The Japan Electric Vehicle Market size was valued at US 40.32 Bn in 2023 and market revenue is growing at a CAGR of 15.58 %from 2023 to 2030, reaching nearly USD 111.10 Bn by 2030.Japan Electric Vehicle Market Overview:

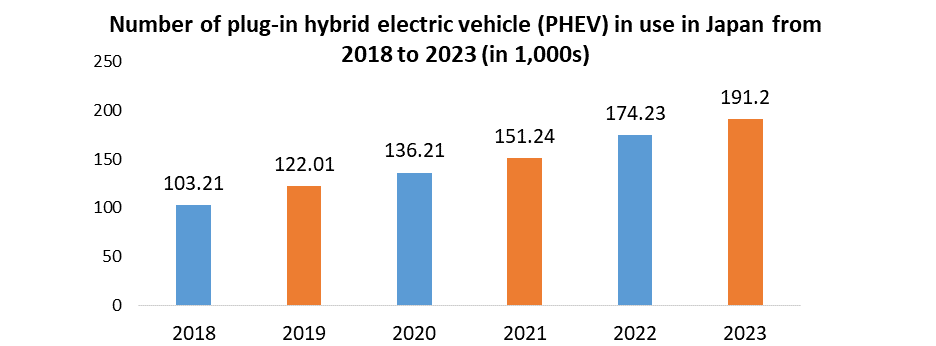

Japan, renowned as the world’s third-largest automotive manufacturer, heavily relies on its automotive sector, constituting over 89% of its GDP. Despite this dominance, Japan has been relatively slow in embracing zero-emission vehicles (ZEVs) compared to other Asian nations. As the global transition towards ZEVs gains momentum, Japan's stance on electric vehicles (EVs) holds critical implications for its economic stability. The evolving global Electric Vehicle Market landscape accentuates the significance of Japan's position. The country hesitant approach to ZEVs contrasts with its automotive prowess, underscoring the complexity of its role in the Japan Electric Vehicle Market. According to MMR Study Report In 2021, Japan saw strong sales in the automotive sector, with 3,675,650 new cars sold, out of which 40.5 percent were electric vehicles (EVs). While Hybrid Electric Vehicles (HEVs) still dominated the Japan Electric Vehicle Market with a 96.8 percent share, there was significant growth in other categories including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). BEVs experienced a significant surge with sales increasing by 48.5 percent to reach 21,693 units, largely driven by a tripling in imported BEV sales. PHEVs also witnessed a notable uptick, with sales rising by 54.5 percent to 22,777 units, supported by both domestic and imported models. FCEVs showed remarkable growth as well, with sales reaching 2,464 units, marking a threefold increase. The government's latest subsidies aimed at encouraging EV adoption is important in driving these sales figures. Subsidies of 650,000 Japanese Yen (US$5,200) for BEVs, 450,000 Japanese Yen (US$3,600) for PHEVs, and 2,300,000 Japanese Yen (US$18,500) for FCEVs were provided. Also, higher subsidy amounts were available for vehicles capable of utilizing power from in-vehicle outlets, power exporters, or Vehicle-to-Home (V2H) bidirectional chargers, reaching up to 850,000 Japanese Yen (US$6,800) for BEVs, 550,000 Japanese Yen (US$4,400) for PHEVs, and 2,550,000 Japanese Yen (US$20,500) for FCEVs.To know about the Research Methodology :- Request Free Sample Report

Japan Electric Vehicle Market Dynamics:

Government Policies and Incentives Drive the Japan Electric Vehicle Market Growth In Japan, government policies and incentives play a pivotal role in boosting the growth of the electric vehicle (EV) market. Through a combination of regulatory measures and financial incentives, the Japanese government aims to accelerate the adoption of EVs for environmental sustainability and energy security reasons. The establishment of stringent emissions standards and targets, incentivizes automakers to invest in electric and hybrid vehicle technologies to meet these requirements. The government offers subsidies and tax incentives to both consumers and businesses purchasing EVs, making them more financially attractive compared to traditional gasoline-powered vehicles. These incentives often include reduced vehicle taxes, registration fees, and purchase subsidies. The Japanese government promotes the development of EV infrastructure by subsidizing the installation of charging stations and offering grants to municipalities and businesses to support the expansion of charging networks. This infrastructure support alleviates range anxiety among consumers and facilitates the widespread adoption of EVs. The combination of regulatory mandates, financial incentives, and infrastructure development initiatives creates a conducive environment for the growth of the Japan Electric Vehicle Market, driving increased consumer adoption and paving the way for a more sustainable transportation sector. For Example, according to the MMR Study Report, The Japanese government has set ambitious targets to shift all new car sales towards environmentally friendly options, particularly electric vehicles (EVs), by 2035. This initiative encompasses Clean Energy Vehicles (CEVs), which include Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). To incentivize adoption, the government provides subsidies for CEVs, offering up to 800,000 Japanese Yen per vehicle in 2021, while Hybrid Electric Vehicles (HEVs) are excluded from this subsidy program. In parallel, Japan is actively promoting the development of EV charging infrastructure through comprehensive guidelines. These guidelines aim to double the current target number of EV chargers, install high-power output chargers, and ensure efficient charger installation, thereby facilitating convenient and sustainable charging options. The government has introduced tax incentives over a decade to stimulate production in key sectors, including electric vehicles and high-tech chips. These incentives offer financial benefits such as 400,000 yen for each battery EV and hydrogen fuel-cell car, and half that amount for plug-in hybrid vehicles. This comprehensive plan also extends incentives to semiconductor production, sustainable aviation fuels, green steel, and green chemicals. Japan is contemplating the establishment of shared standards with the U.S. and Europe for subsidies in critical sectors like electric vehicles and semiconductors. This initiative seeks to foster a fair competitive environment while driving innovation and sustainability in Japan Electric Vehicle Market Infrastructure challenges pose significant restraints for the Japan Electric Vehicle Market Infrastructure challenges pose significant restraints for the Japan Electric Vehicle Market. According To the MMR Study Report As of 2021, the country's charging infrastructure falls behind many others, with approximately 29,000 public charging stations nationwide, many of which are deteriorating. Particularly in rural areas, the scarcity of charging stations is pronounced. Also, Japan only boasts 160 hydrogen refueling stations for fuel cell vehicles. Although there are 7,600 quick chargers available, more than 40% are located in car dealerships, making them inconvenient for general public access. Compounding the issue, the number of charging stations is decreasing rather than increasing. Safety regulations for high-output chargers, exceeding 200 kilowatts, have led to heightened installation costs. The setup of such chargers demands tens of millions of yen, coupled with ongoing operational expenses. While the Japanese government subsidized 67% of charging pile constructions between 2013 and 2016, private sector involvement has been limited, resulting in a decline of 800 charging stations by February 2023 compared to March 2020. Despite the current limitations, Japan's charging infrastructure has yet to strain the national grid significantly. However, as global EV demand escalates, there is a looming need for grid upgrades to accommodate the burgeoning demand. Addressing these infrastructure challenges limits the growth of Japan Electric Vehicle Market.Market Growth Opportunity

Digital Transformation and IoT Connectivity create lucrative growth opportunities for the Japan Electric Vehicle Market Growth The automotive industry in Japan is undergoing a significant transformation, primarily driven by the interconnected domains of connected cars, autonomous driving, sharing, and electrification, collectively referred to as the CASE concept. This paradigm shift signifies not merely a technological advancement but a fundamental restructuring of the transportation sector, with profound implications for the global market. Central to this evolution is the burgeoning market for electric vehicles (EVs), which stands as a focal point for innovation and expansion. Japan, with its commitment to smart city strategies aimed at leveraging digital technologies to enhance urban living, finds itself uniquely positioned to capitalize on this burgeoning opportunity. This factor significantly boosts the Japan Electric Vehicle Market Growth. The convergence of Japan's smart city initiatives with the increasing adoption of EVs presents a compelling market prospect. Practices such as smart charging infrastructure, intelligent parking solutions, and integrated eco-friendly transportation options seamlessly integrate into Japan's existing urban frameworks, laying a solid foundation for widespread EV adoption. Nissan's Choimobi Yokohama car-sharing service serves as a notable example of Japan's strides in promoting low-emission transport and sustainable urban mobility. By specifically targeting ultra-compact EVs and fostering public-private collaboration, this initiative serves as a blueprint for expanding the reach of EVs while simultaneously addressing urban mobility challenges. The Japan electric vehicle market is not solely driven by technological advancements but also by a societal shift towards environmental sustainability and energy efficiency. With a robust ecosystem comprising automotive manufacturers, technology firms, and governmental support, Japan is poised to emerge as a global frontrunner in the electric vehicle market, offering substantial opportunities for investors, innovators, and consumers alike. As the automotive industry continues its trajectory towards a technology-driven future, Japan's steadfast commitment to innovation and sustainability places it at the forefront of the electric vehicle revolution, significantly shaping the mobility landscape for generations to come.

Japan Electric Vehicle Market Segment Analysis:

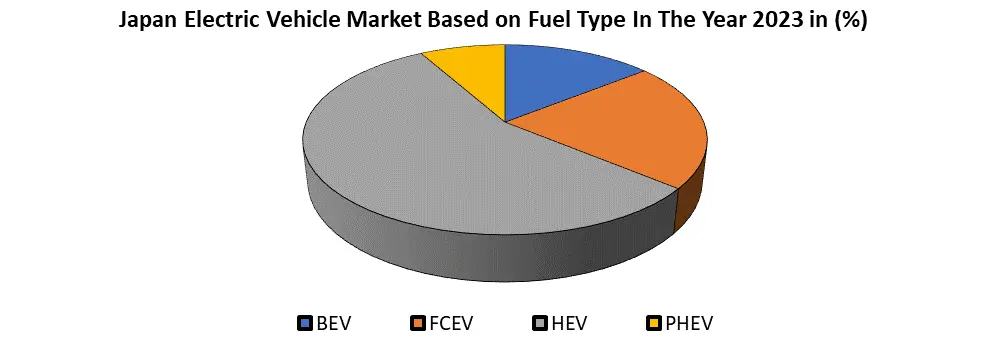

Based on Fuel Type, the HEV segment dominated the Fuel Type segment of the Japan Electric Vehicle Market in the year 2023.HEVs offer a familiar driving experience by combining an internal combustion engine with an electric motor, alleviating range anxiety common in fully electric vehicles (EVs). This hybrid approach provides consumers with a practical transition towards electrification while still retaining the convenience of refueling at traditional gas stations. HEVs are often perceived as more cost-effective than other EV alternatives due to their lower initial purchase price compared to plug-in hybrids (PHEVs) or battery electric vehicles (BEVs). They typically require less infrastructure investment since they don't rely solely on charging stations. The HEV segment benefits from continuous technological advancements, leading to improved fuel efficiency and reduced emissions, aligning with Japan's stringent environmental regulations and sustainability goals. These factors have contributed to the HEV segment's dominance in the Japan Electric Vehicle Market Fuel Type category, appealing to a broad range of consumers seeking efficient and eco-friendly transportation solutions.

Japan Electric Vehicle Market Regional Analysis:

The Tokyo dominated the Japan Electric Vehicle Market in the year 2023. Its high population density and urbanization create a strong demand for transportation alternatives such as EVs, which are seen as practical and eco-friendly in dense city environments. The government's proactive policies and incentives, including subsidies, tax breaks, and preferential parking, encourage consumers to switch to electric vehicles. Tokyo has invested heavily in EV charging infrastructure, alleviating concerns about range anxiety and making it convenient for EV owners to recharge their vehicles. Japan's leading automotive manufacturers based in Tokyo, such as Nissan and Toyota, have been at the forefront of EV research and development, introducing innovative models with advanced technology. Also, Tokyo's environmentally conscious population, combined with the country's cultural inclination towards embracing new technologies, further drives demand for EVs. These factors collectively position Tokyo as a leader in the Japanese EV market, with other major cities in Japan also making strides in promoting electric vehicles.Japan Electric Vehicle Market Scope: Inquiry Before Buying

Japan Electric Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 40.32 Bn. Forecast Period 2024 to 2030 CAGR: 15.58% Market Size in 2030: US $ 111.10 Bn. Segments Covered: by Vehicle Type Passenger Cars Hatchback Multi-purpose Vehicle Sedan Sports Utility Vehicle by Fuel Type BEV FCEV HEV PHEV Japan Electric Vehicle Market Key Players

1. Nissan Motor Co., Ltd. (Japan.) 2. Toyota Motor Corporation (Japan) 3. Honda Motor Co., Ltd. (Japan.) 4. Mitsubishi Motors Corporation (Japan.) 5. Subaru Corporation (Japan) 6. Mazda Motor Corporation (Japan) 7. Panasonic Corporation (Japan) 8. Suzuki Motor Corporation (Japan) 9. Yamaha Motor Co., Ltd. (Japan) 10. Mitsui & Co., Ltd. (Japan) 11. Denso Corporation (Japan) 12. GS Yuasa Corporation (Japan)Frequently Asked Questions

1] What segments are covered in the Japan Electric Vehicle Market report? Ans. The segments covered in the Japan Electric Vehicle Market report are based on, Vehicle Type, and Fuel Type. 2] What is the market size of the Japan Electric Vehicle Market by 2030? Ans. The market size of the Japan Electric Vehicle Market by 2030 is expected to reach US$ 111.10Bn. 3] What was the market size of the Japan Electric Vehicle Market in 2023? Ans. The market size of the Japan Electric Vehicle Market in 2023 was valued at US$ 40.32Bn. 4] Key players in the Japan Electric Vehicle Market. Ans. Nissan Motor Co., Ltd. (Japan.), Toyota Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan.), Mitsubishi Motors Corporation (Japan.), and Subaru Corporation (Japan)

1. Japan Electric Vehicle Market: Research Methodology 2. Japan Electric Vehicle Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Japan Electric Vehicle Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Product Segment 3.3.3. End-user Segment 3.3.4. Revenue (2023) 3.3.5. Company Locations 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Mergers and Acquisitions Details 4. Japan Electric Vehicle Market: Dynamics 4.1. Japan Electric Vehicle Market Trends 4.2. Japan Electric Vehicle Market Drivers 4.3. Japan Electric Vehicle Market Restraints 4.4. Japan Electric Vehicle Market Opportunities 4.5. Japan Electric Vehicle Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Technology Roadmap 4.9. Regulatory Landscape 4.10. Key Opinion Leader Analysis For Japan Electric Vehicle Market 4.11. Analysis of Government Schemes and Initiatives For the Japan Electric Vehicle Market 5. Japan Electric Vehicle Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 5.1. Japan Electric Vehicle Market Size and Forecast, By Vehicle Type (2023-2030) 5.1.1. Passenger Cars 5.1.2. Hatchback 5.1.3. Multi-purpose Vehicle 5.1.4. Sedan 5.1.5. Sports Utility Vehicle 5.2. Japan Electric Vehicle Market Size and Forecast, By Fuel Type (2023-2030) 5.2.1. BEV 5.2.2. FCEV 5.2.3. HEV 5.2.4. PHEV 6. Company Profile: Key Players 6.1. Nissan Motor Co., Ltd. (Japan.) 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Details on Partnership 6.1.7. Recent Developments 6.2. Nissan Motor Co., Ltd. (Japan.) 6.3. Toyota Motor Corporation (Japan) 6.4. Honda Motor Co., Ltd. (Japan.) 6.5. Mitsubishi Motors Corporation (Japan.) 6.6. Subaru Corporation (Japan) 6.7. Mazda Motor Corporation (Japan) 6.8. Panasonic Corporation (Japan) 6.9. Suzuki Motor Corporation (Japan) 6.10. Yamaha Motor Co., Ltd. (Japan) 6.11. Mitsui & Co., Ltd. (Japan) 6.12. Denso Corporation (Japan) 6.13. GS Yuasa Corporation (Japan) 7. Key Findings 8. Analyst Recommendations