India Sports Apparel Market was valued at USD 673.34 Million in 2022, and it is expected to reach USD 1926.10 Million by 2029, exhibiting a CAGR of 16.2% during the forecast period (2023-2029)India Sports Apparel Market Overview:

Sports apparel, often known as sportswear or activewear, is clothing worn for sport or physical activity. Most sports and physical activities need the use of sport-specific apparel for practical, comfort, or safety reasons. Tracksuits, shorts, T-shirts, and polo shirts are examples of typical sport-specific clothing. Swimsuits (for swimming), wet suits (for diving or surfing), ski suits (for skiing), and leotards are examples of specialised clothing (for gymnastics). Trainers, football boots, riding boots, and ice skates are examples of sports footwear. Sportswear is also worn as casual fashion attire at times. The Indian sports clothing market has been around for many decades. People are seeking for the greatest selection from the numerous accessible brands as the economy and money grow. As a result, the athletic goods business is always expanding in response to product demand. Overall, the sports clothing sector in India offers enormous commercial potential, particularly in the categories of marketing, management/sponsorship, and sports apparel selling and exporting.To know about the Research Methodology :- Request Free Sample Report Report Scope The India Sports Apparel Market research assesses the market for the forecast period. The study includes several divisions as well as an analysis of the trends and aspects that are important in the industry. The market outlook portion of the research focuses on the basic characteristics of the market, such as the industry's drivers, constraints, opportunities, and challenges. The report's goal is to provide stakeholders in the industry with a complete study of the India Sports Apparel Market. The research analyses difficult data in simple language and presents the historical and current state of the industry, as well as expected market size and trends. The research examines all areas of the industry, including a detailed examination of important companies such as market leaders, followers, and new entrants. Porter covers competition, new market entrants, supplier power, buyer power, and the dangers of replacement products and services in the paper. PESTLE examines elements such as political, economic, sociocultural, technical, legal, and environmental influences that may have an impact on an organization's competitive position. Research Methodology Secondary research is carried out to determine segment characteristics, qualitative and quantitative data, and the factors driving market growth. Press releases, firm annual reports, government websites, and market research papers were used as secondary sources for the research. Furthermore, quantitative and qualitative data are taken from paid databases such as Reuters, Bloomberg, Hoovers, and others. Primary research validates secondary research conducted at the primary level. Bottom-up market sizing is the most common method for calculating accurate market size, in which a macro and micro perspective of all prospective consumers, revenue, and present market is assessed as a whole. On the other hand, the study is also carried out by taking into account micro level segments that may be realistically targeted and computed, resulting in improved forecasting and more precise data at a more granular level. COVID-19 Impact on India Sports Apparel Market Despite the fact that the COVID-19 pandemic continues to have an impact on businesses across the world, the athletic goods industry has managed to recover to pre-COVID-19 levels of growth despite difficult economic conditions. Executives in the athletic goods business focused on three main developments in 2020: customer transformations, the digital leap, and industry upheavals. These trends persisted, intensified in some cases, or took exciting new twists in 2021. With many individuals still working from home, athleisure has grown in popularity, reflecting changed views regarding traditional office attire. Many people have a fresh perspective on sports and overall fitness as a result of increased health awareness. E-commerce has prospered as customers continue to purchase online despite the relaxation of lockdown restrictions. Digital forms of individual or community-based exercise and physical activity have become more popular and have created new possibilities for sporting-goods companies. The sportswear market expanded 8-10% year on year between July and December 2020, as customers wore such garments for exercise as well as work-from-home clothing or video meetings. Since the onset of Covid-19, sports apparel and footwear companies have outpaced fast-fashion and lifestyle rivals, as sales of sportswear have continued to grow during the pandemic, driven by an increasing appetite for fitness in the country and increased adoption of sporting disciplines other than cricket. According to regulatory filings, companies such as Decathlon, Asics, Puma, Skechers, and Reebok grew 7-24 percent in the fiscal year ended December 2020, significantly outpacing apparel retailers Zara, Benetton, Marks & Spencer, Levi's, and Lifestyle, which either declined or expanded in the low single digits. According to data analytics firm AltInfo, French athletic goods retailer Decathlon gained 24 percent to Rs 2,231 crore in the fiscal year ending March 2020, nearly tripling sales over the previous two years, while Reebok rose 7 percent to Rs 428 crore. Puma, a German brand, increased its revenue by 22% to Rs 1,413 crore in the fiscal year ending December 31, 2019. Unlike other garment firms, which reported poor growth owing to shop closures in March and customer anxiety about venturing out even after the lockdown was lifted, athletic sales increased. Sportswear firms who had previously focused on brick-and-mortar retail profited from expanding their online platforms as well.

India Sports Apparel Market Dynamics

Increasing Online Sales of Sports Apparel: India is one of the fastest-growing and largest marketplaces for footwear makers, with a population of 1.3 billion people. Flipkart, which is owned by Walmart, reported an increase in demand for T-shirts, track trousers, running shoes, walking shoes, and women's tights. According to a Flipkart spokeswoman, sports shoes are becoming increasingly popular even in tier-3 markets. Fitness as a category has been constantly expanding year on year, and as the epidemic has progressed, consumer searches for workout apparel and gear on Flipkart have increased as people continue to experiment with new fitness regimens. Amazon India stated that demand for sporting and comfort apparel, in addition to work-from-home needs such as open footwear, has been high. In 2020, there was 1.2 times more demand for sportswear than the previous year, with constant strong demand for running shoes, particularly 1.6 times rise in women's running shoes. This growth in online purchasing is likely to boost demand for sports apparel in the Indian market. From social media to social commerce and digital ecosystems: The growing effect of social media on consumer purchasing habits is likely to fuel the Indian sports apparel industry. More than 80% of buyers utilise internet platforms to find things. Social media continues to be an effective platform for influencers and digital communities to link consumers and commerce, and prominent players are capitalising on this expanding trend. Companies that were able to streamline this link between engagement and sales in 2021 were able to significantly increase profits and even build digital consumer-engagement ecosystems spanning from the company's website to its own app and retail stores, using the generated data to inform areas such as product development and demand planning. And, as the social-media landscape evolves, the use of livestreaming as a promotional tool as well as a buying channel is already well-established in India and is projected to spread globally. Early adopters in the athletic goods industry are attempting to get a foothold in this "metaverse," and others are likely to follow suit. Changing Consumer Behaviour & Preferences: India has quickly caught up with the worldwide fitness craze in recent years. Today, India's fitness propensity is comparable to that of the rest of the globe. The expanding economy and ever-changing lifestyle choices have caused the Indian people and customers to be more health-conscious. They are now pushed to include new health and wellness regimens in order to maintain a fit lifestyle in their hectic existence. This new fitness lifestyle shift has helped the sportswear business on a massive scale in India, which has now turned out to be one of the country's most in-demand fashion and apparel segments. This shifting tendency has created new trading chances for businesses and investors interested in the Indian market. The country's improving economic situation and changing attitude toward fitness are boosting demand for athleisure apparel and equipment in the market. It has created opportunities for new employment endeavours ranging from brand development and fundamental framework development to entrepreneurial setup, advanced technology, and services. Rising Indian & International Manufacturers: Traditionally, well-known multinational sportswear companies dominated the Indian market. Brands like Reebok, Adidas, Nike, and Puma have been active in India for more than two decades and have expanded through promoting their products by associating with cricket and other athletic events. However, newer players have positioned themselves as comfortable lifestyle and regular athletic clothing businesses. These brands entered the Indian market decades ago and quickly built a strong foothold. However, the growing passion of Indian consumers for fitness and sportswear in general allowed indigenous firms the opportunity to respond to the expanding need in the domestic market over time. Because of the pricing sector, Indian brands have an advantage over these multinational retailers. Many sporting firms with economical and high-quality items have joined the market throughout time and established themselves among the target demographic.India Sports Apparel Market Segment Analysis

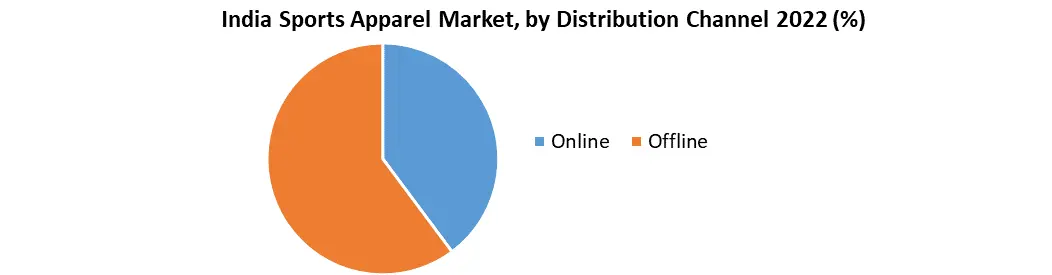

Based on Product Type, the market is segmented into top wear and bottom wear. Because of the general public's choice, top wear are expected to dominate the market during the forecast period. T-shirts are popular among the general public due to the amount of comfort they give. Moreover, morning joggers and elite athletes both choose track pants. The total market is being driven by increased health-consciousness among the populace. Till a few years, Indians were not conscious of the kind of sports shoes or apparel they wear for various activities like running, walking, playing tennis, etc. However, now-adays consumers are becoming aware of these specialized products and are buying these over the regular ones. Based on End-User, the market is segmented into women, men, and kids. Sportswear for men account for the majority of this market in India, which is steadily rising, followed by the market for women, and a little portion is taken by the children's sector. Men's clothing dominates the Indian sportswear market, followed by women's wear and finally children's wear. Women's sportswear is the fastest-growing category of all sportswear due to changing traditions and women's engagement in sports such as marathons, badminton, cricket, and other fitness activities. Previously, men's clothing accounted for the majority of Indian sportswear. However, this has altered in recent years as a result of wage increases, changes in lifestyle, and a focus on wellbeing and health. Not just men's clothing, but also women's and children's wear, are contributing to the Indian sportswear sector. Women's clothes and equipment are presently the fastest growing part of the sportswear business in our country. The segment, which was formerly thought to be severely undervalued, has now accelerated and is a thriving market area. Group activities have a significant influence on the child's segment, which is growing rapidly in tandem with the growing popularity of cricket and football. Based on Distribution Channel, the market is segmented into online, and offline. The offline segment is expected to lead the market due to the increasing number of prominent athletic brands globally, which is boosting the number of physical storefronts. Furthermore, a huge number of consumers who want to prevent mismatches, shipping delays, and hassles with return and replacement would enhance the use of retail outlets. This is estimated to boost the growth of the offline segment even more. Similarly, e-commerce companies are growing popularity since most people nowadays work long hours and find online purchasing easier for saving time. Digitization has aided the industry in disseminating information about such companies and has compelled it to meet the requirements of athletes. This sector is performing well not just in the physical market, but also in the internet market, as Indian clients frequently place orders online these days. If a brand is well-known and trustworthy, purchasing online is better. 43.7 percent of Indians prefer to buy activewear online. The scenario is expected to alter again in the not-too-distant future, with more people switching to online businesses. This is the reason huge Indian firms like HRX, Campus Sutra, and Skult have an online presence and are performing very well.

India Sports Apparel Market Regional Insights

In 2021, the Apparel market in India will generate USD 133,474 million in revenue. According to the India Business of Fashion Report, the clothing market in India is expected to grow at a rate of over 11% to reach USD 85 billion by 2021. The sportswear market is a key contribution to the expansion of the Indian garment sector. The India Sports Apparel Market was worth USD 673.34 million in 2022, and it is expected to grow to USD 1926.10 million by 2029, at a CAGR of 16.2 percent during the forecast period (2023-2029). The increasing government investment in sports has resulted in an increase in demand for the product, which has had a substantial influence on market growth. For example, the Economic Times reported in February 2020 that the Indian government had committed USD 401.6 million in its sports budget, an increase of USD 7.103 million from the previous year. Furthermore, the thriving expansion of sports sectors such as cricket, which has resulted in a significant number of individuals playing the game professionally and as a hobby, has made an important impact. Another data point from the Hindu released in September 2019 stated that the Indian cricket league known as the Indian Premier League is predicted to be worth USD 6.8 billion with a growth rate of 7%.India Sports Apparel Market Competitive Insights

Several garment manufacturers have made significant inroads into the Indian athletic market during the last decade. Shiv Naresh began as a tiny tailor's unit in Delhi, founded by RK Singh, a former athlete. It is commonly referred to be the "Face of Indian Sports," with various athletes, like Vijender Singh and Mary Kom, sporting the famed Shiv Naresh signature on their Indian team shirts. In the 1970s, the firm was one of the pioneers of Indian athletic gear, and it eventually evolved into one of India's most recognisable brands. It features a classic emblem on the breast and side of the shorts, which is frequently visible during international and national tournaments in India and throughout the world. Re Design has taken a somewhat different approach to the Indian sports clothing sector, placing a strong focus on fabric details. Individuals using Re Designs goods enjoy an extra layer of comfort and agility because to garment characteristics such as anti-chafe seams, moisture-wicking, and tailored compression. Tights, skins, and fitness shirts are among the various goods available. This company's low-cost, pocket-friendly price is a big selling point. Furthermore, Performax, situated in Mumbai, has witnessed a significant increase in its clientele after it began selling on e-commerce platforms such as Ajio and Reliance Trends. The sportswear company has also partnered with Mumbai Indians, Chennayin FC, and Jaipur Pink Panthers in several Indian sporting tournaments and continues to grow. This is yet another revolutionary new generation sportswear company that has entered the Indian market and offers its customers a wide range of high-performance clothes.India Sports Apparel Market Scope: Inquire before buying

India Sports Apparel Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US 673.34 Mn. Forecast Period 2023 to 2029 CAGR: 16.2 % Market Size in 2029: US 1926.10 Mn. Segments Covered: by Product Type Top Wear Jackets Tops & T-shirts Polos Fleece Sweatshirts & Hoodies Sports Vests Bottom Wear Pants Shorts Ski Pants / Sweatpants & Joggers Base Layer & Underwear by End-Users Women Men Kids by Fabric Polyster Nylon Cotton Others by Distribution Channel Online Offline Speciality Store Retails Others India Sports Apparel Market Key Players

1. Adidas India Marketing Private Limited 2. Ralph Lauren Corporation 3. Puma Sports India Private Limited 4. Nike India Private Limited 5. Under Armour India Trading Private Limited 6. ASICS India Private Limited 7. Decathlon Sports India Pvt Ltd. 8. Shiv-Naresh Sports Private Limited 9. Skechers Retail India Private Limited 10. Cosco Sports 11. Nivia 12. Tyka 13. Sareen Sports 14. Alcis Sports 15. HRX Frequently Asked Questions: 1] What segments are covered in the India Sports Apparel Market report? Ans. The segments covered in the India Sports Apparel Market report are based on Product Type, End-Users, Fabric and Distribution Channel. 2] What is the market size of the India Sports Apparel Market by 2029? Ans. The market size of the India Sports Apparel Market by 2029 is expected to reach USD 1926.10 Mn. 3] What is the forecast period for the India Sports Apparel Market? Ans. The forecast period for the India Sports Apparel Market is 2023-2029. 4] What was the market size of the India Sports Apparel Market in 2022? Ans. The market size of the India Sports Apparel Market in 2022 was valued at USD 673.34 Mn.

1. India Sports Apparel Market Size: Research Methodology 2. India Sports Apparel Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to India Sports Apparel Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. India Sports Apparel Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape 3.12. COVID-19 Impact 4. India Sports Apparel Market Size Segmentation 4.1. India Sports Apparel Market Size, by Product Type (2022-2029) • Top Wear o Jackets o Tops & T-shirts o Polos o Fleece o Sweatshirts & Hoodies o Sports Vests • Bottom Wear o Pants o Shorts o Ski Pants / Sweatpants & Joggers o Base Layer & Underwear 4.2. India Sports Apparel Market Size, by End-Users (2022-2029) • Women • Men • Kids 4.3. India Sports Apparel Market Size, by Fabric (2022-2029) • Polyster • Nylon • Cotton • Others 4.4. India Sports Apparel Market Size, by Distribution Channel (2022-2029) • Online • Offline o Speciality Store o Retails o Others 5. Company Profile: Key players 5.1. Adidas India Marketing Private Limited 5.1.1. Company Overview 5.1.2. Financial Overview 5.1.3. Global Presence 5.1.4. Capacity Portfolio 5.1.5. Business Strategy 5.1.6. Recent Developments 5.2. Ralph Lauren Corporation 5.3. Puma Sports India Private Limited 5.4. Nike India Private Limited 5.5. Under Armour India Trading Private Limited 5.6. ASICS India Private Limited 5.7. Decathlon Sports India Pvt Ltd. 5.8. Shiv-Naresh Sports Private Limited 5.9. Skechers Retail India Private Limited 5.10. Cosco Sports 5.11. Nivia 5.12. Tyka 5.13. Sareen Sports 5.14. Alcis Sports 5.15. HRX