The Low-Speed Vehicle Market size was valued at USD 11.47 Billion in 2024 and the total Low-Speed Vehicle revenue is expected to grow at a CAGR of 8.4% from 2025 to 2032, reaching nearly USD 21.88 Billion.Low-Speed Vehicle Industry Snapshot

A four-wheeled electric vehicle with a maximum speed of 25 mph and a gross vehicle weight rating of under 3,000 kg is referred to as a low-speed vehicle (LSV). Most states permit LSVs to go on highways with a 35 mph or lower speed limit. Comparatively hybrid low-speed vehicles and electric low-speed vehicles are high in demand. Electric cars generally have a range of roughly 30 miles while traveling at low speeds. In addition, the thanks to strict environmental regulations by the government have increased demand for such vehicles across sectors. Countries worldwide have established performance and safety requirements for low-speed vehicles, which include the need for headlights, front and rear turn signals, taillights, stop lights, reflex reflectors, mirrors, a parking brake, windshield, seat-belt assemblies, and an alert sound (horn). Low-Speed Vehicle Manufacturers are becoming more interested in pushing forward in the industry thanks to government efforts. Today, several countries are providing firms that show a significant interest in the industry with unique packages. These low-speed vehicles are high in demand for Hunting, meter maids, grounds maintenance, yard work, and campus security are some of jobs available. Most low-speed vehicles are extremely light, carrying up to six passengers plus goods while remaining within the weight restriction. This low-speed vehicle provides them with exceptional mileage good and opportunities for new Low-Speed Vehicle market growth. the report covers detailed analyses of the low-speed vehicle (LSV) market and key market opportunities, Increased investments, collaboration, and innovation are being seen in the industries, which is covered in the Low-Speed Vehicle Market report.To know about the Research Methodology :- Request Free Sample Report

Low-Speed Vehicle Market Key Dynamics:

Product innovation and new strategies penetrate the global LSV market The research includes several factors helped Low-Speed Vehicle Market growth in recent years. organizations have profited from the growth in product launches and the emphasis on introducing innovative solutions. This has inspired several Low-Speed Vehicle manufacturing companies to update their offerings. The manufacturers equipped the car with a brand-new TRIO front shock. Although the vehicle initially served a variety of purposes, the manufacturer was prompted to implement this update by the growing popularity of snow biking. This most recent development is expected to help the company attract an even larger customer base given the popularity and strong sales of this product. The most recent move by Polaris is expected to be a beneficial and positive impact on the growth of the overall market in the forthcoming years. The report covers more investment M&A and JVs and new development in low-speed vehicles by region and a new strategy for market expansion covered in the report. Government regulations and slow-moving infrastructure: restraints for Low-Speed Vehicle Market growth For the US, conventional car safety regulations are monitored by the National Highway Traffic Safety Administration (NHTSA). Under section 571.500 Standard No. 500, NHTSA has established requirements for LSVs. According to the standard, low-speed cars must have windshields, seat belts, rearview mirrors, stop lamps, turn signal lamps, taillamps, reflex reflectors, parking brakes, and other safety features. In light of this, a vehicle cannot be licensed for use on public streets if it does not adhere to the requirements established by the regulating agency. The fact that many LSV manufacturers provide customized cars that might not adhere to certain requirements prevents LSVs from running on roadways in many places. NHTSA does not include the LSV category in the typical crash test that is performed for conventional cars in many locations, but only a few nations, like Canada, conducted crash testing for low-speed vehicles in 2020. The safety requirements for these vehicles are lax because they are light and made to run at low speeds for everyday use. Lack of airbag availability in cars raises the danger of injury to passengers. In the event of an accident, the body's design might result in significant injuries since it is not crash-proof or does not protect the driver. Similar exclusions are given to LSVs in European nations. The absence of licensing required for drivers of vehicles with more than one axle is another issue contributing to the lack of safety requirements in European countries. And more details of safety standers and their effect on low-speed vehicles are covered in the report. Increasing residential and commercial sectors’ driving the LSV market Increasing residential and commercial sectors Globally, the real estate industry is growing. Large-scale residential construction is viewed as the new face of the real estate sector. According to IBEF, India's real estate market is expected to contribute 13% of the country's GDP by 2025 and reach USD 1 trillion by 2032. There is an increasing need for simple mobility options in such huge facilities. The latest trend in the real estate sector is the use of golf buggies. LSVs can be used to bridge the gap between two buildings or commercial buildings in the same area. For instance, Club Cars' 2020 Onward sedans provide simple passenger travel inside these zones. In addition to that, MOTOEV debuted a customized line of low-speed electric cars for transit in such real estate developments in 2018. LSVs are also used by the hospitality industry, including hotels and resorts, to provide the finest service and enable client movement in huge spaces. According to IBEF, the Indian travel industry is expected to grow from an estimated USD 75 billion in FY 2020 to USD 125 billion by FY 2027. The hotel industry contributed roughly 3 8% of the US GDP, according to the Federal Reserve Bank of St. Louis, therefore this would offer opportunities for the low-speed vehicle market.Low-Speed Vehicle Market Segment Analysis:

Based on Type, the Low-Speed Vehicle Market is segmented into lithium batteries and lead acid batteries. Lithium batteries held the largest market shear in 2024. As an alternative to conventional lead acid battery technology, lithium battery systems can increase the performance of a low-speed electric car while lightweight less, delivering power reliably, and requiring minimal maintenance. The demand for advice using lithium in electric cars with material removal AC drive systems that can be optimized to take advantage of the lithium power supply and help to boost the market growth. The electric motor of a low-speed electric vehicle is powered by batteries and requires a constant flow of energy to function. These cars employ a range of batteries, including lithium-ion, molten salt, zinc-air, and different nickel-based models. The main purpose of the electric car was to replace traditional forms of transportation since they cause pollution. The popularity of low-speed electric cars has increased as a result of several technological developments. The fuel efficiency, reduced carbon emissions, and low maintenance costs of an electric vehicle exceed those of a conventional vehicle. When compared to conventional lead acid battery technology, lithium battery systems offer weight reductions, constant power supply, and minimal maintenance, which can improve the performance of your low-speed electric car. Lithium is only for use on electric cars with cutting-edge AC drive systems that can be tweaked to take advantage of lithium power supply since the manufacturer has an engineering staff and application experience. Lithium batteries are suitable for a wide range of functions and applications and are lightweight, small, and efficient. Older generation batteries (Lead VRLA, AGM, or OPZ batteries) in 48V, which have poor performance and are bad for the environment, may be replaced with these lithium batteries in EV low-speed vehicles by simply dropping them in (use of heavy metals and acid electrolytes). Based on the Application, the Low-Speed Vehicle Market is segmented into Golf courses, Hotels & Resorts, Airports, Industrial Facilities, Other. Golf courses are expected to dominate the market in the forecast period. There are 15,332 golf courses in total in the United States, including those in Argentina, Canada, Mexico, Brazil, and Canada. Nearly 2 million people are employed by the golf business nationwide, and more money is donated to charitable causes via the golf game than through any other major sport these boost the low-speed vehicle market. Over 107 million people in the United States, or 36% of the total population, played, watched, or read about golf in 2018. According to the U.S.NGF, there were 24.8 million golfers in the country in 2020, an increase of around 2% or 500,000 from the previous year and the most net rise predicted in 17 years. The increase in the number of golfers supports the growth in the number of golf courses this increases low-speed vehicle market demand and make new opportunities for upcoming market players. Golf carts are praised for being small and very maneuverable, however, these two qualities come at the expense of power and speed. This vehicle's engines are designed to operate at low speeds and emit fewer pollutants, making them ideal for environments where low-speed movement is necessary, however they may very popular with the market.Low-speed vehicle (LSV) manufacturers are focusing on developing high-tech golf carts that are reasonably inexpensive and have lower specific emissions. Disabled persons may now enjoy golf courses and video games thanks to new solo rider technology and adaptable golf carts made for single users. Solar-powered and extreme golf cart innovations also contribute to the market's expansion. Has up to 75% less of an effect on turf than conventional golf carts, according to the makers. Such developments in golf cart technology are expected to open up a wide range of opportunities for major industry players.

Low-Speed Vehicle Market Regional Insights:

North American dominated the market with a 45% share in 2024. The Low-speed vehicle market is expected to witness significant growth at a CAGR of 8.4% through the forecast period. The North American low-speed vehicle market is expected to develop rapidly throughout the forecast period. Increasing government measures to encourage sustainable mobility, as well as a growing construction and infrastructure industry, are the key reasons driving the growth of the low-speed vehicle market. To combat environmental pollution, there is an increasing global demand for low-emission, environmentally friendly cars. The increasing rate of urbanization is harming the environment, and to counteract the negative consequences of accompanying deforestation, governments throughout the world are promoting electric transportation and low-emission fuels. North American governments are taking proactive steps to increase the use of low-speed electric cars. Many low-speed vehicle industry players, such as Yamaha Golf-Car Company and Ingersoll Rand, are merging technologies to include features such as GPS tracking and communication software in golf carts for increased monitoring, geofencing, two-way communications, safety, and so on. The need for advanced features in low-speed cars is expected to increase in the next years due to continuing improvements in linked technologies such as IoT and artificial intelligence. As a result, firms in this market are expected to spend on improving their low-speed vehicle products with technology integration and sophisticated features throughout the forecast period. Both main and secondary sources have been used to calculate the size of the North American low-speed vehicle market overall. The primary step in the research process is extensive secondary research to gather qualitative and quantitative data on the North American low-speed vehicle market from both internal and external sources. In addition, it offers a summary and forecast for the North American low-speed vehicle market based on all available segmentations. To validate the data and analysis, primary interviews with industry participants and critics were also undertaken. Industry specialists including VPs, business development managers, market intelligence managers, and national sales managers, as well as external consultants like valuation experts, research analysts, and key opinion leaders, are often involved in the low-speed vehicle.Low-Speed Vehicle Market Scope: Inquire before buying

Low-Speed Vehicle Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 11.47 Bn. Forecast Period 2025 to 2032 CAGR: 8.4% Market Size in 2032: USD 21.88 Bn. Segments Covered: by Battery Type Lithium-iron Lead Acid by Application Golf courses Hotels & Resorts Airports Industrial Facilities Other by Vehicle propulsion Diesel Electric Gasoline Low-Speed Vehicle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Companies in the Low-Speed Vehicle Industry

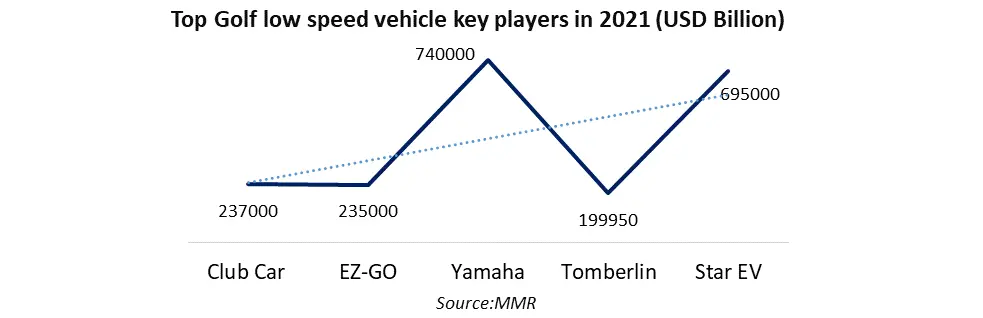

1. ACG Inc 2. AGT Electric Cars 3. American Landmaster 4. Bintelli Electric Vehicles 5. Bradshaw Electric Vehicles 6. Citecar Electric Vehicles 7. Club Car 8. Columbia Vehicle Group Inc 9. Cruise Car Inc 10. Deere & Company 11. Garia 12. HDK Electric Vehicle 13. Kawasaki Motor Corporation USA 14. Kubota Corporation 15. Ligier Group 16. Marshell 17. Moto Electric Vehicles 18. Pilot Cars 19. Speedways Electric 20. Star EV 21. Suzhou Eagle Electric Vehicle Manufacturing 22. Textron Inc 23. The Toro Company 24. Tropos Motors 25. Waev Inc 26. Yamaha Motor Co. Ltd Frequently Asked Questions: 1] What segments are covered in the Global Low-Speed Vehicle Market report? Ans. The segments covered in the Low-Speed Vehicle Market report are based on Product Type and End User. 2] What is considered low speed? Ans. Low-speed vehicles can only be driven on streets with stated speed limits of 35 miles per hour (mph) or less. 3] What is a low-speed electric vehicle? Ans. A low-speed EV, also known as a neighborhood electric vehicle, is defined as a four-wheeled motor vehicle with a gross vehicle weight rating of 3,000 pounds or less that can reach a minimum speed of 20 miles per hour (mph) and a maximum speed of 25 mph. 4] What are the 3 types of vehicles that usually go 25 mph or less? Ans. Farm tractors, animal-drawn vehicles, and road maintenance vehicles often travel at speeds of 25 mph or less. On the rear of these cars, there should be a slow-moving vehicle decal (an orange triangle). 5] What is a low-speed vehicle What risks do LSVs present to drivers of other vehicles? Ans. A lower-speed vehicle (LSV) is a four-wheel vehicle with a top speed of 20 to 25 miles per hour. Golf carts are one example! LSVs pose a risk to other cars since they have limited power and protection, thus other vehicles must avoid collisions.

1. Low-Speed Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Low-Speed Vehicle Market: Dynamics 2.1. Low-Speed Vehicle Market Trends by Region 2.1.1. North America Low-Speed Vehicle Market Trends 2.1.2. Europe Low-Speed Vehicle Market Trends 2.1.3. Asia Pacific Low-Speed Vehicle Market Trends 2.1.4. Middle East and Africa Low-Speed Vehicle Market Trends 2.1.5. South America Low-Speed Vehicle Market Trends 2.2. Low-Speed Vehicle Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Low-Speed Vehicle Market Drivers 2.2.1.2. North America Low-Speed Vehicle Market Restraints 2.2.1.3. North America Low-Speed Vehicle Market Opportunities 2.2.1.4. North America Low-Speed Vehicle Market Challenges 2.2.2. Europe 2.2.2.1. Europe Low-Speed Vehicle Market Drivers 2.2.2.2. Europe Low-Speed Vehicle Market Restraints 2.2.2.3. Europe Low-Speed Vehicle Market Opportunities 2.2.2.4. Europe Low-Speed Vehicle Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Low-Speed Vehicle Market Drivers 2.2.3.2. Asia Pacific Low-Speed Vehicle Market Restraints 2.2.3.3. Asia Pacific Low-Speed Vehicle Market Opportunities 2.2.3.4. Asia Pacific Low-Speed Vehicle Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Low-Speed Vehicle Market Drivers 2.2.4.2. Middle East and Africa Low-Speed Vehicle Market Restraints 2.2.4.3. Middle East and Africa Low-Speed Vehicle Market Opportunities 2.2.4.4. Middle East and Africa Low-Speed Vehicle Market Challenges 2.2.5. South America 2.2.5.1. South America Low-Speed Vehicle Market Drivers 2.2.5.2. South America Low-Speed Vehicle Market Restraints 2.2.5.3. South America Low-Speed Vehicle Market Opportunities 2.2.5.4. South America Low-Speed Vehicle Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Low-Speed Vehicle Industry 2.8. Analysis of Government Schemes and Initiatives For Low-Speed Vehicle Industry 2.9. Low-Speed Vehicle Market Trade Analysis 2.10. The Global Pandemic Impact on Low-Speed Vehicle Market 3. Low-Speed Vehicle Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 3.1.1. Lithium-iron 3.1.2. Lead Acid 3.2. Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 3.2.1. Golf courses 3.2.2. Hotels & Resorts 3.2.3. Airports 3.2.4. Industrial Facilities 3.2.5. Other 3.3. Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 3.3.1. Diesel 3.3.2. Electric 3.3.3. Gasoline 3.4. Low-Speed Vehicle Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Low-Speed Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 4.1.1. Lithium-iron 4.1.2. Lead Acid 4.2. North America Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 4.2.1. Golf courses 4.2.2. Hotels & Resorts 4.2.3. Airports 4.2.4. Industrial Facilities 4.2.5. Other 4.3. North America Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 4.3.1. Diesel 4.3.2. Electric 4.3.3. Gasoline 4.4. North America Low-Speed Vehicle Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 4.4.1.1.1. Lithium-iron 4.4.1.1.2. Lead Acid 4.4.1.2. United States Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 4.4.1.2.1. Golf courses 4.4.1.2.2. Hotels & Resorts 4.4.1.2.3. Airports 4.4.1.2.4. Industrial Facilities 4.4.1.2.5. Other 4.4.1.3. United States Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 4.4.1.3.1. Diesel 4.4.1.3.2. Electric 4.4.1.3.3. Gasoline 4.4.2. Canada 4.4.2.1. Canada Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 4.4.2.1.1. Lithium-iron 4.4.2.1.2. Lead Acid 4.4.2.2. Canada Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 4.4.2.2.1. Golf courses 4.4.2.2.2. Hotels & Resorts 4.4.2.2.3. Airports 4.4.2.2.4. Industrial Facilities 4.4.2.2.5. Other 4.4.2.3. Canada Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 4.4.2.3.1. Diesel 4.4.2.3.2. Electric 4.4.2.3.3. Gasoline 4.4.3. Mexico 4.4.3.1. Mexico Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 4.4.3.1.1. Lithium-iron 4.4.3.1.2. Lead Acid 4.4.3.2. Mexico Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 4.4.3.2.1. Golf courses 4.4.3.2.2. Hotels & Resorts 4.4.3.2.3. Airports 4.4.3.2.4. Industrial Facilities 4.4.3.2.5. Other 4.4.3.3. Mexico Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 4.4.3.3.1. Diesel 4.4.3.3.2. Electric 4.4.3.3.3. Gasoline 5. Europe Low-Speed Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.2. Europe Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.3. Europe Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 5.4. Europe Low-Speed Vehicle Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.4.1.2. United Kingdom Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.4.1.3. United Kingdom Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion(2024-2032) 5.4.2. France 5.4.2.1. France Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.4.2.2. France Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.4.2.3. France Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion(2024-2032) 5.4.3. Germany 5.4.3.1. Germany Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.4.3.2. Germany Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.4.3.3. Germany Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.4.4.2. Italy Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.4.4.3. Italy Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion(2024-2032) 5.4.5. Spain 5.4.5.1. Spain Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.4.5.2. Spain Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.4.5.3. Spain Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.4.6.2. Sweden Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.4.6.3. Sweden Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.4.7.2. Austria Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.4.7.3. Austria Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 5.4.8.2. Rest of Europe Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 5.4.8.3. Rest of Europe Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6. Asia Pacific Low-Speed Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.2. Asia Pacific Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.3. Asia Pacific Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4. Asia Pacific Low-Speed Vehicle Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.1.2. China Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.1.3. China Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.2.2. S Korea Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.2.3. S Korea Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.3.2. Japan Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Japan Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4.4. India 6.4.4.1. India Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.4.2. India Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.4.3. India Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.5.2. Australia Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Australia Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.6.2. Indonesia Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Indonesia Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.7.2. Malaysia Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Malaysia Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.8.2. Vietnam Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Vietnam Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion(2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.9.2. Taiwan Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.9.3. Taiwan Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 6.4.10.2. Rest of Asia Pacific Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 6.4.10.3. Rest of Asia Pacific Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 7. Middle East and Africa Low-Speed Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 7.2. Middle East and Africa Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 7.3. Middle East and Africa Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 7.4. Middle East and Africa Low-Speed Vehicle Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 7.4.1.2. South Africa Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 7.4.1.3. South Africa Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 7.4.2.2. GCC Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 7.4.2.3. GCC Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 7.4.3.2. Nigeria Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Nigeria Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 7.4.4.2. Rest of ME&A Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 7.4.4.3. Rest of ME&A Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 8. South America Low-Speed Vehicle Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 8.2. South America Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 8.3. South America Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion(2024-2032) 8.4. South America Low-Speed Vehicle Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 8.4.1.2. Brazil Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 8.4.1.3. Brazil Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 8.4.2.2. Argentina Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 8.4.2.3. Argentina Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Low-Speed Vehicle Market Size and Forecast, by Battery Type (2024-2032) 8.4.3.2. Rest Of South America Low-Speed Vehicle Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Rest Of South America Low-Speed Vehicle Market Size and Forecast, by Vehicle propulsion (2024-2032) 9. Global Low-Speed Vehicle Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Low-Speed Vehicle Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ACG Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. AGT Electric Cars 10.3. American Landmaster 10.4. Bintelli Electric Vehicles 10.5. Bradshaw Electric Vehicles 10.6. Citecar Electric Vehicles 10.7. Club Car 10.8. Columbia Vehicle Group Inc 10.9. Cruise Car Inc 10.10. Deere & Company 10.11. Garia 10.12. HDK Electric Vehicle 10.13. Kawasaki Motor Corporation USA 10.14. Kubota Corporation 10.15. Ligier Group 10.16. Marshell 10.17. Moto Electric Vehicles 10.18. Pilot Cars 10.19. Speedways Electric 10.20. Star EV 10.21. Suzhou Eagle Electric Vehicle Manufacturing 10.22. Textron Inc 10.23. The Toro Company 10.24. Tropos Motors 10.25. Waev Inc 10.26. Yamaha Motor Co. Ltd 11. Key Findings 12. Industry Recommendations 13. Low-Speed Vehicle Market: Research Methodology 14. Terms and Glossary