Global Lactose Free Butter market size was valued at USD 313.81 Million in 2023 and the total lactose free butter revenue is expected to grow at a CAGR of 8.47% from 2024 to 2030, reaching nearly USD 554.42 Million.Lactose Free Butter Market Dynamics

Lactose-free butter is a type of dairy product, but it's made with an enzyme called lactase. Lactose-free dairy products could include cream cheese, milk, yogurt, sour cream, and others. The growing market for lactose-free butter can be largely attributed to its nutritional benefits such as the presence of vitamin A, vitamin D, and vitamin B12, as well as essential nutrients such as riboflavin and phosphorus, as well as calcium for healthy bones. The major key players of lactose free butter market are Lactalis (France), Arla Foods (Denmark), Kerry Group (Ireland), Britannia Industries (India), Danone (France), Good Day (India), Tillamook County Creamery Association (USA), Organic Valley (USA), Trader Joe's (USA). Due to wide brand recognition, extensive distribution channels and product innovation, these companies are at the forefront of the lactose free butter market. In addition, they are investing in Research and Development to create new lactose butter products with better taste, texture and health benefits. Lactose-free butter market is expected to grow during the forecast period, especially in emerging markets. Growing consumer awareness of the benefits of lactose-free products, introduction of new lactose-free butter products, rising disposable income and popularity of diets are driving the lactose-free butter market.To know about the Research Methodology :- Request Free Sample Report

Lactose Free Butter Market Scope and Research methodology

The report highlights the competitive market view, segment analysis based on the Application, Distribution channel and Region. First, the market overview describes the market trends, key market drivers, market restraints, opportunities, and challenges for the Lactose Free Butter Market. The Market is segmented by application including Commercial and Households. Market also segmented by Distribution Channel includes Retail Stores, Supermarkets, Speciality Stores, Online retail stores and others. The market size and trends for the market were analysed by using both primary and secondary data. Top down approach is used to estimate market size of the market. Market projections were based on historical data, present sector developments, and future market opportunities and challenges. The SWOT analysis of the major market players, which included their strengths, weaknesses, opportunities, and threats, was also included in the research to provide a thorough knowledge of the market dynamics. By employing the PESTLE analysis, the operating environment of an organization can be assessed. Porter's analysis were used to identify crucial factors that directly affect market profitability.Lactose Free Butter Market Dynamics

Lactose Free Butter Market Drivers Increasing awareness about benefits of lactose-free products Lactose free butter is anticipated to experience an increase in demand as customers become more aware of the benefits of these products. People who are lactose intolerant are more likely to choose lactose free butter because they don't have to deal with the same digestive discomfort. People who are more health conscious are also more likely to choose because they know that lactose free butter can help with digestion and bloating. Additionally, people are eating more plant based and vegan foods, so they're more likely to be interested in lactose free butter. With more education, product labels, and health info out there, people are more likely to want to switch to it. Growing demand of organic and natural products Consumers looking for a healthier & more sustainable option are attracted to Lactose-Free Butter made from Natural Ingredients. Organic & Natural Lactose Free Butter is often seen as cleaner, Free from Synthetic Additives or Pesticides, and Consistent with a Health-Conscious Lifestyle. This trend is in line with the overall shift towards Cleaner Eating habits. This trend is likely to increase the appeal of Lactose Free butter among people who are looking for dairy alternatives that match their preference for Organic & Natural foods and will drive its market demand. Increase in disposable income With higher disposable income, consumers spends more on premium and specialty food products like Lactose Free Butter. Lactose free alternatives may be slightly more expensive than regular butter. However, people with higher disposable income tend to prioritize health & dietary preferences, such as lactose intolerances, and are more inclined to opt for Lactose free options. Lactose Free Butter Market will continue to rise as it becomes more widely available and attractive to large number of consumers. Introduction of new lactose-free butter products Lactose free butter will only get more popular as new products are introduced. New products tend to grab people's attention and appeal to different tastes and tastes, so they'll be attractive to both lactose-sensitive and non-lactose-sensitive people. These new products could have new flavours, better textures, or special packaging that makes them even more appealing. So, the market for lactose-free will only keep growing as more and more manufacturers come out with new and different products, reaching more and more people.Lactose Free Butter Market Trends

Lactose free butter manufacturers are constantly introducing new and improved products. This helps the market to grow. Manufacturers of lactose free products are constantly introducing new flavours, textures and packaging to make the product more appealing. More and more people are turning to organic and natural butter because they think it's healthier and more eco-friendly. Companies are now offering organic, lactose free butter made from cows that are grass-fed or raised without antibiotics or hormones. The convenience of online shopping has made it easier for consumers to purchase martket products, which has contributed to the growth of online shopping in this market segment. Lactose-free butter consumption is on the rise in emerging markets like Asia-Pacific & Latin America. This is due to the increasing number of people with intolerances to lactose and the growing disposable income in these countries.Market Opportunities

Manufacturers have the opportunity to create lactose free butter products which contains functional components, including probiotics and prebiotics. These products could be attractive to consumers who are interested in dairy products that provide additional health benefits. Manufacturers can expand their reach to new markets, like emerging or developing countries, so they can reach more people and meet the increasing demand for market products in these areas. Lactose-free butter manufacturers can collaborate with retailers to market and sell their products. This would help manufacturers to reach a broader customer base and boost brand recognition. Through marketing, social media, and educational resources, lactose-free butter producers can highlight the benefits of this butter. This will help to raise awareness of lactose intolerances and the accessibility of low-fat butter choices. Lactose free butter can target specific groups of consumers such as athletes, kids, and seniors. For instance, manufacturers could create lactose free butter that is fortified with proteins or calcium.Market Challenges

Lactose free butter is expensive than regular butter because of higher cost of production for process of removing lactose from milk. Competition in the Lactose Free Butter Market is intensifying. New manufacturers enter the market and current manufacturers expand their product offering. This competition can lead to lower prices and lower profit. Availability of lactose-free butter is not same as regular butter. It may not be available at all supermarkets and restaurants. So consumers may have difficulty locating and purchasing lactose-free butter. It can be difficult to overcome any preconceived notions or preconceptions that some people may have about a lactose-free product. Some consumers may think that a lactose-free product is less natural or less tasty.Lactose Free Butter Market Segment Analysis

Based on application lactose free butter market is segmented into Commercial and Household. Household applications refer to butter consumption in small households or homes. Commercial applications refers to butter consumption at different places such as hotels, restaurants, caterers, hostels, and even schools and colleges. Among them, the household segment held largest share in 2023 due to an increase in consumer demand for lactose-free butter and dairy products. And anticipated to maintain its dominance with a anticipated CAGR of 7% during the estimate period. Based on the distribution channel Lactose Free Butter Market is segmented into Retail Stores, Supermarket, Speciality Stores and Online retail Stores. The Speciality Stores held over 40% of the market share and is anticipated to maintain its dominance with an anticipated CAGR of 6.5% during the estimate period. The growth is mainly due to increased customer preference for organic and natural product in North America and other developing countries. Supermarket also plays a significant role in the distribution of market.Lactose Free Butter Market Regional Insights

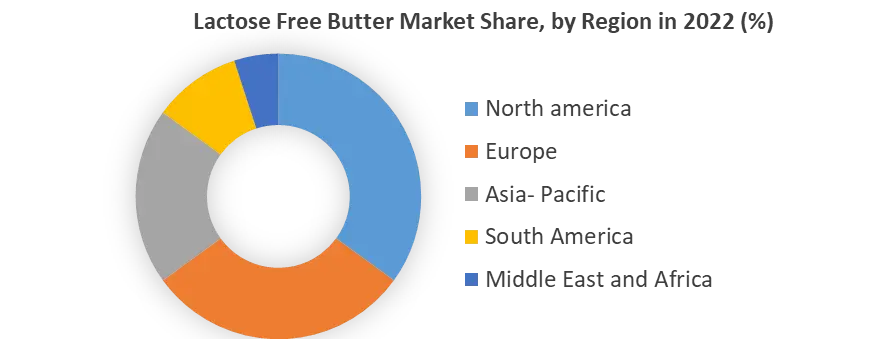

The global Lactose Free Butter Market segmented into North America, Europe, Asia-Pacific, Middle East and Africa and South America. The global market for lactose free butter is dominated by the North American region with anticipated CAGR 6.2%. The market for North American Lactose-free Butter is growing due to an increase in the consumption of natural food products due to a growing awareness of health. Consumers in the region, particularly the United States and Canada, are well informed about the lactose intolerance situation, compared to consumers in the Asia-Pacific region and the rest of the world who are unaware of the condition. As a result, there is a higher demand for lactose-free butter in North America. In addition, due to the increasing health awareness among the native consumers of Guatemala, there is a tendency to switch from dairy products to market and other alternatives as a preventive measure by the consumers themselves. Europe is second largest market for lactose free butter. The European market is expanding as people become more aware of lactose intolerances and the demand for functional foods grows. Germany is the biggest European market for lactose free butter followed by France, UK, and Italy. The Asia Pacific market is expected to grow significantly in the coming years. This is due to several factors such as rising incomes, changing lifestyles and preference for natural dairy products. Lactose-free butter is primarily made using natural methods and natural ingredients. It is also more expensive than traditional butter products. As disposable income increases, consumers can afford to use this butter in cooking. This led to an increase in the demand for lactose-free dairy products, which in turn led to an increase in the consumption of lactose-free butter. Some of the leading countries in Asia Pacific are China, India, South Korea, Japan and Australia.

Lactose Free Butter Market Competitive Landscape

Lactose Free Butter Market is highly competitive and fragmented. The major key players of market are Lactalis (France), Arla Foods (Denmark), Kerry Group (Ireland), Britannia Industries (India), Danone (France), Good Day (India), Nestle (India), Tillamook County Creamery Association (USA), Organic Valley (USA), Trader Joe's (USA). Due to wide brand recognition, extensive distribution channels and product innovation, these companies are at the forefront of the market. In addition, they are investing in Research and Development to create new lactose butter products with better taste, texture and health benefits. In addition to these main competitors, the market includes a number of smaller regional and local companies. To compete with the larger competitors, these companies are starting to concentrate on innovation and product differentiation.Lactose Free Butter Market Scope: Inquiry Before Buying

Lactose Free Butter Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 313.81 Mn. Forecast Period 2024 to 2030 CAGR: 8.47% Market Size in 2030: US $ 554.42 Mn. Segments Covered: by Application Commercial Household by Distribution Channel Retail Stores Supermarket Speciality Stores Online Retail Stores Lactose Free Butter Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Lactose Free Butter Market, Key Players

1. Lactalis (France) 2. Arla Foods (Denmark) 3. Earth Balance (USA) 4. Kerry Group (Ireland) 5. Britannia Industries (India) 6. Danone (France) 7. Good Day (India) 8. Tillamook County Creamery Association (USA) 9. Organic Valley (USA) 10. Trader Joe's (USA) 11. Miyoko's Creamery (USA) 12. Amul (India) 13. Nestle (India) 14. Yili Group (China) 15. Alpura (Mexico) 16. Lactantia (Canada) 17. Meiji Holdings Co., Ltd. (Japan)Frequently Asked Questions:

1] What segments are covered in the Global Lactose Free Butter Market report? Ans. The segments covered in the Market report are based on Application, Distribution Channel and Region. 2] Which region dominated the Global Lactose Free Butter Market in 2023? Ans. The North America region dominated the global Lactose Free Butter Market in 2023. 3] What is the market size of the Global Lactose Free Butter Market by 2030? Ans. The market size of the Lactose Free Butter Market by 2030 is expected to reach 554.42 million. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2024-2030. 5] What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at USD 313.81 Million.

1. Lactose Free Butter Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Lactose Free Butter Market: Dynamics 2.1. Lactose Free Butter Market Trends by Region 2.1.1. Global Lactose Free Butter Market Trends 2.1.2. North America Lactose Free Butter Market Trends 2.1.3. Europe Lactose Free Butter Market Trends 2.1.4. Asia Pacific Lactose Free Butter Market Trends 2.1.5. Middle East and Africa Lactose Free Butter Market Trends 2.1.6. South America Lactose Free Butter Market Trends 2.1.7. Preference Analysis 2.2. Lactose Free Butter Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Lactose Free Butter Market Drivers 2.2.1.2. North America Lactose Free Butter Market Restraints 2.2.1.3. North America Lactose Free Butter Market Opportunities 2.2.1.4. North America Lactose Free Butter Market Challenges 2.2.2. Europe 2.2.2.1. Europe Lactose Free Butter Market Drivers 2.2.2.2. Europe Lactose Free Butter Market Restraints 2.2.2.3. Europe Lactose Free Butter Market Opportunities 2.2.2.4. Europe Lactose Free Butter Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Lactose Free Butter Market Drivers 2.2.3.2. Asia Pacific Lactose Free Butter Market Restraints 2.2.3.3. Asia Pacific Lactose Free Butter Market Opportunities 2.2.3.4. Asia Pacific Lactose Free Butter Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Lactose Free Butter Market Drivers 2.2.4.2. Middle East and Africa Lactose Free Butter Market Restraints 2.2.4.3. Middle East and Africa Lactose Free Butter Market Opportunities 2.2.4.4. Middle East and Africa Lactose Free Butter Market Challenges 2.2.5. South America 2.2.5.1. South America Lactose Free Butter Market Drivers 2.2.5.2. South America Lactose Free Butter Market Restraints 2.2.5.3. South America Lactose Free Butter Market Opportunities 2.2.5.4. South America Lactose Free Butter Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 2.9. Analysis of Government Schemes and Initiatives For Lactose Free Butter Industry 2.10. The Global Pandemic Impact on Lactose Free Butter Market 2.11. Lactose Free Butter Price Trend Analysis (2023-24) 2.12. Global Lactose Free Butter Market Trade Analysis (2018-2023) 2.12.1. Global Import of Coffee 2.12.1.1. Ten Largest Importer 2.12.2. Global Export of Coffee 2.12.3. Ten Largest Exporter 2.13. Production Capacity Analysis 2.13.1. Chapter Overview 2.13.2. Key Assumptions and Methodology 2.13.3. Lactose Free Butter Manufacturers: Global Installed Capacity 3. Lactose Free Butter Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 3.1.1. Retail Stores 3.1.2. Supermarket 3.1.3. Speciality Stores 3.1.4. Online Retail Stores 3.2. Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 3.2.1. Commercial 3.2.2. Household 3.3. Lactose Free Butter Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Lactose Free Butter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. North America Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 4.1.1. Retail Stores 4.1.2. Supermarket 4.1.3. Speciality Stores 4.1.4. Online Retail Stores 4.2. North America Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 4.2.1. Commercial 4.2.2. Household 4.3. North America Lactose Free Butter Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1.1.1. Retail Stores 4.3.1.1.2. Supermarket 4.3.1.1.3. Speciality Stores 4.3.1.1.4. Online Retail Stores 4.3.1.2. United States Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Commercial 4.3.1.2.2. Household 4.3.2. Canada 4.3.2.1. Canada Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.2.1.1. Retail Stores 4.3.2.1.2. Supermarket 4.3.2.1.3. Speciality Stores 4.3.2.1.4. Online Retail Stores 4.3.2.2. Canada Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Commercial 4.3.2.2.2. Household 4.3.3. Mexico 4.3.3.1. Mexico Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.3.1.1. Retail Stores 4.3.3.1.2. Supermarket 4.3.3.1.3. Speciality Stores 4.3.3.1.4. Online Retail Stores 4.3.3.2. Mexico Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Commercial 4.3.3.2.2. Household 5. Europe Lactose Free Butter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.2. Europe Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 5.3. Europe Lactose Free Butter Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.2. France 5.3.2.1. France Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Lactose Free Butter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3. Asia Pacific Lactose Free Butter Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.4. India 6.3.4.1. India Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.8.3. Vietnam Lactose Free Butter Market Size and Forecast, by Industry Vertical(2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Lactose Free Butter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 7.3. Middle East and Africa Lactose Free Butter Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Lactose Free Butter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. South America Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 8.2. South America Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 8.3. South America Lactose Free Butter Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Lactose Free Butter Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Lactose Free Butter Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Lactose Free Butter Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Distribution Channel Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Lactose Free Butter Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Lactalis (France) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Arla Foods (Denmark) 10.3. Earth Balance (USA) 10.4. Kerry Group (Ireland) 10.5. Britannia Industries (India) 10.6. Danone (France) 10.7. Good Day (India) 10.8. Tillamook County Creamery Association (USA) 10.9. Organic Valley (USA) 10.10. Trader Joe's (USA) 10.11. Miyoko's Creamery (USA) 10.12. Amul (India) 10.13. Nestle (India) 10.14. Yili Group (China) 10.15. Alpura (Mexico) 10.16. Lactantia (Canada) 10.17. Meiji Holdings Co., Ltd. (Japan) 11. Key Findings 12. Industry Recommendations 13. Lactose Free Butter Market: Research Methodology 14. Terms and Glossary