Marine Electric Vehicle Market size valued at USD 9.94 Bn. in 2023 & is expected to grow to USD 20.98 Bn. by 2029, representing a compound annual growth rate (CAGR) of 11.26% during the forecast period.Marine Electric Vehicle Market Overview

The market has been growing steadily over the past few years as the industry shifts towards more sustainable and environmentally-friendly transportation options. Electric boats, ships, and other marine vehicles are powered by electricity, either from batteries or fuel cells, and offer numerous benefits over traditional fossil fuel-powered vessels. The marine electric vehicle market is driven by several factors, including government initiatives and regulations aimed at reducing carbon emissions and increasing the adoption of electric vehicles. Additionally, advancements in battery technology and the increasing availability of charging infrastructure have made electric marine vehicles a more viable option for commercial and recreational use. Some of the key players in the marine electric vehicle market include Tesla, Inc., ABB Ltd., General Electric, Rolls-Royce Holdings PLC, Torqeedo GmbH, and Duffy Electric Boat Company. These companies are investing in research and development to improve the performance and range of electric marine vehicles, as well as developing new products to meet the growing demand for sustainable transportation options.To know about the Research Methodology :- Request Free Sample Report

Marine Electric Vehicle Market Report Scope and Research Methodology

To gather insights on the marine electric vehicle market, a combination of primary and secondary research methods is commonly employed. Primary research involves direct data collection from industry experts, stakeholders, and consumers through interviews, surveys, and focus groups. Secondary research involves collating information from various sources such as academic publications, news articles, company websites, and industry reports. Statistical and analytical tools are then used to analyze the data, identify market trends, estimate market size and growth potential. Additionally, competitive analysis may be conducted to understand the market share, product offerings, and competitive strategies of key market players. Comprehensive research is crucial for providing accurate and dependable insights into the marine electric vehicle market, and guiding decision-makers about the present and future status of the market. The aim of this report is to provide stakeholders in the marine electric vehicle market with a comprehensive analysis of the industry's current and past state, as well as a projected market size and trends in a clear and concise language. The report covers all essential aspects of the market, including an in-depth examination of key players, such as market leaders, followers, and new entrants. The report features a PORTER and PESTEL analysis, taking into account micro-economic factors that may have an impact on the industry. Internal and external factors that could have a positive or negative effect on the market have been scrutinized to provide decision-makers with a clear understanding of the market's future outlook. Furthermore, the report assists in comprehending the market dynamics and structure by analysing market segments and forecasting the market size. The report provides investors with a competitive analysis of key players based on product offerings, pricing, financial position, product portfolio, growth strategies, and regional presence.Marine Electric Vehicle Market dynamics

Sustainability and carbon reduction in transportation drive the marine electric vehicle sector. Environmentally friendly and energy-efficient marine transportation choices are also boosting market growth. Battery technology and charging infrastructure have made electric marine vehicles more viable for commercial and leisure use. Sustainable transport legislation and government initiatives are also driving industry expansion. Several countries offer tax benefits and subsidies for electric vehicles, especially marine electric vehicles. Electric marine vehicles cost more than fossil fuel-powered vessels, which prevents widespread adoption. Electric marine vehicles' range and speed limit their use in commercial shipping. Despite these limitations, the marine electric vehicle market is likely to increase in the future years. Battery technologies and charging infrastructure will lower electric marine vehicle prices and boost range and speed. Demand for sustainable transportation will spur marine electric vehicle innovation and investment.Marine electric vehicle market drivers

One of the primary drivers of this market is the increasing need for eco-friendly transportation solutions. As the world becomes more environmentally conscious, there is a growing demand for clean and sustainable transportation options in the marine sector. Electric marine vehicles offer a sustainable and low-carbon alternative to traditional fossil fuel-powered vessels, reducing emissions and pollution in the waterways. Another significant driver of this market is the rising popularity of recreational boating activities. The increasing number of people engaging in water sports and leisure activities such as fishing, cruising, and water sports has led to a surge in demand for electric boats and yachts. These electric vehicles offer a quieter, cleaner, and more enjoyable experience compared to traditional gasoline-powered vessels. The advancement of technology and innovation is also driving the growth of the marine electric vehicle market. The development of high-capacity batteries, electric propulsion systems, and autonomous technology is enabling the production of more efficient and advanced electric marine vehicles. Additionally, the integration of artificial intelligence and machine learning is improving the performance, safety, and energy efficiency of these vehicles, further boosting their appeal to consumers. Finally, the growing government support and initiatives for the adoption of electric vehicles in the marine sector are propelling the growth of this market. Governments across the world are offering incentives, tax breaks, and subsidies to encourage the adoption of electric marine vehicles, promoting sustainable and eco-friendly transportation solutions in the marine sector.Marine Electric Vehicle Market Challenges

One of the significant challenges is the high initial costs associated with electric marine vehicles. The cost of batteries, charging infrastructure, and maintenance can be a barrier to adoption for some customers. Additionally, electric marine vehicles typically have a limited range and speed compared to traditional fuel-powered vessels, which can limit their use in some applications. The lack of a widespread charging infrastructure for electric marine vehicles is another significant challenge, particularly in remote areas and developing countries. The absence of a clear regulatory framework for electric marine vehicles can also be a challenge for Marine Electric Vehicle Market players, as regulations and standards may vary by region. Despite advancements in battery technology, the limited energy density of batteries remains a significant challenge, limiting the range and speed of electric marine vehicles. Finally, the perception that electric marine vehicles have limited capabilities or are not as reliable as traditional fuel-powered vessels can be a challenge for industry players to overcome.Marine electric vehicle market trends

One of how the industry is embracing the shift from electric-powered to fossil fuel-powered is through the partnership between transportation corporations and technology firms. They are collaborating to develop electric ferries and cargo ships that will help reduce emissions and improve the efficiency of marine transport. These electric vessels are expected to have a significant impact on the industry and help drive its Marine Electric Vehicle Market growth. Another trend that is becoming increasingly popular is the use of electric boats for recreational purposes. Consumers are seeking more eco-friendly leisure activities, and electric boats are proving to be a popular option. Electric boats are being developed for fishing, cruising, and water sports, offering a sustainable alternative to traditional fuel-powered boats. The demand for high-performance electric boats, including racing boats and luxury yachts, is also on the rise. This trend is driving the development of advanced electric propulsion technologies and high-capacity batteries, allowing for longer ranges and faster speeds. This technology is revolutionizing the industry and is expected to continue to do so in the future. Another significant trend in the marine industry is the integration of autonomous technology, such as artificial intelligence and machine learning. This technology is being used to optimize performance, reduce energy consumption, and enhance safety. It has the potential to transform the marine sector by enabling more efficient and safer operations. The expansion of charging infrastructure for electric marine vehicles is a growing trend. Ports and marinas are investing in charging facilities to meet the growing demand for electric boats. This investment is expected to continue to increase in the coming years, making electric marine vehicles a more viable option for consumers and businesses alike, which drive the Marine Electric Vehicle Market demand during the forecast period. These trends represent a significant shift towards more sustainable and environmentally friendly solutions in the marine industry. The integration of electric and autonomous technologies is expected to drive innovation and growth in the sector, making it a more attractive and viable option for consumers and businesses.Marine Electric Vehicle Market Segment Analysis

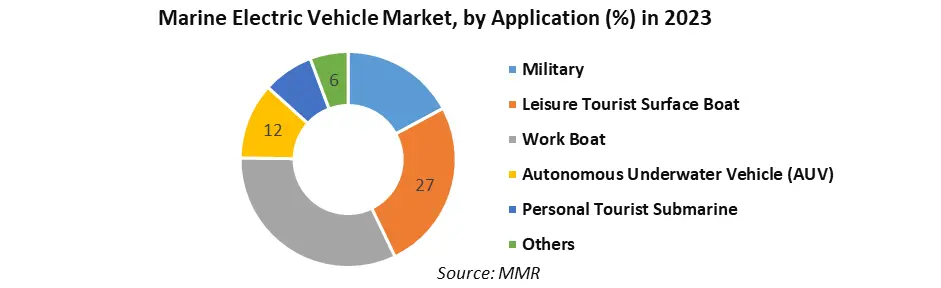

Based on Application: The market is segmented into Military, Leisure Tourist Surface Boat, Work Boat, Autonomous Underwater Vehicle (AUV), Personal Tourist Submarine and Others. The Work Boat segment held the largest Marine Electric Vehicle Market share in 2023. Work boats such as harbor tugs, barges, and patrol vessels form the largest segment, driven by reduced operational costs, lower noise and emissions and improved maneuverability and efficiency. The Leisure Tourist Surface Boat segment is expected to grow rapidly during the forecast period. This segment includes electric ferries, water taxis, and recreational boats whose demand is driven by increasing availability of charging infrastructure and rising environmental consciousness.

Marine Electric Vehicle Market Regional Analysis

North America is expected to be a key market for marine electric vehicles, driven by government initiatives and regulations aimed at promoting sustainable transportation solutions. The region has witnessed an increase in investments in clean energy solutions and the development of charging infrastructure, driving the demand for electric marine vehicles. Europe is another significant market for marine electric vehicles, with several countries implementing policies and incentives to encourage the adoption of electric vehicles. The region is home to several major players in the marine industry, which are investing heavily in the development of electric marine vehicles. Asia-Pacific is expected to witness significant growth in the marine electric vehicle market, driven by the increasing demand for clean energy solutions in countries like China and Japan. The region is home to several major shipbuilding companies, which are investing in the development of electric marine vessels to meet the growing demand for sustainable transportation options. Latin America and the Middle East & Africa are also expected to witness moderate growth in the marine electric vehicle market, driven by the increasing focus on sustainability and the development of clean energy solutions in these regions.Marine Electric Vehicle Market Competitive Landscape

New technology and innovations drive market growth, changing the competitive environment. ABB Ltd., General Electric Company, Wärtsilä Corporation, and Siemens AG are marine electric vehicle market leaders. These firms provide maritime electric vehicle propulsion systems, charging infrastructure, and energy storage solutions worldwide. New market entrants are pushing marine electric vehicle innovation beyond these established firms. Startups like Torqeedo GmbH, Oceanvolt Ltd., and Leclanché SA are examples. These firms develop marine industry-efficient and sustainable technology and products. Strategic alliances and collaborations dominate the marine electric vehicle sector. Startups and technology firms are helping established companies develop new products and expand their market. ABB Ltd. and Ballard Power Systems Inc. are developing marine fuel cell systems, while Wärtsilä Corporation and other startups are developing autonomous vessel technologies. Sustainable and eco-friendly solutions are also boosting marine electric vehicle competitiveness. Environmentally friendly and cost-effective products and services may give companies a commercial advantage.Marine Electric Vehicle Market Scope: Inquire before buying

Global Marine Electric Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 9.94 Bn. Forecast Period 2024 to 2030 CAGR: 11.26% Market Size in 2030: US $ 20.98 Bn. Segments Covered: By Vehicle Type Commercial Defense Unmanned Maritime Vehicles By Technology Hybrid Fully Electric By Mode of Operation Manned Remotely Operated Autonomous By Vessel Transport Seafaring Vessels Inland Vessels By Range <50 km 50–100 km 101–1,000 km >1,000 km By Platform On-water Underwater By Application Military Leisure Tourist Surface Boat Work Boat Autonomous Underwater Vehicle (AUV) Personal Tourist Submarine Others Global Marine Electric Vehicle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Marine Electric Vehicle Key Players

1. Canadian Electric Boat Company (Canada) 2. Torqeedo (Germany, with North American headquarters in Crystal Lake, IL) 3. Vision Marine Technologies (Canada) 4. ABBSwitzerland) 5. Echandia Marine (Sweden) 6. Leclanché (Switzerland) 7. Rolls-Royce (UK) 8. XALT Energy (US, with European headquarters in Dordrecht, Netherlands) 9. Akasol AG (Germany, with Asian headquarters in Shanghai, China) 10. CATL (China) 11. Eco Marine Power (Japan) 12. Samsung SDI (South Korea) 13. Toshiba (Japan) 14. Abu Dhabi Ship Building (UAE) 15. Al Yah Satellite Communications Company (UAE) 16. Dolphin Energy (Qatar) 17. Emirates Global Aluminium (UAE) 18. Ocean Power Technologies (US, with a regional office in Abu Dhabi, UAE) 19. Ampleon (Netherlands, with offices in Brazil and Mexico) 20. EnerSys (US, with operations in several Latin American countries) 21. Naviera Integral (Mexico) 22. WEG (Brazil)FAQs

1: What are the key drivers of growth in the Marine electric vehicle market? Ans: The report identifies several key drivers, including increasing demand for eco-friendly transportation options, rising fuel costs, and advancements in battery technology. 2: What are the major challenges facing the Marine electric vehicle market? Ans: Some of the challenges facing the market include high upfront costs, limited charging infrastructure, and regulatory barriers in some regions. 3: Who are the major players in the Marine electric vehicle Industry? Ans: The report provides a competitive landscape analysis of the industry, identifying key players such as ABB Ltd., General Electric Company, Wärtsilä Corporation, and Siemens AG 4: Are there any particular regions where the Marine electric vehicle market is expected to see high growth? Ans: The report identifies several regions, such as Asia Pacific and Europe, as areas where the market is expected to see strong growth due to factors such as government initiatives and high demand for eco-friendly transportation options. 5: What are some potential opportunities for new entrants in the Marine electric vehicle market? Ans: The report identifies several opportunities, such as developing innovative battery technology, expanding charging infrastructure, and partnering with major players in the industry.

1. Marine Electric Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Marine Electric Vehicle Market: Dynamics 2.1. Marine Electric Vehicle Market Trends by Region 2.1.1. North America Marine Electric Vehicle Market Trends 2.1.2. Europe Marine Electric Vehicle Market Trends 2.1.3. Asia Pacific Marine Electric Vehicle Market Trends 2.1.4. Middle East and Africa Marine Electric Vehicle Market Trends 2.1.5. South America Marine Electric Vehicle Market Trends 2.2. Marine Electric Vehicle Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Marine Electric Vehicle Market Drivers 2.2.1.2. North America Marine Electric Vehicle Market Restraints 2.2.1.3. North America Marine Electric Vehicle Market Opportunities 2.2.1.4. North America Marine Electric Vehicle Market Challenges 2.2.2. Europe 2.2.2.1. Europe Marine Electric Vehicle Market Drivers 2.2.2.2. Europe Marine Electric Vehicle Market Restraints 2.2.2.3. Europe Marine Electric Vehicle Market Opportunities 2.2.2.4. Europe Marine Electric Vehicle Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Marine Electric Vehicle Market Drivers 2.2.3.2. Asia Pacific Marine Electric Vehicle Market Restraints 2.2.3.3. Asia Pacific Marine Electric Vehicle Market Opportunities 2.2.3.4. Asia Pacific Marine Electric Vehicle Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Marine Electric Vehicle Market Drivers 2.2.4.2. Middle East and Africa Marine Electric Vehicle Market Restraints 2.2.4.3. Middle East and Africa Marine Electric Vehicle Market Opportunities 2.2.4.4. Middle East and Africa Marine Electric Vehicle Market Challenges 2.2.5. South America 2.2.5.1. South America Marine Electric Vehicle Market Drivers 2.2.5.2. South America Marine Electric Vehicle Market Restraints 2.2.5.3. South America Marine Electric Vehicle Market Opportunities 2.2.5.4. South America Marine Electric Vehicle Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Marine Electric Vehicle Industry 2.8. Analysis of Government Schemes and Initiatives For Marine Electric Vehicle Industry 2.9. Marine Electric Vehicle Market Trade Analysis 2.10. The Global Pandemic Impact on Marine Electric Vehicle Market 3. Marine Electric Vehicle Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 3.1.1. Commercial 3.1.2. Defense 3.1.3. Unmanned Maritime Vehicles 3.2. Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 3.2.1. Hybrid 3.2.2. Fully Electric 3.3. Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 3.3.1. Manned 3.3.2. Remotely Operated 3.3.3. Autonomous 3.4. Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 3.4.1. Seafaring Vessels 3.4.2. Inland Vessels 3.5. Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 3.5.1. <50 km 3.5.2. 50–100 km 3.5.3. 101–1,000 km 3.5.4. >1,000 km 3.6. Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 3.6.1. On-water 3.6.2. Underwater 3.7. Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 3.7.1. Military 3.7.2. Leisure Tourist Surface Boat 3.7.3. Work Boat 3.7.4. Autonomous Underwater Vehicle (AUV) 3.7.5. Personal Tourist Submarine 3.7.6. Others 3.8. Marine Electric Vehicle Market Size and Forecast, by Region (2023-2030) 3.8.1. North America 3.8.2. Europe 3.8.3. Asia Pacific 3.8.4. Middle East and Africa 3.8.5. South America 4. North America Marine Electric Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.1.1. Commercial 4.1.2. Defense 4.1.3. Unmanned Maritime Vehicles 4.2. North America Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 4.2.1. Hybrid 4.2.2. Fully Electric 4.3. North America Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 4.3.1. Manned 4.3.2. Remotely Operated 4.3.3. Autonomous 4.4. North America Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 4.4.1. Seafaring Vessels 4.4.2. Inland Vessels 4.5. North America Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 4.5.1. <50 km 4.5.2. 50–100 km 4.5.3. 101–1,000 km 4.5.4. >1,000 km 4.6. North America Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 4.6.1. On-water 4.6.2. Underwater 4.7. North America Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 4.7.1. Military 4.7.2. Leisure Tourist Surface Boat 4.7.3. Work Boat 4.7.4. Autonomous Underwater Vehicle (AUV) 4.7.5. Personal Tourist Submarine 4.7.6. Others 4.8. North America Marine Electric Vehicle Market Size and Forecast, by Country (2023-2030) 4.8.1. United States 4.8.1.1. United States Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.8.1.1.1. Commercial 4.8.1.1.2. Defense 4.8.1.1.3. Unmanned Maritime Vehicles 4.8.1.2. United States Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 4.8.1.2.1. Hybrid 4.8.1.2.2. Fully Electric 4.8.1.3. United States Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 4.8.1.3.1. Manned 4.8.1.3.2. Remotely Operated 4.8.1.3.3. Autonomous 4.8.1.4. United States Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 4.8.1.4.1. Seafaring Vessels 4.8.1.4.2. Inland Vessels 4.8.1.5. United States Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 4.8.1.5.1. <50 km 4.8.1.5.2. 50–100 km 4.8.1.5.3. 101–1,000 km 4.8.1.5.4. >1,000 km 4.8.1.6. United States Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 4.8.1.6.1. On-water 4.8.1.6.2. Underwater 4.8.1.7. United States Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 4.8.1.7.1. Military 4.8.1.7.2. Leisure Tourist Surface Boat 4.8.1.7.3. Work Boat 4.8.1.7.4. Autonomous Underwater Vehicle (AUV) 4.8.1.7.5. Personal Tourist Submarine 4.8.1.7.6. Others 4.8.2. Canada 4.8.2.1. Canada Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.8.2.1.1. Commercial 4.8.2.1.2. Defense 4.8.2.1.3. Unmanned Maritime Vehicles 4.8.2.2. Canada Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 4.8.2.2.1. Hybrid 4.8.2.2.2. Fully Electric 4.8.2.3. Canada Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 4.8.2.3.1. Manned 4.8.2.3.2. Remotely Operated 4.8.2.3.3. Autonomous 4.8.2.4. Canada Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 4.8.2.4.1. Seafaring Vessels 4.8.2.4.2. Inland Vessels 4.8.2.5. Canada Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 4.8.2.5.1. <50 km 4.8.2.5.2. 50–100 km 4.8.2.5.3. 101–1,000 km 4.8.2.5.4. >1,000 km 4.8.2.6. Canada Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 4.8.2.6.1. On-water 4.8.2.6.2. Underwater 4.8.2.7. Canada Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 4.8.2.7.1. Military 4.8.2.7.2. Leisure Tourist Surface Boat 4.8.2.7.3. Work Boat 4.8.2.7.4. Autonomous Underwater Vehicle (AUV) 4.8.2.7.5. Personal Tourist Submarine 4.8.2.7.6. Others 4.8.3. Mexico 4.8.3.1. Mexico Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.8.3.1.1. Commercial 4.8.3.1.2. Defense 4.8.3.1.3. Unmanned Maritime Vehicles 4.8.3.2. Mexico Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 4.8.3.2.1. Hybrid 4.8.3.2.2. Fully Electric 4.8.3.3. Mexico Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 4.8.3.3.1. Manned 4.8.3.3.2. Remotely Operated 4.8.3.3.3. Autonomous 4.8.3.4. Mexico Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 4.8.3.4.1. Seafaring Vessels 4.8.3.4.2. Inland Vessels 4.8.3.5. Mexico Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 4.8.3.5.1. <50 km 4.8.3.5.2. 50–100 km 4.8.3.5.3. 101–1,000 km 4.8.3.5.4. >1,000 km 4.8.3.6. Mexico Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 4.8.3.6.1. On-water 4.8.3.6.2. Underwater 4.8.3.7. Mexico Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 4.8.3.7.1. Military 4.8.3.7.2. Leisure Tourist Surface Boat 4.8.3.7.3. Work Boat 4.8.3.7.4. Autonomous Underwater Vehicle (AUV) 4.8.3.7.5. Personal Tourist Submarine 4.8.3.7.6. Others 5. Europe Marine Electric Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.2. Europe Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.4. Europe Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.5. Europe Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.6. Europe Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 5.7. Europe Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 5.8. Europe Marine Electric Vehicle Market Size and Forecast, by Country (2023-2030) 5.8.1. United Kingdom 5.8.1.1. United Kingdom Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.8.1.2. United Kingdom Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.8.1.3. United Kingdom Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.8.1.4. United Kingdom Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.8.1.5. United Kingdom Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.1.6. United Kingdom Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.1.7. United Kingdom Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 5.8.2. France 5.8.2.1. France Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.8.2.2. France Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.8.2.3. France Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.8.2.4. France Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.8.2.5. France Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.2.6. France Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 5.8.2.7. France Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 5.8.3. Germany 5.8.3.1. Germany Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.8.3.2. Germany Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.8.3.3. Germany Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.8.3.4. Germany Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.8.3.5. Germany Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.3.6. Germany Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 5.8.3.7. Germany Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 5.8.4. Italy 5.8.4.1. Italy Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.8.4.2. Italy Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.8.4.3. Italy Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.8.4.4. Italy Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.8.4.5. Italy Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.4.6. Italy Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 5.8.4.7. Italy Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 5.8.5. Spain 5.8.5.1. Spain Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.8.5.2. Spain Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.8.5.3. Spain Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.8.5.4. Spain Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.8.5.5. Spain Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.5.6. Spain Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 5.8.5.7. Spain Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 5.8.6. Sweden 5.8.6.1. Sweden Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.8.6.2. Sweden Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.8.6.3. Sweden Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.8.6.4. Sweden Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.8.6.5. Sweden Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.6.6. Sweden Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 5.8.6.7. Sweden Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 5.8.7. Austria 5.8.7.1. Austria Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.8.7.2. Austria Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.8.7.3. Austria Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.8.7.4. Austria Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.8.7.5. Austria Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.7.6. Austria Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 5.8.7.7. Austria Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 5.8.8. Rest of Europe 5.8.8.1. Rest of Europe Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 5.8.8.2. Rest of Europe Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 5.8.8.3. Rest of Europe Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 5.8.8.4. Rest of Europe Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 5.8.8.5. Rest of Europe Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 5.8.8.6. Rest of Europe Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 5.8.8.7. Rest of Europe Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Marine Electric Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.2. Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.4. Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.5. Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.6. Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.7. Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8. Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Country (2023-2030) 6.8.1. China 6.8.1.1. China Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.1.2. China Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.1.3. China Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.1.4. China Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.1.5. China Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.1.6. China Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.1.7. China Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.2. S Korea 6.8.2.1. S Korea Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.2.2. S Korea Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.2.3. S Korea Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.2.4. S Korea Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.2.5. S Korea Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.2.6. S Korea Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.2.7. S Korea Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.3. Japan 6.8.3.1. Japan Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.3.2. Japan Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.3.3. Japan Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.3.4. Japan Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.3.5. Japan Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.3.6. Japan Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.3.7. Japan Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.4. India 6.8.4.1. India Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.4.2. India Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.4.3. India Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.4.4. India Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.4.5. India Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.4.6. India Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.4.7. India Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.5. Australia 6.8.5.1. Australia Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.5.2. Australia Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.5.3. Australia Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.5.4. Australia Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.5.5. Australia Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.5.6. Australia Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.5.7. Australia Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.6. Indonesia 6.8.6.1. Indonesia Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.6.2. Indonesia Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.6.3. Indonesia Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.6.4. Indonesia Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.6.5. Indonesia Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.6.6. Indonesia Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.6.7. Indonesia Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.7. Malaysia 6.8.7.1. Malaysia Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.7.2. Malaysia Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.7.3. Malaysia Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.7.4. Malaysia Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.7.5. Malaysia Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.7.6. Malaysia Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.7.7. Malaysia Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.8. Vietnam 6.8.8.1. Vietnam Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.8.2. Vietnam Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.8.3. Vietnam Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.8.4. Vietnam Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.8.5. Vietnam Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.8.6. Vietnam Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.8.7. Vietnam Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.9. Taiwan 6.8.9.1. Taiwan Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.9.2. Taiwan Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.9.3. Taiwan Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.9.4. Taiwan Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.9.5. Taiwan Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.9.6. Taiwan Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.9.7. Taiwan Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 6.8.10. Rest of Asia Pacific 6.8.10.1. Rest of Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 6.8.10.2. Rest of Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 6.8.10.3. Rest of Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 6.8.10.4. Rest of Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 6.8.10.5. Rest of Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 6.8.10.6. Rest of Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 6.8.10.7. Rest of Asia Pacific Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Marine Electric Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.2. Middle East and Africa Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 7.4. Middle East and Africa Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 7.5. Middle East and Africa Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 7.6. Middle East and Africa Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 7.7. Middle East and Africa Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 7.8. Middle East and Africa Marine Electric Vehicle Market Size and Forecast, by Country (2023-2030) 7.8.1. South Africa 7.8.1.1. South Africa Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.8.1.2. South Africa Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 7.8.1.3. South Africa Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 7.8.1.4. South Africa Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 7.8.1.5. South Africa Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 7.8.1.6. South Africa Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 7.8.1.7. South Africa Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 7.8.2. GCC 7.8.2.1. GCC Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.8.2.2. GCC Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 7.8.2.3. GCC Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 7.8.2.4. GCC Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 7.8.2.5. GCC Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 7.8.2.6. GCC Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 7.8.2.7. GCC Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 7.8.3. Nigeria 7.8.3.1. Nigeria Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.8.3.2. Nigeria Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 7.8.3.3. Nigeria Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 7.8.3.4. Nigeria Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 7.8.3.5. Nigeria Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 7.8.3.6. Nigeria Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 7.8.3.7. Nigeria Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 7.8.4. Rest of ME&A 7.8.4.1. Rest of ME&A Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.8.4.2. Rest of ME&A Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 7.8.4.3. Rest of ME&A Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 7.8.4.4. Rest of ME&A Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 7.8.4.5. Rest of ME&A Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 7.8.4.6. Rest of ME&A Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 7.8.4.7. Rest of ME&A Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 8. South America Marine Electric Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.2. South America Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 8.3. South America Marine Electric Vehicle Market Size and Forecast, by Mode of Operation(2023-2030) 8.4. South America Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 8.5. South America Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 8.6. South America Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 8.7. South America Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 8.8. South America Marine Electric Vehicle Market Size and Forecast, by Country (2023-2030) 8.8.1. Brazil 8.8.1.1. Brazil Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.8.1.2. Brazil Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 8.8.1.3. Brazil Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 8.8.1.4. Brazil Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 8.8.1.5. Brazil Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 8.8.1.6. Brazil Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 8.8.1.7. Brazil Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 8.8.2. Argentina 8.8.2.1. Argentina Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.8.2.2. Argentina Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 8.8.2.3. Argentina Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 8.8.2.4. Argentina Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 8.8.2.5. Argentina Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 8.8.2.6. Argentina Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 8.8.2.7. Argentina Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 8.8.3. Rest Of South America 8.8.3.1. Rest Of South America Marine Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 8.8.3.2. Rest Of South America Marine Electric Vehicle Market Size and Forecast, by Technology (2023-2030) 8.8.3.3. Rest Of South America Marine Electric Vehicle Market Size and Forecast, by Mode of Operation (2023-2030) 8.8.3.4. Rest Of South America Marine Electric Vehicle Market Size and Forecast, by Vessel Transport (2023-2030) 8.8.3.5. Rest Of South America Marine Electric Vehicle Market Size and Forecast, by Range (2023-2030) 8.8.3.6. Rest Of South America Marine Electric Vehicle Market Size and Forecast, by Platform (2023-2030) 8.8.3.7. Rest Of South America Marine Electric Vehicle Market Size and Forecast, by Application (2023-2030) 9. Global Marine Electric Vehicle Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Marine Electric Vehicle Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Canadian Electric Boat Company (Canada) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Torqeedo (Germany, with North American headquarters in Crystal Lake, IL) 10.3. Vision Marine Technologies (Canada) 10.4. ABBSwitzerland) 10.5. Echandia Marine (Sweden) 10.6. Leclanché (Switzerland) 10.7. Rolls-Royce (UK) 10.8. XALT Energy (US, with European headquarters in Dordrecht, Netherlands) 10.9. Akasol AG (Germany, with Asian headquarters in Shanghai, China) 10.10. CATL (China) 10.11. Eco Marine Power (Japan) 10.12. Samsung SDI (South Korea) 10.13. Toshiba (Japan) 10.14. Abu Dhabi Ship Building (UAE) 10.15. Al Yah Satellite Communications Company (UAE) 10.16. Dolphin Energy (Qatar) 10.17. Emirates Global Aluminium (UAE) 10.18. Ocean Power Technologies (US, with a regional office in Abu Dhabi, UAE) 10.19. Ampleon (Netherlands, with offices in Brazil and Mexico) 10.20. EnerSys (US, with operations in several Latin American countries) 10.21. Naviera Integral (Mexico) 10.22. WEG (Brazil) 11. Key Findings 12. Industry Recommendations 13. Marine Electric Vehicle Market: Research Methodology 14. Terms and Glossary