India Solar Rooftop Market size was valued at USD 5.36 Billion in 2023 and the India Solar Rooftop Market revenue is expected to reach USD 6.17 Billion by 2030, at a CAGR of 15.19 % over the forecast period.India Solar Rooftop Market Overview

Solar rooftop are the installation of solar panels on the rooftops of buildings or other structures to harness solar energy for electricity generation. This decentralized approach to solar power generation allows individuals, businesses, and communities to generate their clean energy, reducing reliance on traditional grid electricity and contributing to sustainability efforts. Solar rooftop systems consist of photovoltaic (PV) panels, inverters to convert solar energy into usable electricity, mounting structures to secure the panels to the rooftop, and often include monitoring systems to track energy production. The top 5 states in rooftop capacity- Maharashtra, Rajasthan, Tamil Nadu, Gujarat, and Karnataka accounted for about 52% of total installed capacity.To know about the Research Methodology:-Request Free Sample Report The Indian government has been actively promoting solar rooftop installations through various initiatives and policies. Programs such as the Jawaharlal Nehru National Solar Mission (JNNSM) and the Solar Rooftop Subsidy Scheme aim to incentivize the adoption of solar energy, making it more accessible and affordable for consumers, which significantly boosts the India Solar Rooftop market growth. Tata Power Solar, India’s largest integrated solar player, emerged as a leader in the industrial and commercial rooftop segment, in the recently released India Solar Rooftop Map 2015 by Bridge to India, a leading cleantech consulting firm. Tata Power Solar also ranked 2 under the residential rooftop space. Initially, rooftop solar projects in India began primarily as captive ventures, with many benefiting from capital subsidies provided by the government. Solar developers typically fulfilled the roles of engineering, procurement, and construction (EPC) contractors, a practice that persists in most cases to this day.

India Solar Rooftop Market Dynamics

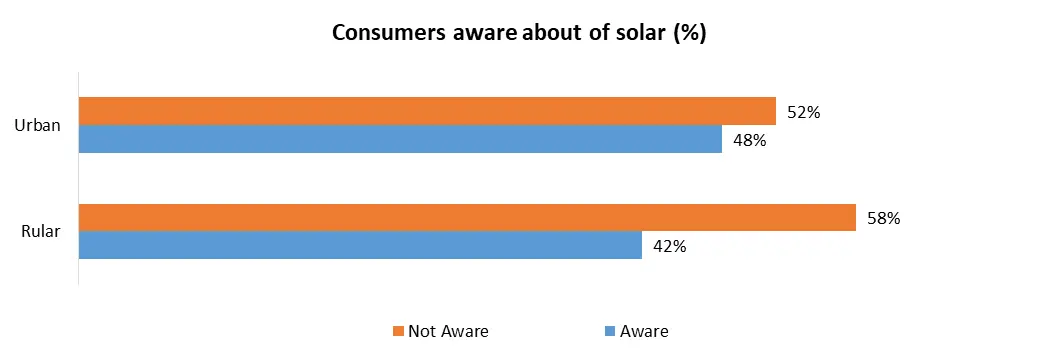

Need for renewable energy solutions to boost the Solar Rooftop Market growth Rooftop solar represents a crucial component of India's solar industry, encompassing on-site solar installations connected in a behind-the-meter (BTM) configuration at consumers' premises, which significantly boosts the India Solar Rooftop Market growth. This approach offers consumers a practical avenue to transition towards greener electricity consumption by accessing cost-effective and environmentally friendly renewable energy directly on-site. As of July 2023, data from the Ministry of New and Renewable Energy (MNRE) indicates that the cumulative installed capacity of rooftop solar in India reached 10.9 gigawatts (GW), comprising approximately 15% of the nation's total solar installations. Prior to the fiscal year (FY) 2019, rooftop solar installations were modest, totaling 1.8GW. The Solar Rooftop market has experienced consistent growth, adding approximately 1.9-2.2GW annually. Projections suggest that FY2024 witness the largest installations on record, with an estimated 4GW expected to be installed, including 2GW already implemented between April and July 2023. India solar rooftop market is pivotal in realizing the nation's ambitious renewable energy objectives for 2022 and beyond. Despite this, the growth of rooftop solar photovoltaic (RTS) installations in residential, commercial, and industrial sectors lags behind utility-scale solar PV and onshore wind power. Various challenges such as policy complexities, regulatory hurdles, and administrative bottlenecks at central and state levels, coupled with limited financing avenues and the reluctance of utility distribution companies (DISCOMs), impede the rapid expansion of rooftop solar projects. To tackle these impediments head-on, an online workshop titled "Unlocking the economic potential of rooftop solar energy in India" was organized on October 12, 2020, by the International Energy Agency (IEA) in partnership with the Council on Energy, Environment and Water (CEEW) and the Ministry of New and Renewable Energy (MNRE) of India. This collaborative platform facilitated discussions among policymakers at both central and state levels, business stakeholders, regulators, DISCOMs, and international experts from leading nations in renewable energy, including Australia, Brazil, Germany, and the United States. Regulatory issues to limit the India Solar Rooftop Market growth The growth of the India Solar Rooftop market faces significant constraints, primarily stemming from regulatory hurdles. These include inconsistencies in net metering policies across states, which directly impact the financial feasibility of rooftop solar installations. Some state electricity distribution companies (DISCOMs) delay or deny net metering approvals, fearing revenue losses from high-paying commercial and industrial (C&I) consumers. The introduction of Green Open Access Rules in 2022 in certain states has diverted attention and resources away from rooftop solar towards open access (OA) solar projects. State regulators prioritize OA approvals over rooftop solar, exacerbating the challenges faced by the India Solar Rooftop market. Financing also presents a substantial obstacle to rooftop solar adoption. Compared to utility-scale and OA solar projects, rooftop solar installations are perceived as riskier investments by leading financiers. This perception results in higher interest rates and longer approval times for loans, undermining the attractiveness of rooftop solar, which offers better returns and shorter payback periods, which is expected to restrain the India Solar Rooftop Market growth. To overcome these constraints and stimulate growth in the Solar Rooftop market, regulators are actively exploring alternative business models such as virtual net metering and peer-to-peer (P2P) trading. These innovative approaches aim to address financing challenges and promote wider adoption of rooftop solar energy solutions. Consumer awareness of solar is still less than 50% at the national level. Awareness in most states is clustered between 30-50% with only three states reporting awareness levels above 60%. The share of awareness in urban areas is slightly higher than that in rural areas, but it is still lower than 50%. High capital cost and limited awareness about the RTS systems are leading barriers across states impacting consumers’ willingness to buy.

India Solar Rooftop Market Segment Analysis

Based on Connectivity, the market is segmented into On-Grid and Off-Grid. The on-grid segment dominated the market in 2023 and is expected to hold the largest India Solar Rooftop Market share over the forecast period. This segment encompasses solar rooftop systems connected directly to the electrical grid, capable of feeding surplus energy back into it. Recent years have seen remarkable growth in the on-grid segment, driven by escalating demand for grid-connected solar solutions in both residential and commercial domains. Factors fueling this surge include government incentives, declining costs of solar panels, and heightened awareness regarding the environmental advantages of solar power. Government policies and incentives wield significant influence over the on-grid solar rooftop market landscape. Initiatives such as net metering and feed-in tariffs empower consumers to sell excess energy to the grid, incentivizing the adoption of solar technology. Numerous state governments in India have also introduced subsidies and tax benefits to spur on-grid solar installations.Seamlessly integrating on-grid solar systems with the existing electrical grid is paramount. While the prospect of feeding surplus energy into the grid is appealing, it necessitates robust grid infrastructure and technology capable of managing solar power's intermittent nature, which significantly boosts the India Solar Rooftop Market growth. Preserving grid stability and reliability is crucial to avert issues such as voltage fluctuations and power quality disturbances. Achieving this integration requires investments in smart grid technology and efficient grid management systems. The decreasing cost of solar panels has rendered on-grid solar installations more economically viable. The initial investment remains a potential hurdle for many consumers. While government incentives and subsidies alleviate some of these costs, the payback period varies depending on factors such as location, system size, and electricity consumption patterns. Based on End User, the market is segmented into Residential, Commercial, and Industrial. Commercial Segment dominated the market in 2023 and is expected to hold the largest India Solar Rooftop market share over the forecast period. Government policies and incentives wield significant influence over the commercial solar rooftop market in India. Both state and central government initiatives actively promote the adoption of solar systems within the commercial sector. These initiatives encompass a range of incentives such as accelerated depreciation benefits, net metering, subsidies, and tax exemptions. The government's commitment to renewable energy targets is compelling businesses to integrate solar solutions into their corporate social responsibility (CSR) agendas.

Cost reduction stands out as a primary motivator driving the commercial segment. Businesses are eager to trim their electricity expenses, and solar installations present an opportunity for substantial long-term savings. With declining solar panel costs and robust government incentives, the return on investment (ROI) for commercial solar systems is particularly attractive, significantly shortening the payback period. Power purchase agreements (PPAs) and leasing options provide accessible pathways for commercial entities to embrace solar energy without bearing a hefty upfront investment, which is expected to boost the India Solar Rooftop Market growth. Commercial properties often boast ample rooftop space compared to residential properties, making them prime candidates for solar installations. These expansive areas accommodate larger solar arrays capable of generating more electricity, offsetting a greater portion of energy consumption, and ultimately leading to heightened cost savings. Amid tightening environmental regulations, businesses recognize the importance of embracing clean energy sources to meet compliance standards. Solar power emerges as a sustainable and conscientious solution for curbing carbon emissions and reducing environmental impact.

India Solar Rooftop Market Regional Insight

In 2023, South India emerged as the dominant region within the India Solar Rooftop market, commanding the largest market share. Comprising Andhra Pradesh, Telangana, Karnataka, Kerala, and Tamil Nadu, South India offers a distinctive environment for solar rooftop endeavors. The region's unique characteristics and opportunities significantly influence the uptake and expansion of solar rooftop installations. Benefiting from elevated solar irradiation levels owing to its proximity to the equator, South India stands as an optimal location for solar energy generation. The abundant sunlight year-round enhances the efficacy of solar rooftop systems, resulting in heightened energy production and shorter payback periods for consumers. South Indian states exhibit a steadfast commitment to renewable energy, exemplified through the introduction of various policies and incentives aimed at fostering solar rooftop installations. These measures encompass net metering, subsidies, tax exemptions, and feed-in tariffs, which is expected to boost the India Solar Rooftop Market growth. Progressive net metering regulations in states like Tamil Nadu and Karnataka incentivize the adoption of grid-connected solar systems. The region boasts rapidly increasing urban centers, including Bangalore, Chennai, and Hyderabad, which serve as bustling hubs for commercial and industrial activities. The presence of these entities, endowed with ample rooftop spaces, presents substantial opportunities for solar rooftop deployments. Businesses in these areas are increasingly embracing solar power to curtail electricity expenses and showcase environmental stewardship. South India harbors a significant residential market for solar rooftops. The dense urban population and burgeoning awareness of environmental sustainability have prompted a growing number of homeowners to contemplate solar installations, aiming to diminish their carbon footprint and trim energy bills.Scope of India Solar Rooftop Market: Inquire before buying

India Solar Rooftop Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.36 Bn. Forecast Period 2024 to 2030 CAGR: 15.19% Market Size in 2030: US $ 6.17 Bn. Segments Covered: by Capacity 1KW to 10 KW 11 KW to 100 KW Above 100 KW by Connectivity On-Grid Off-Grid by End User Residential Commercial Industrial India Solar Rooftop Manufacturers include:

1. Fourth Partner Energy Pvt. Ltd. 2. Amplus Solar Power Pvt. Ltd. 3. Clean Max Enviro Energy Solutions Pvt. Ltd. 4. Sunsource Energy Pvt. Ltd. 5. Orb Energy Pvt. Ltd. 6. Tata Power Solar Systems Limited 7. Mahindra Susten Pvt. Ltd. 8. Growatt New Energy Technology Co. Ltd. 9. Roofsol Energy Pvt. Ltd. 10. Others Frequently asked Questions: 1. What is solar rooftop? Ans: Solar rooftop refers to the installation of solar panels on the rooftops of buildings or structures to harness solar energy for electricity generation. 2. Which are the top states in rooftop solar capacity? Ans: Maharashtra, Rajasthan, Tamil Nadu, Gujarat, and Karnataka accounted for about 52% of total installed capacity in 2023. 3. Which company leads in the industrial and commercial rooftop segment? Ans: Tata Power Solar emerged as a leader in the industrial and commercial rooftop segment according to the India Solar Rooftop Map 2015 by Bridge to India. 4. Why is the commercial segment important in the solar rooftop market? Ans: The commercial segment is crucial due to its large rooftop spaces and potential for significant cost savings, driven by government incentives and decreasing solar panel costs. 5. Which region emerged as the dominant market for solar rooftop in India? Ans: South India, including Andhra Pradesh, Telangana, Karnataka, Kerala, and Tamil Nadu, emerged as the dominant region in the solar rooftop market in 2023.

1. India Solar Rooftop Market: Research Methodology 2. India Solar Rooftop Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. India Solar Rooftop Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Service Segment 3.3.3. End-user Segment 3.3.4. Revenue (2023) 3.3.5. Company Locations 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Mergers and Acquisitions Details 4. India Solar Rooftop Market: Dynamics 4.1. India Solar Rooftop Market Trends 4.2. India Solar Rooftop Market Drivers 4.3. India Solar Rooftop Market Restraints 4.4. India Solar Rooftop Market Opportunities 4.5. India Solar Rooftop Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Key Opinion Leader Analysis For India Solar Rooftop Market 4.9. Technological Advancement in India Solar Rooftop Industry 4.10. Analysis of Government Schemes and Initiatives For India Solar Rooftop Market 4.11. The Global Pandemic Impact on India Solar Rooftop Market 5. India Solar Rooftop Market: India Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 5.1. India Solar Rooftop Market Size and Forecast, By Capacity (2023-2030) 5.1.1.1. Passenger Car Solar Rooftops 5.1.1.2. Two-Wheeler Solar Rooftops 5.1.1.3. Commercial Vehicle Solar Rooftops 5.2. India Solar Rooftop Market Size and Forecast, By Connectivity (2023-2030) 5.2.1. Radial Solar Rooftops 5.2.2. Bias-Ply Solar Rooftops 5.2.3. Tubeless Solar Rooftops 5.3. India Solar Rooftop Market Size and Forecast, By End-User (2023-2030) 5.3.1. OEM Sales 5.3.2. Aftermarket Sales 5.4. India Solar Rooftop Market Size and Forecast, By Region (2023-2030) 5.4.1. East India 5.4.2. West India 5.4.3. North India 5.4.4. South India 6. Company Profile: Key Players 6.1. Fourth Partner Energy Pvt. Ltd. 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Recent Developments 6.2. Amplus Solar Power Pvt. Ltd. 6.3. Clean Max Enviro Energy Solutions Pvt. Ltd. 6.4. Sunsource Energy Pvt. Ltd. 6.5. Orb Energy Pvt. Ltd. 6.6. Tata Power Solar Systems Limited 6.7. Mahindra Susten Pvt. Ltd. 6.8. Growatt New Energy Technology Co. Ltd. 6.9. Roofsol Energy Pvt. Ltd. 6.10. Others 7. Key Findings 8. Industry Recommendations 9. Terms and Glossary