Lignin Market size was valued at US$ 1023.43 Mn. in 2023 and the total revenue is expected to grow by 2.37% from 2024 to 2030,, reaching nearly US$ 1205.78 Mn. Lignin is the second most abundant component in typical biomass, which has the unusual property of being one of the few sources of aromatic compounds that are not petroleum. Lignin is a key renewable resource for the chemical industry and the main byproduct of lignocellosic bio-refineries. Plant lignin has a lot of potentials to be converted into value-added products that can greatly boost bio-profitability. Over the forecast period of 2024 to 2030, an increase in the demand for lignin as an organic additive is expected to propel market growth. The lignin market is being driven by continuing research and development efforts. Thanks to the soaring demand from numerous end-use industries, the lignin market is growing favorably. In developing economies, market growth is accelerated for many reasons, including rapid urbanisation, ongoing infrastructural development, industrial growth, and technical improvement. However, it is expected that a lack of awareness and technological constraints will impede industry growth.Report Scope:

The report provides a comprehensive analysis of the global Lignin Market. The report estimates the Lignin Market, in terms of USD value from 2024 to 2030, base year is 2023. The report includes the major factors that are driving and hampering the growth of the lignin market across the globe. The report includes a thorough segmental analysis based on product type and application. An in-depth understanding of the potential of the lignin market may be gained from a regional examination of the supply chain, corporate operations, and market value. In addition, there is a separate section on the market structure. The section offers a thorough analysis of the major industry participants and their plans for growth in the world lignin market.To know about the Research Methodology:-Request Free Sample Report

Lignin Market Dynamics:

The increased use of fossil fuels for many purposes, including the production of chemicals and transportation fuels, has accelerated their rapid depletion. Currently, fossil fuels account for around 80% of the production of chemicals. There is an urgent need for an alternative source to create energy and chemicals because these resources are scarce. The most promising renewable carbon source today is lignocellulosic biomass, which can provide energy in the form of biofuel and value-added chemicals. More than 70 million tons of lignin per year are produced industrially, and only a tiny portion (1–2%) is used. Because it is polyaromatic, lignin is a proven source of many value-added chemicals. As result, the adoption of lignin from several industries is expected to boost the lignin market growth across the globe.Diverse Applications of Lignin

The usage of lignin and its byproducts as concrete additives in the form of dyes, dust suppressants, etc. is very common. Glass wool building insulation is bound with lignin. It enhances the effectiveness of asphalt dye. During the forecast period, growth and advancement in industries including agriculture, animal feed, and concrete are expected to boost the market growth. The profitable availability of a wide variety of animal feed is thus increasing demand for lignin. In addition, growing uses for industrial cleansers, industrial dyes, batteries, and water treatment are some of the elements influencing lignin's increased sales across the globe.Growing Adoption of Lignin across the Globe

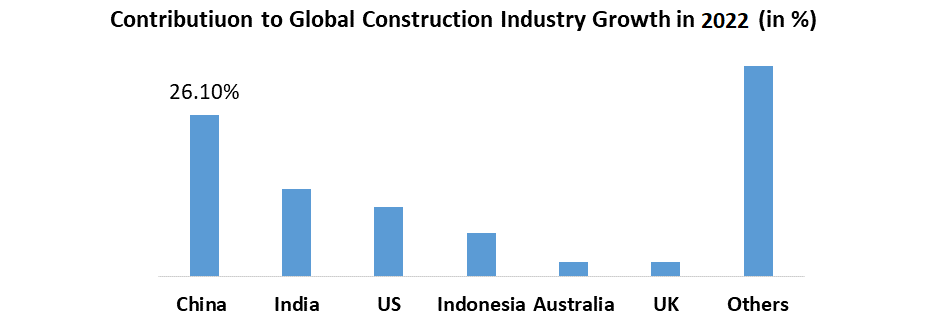

Thanks to the increase in chicken meat consumption across the globe, lignin will become more and more in demand for animal feed applications. For instance, according to the U.S. Department of Agriculture (USDOA) world is expected to produce 100.8 million tonnes of chicken meat by the end of 2023. This shows that suitable feed elements like lignin are widely used in animal feed, with advantages like a high energy source. Governments and corporate investors are increasing their investments to create a public infrastructure that is environmentally friendly. This covers both industrialised and developing economies' railways, roads, and other transportation modalities. For instance, as stated in its Union Budget for 2020–21, the Government of India planned to invest more than USD 6.5 billion in the building of roads and bridges. Such activities would encourage the use of lignin, which is employed in the building industry as a water-reducing additive and an efficient cement substitute.

Growing Adoption of Lignin in the Pharmaceutical Industry

The pharmaceutical Industry is one of the key industry drivers boosting the compound demand. A robust pace of growth is being experienced in the medical industry as a result of the rising global burden of chronic diseases. Due to its low cost and use in a variety of medicinal requirements, including goods for skin disinfection and itch relief, it has raised the demand for phenol-based products from the pharmaceutical industry.The growing use of Lignin in Concrete Additives

During the forecast period, it is expected that increased demand for lignin in building and construction applications will propel the market. Lignin is being employed more frequently in the building and construction sector. During the forecast period, the demand for lignin as a dispersant in concrete additives will be driven by the construction of infrastructure in both developed and emerging nations. Lignin is more widely used as architects and construction designers incorporate them into their plans. In addition, the lignin market is anticipated to grow during the forecast period due to manufacturers' increased focus on creating, selling, and developing lignin for a number of uses in the building & construction sector.Lack of Awareness and Research

The growth of the lignin market is expected to be hampered by industrial and commercial end-users lack of knowledge about the benefits and uses of lignin. Lignin is used in a wide range of industries, from chemicals to food and beverage. However, a dearth of studies into the potential uses for this substance could somewhat restrain demand in the years to come. Despite these issues, a steady increase in infrastructure spending and a high demand for animal feed will present prospects for lignin suppliers across the globe. Lignin Market Key Insights It is expected that the growing trend of burning lignin for usage in dispersants, binders, and adhesives will accelerate market growth through the forecast period. The demand for lignin is expected to be supported on a macro level by elements like rising construction spending and increasing demand for autos, electronics, and equipment manufacture. Many market participants offer full service for lignin and its uses. For instance, Nippon Paper manufactures paper and pulp and obtains lignin from the pulping procedure. The business also runs industrial plantations and cultivates forests.Lignin Market Segment Analysis:

By Product, the Lignin Market is segmented into Kraft Lignin, Lignosulphonates, Low Purity Lignin, and Others. The Lignosulphonates segment held the largest market share accounting for 71.23% in 2023. Lignisulfonates are used in the oil and gas sector to regulate the viscosity of drilling mud for deep oil wells. Lignisulfonates are also employed in the creation of ceramics' smooth clay slips. As a result, over the forecast period, there will be an increase in demand for lignosulfonates lignin due to the aforementioned considerations. The Kraft Lignin segment is expected to grow at a significant CAGR of xx% through the forecast period. As a foam in fire extinguishers and printing inks for high-speed rotary presses, kraft lignin is extensively used. High-grade activated charcoal is also produced using kraft lignin. The demand for lignin is expected to increase over the forecast period as a result of its inventive uses in so many different sectors of the economy. The low-purity lignin segment is expected to grow more than 5% CAGR through the forecast period. The demand for renewable feedstocks, such as biomass is growing at a significant pace as customers are increasing their preference for eco-friendly fuels. According to the U.K. government’s statistics, in 2020, the total volume of locally sourced biofuels used in the region reached 293 million liters/kilogram, a 5% increase from the 2019 figures. Low-purity lignin is used as a biofuel owing to its ability to generate more energy while burning, as compared to cellulose. By Raw Material, the Lignin Market is segmented into Hardwood, Softwood, Straw, Sugarcane, Bagasse, Corn Stover, and Spent Liquor. The Hardwood segment held the largest market share in 2023. Hardwood lignin is used to make a variety of adhesives since it has a high concentration of S-lignin units and a low molecular weight. Given that this kind of lignin is produced from leftover plant materials that remain after harvesting, it can serve as a useful substitute for adhesives that are based on petrochemicals. By effectively using biowaste, it harms the environment as little as possible.By Application, the Lignin Market is segmented into Aromatics and Macromolecules. The Macromolecules segment dominated the market share accounting for 58.63% in 2023. It is expected that the importance of macromolecules will expand as carbon fibers become more widely used as lightweight materials in the construction and automobile industries. The macromolecules are further processed to create carbon fibers, carbon, biofuels, bitumen, catalysts for bio-refineries, and activated carbon. Carbon fibers are becoming more and more common as the aerospace and automobile production industries require lighter materials. In addition, rising demand for lightweight vehicles is anticipated due to their improved durability and performance. Companies that produce polymers have been forced to boost their efforts in the research and development of organically derived raw materials due to strict laws designed to enhance awareness of the benefits of earning carbon credits and decreasing greenhouse gas emissions. The production of phenol, phenolic resins, vanillin, and BTX is thus expected to employ lignin as an intermediary. Growing public concern over GHG emissions has increased demand for items made of bio-based polymers. During the forecast period, lignin is expected to experience increased demand for the manufacturing of aromatics. The chemical industry is expected to continue to advance, which will further boost the market.

Lignin Market Regional Insights:

In 2023, Europe dominated the market with the largest market share, followed by North America. It is expected that Europe’s dominance will continue both in terms of volume and value during the forecast period. Europe has stringent laws governing the emission of greenhouse gases, which may open up new markets for the production of bio-based polymers. Growth in these regional lignin markets is being positively impacted by rising demand for lightweight automotive materials and bio-based materials in nations like Germany, France, and the Netherlands. Asia Pacific is expected to grow at a rapid rate through the forecast period. The region’s growth is attributed to an increase in demand for lignin in a number of applications, including dyes, animal feed, and concrete additives. The region's market is being driven by the sharp increase in demand for lignin in the building and construction and steel industries. China is expected to rule the lignin market in the Asia Pacific region. Value-grab possibilities are being created by the profitable presence of manufacturers operating in the Asia-Pacific region.Lignin Market Scope: Inquire before buying

Lignin Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1023.43 Mn. Forecast Period 2024 to 2030 CAGR: 2.37% Market Size in 2030: US $ 1205.78 Mn. Segments Covered: by Raw Material Hardwood Softwood Straw Sugarcane Bagasse Corn Stover Spent Liquor by Product Kraft Lignin Lignosulphonates Low Purity Lignin Others by Application Aromatics Macromolecules Lignin Market, Key Players are

1. Borregaard LignoTech 2. Liquid Lignin Company LLC 3. Stora Enso 4. Nippon Paper Industries Co., Ltd. 5. Domsjo Fabriker AB (Aditya Birla) 6. Ingevity Corporation 7. Sigma Aldrich 8. GreenValue SA 9. Rayonier Advanced Materials 10. Sappi Limited 11. Versalis (Eni FAQs: 1. What is the study period of the market? Ans. The Global Lignin Market is studied from 2018-2030. 2. What is the growth rate of the Lignin Market? Ans. The Lignin Market is growing at a CAGR of 2.37% over the forecast period. 3. What is the market size of the Lignin Market by 2030? Ans. The market size of the Information Technology Market by 2030 is expected to reach 1205.78 Mn. 4. What is the forecast period for the Lignin Market? Ans. The forecast period for the Lignin Market is 2024-2030. 5. What was the market size of the Lignin Market in 2023? Ans. The market size of the Lignin Market in 2023 was valued at USD 1023.43 Mn.

1. Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. A perspective of lignin processing and utilization technologies 3. Lignin Market: Dynamics 3.1. Lignin Market Trends by Region 3.1.1. Global Market Trends 3.1.2. North America Trends 3.1.3. Europe Trends 3.1.4. Asia Pacific Trends 3.1.5. Middle East and Africa Trends 3.1.6. South America Lignin Market Trends 3.2. Lignin Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Lignin Market Drivers 3.2.1.2. North America Lignin Market Restraints 3.2.1.3. North America Lignin Market Opportunities 3.2.1.4. North America Lignin Market Challenges 3.2.2. Europe 3.2.2.1. Europe Lignin Market Drivers 3.2.2.2. Europe Lignin Market Restraints 3.2.2.3. Europe Lignin Market Opportunities 3.2.2.4. Europe Lignin Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Lignin Market Drivers 3.2.3.2. Asia Pacific Lignin Market Restraints 3.2.3.3. Asia Pacific Lignin Market Opportunities 3.2.3.4. Asia Pacific Lignin Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Lignin Market Drivers 3.2.4.2. Middle East and Africa Lignin Market Restraints 3.2.4.3. Middle East and Africa Lignin Market Opportunities 3.2.4.4. Middle East and Africa Lignin Market Challenges 3.2.5. South America 3.2.5.1. South America Lignin Market Drivers 3.2.5.2. South America Lignin Market Restraints 3.2.5.3. South America Lignin Market Opportunities 3.2.5.4. South America Lignin Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Advancements 3.5.1. Emerging Technologies in Lignin Extraction 3.5.2. Innovative Applications of Lignin 3.5.3. Sustainable Processing Methods 3.5.4. Future Technological Trends 3.6. Value Chain Analysis 3.7. Regulatory Landscape by Region 3.7.1. Global 3.7.2. North America 3.7.3. Europe 3.7.4. Asia Pacific 3.7.5. Middle East and Africa 3.7.6. South America 3.8. Analysis of Government Schemes and Initiatives for Lignin Industry 3.9. The Global Pandemic Impact on Lignin Market 4. Lignin Market: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 4.1. Lignin Market Size and Forecast, by Raw Material (2023-2030) 4.1.1. Hardwood 4.1.2. Softwood 4.1.3. Straw 4.1.4. Sugarcane Bagasse 4.1.5. Corn Stover 4.1.6. Spent Liquor 4.2. Lignin Market Size and Forecast, by Product (2023-2030) 4.2.1. Kraft Lignin 4.2.2. Lignosulphonates 4.2.3. Low Purity Lignin 4.2.4. Others 4.3. Lignin Market Size and Forecast, by Application (2023-2030) 4.3.1. Aromatics 4.3.2. Macromolecules 4.4. Lignin Market Size and Forecast, by region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Lignin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Lignin Market Size and Forecast, by Raw Material (2023-2030) 5.1.1. Hardwood 5.1.2. Softwood 5.1.3. Straw 5.1.4. Sugarcane Bagasse 5.1.5. Corn Stover 5.1.6. Spent Liquor 5.2. North America Lignin Market Size and Forecast, by Product (2023-2030) 5.2.1. Kraft Lignin 5.2.2. Lignosulphonates 5.2.3. Low Purity Lignin 5.2.4. Others 5.3. North America Lignin Market Size and Forecast, by Application (2023-2030) 5.3.1. Aromatics 5.3.2. Macromolecules 5.4. Lignin Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Lignin Market Size and Forecast, by Raw Material (2023-2030) 5.4.1.1.1. Hardwood 5.4.1.1.2. Softwood 5.4.1.1.3. Straw 5.4.1.1.4. Sugarcane Bagasse 5.4.1.1.5. Corn Stover 5.4.1.1.6. Spent Liquor 5.4.1.2. United States Lignin Market Size and Forecast, by Product (2023-2030) 5.4.1.2.1. Kraft Lignin 5.4.1.2.2. Lignosulphonates 5.4.1.2.3. Low Purity Lignin 5.4.1.2.4. Others 5.4.1.3. United States Lignin Market Size and Forecast, by Application (2023-2030) 5.4.1.3.1. Aromatics 5.4.1.3.2. Macromolecules 5.4.2. Canada 5.4.2.1. Canada Lignin Market Size and Forecast, by Raw Material (2023-2030) 5.4.2.1.1. Hardwood 5.4.2.1.2. Softwood 5.4.2.1.3. Straw 5.4.2.1.4. Sugarcane Bagasse 5.4.2.1.5. Corn Stover 5.4.2.1.6. Spent Liquor 5.4.2.2. Canada Lignin Market Size and Forecast, by Product (2023-2030) 5.4.2.2.1. Kraft Lignin 5.4.2.2.2. Lignosulphonates 5.4.2.2.3. Low Purity Lignin 5.4.2.2.4. Others 5.4.2.3. Canada Lignin Market Size and Forecast, by Application (2023-2030) 5.4.2.3.1. Aromatics 5.4.2.3.2. Macromolecules 5.4.3. Mexico 5.4.3.1. Mexico Lignin Market Size and Forecast, by Raw Material (2023-2030) 5.4.3.1.1. Hardwood 5.4.3.1.2. Softwood 5.4.3.1.3. Straw 5.4.3.1.4. Sugarcane Bagasse 5.4.3.1.5. Corn Stover 5.4.3.1.6. Spent Liquor 5.4.3.2. Mexico Lignin Market Size and Forecast, by Product (2023-2030) 5.4.3.2.1. Kraft Lignin 5.4.3.2.2. Lignosulphonates 5.4.3.2.3. Low Purity Lignin 5.4.3.2.4. Others 5.4.3.3. Mexico Lignin Market Size and Forecast, by Application (2023-2030) 5.4.3.3.1. Aromatics 5.4.3.3.2. Macromolecules 6. Europe Lignin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.2. Europe Lignin Market Size and Forecast, by Product (2023-2030) 6.3. Europe Lignin Market Size and Forecast, by Application (2023-2030) 6.4. Europe Lignin Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.4.1.2. United Kingdom Lignin Market Size and Forecast, by Product (2023-2030) 6.4.1.3. United Kingdom Lignin Market Size and Forecast, by Application (2023-2030) 6.4.2. France 6.4.2.1. France Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.4.2.2. France Lignin Market Size and Forecast, by Product (2023-2030) 6.4.2.3. France Lignin Market Size and Forecast, by Application (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.4.3.2. Germany Lignin Market Size and Forecast, by Product (2023-2030) 6.4.3.3. Germany Lignin Market Size and Forecast, by Application (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.4.4.2. Italy Lignin Market Size and Forecast, by Product (2023-2030) 6.4.4.3. Italy Lignin Market Size and Forecast, by Application (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.4.5.2. Spain Lignin Market Size and Forecast, by Product (2023-2030) 6.4.5.3. Spain Lignin Market Size and Forecast, by Application (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.4.6.2. Sweden Lignin Market Size and Forecast, by Product (2023-2030) 6.4.6.3. Sweden Lignin Market Size and Forecast, by Application (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.4.7.2. Austria Lignin Market Size and Forecast, by Product (2023-2030) 6.4.7.3. Austria Lignin Market Size and Forecast, by Application (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Lignin Market Size and Forecast, by Raw Material (2023-2030) 6.4.8.2. Rest of Europe Lignin Market Size and Forecast, by Product (2023-2030) 6.4.8.3. Rest of Europe Lignin Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Lignin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.2. Asia Pacific Lignin Market Size and Forecast, by Product (2023-2030) 7.3. Asia Pacific Lignin Market Size and Forecast, by Application (2023-2030) 7.4. Asia Pacific Lignin Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.1.2. China Lignin Market Size and Forecast, by Product (2023-2030) 7.4.1.3. China Lignin Market Size and Forecast, by Application (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.2.2. S Korea Lignin Market Size and Forecast, by Product (2023-2030) 7.4.2.3. S Korea Lignin Market Size and Forecast, by Application (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.3.2. Japan Lignin Market Size and Forecast, by Product (2023-2030) 7.4.3.3. Japan Lignin Market Size and Forecast, by Application (2023-2030) 7.4.4. India 7.4.4.1. India Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.4.2. India Lignin Market Size and Forecast, by Product (2023-2030) 7.4.4.3. India Lignin Market Size and Forecast, by Application (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.5.2. Australia Lignin Market Size and Forecast, by Product (2023-2030) 7.4.5.3. Australia Lignin Market Size and Forecast, by Application (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.6.2. Indonesia Lignin Market Size and Forecast, by Product (2023-2030) 7.4.6.3. Indonesia Lignin Market Size and Forecast, by Application (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.7.2. Malaysia Lignin Market Size and Forecast, by Product (2023-2030) 7.4.7.3. Malaysia Lignin Market Size and Forecast, by Application (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.8.2. Vietnam Lignin Market Size and Forecast, by Product (2023-2030) 7.4.8.3. Vietnam Lignin Market Size and Forecast, by Application (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.9.2. Taiwan Lignin Market Size and Forecast, by Product (2023-2030) 7.4.9.3. Taiwan Lignin Market Size and Forecast, by Application (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Lignin Market Size and Forecast, by Raw Material (2023-2030) 7.4.10.2. Rest of Asia Pacific Lignin Market Size and Forecast, by Product (2023-2030) 7.4.10.3. Rest of Asia Pacific Lignin Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Lignin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Lignin Market Size and Forecast, by Raw Material (2023-2030) 8.2. Middle East and Africa Lignin Market Size and Forecast, by Product (2023-2030) 8.3. Middle East and Africa Lignin Market Size and Forecast, by Application (2023-2030) 8.4. Middle East and Africa Lignin Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Lignin Market Size and Forecast, by Raw Material (2023-2030) 8.4.1.2. South Africa Lignin Market Size and Forecast, by Product (2023-2030) 8.4.1.3. South Africa Lignin Market Size and Forecast, by Application (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Lignin Market Size and Forecast, by Raw Material (2023-2030) 8.4.2.2. GCC Lignin Market Size and Forecast, by Product (2023-2030) 8.4.2.3. GCC Lignin Market Size and Forecast, by Application (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Lignin Market Size and Forecast, by Raw Material (2023-2030) 8.4.3.2. Nigeria Lignin Market Size and Forecast, by Product (2023-2030) 8.4.3.3. Nigeria Lignin Market Size and Forecast, by Application (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Lignin Market Size and Forecast, by Raw Material (2023-2030) 8.4.4.2. Rest of ME&A Lignin Market Size and Forecast, by Product (2023-2030) 8.4.4.3. Rest of ME&A Lignin Market Size and Forecast, by Application (2023-2030) 9. South America Lignin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Lignin Market Size and Forecast, by Raw Material (2023-2030) 9.2. South America Lignin Market Size and Forecast, by Product (2023-2030) 9.3. South America Lignin Market Size and Forecast, by Product (2023-2030) 9.4. South America Lignin Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Lignin Market Size and Forecast, by Raw Material (2023-2030) 9.4.1.2. Brazil Lignin Market Size and Forecast, by Product (2023-2030) 9.4.1.3. Brazil Lignin Market Size and Forecast, by Application (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Lignin Market Size and Forecast, by Raw Material (2023-2030) 9.4.2.2. Argentina Lignin Market Size and Forecast, by Product (2023-2030) 9.4.2.3. Argentina Lignin Market Size and Forecast, by Application (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Lignin Market Size and Forecast, by Raw Material (2023-2030) 9.4.3.2. Rest Of South America Lignin Market Size and Forecast, by Product (2023-2030) 9.4.3.3. Rest Of South America Lignin Market Size and Forecast, by Application (2023-2030) 10. Global Lignin Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Product Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Lignin Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Borregaard LignoTech 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Liquid Lignin Company LLC 11.3. Stora Enso 11.4. Nippon Paper Industries Co., Ltd. 11.5. Domsjo Fabriker AB (Aditya Birla) 11.6. Ingevity Corporation 11.7. Sigma Aldrich 11.8. GreenValue SA 11.9. Rayonier Advanced Materials 11.10. Sappi Limited 11.11. Versalis (Eni) 12. Key Findings 13. Industry Recommendations 14. Lignin Market: Research Methodology 15. Terms and Glossary