Indian Electric Vehicle Market was valued at USD 3.47 Bn in 2023 and is expected to reach USD 123.20 Bn by 2030, at a CAGR of 66.52 % during the forecast period.Indian Electric Vehicle Market Overview

An electric vehicle (EV) is powered by electricity rather than traditional fossil fuels like gasoline or diesel. EVs use one or more electric motors to drive the vehicle's wheels, drawing energy from rechargeable batteries or other sources such as fuel cells. These vehicles produce zero tailpipe emissions during operation, making them environmentally friendly alternatives to conventional internal combustion engine vehicles. EVs come in various forms, including battery electric vehicles (BEVs), which run solely on electricity, and plug-in hybrid electric vehicles (PHEVs), which combine electric motors with an internal combustion engine and is charged from an external power source.To know about the Research Methodology:-Request Free Sample Report The Indian automotive industry ranks as the fifth largest globally and is poised to ascend to the third position by 2030. According to the India Energy Storage Alliance (IESA), the Indian electric vehicle (EV) sector is projected to grow at a compound annual growth rate (CAGR) of 36%. With population growth and increasing vehicle demand, continued reliance on conventional energy sources is deemed unsustainable, particularly as India currently imports approximately 80% of its crude oil needs. NITI Aayog has set ambitious targets to achieve widespread EV adoption, aiming for 70% penetration in commercial cars, 30% in private cars, 40% in buses, and 80% in two and three-wheelers by 2030, aligning with the overarching objective of achieving net-zero carbon emissions by 2070, which is expected to boost the Indian Electric Vehicle Market growth over the forecast period. Over the past three years, India has witnessed the registration of 0.52 million EVs, as reported by the Ministry of Heavy Industries. The EV sector experienced robust growth in 2021, buoyed by the implementation of favorable government policies and programs. In terms of regional sales distribution in 2021, Uttar Pradesh emerged as the top contributor to EV sales, with 66,704 units sold across all segments. It was followed by Karnataka with 33,302 units and Tamil Nadu with 30,036 units. Uttar Pradesh led the three-wheeler segment, while Karnataka and Maharashtra dominated the two-wheeler and four-wheeler segments, respectively. The Indian government has been actively promoting the adoption of electric vehicles through various initiatives and policies, which is expected to boost the Indian Electric Vehicle Market growth. Programs like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme provide incentives for EV manufacturing and purchases. Additionally, the Production-Linked Incentive (PLI) scheme encourages the local production of EV components, including batteries. Several Indian states are also implementing policies and initiatives to promote the adoption of electric vehicles. For example, Delhi has set ambitious targets for transitioning its public transport fleet to electric power, with plans to electrify a significant portion of city buses by 2025. Despite the positive momentum, the Indian EV market still faces challenges such as infrastructure limitations, including the availability of charging stations, high initial costs of EVs, and concerns about battery technology and range.

Indian Electric Vehicle Market Dynamics

Consumers are driving the transition for electric cars to boost the Indian Electric Vehicle Market growth Indian electric vehicle market is taking off because of an abundance of cheap new models. Sales of passenger EVs in the country rose to 75,000 in the nine months through September — that’s more than double the volume during the same period last year. While their share of the total market remains small at 2.4%, a closer look at the underlying trends highlights an important insight for EV makers hoping to make inroads in India: Some 86% of all electric cars sold this year were priced under $20,000. By providing electric vehicles (EVs) at comparable prices, automakers have successfully attracted demand from individual customers, particularly those commuting to urban workplaces across India. Additionally, due to their cost-effectiveness in terms of operation, battery-powered cars have gained popularity among ride-hailing services and taxi companies as well. India stands out as one of the most rapidly growing electric vehicle (EV) markets globally, boasting millions of EV owners. Among the 2.3 million electric vehicles in the country, over 90% are comprised of the more affordable and widely favored two- or three-wheelers, including motorbikes, scooters, and rickshaws. Remarkably, in 2022, over half of India's three-wheeler registrations were for electric vehicles. India is on the brink of a significant shift towards electric vehicles (EVs), driven by evolving consumer preferences and supportive government policies, which significantly boosts the Indian Electric Vehicle Market growth. With 70% of tier-one Indian car consumers expressing openness to considering an electric car for their next vehicle, surpassing the global average, the country is witnessing a decisive inflection point towards electrification. Government initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, coupled with urban access regulations for internal-combustion engine (ICE) vehicles aimed at reducing air pollution and enhancing traffic conditions, further accelerate this transition. The accessibility of EVs has notably improved, with incumbent car manufacturers setting ambitious electrification targets and new players introducing models tailored to India's urban landscape. Additionally, the total cost of ownership for EVs has reached parity with ICE vehicles, removing a significant barrier to adoption. Projections indicate that EV market penetration reach 10 to 15 percent by 2030, offering substantial opportunities for OEMs, financial institutions, grid operators, and other stakeholders. Sustainability emerges as a key driver shaping consumer preferences in India, with 75% of individuals adjusting their behavior and consumption patterns based on sustainability considerations, which boosts the Indian Electric Vehicle Market growth. This shift towards sustainability is reflected in the car-buying decisions of Indian consumers, where sustainability ranks among the top five criteria alongside safety, brand, and costs. The desire for zero-carbon vehicles is also evident in the dominant two-wheeler market, where it features prominently among the top three purchase criteria. Government Initiatives The success of electric vehicles (EVs) is attributed to a confluence of factors, including proactive government initiatives at both central and state levels, a dedicated focus from the industry, and the increasing public acceptance of electric vehicles. Initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India (FAME India) program, the Production-Linked Incentive (PLI) scheme for the automotive and auto component sectors, and the PLI scheme for the production of advanced chemistry cell (ACC) batteries have played a pivotal role in stimulating local manufacturing and driving EV adoption. Furthermore, the Government of India is exploring the feasibility of transitioning all government vehicles to electric power in the coming years.States have also demonstrated a growing commitment to nurturing the industry and embracing EVs. For instance, Delhi has set an ambitious target of electrifying 80% of its city buses by 2025. Achieving this goal necessitates a significant expansion of the e-bus fleet, from the current 800 to an impressive 8,000 units. Lack of Charging Infrastructure to limit Indian Electric Vehicle Market Growth The lack of adequate charging infrastructure is a significant challenge hindering the widespread adoption of EVs in India. The availability of charging stations, especially in urban areas and along highways, remains limited, which deter potential EV buyers due to concerns about range anxiety and accessibility. Electric vehicles typically have higher upfront costs compared to traditional internal combustion engine vehicles. The initial purchase price of EVs, along with the cost of charging infrastructure installation at homes or businesses is prohibitive for many consumers, especially in a price-sensitive market like India, significantly restraints the Indian Electric Vehicle Market growth. Battery technology advancements are crucial for improving the performance and range of electric vehicles. Concerns about battery life, durability, and range limitations still persist. Consumers hesitate to switch to EVs if they perceive the technology as not mature enough or if they are unsure about the longevity and reliability of batteries. Developing a robust manufacturing ecosystem for electric vehicles requires significant investments in infrastructure, technology, and skilled labor. India faces challenges in establishing a reliable supply chain for EV components, including batteries and electric motors, which affect production scalability and cost competitiveness.

Company Description Kia Kia plans to manufacture small SUV EVs in India for global markets in 202 Maruti Suzuki Maruti Suzuki plans to launch its first EV model in India by 2025. Tata Motors Tata Motors bags an order worth US$ 678 million (Rs 5,000 crore) order from the government for electric buses; it plans to launch 10 more EVs in India. Hopcharge Hopcharge, a Gurgaon- based start-up has created the world’s first on-demand doorstep fast charge service. MG Motors MG Motors India has partnered with Bharath petroleum for expanding the EV charging infrastructure. Mahindra & Mahindra Mahindra and Mahindra targets to launch 16 EV models across its SUV and LCV categories by 2027. Indian Electric Vehicle Market Segment Analysis

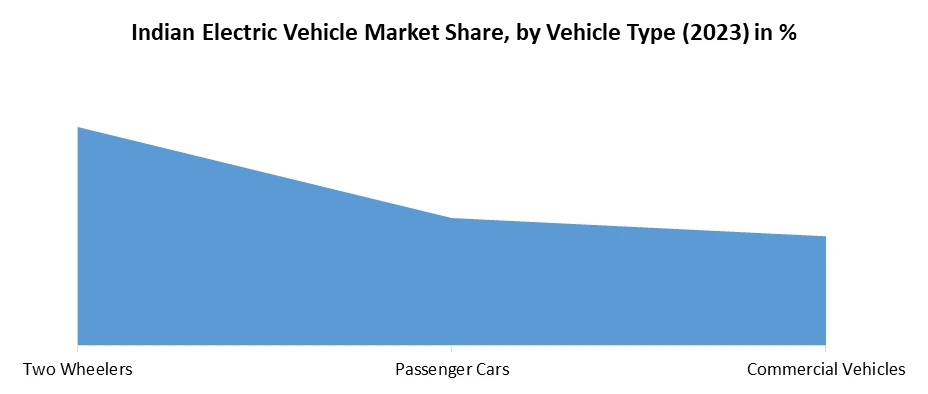

Based on Technology type, the market is segmented into Battery-Electric Vehicle, Plug-in Hybrid Electric Vehicle, and Fuel Cell Electric Vehicle. Battery-Electric Vehicle dominated the market in 2023 and is expected to hold the largest Indian Electric Vehicle Market share over the forecast period. The range of BEVs in the Indian market varies depending on factors such as battery capacity, vehicle weight, and driving conditions. While early models have had limited ranges, advancements in battery technology have led to the introduction of BEVs with increasingly longer ranges, making them more practical for everyday use. BEV adoption in India is the availability of charging infrastructure. While the network of charging stations is expanding, especially in urban areas and along highways, there is still a need for further investment in charging infrastructure to support the widespread adoption of BEVs. With growing concerns about air pollution and climate change, coupled with advancements in battery technology and increasing consumer awareness, the demand for BEVs in India is expected to rise steadily in the coming years. Automakers are launching new BEV models tailored to the Indian market, further driving adoption and Indian Electric Vehicle market growth.Based on Vehicle Type, the market is segmented into Two Wheelers, Passenger Cars, and Commercial Vehicles. Two Wheelers segment dominated the market in 2023 and is expected to hold the largest Indian Electric Vehicle Market share over the forecast period. In the Indian Electric Vehicle market, two-wheelers are the most commonly used type of electric vehicle. Two-wheelers, including electric scooters and motorcycles, have gained significant traction in India due to their affordability, practicality for urban commuting, and suitability for short-distance travel. The popularity of electric two-wheelers is driven by factors such as rising fuel costs, increasing traffic congestion in cities, and government incentives promoting electric mobility. Several Indian startups and established manufacturers have introduced a wide range of electric two-wheeler models, catering to different customer preferences and budget ranges. As a result, two-wheelers dominate the Indian Electric Vehicle market, accounting for a significant portion of total EV sales in the country.

Indian Electric Vehicles Market Scope: Inquire before buying

Indian Electric Vehicles Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.47 Bn. Forecast Period 2024 to 2030 CAGR: 66.52% Market Size in 2030: US $ 123.20 Bn. Segments Covered: by Technology Type Battery-Electric Vehicle Plug-in Hybrid Electric Vehicle Fuel Cell Electric Vehicle by Vehicle Type Two Wheelers Passenger Cars Commercial Vehicles by End User Individual Consumers Fleet Owners and Operators Car Rental Companies Others Leading Indian Electric Vehicle Manufacturer

1. Electrotherm (India) Limited 2. Hero Electric Vehicles Pvt. Ltd. 3. Hyundai Motor India Ltd (HMIL) 4. JBM Group 5. Mahindra & Mahindra Limited 6. MG Motor India Private Limited 7. Okinawa Autotech International Private Limited 8. Olectra Greentech Limited 9. Omega Seiki Mobility 10. Piaggio & C. S.p.A. 11. Tata Motors Ltd. 12. TVS Motor Company 13. VE Commercial Vehicles Limited Frequently asked Questions: 1. What is an electric vehicle (EV)? Ans: An electric vehicle (EV) is a vehicle powered by electricity instead of traditional fossil fuels like gasoline or diesel. It uses one or more electric motors to drive the wheels, drawing energy from rechargeable batteries or other sources such as fuel cells. 2. What are the challenges facing the Indian electric vehicle market? Ans: Challenges facing the Indian electric vehicle market include infrastructure limitations such as the availability of charging stations, high initial costs of EVs, concerns about battery technology and range, and the need for investments in manufacturing ecosystems. 3. Which segment dominates the Indian electric vehicle market? Ans: Two-wheelers dominate the Indian electric vehicle market, followed by passenger cars and commercial vehicles. Two-wheelers, including electric scooters and motorcycles, are the most commonly used type of electric vehicle in India due to their affordability and practicality for urban commuting. 4. Which states in India have shown significant growth in electric vehicle sales? Ans: Uttar Pradesh, Karnataka, and Tamil Nadu emerged as top contributors to electric vehicle sales in India in 2021, with each state witnessing substantial growth in EV adoption across different vehicle segments. 5. What are the key targets set by NITI Aayog for electric vehicle adoption in India? Ans: NITI Aayog aims to achieve significant penetration of electric vehicles by 2030, targeting 70% adoption in commercial cars, 30% in private cars, 40% in buses, and 80% in two and three-wheelers, aligning with the goal of achieving net-zero carbon emissions by 2070.

1. Indian Electric Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Indian Electric Vehicle Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Service Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. India Electric Vehicle Market Companies Share 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. India Electric Vehicle Market: Dynamics 3.1. Indian Electric Vehicle Market Trends 3.2. Indian Electric Vehicle Market Drivers 3.3. Indian Electric Vehicle Market Restraints 3.4. Indian Electric Vehicle Market Opportunities 3.5. Indian Electric Vehicle Market Challenges 3.6. PORTER’s Five Forces Analysis 3.7. PESTLE Analysis 3.8. Regulatory Landscape 3.9. Consumer Behaviour Analysis 3.9.1. Purchase Decision Factor 3.9.2. Emerging Consumers/Buyers Preference 3.10. Key Opinion Leader Analysis For Indian Electric Vehicle Market 3.11. Technological Advancement in Indian Electric Vehicle Industry 3.12. Analysis of Government Schemes and Initiatives For Indian Electric Vehicle Market 3.13. The COVID-19 Pandemic Impact on Indian Electric Vehicle Market 4. Indian Electric Vehicle Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Indian Electric Vehicle Market Size and Forecast, Technology Type (2023-2030) 4.1.1. Battery-Electric Vehicle 4.1.2. Plug-in Hybrid Electric Vehicle 4.1.3. Fuel Cell Electric Vehicle 4.2. Indian Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 4.2.1. Two Wheelers 4.2.2. Passenger Cars 4.2.3. Commercial Vehicles 4.3. Indian Electric Vehicle Market Size and Forecast, by End User (2023-2030) 4.3.1. Individual Consumers 4.3.2. Fleet Owners and Operators 4.3.3. Car Rental Companies 4.3.4. Others 5. Company Profile: Key Players 5.1. Electrotherm (India) Limited 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Recent Developments 5.2. Hero Electric Vehicles Pvt. Ltd. 5.3. Hyundai Motor India Ltd (HMIL) 5.4. JBM Group 5.5. Mahindra & Mahindra Limited 5.6. MG Motor India Private Limited 5.7. Okinawa Autotech International Private Limited 5.8. Olectra Greentech Limited 5.9. Omega Seiki Mobility 5.10. Piaggio & C. S.p.A. 5.11. Tata Motors Ltd. 5.12. TVS Motor Company 5.13. VE Commercial Vehicles Limited 6. Key Findings 7. Analyst Recommendations 8. India Electric Vehicle Market: Research Methodology