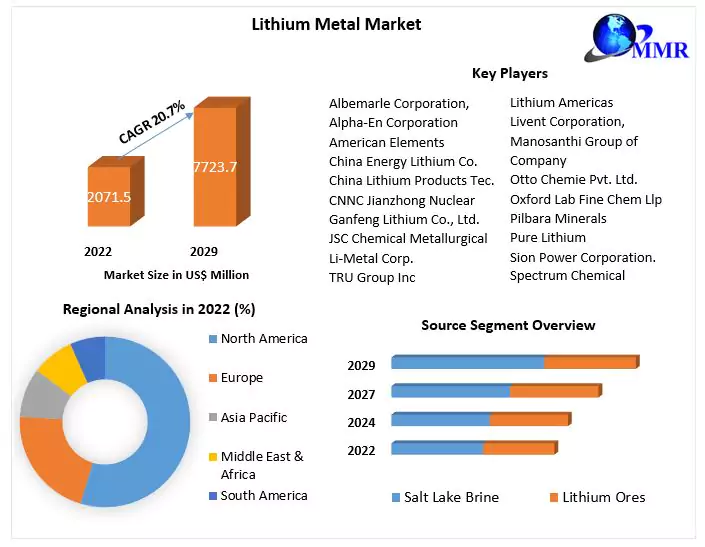

The Lithium Metal Market size was valued at USD 2071.5 Million in 2022 and the total Lithium Metal Market revenue is expected to grow at a CAGR of 20.7% from 2023 to 2029, reaching nearly USD 7723.7 Million.Lithium Metal Market Overview:

Lithium metal is a chemical element and the lightest solid metal known. It is highly reactive and has excellent energy storage properties, making it a crucial component in lithium-ion batteries used in electric vehicles, electronics, and energy storage systems. The global lithium metal market is currently experiencing significant growth, driven by the increasing demand for lithium-ion batteries used in electric vehicles (EVs) and grid-scale energy storage systems. With a current annual production of approximately 5,000 tonnes, the market is expected to expand exponentially as advancing technologies, such as lithium-metal-based secondary batteries, are introduced. Lithium metal is produced through a capital and energy-intensive process known as molten salt electrolysis of a chloride mixture. This method, while commercially viable, has environmental concerns associated with it. However, a new technology called LithSoni aims to revolutionize lithium metal production by utilizing supersonic flow, similar to a rocket engine, for rapid cooling called "shock quenching." This innovative approach prevents back reaction and offers a promising solution for efficient and sustainable lithium metal production. Lithium demand is driven by electric vehicle adoption worldwide. EVs require lithium-ion batteries for energy storage, and lithium metal plays a crucial role in battery performance. Additionally, grid-scale lithium-ion batteries are gaining popularity for energy storage applications, further contributing to lithium metal demand. Industry experts and organizations closely monitor lithium price trends, global reserves, production, exports, and imports. These analyses provide valuable insights into the market's current state and its prospects. Major lithium mining companies and active lithium mines are monitored to assess production capacity and supply capabilities. Global lithium metal production is projected to exceed 100 thousand tonnes (kt) in 2023. This forecast indicates a significant increase over current production levels, highlighting the market's robust growth potential. New lithium exploration and mining projects worldwide further support this upward trend. Lithium metal finds extensive applications beyond battery production. It can be used as a powder or an ingot in batteries for electric vehicles and electronic devices, providing enhanced energy storage capabilities. Additionally, lithium metal serves as an alloying element for aluminum, improving its strength and durability. The lithium metal market's growth is intertwined with the EV and renewable energy sectors, as lithium-ion batteries play a pivotal role in the transition to sustainable transportation and energy systems. As governments worldwide emphasize decarbonization and strive to achieve climate goals, lithium metal demand is expected to continue its upward trajectory.To know about the Research Methodology :- Request Free Sample Report

Scope and Research Methodology:

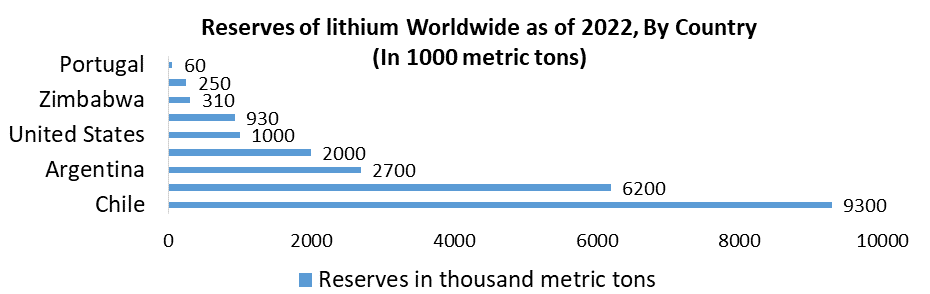

The lithium metal market encompasses global production, consumption, and trade. It includes the analysis of various lithium sources, such as salt lake brine and lithium ores, and their respective contributions to the market. The market scope also includes an assessment of lithium metal applications, primarily in lithium-ion batteries for electric vehicles, electronic devices, and alloying with aluminum. The market analysis covers historical data, current market trends, and future projections for the lithium metal industry. Lithium metal market research typically involves primary and secondary research. Primary research involves gathering data directly from industry experts, lithium producers, lithium mining companies, and other stakeholders through interviews, surveys, and interactions. Secondary research involves the collection of data from various reliable sources, such as industry reports, company websites, government publications, trade journals, and databases. These sources provide valuable information on lithium metal production, consumption patterns, pricing trends, market analysis, and other pertinent data points. Research methodologies include data analysis, and forecasting techniques to make predictions about the lithium metal market's growth. Electric Vehicle Adoption Fuels Growth in the Lithium Metal Market: The lithium metal market is primarily driven by the increasing demand for lithium-ion batteries, which are extensively used in electric vehicles (EVs), energy grid storage, and various electronic devices. Growth in battery usage, especially in the EV and energy storage sectors, has propelled lithium demand and subsequently the lithium metal market. The transition towards electric mobility and the increasing adoption of EVs worldwide are key drivers for the lithium metal market. Lithium-ion batteries are the preferred choice for EV manufacturers due to their high energy density, long cycle life, and lightweight properties. Rapid growth in EV sales and government initiatives to promote clean transportation has significantly boosted lithium metal demand. Grid-scale lithium-ion battery systems have led to efficient energy storage solutions. These systems, such as Tesla's Powerwall and Powerpack, store renewable energy and balance supply-demand fluctuations on the power grid. Lithium-ion batteries are used in electronic devices such as mobile phones, laptops, digital cameras, and handheld devices. Lithium metal finds application in the aerospace and defense sectors, where lightweight and high-strength materials are crucial. When combined with aluminum and magnesium, lithium alloys are used in armor plating, aircraft structures, trains, and bicycles. The growing aerospace industry and defense modernization initiatives contribute to lithium metal demand. Lithium chloride, known for its hygroscopic properties, is utilized in air conditioning and industrial drying systems. Its ability to efficiently absorb moisture makes it valuable in these applications, driving lithium metal demand in the automotive and HVAC sectors. Lithium carbonate is used in bipolar disorder and manic depression medications. As mental health awareness increases and pharmaceutical advancements continue, lithium metal demand in the pharmaceutical sector is expected to grow. Lithium metal is also utilized in optics, glassware, ceramics, lubricants, and other industrial applications. Its unique properties make it suitable for various specialized applications, contributing to lithium metal demand. The projected increase in lithium consumption and limited supply capacity has led to predictions of supply shortages and a significant price increase in the market.Accelerated Adoption of Next-Generation Lithium Batteries Drives Lithium Metal Market Growth. The lithium metal market is experiencing a significant growth boost due to the accelerated adoption of next-generation lithium batteries. These batteries are widely used in different industries, including consumer electronics, energy storage, and transportation electrification. The key factors driving this market expansion are the emergence of Li-Metal and its advanced lithium metal anode these technologies offer more sustainable production processes than conventional methods. Lithium metal anode and production processes lead to smaller, lighter, and safer batteries. These batteries can travel longer distances, making them highly desirable for the electric vehicle industry. Electric vehicles equipped with these advanced lithium batteries can achieve extended ranges, eliminating limited travel and enhancing overall performance. This combination of high-quality lithium anodes and sustainable lithium metal production processes creates a formidable solution for low-cost, high-efficiency energy systems. Li-Metal's commitment to a more environmentally friendly production process sets them apart from industry standards. Their methods prioritize sustainability, minimizing lithium metal production's environmental impact. Additionally, the adoption of these safer processes enhances the overall safety of batteries, addressing concerns about battery-related accidents. Lithium Metals Power the Future of Energy Storage and Electrification. Lithium metal holds significant potential for growth and progress in diverse industries. With the increasing demand for energy storage, electric transportation, and consumer electronics, lithium metal emerges as a promising contender for next-generation batteries and energy systems. Portable devices, electric vehicles, and renewable energy systems use this characteristic for longer periods, driving demand for reliable and sustainable energy solutions. Furthermore, lithium metal batteries offer enhanced energy storage in a compact form. This facilitates the development of slimmer and lighter smartphones, laptops, wearables, and other portable electronics. The renewable energy sector stands to benefit from advancements in the lithium metal market as well. As solar and wind power, among other renewable energy sources, expand, efficient energy storage solutions become crucial for grid stability and power supply. Lithium metal batteries can store surplus energy generated during peak production periods and release it during high demand. This contributes to grid balancing and renewable energy integration into existing infrastructure. Moreover, the lithium metal market can contribute to sustainability objectives. The more environmentally friendly production processes associated with lithium metal extraction and manufacturing reduce the overall ecological impact. This aligns with the growing awareness and demand for eco-friendly products, granting a competitive advantage to companies that prioritize sustainability in their operations.

The global lithium metal market is witnessing significant expansion, driven by the soaring demand for lithium-ion batteries in EVs and grid-scale energy storage. Various technologies, such as LithSonic, offer innovative approaches to lithium metal production, addressing environmental concerns associated with traditional methods. With a projected production volume surpassing 100 kt in 2023, the market is poised for substantial growth. This is supported by ongoing lithium exploration and mining projects. As the world embraces sustainable transportation and energy solutions, lithium metal demand is expected to soar. This makes it a crucial component of the evolving global energy landscape. High Production Costs Impact Lithium Metal's Competitiveness: Lithium metal is highly reactive and poses safety risks such as flammability and thermal runaway. Safety concerns limit its adoption in certain applications and industries. Lithium metal production is expensive, which impacts its market competitiveness. Higher production costs translate into higher prices for lithium metal-based products, making them less attractive to consumers. Lithium metal is not as abundant as other lithium compounds, making action and production. Limited supply leads to price volatility and supply chain disruptions, hindering lithium metal market growth. The lithium metal market is subject to various regulations and standards aimed at safety and environmental protection. Compliance with these regulations adds complexity and costs to lithium metal-based products' production and distribution. Despite advancements, there are still technological challenges associated with lithium metal, such as dendrite formation and low Coulombic efficiency. These limitations affect lithium metal-based batteries' overall performance and reliability, limiting their widespread adoption.

Lithium Metal Market Segment Analysis:

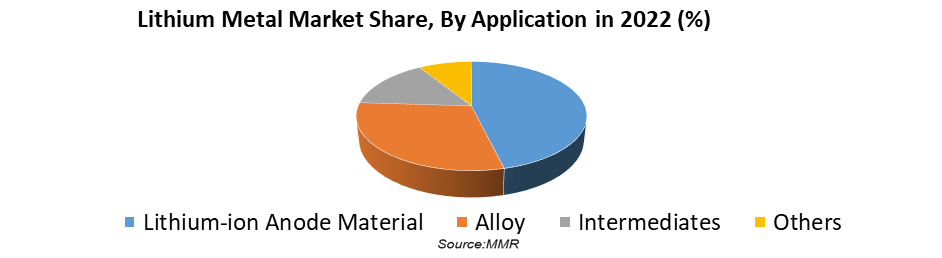

Based on the Source, the lithium metal market is segmented into Salt Lake Brine and Lithium Ores. The salt lake brine segment dominates the global lithium metal market in the year 2022 and is expected to continue its dominance during the forecast period. Cost-effectiveness and a large volume of lithium production from lithium-enriched brines have made it the primary source of lithium globally. The dominant segment in the lithium metal market is the salt lake brine segment. This shift occurred due to the lower cost and larger volume of lithium production from brine sources than hard rock sources. The salt lake brine segment refers to the production of lithium from lithium-enriched brines found in saltwater lakes or underground reservoirs. This process involves extracting the brine and evaporating it to concentrate the lithium content. The major regions for salt lake brine production are Nevada (USA), Chile and Bolivia, Argentina), and Tibet.The lithium ores segment involves lithium extraction from hard rock minerals. Lithium production was predominantly sourced from lithium ores found in countries such as the USA, Russia, Chile, Australia, China, and Canada. Based on the Application, Lithium-ion anode materials segment the dominated tarket in the year 2022 and is expected to continue its dominance during the forecast period. lithium metal applications. With the growing demand, lithium-ion anode materials, including lithium metal, remain high. Lithium-ion anode materials play a significant role in a lithium-ion battery's performance and efficiency. The lithium-ion anode stores and releases lithium ions during charging and discharge cycles, allowing the battery to provide reliable and long-lasting power. Lithium metal is used in alloy production. Lithium metal is combined with other metals to create specialized alloys with unique properties for specific applications. The intermediates segment includes the use of lithium metal as an intermediate product in the production of various chemicals and compounds. For example, lithium carbonate or lithium hydroxide. The Lithium-ion Anode Material segment dominates the lithium metal market due to its widespread use in different sectors and its significant role in the development of high-performance lithium-ion batteries. As a key component of lithium-ion batteries, the demand for lithium metal in anode materials plays a significant role due to its unique properties and ability to increase the energy storage capacity and performance of batteries.

Lithium Metal Market Regional Insights:

The global lithium metal market exhibits significant regional variations in production, consumption, and market dynamics. Asia-Pacific region dominates the global lithium metal market in the year 2022 with a market share of 50% and is expected to continue its dominance during the forecast period. In terms of production and consumption. China is the largest manufacturer of lithium metal with its abundant lithium reserves and well-established lithium industry. The robust manufacturing capabilities and thriving electronics sector contribute to the high consumption of lithium metal in the region. The rapid growth of the electric vehicle (EV) market further boosts lithium metal demand as a crucial component in lithium-ion batteries. South Korea and Japan are also players in the lithium metal market. The rising adoption of EVs, and supportive government policies promoting clean energy and sustainable transportation, further propels lithium metal demand in these countries. North America is a significant lithium metal market, driven by the United States and Canada. North America has a growing demand for lithium metal because of the expanding electric vehicle market. The United States is actively investing in the development of domestic lithium resources and manufacturing capabilities to reduce import dependence. This is due to increasing renewable energy projects, and a strong focus on energy storage systems. The presence of major electric vehicle manufacturers and renewable energy companies in the region contributes to lithium metal demand. Europe is also experiencing an increasing demand for lithium metal, fueled by electric vehicles and renewable energy. Germany, France, and the United Kingdom are leading the transition towards clean energy and investing heavily in electric mobility infrastructure. This drives the need for lithium-ion batteries and lithium metals. The European Union has also implemented strict emission regulations, boosting demand for EVs and energy storage systems. Latin America possesses significant lithium resources, making it a significant region in the global lithium metal market. Countries like Chile and Argentina have abundant lithium reserves and are major lithium metal producers. These countries benefit from favorable geological conditions and low-cost extraction methods. With the growing demand for lithium, Latin American countries are expanding their production capacities to both domestic and international markets. The other regions also contribute significantly to market growth. The increasing demand for electric vehicles, renewable energy systems, and energy storage solutions drives global lithium consumption. With ongoing advancements in technology and sustainability initiatives, the regional dynamics of the lithium metal market are expected to evolve. This will present new opportunities for industry stakeholders.

Competitive Landscape

Key Players of the Lithium Metal Market profiled in the report include Albemarle Corporation, China Energy Lithium Co., Ltd., JSC Chemical Metallurgical Plant, Li-Metal Corp., Lithium Americas, Livent Corporation, Manosanthi Group Of Company, Otto Chemie Pvt. Ltd., Oxford Lab Fine Chem Llp, Pilbara Minerals, Pure Lithium, Shanghai China Lithium Industrial Co., Ltd., Shenzhen Chengxin Lithium Group Co. Ltd., Sion Power Corporation., Spectrum Chemical, The Honjo Chemical Corporation, Tianqui Lithium Industries Inc, TRU Group Inc. These Key manufacturers have a prevalent existence worldwide. This provides huge opportunities to serve many End-uses & customers and expand the Lithium Metal Market. Technological advancement, funding, expansion, partnership, and acquisition are the common strategies used by major market players for the expansion of business. n February 10, 2023, SES Awarded Cash Grants in South Korea to Support Li-Metal Expansion. SES AI Corporation a global leader in the development and manufacturing of high-performance lithium-metal (Li-Metal) rechargeable batteries for electric vehicles (EVs) and other applications, declared it was awarded cash grants from the South Korean Central Government, represented by the Ministry of Trade, Industry, and Energy (MOTIE), as well as Chung-Buk Province and Chung-Ju City. On June 6, 2023, Li-Metal gets a $1 million grant from Ontario gov’t to develop lithium metal production technology. Li-Metal Corp. a developer of lithium metal and lithium metal anode technologies for next-generation batteries, declared that it has been awarded over C$1.4 million ($1m) in grant funding from programs sponsored by the Government of Ontario to develop and commercialize its lithium metal production technology.Lithium Metal Market Scope: Inquire before buying

Lithium Metal Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 2071.5 Million. Forecast Period 2023 to 2029 CAGR: 20.7% Market Size in 2029: USD 7723.7 Million. Segments Covered: by Source Salt Lake Brine Lithium Ores by Application Lithium-ion Anode Material Alloy Intermediates Others by End-users Batteries Metal Processing Pharmaceutical Others Lithium Metal Market Regional Insights:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina, and the Rest of South America)Lithium Metal Market Key Players:

1. Albemarle Corporation, 2. Alpha-En Corporation 3. American Elements 4. China Energy Lithium Co., Ltd., 5. China Lithium Products Technology Co., Ltd. 6. CNNC Jianzhong Nuclear Fuel Co., Ltd. 7. Ganfeng Lithium Co., Ltd. 8. JSC Chemical Metallurgical Plant 9. Li-Metal Corp. 10. Lithium Americas 11. Livent Corporation, 12. Manosanthi Group Of Company 13. Otto Chemie Pvt. Ltd. 14. Oxford Lab Fine Chem Llp 15. Pilbara Minerals 16. Pure Lithium 17. Shandong Ruifu Lithium Industry Co., Ltd. 18. Shanghai China Lithium Industrial Co., Ltd., 19. Shenzhen Chengxin Lithium Group Co. Ltd. 20. Sion Power Corporation. 21. Spectrum Chemical 22. The Honjo Chemical Corporation 23. Tianqui Lithium Industries Inc, 24. Tru Group Inc FAQs: 1. What are the growth drivers for the Lithium Metal Market? Ans. Electric Vehicle Adoption and Accelerated Adoption of Next-Generation Lithium Batteries Drives Lithium Metal Market Growth. 2. What is the major restraint for the Lithium Metal Market growth? Ans. High Production Costs Impact Lithium Metal's Competitiveness is a major restraining factor for the Lithium Metal Market growth. 3. Which region is expected to lead the global Lithium Metal Market during the forecast period? Ans. Asia Pacific is expected to lead the global Lithium Metal Market during the forecast period. 4. What is the projected market size & growth rate of the Lithium Metal Market? Ans. The Lithium Metal Market size was valued at USD 2071.5 Million in 2022 and the total Lithium Metal Market revenue is expected to grow at a CAGR of 20.7% from 2023 to 2029, reaching nearly USD 7723.7 Million 5. What segments are covered in the Lithium Metal Market report? Ans. The segments covered in the Lithium Metal Market report are Source, Application, End-use, and Region.

1. Lithium Metal Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Lithium Metal Market: Dynamics 2.1. Lithium Metal Market Trends by Region 2.1.1. North America Lithium Metal Market Trends 2.1.2. Europe Lithium Metal Market Trends 2.1.3. Asia Pacific Lithium Metal Market Trends 2.1.4. Middle East and Africa Lithium Metal Market Trends 2.1.5. South America Lithium Metal Market Trends 2.2. Lithium Metal Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Lithium Metal Market Drivers 2.2.1.2. North America Lithium Metal Market Restraints 2.2.1.3. North America Lithium Metal Market Opportunities 2.2.1.4. North America Lithium Metal Market Challenges 2.2.2. Europe 2.2.2.1. Europe Lithium Metal Market Drivers 2.2.2.2. Europe Lithium Metal Market Restraints 2.2.2.3. Europe Lithium Metal Market Opportunities 2.2.2.4. Europe Lithium Metal Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Lithium Metal Market Drivers 2.2.3.2. Asia Pacific Lithium Metal Market Restraints 2.2.3.3. Asia Pacific Lithium Metal Market Opportunities 2.2.3.4. Asia Pacific Lithium Metal Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Lithium Metal Market Drivers 2.2.4.2. Middle East and Africa Lithium Metal Market Restraints 2.2.4.3. Middle East and Africa Lithium Metal Market Opportunities 2.2.4.4. Middle East and Africa Lithium Metal Market Challenges 2.2.5. South America 2.2.5.1. South America Lithium Metal Market Drivers 2.2.5.2. South America Lithium Metal Market Restraints 2.2.5.3. South America Lithium Metal Market Opportunities 2.2.5.4. South America Lithium Metal Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Lithium Metal Industry 2.8. Analysis of Government Schemes and Initiatives For Lithium Metal Industry 2.9. Lithium Metal Market price trend Analysis (2021-22) 2.10. Lithium Metal Market Trade Analysis 2.10.1. Global Import Analysis 2.10.1.1. Top Importer of Lithium Metal 2.10.2. Global Export Analysis 2.10.2.1. Top Exporter of Lithium Metal 2.11. Lithium Metal Production Analysis 2.12. The Global Pandemic Impact on Lithium Metal Market 3. Lithium Metal Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) 2022-2029 3.1. Lithium Metal Market Size and Forecast, by Source (2022-2029) 3.1.1. Salt Lake Brine 3.1.2. Lithium Ores 3.2. Lithium Metal Market Size and Forecast, by Applications (2022-2029) 3.2.1. Lithium-ion Anode Material 3.2.2. Alloy 3.2.3. Intermediates 3.2.4. Others 3.3. Lithium Metal Market Size and Forecast, by End User (2022-2029) 3.3.1. Batteries 3.3.2. Metal Processing 3.3.3. Pharmaceutical 3.3.4. Others 3.4. Lithium Metal Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Lithium Metal Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 4.1. North America Lithium Metal Market Size and Forecast, by Source (2022-2029) 4.1.1. Salt Lake Brine 4.1.2. Lithium Ores 4.2. North America Lithium Metal Market Size and Forecast, by Applications (2022-2029) 4.2.1. Lithium-ion Anode Material 4.2.2. Alloy 4.2.3. Intermediates 4.2.4. Others 4.3. North America Lithium Metal Market Size and Forecast, by End User (2022-2029) 4.3.1. Batteries 4.3.2. Metal Processing 4.3.3. Pharmaceutical 4.3.4. Others 4.4. North America Lithium Metal Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Lithium Metal Market Size and Forecast, by Source (2022-2029) 4.4.1.1.1. Salt Lake Brine 4.4.1.1.2. Lithium Ores 4.4.1.2. United States Lithium Metal Market Size and Forecast, by Applications (2022-2029) 4.4.1.2.1. Lithium-ion Anode Material 4.4.1.2.2. Alloy 4.4.1.2.3. Intermediates 4.4.1.2.4. Others 4.4.1.3. United States Lithium Metal Market Size and Forecast, by End User (2022-2029) 4.4.1.3.1. Batteries 4.4.1.3.2. Metal Processing 4.4.1.3.3. Pharmaceutical 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Lithium Metal Market Size and Forecast, by Source (2022-2029) 4.4.2.1.1. Salt Lake Brine 4.4.2.1.2. Lithium Ores 4.4.2.2. Canada Lithium Metal Market Size and Forecast, by Applications (2022-2029) 4.4.2.2.1. Lithium-ion Anode Material 4.4.2.2.2. Alloy 4.4.2.2.3. Intermediates 4.4.2.2.4. Others 4.4.2.3. Canada Lithium Metal Market Size and Forecast, by End User (2022-2029) 4.4.2.3.1. Batteries 4.4.2.3.2. Metal Processing 4.4.2.3.3. Pharmaceutical 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Lithium Metal Market Size and Forecast, by Source (2022-2029) 4.4.3.1.1. Salt Lake Brine 4.4.3.1.2. Lithium Ores 4.4.3.2. Mexico Lithium Metal Market Size and Forecast, by Applications (2022-2029) 4.4.3.2.1. Lithium-ion Anode Material 4.4.3.2.2. Alloy 4.4.3.2.3. Intermediates 4.4.3.2.4. Others 4.4.3.3. Mexico Lithium Metal Market Size and Forecast, by End User (2022-2029) 4.4.3.3.1. Batteries 4.4.3.3.2. Metal Processing 4.4.3.3.3. Pharmaceutical 4.4.3.3.4. Others 5. Europe Lithium Metal Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 5.1. Europe Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.2. Europe Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.3. Europe Lithium Metal Market Size and Forecast, by End User (2022-2029) 5.4. Europe Lithium Metal Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.4.1.2. United Kingdom Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.4.1.3. United Kingdom Lithium Metal Market Size and Forecast, by End User (2022-2029) 5.4.2. France 5.4.2.1. France Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.4.2.2. France Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.4.2.3. France Lithium Metal Market Size and Forecast, by End User (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.4.3.2. Germany Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.4.3.3. Germany Lithium Metal Market Size and Forecast, by End User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.4.4.2. Italy Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.4.4.3. Italy Lithium Metal Market Size and Forecast, by End User (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.4.5.2. Spain Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.4.5.3. Spain Lithium Metal Market Size and Forecast, by End User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.4.6.2. Sweden Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.4.6.3. Sweden Lithium Metal Market Size and Forecast, by End User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.4.7.2. Austria Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.4.7.3. Austria Lithium Metal Market Size and Forecast, by End User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Lithium Metal Market Size and Forecast, by Source (2022-2029) 5.4.8.2. Rest of Europe Lithium Metal Market Size and Forecast, by Applications (2022-2029) 5.4.8.3. Rest of Europe Lithium Metal Market Size and Forecast, by End User (2022-2029) 6. Asia Pacific Lithium Metal Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 6.1. Asia Pacific Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.2. Asia Pacific Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.3. Asia Pacific Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4. Asia Pacific Lithium Metal Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.1.2. China Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.1.3. China Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.2.2. S Korea Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.2.3. S Korea Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.3.2. Japan Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.3.3. Japan Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.4. India 6.4.4.1. India Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.4.2. India Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.4.3. India Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.5.2. Australia Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.5.3. Australia Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.6.2. Indonesia Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.6.3. Indonesia Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.7.2. Malaysia Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.7.3. Malaysia Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.8.2. Vietnam Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.8.3. Vietnam Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.9.2. Taiwan Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.9.3. Taiwan Lithium Metal Market Size and Forecast, by End User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Lithium Metal Market Size and Forecast, by Source (2022-2029) 6.4.10.2. Rest of Asia Pacific Lithium Metal Market Size and Forecast, by Applications (2022-2029) 6.4.10.3. Rest of Asia Pacific Lithium Metal Market Size and Forecast, by End User (2022-2029) 7. Middle East and Africa Lithium Metal Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 7.1. Middle East and Africa Lithium Metal Market Size and Forecast, by Source (2022-2029) 7.2. Middle East and Africa Lithium Metal Market Size and Forecast, by Applications (2022-2029) 7.3. Middle East and Africa Lithium Metal Market Size and Forecast, by End User (2022-2029) 7.4. Middle East and Africa Lithium Metal Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Lithium Metal Market Size and Forecast, by Source (2022-2029) 7.4.1.2. South Africa Lithium Metal Market Size and Forecast, by Applications (2022-2029) 7.4.1.3. South Africa Lithium Metal Market Size and Forecast, by End User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Lithium Metal Market Size and Forecast, by Source (2022-2029) 7.4.2.2. GCC Lithium Metal Market Size and Forecast, by Applications (2022-2029) 7.4.2.3. GCC Lithium Metal Market Size and Forecast, by End User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Lithium Metal Market Size and Forecast, by Source (2022-2029) 7.4.3.2. Nigeria Lithium Metal Market Size and Forecast, by Applications (2022-2029) 7.4.3.3. Nigeria Lithium Metal Market Size and Forecast, by End User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Lithium Metal Market Size and Forecast, by Source (2022-2029) 7.4.4.2. Rest of ME&A Lithium Metal Market Size and Forecast, by Applications (2022-2029) 7.4.4.3. Rest of ME&A Lithium Metal Market Size and Forecast, by End User (2022-2029) 8. South America Lithium Metal Market Size and Forecast by Segmentation (by Value and Volume) 2022-2029 8.1. South America Lithium Metal Market Size and Forecast, by Source (2022-2029) 8.2. South America Lithium Metal Market Size and Forecast, by Applications (2022-2029) 8.3. South America Lithium Metal Market Size and Forecast, by End User(2022-2029) 8.4. South America Lithium Metal Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Lithium Metal Market Size and Forecast, by Source (2022-2029) 8.4.1.2. Brazil Lithium Metal Market Size and Forecast, by Applications (2022-2029) 8.4.1.3. Brazil Lithium Metal Market Size and Forecast, by End User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Lithium Metal Market Size and Forecast, by Source (2022-2029) 8.4.2.2. Argentina Lithium Metal Market Size and Forecast, by Applications (2022-2029) 8.4.2.3. Argentina Lithium Metal Market Size and Forecast, by End User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Lithium Metal Market Size and Forecast, by Source (2022-2029) 8.4.3.2. Rest Of South America Lithium Metal Market Size and Forecast, by Applications (2022-2029) 8.4.3.3. Rest Of South America Lithium Metal Market Size and Forecast, by End User (2022-2029) 9. Global Lithium Metal Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Production of 2022 9.3.6. Company Locations 9.4. Leading Lithium Metal Market Companies, by market capitalization 9.5. Analysis of Organized and Unorganized Key Players in Lithium Metal Industry 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Albemarle Corporation, 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Alpha-En Corporation 10.3. American Elements 10.4. China Energy Lithium Co., Ltd., 10.5. China Lithium Products Technology Co., Ltd. 10.6. CNNC Jianzhong Nuclear Fuel Co., Ltd. 10.7. Ganfeng Lithium Co., Ltd. 10.8. JSC Chemical Metallurgical Plant 10.9. Li-Metal Corp. 10.10. Lithium Americas 10.11. Livent Corporation, 10.12. Manosanthi Group Of Company 10.13. Otto Chemie Pvt. Ltd. 10.14. Oxford Lab Fine Chem Llp 10.15. Pilbara Minerals 10.16. Pure Lithium 10.17. Shandong Ruifu Lithium Industry Co., Ltd. 10.18. Shanghai China Lithium Industrial Co., Ltd., 10.19. Shenzhen Chengxin Lithium Group Co. Ltd. 10.20. Sion Power Corporation. 10.21. Spectrum Chemical 10.22. The Honjo Chemical Corporation 10.23. Tianqui Lithium Industries Inc, 10.24. Tru Group Inc 11. Key Findings 12. Industry Recommendations 13. Lithium Metal Market: Research Methodology 14. Terms and Glossary