwan Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 7.6.10.2. Rest of Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 7.6.10.3. Rest of Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 7.6.10.4. Rest of Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 7.6.10.5. Rest of Asia Pacific Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 8. Middle East and Africa Military Electro-optical and Infrared Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 8.2. Middle East and Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 8.3. Middle East and Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 8.4. Middle East and Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 8.5. Middle East and Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 8.6. Middle East and Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Country (2023-2030) 8.6.1. South Africa 8.6.1.1. South Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 8.6.1.2. South Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 8.6.1.3. South Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 8.6.1.4. South Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 8.6.1.5. South Africa Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 8.6.2. GCC 8.6.2.1. GCC Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 8.6.2.2. GCC Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 8.6.2.3. GCC Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 8.6.2.4. GCC Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 8.6.2.5. GCC Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 8.6.3. Nigeria 8.6.3.1. Nigeria Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 8.6.3.2. Nigeria Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 8.6.3.3. Nigeria Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 8.6.3.4. Nigeria Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 8.6.3.5. Nigeria Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 8.6.4.2. Rest of ME&A Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 8.6.4.3. Rest of ME&A Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 8.6.4.4. Rest of ME&A Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 8.6.4.5. Rest of ME&A Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 9. South America Military Electro-optical and Infrared Systems Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 9.2. South America Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 9.3. South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 9.4. South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 9.5. South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 9.6. South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Country (2023-2030) 9.6.1. Brazil 9.6.1.1. Brazil Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 9.6.1.2. Brazil Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 9.6.1.3. Brazil Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 9.6.1.4. Brazil Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 9.6.1.5. Brazil Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 9.6.2. Argentina 9.6.2.1. Argentina Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 9.6.2.2. Argentina Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 9.6.2.3. Argentina Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 9.6.3.1. Argentina Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 9.6.3.2. Argentina Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 9.6.4. Rest Of South America 9.6.4.1. Rest Of South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Cooling Technology (2023-2030) 9.6.4.2. Rest Of South America Military Electro-optical and Infrared Systems Market Size and Forecast, by System (2023-2030) 9.6.4.3. Rest Of South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Imaging Technology (2023-2030) 9.6.4.4. Rest Of South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Application (2023-2030) 9.6.4.5. Rest Of South America Military Electro-optical and Infrared Systems Market Size and Forecast, by Platform (2023-2030) 10. Global Military Electro-optical and Infrared Systems Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Cooling Technology Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Military Electro-optical and Infrared Systems Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Lockheed Martin Corporation 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2 Raytheon Technologies Corporation 11.3 L3Harris Technologies, Inc. 11.4 BAE Systems plc 11.5 Thales Group 11.6 Leonardo S.p.A. 11.7 Mitsubishi Electric Corporation 11.8 Hanwha Corporation 11.9 Bharat Electronics Limited 11.10 Israel Aerospace Industries (IAI) 11.11 Aselsan A.Ş. 11.12 Saudi Arabian Military Industries (SAMI) 11.13 Embraer Defense & Security 11.14 Tecnobit 11.15 COTI 12. Key Findings 13. Industry Recommendations