The Industrial Chain Market size was valued at USD 4.35 Bn in 2022 and is expected to reach USD 6.93 Bn by 2029, at a CAGR of 6.8 %Overview of the Industrial Chain Market

An industrial chain refers to a system of interconnected components, often in the form of mechanical links or links of other materials, designed to transmit power or convey goods within industrial processes. These chains are crucial in various industries for tasks such as power transmission, material handling, and machinery operation. Industrial chains come in diverse types, including roller chains, conveyor chains, and specialty chains, each tailored to specific applications and industries. These chains play a fundamental role in ensuring the efficient and reliable functioning of machinery and processes across sectors such as automotive, construction, energy, and manufacturing. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data.To know about the Research Methodology :- Request Free Sample Report

Industrial Chain Market Dynamics

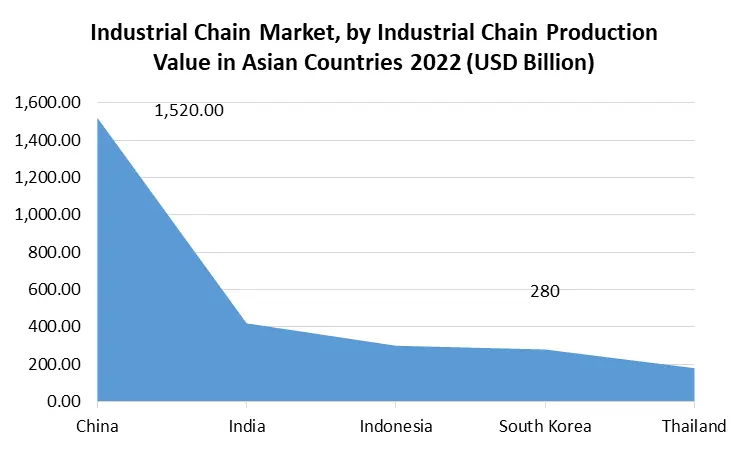

Emerging Demand for Industrial Chains in Developing Regions and Growing Manufacturing Sector Worldwide are majorly driving the Industrial Chain Market The Asia Pacific (APAC) industrial chain market is undergoing noteworthy growth, propelled by a heightened focus on infrastructure development. Countries such as Japan, China, and Thailand are making substantial investments in large-scale projects like highways, airports, railways, and seaports, generating a surge in demand for industrial chains. This upswing in infrastructure initiatives is a direct catalyst for the growth of the industrial chain market, with a specific emphasis on fulfilling the demand and supply requisites for raw materials, construction equipment, and transportation services. These developments position the United States as a significant participant in the burgeoning growth of the industrial chain market in the Asia Pacific region. The global manufacturing sector is undergoing significant expansion, driven by various factors, including governmental initiatives to promote industrial automation and the widespread adoption of Industry 4.0 practices. This trend is not exclusive to the United States but is also evident in key regions such as India and Germany, where the manufacturing sector plays a pivotal role in producing a diverse range of goods. The industrial chain market share in the United States, India, and Germany mirrors the robust growth of the sector, fuelled by increased automation, supply chain intricacies, and an enhanced focus on regulatory compliance. The upswing in e-commerce activities and the expanding logistics sector significantly contribute to the driving forces and opportunities within the industrial chain market. The escalating demand for efficient supply chain solutions, swift order fulfilment, and seamless transportation services is compelling the necessity for robust industrial chains. As e-commerce continues to redefine consumer expectations, manufacturers in the industrial chain sector find an opportune moment to introduce innovative solutions that elevate the efficiency and reliability of logistics operations. This trend is particularly evident in the United States, where the industrial chain market is undergoing notable growth, propelled by the increasing demands of the burgeoning e-commerce and logistics sector. The growing global emphasis on sustainability and eco-friendly practices stands out as a prominent driver in the industrial chain market. Manufacturers face increasing pressure to embrace environmentally responsible processes and materials. This shift towards sustainability creates openings for the development and implementation of eco-friendly industrial chains. Market players leverage this trend by pioneering advancements in materials, manufacturing processes, and recycling initiatives, aligning with the escalating demand for sustainable solutions across various industries. The focus on sustainability resonates in the industrial chain market share, not only in the United States but also in countries such as India and Germany. Challenges Arising from the High Initial Costs of Industrial Chain Market Despite promising growth prospects, the industrial chain market confronts challenges, notably the substantial initial costs linked to establishing and maintaining industrial chain manufacturing units. This challenge is particularly pronounced for smaller market players and new entrants in countries like Canada and Mexico, where industrial chain market penetration is still evolving. The significant initial costs extend to the maintenance and upgrading of industrial chains, encompassing expenses related to equipment upkeep and the replacement of outdated machinery. Furthermore, the elevated costs associated with lubrication and related services pose a considerable obstacle for industrial chain market players. To surmount challenges and foster growth, market players in the industrial chain sector are increasingly embracing strategic initiatives, such as mergers and acquisitions. These Endeavors not only influence competitive forces within the industrial chain market but also impact market dynamics in regions like the United States. A remarkable example is the 2019 acquisition of Diamond Chain by the Timken Company. Such strategic maneuvers by major industrial chain manufacturers aim to enhance global operations, including in developing nations. These efforts fortify market share and further establish the industrial chain market potential in emerging economies. Adoption of Block chain Technology in Supply Chains and Increased Focus on Robotics and Automation creating Opportunities in the Industrial Chain Market The integration of blockchain technology into supply chain management is emerging as a driving force and opportunity in the industrial chain market. Blockchain offers transparency, traceability, and security in supply chain transactions. Industrial chains equipped with blockchain technology can furnish real-time visibility into the movement of goods, mitigating the risk of counterfeiting and augmenting overall supply chain efficiency. This technological progression opens avenues for industrial chain manufacturers to present cutting-edge solutions aligned with the digital transformation of supply chain processes. The market penetration in Canada and Mexico exemplifies the potential for the adoption of blockchain technology in these regions. The escalating trend towards robotics and automation in manufacturing processes propels the demand for specialized industrial chains engineered to endure the challenges of automated systems. Robotics and automation contribute to heightened production efficiency, reduced labour costs, and enhanced operational precision. Industrial chain manufacturers have a unique opportunity to craft high-performance chains meeting the specific requirements of automated machinery, catering to industries such as automotive, electronics, and advanced manufacturing. This trend is particularly accentuated in countries with substantial industrial activity, including Japan, China, and Thailand, where the potential of the industrial chain market is significantly pronounced. The ongoing momentum of globalization and the expansion of cross-border trade present both driving forces and opportunities within the industrial chain market. As businesses operate on a global scale, there is an augmented need for robust supply chain infrastructure. Industrial chains play a pivotal role in facilitating the smooth movement of goods across borders. Market players can harness this trend by offering solutions tailored to the unique challenges of international logistics, encompassing aspects such as customs compliance, diverse transportation modes, and fluctuating environmental conditions. This dynamic interplay of demand and supply is molding the industrial chain market on a global scale. The advent of 5G technology is exerting a profound influence on the industrial chain market by enabling faster and more reliable communication in manufacturing and supply chain operations. Industrial chains equipped with smart sensors and connected technologies can leverage 5G networks to amplify real-time monitoring, predictive maintenance, and overall operational efficiency. This technological leap offers an opportunity for industrial chain manufacturers to develop and market intelligent, data-driven solutions harmonizing with the evolving landscape of smart manufacturing. As 5G becomes a potent competitive force in the market, industrial chain manufacturers must adapt and integrate these technologies to sustain a competitive edge in the rapidly evolving industrial landscape.

Industrial Chain Market Segment Analysis

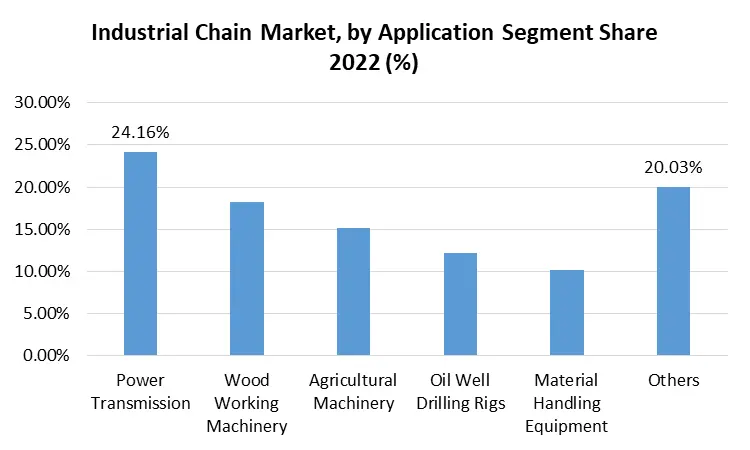

Product Type: Roller chains, revered for their versatile design and enduring durability, anchor the industrial chain market. Found ubiquitously across automotive, power transmission, and material handling equipment industries, roller chains form the backbone of seamless mechanical operations. This trend contributes significantly to the industrial chain market growth in the United States. Leaf chains, with a focus on high-strength precision, emerge as indispensable components in construction and agricultural machinery sectors. Renowned for their robustness and ability to bear heavy loads, leaf chains ensure reliability in demanding industrial applications. Their prominence contributes to the Industrial Chain Market share in the US, India, and Germany. At the heart of material handling equipment, conveyor chains play a pivotal role in facilitating the fluid movement of goods within manufacturing and logistics. The burgeoning e-commerce and logistics sectors significantly propel the demand for conveyor chains, contributing to Industrial Chain Market penetration in Canada and Mexico. Recognized for versatility and adaptability, hollow pin chains carve a niche in applications requiring customization. Spanning various industries, from wood working machinery to power transmission, these chains showcase adaptability to diverse industrial needs. Their application potential adds to the Industrial Chain Market potential in Japan, China, and Thailand. Tailored for specific applications such as oil well drilling rigs, ladder chains excel in enabling efficient and stable vertical movement. Their critical role in the oil and gas industry underscores their durability and stability in challenging environments, contributing to the regulatory influences in the Industrial Chain Market. The "Others" category encapsulates specialized chains designed for unique applications, portraying the dynamic and evolving nature of the industrial chain market. Innovations in materials and manufacturing processes continually give rise to new chain types, reflecting the industry's commitment to innovation and driving Industrial Chain Market Technological advancements. Application: Foundational to power transmission applications, industrial chains play a fundamental role in ensuring the efficient transfer of mechanical energy. Roller chains, in particular, emerge as pivotal components in maintaining the seamless flow of power. This application aligns with the Target Industrial chain market analysis. Leaf chains and conveyor chains form integral components in wood working machinery, providing the necessary strength and reliability essential for the intricate processes within this industry. Their prevalence contributes to the Industrial Chain Market Consumer demographics. Renowned for their high tensile strength, leaf chains find extensive use in the demanding conditions of agricultural machinery. From plowing to harvesting, leaf chains withstand the rigors of varied agricultural operations, contributing to Industrial Chain Market Demand and supply. Crucial in the challenging domain of oil well drilling rigs, ladder chains and specialized chains designed for vertical movement play a pivotal role. Their durability and stability are paramount in the demanding environments of the oil and gas industry, contributing to the Industrial Chain Market Competitive forces. Key components in material handling equipment, conveyor chains, and roller chains facilitate the efficient movement of goods within warehouses, distribution centers, and manufacturing facilities. Their application aligns with the Industrial Chain Market Product segmentation. The "Others" category within applications encompasses specific use cases where industrial chains contribute to unique processes, showcasing the adaptability of industrial chains across diverse industries. This diversity is reflected in the Industrial Chain Market Geographic segmentation.

Industrial Chain Market Regional Analysis

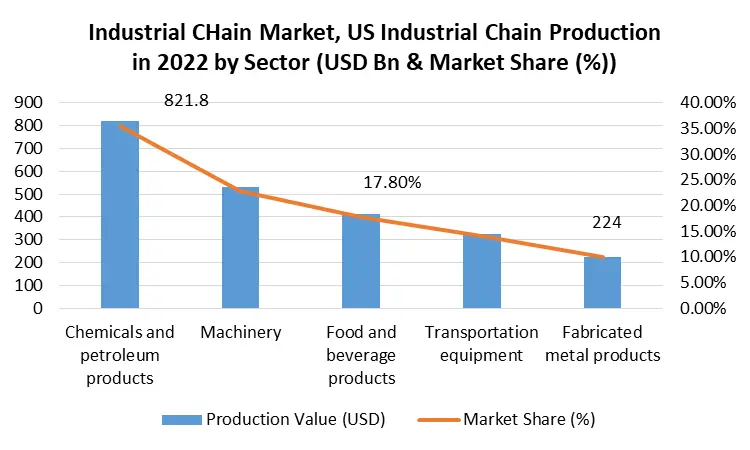

The industrial chain market showcases distinctive dynamics across key regions, including North America, Asia Pacific, and Europe. These regions wield significant influence in shaping the demand, growth patterns, and overall landscape of the industrial chain market. North America emerges as a dominant force in the global industrial chain market, with a notable impact in the sub-regions. United States, takes the lead in driving industrial chain market growth, emphasizing technological advancements and innovation and has high demand, particularly in the automotive and aerospace industries, solidifies its industrial prowess. Regulatory influences direct a focused effort toward sustainable practices, contributing to Market share in the US. Canada witnesses steady industrial chain market penetration, especially in forestry and mining sectors and demonstrates commitment to advanced technologies, elevating manufacturing processes. Presents opportunities for market players to cater to evolving consumer demographics, influencing Market penetration. Mexico experiences growing industrial chain market penetration, amplifying its role in the overall supply chain. The rising manufacturing sector significantly boosts demand. Mexico faces challenges due to fluctuating regulatory environments, creating both challenges and opportunities. Europe plays a pivotal role in the global industrial chain market, with emphasis on the countries, Germany holds a key position in the global industrial chain market share, supported by a thriving manufacturing sector. The country emphasizes Industry 4.0 and automation, contributing to substantial market penetration. Germany witnesses a mounting demand for eco-friendly industrial chains, shaping Market Local consumer behaviour. United Kingdom experiences an evolving industrial chain market with a focus on innovation. Growing demand, especially in the automotive and construction sectors, impacts regional trends and regulatory influences actively shape sustainable practices, influencing region-specific Industrial Chain industry outlook. France commands a significant presence in the market, driven by diverse demand from manufacturing and energy sectors. Integrates advanced technologies, influencing local consumer behaviour and market dynamics. Regulatory landscapes significantly impact market dynamics, shaping the Market Regional competitive landscape. Asia Pacific emerges as a powerhouse in the market. China holds a central and decisive position in the industrial chain market potential within the region with rapid industrialization fuels substantial demand across sectors such as power transmission and material handling and showcases noteworthy technological advancements in manufacturing processes, influencing Market potential in Japan, China, and Thailand. Japan presents high potential for industrial chain market growth, particularly in robotics and automation applications. Adopts sophisticated manufacturing practices, contributing to robust demand, especially in automotive and electronics industries. Experiences notable growth, impacting Area-specific opportunities in the Market. India emerges as a significant contributor to the industrial chain market share, driven by infrastructure development. Observes rising demand for industrial chains in the agriculture sector. Witnesses a growing adoption of sustainable practices, impacting Industrial Chain Regional economic factors.Industrial Chain Competitive Landscape The competitive landscape of the Industrial Chain Market is dynamic and diverse, characterized by the presence of several key players vying for market share and strategic positioning. As a leading manufacturer of chains and power transmission products, TSUBAKIMOTO CHAIN CO. holds a significant position in the market. Its global reach and focus on quality make it a formidable competitor. U.S. Tsubaki has recently completed the acquisition of ATRA-FLEX, a strategic move to enhance its manufacturing capabilities for premium industrial couplings in North America. The acquisition aligns with U.S. Tsubaki's commitment to providing high-quality solutions for rotating equipment, thereby increasing customer productivity and profitability. ATRA-FLEX's dedication to quality products and strong end-user relationships seamlessly integrates with U.S. Tsubaki's long-term growth strategy. As a leading manufacturer and supplier of motion control and power transmission products, U.S. Tsubaki, a subsidiary of Tsubakimoto Chain Co., headquartered in Japan, continues to offer top-notch products across various industries, including roller chains, conveyor chains, sprockets, and more. Furthermore, U.S. Tsubaki has expanded its global materials handling business through strategic ventures. The company has strengthened its presence in India by transitioning its joint venture with Mahindra Conveyor Systems Private Limited ("MTC") into a wholly owned subsidiary named "Mahindra Tsubaki Conveyor Systems Private Limited." This move underscores U.S. Tsubaki's commitment to the Indian market, focusing on bulk handling conveyors and material handling products. The acquisition aims to broaden the business scope, targeting industries such as biomass, cement, and automotive, with the goal of establishing Tsubaki as a prominent brand in the Indian market. In another significant development, Renold, a renowned international supplier of industrial chains and power transmission products, has successfully acquired the business and trading assets of Aventics Tooth Chain ("Aventics TC"), an operating division of Aventics GmbH in Germany. This acquisition marks a crucial step in Renold's strategic plan (STEP 2020), specifically in its 'Acquisitions' Phase. Renold is now focused on integrating Aventics TC's specialist and high-quality product range into its portfolio. The completion of this acquisition sets the stage for leveraging sales opportunities internationally through Renold's extensive footprint. The company extends a warm welcome to the transferring employees of Aventics TC, anticipating a collaborative effort to strengthen and expand its Chain division. Also, Reynolds, a leading international supplier of industrial chains and power transmission products, has made its third acquisition of 2023, this time with a focus on used vehicles. The acquisition is centered on the idea of streamlining processes within the Reynolds Retail Management System. By consolidating all dealership and enterprise activities under a single unique identifier for customers, vehicles, and transactions, Reynolds aims to eliminate the inefficiencies associated with managing used vehicle information separately. The acquisition of AutoVision, following previous acquisitions like DealerCorp Solutions and American Guardian Warranty Services, aligns with Reynolds' commitment to providing comprehensive solutions for the automotive industry. Chris Walsh, the President of Reynolds and Reynolds, highlights the transformative impact of AutoVision within the Retail Management System, offering a unified platform for managing diverse aspects of dealership operations. The competitive landscape is shaped by regional players, emerging startups, and strategic partnerships within the industrial chain market. Market dynamics, including technological advancements, sustainability practices, and the ability to offer tailored solutions, play a crucial role in determining the competitive positioning of companies within this dynamic industry.

Industrial Chain Market Scope Table:Inquire Before Buying

Global Industrial Chain Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 4.35 Bn. Forecast Period 2023 to 2029 CAGR: 6.8% Market Size in 2029: US $ 6.93 Bn. Segments Covered: by Product Type Roller Chains Leaf Chains Conveyor Chains Hollow Pin Chains Ladder Chains Others by Application Power Transmission Wood Working Machinery Agricultural Machinery Oil Well Drilling Rigs Material Handling Equipment Others by End Use Industry Automotive Industrial Equipment & Machinery Energy & Power Building & Construction Others Industrial Chain Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Industrial Chain Market

1. Michelin Group (France) 2. TSUBAKIMOTO CHAIN CO. (Japan) 3. SKF (Sweden) 4. Renold (United Kingdom) 5. DAIDO KOGYO CO., LTD. (Japan) 6. KettenWulf Betriebs GmbH (Germany) 7. Regal Rexnord Corporation (United States) 8. Wippermann jr. GmbH (Germany) 9. BANDO CHAIN IND.CO., LTD (Japan) 10. PEER Chain (United States) 11. Ewart Agri Services Ltd. (United Kingdom) 12. Donghua Limited (China) 13. YUK (Turkey) 14. Dongyang Chain Co. Ltd. (South Korea) 15. ZEXUS CHAIN Co., Ltd. (Japan) 16. Cross+Morse (United Kingdom) 17. iwis (Germany) 18. Diamond Chain Company Inc. (United States) 19. Rombo Reliability (India) Frequently Asked Questions and Answers 1. What is the Industrial Chain Market? Ans: It's a global market for manufacturing and supplying industrial chains used in sectors like automotive and aerospace. 2. What are the key Drivers of Market Growth? Ans: Increased demand, technological advancements, and a focus on sustainability are the key drivers for Market. 3. Who are Major Players in Market? Ans: Michelin, TSUBAKIMOTO, Renold, SKF are the Major Players in Market. 4. How can Market Challenges be addressed? Ans: Through innovation, regulatory adaptation, and strategic collaborations Market Challenges be addressed. 5. What is the impact of Regulatory Environment on Market? Ans: Regulatory Environment on Market influences sustainability practices and industry norms.

1. Industrial Chain Market: Research Methodology 2. Industrial Chain Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Industrial Chain Market: Dynamics 3.1. Industrial Chain Market Trends by Region 3.1.1. Global Industrial Chain Market Trends 3.1.2. North America Industrial Chain Market Trends 3.1.3. Europe Industrial Chain Market Trends 3.1.4. Asia Pacific Industrial Chain Market Trends 3.1.5. Middle East and Africa Industrial Chain Market Trends 3.1.6. South America Industrial Chain Market Trends 3.2. Industrial Chain Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Industrial Chain Market Drivers 3.2.1.2. North America Industrial Chain Market Restraints 3.2.1.3. North America Industrial Chain Market Opportunities 3.2.1.4. North America Industrial Chain Market Challenges 3.2.2. Europe 3.2.2.1. Europe Industrial Chain Market Drivers 3.2.2.2. Europe Industrial Chain Market Restraints 3.2.2.3. Europe Industrial Chain Market Opportunities 3.2.2.4. Europe Industrial Chain Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Industrial Chain Market Drivers 3.2.3.2. Asia Pacific Industrial Chain Market Restraints 3.2.3.3. Asia Pacific Industrial Chain Market Opportunities 3.2.3.4. Asia Pacific Industrial Chain Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Industrial Chain Market Drivers 3.2.4.2. Middle East and Africa Industrial Chain Market Restraints 3.2.4.3. Middle East and Africa Industrial Chain Market Opportunities 3.2.4.4. Middle East and Africa Industrial Chain Market Challenges 3.2.5. South America 3.2.5.1. South America Industrial Chain Market Drivers 3.2.5.2. South America Industrial Chain Market Restraints 3.2.5.3. South America Industrial Chain Market Opportunities 3.2.5.4. South America Industrial Chain Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Key Opinion Leader Analysis For Industrial Chain Market 3.7. Analysis of Government Schemes and Initiatives For Industrial Chain Market 3.8. The Global Pandemic Impact on Industrial Chain Market 4. Industrial Chain Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 4.1.1. Roller Chains 4.1.2. Leaf Chains 4.1.3. Conveyor Chains 4.1.4. Hollow Pin Chains 4.1.5. Ladder Chains 4.1.6. Others 4.2. Industrial Chain Market Size and Forecast, by Application (2022-2029) 4.2.1. Power Transmission 4.2.2. Wood Working Machinery 4.2.3. Agricultural Machinery 4.2.4. Oil Well Drilling Rigs 4.2.5. Material Handling Equipment 4.2.6. Others 4.3. Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 4.3.1. Automotive 4.3.2. Industrial Equipment & Machinery 4.3.3. Energy & Power 4.3.4. Building & Construction 4.3.5. Others 4.4. Industrial Chain Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Industrial Chain Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. North America Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 5.1.1. Roller Chains 5.1.2. Leaf Chains 5.1.3. Conveyor Chains 5.1.4. Hollow Pin Chains 5.1.5. Ladder Chains 5.1.6. Others 5.2. North America Industrial Chain Market Size and Forecast, by Application (2022-2029) 5.2.1. Power Transmission 5.2.2. Wood Working Machinery 5.2.3. Agricultural Machinery 5.2.4. Oil Well Drilling Rigs 5.2.5. Material Handling Equipment 5.2.6. Others 5.3. North America Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 5.3.1. Automotive 5.3.2. Industrial Equipment & Machinery 5.3.3. Energy & Power 5.3.4. Building & Construction 5.3.5. Others 5.4. North America Industrial Chain Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 5.4.1.1.1. Roller Chains 5.4.1.1.2. Leaf Chains 5.4.1.1.3. Conveyor Chains 5.4.1.1.4. Hollow Pin Chains 5.4.1.1.5. Ladder Chains 5.4.1.1.6. Others 5.4.1.2. United States Industrial Chain Market Size and Forecast, by Application (2022-2029) 5.4.1.2.1. Power Transmission 5.4.1.2.2. Wood Working Machinery 5.4.1.2.3. Agricultural Machinery 5.4.1.2.4. Oil Well Drilling Rigs 5.4.1.2.5. Material Handling Equipment 5.4.1.2.6. Others 5.4.1.3. United States Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 5.4.1.3.1. Automotive 5.4.1.3.2. Industrial Equipment & Machinery 5.4.1.3.3. Energy & Power 5.4.1.3.4. Building & Construction 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 5.4.2.1.1. Roller Chains 5.4.2.1.2. Leaf Chains 5.4.2.1.3. Conveyor Chains 5.4.2.1.4. Hollow Pin Chains 5.4.2.1.5. Ladder Chains 5.4.2.1.6. Others 5.4.2.2. Canada Industrial Chain Market Size and Forecast, by Application (2022-2029) 5.4.2.2.1. Power Transmission 5.4.2.2.2. Wood Working Machinery 5.4.2.2.3. Agricultural Machinery 5.4.2.2.4. Oil Well Drilling Rigs 5.4.2.2.5. Material Handling Equipment 5.4.2.2.6. Others 5.4.2.3. Canada Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 5.4.2.3.1. Automotive 5.4.2.3.2. Industrial Equipment & Machinery 5.4.2.3.3. Energy & Power 5.4.2.3.4. Building & Construction 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 5.4.3.1.1. Roller Chains 5.4.3.1.2. Leaf Chains 5.4.3.1.3. Conveyor Chains 5.4.3.1.4. Hollow Pin Chains 5.4.3.1.5. Ladder Chains 5.4.3.1.6. Others 5.4.3.2. Mexico Industrial Chain Market Size and Forecast, by Application (2022-2029) 5.4.3.2.1. Power Transmission 5.4.3.2.2. Wood Working Machinery 5.4.3.2.3. Agricultural Machinery 5.4.3.2.4. Oil Well Drilling Rigs 5.4.3.2.5. Material Handling Equipment 5.4.3.2.6. Others 5.4.3.3. Mexico Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 5.4.3.3.1. Automotive 5.4.3.3.2. Industrial Equipment & Machinery 5.4.3.3.3. Energy & Power 5.4.3.3.4. Building & Construction 5.4.3.3.5. Others 6. Europe Industrial Chain Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Europe Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.2. Europe Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.3. Europe Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 6.4. Europe Industrial Chain Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.4.1.2. United Kingdom Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.4.1.3. United Kingdom Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 6.4.2. France 6.4.2.1. France Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.4.2.2. France Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.4.2.3. France Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.4.3.2. Germany Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.4.3.3. Germany Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.4.4.2. Italy Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.4.4.3. Italy Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.4.5.2. Spain Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.4.5.3. Spain Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.4.6.2. Sweden Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.4.6.3. Sweden Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.4.7.2. Austria Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.4.7.3. Austria Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 6.4.8.2. Rest of Europe Industrial Chain Market Size and Forecast, by Application (2022-2029) 6.4.8.3. Rest of Europe Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7. Asia Pacific Industrial Chain Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.2. Asia Pacific Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.3. Asia Pacific Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4. Asia Pacific Industrial Chain Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.1.2. China Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.1.3. China Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.2.2. S Korea Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.2.3. S Korea Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.3.2. Japan Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.3.3. Japan Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.4. India 7.4.4.1. India Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.4.2. India Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.4.3. India Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.5.2. Australia Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.5.3. Australia Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.6.2. Indonesia Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.6.3. Indonesia Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.7.2. Malaysia Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.7.3. Malaysia Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.8.2. Vietnam Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.8.3. Vietnam Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.9.2. Taiwan Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.9.3. Taiwan Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 7.4.10.2. Rest of Asia Pacific Industrial Chain Market Size and Forecast, by Application (2022-2029) 7.4.10.3. Rest of Asia Pacific Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 8. Middle East and Africa Industrial Chain Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 8.2. Middle East and Africa Industrial Chain Market Size and Forecast, by Application (2022-2029) 8.3. Middle East and Africa Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 8.4. Middle East and Africa Industrial Chain Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 8.4.1.2. South Africa Industrial Chain Market Size and Forecast, by Application (2022-2029) 8.4.1.3. South Africa Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 8.4.2.2. GCC Industrial Chain Market Size and Forecast, by Application (2022-2029) 8.4.2.3. GCC Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 8.4.3.2. Nigeria Industrial Chain Market Size and Forecast, by Application (2022-2029) 8.4.3.3. Nigeria Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 8.4.4.2. Rest of ME&A Industrial Chain Market Size and Forecast, by Application (2022-2029) 8.4.4.3. Rest of ME&A Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 9. South America Industrial Chain Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 9.1. South America Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 9.2. South America Industrial Chain Market Size and Forecast, by Application (2022-2029) 9.3. South America Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 9.4. South America Industrial Chain Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 9.4.1.2. Brazil Industrial Chain Market Size and Forecast, by Application (2022-2029) 9.4.1.3. Brazil Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 9.4.2.2. Argentina Industrial Chain Market Size and Forecast, by Application (2022-2029) 9.4.2.3. Argentina Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Industrial Chain Market Size and Forecast, by Product Type (2022-2029) 9.4.3.2. Rest Of South America Industrial Chain Market Size and Forecast, by Application (2022-2029) 9.4.3.3. Rest Of South America Industrial Chain Market Size and Forecast, by End User Industry (2022-2029) 10. Global Industrial Chain Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Industrial Chain Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Michelin Group (France) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Michelin Group (France) 11.3. TSUBAKIMOTO CHAIN CO. (Japan) 11.4. Renold (United Kingdom) 11.5. SKF (Sweden) 11.6. DAIDO KOGYO CO., LTD. (Japan) 11.7. KettenWulf Betriebs GmbH (Germany) 11.8. Regal Rexnord Corporation (United States) 11.9. Wippermann jr. GmbH (Germany) 11.10. BANDO CHAIN IND.CO., LTD (Japan) 11.11. PEER Chain (United States) 11.12. Ewart Agri Services Ltd. (United Kingdom) 11.13. Donghua Limited (China) 11.14. YUK (Turkey) 11.15. Dongyang Chain Co. Ltd. (South Korea) 11.16. ZEXUS CHAIN Co., Ltd. (Japan) 11.17. Cross+Morse (United Kingdom) 11.18. iwis (Germany) 11.19. Diamond Chain Company Inc. (United States) 11.20. Rombo Reliability (India) 12. Key Findings 13. Industry Recommendations