The Medical Pendant Market size was valued at USD 509.85 Million in 2023 and the total Medical Pendant revenue is expected to grow at a CAGR of 6.70% from 2024 to 2030, reaching nearly USD 802.77 Million in 2030.Medical Pendant Market

The report provides a comprehensive analysis of the Medical Pendant market, focusing on key factors influencing industry growth, including market size, trends, drivers, challenges, and opportunities. An in-depth analysis of the current market size and projected growth rate offers valuable insights into the market's overall potential and attractiveness for investors and stakeholders. The section examines historical data and forecasts future trends to assess growth prospects. A preference for advanced pendants results from hospitals and clinics updating their facilities in response to the growing demand for cutting-edge healthcare infrastructure. These innovative pendants meet changing healthcare needs with features including data networking, variable configurations, and integration with other medical equipment. Additionally, to fulfill strict hygiene standards in healthcare facilities, pendants with antimicrobial surfaces, easily cleanable designs, and automated disinfection systems are being adopted. It is because of the increased focus on infection control and patient safety. The need for effective patient care solutions is being driven by the aging population and the rising incidence of chronic diseases. This is a growing demand for modern pendants that can optimize workflow efficiency. Also, real-time monitoring and remote care capabilities are made possible by advances in technology including IoT, AI, and data analytics integration, which give pendants these advantages. Advanced Medical Pendant systems are being used as a result of encouraging government initiatives and financing programs for healthcare infrastructure upgrades, which further drive market growth throughout different areas.To know about the Research Methodology :- Request Free Sample Report Investing in R&D for features such as AI-driven data analysis and seamless interaction with other technologies might help manufacturers become more competitive. Customer bases can be increased by focusing on specialist markets with pendants for telemedicine or surgical suites. Geographical growth is supported by taking advantage of opportunities in developing nations with expanding healthcare infrastructure. The development of cost-effective solutions that strike a balance between affordability and advanced functionality appeals to budget-conscious facilities, particularly in emerging countries. Additionally, hospitals' preferences for sustainable practices are aligned with sustainability investments through the use of eco-friendly materials and energy-efficient designs, which improves market appeal and long-term profitability. The Medical Pendant market is concentrated in North America, Europe, and Asia-Pacific. Growing healthcare spending and infrastructure renovations present significant growth potential in emerging nations such as China and India.

Medical Pendant Market Dynamics

Rising Demand for Advanced Healthcare Infrastructure As healthcare facilities strive to enhance patient care and optimize operational efficiency, there is a growing demand for advanced infrastructure and medical equipment, including Medical Pendant s. Modern hospitals and clinics are increasingly investing in state-of-the-art Pendant systems to support the delivery of high-quality medical care. Clinics and hospitals are constantly working to improve patient outcomes by streamlining processes and raising the standard of service. The effort requires upgrading infrastructure, which includes medical equipment. Medical Pendant s s are essential because they have integrated medical gas and power outlets, lighting, and communication systems. They greatly contribute to the general enhancement of healthcare facilities by directly supporting improved patient care as well as facilitating effective workflows for medical staff. Modern infrastructure is becoming increasingly important to healthcare facilities, which is increasing demand for high-tech Medical Pendant s. For suppliers and manufacturers, this upsurge drives market growth. An increased need for Pendant with integrated functions can be found in facilities that prioritize patient care and operational effectiveness. These consist of advanced communication systems, ergonomic design for increased accessibility, remote monitoring capabilities for increased safety, and seamless integration with medical devices. With new companies joining the market and established ones developing, the competitive landscape gets more intense, which could result in cheaper costs and better technology. Focus on Infection Control and Patient Safety The rising focus on infection control and patient safety presents a significant opportunity for the Medical Pendant market. Hospitals and clinics are increasingly prioritizing measures to prevent the spread of infections and ensure patient well-being, driving the demand for Pendant with features that support these goals. Medical Pendant s play a crucial part in infection prevention, which is driving up demand for devices with antimicrobial coatings, easily cleaned surfaces, and effective cable management. The use of pendants that prioritize patient safety is being driven by adherence to strict safety standards such as UL 60601-1 and IEC 60601-1. The attractiveness of Pendant in medical environments is increasing with their integration with automated disinfection systems and other hospital cleanliness practices. The healthcare industry's choice for advanced Medical Pendant solutions is driven by these trends, which highlight a heightened focus on infection prevention, safety compliance, and seamless integration with cleanliness standards. 1. MMR Research estimates that HAIs affect $XX millions of patients globally each year, highlighting the need for stricter infection control measures. Installation Complexity The complicated installation process stifles the growing demand for improved Medical Pendant s. Conventional Pendant installations require careful coordination with construction teams, which often causes delays and interferes with the planning of the facility layout. Patient care and operational effectiveness are impacted when Pendant s are integrated into pre-existing infrastructure, which lengthens installation schedules. In addition, the process requires more manpower, and time, structural changes, which results in cost overruns, especially when retrofitting already existing facilities. These difficulties indicate the necessity for expedited installation processes to minimize disruptions and cost increases in healthcare settings and satisfy the growing demand for Medical Pendant s. The complicated process of installation presents a significant obstacle to new entrants in the sector, hence potentially hindering its expansion. Additionally, the installation complexity of advanced Pendants is expected to be a deterrent for smaller healthcare facilities with tighter resources from implementing them. Aware of this difficulty, producers are placing a greater focus on creating pendants with easier installation procedures to demand a wider range of consumers. By focusing on installation simplicity. It is expected to break down the obstacles in the market and encourage greater uptake of modern Medical Pendant systems in healthcare facilities of various sizes and budgetary capacities. 1. A 2023 study by MMR found that installing a new Medical Pendant system can take up to 12 weeks, highlighting the time constraints involved. 2. Construction projects typically experience cost overruns of XX%, with complex installations contributing significantly.Medical Pendant Market Segment Analysis

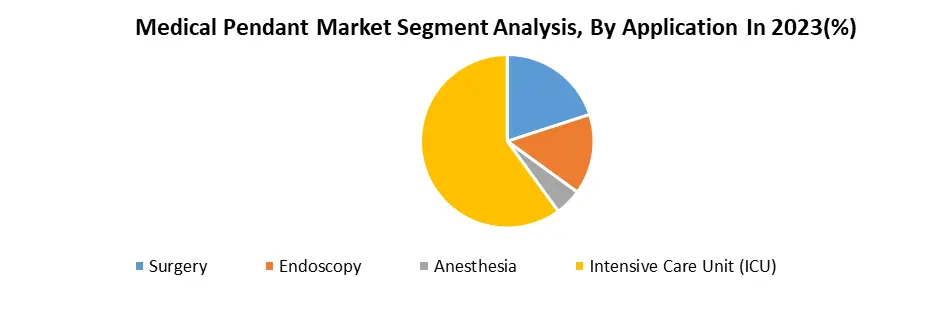

By Application, The Surgery segment accounts for an estimated 40% of the overall Medical Pendant Market. The increased number of surgeries performed worldwide as a result of variables including the growing incidence of chronic illnesses and improvements in surgical methods is driving the market for surgical pendants. Surgical pendants are distinguished by their intricate features and functionality designed specifically for surgical use. These include heavy-duty load capacity to accommodate a variety of devices, multi-articulating arms for efficient equipment positioning, and data connectivity and interaction with surgical navigation systems to optimize productivity and communication. In addition, characteristics including easy-to-clean designs and antibacterial surfaces guarantee infection prevention in surgical settings. The increasing popularity of minimally invasive surgery (MIS) is driving up demand for sophisticated pendants that can integrate high-resolution cameras, allow for flexible positioning, and work in tandem with robotics and artificial intelligence (AI) to support the growing field of technology-driven surgical interventions. The need for surgical pendants is driven by increased surgical volumes worldwide, which are influenced by causes such as the rising prevalence of chronic diseases and developments in surgical methods. The intricate features and functionality of surgical pendants are designed specifically to meet the needs of surgery. Surgical navigation systems and data networking integration to optimize workflow and communication are a few of these, as are multi-articulating arms for ideal equipment positioning and heavy-duty load capacity to accommodate a variety of devices. In surgical settings, infection prevention is further guaranteed by attributes including antimicrobial surfaces and easily cleaned designs. The demand for advanced pendants with features like flexible positioning, high-resolution camera integration, and integration with robotics and AI-assisted surgery is increasing due to the rapid adoption of minimally invasive surgery (MIS). These pendants are designed to meet the changing needs of surgical interventions that leverage technology.

Medical Pendant Market Regional Insights

North America held a share of more than 85.73% in 2023, making it the dominant region in the worldwide Medical Pendant market. Several factors, including an aging population and poor lifestyles, contributed to the increased frequency of chronic diseases such as neurological problems, orthopaedic troubles, and cardiovascular disorders. Significant investments in innovative medical equipment were spurred by the region's well-established healthcare infrastructure and focus on implementing cutting-edge technology to improve patient care and operational effectiveness. Additionally, encouraging government programs such as financing and policy for healthcare infrastructure improvements was essential in promoting additional market sector growth. Increased interest in the Medical Pendant market has been attributed to manufacturers in North America introducing products with cutting-edge features including IoT connectivity, AI-driven data analysis, and integration with surgical navigation systems. The need for portable and mobile Pendant systems to provide remote patient monitoring and interventions is being driven by the growing acceptance of telemedicine. In addition, there is an increasing focus on infection management, which has increased the use of automatic cleaning systems and Pendant s with antimicrobial surfaces. These innovations in technology meet the changing demands of the healthcare industry, improving patient care and tackling hygienic issues in medical institutions around the region. The Centres for Medicare & Medicaid Services (CMS) launched the Hospital Inpatient Prospective Payment System (IPPS) to update healthcare facilities and maybe promote the use of advanced medical devices. Government programs such as the US's Affordable Care Act (ACA) have increased health insurance coverage, which has raised healthcare consumption and raised the possibility of growing markets for Medical Pendant. Additionally, hospitals and clinics are assisted by government subsidies and financial initiatives in modernizing their infrastructure, which includes Medical Pendant systems. To guarantee patient safety, regulatory organizations such as the FDA set safety requirements for medical devices, which have an impact on Pendant features and design. 1. The MMR Analysis reports that in the US alone, HAIs cause around 1.7 million infections and 99,000 deaths annually. Medical Pendant Market Competitive Landscape In the Medical Pendant market, Hillrom (US) is well-known for its VersaFlex+ and Alaris G7 Pendant, which have antimicrobial surfaces and easy data connection. Prioritizing connectivity and safety aspects, Getinge (Sweden) produces Pendant systems such as the Alaris G7 and Spacelabs Healthcare Pendant. Perseus and Perseus Select Pendants, which are modular and ergonomically designed, are offered by Draegerwerk AG & Co. KGaA (Germany). The Carescape Pendant system from GE Healthcare (US) combines data management and vital sign monitoring features. Elekta AB (Sweden) is a manufacturer of pendants that are designed to work with their radiation therapy equipment. One such Pendant is the Elekta Clarity Pendant. Considerable progress has been made in the Medical Pendant industry in the last few years. With improved maneuverability and cable management capabilities, Hillrom introduced the VersaGlide Pro Pendant in 2023. The SpaceLabs Fusion IQ Pendant, which Getinge unveiled in 2022, has AI-powered data analysis features. The Perseus Select Pendant, which features touchscreen controls and a flexible arm design, was launched by Draegerwerk in 2021. In 2020, GE Healthcare introduced the Carescape R860, which had an enhanced user interface along with sophisticated monitoring capabilities. These developments demonstrate the Medical Pendant industry’s continuous evolution and advances in technology. 1. The Mexican state of Jalisco announced in April 2022 that it was going to spend more than USD 301.5 million on healthcare facilities over the following three years to construct new facilities and renovate old ones. In addition, plans were disclosed by the "Mexican Social Security Institute (IMSS)" to invest USD 677.2 million in the construction of 111 new hospitals in Mexico by 2024. It is anticipated that these investments are going to promote the nation's overall market growth. 2. The Well Be Pendant was introduced in September 2021 by Hands-Free Health, the company behind the Well Be voice-activated virtual health assistant platform. It is an innovative medical alert gadget with advanced technology that makes calling for assistance on the national cellular network quick and simple from anywhere.Medical Pendant Market Scope: Inquire Before Buying

Global Medical Pendant Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 509.85 Mn. Forecast Period 2024 to 2030 CAGR: 6.70% Market Size in 2030: US $ 802.77 Mn. Segments Covered: by Product Fixed Fixed Retractable Single Arm Movable Double & Multi-arm Movable Accessories by Application Surgery Endoscopy Anesthesia Intensive Care Unit (ICU) by Capacity Low Duty Medium Duty Heavy Duty by End-User Hospitals Clinics Medical Pendant Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Medical Pendant Market

1. Drägerwerk AG & Co. 2. KGaA 3. Steris Plc 4. Shenzhen Mindray Bio-Medical Electronics Co. Ltd 5. BeaconMedaes 6. Novair Medical 7. Hillrom 8. Getinge 9. GE Healthcare 10. Elekta AB 11. Medimaxkorea 12. Tedisel Medical 13. Skytron LLC 14. Novair Medical 15. Ondal Medical Systems GmbH 16. Megasan Medikal 17. Elekta Hellas S.A. 18. Starkstrom 19. Brandon Medical Co. Ltd. 20. medicalexpo bender 21. bloombiz 22. amcaremed 23. kolabtree FAQs: 1. What are some key trends shaping the Medical Pendant market? Ans. Key trends include technological advancements such as IoT integration and AI-powered analytics, growing demand for infection control features, and the rising adoption of telemedicine. 2. What factors are driving the growth of the Medical Pendant market? Ans. Factors driving market growth include increasing healthcare expenditures, rising prevalence of chronic diseases, government initiatives to modernize healthcare infrastructure, and the focus on patient safety and operational efficiency. 3. What is the projected market size & and growth rate of the Medical Pendant Market? Ans. The Medical Pendant Market size was valued at USD 509.85 Million in 2023 and the total Medical Pendant revenue is expected to grow at a CAGR of 6.70% from 2023 to 2030, reaching nearly USD 802.77 Million in 2030. 4. What segments are covered in the Medical Pendant Market report? Ans. The segments covered in the Medical Pendant market report are Interconnecting Products, Applications, Capacity, and End-Users.

1. Medical Pendant Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Medical Pendant Market: Dynamics 2.1. Medical Pendant Market Trends by Region 2.1.1. North America Medical Pendant Market Trends 2.1.2. Europe Medical Pendant Market Trends 2.1.3. Asia Pacific Medical Pendant Market Trends 2.1.4. Middle East and Africa Medical Pendant Market Trends 2.1.5. South America Medical Pendant Market Trends 2.2. Medical Pendant Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Medical Pendant Market Drivers 2.2.1.2. North America Medical Pendant Market Restraints 2.2.1.3. North America Medical Pendant Market Opportunities 2.2.1.4. North America Medical Pendant Market Challenges 2.2.2. Europe 2.2.2.1. Europe Medical Pendant Market Drivers 2.2.2.2. Europe Medical Pendant Market Restraints 2.2.2.3. Europe Medical Pendant Market Opportunities 2.2.2.4. Europe Medical Pendant Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Medical Pendant Market Drivers 2.2.3.2. Asia Pacific Medical Pendant Market Restraints 2.2.3.3. Asia Pacific Medical Pendant Market Opportunities 2.2.3.4. Asia Pacific Medical Pendant Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Medical Pendant Market Drivers 2.2.4.2. Middle East and Africa Medical Pendant Market Restraints 2.2.4.3. Middle East and Africa Medical Pendant Market Opportunities 2.2.4.4. Middle East and Africa Medical Pendant Market Challenges 2.2.5. South America 2.2.5.1. South America Medical Pendant Market Drivers 2.2.5.2. South America Medical Pendant Market Restraints 2.2.5.3. South America Medical Pendant Market Opportunities 2.2.5.4. South America Medical Pendant Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Medical Pendant Industry 2.8. Analysis of Government Schemes and Initiatives For Medical Pendant Industry 2.9. Medical Pendant Market Trade Analysis 2.10. The Global Pandemic Impact on Medical Pendant Market 3. Medical Pendant Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Medical Pendant Market Size and Forecast, by Product (2023-2030) 3.1.1. Fixed 3.1.2. Fixed Retractable 3.1.3. Single Arm Movable 3.1.4. Double & Multi-arm Movable 3.1.5. Accessories 3.2. Medical Pendant Market Size and Forecast, by Application (2023-2030) 3.2.1. Surgery 3.2.2. Endoscopy 3.2.3. Anesthesia 3.2.4. Intensive Care Unit (ICU) 3.3. Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 3.3.1. Low Duty 3.3.2. Medium Duty 3.3.3. Heavy Duty 3.4. Medical Pendant Market Size and Forecast, by End User (2023-2030) 3.4.1. Hospitals 3.4.2. Clinics 3.5. Medical Pendant Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Medical Pendant Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Medical Pendant Market Size and Forecast, by Product (2023-2030) 4.1.1. Fixed 4.1.2. Fixed Retractable 4.1.3. Single Arm Movable 4.1.4. Double & Multi-arm Movable 4.1.5. Accessories 4.2. North America Medical Pendant Market Size and Forecast, by Application (2023-2030) 4.2.1. Surgery 4.2.2. Endoscopy 4.2.3. Anesthesia 4.2.4. Intensive Care Unit (ICU) 4.3. North America Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 4.3.1. Low Duty 4.3.2. Medium Duty 4.3.3. Heavy Duty 4.4. North America Medical Pendant Market Size and Forecast, by End User (2023-2030) 4.4.1. Hospitals 4.4.2. Clinics 4.5. North America Medical Pendant Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Medical Pendant Market Size and Forecast, by Product (2023-2030) 4.5.1.1.1. Fixed 4.5.1.1.2. Fixed Retractable 4.5.1.1.3. Single Arm Movable 4.5.1.1.4. Double & Multi-arm Movable 4.5.1.1.5. Accessories 4.5.1.2. United States Medical Pendant Market Size and Forecast, by Application (2023-2030) 4.5.1.2.1. Surgery 4.5.1.2.2. Endoscopy 4.5.1.2.3. Anesthesia 4.5.1.2.4. Intensive Care Unit (ICU) 4.5.1.3. United States Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 4.5.1.3.1. Low Duty 4.5.1.3.2. Medium Duty 4.5.1.3.3. Heavy Duty 4.5.1.4. United States Medical Pendant Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Hospitals 4.5.1.4.2. Clinics 4.5.2. Canada 4.5.2.1. Canada Medical Pendant Market Size and Forecast, by Product (2023-2030) 4.5.2.1.1. Fixed 4.5.2.1.2. Fixed Retractable 4.5.2.1.3. Single Arm Movable 4.5.2.1.4. Double & Multi-arm Movable 4.5.2.1.5. Accessories 4.5.2.2. Canada Medical Pendant Market Size and Forecast, by Application (2023-2030) 4.5.2.2.1. Surgery 4.5.2.2.2. Endoscopy 4.5.2.2.3. Anesthesia 4.5.2.2.4. Intensive Care Unit (ICU) 4.5.2.3. Canada Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 4.5.2.3.1. Low Duty 4.5.2.3.2. Medium Duty 4.5.2.3.3. Heavy Duty 4.5.2.4. Canada Medical Pendant Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Hospitals 4.5.2.4.2. Clinics 4.5.3. Mexico 4.5.3.1. Mexico Medical Pendant Market Size and Forecast, by Product (2023-2030) 4.5.3.1.1. Fixed 4.5.3.1.2. Fixed Retractable 4.5.3.1.3. Single Arm Movable 4.5.3.1.4. Double & Multi-arm Movable 4.5.3.1.5. Accessories 4.5.3.2. Mexico Medical Pendant Market Size and Forecast, by Application (2023-2030) 4.5.3.2.1. Surgery 4.5.3.2.2. Endoscopy 4.5.3.2.3. Anesthesia 4.5.3.2.4. Intensive Care Unit (ICU) 4.5.3.3. Mexico Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 4.5.3.3.1. Low Duty 4.5.3.3.2. Medium Duty 4.5.3.3.3. Heavy Duty 4.5.3.4. Mexico Medical Pendant Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Hospitals 4.5.3.4.2. Clinics 5. Europe Medical Pendant Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.2. Europe Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.3. Europe Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.4. Europe Medical Pendant Market Size and Forecast, by End User (2023-2030) 5.5. Europe Medical Pendant Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.5.1.2. United Kingdom Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.5.1.3. United Kingdom Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.5.1.4. United Kingdom Medical Pendant Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.5.2.2. France Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.5.2.3. France Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.5.2.4. France Medical Pendant Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.5.3.2. Germany Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.5.3.3. Germany Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.5.3.4. Germany Medical Pendant Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.5.4.2. Italy Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.5.4.3. Italy Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.5.4.4. Italy Medical Pendant Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.5.5.2. Spain Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.5.5.3. Spain Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.5.5.4. Spain Medical Pendant Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.5.6.2. Sweden Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.5.6.3. Sweden Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.5.6.4. Sweden Medical Pendant Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.5.7.2. Austria Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.5.7.3. Austria Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.5.7.4. Austria Medical Pendant Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Medical Pendant Market Size and Forecast, by Product (2023-2030) 5.5.8.2. Rest of Europe Medical Pendant Market Size and Forecast, by Application (2023-2030) 5.5.8.3. Rest of Europe Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 5.5.8.4. Rest of Europe Medical Pendant Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Medical Pendant Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.4. Asia Pacific Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Medical Pendant Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.1.2. China Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.1.3. China Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.1.4. China Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.2.2. S Korea Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.2.3. S Korea Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.2.4. S Korea Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.3.2. Japan Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.3.3. Japan Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.3.4. Japan Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.4.2. India Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.4.3. India Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.4.4. India Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.5.2. Australia Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.5.3. Australia Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.5.4. Australia Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.6.2. Indonesia Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.6.3. Indonesia Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.6.4. Indonesia Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.7.2. Malaysia Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.7.3. Malaysia Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.7.4. Malaysia Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.8.2. Vietnam Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.8.3. Vietnam Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.8.4. Vietnam Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.9.2. Taiwan Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.9.3. Taiwan Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.9.4. Taiwan Medical Pendant Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Medical Pendant Market Size and Forecast, by Product (2023-2030) 6.5.10.2. Rest of Asia Pacific Medical Pendant Market Size and Forecast, by Application (2023-2030) 6.5.10.3. Rest of Asia Pacific Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 6.5.10.4. Rest of Asia Pacific Medical Pendant Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Medical Pendant Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Medical Pendant Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Medical Pendant Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 7.4. Middle East and Africa Medical Pendant Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Medical Pendant Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Medical Pendant Market Size and Forecast, by Product (2023-2030) 7.5.1.2. South Africa Medical Pendant Market Size and Forecast, by Application (2023-2030) 7.5.1.3. South Africa Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 7.5.1.4. South Africa Medical Pendant Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Medical Pendant Market Size and Forecast, by Product (2023-2030) 7.5.2.2. GCC Medical Pendant Market Size and Forecast, by Application (2023-2030) 7.5.2.3. GCC Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 7.5.2.4. GCC Medical Pendant Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Medical Pendant Market Size and Forecast, by Product (2023-2030) 7.5.3.2. Nigeria Medical Pendant Market Size and Forecast, by Application (2023-2030) 7.5.3.3. Nigeria Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 7.5.3.4. Nigeria Medical Pendant Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Medical Pendant Market Size and Forecast, by Product (2023-2030) 7.5.4.2. Rest of ME&A Medical Pendant Market Size and Forecast, by Application (2023-2030) 7.5.4.3. Rest of ME&A Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 7.5.4.4. Rest of ME&A Medical Pendant Market Size and Forecast, by End User (2023-2030) 8. South America Medical Pendant Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Medical Pendant Market Size and Forecast, by Product (2023-2030) 8.2. South America Medical Pendant Market Size and Forecast, by Application (2023-2030) 8.3. South America Medical Pendant Market Size and Forecast, by Capacity(2023-2030) 8.4. South America Medical Pendant Market Size and Forecast, by End User (2023-2030) 8.5. South America Medical Pendant Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Medical Pendant Market Size and Forecast, by Product (2023-2030) 8.5.1.2. Brazil Medical Pendant Market Size and Forecast, by Application (2023-2030) 8.5.1.3. Brazil Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 8.5.1.4. Brazil Medical Pendant Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Medical Pendant Market Size and Forecast, by Product (2023-2030) 8.5.2.2. Argentina Medical Pendant Market Size and Forecast, by Application (2023-2030) 8.5.2.3. Argentina Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 8.5.2.4. Argentina Medical Pendant Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Medical Pendant Market Size and Forecast, by Product (2023-2030) 8.5.3.2. Rest Of South America Medical Pendant Market Size and Forecast, by Application (2023-2030) 8.5.3.3. Rest Of South America Medical Pendant Market Size and Forecast, by Capacity (2023-2030) 8.5.3.4. Rest Of South America Medical Pendant Market Size and Forecast, by End User (2023-2030) 9. Global Medical Pendant Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Medical Pendant Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Drägerwerk AG & Co. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. KGaA 10.3. Steris Plc 10.4. Shenzhen Mindray Bio-Medical Electronics Co. Ltd 10.5. BeaconMedaes 10.6. Novair Medical 10.7. Hillrom 10.8. Getinge 10.9. GE Healthcare 10.10. Elekta AB 10.11. Medimaxkorea 10.12. Tedisel Medical 10.13. Skytron LLC 10.14. Novair Medical 10.15. Ondal Medical Systems GmbH 10.16. Megasan Medikal 10.17. Elekta Hellas S.A. 10.18. Starkstrom 10.19. Brandon Medical Co. Ltd. 10.20. medicalexpo bender 10.21. bloombiz 10.22. amcaremed 10.23. kolabtree 11. Key Findings 12. Industry Recommendations 13. Medical Pendant Market: Research Methodology 14. Terms and Glossary