The Luxury Packaging Market size is valued at USD 15.61 Billion in 2022 and is forecasted to grow at a CAGR of 4.6% from 2023 to 2029, reaching nearly USD 21.45 Billion. The Luxury Packaging Market encompasses the production and distribution of premium packaging materials for high end products. It caters to various industries such as cosmetics, jewelry and electronics offering a diverse range of materials like high quality paper, metal and sustainable options. Luxury packaging stands out with its unique designs, customization and branding elements effectively communicating the brand story and enhancing the perceived value. The market has witnessed steady growth driven by rising disposable incomes and the premiumization trend. Sustainable packaging practices and technological advancements such as smart packaging and digital experiences further shape the industry's landscape. This dynamic market presents opportunities for innovation and helps luxury brands create exceptional consumer experiences. Asia Pacific is leading region in the global Luxury Packaging industry with a share of 34.1% in 2022 and is forecasted to have continuous growth in the period from 2023-2029.To know about the Research Methodology :- Request Free Sample Report

Luxury Packaging Market Dynamics

Luxury Packaging Market Drivers Driving Forces in the Luxury Packaging Market: Brand Differentiation, Consumer Experience, Rising Incomes, Premiumization, Sustainability, Technology, and Emerging Markets The luxury packaging market is influenced by various drivers that propel its growth and advancement. These drivers include the need for luxury brands to establish a unique brand image and differentiate their products from competitors through visually appealing and high-quality packaging. Luxury packaging plays a crucial role in meeting consumer expectations by providing an exclusive and sensory experience that enhances the overall perception of the brand. The market is also driven by the increasing disposable incomes of consumers particularly in emerging economies leading to higher spending on luxury goods and the accompanying premium packaging. Ongoing premiumization trend across industries contributes to the demand for luxury packaging as brands strive to elevate the perceived value of their products. Sustainability also plays a significant role with brands adopting eco-friendly packaging practices to align with consumer values. Smart packaging and personalized digital interactions are integrated into luxury packaging to engage consumers and create interactive brand experiences. Growth of emerging markets especially in Asia-Pacific fuels the demand for luxury packaging as luxury brands expand their presence and cater to the preferences of local consumers. These drivers shape the luxury packaging market driving innovation and creating opportunities for brands to enhance their products value and appeal. Luxury Packaging Market Opportunities Brand Enhancement, Customization, Sustainability, Technological Innovations and Emerging Markets The luxury packaging market offers a range of promising opportunities for businesses that encompass brand enhancement through the use of premium materials, innovative designs and unique finishing techniques to elevate brand perception and identity. Customization emerges as a key trend allowing brands to personalize packaging designs, colors and materials to create exclusive experiences that foster consumer engagement. Sustainability presents a significant opportunity as eco-conscious consumers seek brands that prioritize ecofriendly packaging practices such as utilizing sustainable materials and implementing recycling initiatives. Technological innovations provide avenues for integrating smart packaging solutions like NFC tags and augmented reality to enhance product experiences and create interactive brand interactions. The growth of luxury markets in emerging economies including China and India, creates new opportunities for luxury packaging, while catering to e-commerce packaging needs becomes crucial in the digital retail landscape. Collaborations and limited editions offer avenues to generate excitement and urgency among consumers, driving sales and brand visibility.Luxury Packaging Market Restraints and Challenges

The luxury packaging market encounters various challenges and restraints that impact its progress and growth that include high costs associated with premium materials, intricate designs and customization which strains the budgets of smaller businesses. Sustainability, while presenting an opportunity, also poses challenges as luxury brands strive to find ecofriendly alternatives without compromising on visual appeal. Compliance with diverse regulatory requirements regarding safety, labeling and product information adds complexity and expenses to the packaging process. Counterfeiting and imitation remain significant concerns necessitating the implementation of robust anti-counterfeiting measures. The ever-changing consumer preferences and trends demand continuous market research and investment in design and innovation. Managing complex supply chains, limited shelf space in upscale retail environments and ensuring brand consistency across various packaging designs are additional challenges faced by luxury packaging businesses.Luxury Packaging Market Trends

The luxury packaging market is influenced by a range of prominent trends that shape its trajectory and growth. These trends include increasing emphasis on sustainability with luxury brands adopting ecofriendly materials and practices to reduce their environmental impact. Minimalist and elegant designs are gaining popularity with a shift towards clean and sophisticated packaging aesthetics. Personalization and exclusivity are key trends as brands offer custom touches to create a unique connection with consumers. Innovative materials and finishes such as textured papers and special coatings that contribute to visually striking packaging. Augmented reality and QR codes enhances consumer experiences by providing interactive elements and additional product information. Artistic collaborations with renowned designers and artists result in limited edition packaging collections that combine luxury and artistry. Sustainable luxury unboxing experiences are prioritized that focuses on thoughtful design and use of luxurious and eco-friendly materials. Digital integration such as QR codes and smart packaging bridges the gap between online and offline interactions.Luxury Packaging Market Segmentation

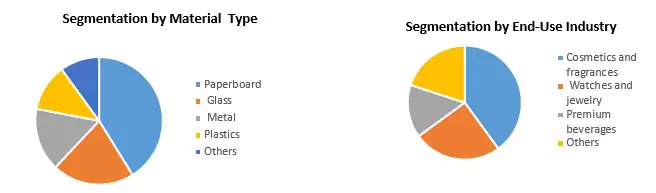

The Luxury Packaging Market has following segments which gives the details about market by Material Type, Packaging Type, End-Use Industry, Price Range, Distribution Channel and by Region. By Material Type, the Market is segmented into Paperboard, Glass, Metal, Plastics and Others. Paperboard is the most popular material used for market with market share of over 40% as the paperboard is a lightweight, sustainable and cost-effective material. Glass is a durable and elegant material that is often used for packaging high-end products such as perfumes and cosmetics. Metal is a strong and secure material which is used to package jewelry and watches along with electronics and other high-value products. By Packaging Type, the Luxury Packaging Market is segmented into Boxes, Bottles, Bags, Containers and Others. Boxes are the most popular type of luxury packaging market with share of over 35% as boxes are versatile and customizable packaging option that are used to pack a wide variety of products. Bottles are another popular type of luxury packaging which are durable and elegant packaging option that is often used to package high-end products such as perfumes and cosmetics. By End-Use Industry, the Luxury Packaging Market is segmented as Cosmetics and fragrances, Watches and jewelry, Premium beverages and Others. Cosmetics and fragrances is the largest end use segment for luxury packaging market with share of over 40%. This is due to the fact that cosmetics and fragrances are often seen as luxury products and their packaging is an important part of their appeal. Watches and jewelry are often seen as status symbols and their packaging is an important way to communicate their value. By Price Range, the Luxury Packaging Market is segmented as Under $100, $100-$500, $500-$1000 and Over $1000. Under $100 is the largest price range segment for luxury packaging market with share of over 30% as there is a growing demand for affordable luxury goods and this price range offers a good balance of quality and price. $500-$1000 price range offers a high level of quality and craftsmanship and it is often chosen by consumers who are looking for a truly luxurious product. By Distribution Channel, the Luxury Packaging Market is segmented as Offline and Online. Offline is the largest distribution channel for market with share of over 65% as the consumers prefer to see and touch luxury products before making a buying decision. Online is another growing distribution channel due to the increasing popularity of online shopping and the fact that online retailers offer a wider selection of luxury products than offline retailers. The Luxury Packaging Market is analyzed within 5 regions: North America, Europe, Asia Pacific, Middle East & Africa and South America.

Regional Insights

North America, South America, Europe, Asia-Pacific, Middle East and Africa and South America are the five geographic regions that provides complete analysis for the investment and future growth. The Luxury Packaging Market is led by Asia-Pacific market and is forecasted to be largest region for Luxury Packaging Market in the forecast period 2023-2029. Asia Pacific: Asia Pacific is the largest region for Luxury Packaging Market in 2022 with share of over 34%. In this region, there is a preference for packaging designs that reflect cultural heritage and symbolism. The cosmetics, skincare and electronics industries are major contributors to the luxury packaging market in Asia-Pacific. North America: North America is the second largest region for Market with share of over 29% in the global market share. The region is characterized by a strong focus on sustainability with increasing demand for ecofriendly packaging solutions. The cosmetics and personal care industry along with the alcoholic beverages sector are major contributors to the market in North America. Europe: Europe is the third largest region for Luxury Packaging Market with share of over 23% in the global market share. The region emphasizes elegance, sophistication and craftsmanship in luxury packaging design. The perfume and fragrance industry as well as the fashion and accessories sector are key drivers of the market in Europe. South America: The South America is forecasted to be the fourth largest region for Luxury Packaging market. The region emphasizes vibrant colors, unique designs and a mix of traditional and modern elements in luxury packaging. The fragrance, cosmetics and confectionery industries are significant contributors to the market in South America. Middle East & Africa: The Middle East & Africa is the growing region for Luxury Packaging Market. The region values opulence, lavishness and intricate designs in luxury packaging. The perfume, cosmetics and jewelry sectors are key drivers of the luxury packaging market in this region.Competitive Analysis

The luxury packaging market observes significant contributions from key players such as Amcor, DS Smith, Huhtamaki, Mauser Group, Sealed Air, Sonoco, Tetra Pak and WestRock. Amcor recently launched an eco-friendly packaging line for cosmetics and fragrances, while DS Smith introduced a sustainable paperboard bottle for wine. Huhtamaki unveiled a sustainable packaging range for food and beverages and Mauser Group expanded its market presence by acquiring a packaging company in China. Sealed Air released sustainable packaging solutions for electronics and Sonoco developed a paperboard bottle for spirits. Tetra Pak introduced eco-friendly packaging options for milk and dairy products and WestRock expanded its portfolio through the acquisition of a packaging company in the United States. These contributions align with emerging trends in the market which focuses on sustainability, personalization and technology integration. By embracing these trends and delivering innovative solutions, companies succeed in meeting the evolving demands of consumers and brands in the luxury packaging industry.Luxury Packaging Market Scope: Inquire before buying

Luxury Packaging Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 15.6 Billion Forecast Period 2023 to 2029 CAGR: 4.6% Market Size in 2029: USD 21.4 Billion Segments Covered: by Material Type Paperboard Glass Metal Plastics Others by Packaging Type Boxes Bottles Bags Containers Others by End-Use Industry Cosmetics and fragrances Watches and jewelry Premium beverages Others by Price Range Under $100 $100-$500 $500-$1000 Over $1000 by Distribution Channel Offline Online Key players in the Global Luxury Packaging Market

In the report, the company portfolio of leading Global Market manufacturer has been covered on the basis of study and research of the global Luxury Packaging industry. 1. International Paper Company 2. DS Smith Plc 3. Amcor Plc 4. Crown Holdings, Inc. 5. WestRock Company 6. Seda International Packaging Group 7. GPA Global 8. MW Luxury Packaging 9. Quadpack 10. Coveris Holdings SA 11. Verpack Group 12. Curtis Packaging 13. Design Packaging Inc. 14. HH Deluxe Packaging 15. Elegant Packaging 16. Neenah Packaging 17. Diam Pack 18. GPA Luxury 19. Alliora Coffrets 20. Delta Global 21. MW Creative Ltd. 22. Ball Corporation 23. James Cropper Plc 24. API Group 25. Winter & Company 26. Roberts Mart & Co. Ltd. 27. Karl Knauer KG 28. Smurfit Kappa Group 29. Canpack Group 30. Elanders Group FAQs 1) What is the estimated value of the Global Luxury Packaging Market in 2022? Ans. The Global market was estimated to be valued at USD 15.61 Billion in 2022. 2) What is the growth rate of the Global Luxury Packaging Market? Ans. The market growth rate at the global level is 4.6% CAGR with a forecasted value of USD 21.4 Billion by 2029. 3) Which region has the highest growing potential globally? Ans. Asia Pacific region is forecasted to grow at a CAGR of 4.6% in the Luxury Packaging Market at highest rate among all regions in the forecast period of 2023-2029. 4) How is Global Market segmented by Packaging Type? Ans. The Market is segmented as – Boxes, Bottles, Bags, Containers, and Others. 5) By End-Use Industry, how is Global Market segmented? Ans. The Luxury Packaging Market is segmented into – Cosmetics and fragrances, Watches and jewelry, Premium beverages, and others. 6) How are the top players in the Global Luxury Packaging Market? Ans. The research and analysis on the report encompass the key companies in the Luxury Packaging industry are Amcor, DS Smith, Huhtamaki, Mauser Group, Sealed Air, Sonoco, Tetra Pak, and WestRock.

1. Luxury Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Luxury Packaging Market: Dynamics 2.1. Luxury Packaging Market Trends by Region 2.1.1. North America Luxury Packaging Market Trends 2.1.2. Europe Luxury Packaging Market Trends 2.1.3. Asia Pacific Luxury Packaging Market Trends 2.1.4. Middle East and Africa Luxury Packaging Market Trends 2.1.5. South America Luxury Packaging Market Trends 2.2. Luxury Packaging Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Luxury Packaging Market Drivers 2.2.1.2. North America Luxury Packaging Market Restraints 2.2.1.3. North America Luxury Packaging Market Opportunities 2.2.1.4. North America Luxury Packaging Market Challenges 2.2.2. Europe 2.2.2.1. Europe Luxury Packaging Market Drivers 2.2.2.2. Europe Luxury Packaging Market Restraints 2.2.2.3. Europe Luxury Packaging Market Opportunities 2.2.2.4. Europe Luxury Packaging Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Luxury Packaging Market Drivers 2.2.3.2. Asia Pacific Luxury Packaging Market Restraints 2.2.3.3. Asia Pacific Luxury Packaging Market Opportunities 2.2.3.4. Asia Pacific Luxury Packaging Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Luxury Packaging Market Drivers 2.2.4.2. Middle East and Africa Luxury Packaging Market Restraints 2.2.4.3. Middle East and Africa Luxury Packaging Market Opportunities 2.2.4.4. Middle East and Africa Luxury Packaging Market Challenges 2.2.5. South America 2.2.5.1. South America Luxury Packaging Market Drivers 2.2.5.2. South America Luxury Packaging Market Restraints 2.2.5.3. South America Luxury Packaging Market Opportunities 2.2.5.4. South America Luxury Packaging Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Luxury Packaging Industry 2.8. Analysis of Government Schemes and Initiatives For Luxury Packaging Industry 2.9. Luxury Packaging Market Trade Analysis 2.10. The Global Pandemic Impact on Luxury Packaging Market 3. Luxury Packaging Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 3.1.1. Paperboard 3.1.2. Glass 3.1.3. Metal 3.1.4. Plastics 3.1.5. Others 3.2. Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 3.2.1. Boxes 3.2.2. Bottles 3.2.3. Bags 3.2.4. Containers 3.2.5. Others 3.3. Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 3.3.1. Cosmetics and fragrances 3.3.2. Watches and jewelry 3.3.3. Premium beverages 3.3.4. Others 3.4. Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 3.4.1. Under $100 3.4.2. $100-$500 3.4.3. $500-$1000 3.4.4. Over $1000 3.5. Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 3.5.1. Offline 3.5.2. Online 3.6. Luxury Packaging Market Size and Forecast, by Region (2022-2029) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Luxury Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 4.1.1. Paperboard 4.1.2. Glass 4.1.3. Metal 4.1.4. Plastics 4.1.5. Others 4.2. North America Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 4.2.1. Boxes 4.2.2. Bottles 4.2.3. Bags 4.2.4. Containers 4.2.5. Others 4.3. North America Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 4.3.1. Cosmetics and fragrances 4.3.2. Watches and jewelry 4.3.3. Premium beverages 4.3.4. Others 4.4. North America Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 4.4.1. Under $100 4.4.2. $100-$500 4.4.3. $500-$1000 4.4.4. Over $1000 4.5. North America Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.1. Offline 4.5.2. Online 4.6. North America Luxury Packaging Market Size and Forecast, by Country (2022-2029) 4.6.1. United States 4.6.1.1. United States Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 4.6.1.1.1. Paperboard 4.6.1.1.2. Glass 4.6.1.1.3. Metal 4.6.1.1.4. Plastics 4.6.1.1.5. Others 4.6.1.2. United States Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 4.6.1.2.1. Boxes 4.6.1.2.2. Bottles 4.6.1.2.3. Bags 4.6.1.2.4. Containers 4.6.1.2.5. Others 4.6.1.3. United States Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 4.6.1.3.1. Cosmetics and fragrances 4.6.1.3.2. Watches and jewelry 4.6.1.3.3. Premium beverages 4.6.1.3.4. Others 4.6.1.4. United States Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 4.6.1.4.1. Under $100 4.6.1.4.2. $100-$500 4.6.1.4.3. $500-$1000 4.6.1.4.4. Over $1000 4.6.1.5. United States Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.1.5.1. Offline 4.6.1.5.2. Online 4.6.2. Canada 4.6.2.1. Canada Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 4.6.2.1.1. Paperboard 4.6.2.1.2. Glass 4.6.2.1.3. Metal 4.6.2.1.4. Plastics 4.6.2.1.5. Others 4.6.2.2. Canada Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 4.6.2.2.1. Boxes 4.6.2.2.2. Bottles 4.6.2.2.3. Bags 4.6.2.2.4. Containers 4.6.2.2.5. Others 4.6.2.3. Canada Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 4.6.2.3.1. Cosmetics and fragrances 4.6.2.3.2. Watches and jewelry 4.6.2.3.3. Premium beverages 4.6.2.3.4. Others 4.6.2.4. Canada Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 4.6.2.4.1. Under $100 4.6.2.4.2. $100-$500 4.6.2.4.3. $500-$1000 4.6.2.4.4. Over $1000 4.6.2.5. Canada Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.2.5.1. Offline 4.6.2.5.2. Online 4.6.3. Mexico 4.6.3.1. Mexico Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 4.6.3.1.1. Paperboard 4.6.3.1.2. Glass 4.6.3.1.3. Metal 4.6.3.1.4. Plastics 4.6.3.1.5. Others 4.6.3.2. Mexico Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 4.6.3.2.1. Boxes 4.6.3.2.2. Bottles 4.6.3.2.3. Bags 4.6.3.2.4. Containers 4.6.3.2.5. Others 4.6.3.3. Mexico Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 4.6.3.3.1. Cosmetics and fragrances 4.6.3.3.2. Watches and jewelry 4.6.3.3.3. Premium beverages 4.6.3.3.4. Others 4.6.3.4. Mexico Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 4.6.3.4.1. Under $100 4.6.3.4.2. $100-$500 4.6.3.4.3. $500-$1000 4.6.3.4.4. Over $1000 4.6.3.5. Mexico Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.3.5.1. Offline 4.6.3.5.2. Online 5. Europe Luxury Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.1. Europe Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.1. Europe Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.1. Europe Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.1. Europe Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.6. Europe Luxury Packaging Market Size and Forecast, by Country (2022-2029) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.6.1.2. United Kingdom Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.6.1.3. United Kingdom Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.1.4. United Kingdom Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.6.1.5. United Kingdom Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.2. France 5.6.2.1. France Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.6.2.2. France Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.6.2.3. France Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.2.4. France Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.6.2.5. France Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.3. Germany 5.6.3.1. Germany Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.6.3.2. Germany Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.6.3.3. Germany Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.3.4. Germany Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.6.3.5. Germany Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.4. Italy 5.6.4.1. Italy Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.6.4.2. Italy Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.6.4.3. Italy Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.4.4. Italy Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.6.4.5. Italy Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.5. Spain 5.6.5.1. Spain Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.6.5.2. Spain Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.6.5.3. Spain Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.5.4. Spain Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.6.5.5. Spain Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.6. Sweden 5.6.6.1. Sweden Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.6.6.2. Sweden Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.6.6.3. Sweden Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.6.4. Sweden Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.6.6.5. Sweden Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.7. Austria 5.6.7.1. Austria Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.6.7.2. Austria Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.6.7.3. Austria Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.7.4. Austria Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.6.7.5. Austria Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 5.6.8.2. Rest of Europe Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 5.6.8.3. Rest of Europe Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 5.6.8.4. Rest of Europe Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 5.6.8.5. Rest of Europe Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Luxury Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.2. Asia Pacific Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.3. Asia Pacific Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.4. Asia Pacific Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.5. Asia Pacific Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6. Asia Pacific Luxury Packaging Market Size and Forecast, by Country (2022-2029) 6.6.1. China 6.6.1.1. China Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.1.2. China Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.1.3. China Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.1.4. China Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.1.5. China Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.2. S Korea 6.6.2.1. S Korea Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.2.2. S Korea Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.2.3. S Korea Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.2.4. S Korea Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.2.5. S Korea Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.3. Japan 6.6.3.1. Japan Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.3.2. Japan Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.3.3. Japan Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.3.4. Japan Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.3.5. Japan Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.4. India 6.6.4.1. India Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.4.2. India Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.4.3. India Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.4.4. India Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.4.5. India Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.5. Australia 6.6.5.1. Australia Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.5.2. Australia Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.5.3. Australia Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.5.4. Australia Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.5.5. Australia Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.6. Indonesia 6.6.6.1. Indonesia Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.6.2. Indonesia Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.6.3. Indonesia Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.6.4. Indonesia Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.6.5. Indonesia Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.7. Malaysia 6.6.7.1. Malaysia Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.7.2. Malaysia Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.7.3. Malaysia Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.7.4. Malaysia Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.7.5. Malaysia Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.8. Vietnam 6.6.8.1. Vietnam Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.8.2. Vietnam Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.8.3. Vietnam Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.8.4. Vietnam Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.8.5. Vietnam Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.9. Taiwan 6.6.9.1. Taiwan Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.9.2. Taiwan Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.9.3. Taiwan Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.9.4. Taiwan Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.9.5. Taiwan Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 6.6.10.2. Rest of Asia Pacific Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 6.6.10.3. Rest of Asia Pacific Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 6.6.10.4. Rest of Asia Pacific Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 6.6.10.5. Rest of Asia Pacific Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Luxury Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 7.2. Middle East and Africa Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 7.3. Middle East and Africa Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 7.4. Middle East and Africa Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 7.5. Middle East and Africa Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7.6. Middle East and Africa Luxury Packaging Market Size and Forecast, by Country (2022-2029) 7.6.1. South Africa 7.6.1.1. South Africa Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 7.6.1.2. South Africa Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 7.6.1.3. South Africa Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 7.6.1.4. South Africa Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 7.6.1.5. South Africa Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.2. GCC 7.6.2.1. GCC Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 7.6.2.2. GCC Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 7.6.2.3. GCC Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 7.6.2.4. GCC Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 7.6.2.5. GCC Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.3. Nigeria 7.6.3.1. Nigeria Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 7.6.3.2. Nigeria Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 7.6.3.3. Nigeria Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 7.6.3.4. Nigeria Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 7.6.3.5. Nigeria Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 7.6.4.2. Rest of ME&A Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 7.6.4.3. Rest of ME&A Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 7.6.4.4. Rest of ME&A Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 7.6.4.5. Rest of ME&A Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Luxury Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 8.2. South America Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 8.3. South America Luxury Packaging Market Size and Forecast, by End-Use Industry(2022-2029) 8.4. South America Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 8.5. South America Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 8.6. South America Luxury Packaging Market Size and Forecast, by Country (2022-2029) 8.6.1. Brazil 8.6.1.1. Brazil Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 8.6.1.2. Brazil Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 8.6.1.3. Brazil Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 8.6.1.4. Brazil Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 8.6.1.5. Brazil Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.2. Argentina 8.6.2.1. Argentina Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 8.6.2.2. Argentina Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 8.6.2.3. Argentina Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 8.6.2.4. Argentina Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 8.6.2.5. Argentina Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Luxury Packaging Market Size and Forecast, by Material Type (2022-2029) 8.6.3.2. Rest Of South America Luxury Packaging Market Size and Forecast, by Packaging Type (2022-2029) 8.6.3.3. Rest Of South America Luxury Packaging Market Size and Forecast, by End-Use Industry (2022-2029) 8.6.3.4. Rest Of South America Luxury Packaging Market Size and Forecast, by Price Range (2022-2029) 8.6.3.5. Rest Of South America Luxury Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Luxury Packaging Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Luxury Packaging Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. International Paper Company 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. DS Smith Plc 10.3. Amcor Plc 10.4. Crown Holdings, Inc. 10.5. WestRock Company 10.6. Seda International Packaging Group 10.7. GPA Global 10.8. MW Luxury Packaging 10.9. Quadpack 10.10. Coveris Holdings SA 10.11. Verpack Group 10.12. Curtis Packaging 10.13. Design Packaging Inc. 10.14. HH Deluxe Packaging 10.15. Elegant Packaging 10.16. Neenah Packaging 10.17. Diam Pack 10.18. GPA Luxury 10.19. Alliora Coffrets 10.20. Delta Global 10.21. MW Creative Ltd. 10.22. Ball Corporation 10.23. James Cropper Plc 10.24. API Group 10.25. Winter & Company 10.26. Roberts Mart & Co. Ltd. 10.27. Karl Knauer KG 10.28. Smurfit Kappa Group 10.29. Canpack Group 10.30. Elanders Group 11. Key Findings 12. Industry Recommendations 13. Luxury Packaging Market: Research Methodology 14. Terms and Glossary