The India Smart TV Market size was valued at USD 11.53 Billion in 2023 and the India Smart TV revenue is expected to grow at a CAGR of 16.57 % from 2024 to 2030, reaching nearly USD 33.72 Billion by 2030.Indian Smart TV Market Overview:

Television, a longstanding staple of entertainment in India, has evolved into the modern Smart TV era. With integrated internet connectivity, these TVs offer embarrass of features such as streaming services, on-demand content from various apps, and compatibility with wireless devices. Operating on the Android system, Smart TVs grant easy access to popular OTT platforms like Hulu, Netflix, and YouTube, along with social media apps such as Twitter and Facebook through Google Play. Voice commands enhance user experience. Beyond entertainment, these versatile devices function as DVD and music players, and support web-based apps, embodying a comprehensive entertainment and connectivity hub. India is the second-largest television market in Asia-Pacific region. As Smart TVs play a significant role in the growing trend of smart homes and offices as technology develops and this are reason for growth of India Smart TV Market. Manufacturers of entertainment devices and other industry stakeholders are increasingly working together to boost presence and diversify product offerings. In the near future, it is believed that each of these variables will contribute to market growth. Additionally, India Smart TV market is benefiting after the increasing interest of OTT. Pre-loaded apps and in-built functions on TVs are likewise becoming more and more popular, additionally, rising levels of financial freedom and nationally improving internet usage both helped to boost smart TV sales in India Smart TV Market. TVs with 8GB of internal storage are the most widely used among them, increase in sales in the first half of 2023. Millions of Units were shipped to India in previous year. Customers are choosing to purchase an inexpensive smart TV rather than installing a streaming stick on an older, non-smart TV as a result of lowering costs. Televisions were included in the countries consumer durable market. As it growing into semi-urban and rural regions, TV penetration increased to 69 percent in the year ending in 2023, with a large number of TV sets owned by rural Indians. As a result of the majority of product lines with smart TVs, entry-level smart TVs are now available for less than $200 USD and because of this India smart TV market can grow effectively. Nearly half of the India smart TV market was occupied by the top five smart TV brands, and over 95% of the televisions sold there were made in the country. In 2023, OnePlus, Vu, and TCL were some of the brands in the India smart TV market with the fastest growth rates. With an 11% market share, Xiaomi lead the entire Indian smart TV market, followed by LG and Samsung. The share of India Smart TV Market shipments in the INR 20,000–INR 30,000 price range increased by 40% year over year to 29%.Even so, despite VU's ascent, With Xiaomi emphasizing affordable options, Samsung dominating the high-end QLED TV market, LG gaining traction with Nano cell and OLED TVs, TCL making waves with new products, and OnePlus showcasing its mettle with its budget series, each of these businesses has carved out its own place in the industry. Other domestic businesses have struggled in this market because of a variety of poorly executed business plans, problems with supply chain management, and intense rivalry from outside firms.To know about the Research Methodology :- Request Free Sample Report

Competitive Landscapes:

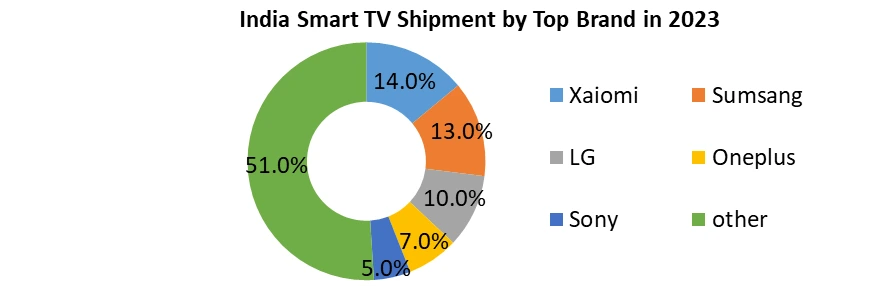

With a 14% market share, Xiaomi established the market leader in India Smart TV Market. Their leading position was strengthened by their ongoing center on their TV line-up, which includes the Redmi and 5A series. Xiaomi has a 23% market share and dominates in both the HD and FHD segments. With a 13% market share, Samsung came in second. In addition to high-end QLED TVs, its T4000 series, which is priced lower, is quite popular. With a quarter of the India Smart TV Market for 4K TVs and over 90% of the market for 8K TVs. LG has third position with 10 % of share all over the India Smart TV Market, OLED and Nano cell TVs are becoming more popular. Dependency on the more costly OLED TV range is typically reduced by the nano cell range. One Plus have 7 % share in India Smart TV Market segment and gaining significant shipments. The BRAVIA XR 86X95K 4K Mini LED TV, which boasts cutting-edge XR Backlight Master Drive technology, was released by Sony India in August 2023. With variable refresh rate, auto low-lag mode, auto HDR tone, and auto game mode, this smart TV can play 4K 120fps videos. Since Sony had 5 % share in India Smart TV Market. In 2023 Samsung, made world’s 1st a 16K which has 133 mega pixel resolution with 110 inch screen, on other side with the latest version of PatchWall, Xiaomi has included a number of new features and improvements, including improved recommendation with IMDB integration, Live TV with additional channels, and content search across several OTT platforms, meanwhile In the HD and FHD segment, Xiaomi leads with 23% share. In the 32" market, LG introduced new models that are their volume gaining in India Smart TV Market. Additionally, it introduced high-end QNED TVs to India. LG provided rebates, free EMIs on some models, and free product insurance for a year during the sales events, that work strategically. Other side the share of small brand like BPL, Sansui, Haier, etc. are becoming popular and offering a discount, this are making almost 40-50% share in India Smart TV Market.

India Smart TV Market Dynamics:

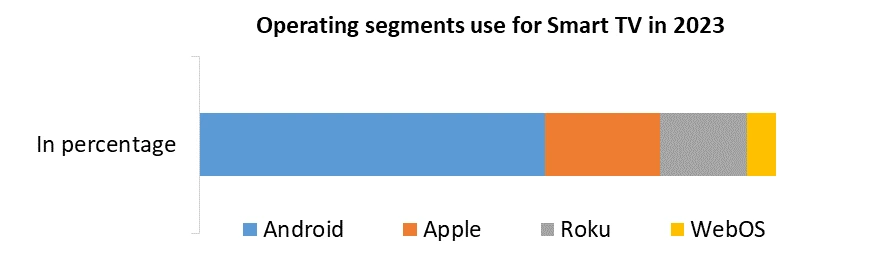

Drivers: Growing interest in customized entertainment Growing interest in customized entertainment is accelerating the rate of development of the smart television (T.V.) market. The days of crowding around movie auditoriums or lifting through satellite TV stations are long gone. This service is offered by smart televisions, which link to the internet and let consumers sign up for streaming services like Netflix and Amazon Prime etc. The majority of India's high-speed Internet boom has changed consumer preferences to online content, which is propelling the India Smart TV Market growth. The great deal of money that streaming media businesses and also beneficial for India Smart TV Market, that invested as led to a rise in Pay-Tv subscribers. Rising income levels, increased knowledge, the introduction and uptake of new technology, Internet penetration, and government initiatives—mainly in smart cities—are all contributing factors to changes in middle-class lifestyles and this factor leads to growth of India’s smart TV market. Service providers now have the chance to enter OTT market and offer content online, thanks to the rising demand for online streaming. DTH and TV cable services are being replaced by over-the-top (OTT) content providers like Netflix, Amazon, and a number of other streaming services. Customers are switching to smart TVs as a result of these causes. Operating Sights The broad Play Store availability for app downloads is responsible for this Operating sights segment's leadership. Voice search and content collection from various media apps and services are also added. Additionally, connection with more contemporary Google technologies like Knowledge Graph, Cast, and Assistant is made easier by the Android TV operating system. The Android TV operating system (OS) segment had a consistent growth in forecast period, in India Smart TV Market. The push for advanced features and exclusive applications sets Smart TVs apart from conventional models. In response to fierce competition from rivals like Roku and Apple, major players in the streaming market are actively developing proprietary operating systems, aiming to establish a unique edge and secure a dominant position in the industry. This drive for innovation underscores the dynamic landscape and intense competition within the realm of India Smart TV Market TV technology. Multiple port are available in Smart TVs: The majority of smart TVs have several ports, such as Ethernet, USB, and HDMI, so you may connect a range of devices to them. The ability to connect a wide range of devices to smart TVs is made possible by the ports on them, which include HDMI, USB, and Ethernet connectors. This is one of the main reasons why smart TVs have become so popular. Smart TV taxes will function as a market boundary Taxes on smart TVs will act as a barrier to the India Smart TV Market they can be a powerful tool for market restraint that effects on consumer behavior and business dynamics. Taxes increase the cost of goods for consumers and manufacturers alike, which results in higher pricing for goods. This increase in price expected to deter prospective of customers, especially those with limited funds or who are price sensitive, which would prevent smart TVs from becoming widely used. Moreover, taxes have the potential to upset the delicate balance in the market and reduce the competitiveness of India Smart TV Market TV makers. Businesses find it difficult to sustain competitive pricing tactics, which could result in their losing market share to less expensive competitors. This, in turn, is limiting investment and innovation in the smart TV industry as producers struggle with narrowing profit margins.

India Smart TV Market Segment Analysis:

By Resolution, with the largest revenue share of about 45% in the HDTV resolution segment is expected to see a significant rise in the India Smart TV Market over the forecast period. 4K UHD TV has a 35% market share, is second dominating segment. Indian consumers may now buy 4K HD TVs appreciate to technological advancements and cost-effectiveness. To enhance the picture quality of their products, major firms like Sony Corporation and Samsung Electronics Co. have embraced nanotechnology and quantum dot technology. These elements are fueling the segment's market growth in the Indian smart TV market. For the duration of the forecast period, 8K TV is growing at a CAGR of 15% and also throughout the forecast period, the 8K sector is expected to grow at a greater pace of more than 33.0% in India Smart TV Market in 2030. In 2023 approximately 33 mega pixels make up 8K TVs, which is more than 4K HDTV's 8.4 mega pixels. It is expected that growing customer demand for TVs with high-resolution picture quality which boots the Indian Smart TV Market growth. Moreover, compared to higher resolutions like 4K, 8K, and UHD, smart TVs with HDTV resolution are more reasonably priced. The rise of this market has also been fuelled by the affordability of TVs with HDTV quality.By screen type, the Flat screen segment led the market in 2023 and are expected to grow at a CAGR of about 17.0% in forecast period in India Smart TV Market. The preference of consumers for flat-screen TVs over more expensive alternatives which leads the growth. These TVs are also simpler to install on walls. The development of this India Smart TV Market has also been aided by the advent of small, entry-level smart TV models with flat screens and the removal of import duties on LCD panels. Curved TVs are regarded as high-end, luxurious versions with large screens that provide the spectator with an enhanced depth of field. These TV screens also aid in removing the vision deprivation that arises from viewing photos or videos from an off-centre angle. Thus, the need for a more inviting and engaging viewing environment has contributed to the segment's growth. This of Curved Smart TV are high rolling demand of this Cured screen are rising there position in Indian Smart TV Market. By Screen Size, the segment ranging from 32 to 45 inches with share of more than 36%, led the market in 2023. The rising popularity of India Smart TV Market is fueling the growth of the medium-screen TV market, and 4K technology is being incorporated into these models. In order to appeal to the middle-class and lower-class populations, India Smart TV Market companies are also introducing smart TVs with screens ranging from 32 to 45 inches or Below the 32 inches at cheap costs. 46 to 55 inches screen size segments have market with a 41% India Smart TV Market share in 2023. With lower product prices and the rapid integration of 4K technology with compelling features, consumers are buying TVs with larger screen sizes. In addition, it is expected that the above 65-inch sector would grow at a notable rate of about 17.8 % throughout the forecast year. India Smart TV market is expected to develop as a result of the growing acceptance of large-screen televisions, rising income, and convenient financing options like EMIs. Also for the 50 to 65 sector is expected to develop at a CAGR of 12%. Customers are buying more and more next-generation large-screen TVs because they provide a home theater experience with surround sound, 3D glasses, and other features. Over the course of the forecast period, these variables are anticipated to propel the segment's market growth.

By Distribution Channel, throughout the forecast period, the offline segment's India Smart TV Market share rise will be remarkable. Supermarkets, hypermarkets, and speciality Store that offer smart TVs are all included in the offline India Smart TV Market segment. The majority of distribution channels in the sector are still offline. In the offline market segment was valued in billions, and by 2023, it was expected to continue growing. India Smart TV market vendors also sell their goods through a number of well-known offline retailers, including Croma, Reliance, Vijay Sales, Kohinoor Etc. Also, well-known foreign suppliers with a broad distribution network, like LG, Samsung, and Toshiba, have a significant international footprint in India Smart TV Market. Customers still like shopping in offline stores because they are drawn to experience-based shopping. Many customers still depend on in-store performance. Store expert demonstrators to make knowledgeable purchase decisions.

By Technology of Screen, TV screen play an important role in for top notch picture quality. LED advance their technology to Micro-LED displays offer great quality and large screen size which attract the consumers. This displays have advantage like Energy Saving, Better contrast, and Quick Response. Nano Cell is the next screen on the list add in India Smart TV Market. Nanoparticles are used at individual pixels in Nano Cell technology. They improve the screen's primary red, green, and blue colours by absorbing undesired light. Deeper hues, crisper tones, and a broader colour palette will all be apparent as a consequence, producing natural colours and crisper images from any viewing angle. According to MMR Research this new type of screen led the India Smart TV Market. By Application, Advertisements for Local Attractions, The entertainment technology offered by the hotel, Cafes and restaurant should be on par with, if not better than, that of the guests' homes. They appear to enjoy having high-definition visuals and audio as part of their in-room experiences, and Some top companies of India Smart TV Market are launch their TV units to let them people recognise.

India Smart TV Industry Ecosystem

India Smart TV Market Scope: Inquire before buying

India Smart TV Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 11.53 Bn. Forecast Period 2024 to 2030 CAGR: 16.57 % Market Size in 2030: USD 33.72 Bn. Segments Covered: by Operating System Android TV Tizen WebOS Others by Resolution HDTV FULL HD TV 4K UHD TV 8K UHD Others by Technology QLED OLED Nano-cell HDR Others by Screen Type Flat Curved by Screen Size Below 32 Inches 32 To 45 Inches 46 To 55 Inches 56 To 65 Inches Above 65 Inches by Prize Range Online Offline India Smart TV Market Key Players

1. Samsung India Electronics Pvt. Ltd. 2. LG Electronics India Pvt. Ltd. 3. Sony 4. Skyworth 5. Panasonic Corporation 6. TCL India 7. Croma 8. Philips 9. JVC 10. Haier India 11. Intex Technologies 12. Vu Televisions 13. Videocon Industries Ltd. 14. Sansui Electric Co. Ltd. 15. Toshiba Corporation 16. Vu Televisions 17. Xiaomi 18. OnePlus FAQs: 1. What segments are covered in the India Smart TV Market report? Ans. The segments covered in the India Smart TV Market report are based on Resolution, Application, Technology Used, prize range, and screen type. 2. What is the market size of the India Smart TV Market by 2030? Ans. The market Revenue of the India Smart TV Market by 2030 is 33.72 Billion. 3. Who are the top key players in the India Smart TV Market? Ans. Xiaomi Technology India Pvt. Ltd., LG Electronics Inc., Apple Inc., Samsung India Electronics Pvt. Ltd, Sony India Pvt. Ltd., TCL India, Vu Technologies Pvt. Ltd., Hisense Group Co. Ltd, Haier Group Corporation, Hitachi Ltd, Intex Technologies, Micromax Informatics Ltd., Panasonic India Pvt. Ltd., Philips India Ltd. 4. What was the market size of the Market in 2023 and 2030? Ans. The market of the Market in 2023 is 11.53 billion and 2030 is 33.72 billion. 5. What is the major restraint for the Market growth? Ans. Taxes on smart TVs will act as a barrier for the Market growth. 6. What is the major restraint for the Market growth? Ans. Taxes on smart TVs will act as a barrier for the Market growth.

1. India Smart TV Market: Executive Summary 1.1. Market Size (2023) & Forecast (2024-2030) 1.2. Market Size (Value and Volume) and Market Share (%) - By Segments and Regions 2. India Smart TV Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. Resolution 2.3.5. Technology 2.3.6. Total Product Sold 2.3.7. Price 2.3.8. Total Revenue 2.3.9. Market Share (%) 2.3.10. Presence in India 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. India Smart TV Market: Dynamics 3.1. Industry Ecosystem 3.2. India Smart TV Market Trends 3.3. India Smart TV Market Dynamics 3.3.1. Drivers 3.3.2. Restraints 3.3.3. Opportunities 3.3.4. Challenges 3.4. PORTER’s Five Forces Analysis 3.5. PESTLE Analysis 3.6. Value Chain Analysis 3.7. Regulatory Landscape 3.8. Key Opinion Leader Analysis For the India Smart TV Industry 3.9. Analysis of Government Schemes and Initiatives on the India Smart TV Industry 4. Consumer Analysis 4.1. Overview of Consumer Buying Patterns 4.2. Factors Influencing Buying Decisions 4.2.1. Price 4.2.2. Features & Specifications 4.2.3. Brand Perception 4.3. Frequency of Buying & Analysis of Replacement Cycles 4.4. Frequency of Upgrades & Reasons 4.4.1. Technological Upgrades 4.4.2. Product Wear & Tear 4.4.3. Consumer Desire for New Features 4.5. Common Issues Faced by Consumers 4.5.1. Hardware Issues 4.5.2. Software Glitches 4.6. Brand-Specific Reliability Analysis 4.7. Measures and Initiatives by Key Players to Improve Reliability 4.7.1. After-Sales Services 4.7.2. Warranty Programs 5. Brand Loyalty 5.1. Major Brands & Their Loyal Consumer Metrics 5.2. Factors Driving Brand Loyalty in India 5.2.1. Product Quality 5.2.2. Customer Service 5.2.3. Price 5.2.4. Brand Image & Recommendations 5.3. Brand Switching Trends Over Past 5 Years 5.4. Strategies & Initiatives for Building & Maintaining Brand Loyalty 6. Technology Enthusiasts & Early Adopters 6.1. Profile of Technology Enthusiasts & Key Features Attracting Tech Enthusiasts 6.2. Demographic Segmentation 6.2.1. Age 6.2.2. Gender 6.2.3. Income Levels 6.2.4. Urban vs. Rural Consumers 7. Pricing Analysis & Financing Options 7.1. Price Trends & Segmentation Analysis 7.1.1. Entry-Level 7.1.2. Mid-Range 7.1.3. Premium 7.2. Competitor Price Comparison & Impact on Consumer Buying Behavior 7.3. Analysis of Purchases Made on Financing Options 7.3.1. EMIs 7.3.2. No-Cost EMIs 7.3.3. Credit Card Offers 7.4. Consumer Perception and Impact of Financing Options 7.5. Disposable Income Levels & Economic Growth Rates Impact on Smart TV Market 8. Technological Landscape Roadmap 8.1. Current Technological Trends 8.1.1. 4K & 8K Resolution 8.1.2. OLED vs. LED 8.1.3. Smart Features (AI & IoT Integration) 8.2. Future Technology Roadmap 8.2.1. Emerging Technologies (AR/VR, Quantum, Dot Displays) 8.2.2. Forecast Scenario of Technological Adoption Over the Next Decade 9. India Smart TV Market Size and Forecast by Segmentation (by Value USD and Volume Units) (2023-2030) 9.1. India Smart TV Market Size and Forecast, by Operating System (2023-2030) 9.1.1. Android TV 9.1.2. Tizen 9.1.3. WebOS 9.1.4. Others 9.2. India Smart TV Market Size and Forecast, by Resolution (2023-2030) 9.2.1. HDTV 9.2.2. Full HD TV 9.2.3. 4K UHD TV 9.2.4. 8K UHD 9.2.5. Others 9.3. India Smart TV Market Size and Forecast, by Technology (2023-2030) 9.3.1. QLED 9.3.2. OLED 9.3.3. Nano-Cell 9.3.4. HDR 9.3.5. Others 9.4. India Smart TV Market Size and Forecast, by Screen Type (2023-2030) 9.4.1. Flat 9.4.2. Curved 9.5. India Smart TV Market Size and Forecast, by Screen Size (2023-2030) 9.5.1. Below 32 Inches 9.5.2. 32 To 45 Inches 9.5.3. 46 To 55 Inches 9.5.4. 56 To 65 Inches 9.5.5. Above 65 Inches 9.6. India Smart TV Market Size and Forecast, by Distribution Channel (2023-2030) 9.6.1. Online 9.6.2. Offline 9.7. India Smart TV Market Size and Forecast, by Region (2023-2030) 9.7.1. North India 9.7.2. South India 9.7.3. East India 9.7.4. West India 10. Company Profile: Key Players 10.1. Samsung India Electronics Pvt. Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. LG Electronics India Pvt. Ltd. 10.3. Sony 10.4. Skyworth 10.5. Panasonic Corporation 10.6. TCL India 10.7. Croma 10.8. Philips 10.9. JVC 10.10. Haier India 10.11. Intex Technologies 10.12. Vu Televisions 10.13. Videocon Industries Ltd. 10.14. Sansui Electric Co. Ltd. 10.15. Toshiba Corporation 10.16. Xiaomi 10.17. OnePlus 10.18. Micromax Informatics 11. Key Findings 12. Analyst Recommendations 13. India Smart TV Market: Research Methodology