Global Jewelry Market size was valued at USD 260.46 Bn in 2023 and is expected to reach USD 373.39 Bn by 2030, at a CAGR of 5.28 % over the forecast period.Jewelry Market Overview

The jewelry market is heavily influenced by fashion trends and the changing tastes of consumers. Jewelry designers and brands often adapt their collections to reflect the latest fashion trends. Whether it's minimalist, vintage, or statement jewelry, designers continually introduce new styles to cater to evolving consumer preferences. Customization and personalization have gained prominence in the jewelry market. Many consumers prefer jewelry that is unique and reflects their individuality. Jewelry brands and designers offer customization options, allowing customers to choose the metal, gemstones, and design elements to create personalized pieces.To know about the Research Methodology:-Request Free Sample Report

Jewelry Market Dynamics

Increasing Fashion Trends to boost the Jewelry Market Jewelry is a reflection of personal style, and it is closely tied to fashion trends. The jewelry market is highly influenced by the changing tastes of consumers and the fashion industry. Jewelry designers and brands adapt their collections to align with current fashion trends. Whether it's minimalist, vintage-inspired, or bold statement jewelry, designers continually introduce new styles to cater to evolving consumer preferences. Celebrity endorsements and red-carpet appearances often influence consumer trends in the jewelry market. Iconic jewelry moments at major events can lead to increased demand for specific styles and designs. Celebrity collaborations with jewelry brands also contribute to the market's dynamism. Innovations in design and manufacturing technologies have expanded the possibilities in jewelry creation. Special occasions, including weddings, engagements, anniversaries, and birthdays, are often celebrated extravagantly during periods of economic prosperity. Gifting jewelry is a common tradition for marking these milestones. Engagement rings, wedding bands, and anniversary gifts become popular choices during such times. Luxury jewelry brands and high-end jewelry retailers benefit from economic prosperity as consumers are more inclined to shop in these exclusive stores. These brands cater to individuals seeking exclusive and extravagant pieces, and they see increased sales during prosperous periods. Economic prosperity also influences the e-commerce aspect of the jewelry market. With more people having access to the internet and higher disposable incomes, online jewelry shopping becomes increasingly popular. Consumers may explore a wider range of options and price points when shopping for jewelry online. Jewelers and jewelry designers often introduce innovative and unique designs during economically prosperous times. They take advantage of higher consumer spending by creating intricate, custom, and one-of-a-kind jewelry pieces to attract buyers seeking exclusive and personalized items. Bridal jewelry is a vital segment of the jewelry market, encompassing engagement rings, wedding bands, and other wedding-related adornments. Weddings are universal celebrations, and couples often invest in high-quality, sentimental pieces to symbolize their love. This enduring tradition ensures a steady demand for bridal jewelry. Advancements in jewelry manufacturing techniques have opened up new design possibilities. Computer-aided design (CAD) software and 3D printing have revolutionized the industry, allowing for intricate and customized jewelry pieces. Improved manufacturing processes enable faster production, reducing lead times, which significantly boosts the Jewelry Market. Changing Consumer Preferences to restrain the Jewelry Market growth The preferences of jewelry consumers are continually evolving. While traditional and classic designs remain timeless, consumer tastes have shifted toward more minimalistic, contemporary, and personalized pieces. The jewelry market must adapt to these changing preferences and invest in new designs and materials to remain relevant consumers now prioritize conflict-free diamonds, fair trade practices, and eco-friendly production processes. Meeting these demands can be challenging for the jewelry industry, as it often requires changes in supply chains and adherence to strict ethical standards. The jewelry market is plagued by counterfeit products and fraudulent practices. This includes imitation gemstones, misrepresentation of metal quality, and fake designer pieces. The production of fine jewelry often relies on skilled craftsmen who create intricate and high-quality pieces. Labor costs and the availability of skilled artisans impact the jewelry market growth. Maintaining a skilled workforce and balancing labor costs with product pricing can be a restraint for businesses, particularly those producing handcrafted jewelry. Jewelry supply chains can be susceptible to disruptions caused by global events, such as natural disasters, political instability, or pandemics. The COVID-19 pandemic, for example, severely impacted jewelry production and retail operations. Such events can lead to supply chain interruptions and inventory challenges. Jewelry Market Trends: Sustainability and Ethical Sourcing: Increasing environmental and ethical awareness has led to a surge in demand for sustainable and ethically sourced jewelry. Consumers are seeking pieces made from recycled metals, lab-grown gemstones, and materials that adhere to fair trade and environmentally friendly practices. Brands are responding by incorporating eco-friendly materials and transparent supply chain practices into their offerings. Cultural and Symbolic Jewelry: Jewelry with cultural and symbolic significance is in demand. Pieces that incorporate religious symbols, meaningful charms, or talismans are sought after as wearers seek to express their beliefs, values, and personal connections. Technology Integration: Technology is being integrated into jewelry in innovative ways. Smart jewelry, such as rings that track fitness data or necklaces with hidden USB drives, is emerging. Wearable technology is becoming more fashionable and functional. Digital Shopping and Augmented Reality: The jewelry industry is embracing digital shopping experiences. Brands are using augmented reality (AR) and virtual reality (VR) technologies to offer consumers immersive and interactive online shopping experiences. AR apps allow customers to virtually try on jewelry before making a purchase.Jewelry Market Segment Analysis

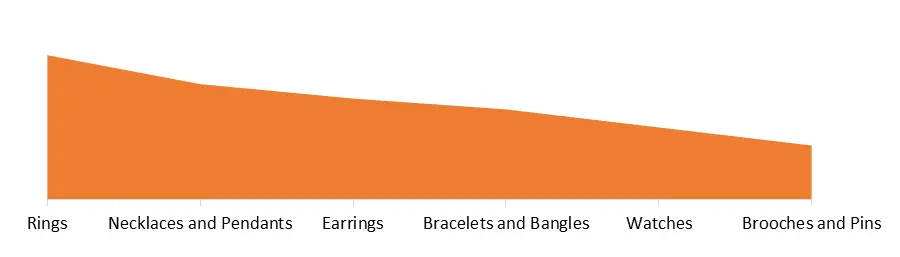

Based on product type, the market is segmented into Rings, Necklaces and Pendants, Earrings, Bracelets and Bangles, Watches, and Brooches and Pins. Rings segment dominated the market in 2022 and is expected to continue the dominance with the largest jewelry market share over the forecast period. Engagement rings and wedding bands, in particular, contribute significantly to the popularity and sales of rings. Engagement rings are often considered symbolic and essential for proposals and weddings, making them a staple in the jewelry industry. Wedding bands for both brides and grooms also contribute to the demand for rings. Besides bridal jewelry, fashion and statement rings are popular choices for everyday wear and special occasions, adding versatility to this segment, which is expected to boost the jewelry market growth. While rings have historically held a dominant position, other segments like Necklaces and Pendants, Earrings, and Bracelets and Bangles also have a substantial market share and consumer following. Each of these segments caters to different preferences and styles, offering a variety of designs and materials for consumers to choose from.Jewelry Market share, by Product Type 2023

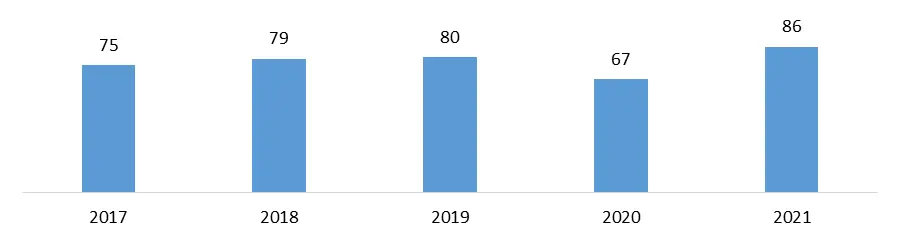

Based on Material, the market is segmented into Gold, Diamond, Platinum, Stainless steel, and Other. Gold and Diamond segment held the largest Jewelry market share in 2022 and is expected to dominate the market over the forecast period. Gold jewelry is chosen for special occasions and life events, such as weddings, engagements, and anniversaries. It carries emotional and cultural significance in many societies. Apart from its ornamental value, gold is also considered an investment, which is expected to boost the Jewelry market growth. People buy gold jewelry as a store of value, especially in regions where gold is a form of savings and can be easily liquidated when needed. Diamond jewelry are renowned for their exceptional brilliance, sparkle, and timeless beauty. They are often associated with love, commitment, and eternal relationships. The tradition of giving a diamond engagement ring to symbolize a proposal is a significant driver of the diamond market. The phrase "A diamond is forever" reflects the enduring nature of the gemstone. Diamonds are one of the hardest natural materials on Earth. Their rarity, combined with their exceptional durability, makes them highly prized. They can last for generations without losing their brilliance.Diamond Jewelry Market Value worldwide(2017-2021) in USD Bn

Jewelry Market Regional Insight

The Asia Pacific jewelry market is a dynamic and thriving industry influenced by various drivers that contribute to its growth and evolution. These drivers shape the market and dictate the trends in jewelry manufacturing, online shopping, branding, and the demand for custom jewelry. The Asia Pacific region is renowned for its rich tradition of jewelry craftsmanship. Countries like India, China, Thailand, and Indonesia have a centuries-old tradition of creating intricate and culturally significant jewelry pieces. This tradition is a significant driver of the jewelry market, as consumers appreciate the heritage and craftsmanship behind each piece. Manufacturers in the Asia Pacific continuously innovate in jewelry design, blending traditional and contemporary elements. They create pieces that cater to both local and international tastes. This innovation helps the industry stay competitive and meet evolving consumer preferences. Countries are rich in resources such as gold, diamonds, and colored gemstones. This easy access to raw materials plays a pivotal role in driving the jewelry manufacturing sector, allowing for a diverse range of designs and styles. The availability of secure and efficient digital payment solutions has made online jewelry shopping more accessible and trustworthy. Consumers can make purchases with confidence, even for high-value items. The presence of global luxury jewelry brands in the Asia Pacific region has created a strong aspirational market. These brands often establish a reputation for quality, exclusivity, and craftsmanship, attracting consumers who seek status symbols. Online jewelry retailers provide easy-to-use customization tools that allow customers to select metals, gemstones, and design elements. These tools make the customization process more accessible and engaging.Jewelry Market Competitive Landscape

The competitive landscape of the jewelry market is a vibrant and diverse arena characterized by a multitude of players, each vying for a share of the Jewelry industry. High-end luxury jewelry houses create exquisite and exclusive pieces that cater to affluent consumers. These brands are known for their use of rare and precious materials, intricate designs, and iconic jewelry collections. Fast fashion brands and costume jewelry retailers offer trendy and affordable jewelry options. They quickly adapt to fashion trends and provide consumers with fashionable pieces at accessible price points. In some regions, local artisanal markets play a significant role in the jewelry trade. Artisans and craftsmen showcase their creations, allowing consumers to buy directly from the creators. Some Jewelry manufacturers in the jewelry market focus on technological innovations and the use of unconventional materials, pushing the boundaries of traditional jewelry design. Startups and disruptors are challenging traditional business models and offering new approaches to jewelry retail. They may focus on direct-to-consumer sales, unique business models, or innovative designs. Certain jewelry brands incorporate social causes into their business models. They donate a portion of their proceeds to charitable organizations or support specific social initiatives, appealing to socially conscious consumers.Jewelry Market Scope: Inquire before buying

Global Jewelry Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 260.46 Bn. Forecast Period 2024 to 2030 CAGR: 5.28% Market Size in 2030: US $ 373.39 Bn. Segments Covered: by Product Type Rings Necklaces and Pendants Earrings Bracelets and Bangles Watches Brooches and Pins by Material Gold Diamond Platinum Stainless steel Other by End-user Men Women Children Jewelry Market by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Jewelry Key players include:

1. Tiffany & Co. 2. Pandora 3. Chow Tai Fook 4. Louis Vuitton SE 5. Richemont 6. GRAFF 7. Signet Jewelers Limited 8. H. Stern 9. Malabar Gold & Diamonds 10. Buccellati 11. Cartier 12. LVMH Group 13. SHR Jewelry Group 14. Swarovski 15. Tata Sons Private Ltd 16. The Swatch Group AG 17. Rajesh Exports Ltd. 18. Chopard 19. Hary Winston, Inc. Frequently Asked Questions: 1. What factors drive the demand for jewelry in the market? Ans: The demand for jewelry is primarily driven by consumer preferences and fashion trends. Celebrities, endorsements, and red-carpet appearances also influence consumer choices. 2. How does the rich tradition of jewelry craftsmanship in countries like India and China impact the Asia Pacific jewelry market? Ans: The rich tradition of jewelry craftsmanship in Asia Pacific countries contributes to the market by offering heritage-inspired and culturally significant jewelry. This craftsmanship helps the industry stay competitive and meet consumer preferences. 3. What is the role of online shopping in the jewelry market? Ans: The availability of secure online payment solutions has made online jewelry shopping more accessible. Consumers can explore a wide range of options and make confident purchases. 4. How do supply chain disruptions affect the jewelry market? Ans: Global events like natural disasters or pandemics can disrupt the jewelry supply chain, leading to interruptions in production and inventory challenges. 5. Why is customization gaining prominence in the jewelry market? Ans: Many consumers seek personalized and unique jewelry pieces that reflect their individuality. Brands offer customization options to allow customers to create personalized jewelry.

1. Jewelry Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Jewelry Market: Dynamics 2.1. Jewelry Market Trends by Region 2.1.1. Global Jewelry Market Trends 2.1.2. North America Jewelry Market Trends 2.1.3. Europe Jewelry Market Trends 2.1.4. Asia Pacific Jewelry Market Trends 2.1.5. Middle East and Africa Jewelry Market Trends 2.1.6. South America Jewelry Market Trends 2.2. Jewelry Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Jewelry Market Drivers 2.2.1.2. North America Jewelry Market Restraints 2.2.1.3. North America Jewelry Market Opportunities 2.2.1.4. North America Jewelry Market Challenges 2.2.2. Europe 2.2.2.1. Europe Jewelry Market Drivers 2.2.2.2. Europe Jewelry Market Restraints 2.2.2.3. Europe Jewelry Market Opportunities 2.2.2.4. Europe Jewelry Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Jewelry Market Drivers 2.2.3.2. Asia Pacific Jewelry Market Restraints 2.2.3.3. Asia Pacific Jewelry Market Opportunities 2.2.3.4. Asia Pacific Jewelry Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Jewelry Market Drivers 2.2.4.2. Middle East and Africa Jewelry Market Restraints 2.2.4.3. Middle East and Africa Jewelry Market Opportunities 2.2.4.4. Middle East and Africa Jewelry Market Challenges 2.2.5. South America 2.2.5.1. South America Jewelry Market Drivers 2.2.5.2. South America Jewelry Market Restraints 2.2.5.3. South America Jewelry Market Opportunities 2.2.5.4. South America Jewelry Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Analysis of Government Schemes and Initiatives For Jewelry Industry 2.9. The Global Pandemic Impact on Jewelry Market 2.10. Jewelry Price Trend Analysis (2021-22) 2.11. Global Jewelry Market Trade Analysis (2018-2023) 2.11.1. Global Import of Jewelry 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of Jewelry 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Jewelry Manufacturers: Global Installed Capacity 2.12.3.1. Analysis by Size of Manufacturer 2.12.3.2. Analysis by Scale of Operation 2.12.4. Analysis by Location of Manufacturing Facility 2.13. Demand and Supply Analysis 3. Jewelry Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Jewelry Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Rings 3.1.2. Necklaces and Pendants 3.1.3. Earrings 3.1.4. Bracelets and Bangles 3.1.5. Watches 3.1.6. Brooches and Pins 3.2. Jewelry Market Size and Forecast, by Material (2023-2030) 3.2.1. Gold 3.2.2. Diamond 3.2.3. Platinum 3.2.4. Stainless steel 3.2.5. Other 3.3. Jewelry Market Size and Forecast, by End-User (2023-2030) 3.3.1. Men 3.3.2. Women 3.3.3. Children 3.4. Jewelry Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Jewelry Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. North America Jewelry Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Rings 4.1.2. Necklaces and Pendants 4.1.3. Earrings 4.1.4. Bracelets and Bangles 4.1.5. Watches 4.1.6. Brooches and Pins 4.2. North America Jewelry Market Size and Forecast, by Material (2023-2030) 4.2.1. Gold 4.2.2. Diamond 4.2.3. Platinum 4.2.4. Stainless steel 4.2.5. Other 4.3. North America Jewelry Market Size and Forecast, by End-User (2023-2030) 4.3.1. Men 4.3.2. Women 4.3.3. Children 4.4. Jewelry Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Jewelry Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Rings 4.4.1.1.2. Necklaces and Pendants 4.4.1.1.3. Earrings 4.4.1.1.4. Bracelets and Bangles 4.4.1.1.5. Watches 4.4.1.1.6. Brooches and Pins 4.4.1.2. United States Jewelry Market Size and Forecast, by Material (2023-2030) 4.4.1.2.1. Gold 4.4.1.2.2. Diamond 4.4.1.2.3. Platinum 4.4.1.2.4. Stainless steel 4.4.1.2.5. Other 4.4.1.3. United States Jewelry Market Size and Forecast, by End-User (2023-2030) 4.4.1.3.1. Men 4.4.1.3.2. Women 4.4.1.3.3. Children 4.4.2. Canada 4.4.2.1. Canada Jewelry Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Rings 4.4.2.1.2. Necklaces and Pendants 4.4.2.1.3. Earrings 4.4.2.1.4. Bracelets and Bangles 4.4.2.1.5. Watches 4.4.2.1.6. Brooches and Pins 4.4.2.2. Canada Jewelry Market Size and Forecast, by Material (2023-2030) 4.4.2.2.1. Gold 4.4.2.2.2. Diamond 4.4.2.2.3. Platinum 4.4.2.2.4. Stainless steel 4.4.2.2.5. Other 4.4.2.3. Canada Jewelry Market Size and Forecast, by End-User (2023-2030) 4.4.2.3.1. Men 4.4.2.3.2. Women 4.4.2.3.3. Children 4.4.3. Mexico 4.4.3.1. Mexico Jewelry Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Rings 4.4.3.1.2. Necklaces and Pendants 4.4.3.1.3. Earrings 4.4.3.1.4. Bracelets and Bangles 4.4.3.1.5. Watches 4.4.3.1.6. Brooches and Pins 4.4.3.2. Mexico Jewelry Market Size and Forecast, by Material (2023-2030) 4.4.3.2.1. Gold 4.4.3.2.2. Diamond 4.4.3.2.3. Platinum 4.4.3.2.4. Stainless steel 4.4.3.2.5. Other 4.4.3.3. Mexico Jewelry Market Size and Forecast, by End-User (2023-2030) 4.4.3.3.1. Men 4.4.3.3.2. Women 4.4.3.3.3. Children 5. Europe Jewelry Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Jewelry Market Size and Forecast, by Material (2023-2030) 5.3. Europe Jewelry Market Size and Forecast, by End-User (2023-2030) 5.4. Europe Jewelry Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Jewelry Market Size and Forecast, by Material (2023-2030) 5.4.2. France 5.4.2.1. France Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Jewelry Market Size and Forecast, by Material (2023-2030) 5.4.2.3. France Jewelry Market Size and Forecast, by End-User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Jewelry Market Size and Forecast, by Material (2023-2030) 5.4.3.3. Germany Jewelry Market Size and Forecast, by End-User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Jewelry Market Size and Forecast, by Material (2023-2030) 5.4.4.3. Italy Jewelry Market Size and Forecast, by End-User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Jewelry Market Size and Forecast, by Material (2023-2030) 5.4.5.3. Spain Jewelry Market Size and Forecast, by End-User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Jewelry Market Size and Forecast, by Material (2023-2030) 5.4.6.3. Sweden Jewelry Market Size and Forecast, by End-User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Jewelry Market Size and Forecast, by Material (2023-2030) 5.4.7.3. Austria Jewelry Market Size and Forecast, by End-User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Jewelry Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Jewelry Market Size and Forecast, by Material (2023-2030) 5.4.8.3. Rest of Europe Jewelry Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Jewelry Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Jewelry Market Size and Forecast, by Material (2023-2030) 6.3. Asia Pacific Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4. Asia Pacific Jewelry Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.1.3. China Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.2.3. S Korea Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.3.3. Japan Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.4. India 6.4.4.1. India Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.4.3. India Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.5.3. Australia Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.6.3. Indonesia Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.7.3. Malaysia Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.8.3. Vietnam Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.9.3. Taiwan Jewelry Market Size and Forecast, by End-User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Jewelry Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Jewelry Market Size and Forecast, by Material (2023-2030) 6.4.10.3. Rest of Asia Pacific Jewelry Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Jewelry Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Jewelry Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Jewelry Market Size and Forecast, by Material (2023-2030) 7.3. Middle East and Africa Jewelry Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Jewelry Market Size and Forecast, by Product Type (2023-2030) 7.3.1.2. South Africa Jewelry Market Size and Forecast, by Material (2023-2030) 7.3.1.3. South Africa Jewelry Market Size and Forecast, by End-User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Jewelry Market Size and Forecast, by Product Type (2023-2030) 7.3.2.2. GCC Jewelry Market Size and Forecast, by Material (2023-2030) 7.3.2.3. GCC Jewelry Market Size and Forecast, by End-User (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Jewelry Market Size and Forecast, by Product Type (2023-2030) 7.3.3.2. Nigeria Jewelry Market Size and Forecast, by Material (2023-2030) 7.3.3.3. Nigeria Jewelry Market Size and Forecast, by End-User (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Jewelry Market Size and Forecast, by Product Type (2023-2030) 7.3.4.2. Rest of ME&A Jewelry Market Size and Forecast, by Material (2023-2030) 7.3.4.3. Rest of ME&A Jewelry Market Size and Forecast, by End-User (2023-2030) 8. South America Jewelry Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. South America Jewelry Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Jewelry Market Size and Forecast, by Material (2023-2030) 8.3. South America Jewelry Market Size and Forecast, by End-User (2023-2030) 8.4. South America Jewelry Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Jewelry Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Jewelry Market Size and Forecast, by Material (2023-2030) 8.4.1.3. Brazil Jewelry Market Size and Forecast, by End-User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Jewelry Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Jewelry Market Size and Forecast, by Material (2023-2030) 8.4.2.3. Argentina Jewelry Market Size and Forecast, by End-User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Jewelry Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Jewelry Market Size and Forecast, by Material (2023-2030) 8.4.3.3. Rest Of South America Jewelry Market Size and Forecast, by End-User (2023-2030) 9. Global Jewelry Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Jewelry Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Tiffany & Co. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Pandora 10.3. Chow Tai Fook 10.4. Louis Vuitton SE 10.5. Richemont 10.6. GRAFF 10.7. Signet Jewelers Limited 10.8. H. Stern 10.9. Malabar Gold & Diamonds 10.10. Buccellati 10.11. Cartier 10.12. LVMH Group 10.13. SHR Jewelry Group 10.14. Swarovski 10.15. Tata Sons Private Ltd 10.16. The Swatch Group AG 10.17. Rajesh Exports Ltd. 10.18. Chopard 10.19. Hary Winston, Inc. 11. Key Findings 12. Industry Recommendations 13. Jewelry Market: Research Methodology 14. Terms and Glossary