The Liver Disease Therapeutics Market size was valued at USD 21.10 Billion in 2023 and the total Liver Disease Therapeutics Revenue is expected to grow at a CAGR of 7.4% from 2024 to 2030, reaching nearly USD 34.78 Billion by 2030.Liver Disease Therapeutics Market Overview

The liver is the largest solid internal organ in the body which helps in removing toxins from the blood supply. It regulates blood clotting, performs other vital functions, and maintains healthy blood sugar levels and any disturbance in the functioning of the liver that causes illness is a liver disease.• Annually, Liver disease accounts for over 2 million deaths and accounts for 4% of all deaths worldwide (1 out of every 25 deaths), while 1 out of 3 liver-related deaths occur among females.

The global market for liver disease therapeutics witnessed increased traction globally owing to factors such as the rapid rise in the world’s population of geriatrics, changing lifestyle patterns, government and NGO awareness programs, increasing consumption of unhealthy fast food diets, and rising investment in research and development. Technological advancements in liver disease diagnosis that include imaging techniques, liver function tests, and biomarker-based diagnostics encourage market growth. These advancements have improved the early detection and accurate assessment of liver diseases. The development of new therapeutic options such as antiviral drugs, immunosuppressants, targeted therapies, and liver transplantation techniques provide more effective and diverse treatment choices for liver diseases that fuel the market growth. Immunoglobulin has been used in the treatment of certain types of hepatitis and vaccines are used to prevent hepatitis viral infection. For instance, vaccines are available for the prevention of hepatitis A, B, and C, and other products such as corticosteroids are used in the treatment of liver-related autoimmune diseases such as autoimmune hepatitis. Additionally, the availability of alternative treatment procedures such as organ transplantation and liver resection drives the market growth.• According to MMR analysis, Alcohol consumption is about 25.1% of adults age 18 and older had approximately one heavy drinking day (five or more drinks for men and four or more drinks for women) in 2023.

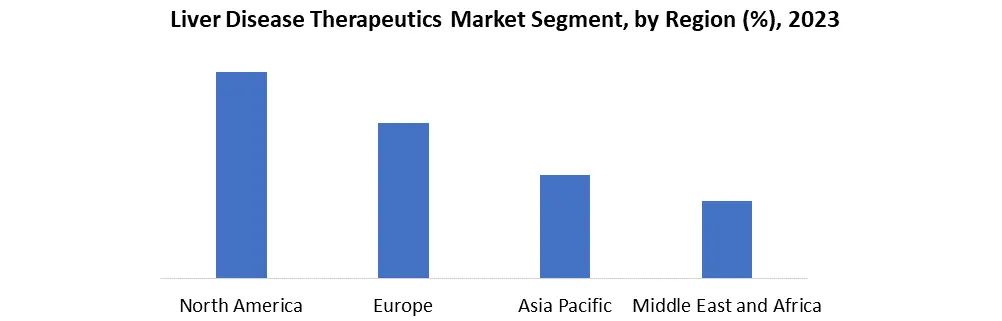

In 2023, Asia Pacific held a market share of xx% and is the fastest-growing Liver Disease Therapeutics Market. The region houses half of the global population and faces a significant burden of various liver diseases creating a demand for therapeutic options. The increasing investments in healthcare are raising access to medical care fuelling the market. In addition, emerging research & development, focus on cost-effective and accessible drugs are further driving the liver disease therapeutics market.To know about the Research Methodology :- Request Free Sample Report

Liver Disease Therapeutics Market Dynamics

Increasing Prevalence of Liver Disease and Adoption of Combination Therapies Chronic liver disease affects more than 800 million individuals and causes an estimated 2 million deaths per year worldwide. An increase in hours spent in front of screens combined with a sedentary lifestyle, no physical exercise & unhealthy diet has led to an increase in the number of individuals suffering from liver diseases. Increasing alcohol consumption has also contributed significantly to the growing number of patients. The most common causes of liver-related mortality are chronic hepatitis B (HBV), chronic hepatitis C (HCV), alcohol-related liver disease (ALD), and non-alcoholic fatty liver disease (NAFLD). The NAFLD accounts for about 25% of the total liver diseases, progressing towards cirrhosis, a more chronic stage. The flow in the number of patients creates a demand for effective treatments, pushing the development and adoption of combination therapies. Additionally, liver diseases particularly, NAFLD and Hepatitis C require a combination of multiple drugs as single therapies fall short. The shift towards combination therapies has led to several opportunities for the market, attracting both established players and innovative startups. Despite the challenges such as optimizing treatment combinations navigating obstacles, and ensuring affordability worldwide the liver disease therapeutics market looks promising with advancements.• The global prevalence of alcohol use disorder is 5.1%, with the highest prevalence among men and women in the European Region (14.8% and 3.5%) and the Americas (11.5% and 5.1%).

High Treatment Cost and Disease Side Effects Extensive investment is utilized in the research and development of drugs and therapies used to treat liver diseases and associated conditions. Key Market players use advanced technologies and innovations to improve the efficacy and safety of these drugs; such technologies are expensive, making drug development costly. The complex regulatory approvals and numerous trials to test the drug further add to the costs. The side effects associated with liver disease medications discourage consumers from adhering to the treatment. The traditional antiviral drugs come with side effects such as fatigue, nausea, and flu, impacting the patients and leading to non-adherence to treatment. Additionally, hepatoprotective agents interact with other medications and require constant monitoring. The balance between efficacy and side effects needs to be addressed to improve patient acceptance and adherence. The high treatment costs complicate the health differences, impacting low & middle-income countries and economically backward customers. The unmanaged side effects lead to non-adherence to treatments, reducing medicine effectiveness and rejecting the benefits as it not only harms the individual but leads to drug resistance further complicating the treatment.

Liver Disease Therapeutics Market Segment Analysis

Based on Treatment Type, the Antiviral segment holds the largest market share of about 43% in the Global Liver Disease Therapeutics Market. According to MMR analysis, the segment is further expected to grow at a CAGR of 7.4% during the forecast period. It stands out as the dominant segment within the Global Liver Disease Therapeutics Market. The increase in the prevalence of viral hepatitis (B & C) and the rise in the alcohol consumption population drives the market for Liver Disease Therapeutics. The leading key players like Gilead Sciences, Abbvie, Merck & Co, and Chimeric have been engaged in the innovation, research, and development of several antiviral drugs. Antiviral drugs are used for treating chronic hepatitis B, which leads to liver cirrhosis and hepatocellular carcinoma. Antiviral therapies address a broader range of populations across varied geographical areas, which contributes to their widespread applicability. The efficiency of antiviral drugs in suppressing the infection and improving the liver function in hepatitis has made antiviral treatment use widespread and fuels market growth. Additionally, the treatment guidelines, focus on prevention, and limited treatment alternatives further drive the Liver Disease Therapeutics Market. • According to MMR analysis, out of total patients with tuberculosis–HBV coinfection, 13.2% were patients on antiviral therapy, while 13.9% started antiviral therapy within 1 year of tuberculosis diagnosis. Patients on antiviral therapy had a lower risk of hospitalization due to drug-induced liver injury compared with those not on treatment.Additionally, the Hepatoprotective Agents Segment is the second largest with a market share of about 20.7% in the Liver Disease Therapeutic Market. The hepatoprotective drugs are derived from natural sources or synthetic sources. The increasing demand for NAFLD treatments, inclination towards the use of natural medications, and rising investments in R&D are fuelling the growth of the segment. Additionally, the rising demand for safe and effective treatments rather than the current treatments owing to their side effects is driving the demand for hepatoprotective agents responsible for its growth significantly.

Liver Disease Therapeutics Market Regional Insights

North America dominated the Global Liver Disease Therapeutics Market with the highest share of over XX% in 2023. The region is expected to grow at a CAGR of 7.4% during the forecast period and maintain its dominance. The lifestyle changes in the region like alcohol consumption and unhealthy eating habits have led to the increased prevalence of liver diseases in the region. The region is supported by strong government funding for research and development and the presence of market leaders raises the innovation in new therapeutic drugs. The public health campaigns have raised awareness about liver diseases and encouraged diagnosis and treatment of liver diseases. Additionally, the rise in disposable incomes, widespread insurance coverage, and approval of new combination therapies for the treatment of liver diseases make the region dominant in the market. According to the Centers for Disease Control and Prevention, in the United States, 4.5 Million adults were diagnosed with liver diseases in 2023.• According to MMR Analysis, in January 2023, 4.5 million adults were diagnosed with liver disease in the United States.

Europe holds a significant second-largest region in the global Liver Disease Therapeutics market as it treasures a large and well-developed pharmaceutical industry that serves as a key driver for treating liver diseases. The European region, particularly Germany and the United Kingdom are the key players in the Liver Disease Therapeutics Market. The region has a varied patient population with a large number of hepatitis C carriers. Factors such as rising awareness of liver diseases, the growing elderly population, and the development of new products to complete the medical needs drive the European Market of Liver Therapeutics.

• Hepatitis B virus (HBV) is especially common in the African and Western Pacific regions.

Liver Disease Therapeutics Market Competitive Landscapes

The market for Liver Disease Therapeutics is competitive for both well-established and emerging companies. The key players such as Johnson & Johnson Services Inc., F. Hoffmann, La Roche Ltd., Pfizer Inc., Abbott Laboratories, Novartis AG, Eli Lilly and Company, Gilead Sciences, Bristol Myers Squibb, AbbVie Inc., Zydus Pharmaceuticals Inc. have been concentrating on adopting new technology, product innovations, mergers & acquisitions, joint venture, alliances, and partnerships to improve their market position in the global liver disease treatment industry.1. In 2023, Bristol Myers Squibb acquired Assembly Biosciences and gained access to the pipeline of potential NASH therapies. 2. Johnson & Johnson acquired Momenta Pharmaceuticals and expanded treatments for Wilson’s disease. 3. Gilead Sciences received FDA approval for Vemlidy for the treatment of chronic hepatitis B infection in adults and adolescents.

Liver Disease Therapeutics Market Scope: Inquiry Before Buying

Liver Disease Therapeutics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 21.10 Bn. Forecast Period 2024 to 2030 CAGR: 7.4% Market Size in 2030: US $ 34.78 Bn. Segments Covered: by Treatment Type Antiviral Drugs Immunosuppressant Vaccines Immunoglobulin Corticosteroids Targeted Therapy Chemotherapy by Disease Type Hepatitis Autoimmune Diseases Non-alcoholic Fatty Liver Disease (NAFLD) Cancer Genetic Disorders Liver Disease Therapeutics Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Liver Disease Therapeutics Market Key Players

1. Johnson & Johnson Services Inc. 2. F. Hoffmann-La Roche Ltd. 3. Pfizer Inc. 4. Abbott Laboratories 5. Novartis AG 6. Eli Lilly and Company 7. Gilead Sciences 8. Bristol Myers Squibb 9. AbbVie Inc. 10. Zydus Pharmaceuticals Inc. 11. Intercept Pharmaceuticals, Inc. 12. Merck & Co., Inc. 13. Bristol-Myers Squibb Company 14. Johnson & Johnson 15. Takeda Pharmaceutical Company Limited 16. Eli Lilly and Company 17. Astellas Pharma Inc., Bristol-Myers Squibb 18. GlaxoSmithKline Plc, 19. Merck & Co. Inc. 20. Sanofi S.A 21. Takeda Pharmaceutical 22. Valeant Pharmaceuticals 23. Watson Pharmaceuticals Inc. 24. Theratechnologies Inc. 25. Alnylam Pharmaceuticals Inc. 26. Protagonist Therapeutics Inc. 27. Dicerna Pharmaceuticals Inc. 28. Endo International 29. Provectus Biopharmaceuticals Inc. 30. MAX BioPharma Inc. 31. Achillion Pharmaceuticals 32. Actavis Pharma Inc 33. Alkermes Plc 34. Antipodean Pharmaceuticals 35. Bayer Healthcare Pharmaceuticals 36. Biotest Pharma GmbH 37. Bristol-Myers Squibb Company 38. Conatus PharmaceuticalsFAQs:

1. What are the growth drivers for the Liver Disease Therapeutics market? Ans. Increased prevalence of liver diseases, alcohol consumption, and changing lifestyles are the drivers of the Global Liver Disease Therapeutics Market. 2. What are the major challenges for the Liver Disease Therapeutics market growth? Ans. Limited treatment options, high costs, and stringent regulations are the major challenges for the Liver Disease Therapeutics Market. 3. Which region is expected to lead the global Liver Disease Therapeutics market during the forecast period? Ans. North America is expected to lead the global Liver Disease Therapeutics market during the forecast period. 4. What is the projected market size & and growth rate of the Liver Disease Therapeutics Market? Ans. The Liver Disease Therapeutics Market size was valued at USD 21.10 Billion in 2023 and the total Liver Disease Therapeutics revenue is expected to grow at a CAGR of 7.4% from 2024 to 2030, reaching nearly USD 34.78 Billion by 2030. 5. What segments are covered in the Liver Disease Therapeutics Market report? Ans. The segments covered in the Liver Disease Therapeutics market report are treatment type, disease type, and region.

1. Liver Disease Therapeutics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Liver Disease Therapeutics Market: Dynamics 2.1. Liver Disease Therapeutics Market Trends by Region 2.1.1. North America Liver Disease Therapeutics Market Trends 2.1.2. Europe Liver Disease Therapeutics Market Trends 2.1.3. Asia Pacific Liver Disease Therapeutics Market Trends 2.1.4. Middle East and Africa Liver Disease Therapeutics Market Trends 2.1.5. South America Liver Disease Therapeutics Market Trends 2.2. Liver Disease Therapeutics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Liver Disease Therapeutics Market Drivers 2.2.1.2. North America Liver Disease Therapeutics Market Restraints 2.2.1.3. North America Liver Disease Therapeutics Market Opportunities 2.2.1.4. North America Liver Disease Therapeutics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Liver Disease Therapeutics Market Drivers 2.2.2.2. Europe Liver Disease Therapeutics Market Restraints 2.2.2.3. Europe Liver Disease Therapeutics Market Opportunities 2.2.2.4. Europe Liver Disease Therapeutics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Liver Disease Therapeutics Market Drivers 2.2.3.2. Asia Pacific Liver Disease Therapeutics Market Restraints 2.2.3.3. Asia Pacific Liver Disease Therapeutics Market Opportunities 2.2.3.4. Asia Pacific Liver Disease Therapeutics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Liver Disease Therapeutics Market Drivers 2.2.4.2. Middle East and Africa Liver Disease Therapeutics Market Restraints 2.2.4.3. Middle East and Africa Liver Disease Therapeutics Market Opportunities 2.2.4.4. Middle East and Africa Liver Disease Therapeutics Market Challenges 2.2.5. South America 2.2.5.1. South America Liver Disease Therapeutics Market Drivers 2.2.5.2. South America Liver Disease Therapeutics Market Restraints 2.2.5.3. South America Liver Disease Therapeutics Market Opportunities 2.2.5.4. South America Liver Disease Therapeutics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis For the Liver Disease Therapeutics Industry 2.7. Analysis of Government Schemes and Initiatives For the Liver Disease Therapeutics Industry 3. Liver Disease Therapeutics Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 3.1. Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 3.1.1. Antiviral Drugs 3.1.2. Immunosuppressant 3.1.3. Vaccines 3.1.4. Immunoglobulin 3.1.5. Corticosteroids 3.1.6. Targeted Therapy 3.1.7. Chemotherapy 3.2. Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 3.2.1. Hepatitis 3.2.2. Autoimmune Diseases 3.2.3. Non-alcoholic Fatty Liver Disease (NAFLD) 3.2.4. Cancer 3.2.5. Genetic Disorders 3.3. Liver Disease Therapeutics Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Liver Disease Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 4.1. North America Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 4.1.1. Antiviral Drugs 4.1.2. Immunosuppressant 4.1.3. Vaccines 4.1.4. Immunoglobulin 4.1.5. Corticosteroids 4.1.6. Targeted Therapy 4.1.7. Chemotherapy 4.2. North America Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 4.2.1. Hepatitis 4.2.2. Autoimmune Diseases 4.2.3. Non-alcoholic Fatty Liver Disease (NAFLD) 4.2.4. Cancer 4.2.5. Genetic Disorders 4.3. North America Liver Disease Therapeutics Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 4.3.1.1.1. Antiviral Drugs 4.3.1.1.2. Immunosuppressant 4.3.1.1.3. Vaccines 4.3.1.1.4. Immunoglobulin 4.3.1.1.5. Corticosteroids 4.3.1.1.6. Targeted Therapy 4.3.1.1.7. Chemotherapy 4.3.1.2. United States Liver Disease Therapeutics Market Size and Forecast, by Disease Type (2023-2030) 4.3.1.2.1. Hepatitis 4.3.1.2.2. Autoimmune Diseases 4.3.1.2.3. Non-alcoholic Fatty Liver Disease (NAFLD) 4.3.1.2.4. Cancer 4.3.1.2.5. Genetic Disorders 4.3.2. Canada 4.3.2.1. Canada Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 4.3.2.1.1. Antiviral Drugs 4.3.2.1.2. Immunosuppressant 4.3.2.1.3. Vaccines 4.3.2.1.4. Immunoglobulin 4.3.2.1.5. Corticosteroids 4.3.2.1.6. Targeted Therapy 4.3.2.1.7. Chemotherapy 4.3.2.2. Canada Liver Disease Therapeutics Market Size and Forecast, by Disease Type (2023-2030) 4.3.2.2.1. Hepatitis 4.3.2.2.2. Autoimmune Diseases 4.3.2.2.3. Non-alcoholic Fatty Liver Disease (NAFLD) 4.3.2.2.4. Cancer 4.3.2.2.5. Genetic Disorders 4.3.3. Mexico 4.3.3.1. Mexico Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 4.3.3.1.1. Antiviral Drugs 4.3.3.1.2. Immunosuppressant 4.3.3.1.3. Vaccines 4.3.3.1.4. Immunoglobulin 4.3.3.1.5. Corticosteroids 4.3.3.1.6. Targeted Therapy 4.3.3.1.7. Chemotherapy 4.3.3.2. Mexico Liver Disease Therapeutics Market Size and Forecast, by Disease Type (2023-2030) 4.3.3.2.1. Hepatitis 4.3.3.2.2. Autoimmune Diseases 4.3.3.2.3. Non-alcoholic Fatty Liver Disease (NAFLD) 4.3.3.2.4. Cancer 4.3.3.2.5. Genetic Disorders 5. Europe Liver Disease Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 5.1. Europe Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.2. Europe Liver Disease Therapeutics Market Size and Forecast, by Disease Type (2023-2030) 5.3. Europe Liver Disease Therapeutics Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.3.1.2. United Kingdom Liver Disease Therapeutics Market Size and Forecast, by Disease Type (2023-2030) 5.3.2. France 5.3.2.1. France Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.3.2.2. France Liver Disease Therapeutics Market Size and Forecast, by Disease Type (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.3.3.2. Germany Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 5.3.4. Italy 5.3.4.1. Italy Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.3.4.2. Italy Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 5.3.5. Spain 5.3.5.1. Spain Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.3.5.2. Spain Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.3.6.2. Sweden Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 5.3.7. Austria 5.3.7.1. Austria Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.3.7.2. Austria Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 5.3.8.2. Rest of Europe Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6. Asia Pacific Liver Disease Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 6.1. Asia Pacific Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.2. Asia Pacific Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3. Asia Pacific Liver Disease Therapeutics Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.1.2. China Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.2.2. S Korea Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.3. Japan 6.3.3.1. Japan Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.3.2. Japan Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.4. India 6.3.4.1. India Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.4.2. India Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.5. Australia 6.3.5.1. Australia Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.5.2. Australia Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.6.2. Indonesia Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.7.2. Malaysia Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.8.2. Vietnam Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.9.2. Taiwan Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 7. Middle East and Africa Liver Disease Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 7.1. Middle East and Africa Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 7.2. Middle East and Africa Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 7.3. Middle East and Africa Liver Disease Therapeutics Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 7.3.1.2. South Africa Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 7.3.2. GCC 7.3.2.1. GCC Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 7.3.2.2. GCC Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 7.3.3.2. Nigeria Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 7.3.4.2. Rest of ME&A Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 8. South America Liver Disease Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion ) (2023-2030) 8.1. South America Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 8.2. South America Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 8.3. South America Liver Disease Therapeutics Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 8.3.1.2. Brazil Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 8.3.2.2. Argentina Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Liver Disease Therapeutics Market Size and Forecast, by Treatment Type (2023-2030) 8.3.3.2. Rest Of South America Liver Disease Therapeutics Market Size and Forecast, by Disease Type(2023-2030) 9. Global Liver Disease Therapeutics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Distribution Channels 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Liver Disease Therapeutics Market Companies, by market capitalization 9.6. Market Nature 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Gilead Sciences 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bristol Myers Squibb 10.3. AbbVie Inc. 10.4. Zydus Pharmaceuticals Inc. 10.5. Intercept Pharmaceuticals, Inc. 10.6. Merck & Co., Inc. 10.7. Bristol-Myers Squibb Company 10.8. Johnson & Johnson 10.9. Takeda Pharmaceutical Company Limited 10.10. Eli Lilly and Company 10.11. Astellas Pharma Inc., Bristol-Myers Squibb 10.12. GlaxoSmithKline Plc, 10.13. Merck & Co. Inc. 10.14. Sanofi S.A 10.15. Takeda Pharmaceutical 10.16. Valeant Pharmaceuticals 11. Key Findings 12. Industry Recommendations 13. Liver Disease Therapeutics Market: Research Methodology