The Marine HVAC Market size was valued at USD 834 Mn in 2022 and is expected to reach USD 1057.5 Mn by 2029, at a CAGR of 3.45 %.Overview of the Marine HVAC Market

The maritime vessel's HVAC (Heating, Ventilation, and Air Conditioning) system plays a pivotal role in regulating the overall on-board climate. Designing HVAC systems for ships is seldom a standardized endeavor, as each vessel presents unique challenges and requirements. Consequently, a comprehensive evaluation of your specific objectives and needs becomes imperative to ensure the installation of the most effective HVAC system tailored to your ship. Factors such as confined spatial constraints, environmental considerations, cargo characteristics, and vessel type all contribute significantly to the decision-making process during the HVAC system design phase. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data.To know about the Research Methodology :- Request Free Sample Report

Marine HVAC Market Dynamics

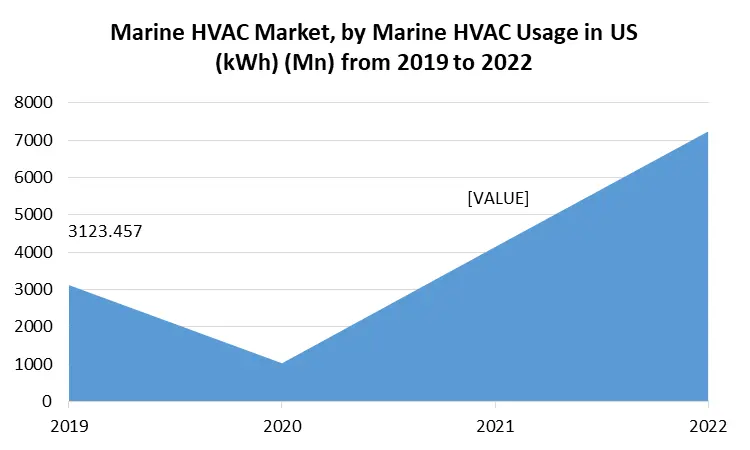

Growing Shipping Industry and Stringent Environmental Regulations are driving the Marine HVAC Market The marine HVAC market in the United States had undergone substantial growth, predominantly driven by the extensive global shipping industry and the incessant rise in global trade. The US played a pivotal role in propelling this growth, and the market exhibited potential regions for development not only within the US but also in neighbouring countries such as Canada and Mexico. This development was further influenced by the imposition of severe environmental protocols within the sector, prompting a shift towards the adoption of energy-efficient and environmentally friendly HVAC solutions to ensure compliance. The competitive landscape underscored the importance of Marine HVAC Market share, especially among major players, including the US, Germany, and France. Also, the US marine HVAC market demonstrated a significant focus on enhancing crew well-being, leading to an increased demand for systems that enhance on board living conditions. Ongoing technological advancements, particularly in smart and connected HVAC systems, positioned the US at the forefront of innovation, presenting the potential to drive further growth in the market. The market exhibited distinct key segments, and competition extended beyond the US to international rivals, notably China. Rising Demand for Specialized Vessels and Increase in Retrofitting Projects are bolstering the opportunities in Marine HVAC Market In terms of opportunities, retrofitting projects emerged as a substantial avenue for manufacturers and service providers in the US marine HVAC market. This involved upgrading and modernizing existing vessels, aligning with the growing demand for specialized vessels such as offshore support vessels and cruise ships. The global expansion of offshore wind farms presented another notable opportunity, requiring HVAC systems tailored to the unique environmental conditions associated with offshore installations, both within the US and globally. The industry's heightened focus on sustainability created additional prospects for marine HVAC systems prioritizing energy efficiency and utilizing environmentally friendly refrigerants, aligning with the growing trends in the US Cost Constraints with Technical Challenges Restraining the Marine HVAC Market Growth Conversely, the US marine HVAC market faced specific challenges. Cost constraints within the cost-sensitive maritime industry posed hurdles, as the initial and operational costs associated with advanced HVAC systems acted as a restraint for some US ship operators. Technical challenges, particularly in designing HVAC systems capable of withstanding the harsh marine environment, presented obstacles that could impact the market's growth rate in the US the COVID-19 pandemic had a notable impact on the US shipping industry, leading to delays in new builds and retrofits, potentially affecting the demand for marine HVAC systems. Additionally, regulatory uncertainties or changes in environmental regulations posed challenges for US manufacturers, necessitating compliance efforts and adaptation to evolving standards.

Marine HVAC Market Segment Analysis

Type: The Marine HVAC market in the US has experienced substantial growth, with all water systems emerging as a key contributor. This type dominates the US market, positioning the country as a significant player in this segment. The potential for expansion extends beyond US borders, presenting opportunities in neighbouring regions such as Canada and Mexico. The growth of all air systems, whether high or low-pressure, has been notable in the US Marine HVAC market. This segment operates within a competitive landscape, marked by market penetration strategies within the US and intense competition, particularly between the US and China. The integration of air-and-water systems stands out as a distinctive segment in the Marine HVAC market, with the US holding a substantial market share. Competition dynamics transcend national borders, involving major players from the US, Germany, and France. The others category introduces diverse HVAC solutions, showcasing innovations within the US Marine HVAC market. This segment offers an opportunity for targeted market analysis, exploring consumer demographics and specific trends in product segmentation. Capacity: HVAC systems with a capacity of less than 10 Refrigeration Tons (RT) demonstrate significant growth potential in the US market. Sub segments within this category warrant detailed product segmentation analysis to align with consumer preferences and market demands. The 11-100 RT segment presents growth opportunities in the US, striking a balance between efficiency and adaptability. Geographic market segmentation within the US can further refine strategies to target specific regions and meet diverse consumer needs. HVAC systems exceeding 100 RT capacity cater to larger vessels, holding promise for substantial growth in the European market. Market segmentation should consider dominant sectors and geographic nuances to ensure effective penetration. Technology: Marine ventilation systems are witnessing a growing trend in the US, contributing significantly to the overall growth rate of the Marine HVAC market. In-depth product segmentation analysis can unveil specific technology preferences within this evolving segment. Marine air conditioning systems, focusing on maintaining optimal temperatures, align with the growing demand in the Canada Opportunities lie in understanding consumer demographics and tailoring products accordingly to capture a significant market share. The US market for marine heating systems is primarily driven by the need for climate control in colder climates. Geographic market segmentation should consider regions where these systems are in high demand to capitalize on emerging opportunities. Marine refrigeration systems play a crucial role in preserving perishable goods, presenting considerable growth opportunities in the Japan, Germany and US Targeted market analysis can identify specific product preferences within this technology segment to meet consumer needs effectively.Application: HVAC systems applied to engine rooms contribute significantly to the efficiency and longevity of propulsion systems in the Mexico and Canada opportunities for growth exist by understanding the dominant sectors within this application segment and tailoring solutions accordingly. Tailored HVAC solutions for cargo holds cater to the preservation of goods during transit, presenting substantial growth prospects in the Europe Marine HVAC market. Product segmentation should consider the unique requirements of different cargo types to meet diverse industry needs. Deck-based HVAC systems enhance crew and passenger comfort during various maritime activities in the US Geographic market segmentation can identify regions with a higher demand for these systems, allowing for targeted marketing efforts. HVAC systems in galleys are crucial for maintaining optimal conditions for food preparation in the US Consumer demographics and product segmentation analysis can uncover preferences within this application segment to align with market trends. HVAC systems for tender garages present significant growth opportunities in the US, considering the specific requirements of vessels with such compartments. Targeted market analysis can reveal sub segments within this application category for a more focused approach. The others category signifies additional applications, highlighting the versatility of HVAC systems across various maritime environments in the Marine HVAC market. Sub segment analysis can unveil specific trends and preferences within this diverse category, allowing for targeted innovation and product development.

The Marine HVAC market in North America is undergoing remarkable growth, particularly in the US, where it plays a vital role in the dominant sector of the industry. The US exhibits continuous market growth, showcasing potential regions for expansion not only within its borders but also in Canada and Mexico. Market penetration in the US is characterized by a focus on advanced HVAC solutions, including all water and air systems, to align with stringent environmental regulations. The competitive landscape in the US involves notable market share dynamics among major players, emphasizing the region's significance in driving overall market growth. In Europe, the Marine HVAC market boasts a robust presence, driven by the well-established shipping industry and maritime infrastructure. Key players such as Germany and France significantly contribute to the market's development. The region prioritizes the adoption of innovative HVAC technologies, with a notable emphasis on air-and-water systems, reflecting a commitment to environmental sustainability. The competitive landscape in Europe places a strong focus on market share, with continuous efforts directed at technological advancements. The European market presents opportunities for growth through retrofitting projects and the customization of HVAC solutions for specialized vessels. The Asia Pacific region emerges as a dynamic hub for the Marine HVAC market, experiencing exponential growth fuelled by the thriving shipping and offshore industries. Remarkably, China plays a substantial role in the region's market expansion, fostering intense competition, particularly with the US Market penetration in Asia Pacific is marked by a focus on high-capacity HVAC systems catering to large vessels navigating these waters. Technological advancements in marine ventilation and air conditioning systems align with the region's emphasis on innovation. The Asia Pacific market offers lucrative opportunities, especially in the global expansion of offshore wind farms, driving demand for specialized HVAC solutions. The Marine HVAC market in the Middle East and Africa is witnessing growth influenced by the region's strategic maritime positioning and the presence of vital shipping routes. The demand for efficient HVAC systems is driven by the extreme environmental conditions prevalent in these areas. The Middle East, in particular, stands out as a dominant sector, presenting opportunities in retrofitting projects and addressing specific HVAC needs for vessels navigating through challenging climates. The regional competitive landscape places emphasis on marine refrigeration systems, vital for preserving perishable goods during transit. Market segmentation in the Middle East and Africa considers unique applications, including deck-based systems and those tailored for cargo holds. South America's Marine HVAC market showcases significant potential, driven by the region's growing maritime activities and expanding fleet. The market experiences notable growth in South America, with Brazil emerging as a dominant sector contributing significantly to the overall market share. Opportunities for growth exist in retrofitting projects and the strategic deployment of HVAC systems in specialized vessels navigating South American waters. The competitive landscape involves focused market penetration efforts, considering diverse applications and environmental conditions specific to the region. The regional outlook underscores the importance of understanding local market entry strategies and tailoring products to meet the unique demands of the South American marine HVAC market. Marine HVAC Market Competitive Landscape The competitive landscape of the Marine HVAC market is characterized by robust competition, technological innovation, and strategic acquisitions, reflecting the industry's dynamic nature. Key players engage in competitor benchmarking, strategic reviews, and continuous adaptation to maintain and enhance their market positions. Johnson Controls is set to expand its OpenBlue digital buildings capabilities through the acquisition of workplace management software leader FM:Systems. This strategic move enhances Johnson Controls' leading OpenBlue digital buildings software portfolio by incorporating complementary cloud-based software as a service (SaaS) digital workplace management capabilities. The acquisition anticipates double-digit revenue growth and accretive gross and operating margins for Johnson Controls. The synergy between the two entities is expected to provide increased capabilities and offerings, benefiting Johnson Controls customers. As the global leader in smart, healthy, and sustainable buildings, Johnson Controls solidifies its position by acquiring FM:Systems, a prominent provider of digital workplace management and Internet of Things (IoT) solutions for facilities and real estate professionals. The transaction involves a base purchase price of USD 455 million, with additional payments contingent on the achievement of post-closing earn-out milestones. In another strategic move, Johnson Controls acquires M&M Carnot to enhance its sustainable Industrial Refrigeration portfolio. This acquisition is a response to the growing demand for ultra-low global warming potential refrigerant technologies. The incorporation of unique CO2 technology broadens Johnson Controls' portfolio of sustainable solutions, aligning with the objective of helping customers achieve net-zero emissions. The acquisition of M&M Carnot positions Johnson Controls as a leader in providing natural refrigeration solutions with ultra-low global warming potential. Carrier Commercial Refrigeration, in collaboration with METRO AG, receives recognition as a Top Project of the Year in the Environment and Energy Leader Awards 2023. This acknowledgment is based on Carrier Commercial Refrigeration's multi-year collaboration with METRO AG, deploying new natural refrigerant equipment across METRO stores in Europe. The collaboration supports METRO's F-Gas Exit Program, aiming to convert over 760 stores to natural refrigerant systems and reduce carbon dioxide (CO2) footprint by 60% by 2030. Carrier Commercial Refrigeration's installation of high-efficiency remote cabinets and cold-room equipment, including the CO2OLtec Evo system, contributes to average energy savings of up to 30% compared to traditional hydro fluorocarbon products. The use of climate-neutral CO2 refrigerant aligns with Carrier's commitment to sustainability, with a Global Warming Potential (GWP) of just one. Additionally, Carrier Commercial Refrigeration introduces Refrigeration-as-a-Service (RaaS) for the food retail industry in collaboration with Relayr, Inc. This innovative offering eliminates the need for food retailers to make upfront investments in refrigeration equipment and infrastructure. Instead, they pay a monthly fee based on the performance of the equipment in use. The RaaS solution aims to empower food retailers by enhancing efficiency, reliability, cost performance, and overall business resilience. Carrier Commercial Refrigeration's expertise in designing, manufacturing, installing, and servicing refrigeration solutions combines with Relayr's IoT technology, equipment financing, and operational asset management, providing a comprehensive and forward-thinking solution for the food retail industry. The Marine HVAC market's competitive landscape is witness further consolidation through strategic acquisitions and collaborations. Key players will continue to invest in research and development, aiming to stay ahead in technological innovation and address the evolving demands of the maritime industry.

Marine HVAC Market Regional Analysis

Marine HVAC Market Scope Table:Inquire Before Buying

Global Marine HVAC Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 834 Mn. Forecast Period 2023 to 2029 CAGR: 3.45% Market Size in 2029: US $ 1057.5 Mn. Segments Covered: by Type All water systems All air systems (high or low-pressure) Air-and-water systems Others by Capacity Less than 10 RT 11- 100 RT More than 100 RT by Technology Marine ventilation systems Marine air conditioning Marine heating systems Marine refrigeration systems by Application Engine room Cargo hold Deck Galley Tender garage Others Marine HVAC Market, by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Marine HVAC Market

1. Carrier Corporation (US) 2. Daikin Industries (Japan) 3. Johnson Controls (US) 4. Bronswerk Marine Inc.(Canada) 5. Drews Marine GmbH (Germany) 6. Frigomar (Italy) 7. Viking Airtech (Norway) 8. HI AIR KOREA (Korea) 9. SINDEX REFRIGERATION PTE (Singapore) 10. MarinAire (US) 11. United CoolAir, LLC (US) 12. Trident Maritime LLC (US) 13. Dometic Group (Sweden) 14. GEA Farm Technologies (Germany) Frequently Asked Questions and Answers about Marine HVAC Market 1. What is the current status of the Marine HVAC market in the US? Ans: The Marine HVAC market in the US is experiencing significant growth, driven by the expanding global shipping industry and international trade. 2. Which regions show potential for Marine HVAC market expansion? Ans: Potential regions for Marine HVAC market expansion include the US, Canada, and Mexico. 3. How is the competitive landscape in the US Marine HVAC market? Ans: The Marine HVAC market is characterized by intense competition, particularly with major players in the US, Germany, and France.. 4. What are the key segments within the Marine HVAC market? Ans: Key segments in the Marine HVAC market include All Water Systems, All Air Systems, Air-and-Water Systems, and others. 5. What opportunities exist in the Marine HVAC market? Ans: Opportunities include retrofitting projects, demand for specialized vessels, and the global expansion of offshore wind farms.

1. Marine HVAC Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Marine HVAC Market: Dynamics 2.1. Marine HVAC Market Trends by Region 2.1.1. Global Marine HVAC Market Trends 2.1.2. North America Marine HVAC Market Trends 2.1.3. Europe Marine HVAC Market Trends 2.1.4. Asia Pacific Marine HVAC Market Trends 2.1.5. Middle East and Africa Marine HVAC Market Trends 2.1.6. South America Marine HVAC Market Trends 2.2. Marine HVAC Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Marine HVAC Market Drivers 2.2.1.2. North America Marine HVAC Market Restraints 2.2.1.3. North America Marine HVAC Market Opportunities 2.2.1.4. North America Marine HVAC Market Challenges 2.2.2. Europe 2.2.2.1. Europe Marine HVAC Market Drivers 2.2.2.2. Europe Marine HVAC Market Restraints 2.2.2.3. Europe Marine HVAC Market Opportunities 2.2.2.4. Europe Marine HVAC Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Marine HVAC Market Drivers 2.2.3.2. Asia Pacific Marine HVAC Market Restraints 2.2.3.3. Asia Pacific Marine HVAC Market Opportunities 2.2.3.4. Asia Pacific Marine HVAC Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Marine HVAC Market Drivers 2.2.4.2. Middle East and Africa Marine HVAC Market Restraints 2.2.4.3. Middle East and Africa Marine HVAC Market Opportunities 2.2.4.4. Middle East and Africa Marine HVAC Market Challenges 2.2.5. South America 2.2.5.1. South America Marine HVAC Market Drivers 2.2.5.2. South America Marine HVAC Market Restraints 2.2.5.3. South America Marine HVAC Market Opportunities 2.2.5.4. South America Marine HVAC Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Analysis of Government Schemes and Initiatives For Commercial Aerospace Industry 2.9. The Global Pandemic Impact on Marine HVAC Market 2.10. Commercial Aerospace Price Trend Analysis (2021-22) 2.11. Global Marine HVAC Market Trade Analysis (2017-2022) 2.11.1. Global Import of Commercial Aerospace 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of Commercial Aerospace 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Commercial Aerospace Manufacturers: Global Installed Capacity 2.12.3.1. Analysis by Size of Manufacturer 2.12.3.2. Analysis by Scale of Operation 2.12.4. Analysis by Location of Manufacturing Facility 2.13. Demand and Supply Analysis 3. Marine HVAC Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. Marine HVAC Market Size and Forecast, by Type (2022-2029) 3.1.1. Light 3.1.2. Medium 3.1.3. Heavy 3.2. Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 3.2.1. OEM 3.2.2. Aftermarket 3.3. Marine HVAC Market Size and Forecast, by Technology (2022-2029) 3.3.1. Airframe 3.3.2. Engine 3.4. Marine HVAC Market Size and Forecast, by Application (2022-2029) 3.4.1. Military 3.4.2. Civil 3.4.3. Commercial 3.5. Marine HVAC Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Marine HVAC Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. North America Marine HVAC Market Size and Forecast, by Type (2022-2029) 4.1.1. All water systems 4.1.2. All air systems (high or low-pressure) 4.1.3. Air-and-water systems 4.1.4. Others 4.2. North America Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 4.2.1. Less than 10 RT 4.2.2. 11- 100 RT 4.2.3. More than 100 RT 4.3. North America Marine HVAC Market Size and Forecast, by Technology (2022-2029) 4.3.1. Marine ventilation systems 4.3.2. Marine air conditioning 4.3.3. Marine heating systems 4.3.4. Marine refrigeration systems 4.4. North America Marine HVAC Market Size and Forecast, by Application (2022-2029) 4.4.1. Engine room 4.4.2. Cargo hold 4.4.3. Deck 4.4.4. Galley 4.4.5. Tender garage 4.4.6. Others 4.5. North America Marine HVAC Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Marine HVAC Market Size and Forecast, by Type (2022-2029) 4.5.1.1.1. All water systems 4.5.1.1.2. All air systems (high or low-pressure) 4.5.1.1.3. Air-and-water systems 4.5.1.1.4. Others 4.5.1.2. United States Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 4.5.1.2.1. Less than 10 RT 4.5.1.2.2. 11- 100 RT 4.5.1.2.3. More than 100 RT 4.5.1.3. United States Marine HVAC Market Size and Forecast, by Technology (2022-2029) 4.5.1.3.1. Marine ventilation systems 4.5.1.3.2. Marine air conditioning 4.5.1.3.3. Marine heating systems 4.5.1.3.4. Marine refrigeration systems 4.5.1.4. United States Marine HVAC Market Size and Forecast, by Application (2022-2029) 4.5.1.4.1. Engine room 4.5.1.4.2. Cargo hold 4.5.1.4.3. Deck 4.5.1.4.4. Galley 4.5.1.4.5. Tender garage 4.5.1.4.6. Others 4.5.2. Canada 4.5.2.1. Canada Marine HVAC Market Size and Forecast, by Type (2022-2029) 4.5.2.1.1. All water systems 4.5.2.1.2. All air systems (high or low-pressure) 4.5.2.1.3. Air-and-water systems 4.5.2.1.4. Others 4.5.2.2. Canada Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 4.5.2.2.1. Less than 10 RT 4.5.2.2.2. 11- 100 RT 4.5.2.2.3. More than 100 RT 4.5.2.3. Canada Marine HVAC Market Size and Forecast, by Technology (2022-2029) 4.5.2.3.1. Marine ventilation systems 4.5.2.3.2. Marine air conditioning 4.5.2.3.3. Marine heating systems 4.5.2.3.4. Marine refrigeration systems 4.5.2.4. Canada Marine HVAC Market Size and Forecast, by Application (2022-2029) 4.5.2.4.1. Engine room 4.5.2.4.2. Cargo hold 4.5.2.4.3. Deck 4.5.2.4.4. Galley 4.5.2.4.5. Tender garage 4.5.2.4.6. Others 4.5.3. Mexico 4.5.3.1. Mexico Marine HVAC Market Size and Forecast, by Type (2022-2029) 4.5.3.1.1. All water systems 4.5.3.1.2. All air systems (high or low-pressure) 4.5.3.1.3. Air-and-water systems 4.5.3.1.4. Others 4.5.3.2. Mexico Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 4.5.3.2.1. Less than 10 RT 4.5.3.2.2. 11- 100 RT 4.5.3.2.3. More than 100 RT 4.5.3.3. Mexico Marine HVAC Market Size and Forecast, by Technology (2022-2029) 4.5.3.3.1. Marine ventilation systems 4.5.3.3.2. Marine air conditioning 4.5.3.3.3. Marine heating systems 4.5.3.3.4. Marine refrigeration systems 4.5.3.4. Mexico Marine HVAC Market Size and Forecast, by Application (2022-2029) 4.5.3.4.1. Engine room 4.5.3.4.2. Cargo hold 4.5.3.4.3. Deck 4.5.3.4.4. Galley 4.5.3.4.5. Tender garage 4.5.3.4.6. Others 5. Europe Marine HVAC Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.2. Europe Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.3. Europe Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.4. Europe Marine HVAC Market Size and Forecast, by Application (2022-2029) 5.5. Europe Marine HVAC Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.5.1.2. United Kingdom Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.5.1.3. United Kingdom Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.5.1.4. United Kingdom Marine HVAC Market Size and Forecast, by Application (2022-2029) 5.5.2. France 5.5.2.1. France Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.5.2.2. France Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.5.2.3. France Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.5.2.4. France Marine HVAC Market Size and Forecast, by Application (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.5.3.2. Germany Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.5.3.3. Germany Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.5.3.4. Germany Marine HVAC Market Size and Forecast, by Application (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.5.4.2. Italy Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.5.4.3. Italy Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.5.4.4. Italy Marine HVAC Market Size and Forecast, by Application (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.5.5.2. Spain Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.5.5.3. Spain Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.5.5.4. Spain Marine HVAC Market Size and Forecast, by Application (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.5.6.2. Sweden Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.5.6.3. Sweden Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.5.6.4. Sweden Marine HVAC Market Size and Forecast, by Application (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.5.7.2. Austria Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.5.7.3. Austria Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.5.7.4. Austria Marine HVAC Market Size and Forecast, by Application (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Marine HVAC Market Size and Forecast, by Type (2022-2029) 5.5.8.2. Rest of Europe Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 5.5.8.3. Rest of Europe Marine HVAC Market Size and Forecast, by Technology (2022-2029) 5.5.8.4. Rest of Europe Marine HVAC Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Marine HVAC Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 6.3. Asia Pacific Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.4. Asia Pacific Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5. Asia Pacific Marine HVAC Market Size and Forecast, by Country (2022-2029) 6.5.1. China 6.5.1.1. China Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.1.2. China Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 6.5.1.3. China Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.1.4. China Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.2.2. S Korea Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 6.5.2.3. S Korea Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.2.4. S Korea Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.3.2. Japan Marine HVAC Market Size and Forecast, by Capacity (2022-2029) 6.5.3.3. Japan Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.3.4. Japan Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.4. India 6.5.4.1. India Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.4.2. India Marine HVAC Market Size and Forecast, by Capacity (2022-2029) 6.5.4.3. India Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.4.4. India Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.5.2. Australia Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 6.5.5.3. Australia Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.5.4. Australia Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.6.2. Indonesia Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 6.5.6.3. Indonesia Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.6.4. Indonesia Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.7.2. Malaysia Marine HVAC Market Size and Forecast, by Capacity (2022-2029) 6.5.7.3. Malaysia Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.7.4. Malaysia Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.8.2. Vietnam Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 6.5.8.3. Vietnam Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.8.4. Vietnam Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.9.2. Taiwan Marine HVAC Market Size and Forecast, by Capacity (2022-2029) 6.5.9.3. Taiwan Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.9.4. Taiwan Marine HVAC Market Size and Forecast, by Application (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Marine HVAC Market Size and Forecast, by Type (2022-2029) 6.5.10.2. Rest of Asia Pacific Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 6.5.10.3. Rest of Asia Pacific Marine HVAC Market Size and Forecast, by Technology (2022-2029) 6.5.10.4. Rest of Asia Pacific Marine HVAC Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Marine HVAC Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Marine HVAC Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Marine HVAC Market Size and Forecast, by Capacity (2022-2029) 7.3. Middle East and Africa Marine HVAC Market Size and Forecast, by Technology (2022-2029) 7.4. Middle East and Africa Marine HVAC Market Size and Forecast, by Application (2022-2029) 7.5. Middle East and Africa Marine HVAC Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Marine HVAC Market Size and Forecast, by Type (2022-2029) 7.5.1.2. South Africa Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 7.5.1.3. South Africa Marine HVAC Market Size and Forecast, by Technology (2022-2029) 7.5.1.4. South Africa Marine HVAC Market Size and Forecast, by Application (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Marine HVAC Market Size and Forecast, by Type (2022-2029) 7.5.2.2. GCC Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 7.5.2.3. GCC Marine HVAC Market Size and Forecast, by Technology (2022-2029) 7.5.2.4. GCC Marine HVAC Market Size and Forecast, by Application (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Marine HVAC Market Size and Forecast, by Type (2022-2029) 7.5.3.2. Nigeria Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 7.5.3.3. Nigeria Marine HVAC Market Size and Forecast, by Technology (2022-2029) 7.5.3.4. Nigeria Marine HVAC Market Size and Forecast, by Application (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Marine HVAC Market Size and Forecast, by Type (2022-2029) 7.5.4.2. Rest of ME&A Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 7.5.4.3. Rest of ME&A Marine HVAC Market Size and Forecast, by Technology (2022-2029) 7.5.4.4. Rest of ME&A Marine HVAC Market Size and Forecast, by Application (2022-2029) 8. South America Marine HVAC Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Marine HVAC Market Size and Forecast, by Type (2022-2029) 8.2. South America Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 8.3. South America Marine HVAC Market Size and Forecast, by Technology (2022-2029) 8.4. South America Marine HVAC Market Size and Forecast, by Application (2022-2029) 8.5. South America Marine HVAC Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Marine HVAC Market Size and Forecast, by Type (2022-2029) 8.5.1.2. Brazil Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 8.5.1.3. Brazil Marine HVAC Market Size and Forecast, by Technology (2022-2029) 8.5.1.4. Brazil Marine HVAC Market Size and Forecast, by Application (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Marine HVAC Market Size and Forecast, by Type (2022-2029) 8.5.2.2. Argentina Marine HVAC Market Size and Forecast, by Capacity (2022-2029) 8.5.2.3. Argentina Marine HVAC Market Size and Forecast, by Technology (2022-2029) 8.5.2.4. Argentina Marine HVAC Market Size and Forecast, by Application (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Marine HVAC Market Size and Forecast, by Type (2022-2029) 8.5.3.2. Rest Of South America Marine HVAC Market Size and Forecast, by Capacity(2022-2029) 8.5.3.3. Rest Of South America Marine HVAC Market Size and Forecast, by Technology (2022-2029) 8.5.3.4. Rest Of South America Marine HVAC Market Size and Forecast, by Application (2022-2029) 9. Global Marine HVAC Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. Production Capacity 9.3.7. Production for 2022 9.4. Leading Marine HVAC Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Carrier Corporation (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Daikin Industries (Japan) 10.3. Johnson Controls (US) 10.4. Bronswerk Marine Inc.(Canada) 10.5. Drews Marine GmbH (Germany) 10.6. Frigomar (Italy) 10.7. Viking Airtech (Norway) 10.8. HI AIR KOREA (Korea) 10.9. SINDEX REFRIGERATION PTE (Singapore) 10.10. MarinAire (US) 10.11. United CoolAir, LLC (US) 10.12. Trident Maritime LLC (US) 10.13. Dometic Group (Sweden) 10.14. GEA Farm Technologies (Germany) 11. Key Findings 12. Industry Recommendations 13. Marine HVAC Market: Research Methodology 14. Terms and Glossary