The Medical Polyoxymethylene Market size was valued at USD 192.86 Million in 2023 and the total Medical Polyoxymethylene revenue is expected to grow at a CAGR of 3.47% from 2024 to 2030, reaching nearly USD 244.88 Million.Medical Polyoxymethylene Market Overview

Medical Polyoxymethylene (POM), known as acetal or polyacetal, is a high-performance engineering plastic that is widely used in various medical and healthcare applications. It is a type of thermoplastic polymer known for its excellent combination of properties, making it suitable for several medical applications. Key characteristics of medical POM include high strength, stiffness, chemical resistance, low friction, and excellent dimensional stability. Its key applications and industries in the medical field include: Medical Devices, Catheters and Tubing, Dental Components, Diagnostic Equipment and others. The market for medical polyoxymethylene (POM) is expanding as a result of the material's beneficial characteristics, including as high stiffness, low friction, and biocompatibility, which make it suited for a variety of medical applications. The usage of POM in dental components, orthopaedic implants, medication delivery systems, and surgical equipment is growing. Growing healthcare infrastructure and technological improvements are the main drivers of demand. However, it is important to take into account any potential health dangers and environmental issues associated to POM's non-biodegradability. Manufacturers are investigating environmentally friendly alternatives as laws and customer awareness change. The healthcare sector is looking for dependable, long-lasting, and secure materials for crucial applications, and despite obstacles, the medical POM market is positioned for steady growth.To know about the Research Methodology :- Request Free Sample Report

Medical Polyoxymethylene Market Dynamics:

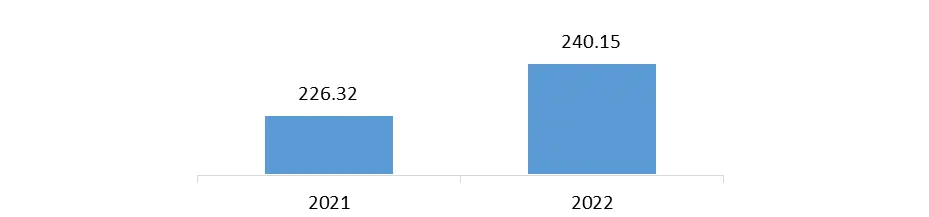

Drivers Several important factors are driving the worldwide polyoxymethylene (POM) market for medical applications. POM is perfect for medical equipment that needs precision and endurance because to its remarkable mechanical features, such as high strength, stiffness, and resistance to wear. The material is a favored option for implants and surgical equipment due to its biocompatibility, which guarantees a lower risk of adverse responses when utilized in contact with bodily tissues. There is a persistent need for POM in a variety of fields, including orthopedics and drug delivery systems, as a result of the developing healthcare industry, which is fuelled by increased populations and improvements in medical technology. The demand for dependable, friction-resistant components as well as the push toward minimally invasive surgeries all contribute to POM's increased acceptance. However, the market's projected growth path is hampered by environmental issues and laws pertaining to plastic trash. The medical POM market is positioned to make use of its advantages while resolving its disadvantages as manufacturers place an increased emphasis on sustainable practices and innovations. The global medical POM market is being driven by the rising demand for medical-grade POM in the manufacturing of various medical devices and components. POM's exceptional properties, such as high strength, stiffness, and excellent biocompatibility, make it suitable for applications in medical devices like insulin pens, surgical instruments, catheters, and components for diagnostic equipment. As the medical industry continues to advance, the demand for high-performance materials like POM is expected to grow. Medical POM is preferred for its ability to withstand repeated sterilization processes, including autoclaving and chemical sterilization, without significant degradation. Moreover, its lightweight nature is advantageous for portable medical devices. As the healthcare sector emphasizes the development of lightweight, sterilizable, and durable medical equipment and devices, the use of POM is projected to increase, driving growth in the global medical POM market.Annual Value Of The Medical Devices In The United States (In Billion U.S. Dollars)

Medical Polyoxymethylene Market Restraints

While growing, the global Medical Polyoxymethylene Market is nonetheless constrained by significant factors. The effects of POM on the environment are a big difficulty. Due to the fact that it is a non-biodegradable substance, disposal of it may result in plastic waste and long-lasting environmental contamination. Pressure to use eco-friendly products is mounting in the medical field as sustainability issues become more prominent across industries. Formaldehyde is utilized throughout the production process of POM, which could have negative health effects on both end consumers and employees. This raises concerns about the biocompatibility and safety of POM-based medical devices. To ensure patient safety, medical device materials must undergo thorough testing and validation in accordance with strict requirements. POM's extensive use in vital medical applications could be hampered by any doubt or unfavorable research results on its long-term impacts on health. The comparatively high price of POM in comparison to competing materials is a factor, especially in cost-sensitive industries. The efficiency of POM-based solutions is called into doubt as healthcare finances are increasingly reviewed. POM has a number of benefits, such as mechanical qualities and biocompatibility, these obstacles need to be overcome to ensure its continued development in the medical industry. To address these issues, manufacturers and the healthcare sector must work together to look into more environmentally friendly options, enhance disposal procedures, and make sure that all products are thoroughly tested and adhere to all applicable regulations. Medical Polyoxymethylene Market Opportunities The medical polyoxymethylene (POM) industry offers potential opportunities. The expanding tendency toward innovation and miniaturization in medical devices is one important route. Because of its superior mechanical qualities and biocompatibility, POM is well-suited for creating delicate parts for cutting-edge medical technology. POM is a good contender because of the growing demand for minimally invasive surgical procedures, which asks for materials that offer low friction and excellent precision. Initiatives that promote sustainability also let the market in. Manufacturers have the chance to create bio-based or recyclable POM formulations that address plastic waste issues while preserving POM's desired properties as environmental awareness increases. Cooperation between POM producers and the medical sector may result in solutions that are specially designed for particular medical uses. POM's adaptability can be used to create tailored goods that satisfy certain medical needs as the need for personalized devices and implants increases. Challenging Factors for Medical Polyoxymethylene Market Due to POM's inability to biodegrade, environmental considerations are particularly important. POM product disposal increases plastic waste and has long-term environmental effects. The formaldehyde used in the material's production raises possible health and safety issues for both production employees and end consumers. Regulations that are too strict make it difficult to test and validate medical supplies in a way that ensures patient safety. POM's relatively high cost as compared to alternative materials presents a challenge in healthcare sectors that are concerned with saving money. The financial sustainability of POM-based solutions becomes a factor as the industry places a focus on cost-effectiveness. In order to ensure the POM industry's sustainable growth, producers, healthcare practitioners, and regulatory organizations must work together to address these issues.Medical Polyoxymethylene Market Trends

1. Increasing Demand for Less Invasive Procedures: The demand for accurate, low-friction components in medical equipment is being driven by the move toward less invasive surgeries. POM's use in this area is facilitated by the fact that it can be crafted into such components thanks to its mechanical qualities. 2. Medical Technology Advancements: Materials that can meet strict performance standards are necessary for the ongoing development of innovative medical devices and equipment. Because of its strength, biocompatibility, and resistance to wear, POM is a top choice for crucial components. 3. Medical Device Customization: Medical device customization is being driven by the rising need for individualized healthcare solutions. Due of POM's adaptability, customized components can be made, improving patient results. 4. Sustainability and Material Innovation: Environmental considerations are having an impact on the medical industry's material decisions. To combat plastic waste and support sustainability objectives, manufacturers are looking into bio-based or recyclable POM formulations. 5. Strict Regulatory Compliance Medical device materials must undergo extensive testing and validation due to the strict standards governing the medical industry. To guarantee patient safety, POM producers must make sure that certain requirements are followed. 6. The Development of Biocompatible Materials: They are used in medical devices must be biocompatible. POM is a good option for applications where interactions with biological tissues are a concern due to its biocompatibility. 7. Change in Favour of Value-Based Healthcare: The emphasis on value-based healthcare is encouraging the adoption of products with long-term advantages and low costs. The mechanical robustness of POM and the possibility for reduced maintenance and cost.Regional Insights for Medical Polyoxymethylene Market

Asia-Pacific: The Medical Polyoxymethylene Market in the Asia Pacific region is expanding significantly due to a number of factors. In 2023, the Asia Pacific dominated the largest market share. The demand for high-quality medical devices and components is being fuelled by the region's expanding healthcare infrastructure, rising healthcare costs, and growing knowledge of cutting-edge medical treatments. Precision tools and implants can use POM since nations like China, Japan, and South Korea are at the forefront of technological breakthroughs in the medical field. In Asia Pacific, there is an increasing need for materials like POM that provide low friction and accurate performance due to the push toward minimally invasive operations. Furthermore, the region's strong manufacturing capabilities make it a significant centre for the production of medical equipment, with POM finding use in a variety of applications due to its mechanical properties. Europe: The Medical Polyoxymethylene Market in Europe is distinguished by a strong focus on innovation, precise engineering, and quality assurance in the production of medical devices. The market is expected to at a significant CAGR during the forecast period. The region has a strong demand for dependable and high-performance materials like POM because of its sophisticated healthcare infrastructure, strict regulatory standards, and well-established medical research. POM can be used in surgical tools, orthopedic implants, and other vital medical devices because European nations are known for embracing cutting-edge medical innovations. POM's advantages, such as its low friction and mechanical stability, are in line with the trend toward minimally invasive procedures and meet the needs of precision medical equipment. Additionally, the research of bio-based or recyclable POM formulations to address environmental issues is motivated by the European market's growing emphasis on sustainability.Medical Polyoxymethylene Market Segment Analysis

By Product Type: Depending on the applications in the medical field, the global polyoxymethylene (POM) market can be divided by product type into a number of categories. These include, among other things, surgical instruments, dental and orthopedic implants, drug delivery systems, and diagnostic tools. POM's low friction, high rigidity, and biocompatibility are advantageous for surgical equipment and improve procedure precision. POM is a good option because orthopedic implants like joint parts and bone fixation devices need materials that can tolerate mechanical stress. Dental applications make use of POM's endurance in oral conditions and resistance to repeated sterilizing. Drug delivery devices, such as insulin pens and inhalers, call for materials that keep their integrity when in touch with pharmaceuticals. Precision parts and gears used in diagnostic equipment depend on POM's stability and precision.Medical Polyoxymethylene (POM) Market by Product Type, in (%) 2023

By Material Form: The Medical Polyoxymethylene Market divided into a number of different categories. Between POM in its original or unfilled form and its modified or filled forms is one important segmentation. Original POM demonstrates the material's intrinsic qualities, including high rigidity, minimal friction, and biocompatibility. In 2023 the sheets segment held largest market share. On the other hand, modified or filled POM entails adding reinforcements or Drilling Fluid additives to improve certain properties. Reinforcing materials like glass fibres or mineral fillers can be included as part of these adjustments to boost strength or enhance thermal characteristics. Different grades of POM, including homopolymer and copolymer, could also be segmented. Each grade has unique qualities that make it suitable for specific medical uses. Manufacturers frequently modify the physical properties of materials to satisfy the exacting standards of medical equipment, taking into account properties such as wear resistance, dimensional stability, and biocompatibility. It is possible to choose the best alternative for particular medical device applications by having a thorough understanding of the various material forms available in the medical POM market, resulting in the best performance and patient safety. By Application: The global Medical Polyoxymethylene Market is divided into several important medical subfields based on application. POM is a good choice for surgical equipment because of its mechanical qualities and biocompatibility, where accuracy and toughness are crucial. POM has great strength and wear resistance, which are advantageous for orthopedic implants. POM is also used in drug delivery systems and medical equipment that needs minimal friction, including gears and bearings. The chemical and repeated sterilization resistance of POM is advantageous for dental components. POM is also utilized in endoscopic instruments, diagnostic equipment, and other medical devices. Due to its adaptability, it can be tailored to meet certain medical needs. However, manufacturers must take into account important factors including regulatory compliance, and environmental concerns, and performing thorough biocompatibility testing in each application to ensure the safety and effectiveness of POM products.

Medical Polyoxymethylene Market: Competitive Landscape

The presence of significant companies working to provide cutting-edge solutions that satisfy the demanding requirements of the medical sector characterizes the worldwide competitive landscape of the polyoxymethylene (POM) market for medical products. Leading producers like Celanese Corporation, DuPont, and Ensinger are providing premium POM materials specifically designed for medical applications by drawing on their wealth of knowledge and experience. These market leaders concentrate on R&D to improve POM's characteristics, such as biocompatibility and mechanical strength, making sure their products are in line with shifting medical trends. The competitive landscape is also being shaped by alliances and partnerships between POM producers and firms that make medical devices. These partnerships make it possible to adapt POM-based components for certain medical devices, encouraging innovation and satisfying the particular needs of healthcare applications. In response to environmental issues related to plastics, various firms are looking into environmentally acceptable alternatives within the POM market as sustainability gains popularity. Due to this tendency, smaller companies and new competitors can set themselves apart by providing POM formulations that are recyclable or based on biomaterials. The competitive environment, however, also poses difficulties. POM materials must be thoroughly tested and validated in order to meet strict regulatory requirements, which forces businesses to make significant investments in High-Temperature Fluid Loss Control and compliance processes. Another obstacle that producers must overcome in order to be competitive in the changing medical POM market is how to address environmental issues while keeping POM's attractive characteristics.Medical Polyoxymethylene Market Scope Table : Inquire Before Buying

Global Medical Polyoxymethylene Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 192.86 Million Forecast Period 2024 to 2030 CAGR: 3.47% Market Size in 2030: USD 244.88 Million Segments Covered: by Product Type Copolymer POM Homopolymer POM by Application Surgical Instruments Implants Drug Delivery Devices Diagnostic Equipment’s by Material Form Sheets Rods Tubes Others Medical Polyoxymethylene Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Medical Polyoxymethylene Market Key players

1. Celanese Corporation 2. DuPont 3. Ensinger 4. BASF SE 5. SABIC 6. Mitsubishi Engineering-Plastics Corporation 7. Kolon Plastics, Inc. 8. Ticona Engineering Polymers 9. RTP Company 10. Westlake Plastics Company 11. PolyOne Corporation 12. Daicel Corporation 13. Formosa Plastics Corporation 14. Quadrant Engineering Plastics Products 15. PlastiComp, Inc. 16. Lehmann & Voss & Co. 17. Solvay S.A. 18. Saint-Gobain Performance Plastics 19. Nylacast 20. A. Schulman, Inc. 21. KEP Europe GmbH 22. AIP Precision Machining 23. POM Wonderful LLC 24. Topas Advanced Polymers 25. Kaneka Corporation 26. Amco Polymers 27. LATI S.p.A. 28. Evonik Industries AG 29. Ensinger Medical 30. Innovative PolymersFrequently Asked Questions:

1] What is the growth rate of the Medical Polyoxymethylene Market? Ans. The Global Medical Polyoxymethylene Market is growing at a significant rate of 3.47 % over the forecast period. 2] Which region is expected to dominate the Medical Polyoxymethylene Market? Ans. Asia Pacific region is expected to dominate the Medical Polyoxymethylene Market over the forecast period. 3] What is the expected Global Medical Polyoxymethylene Market size by 2030? Ans. The market size of the Medical Polyoxymethylene Market is expected to reach USD 244.88 Million by 2030. 4] Who are the top players in the Medical Polyoxymethylene Market? Ans. The major key players in the Global Medical Polyoxymethylene Market are Celanese Corporation, DuPont, Ensinger, BASF SE, SABIC, Mitsubishi Engineering-Plastics Corporation. 5] What was the Global Medical Polyoxymethylene Market size in 2023? Ans. The Global Medical Polyoxymethylene Market size was USD 192.86 Million in 2023.

1. Medical Polyoxymethylene Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Medical Polyoxymethylene Market: Dynamics 2.1 Medical Polyoxymethylene Market Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 Medical Polyoxymethylene Market Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 Medical Polyoxymethylene Market Restraints 2.4 Medical Polyoxymethylene Market Opportunities 2.5 Medical Polyoxymethylene Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power Of Suppliers 2.6.2 Bargaining Power Of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives For Medical Polyoxymethylene Industry 2.11 The Global Pandemic and Redefining of The Medical Polyoxymethylene Industry Landscape 2.12 Price Trend Analysis 2.13 Technological Road Map 2.14 Global Medical Polyoxymethylene Trade Analysis (2018-2023) 2.14.1 Global Import of Medical Polyoxymethylene 2.14.1.1 Ten largest Importer 2.14.2 Global Export of Medical Polyoxymethylene 2.14.2.1 Ten largest Exporter 2.15 Medical Polyoxymethylene Production Capacity Analysis 2.15.1 Chapter Overview 2.15.2 Key Assumptions and Methodology 2.15.3 Medical Polyoxymethylene Manufacturers: Global Installed Capacity 2.15.4 Analysis by Size of Manufacturer 2.15.5 Analysis by Demand Side 2.15.6 Analysis by Supply Side 3. Medical Polyoxymethylene Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 3.1 Global Medical Polyoxymethylene Market, by Product Type (2023-2030) 3.1.1 Copolymer POM 3.1.2 Homopolymer POM 3.2 Global Medical Polyoxymethylene Market, by Application (2023-2030) 3.2.1 Surgical Instruments 3.2.2 Implants 3.2.3 Drug Delivery Devices 3.2.4 Diagnostic Equipment’s 3.3 Global Medical Polyoxymethylene Market, by Material Form (2023-2030) 3.3.1 Sheets 3.3.2 Rods 3.3.3 Tubes 3.3.4 Others 3.4 Global Medical Polyoxymethylene Market, by Region (2023-2030) 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Middle East and Africa 3.4.5 South America 4. North America Medical Polyoxymethylene Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 4.1 North America Medical Polyoxymethylene Market, by Product Type (2023-2030) 4.1.1 Copolymer POM 4.1.2 Homopolymer POM 4.2 North America Medical Polyoxymethylene Market, by Application (2023-2030) 4.2.1 Surgical Instruments 4.2.2 Implants 4.2.3 Drug Delivery Devices 4.2.4 Diagnostic Equipment’s 4.3 Medical Polyoxymethylene Market, by Material Form (2023-2030) 4.3.1 Sheets 4.3.2 Rods 4.3.3 Tubes 4.3.4 Others 4.4 North America Medical Polyoxymethylene Market, by Country (2023-2030) 4.4.1 United States 4.4.1.1 United States Medical Polyoxymethylene Market, by Product Type (2023-2030) 4.4.1.1.1 Copolymer POM 4.4.1.1.2 Homopolymer POM 4.4.1.2 United States Medical Polyoxymethylene Market, by Application (2023-2030) 4.4.1.2.1 Surgical Instruments 4.4.1.2.2 Implants 4.4.1.2.3 Drug Delivery Devices 4.4.1.2.4 Diagnostic Equipment’s 4.4.1.3 Application3Medical Polyoxymethylene Market, by Material Form (2023-2030) 4.4.1.3.1 Sheets 4.4.1.3.2 Rods 4.4.1.3.3 Tubes 4.4.1.3.4 Others 4.4.2 Canada 4.4.2.1 Canada Medical Polyoxymethylene Market, by Product Type (2023-2030) 4.4.2.1.1 Copolymer POM 4.4.2.1.2 Homopolymer POM 4.4.2.2 Canada Medical Polyoxymethylene Market, by Application (2023-2030) 4.4.2.2.1 Surgical Instruments 4.4.2.2.2 Implants 4.4.2.2.3 Drug Delivery Devices 4.4.2.2.4 Diagnostic Equipment’s 4.4.2.3 Application3Medical Polyoxymethylene Market, by Material Form (2023-2030) 4.4.2.3.1 Sheets 4.4.2.3.2 Rods 4.4.2.3.3 Tubes 4.4.2.3.4 Others 4.4.3 Mexico 4.4.3.1 Mexico Medical Polyoxymethylene Market, by Product Material (2023-2030) 4.4.3.1.1 Copolymer POM 4.4.3.1.2 Homopolymer POM 4.4.3.2 Mexico Medical Polyoxymethylene Market, by Application (2023-2030) 4.4.3.2.1 Surgical Instruments 4.4.3.2.2 Implants 4.4.3.2.3 Drug Delivery Devices 4.4.3.2.4 Diagnostic Equipment’s 4.4.3.3 Application3Medical Polyoxymethylene Market, by Material Form (2023-2030) 4.4.3.3.1 Sheets 4.4.3.3.2 Rods 4.4.3.3.3 Tubes 4.4.3.3.4 Others 5. Europe Medical Polyoxymethylene Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 5.1 Europe Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.2 Europe Medical Polyoxymethylene Market, by Application (2023-2030) 5.3 Europe Medical Polyoxymethylene Market, by Material Form (2023-2030) 5.4 Europe Medical Polyoxymethylene Market, by Country (2023-2030) 5.4.1 United Kingdom 5.4.1.1 United Kingdom Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.4.1.2 United Kingdom Medical Polyoxymethylene Market, by Application (2023-2030) 5.4.1.3 United Kingdom Medical Polyoxymethylene Market, by Material Form (2023-2030) 5.4.2 France 5.4.2.1 France Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.4.2.2 France Medical Polyoxymethylene Market, by Application (2023-2030) 5.4.2.3 France Medical Polyoxymethylene Market, by Material Form (2023-2030) 5.4.2.4 5.4.3 Germany 5.4.3.1 Germany Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.4.3.2 Germany Medical Polyoxymethylene Market, by Application (2023-2030) 5.4.3.3 Germany Medical Polyoxymethylene Market, by Material Form (2023-2030) 5.4.4 Italy 5.4.4.1 Italy Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.4.4.2 Italy Medical Polyoxymethylene Market, by Application (2023-2030) 5.4.4.3 Italy Medical Polyoxymethylene Market, by Material Form (2023-2030) 5.4.5 Spain 5.4.5.1 Spain Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.4.5.2 Spain Medical Polyoxymethylene Market, by Application (2023-2030) 5.4.5.3 Spain Medical Polyoxymethylene Market, by Material Form (2023-2030) 5.4.6 Sweden 5.4.6.1 Sweden Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.4.6.2 Sweden Medical Polyoxymethylene Market, by Application (2023-2030) 5.4.6.3 Sweden Medical Polyoxymethylene Market, by Material Form (2023-2030) 5.4.7 Austria 5.4.7.1 Austria Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.4.7.2 Austria Medical Polyoxymethylene Market, by Application (2023-2030) 5.4.7.3 Austria Medical Polyoxymethylene Market, by Material Form (2023-2030) 5.4.8 Rest of Europe 5.4.8.1 Rest of Europe Medical Polyoxymethylene Market, by Product Type (2023-2030) 5.4.8.2 Rest of Europe Medical Polyoxymethylene Market, by Application (2023-2030). 5.4.8.3 Rest of Europe Medical Polyoxymethylene Market, by Material Form (2023-2030) 6. Asia Pacific Medical Polyoxymethylene Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 6.1 Asia Pacific Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.2 Asia Pacific Medical Polyoxymethylene Market, by Application (2023-2030) 6.3 Asia Pacific Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4 Asia Pacific Medical Polyoxymethylene Market, by Country (2023-2030) 6.4.1 China 6.4.1.1 China Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.1.2 China Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.1.3 China Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.2 South Korea 6.4.2.1 S Korea Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.2.2 S Korea Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.2.3 S Korea Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.3 Japan 6.4.3.1 Japan Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.3.2 Japan Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.3.3 Japan Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.4 India 6.4.4.1 India Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.4.2 India Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.4.3 India Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.5 Australia 6.4.5.1 Australia Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.5.2 Australia Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.5.3 Australia Medical Polyoxymethylene Market, by End-Use (2023-2030) 6.4.6 Indonesia 6.4.6.1 Indonesia Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.6.2 Indonesia Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.6.3 Indonesia Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.7 Malaysia 6.4.7.1 Malaysia Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.7.2 Malaysia Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.7.3 Malaysia Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.8 Vietnam 6.4.8.1 Vietnam Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.8.2 Vietnam Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.8.3 Vietnam Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.9 Taiwan 6.4.9.1 Taiwan Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.9.2 Taiwan Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.9.3 Taiwan Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.10 Bangladesh 6.4.10.1 Bangladesh Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.10.2 Bangladesh Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.10.3 Bangladesh Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.11 Pakistan 6.4.11.1 Pakistan Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.11.2 Pakistan Medical Polyoxymethylene Market, by Application (2023-2030) 6.4.11.3 Pakistan Medical Polyoxymethylene Market, by Material Form (2023-2030) 6.4.12 Rest of Asia Pacific 6.4.12.1 Rest of Asia Pacific Medical Polyoxymethylene Market, by Product Type (2023-2030) 6.4.12.2 Rest of Asia PacificMedical Polyoxymethylene Market, by Application (2023-2030) 6.4.12.3 Rest of Asia Pacific Medical Polyoxymethylene Market, by Material Form (2023-2030) 7. Middle East and Africa Medical Polyoxymethylene Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 7.1 Middle East and Africa Medical Polyoxymethylene Market, by Product Type (2023-2030) 7.2 Middle East and Africa Medical Polyoxymethylene Market, by Application (2023-2030) 7.3 Middle East and Africa Medical Polyoxymethylene Market, by Material Form (2023-2030) 7.4 Middle East and Africa Medical Polyoxymethylene Market, by Country (2023-2030) 7.4.1 South Africa 7.4.1.1 South Africa Medical Polyoxymethylene Market, by Product Type (2023-2030) 7.4.1.2 South Africa Medical Polyoxymethylene Market, by Application (2023-2030) 7.4.1.3 South Africa Medical Polyoxymethylene Market, by Material Form (2023-2030) 7.4.2 GCC 7.4.2.1 GCC Medical Polyoxymethylene Market, by Product Type (2023-2030) 7.4.2.2 GCC Medical Polyoxymethylene Market, by Application (2023-2030) 7.4.2.3 GCC Medical Polyoxymethylene Market, by Material Form (2023-2030) 7.4.3 Egypt 7.4.3.1 Egypt Medical Polyoxymethylene Market, by Product Type (2023-2030) 7.4.3.2 Egypt Medical Polyoxymethylene Market, by Application (2023-2030) 7.4.3.3 Egypt Medical Polyoxymethylene Market, by Material Form (2023-2030) 7.4.4 Nigeria 7.4.4.1 Nigeria Medical Polyoxymethylene Market, by Product Type (2023-2030) 7.4.4.2 Nigeria Medical Polyoxymethylene Market, by Application (2023-2030) 7.4.4.3 Nigeria Medical Polyoxymethylene Market, by Material Form (2023-2030) 7.4.5 Rest of ME&A 7.4.5.1 Rest of ME&A Medical Polyoxymethylene Market, by Product Type (2023-2030) 7.4.5.2 Rest of ME&A Medical Polyoxymethylene Market, by Application (2023-2030) 7.4.5.3 Rest of ME&A Medical Polyoxymethylene Market, by Material Form (2023-2030) 8. South America Medical Polyoxymethylene Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 8.1 South America Medical Polyoxymethylene Market, by Product Type (2023-2030) 8.2 South America Medical Polyoxymethylene Market, by Application (2023-2030) 8.3 South America Medical Polyoxymethylene Market, by Material Form (2023-2030) 8.4 South America Medical Polyoxymethylene Market, by Country (2023-2030) 8.4.1 Brazil 8.4.1.1 Brazil Medical Polyoxymethylene Market, by Product Type (2023-2030) 8.4.1.2 Brazil Medical Polyoxymethylene Market, by Application (2023-2030) 8.4.1.3 Brazil Medical Polyoxymethylene Market, by Material Form (2023-2030) 8.4.2 Argentina 8.4.2.1 Argentina Medical Polyoxymethylene Market, by Product Type (2023-2030) 8.4.2.2 Argentina Medical Polyoxymethylene Market, by Application (2023-2030) 8.4.2.3 Argentina Medical Polyoxymethylene Market, by Material Form (2023-2030) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America Medical Polyoxymethylene Market, by Product Type (2023-2030) 8.4.3.2 Rest Of South America Medical Polyoxymethylene Market, by Application (2023-2030) 8.4.3.3 Rest Of South America Medical Polyoxymethylene Market, by Material Form (2023-2030) 9. Global Medical Polyoxymethylene Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Manufacturing Locations 9.3.6 SKU Details 9.3.7 Production Capacity 9.3.8 Production for 2022 9.3.9 No. of Stores 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading Medical Polyoxymethylene Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 Celanese Corporation 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 DuPont 10.3 Ensinger 10.4 BASF SE 10.5 SABIC 10.6 Mitsubishi Engineering-Plastics Corporation 10.7 Kolon Plastics, Inc. 10.8 Ticona Engineering Polymers 10.9 RTP Company 10.10 Westlake Plastics Company 10.11 PolyOne Corporation 10.12 Daicel Corporation 10.13 Formosa Plastics Corporation 10.14 Quadrant Engineering Plastics Products 10.15 PlastiComp, Inc. 10.16 Lehmann & Voss & Co. 10.17 Solvay S.A. 10.18 Saint-Gobain Performance Plastics 10.19 Nylacast 10.20 A. Schulman, Inc. 10.21 KEP Europe GmbH 10.22 AIP Precision Machining 10.23 POM Wonderful LLC 10.24 Topas Advanced Polymers 10.25 Kaneka Corporation 10.26 Amco Polymers 10.27 LATI S.p.A. 10.28 Evonik Industries AG 10.29 Ensinger Medical 10.30 Innovative Polymers 11. Key Findings 12. Industry Recommendations 13. Medical Polyoxymethylene Market: Research Methodology 14. Terms and Glossary