Infusion Pump Software Market size was valued at USD 0.75 Bn. in 2022 and the total 3D Cell Culture revenue is expected to grow by 8 % from 2023 to 2029, reaching nearly USD 1.29 Bn.Infusion Pump Software Market Overview:

Infusion pumps are devices used to deliver fluids such as medicines and nutrients to patients in precise and controlled amounts. The software monitors the rate at which fluids are transported. The software also controls the user interface and the pumping mechanism to keep the rate stable, as well as other critical functions such as safety. These pumps are standalone devices. Thus the pump transports fluids via arterial, intravenous, and subcutaneous routes. Growing levels of environmental pollution worldwide, increased government regulations and initiatives for environmental protection, privatization of environmental testing services, and increased focus on wastewater are driving growth in the infusion pump software market. The current generation of infusion pumps is outfitted with software that controls the entire pumping mechanism, with the dual goals of safety and ease of use in mind. The infusion pump software is programmed to compare the calculated rate of infusion with the required and allowed dosing regimens, and to alert on dosing errors based on this comparison. Software controls a variety of safety parameters. The role of infusion pump software in delivering medication, fluids, and nutrients to the target population in a safe and effective manner. Software in intravenous infusion pumps includes drug libraries and dose error reduction systems (DERSs). Surprisingly, there have been instances where a software error has negatively impacted patient safety. Few adverse drug events and medication administration errors have occurred in recent years, owing to the complexity of the device user interface. Incomplete and incorrect programming, regarded as major errors, has thus become a major avenue for software developers in the medical device manufacturing market. This trend drives the drive for continuous product improvements in the infusion pump software market.To know about the Research Methodology :- Request Free Sample Report

Infusion Pump Software Market Dynamics:

Market Drivers Growing demand for advanced infusion pump software The growing demand for smart infusion pumps is a major driver of the infusion pump software market. The need to address IV medication safety has become more pressing than ever in recent years. The infusion pump software in health technology hazards prompted the urgency. On the other hand, the increasing number of skilled engineers engaged in rigorous software development has improved the reliability and safety of products in the infusion pump software market. Several prototypes are used to test the software under real-world conditions, resulting in increased R&D investments. The use of model-based approaches is a critical foundation for new avenues in the infusion pump software market. Industry participants in the infusion pump market are working hard to collect high-quality evidence on the safety implications of various infusion pumps. The efforts will clearly open up new revenue streams for technology companies catering to the demand for medical device software. Collaborations between academia and industry have opened up new avenues for software developers to improve model-based engineering methods and verification techniques. Increasing Prevalence of Chronic Diseases to Drive Market Growth Infusion pump software has significant advantages over manual fluid delivery, such as the ability to administer fluids in very small doses and at precise programmed rates. In many cases, such as cancer and diabetic conditions, these pumps are used to deliver medication in order to keep the drug level in the bloodstream stable. According to the World Health Organization (WHO), cancer was estimated to be the second leading cause of death globally in 2019, accounting for approximately 9.8 million deaths. Cancer patients require chemotherapy to be delivered to them in a continuous manner, which the pump can accomplish. Furthermore, the Centers for Disease Control and Prevention (CDC) estimates that the prevalence of diabetes will be around 463 million cases worldwide in 2020, with 34.2 million adults in the United States having diabetes, accounting for 10.5% of the total population. Insulin pumps are becoming more popular in the treatment of type 1 diabetes. To achieve continuous medication delivery, these patients require user-friendly self-controlled pumps. These factors are driving the infusion pump software market growth in all regions. Growing Demand for Ambulatory Pumps to Drive Market Growth The ambulatory pump is an important means of drug delivery in a variety of medical situations. They are critical in providing analgesics, chemotherapy, TPN infusions, and other infusions to patients in both hospitals and at home. The shift to site-of-care management of chronic diseases in developed countries to reduce the cost burdens associated with hospital-based management is likely to increase demand for portable pumps in the forecast years. These all aspects drive the growth of the infusion pump software market. Market Restraints Pump Manufacturing Regulations to Limit Market Growth Increasingly stringent regulations governing the manufacture and incorporation of pumps slow the approval process for new products. This factor is expected to slow infusion Pump software market growth. Moreover, growing product recalls due to manufacturing flaws are limiting market growth. Fresenius Kabi, for example, recalled the Vigilant Agilia drug library and the Volume MC Agilia infusion pump in August 2019 due to infusion alarm, low priority keep vein open (KVO), and multiple software errors.Infusion Pump Software Market Opportunity

Bolstering R&D Activities to Launch Home Infusion Systems Software The growing prevalence of chronic diseases, combined with the rising cost of hospital-based infusion therapies, has resulted in an increase in research and development activities to develop home-based infusion products. For example, the growing patient population in diabetes, cancer, and neurological disorders has resulted in an increase in demand for long-term care, preferably in home care settings. Furthermore, the growing geriatric population in need of long-term care therapies is driving new product development aimed at home-based infusion therapies. The infusion pump software market top players are concentrating on specialty medicine sites of care management. In August 2020, Ivenix, Inc. released Epic, a smart infusion pump that helps to eliminate infusion-related injuries in patients. The increasing rate of innovation in smart pumps in recent years has been a key driver of trends in the infusion pump software market. Top vendors are emphasizing the benefits of static analysis tools for model-based approaches, particularly in assisting coders in overcoming a plethora of insidious software errors. Regulators are also supporting various generic infusion pump projects, which is another source of research funding. A number of smart pump manufacturers are interested in funding hardware and software development efforts, as patient safety in infusion devices has become a critical imperative, particularly for chronic disease management.Infusion Pump Software Market Segment Analysis:

Based on Type, the Dose Error Reduction Software segment dominates the Infusion Pump Software Market, Despite the fact that patient safety is the most important principle in health care, medication-related errors do occur and have a significant impact. The World Health Organization designated medication error reduction by 55% within the forecast years as one of the major health challenges of their time in 2017. Baxter received CE marking for the EVO IQ Infusion System in August 2019. To promote patient safety, the Evo IQ Infusion System has a scalable platform and user-centric design that includes an advanced drug library and dose error reduction software.Based on the Application, In 2022, the general infusion segment dominated the infusion pump software market. Infusion pump software is widely used to test the quality of drinking water, screen pesticides, and detect contamination in soil samples. The infusion pump software market is divided into several segments, including general infusion, insulin infusion, pain and anesthesia management, chemotherapy, and others. The general infusion segment held the largest market share in 2022 and is expected to maintain this position throughout the forecast period. The large share of this segment can be attributed to the safety and efficacy provided by infusion systems for the appropriate delivery of medications to patients suffering from a variety of general health conditions.

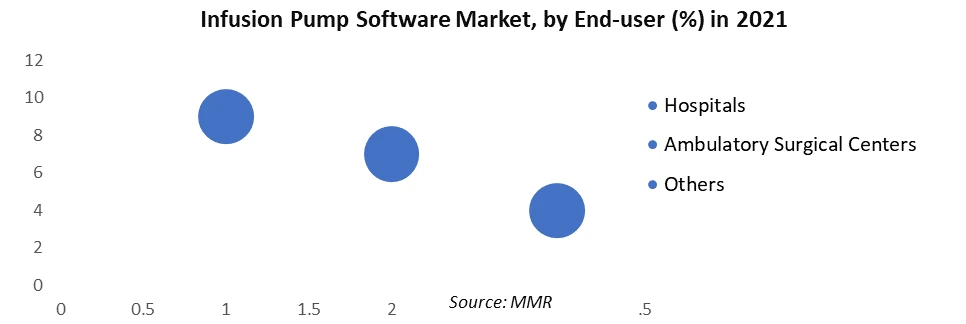

Based on the End-user, the hospital’s segment dominated the infusion pump software market with a revenue share of more than 48.0% in 2022, Because of the applicability, increasing number of healthcare facilities, and associated data that requires proper management as well as privacy. Moreover, government initiatives to support the healthcare sector and simplify the complexity of a large amount of data in hospitals are expected to drive the market. Additionally, growing demand for workflow and the ongoing trend toward connected hospitals are expected to drive the segment during the forecast period. The segment's growth is being fueled by a high demand for collaborative and integrated care delivery, unified critical clinical communications, and streamlining the call scheduling process. Because of the increase in outpatient admissions, ambulatory surgical centers are expected to see profitable growth during the forecast period. The implementation of IT solutions in ambulatory care centers aids in the reduction of medical errors and the improvement of communication between entities such as nursing staff, physicians, pharmacies, and residents' families. High adoption rates of such technologically advanced systems in outpatient centers speed up treatment and provide cost-effective outcomes. As the demand for home healthcare grows, providers are introducing newer technologies and software to improve the quality of services offered. During the forecast period, an increase in demand for value-based care models and improved collaboration between providers and payers are expected to drive the adoption of clinical workflow management systems in long-term care facilities.

Infusion Pump Software Market Regional Insights:

The Global Infusion Pump Software Market is dominated by North America in 2022 and is expected to do so in the forecast period. The current growth of the North American infusion pump software market can be attributed primarily to the home healthcare segment, as well as patients and physicians, who are consistently adopting new technologically advanced products for the regular treatment of chronic disease conditions. The infusion pump software market in the region has been experiencing significant growth, driven by increased patient awareness, the growing prevalence of chronic diseases, the increasing number of surgeries performed in the region, and the need to control escalating healthcare costs. Each year, approximately 27 million surgical procedures are performed in the United States, according to the Journal of Infectious Disease Adviser. Flowonix Medical, Inc. received US Food and Drug Administration (FDA) market approval for their Maestro Infusion Pump Software Upgrade for Clinician Programmers in February 2019.Infusion Pump Software Market Scope: Inquire before buying

Infusion Pump Software Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 0.75 Bn. Forecast Period 2023 to 2029 CAGR: 8% Market Size in 2029: US $ 1.29 Bn. Segments Covered: by Type 1. Dose Error Reduction Software (DERS) 2. Clinical Workflow Software 3. Others by Application 1. General Infusion 2. Insulin Infusion 3. Pain & Anesthesia Management 4. Chemotherapy 5. Others by End-user 1. Hospitals 2. Ambulatory Surgical Centers 3. Others Infusion Pump Software Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Infusion Pump Software Market, Key Players are

1. Agilent Technologies 2. Roche Diagnostics 3. Baxter International 4. B. Braun Medical Inc. 5. Becton, Dickinson and Company 6. Fresenius Kabi 7. FLOWONIX MEDICAL INC 8. ICU Medical Inc. 9. Medtronic 10. Merck KGaA 11. Q Core Medical Ltd 12. Smiths Medical 13. Terumo Medical 14. Moog 15. F. Hoffmann-La Roche 16. Ypsomed 17. Micrel Medical Devices Frequently Asked Questions: 1] What is an infusion pump system? Ans. An infusion pump is a medical device that delivers fluids into a patient's body in controlled amounts, such as nutrients and medications. Infusion pumps are commonly used in clinical settings such as hospitals, nursing homes, and homes. 2] What are the application of infusion pumps? Ans. Infusion pumps can deliver large or small amounts of fluids and can be used to deliver nutrients or medications like insulin or other hormones, antibiotics, chemotherapy drugs, and pain relievers. Some infusion pumps are primarily intended for stationary use at the patient's bedside. 3] How to use infusion software? Ans. In the hospital, IV therapy is commonly used when a patient is unable to take medications or when an intravenous route is more effective. Examples include the treatment of severe infections, cancer, dehydration, gastrointestinal diseases, and autoimmune diseases. 4] How is the infusion pump rate calculated? Ans. By using the following formulas: total volume (mL) infusion time flow rate (mL/hr) (hr) total volume (mL) flow rate (mL/hr) infusion time (hr). 5] What is another word for infusion? Ans. Imbue, ingrain, inoculate, leaven, and suffuse are some synonyms for infuse. While all of these words mean "to introduce one thing into another so that it affects it throughout," infuse implies a pouring in of something that gives new life or significance to the other. 6] What is infusion technology? Ans. Infusion Technology manages the communication of Industrial and Municipal sales leads that travel across a large web or network. This web has been built over a 30-year period.

1. Infusion Pump Software Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Infusion Pump Software Market: Dynamics 2.1. Infusion Pump Software Market Trends by Region 2.1.1. North America Infusion Pump Software Market Trends 2.1.2. Europe Infusion Pump Software Market Trends 2.1.3. Asia Pacific Infusion Pump Software Market Trends 2.1.4. Middle East and Africa Infusion Pump Software Market Trends 2.1.5. South America Infusion Pump Software Market Trends 2.2. Infusion Pump Software Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Infusion Pump Software Market Drivers 2.2.1.2. North America Infusion Pump Software Market Restraints 2.2.1.3. North America Infusion Pump Software Market Opportunities 2.2.1.4. North America Infusion Pump Software Market Challenges 2.2.2. Europe 2.2.2.1. Europe Infusion Pump Software Market Drivers 2.2.2.2. Europe Infusion Pump Software Market Restraints 2.2.2.3. Europe Infusion Pump Software Market Opportunities 2.2.2.4. Europe Infusion Pump Software Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Infusion Pump Software Market Drivers 2.2.3.2. Asia Pacific Infusion Pump Software Market Restraints 2.2.3.3. Asia Pacific Infusion Pump Software Market Opportunities 2.2.3.4. Asia Pacific Infusion Pump Software Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Infusion Pump Software Market Drivers 2.2.4.2. Middle East and Africa Infusion Pump Software Market Restraints 2.2.4.3. Middle East and Africa Infusion Pump Software Market Opportunities 2.2.4.4. Middle East and Africa Infusion Pump Software Market Challenges 2.2.5. South America 2.2.5.1. South America Infusion Pump Software Market Drivers 2.2.5.2. South America Infusion Pump Software Market Restraints 2.2.5.3. South America Infusion Pump Software Market Opportunities 2.2.5.4. South America Infusion Pump Software Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Infusion Pump Software Industry 2.8. Analysis of Government Schemes and Initiatives For Infusion Pump Software Industry 2.9. Infusion Pump Software Market Trade Analysis 2.10. The Global Pandemic Impact on Infusion Pump Software Market 3. Infusion Pump Software Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 3.1.1. Dose Error Reduction Software (DERS) 3.1.2. Clinical Workflow Software 3.1.3. Others 3.2. Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 3.2.1. General Infusion 3.2.2. Insulin Infusion 3.2.3. Pain & Anesthesia Management 3.2.4. Chemotherapy 3.2.5. Others 3.3. Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 3.3.1. Hospitals 3.3.2. Ambulatory Surgical Centers 3.3.3. Others 3.4. Infusion Pump Software Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Infusion Pump Software Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 4.1.1. Dose Error Reduction Software (DERS) 4.1.2. Clinical Workflow Software 4.1.3. Others 4.2. North America Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 4.2.1. General Infusion 4.2.2. Insulin Infusion 4.2.3. Pain & Anesthesia Management 4.2.4. Chemotherapy 4.2.5. Others 4.3. North America Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 4.3.1. Hospitals 4.3.2. Ambulatory Surgical Centers 4.3.3. Others 4.4. North America Infusion Pump Software Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Dose Error Reduction Software (DERS) 4.4.1.1.2. Clinical Workflow Software 4.4.1.1.3. Others 4.4.1.2. United States Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 4.4.1.2.1. General Infusion 4.4.1.2.2. Insulin Infusion 4.4.1.2.3. Pain & Anesthesia Management 4.4.1.2.4. Chemotherapy 4.4.1.2.5. Others 4.4.1.3. United States Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 4.4.1.3.1. Hospitals 4.4.1.3.2. Ambulatory Surgical Centers 4.4.1.3.3. Others 4.4.2. Canada 4.4.2.1. Canada Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Dose Error Reduction Software (DERS) 4.4.2.1.2. Clinical Workflow Software 4.4.2.1.3. Others 4.4.2.2. Canada Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 4.4.2.2.1. General Infusion 4.4.2.2.2. Insulin Infusion 4.4.2.2.3. Pain & Anesthesia Management 4.4.2.2.4. Chemotherapy 4.4.2.2.5. Others 4.4.2.3. Canada Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 4.4.2.3.1. Hospitals 4.4.2.3.2. Ambulatory Surgical Centers 4.4.2.3.3. Others 4.4.3. Mexico 4.4.3.1. Mexico Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Dose Error Reduction Software (DERS) 4.4.3.1.2. Clinical Workflow Software 4.4.3.1.3. Others 4.4.3.2. Mexico Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 4.4.3.2.1. General Infusion 4.4.3.2.2. Insulin Infusion 4.4.3.2.3. Pain & Anesthesia Management 4.4.3.2.4. Chemotherapy 4.4.3.2.5. Others 4.4.3.3. Mexico Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 4.4.3.3.1. Hospitals 4.4.3.3.2. Ambulatory Surgical Centers 4.4.3.3.3. Others 5. Europe Infusion Pump Software Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.2. Europe Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.3. Europe Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 5.4. Europe Infusion Pump Software Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.4.1.3. United Kingdom Infusion Pump Software Market Size and Forecast, by End-user(2022-2029) 5.4.2. France 5.4.2.1. France Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.4.2.3. France Infusion Pump Software Market Size and Forecast, by End-user(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.4.3.3. Germany Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.4.4.3. Italy Infusion Pump Software Market Size and Forecast, by End-user(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.4.5.3. Spain Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.4.6.3. Sweden Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.4.7.3. Austria Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 5.4.8.3. Rest of Europe Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6. Asia Pacific Infusion Pump Software Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4. Asia Pacific Infusion Pump Software Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.1.3. China Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.2.3. S Korea Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.3.3. Japan Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4.4. India 6.4.4.1. India Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.4.3. India Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.5.3. Australia Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.6.3. Indonesia Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.7.3. Malaysia Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.8.3. Vietnam Infusion Pump Software Market Size and Forecast, by End-user(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.9.3. Taiwan Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 6.4.10.3. Rest of Asia Pacific Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 7. Middle East and Africa Infusion Pump Software Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 7.4. Middle East and Africa Infusion Pump Software Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 7.4.1.3. South Africa Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 7.4.2.3. GCC Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 7.4.3.3. Nigeria Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 7.4.4.3. Rest of ME&A Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 8. South America Infusion Pump Software Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 8.2. South America Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 8.3. South America Infusion Pump Software Market Size and Forecast, by End-user(2022-2029) 8.4. South America Infusion Pump Software Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 8.4.1.3. Brazil Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 8.4.2.3. Argentina Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Infusion Pump Software Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Infusion Pump Software Market Size and Forecast, by Application (2022-2029) 8.4.3.3. Rest Of South America Infusion Pump Software Market Size and Forecast, by End-user (2022-2029) 9. Global Infusion Pump Software Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Infusion Pump Software Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Agilent Technologies 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Roche Diagnostics 10.3. Baxter International 10.4. B. Braun Medical Inc. 10.5. Becton, Dickinson and Company 10.6. Fresenius Kabi 10.7. FLOWONIX MEDICAL INC 10.8. ICU Medical Inc. 10.9. Medtronic 10.10. Merck KGaA 10.11. Q Core Medical Ltd 10.12. Smiths Medical 10.13. Terumo Medical 10.14. Moog 10.15. F. Hoffmann-La Roche 10.16. Ypsomed 10.17. Micrel Medical Devices 10.24. Wipro, Ltd. 10.25. Inovalon 11. Key Findings 12. Industry Recommendations 13. Infusion Pump Software Market: Research Methodology 14. Terms and Glossary