The Metal Recycling Market size was valued at USD 69.07 Billion in 2024 and the total Metal Recycling revenue is expected to grow at a CAGR of 6.01% from 2025 to 2032, reaching nearly USD 110.18 Billion. The global metal recycling industry acts as an important segment in the circular economy, decreasing dependence on virgin metal extraction, decreasing carbon footprints, and promoting sustainability. The global market for Metal Recycling was valued at USD 69.07 Billion in 2024 and is expected to grow at a CAGR of 6.01% from 2025-2032 to a value of USD 110.18 Billion by the end of the decade. Increasing urbanization and industrialization, along with strict government regulations on waste reduction and efficient use of resources, are facilitating the growth of this market. Almost 70 of total recycled metals are ferrous metals (steel and iron), the remainder being non-ferrous metals (aluminum, copper, lead and zinc). The top contributors to metal recycling are China, the U.S., Germany, India and Japan, primarily due to their large industrial output and strict environmental regulations.With more than 700 million metric tons of scrap metal recycled every year, global metal consumption is booming, accounting for almost 40% of the world’s raw material needs. Recycled steel, which is the most significant example of secondary raw material, is consumed by steel industry, accounting 35–40% of worldwide steel production, or around 630 million tons steel, annually. Around 25% of the materials used in the manufacture of cars are from recycled metals in the automotive sector. With the infinite recyclability of aluminum, the aluminum recycling market is growing at a rapid pace and currently more than 75 percent of all aluminum ever produced is still being used. The electronics sector also has an important role in metal recycling with around 50 million tons of e-waste produced every year and large amounts of metals such as gold, silver, and palladium, which can be recovered. Metal prices are known for their volatility and affected by various factors such as supply chain breakdowns, geopolitical concerns, availability of raw materials and energy prices. Ferrous scrap prices traded between 300 and 500 dollars/ton in 2023, at the same time non-ferrous metals have even wider volatility with copper at around 8,500 dollars/ton and aluminum between 2,200 and 2,500 dollars/ton. Recycled (or secondary) metals usually cost 30–40% less than virgin metals, providing a cost-saving opportunity for sectors. But profits can be affected by issues such as scrap contamination, processing costs and expenses incurred to comply with regulations.

To know about the Research Methodology :- Request Free Sample Report Metal recycling market has high integration with construction, automotive, aerospace, packaging, and electronics sectors, and as the infrastructure development, and manufacturing activities are booming in the developing economies, they are also finding their way into it. The metal recycling sector is still strongest in Europe where about 56% of steel and 75% of aluminum demand are satisfied with secondary metals. More than 70 million metric tons of scrap metal are processed annually in the U.S., leading to over $27 billion in revenue for the recycling industry. With growing government investments in waste management infrastructure and circular economy efforts in Asia-Pacific particularly China and India, this region is anticipated to be the fastest growing during the forecast period.

As demand for sustainable materials is increasing and industries are gradually moving to low-carbon production, the metal recycling sector will grow further. To overcome some of the challenges such as new market/region lacking necessary infrastructure, raw material availability fluctuation and contamination issues, continuous development needs to be established. Industry breakthroughs in artificial intelligence-based sorting, automated disassembly with robotics, and supply chain transparency through blockchain are anticipated. Investors and stakeholders need to target regional policies, advances in automation of metal processing, and strategic partnerships with primary suppliers to gain growth multipliers in this domain.

Metal Recycling Market Dynamics:

The primary driver of market expansion is the rising demand for metals, which is being accompanied by a growing emphasis on resource conservation and greenhouse gas emission reduction. Recycling metal enables businesses to obtain raw materials without compromising the quality of the products they produce. The market is also influenced by the increased interest in recycling metals for energy savings and the growing awareness of the efficient use of natural resources. Additionally, the market for metal recycling is positively impacted by the development in environmental concerns, increase in investments, rise in awareness, and availability of awareness programmes for sustainable waste management techniques. The building and construction, packing, automotive, industrial machinery, and shipbuilding industries are just a few of the industries that employ metals. Global building activity expansion is anticipated to drive the growth of the market. Rapid urbanisation increases government and consumer investment on housing and infrastructure development, which has a substantial positive impact on the metal recycling business. The market for recycled metal is growing as a result of manufacturers' high acceptance of the method for getting raw materials to make completed items without altering their qualities and the existence of government-enforced laws and regulations. The automobile sector makes substantial use of metal. Engine components and a wide range of other auto parts, including hoods, mufflers, fundamental vehicle chassis for doors, and fuel tanks, are made of steel. As a result, it is anticipated that the market for metal recycling would grow. Metal production would require less energy and ore if most people recycled metal and metal products on a regular basis. This will result in a decrease in the actual cost of purchasing metal, which will enable you to save some money and fuel the growth of the metal recycling business. Raising public awareness of the diseases that air pollution causes, such as respiratory illnesses. When any industry creates a new metal product, they occasionally emit highly hazardous emissions into the air, increasing the harmful levels of air pollution in cities and maybe endangering your and other people' respiratory health. Due to the rapidly expanding public awareness of the advantages of using metal wastes, the industry for metal recycling seems to have a promising future. Key market trends in the metal recycling industry include worries about the depletion of rare earth metals as well as strict government laws and environmental protection standards. The economy and market actors are anticipated to gain a lot from metal recycling technologies.Metal Recycling Market Segment Analysis:

Based on the Metal Type, the market is segmented into ferrous metal and non-ferrous metal. Ferrous metal would dominate the market, with a high market share during the forecast period. Ferrous scrap metal accounts for the largest volume of metal scrapped worldwide, and ferrous metal is typically more resistant to rust and staining than non-ferrous metal. Based on the Scrap Type, the market is segmented into old scrap and new scrap. Old scrap is expected to dominate the market with a market share high during the forecast period for metal recycling. Old scrap is the most used Scrap type because reducing greenhouse gas emissions and using less energy than making metal. Based on Equipment, the metal recycling market is segmented into shredders, shears, granulating machines and briquetting machines.Shredders equipment would have dominance in the market with a market share high during the forecast period for metal recycling Market. Due to benefit of recycling reduces air pollution and environmental hazards. Shredded scrap is easier to manage and provides a dense mix when blended with other stock. The shredded scrap is automatically segregated into ferrous and non-ferrous materials.Metal Recycling Market Regional Insights:

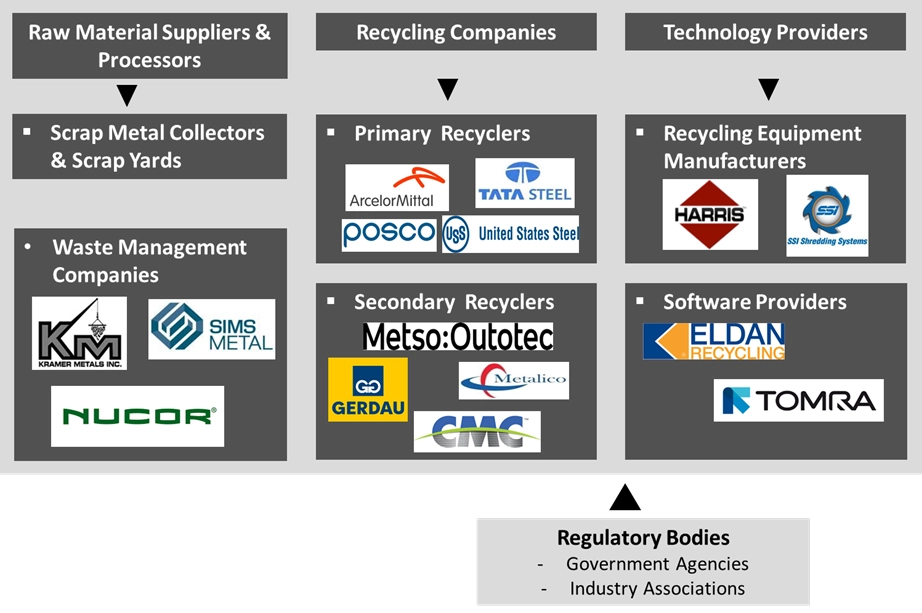

Asia pacific is anticipated to be the largest and fastest growing market and the growth is attributed to the increasing economic growth. Increasing demand of metal from emerging nations like India and China is expected to boost the regional market. North America is expected to show considerable growth due to stringent rules imposed by government authorities to stop illegal and exploitation of mines and metal reserves and well-established construction and automobile sectors in the region.Metal Recycling Market Ecosystem

Metal Recycling Market Scope: Inquire before buying

Metal Recycling Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 69.07 Bn. Forecast Period 2025 to 2032 CAGR: 6.01 % Market Size in 2032: USD 110.18 Bn. Segments Covered: by Metal Type Ferrous Metal Non-Ferrous Metal by Scrap type Old Scrap New Scrap by End User Building & Construction Automotive Shipbuilding Consumer Durables Recycling Industrial Machinery Others Metal Recycling Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Metal Recycling Market, Key Players

1. CMC 2. GFG Alliance 3. Norsk Hydro ASA 4. Kimmel Scrap Iron & Metal Co., Inc. 5. Schnitzer Steel Industries, Inc. 6. Novelis 7. Tata Steel 8. Sims Metal 9. Utah Metal Works 10. Aqua Metals 11. Sortera Alloys 12. Nth Cycle 13. Mint Innovation 14. Metaloop 15. pH7 16. Emulsion Flow Technologies 17. Saperatec 18. Metycle 19. Zincovery 20. Lemontri 21. Namo E-waste 22. Chanja Datti 23. MolyWorks Materials 24. ReCycle Bikes 25. Nupur Recyclers 26. AMG ChemTech 27. GreenIron H2 28. Earth Recycling Services 29. Solar Kisasa 30. enim 31. Runaya 32. Agave Networks 33. Hydro 34. VALIS Insights 35. MATR 36. European Metal RecyclingFrequently Asked Questions:

1] What segments are covered in the Global Metal Recycling Market report? Ans. The segments covered in the Metal Recycling Market report are based on Type of metal, type of scrap, equipment and end user. 2] Which region is expected to hold the highest share in the Global Metal Recycling Market? Ans. Asia Pacific region is expected to hold the highest share in the Metal Recycling Market. 3] What is the market size of the Global Metal Recycling Market by 2032? Ans. The market size of the Metal Recycling Market by 2032 is expected to reach USD 110.18 Bn. 4] What is the forecast period for the Global Metal Recycling Market? Ans. The forecast period for the Metal Recycling Market is 2025-2032. 5] What was the Global Metal Recycling Market size in 2024? Ans: The Global Metal Recycling Market size was USD 69.07 Billion in 2024.

1. Metal Recycling Market: Research Methodology 2. Metal Recycling Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Consumption & Production Analysis 3.1. Total Scrap Metal Recycling Volume (Current & Forecasted) 3.2. Primary vs. Secondary Metal Supply Contribution 3.3. Breakdown by Type: Ferrous vs. Non-Ferrous Metals 3.4. Industry-wise Metal Recycling Trends (Automotive, Construction, Electronics, Packaging, etc.) 3.5. Key Processing Methods and Their Market Share 4. Pricing Analysis & Cost Structure 4.1. Current Scrap Metal Pricing Trends (Ferrous & Non-Ferrous) 4.2. Regional Price Variations & Market Volatility 4.3. Impact of Raw Material Cost on Final Product Pricing 4.4. Comparison of Recycled Metal Prices vs. Virgin Metal Prices 4.5. Trade Tariffs, Supply Chain Costs & Transportation Expenses 5. Substitutes & Impact on Market 5.1. Adoption of Composite Materials (Plastics, Carbon Fiber) 5.2. Hybrid Materials & Alloys Reducing Scrap Generation 5.3. Advancements in Waste-to-Material Technology 5.4. Comparative Analysis: Virgin vs. Recycled vs. Alternative Materials 6. Regional Dynamics & Market Fluctuations 6.1. Impact of Global Economic Trends on Recycling Industry 6.2. Regional Trade Agreements and their Influence on Scrap Metal Trade 6.3. Fluctuations in Metal Supply & Demand Across Regions 6.4. Role of China & India as Major Scrap Metal Importers 7. High Production & Consumption Regions and Countries 7.1. Top Metal Recycling Countries (China, US, Germany, India, Japan) 7.2. Analysis of Leading Scrap Metal Exporters & Importers 7.3. Emerging Markets & Growth Opportunities (Southeast Asia, Africa) 8. Metal Recycling Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 8.1.1. Ferrous Metal 8.1.2. Non-Ferrous Metal 8.2. Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 8.2.1. Old Scrap 8.2.2. New Scrap 8.3. Metal Recycling Market Size and Forecast, by End User (2024-2032) 8.3.1. Building & Construction 8.3.2. Automotive 8.3.3. Shipbuilding 8.3.4. Consumer Durables 8.3.5. Recycling 8.3.6. Industrial Machinery 8.3.7. Others 8.4. Metal Recycling Market Size and Forecast, by region (2024-2032) 8.4.1. North America 8.4.2. Europe 8.4.3. Asia Pacific 8.4.4. Middle East and Africa 8.4.5. South America 9. North America Metal Recycling Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. North America Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 9.1.1. Ferrous Metal 9.1.2. Non-Ferrous Metal 9.2. North America Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 9.2.1. Old Scrap 9.2.2. New Scrap 9.3. North America Metal Recycling Market Size and Forecast, by End User (2024-2032) 9.3.1. Building & Construction 9.3.2. Automotive 9.3.3. Shipbuilding 9.3.4. Consumer Durables 9.3.5. Recycling 9.3.6. Industrial Machinery 9.3.7. Others 9.4. North America Metal Recycling Market Size and Forecast, by Country (2024-2032) 9.4.1. United States 9.4.1.1. United States Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 9.4.1.2. United States Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 9.4.1.3. United States Metal Recycling Market Size and Forecast, by End User (2024-2032) 9.4.2. Canada 9.4.2.1. Canada Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 9.4.2.2. Canada Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 9.4.2.3. Canada Metal Recycling Market Size and Forecast, by End User (2024-2032) 9.4.3. Mexico 9.4.3.1. Mexico Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 9.4.3.2. Mexico Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 9.4.3.3. Mexico Metal Recycling Market Size and Forecast, by End User (2024-2032) 10. Europe Metal Recycling Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 10.1. Europe Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 10.2. Europe Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 10.3. Europe Metal Recycling Market Size and Forecast, by End User (2024-2032) 10.4. Europe Metal Recycling Market Size and Forecast, by Country (2024-2032) 10.4.1. United Kingdom 10.4.2. France 10.4.3. Germany 10.4.4. Italy 10.4.5. Spain 10.4.6. Sweden 10.4.7. Russia 10.4.8. Rest of Europe 11. Asia Pacific Metal Recycling Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 11.1. Asia Pacific Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 11.2. Asia Pacific Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 11.3. Asia Pacific Metal Recycling Market Size and Forecast, by End User (2024-2032) 11.4. Asia Pacific Metal Recycling Market Size and Forecast, by Country (2024-2032) 11.4.1. China 11.4.2. S Korea 11.4.3. Japan 11.4.4. India 11.4.5. Australia 11.4.6. Indonesia 11.4.7. Malaysia 11.4.8. Philippines 11.4.9. Thailand 11.4.10. Vietnam 11.4.11. Rest of Asia Pacific 12. Middle East and Africa Metal Recycling Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 12.1. Middle East and Africa Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 12.2. Middle East and Africa Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 12.3. Middle East and Africa Metal Recycling Market Size and Forecast, by End User (2024-2032) 12.4. Middle East and Africa Metal Recycling Market Size and Forecast, by Country (2024-2032) 12.4.1. South Africa 12.4.2. GCC 12.4.3. Nigeria 12.4.4. Rest of ME&A 13. South America Metal Recycling Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 13.1. South America Metal Recycling Market Size and Forecast, by Metal Type (2024-2032) 13.2. South America Metal Recycling Market Size and Forecast, by Scrap Type (2024-2032) 13.3. South America Metal Recycling Market Size and Forecast, by End User (2024-2032) 13.4. South America Metal Recycling Market Size and Forecast, by Country (2024-2032) 13.4.1. Brazil 13.4.2. Argentina 13.4.3. Colombia 13.4.4. Chile 13.4.5. Rest of South America 14. Competitive Analysis of Metal Recycling Companies 14.1. Market Share of Leading Metal Recycling Companies 14.2. SWOT Analysis of Key Players 14.3. Strategies for Market Penetration & Expansion 14.4. Investment Trends & Mergers & Acquisitions in the Industry 15. Competitive Analysis & Company Benchmarking 15.1. Revenue & Profitability Comparison (2023-2025) 15.2. Geographic Presence & Expansion Strategies 15.3. Production Capacity & Processing Capabilities 15.4. Technology Adoption & Innovation in Recycling Processes 16. Key Players & Market Positioning 16.1. Tier 1 Companies 16.2. Tier 2 Companies 16.3. Tier 3 Companies 17. Company Profile: Key Players 17.1. CMC 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Branding & Market Positioning Strategies 17.1.4. Financial Overview 17.1.4.1. Revenue 17.1.4.2. Profit margin 17.1.4.3. Cost of Sales 17.1.4.4. Earnings 17.1.5. SWOT Analysis 17.1.6. Strategic Analysis 17.2. GFG Alliance 17.3. Norsk Hydro ASA 17.4. Kimmel Scrap Iron & Metal Co., Inc. 17.5. Schnitzer Steel Industries, Inc. 17.6. Novelis 17.7. Tata Steel 17.8. Sims Metal 17.9. Utah Metal Works 17.10. Aqua Metals 17.11. Sortera Alloys 17.12. Nth Cycle 17.13. Mint Innovation 17.14. Metaloop 17.15. pH7 17.16. Emulsion Flow Technologies 17.17. Saperatec 17.18. Metycle 17.19. Zincovery 17.20. Lemontri 17.21. Namo E-waste 17.22. Chanja Datti 17.23. MolyWorks Materials 17.24. ReCycle Bikes 17.25. Nupur Recyclers 17.26. AMG ChemTech 17.27. GreenIron H2 17.28. Earth Recycling Services 17.29. Solar Kisasa 17.30. enim 17.31. Runaya 17.32. Agave Networks 17.33. Hydro 17.34. VALIS Insights 17.35. MATR 17.36. European Metal Recycling 18. Key Findings 19. Analyst Recommendation