The Metal Furniture Market size was valued at USD 141.8 Billion in 2023 and the total Metal Furniture Market revenue is expected to grow at a CAGR of 4.7% from 2023 to 2030, reaching nearly USD 195.57 Billion in 2030. Metal furniture is furniture made with Iron, Aluminium, brass, and stainless steel metals. Metal furniture is increasingly popular for use in homes thanks to its durability, Comfort, style, and versatility. The major applications of metal furniture are Metal beds, Sofas, chairs, tables, and storage units are also used in commercial places. Metal-based products are also common in commercial gardens and playgrounds. These metals are chosen for their durability, strength, and functional requirements.To know about the Research Methodology :- Request Free Sample Report 1. According to MMR analysis, over 3 billion people will be located in urban dwellings, with a major number of the population and will require small space-saving metal furniture in small houses in countries such as Japan and Singapore till 2030. Folding furniture serves as an ideal solution by offering the dual benefit of functionality and space optimization. Folding furniture comes in various forms including tables, beds, sofas, and chairs, which get folded after use. Given the large variety of distinctive furniture models and styles available, the metal furniture business has grown rapidly along with e-commerce websites in developed countries. Some of the key players in the metal furniture market include IKEA, Steelcase Inc., Herman Miller Inc., Haworth Inc., KI Furniture Corporation, and Knoll Inc. Asia-Pacific is the fastest-growing region with a market share of over 33.5% in 2023. The region is expected to grow at a CAGR of 6.4% during the forecast period and maintain its dominance by 2030. Online platforms like Flipkart and Amazon India have played a crucial role in providing access to a wide range of metal furniture options to consumers across the country. Metal Furniture Market is enlarged with the help of China, which accounts for 25% of global metal furniture exports. The increasing housing needs of the growing population.

Metal Furniture Market Dynamics:

Rising Demand for Premium-Quality and Luxury Metal Furniture Products The increasing preference for premium-quality and luxury furniture products is driving the growth of the metal furniture market. Metal Furniture trends include the improvement of the standard of living by using high-quality materials in home and corporate decor. People's busy lifestyles want the comfort and durability of metal furniture for relaxation Construction of residential and commercial facilities, including hotels, hospitals, residences, apartments, and offices, rises in tandem with the real estate industry's development. An increase in residential and commercial institutes leads to a rise in demand for the installation of Metal Furniture. The Metal Furniture industries have also started finding popularity through their technical developments and personalization. Digitally controlled furniture and smart applications that show virtual room decor recommendations. The metal furniture is cost-effective and has a wide variety to fit modern furnishing needs. The growing demand for premium and luxury metal furniture presents productive opportunities for the Metal Furniture Market players. Some of the Top furniture companies offer a warranty for furniture materials. They ensure that enjoy your luxury furniture without worrying about damage.Adverse weather conditions impact the durability and lifespan of outdoor metal furniture The metal furniture material included steel, Aluminium, and iron. In adverse weather conditions like moisture and humidity Metal Furniture has a negative impact on the lifespan of metal furniture. Metal gets corroded and rusted. Corrosion leads to damage to the metal furniture integrity. They reduced the lifespan of metal furniture and maintenance costs for consumers. So, clean the furniture regularly and apply the paint coating to prevent metal from rusts.

Metal Furniture Market Segment Analysis:

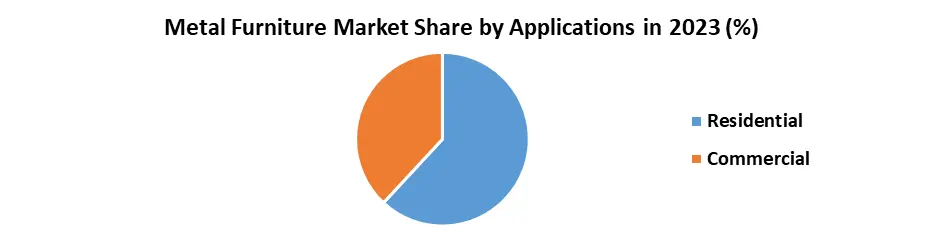

Based on Type, the Bed segment held the largest market share of about 32.4% in the Metal Furniture Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 4.7% during the forecast period and maintain its dominance till 2030. A bed furniture that makes up a place to sleep. Metal beds are affordable and more durable than wood-based beds. Metal beds are light weighted as well as slim and adjust in small spaces The table segment has emerged to grow because of an increasing number of workplaces and offices that require tables for basic needs. The rising infrastructure investment in education, healthcare, and restaurants drives the demand for tables in the forecast period.Based on Applications, the Residential segment held the largest market share of about 49.4% in the Metal Furniture market in 2023 and is expected to maintain its dominance till 2030. Customers upgrade their standard of living so more invest in home décor and furniture. A rise in the number of tenants, mainly students and young couples looking for budget-friendly home decor items like Bed, sofas, Shelves, and tables as well as demand for fully furnished houses offering immediate move-in convenience. So expected to grow the Metal Furniture Market. The commercial segment is the fastest-growing segment with a market share is 34.1% in 2023. With rising corporate infrastructure as well as growing urbanization demand for metal furniture is increasing. Commercial segments include Metal Furniture for Offices, Hospital, Schools, Colleges, and Restaurants. Rising Construction offices also grow to the segment in the forecast period.

Metal Furniture Market of Regional Insights:

North America region dominates the Metal Furniture Market with the largest market share accounting for 41.3% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. North American region, with rising changes in luxurious lifestyles consumers invest more in a variety of metal furniture. They give increasing preference to the renovation of homes. Steelcase and Herman Miller are strong key players supporting to growth of the Metal Furniture Market.Europe held a market share of about 19.5% in the Metal Furniture Market in 2023 and is expected to maintain its dominance till 2030. Metal Furniture is commonly considered to be more sustainable and durable than other materials like wood and plastic. Awareness about Environmental consumers prefer Metal Furniture. European Brands for Metal Furniture Wikhahn and Kinnarps are key players catering to the growing market in the region. Competitive Landscape for the Metal Furniture Market: The competitive landscape of the Metal Furniture market is constantly evolving, with new players emerging and established players adapting their strategies with the rapid industrialization in developing countries like China and India, Metal Furniture has become increasingly popular in a variety of industries, including manufacturing, automotive, and construction. It is estimated that key players have major growth prospects in the growing usage of Metal Furniture in the defence and aerospace industries. Rising disposable income and shifting consumer habits are expected to promote growth in the market, with a focus on the launch of the innovative Metal Furniture Market. The rise of smart home technology is influencing the Metal Furniture market, with appliances, furniture, and other products becoming increasingly connected and automated. 1) In May 2023, the largest owner of IKEA stores, Ingka Group, acquired supply chain software firm Made4Net to improve its warehouse and logistics operations. 2) In January 2023, IKEA announced a $2.2 billion investment in the U.S. to grow its omnichannel presence, focusing on opening new locations, enlarging fulfilment network, and creating more effective replenishment and delivery capabilities 3) In February 2022, The Teknion Corporation introduced the creative and opulent Libelle range of lounge chair alternatives, and also Libelle offers a variety of seating alternatives including a pouffe, a low-back lounge chair, and a high-back privacy lounge chair. 4) In October 2022, The Broadband Quad Chair, which can be folded and transported easily thanks to a bag was one outdoor product that the Coleman Company and Vera Bradley Inc. jointly launched.

Metal Furniture Market Scope: Inquire before buying

Global Metal Furniture Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 141.8 Bn. Forecast Period 2024 to 2030 CAGR: 4.7% Market Size in 2030: US $ 195.57 Bn. Segments Covered: by Type Bed Chair Sofa Table Others by Application Residential Commercial by Distribution Channel E-Commerce Supermarket & Hypermarket Speciality Stores Online Stores Metal Furniture Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Metal Furniture Market Key Players:

1. Godrej interior 2. Dorel Industries, Inc. (Dorel Home Products Furniture) 3. Zuari Furniture 4. Nilkamal 5. IKEA 6. Aldermans 7. Hangzhou Weiling Steel Furniture Co., Ltd. 8. Shanghai Yanfeng Adient Controls Seating Co. Ltd. 9. Samsonite. 10. Jinhua UE Furniture Co. Ltd. 11. Meco Corporation 12. Hussey. 13. Steelcase Inc. 14. DHP Furniture 15. Zinus 16. Cymax Group Inc. 17. Chyuan Chern Furniture Co., Ltd. 18. Meco Corporation (Unaka Corporation) 19. Hillsdale Furniture 20. Simpli Home 21. Oliver Metal Furniture 22. Herman Miller Inc. 23. Haworth Inc. 24. Knoll, Inc. 25. Kimball International, Inc. 26. Teknion Corporation 27. Global Furniture Group 28. Itoki Corporation FAQs: 1] Which region is expected to hold the highest share in the Global Metal Furniture Market during the forecast period? Ans. North America region is expected to hold the highest share of the Metal Furniture Market during the forecast period. 2] What is the market size of the Metal Furniture Market? Ans. The Metal Furniture Market size was valued at USD 141.8 Billion in 2023 reaching nearly USD 195.57 Billion in 2030. 3] What is the growth rate of the Metal Furniture Market? Ans. The Homeware market is expected to grow at a CAGR of 4.7% during the forecast period of 2023 to 2030. 4] What are some of the factors driving market growth in the Metal Furniture Market? Ans. The increasing preference for premium-quality and luxury furniture products is driving the growth of the metal furniture market. 5] What segments are covered in the Metal Furniture Market report? Ans. The segments covered in the metal furniture market report are Type, Application, Distribution Channel, and Region.

1. Metal Furniture Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Metal Furniture Market: Dynamics 2.1. Metal Furniture Market Trends by Region 2.1.1. North America Metal Furniture Market Trends 2.1.2. Europe Metal Furniture Market Trends 2.1.3. Asia Pacific Metal Furniture Market Trends 2.1.4. Middle East and Africa Metal Furniture Market Trends 2.1.5. South America Metal Furniture Market Trends 2.2. Metal Furniture Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Metal Furniture Market Drivers 2.2.1.2. North America Metal Furniture Market Restraints 2.2.1.3. North America Metal Furniture Market Opportunities 2.2.1.4. North America Metal Furniture Market Challenges 2.2.2. Europe 2.2.2.1. Europe Metal Furniture Market Drivers 2.2.2.2. Europe Metal Furniture Market Restraints 2.2.2.3. Europe Metal Furniture Market Opportunities 2.2.2.4. Europe Metal Furniture Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Metal Furniture Market Drivers 2.2.3.2. Asia Pacific Metal Furniture Market Restraints 2.2.3.3. Asia Pacific Metal Furniture Market Opportunities 2.2.3.4. Asia Pacific Metal Furniture Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Metal Furniture Market Drivers 2.2.4.2. Middle East and Africa Metal Furniture Market Restraints 2.2.4.3. Middle East and Africa Metal Furniture Market Opportunities 2.2.4.4. Middle East and Africa Metal Furniture Market Challenges 2.2.5. South America 2.2.5.1. South America Metal Furniture Market Drivers 2.2.5.2. South America Metal Furniture Market Restraints 2.2.5.3. South America Metal Furniture Market Opportunities 2.2.5.4. South America Metal Furniture Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Metal Furniture Industry 2.8. Analysis of Government Schemes and Initiatives For Metal Furniture Industry 2.9. Metal Furniture Market Trade Analysis 2.10. The Global Pandemic Impact on Metal Furniture Market 3. Metal Furniture Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Metal Furniture Market Size and Forecast, by Type (2023-2030) 3.1.1. Bed 3.1.2. Chair 3.1.3. Sofa 3.1.4. Table 3.1.5. Others 3.2. Metal Furniture Market Size and Forecast, by Application (2023-2030) 3.2.1. Commercial 3.2.2. Residential 3.3. Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. E-Commerce 3.3.2. Supermarket & Hypermarket 3.3.3. Speciality Stores 3.3.4. Online Stores 3.4. Metal Furniture Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Metal Furniture Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Metal Furniture Market Size and Forecast, by Type (2023-2030) 4.1.1. Bed 4.1.2. Chair 4.1.3. Sofa 4.1.4. Table 4.1.5. Others 4.2. North America Metal Furniture Market Size and Forecast, by Application (2023-2030) 4.2.1. Commercial 4.2.2. Residential 4.3. North America Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. E-Commerce 4.3.2. Supermarket & Hypermarket 4.3.3. Speciality Stores 4.3.4. Online Stores 4.4. North America Metal Furniture Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Metal Furniture Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Bed 4.4.1.1.2. Chair 4.4.1.1.3. Sofa 4.4.1.1.4. Table 4.4.1.1.5. Others 4.4.1.2. United States Metal Furniture Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Commercial 4.4.1.2.2. Residential 4.4.1.3. United States Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. E-Commerce 4.4.1.3.2. Supermarket & Hypermarket 4.4.1.3.3. Speciality Stores 4.4.1.3.4. Online Stores 4.4.2. Canada 4.4.2.1. Canada Metal Furniture Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Bed 4.4.2.1.2. Chair 4.4.2.1.3. Sofa 4.4.2.1.4. Table 4.4.2.1.5. Others 4.4.2.2. Canada Metal Furniture Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Commercial 4.4.2.2.2. Residential 4.4.2.3. Canada Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. E-Commerce 4.4.2.3.2. Supermarket & Hypermarket 4.4.2.3.3. Speciality Stores 4.4.2.3.4. Online Stores 4.4.3. Mexico 4.4.3.1. Mexico Metal Furniture Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Bed 4.4.3.1.2. Chair 4.4.3.1.3. Sofa 4.4.3.1.4. Table 4.4.3.1.5. Others 4.4.3.2. Mexico Metal Furniture Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Commercial 4.4.3.2.2. Residential 4.4.3.3. Mexico Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. E-Commerce 4.4.3.3.2. Supermarket & Hypermarket 4.4.3.3.3. Speciality Stores 4.4.3.3.4. Online Stores 5. Europe Metal Furniture Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.2. Europe Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.3. Europe Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Metal Furniture Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Metal Furniture Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Metal Furniture Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Metal Furniture Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Metal Furniture Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Metal Furniture Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Metal Furniture Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Metal Furniture Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Metal Furniture Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Metal Furniture Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Metal Furniture Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Metal Furniture Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Metal Furniture Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Metal Furniture Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Metal Furniture Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Metal Furniture Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Metal Furniture Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Metal Furniture Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Metal Furniture Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Metal Furniture Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Metal Furniture Market Size and Forecast, by Type (2023-2030) 8.2. South America Metal Furniture Market Size and Forecast, by Application (2023-2030) 8.3. South America Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Metal Furniture Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Metal Furniture Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Metal Furniture Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Metal Furniture Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Metal Furniture Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Metal Furniture Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Metal Furniture Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Metal Furniture Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Metal Furniture Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Metal Furniture Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Godrej interior 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Dorel Industries, Inc. (Dorel Home Products Furniture) 10.3. Zuari Furniture 10.4. Nilkamal 10.5. IKEA 10.6. Aldermans 10.7. Hangzhou Weiling Steel Furniture Co., Ltd. 10.8. Shanghai Yanfeng Adient Controls Seating Co. Ltd. 10.9. Samsonite. 10.10. Jinhua UE Furniture Co. Ltd. 10.11. Meco Corporation 10.12. Hussey. 10.13. Steelcase Inc. 10.14. DHP Furniture 10.15. Zinus 10.16. Cymax Group Inc. 10.17. Chyuan Chern Furniture Co., Ltd. 10.18. Meco Corporation (Unaka Corporation) 10.19. Hillsdale Furniture 10.20. Simpli Home 10.21. Oliver Metal Furniture 10.22. Herman Miller Inc. 10.23. Haworth Inc. 10.24. Knoll, Inc. 10.25. Kimball International, Inc. 10.26. Teknion Corporation 10.27. Global Furniture Group 10.28. Itoki Corporation 11. Key Findings 12. Industry Recommendations 13. Metal Furniture Market: Research Methodology 14. Terms and Glossary