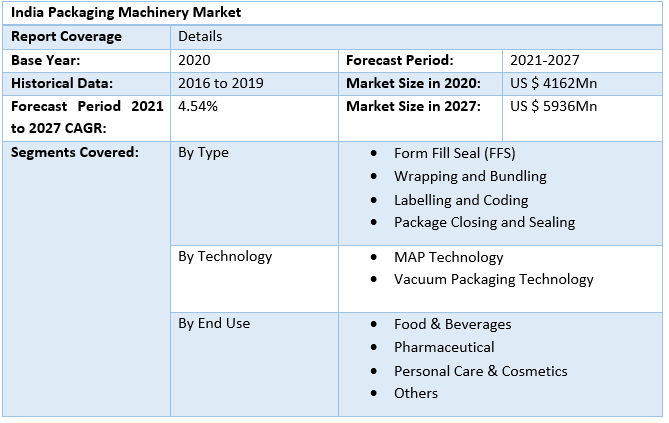

India Packaging Machinery Market was worth US$ 4162 Mn. in 2020 and total revenue is expected to grow at a rate of 4.54 % CAGR from 2021 to 2027, reaching almost US$ 5936 Mn. in 2027.India Packaging Machinery Market Overview:

Indian market for Packaging Machinery is compelled by the growing demand for packaging in numerous end use application of packaging machinery together with rising disposable income. The fast development in the end user market is also increasing the demand for Packaging Machinery Market in the country. The rising pharmaceutical sector & e-commerce segment are the key influences growing the demand for the Packaging Machinery Market of the country. Moreover, the consumption of nearby available labour & material has favoured the business which further confirms the growth of the industry & the country.To know about the Research Methodology :- Request Free Sample Report

Pharmaceutical Industry:

India is the major supplier of generic medications globally. Indian pharmaceutical segment supplies above 50 percent of global demand for many vaccines, 40 percent of general demand in the United States & 25% of all drug in the United Kingdom. Worldwide, India positions 3rd in terms of pharmaceutical manufacturing by volume & 14th by value. The local pharmaceutical industry comprises a system of 3,000 medication companies & ~10,500 industrial units. India likes a significant place in the worldwide pharmaceuticals segment. The nation also has a big pool of experts & engineers with a possible to steer the industry ahead to superior heights. Currently, above 80 percent of the antiretroviral medications used worldwide to fight AIDS are provided by Indian pharmaceutical companies. According to the MMR report study, the local market is anticipated to raise 3x in the succeeding decade. India’s local pharmaceutical market is expected at USD 42 Bn in the year 2021 & expected to reach USD 65 Bn by the end of 2024 & further expand to touch USD 120-130 Bn by the end of 2030. India's biotechnology sector including biopharmaceuticals & bioinformatics. The Indian biotechnology sector was valued at USD 64 Bn in the year 2019 & is anticipated to touch USD 150 Bn by the end of 2025. Indian medical devices market raised at USD 10.36 Bn in the year 2020. The market is anticipated to rise at a CAGR of 37 percent from 2020 to 2025 to touch USD 50 Bn. According to MMR report study, in western India, a considerable number of companies are situated which is a significant cause for the development in the Packaging Machinery Market in India. Also, the Indian government has started a movement (Make in India) to support new industrialists in country by offering capital investments & tax discount such initiatives are anticipated to increase the development of the Packaging Machinery Market in India. Based on the end-user segment, the food and beverage sector is expected to hold the maximum market share due to fast urbanization & growing demand for packed food items. Also, there is an influence of corona virus pandemic on the industry worldwide even in India as individuals have reduced buying material in the market.Segment Overview:

On the basis of types segment, the filling machine sector is anticipated to rule the total market share as it is used most extensively in food processing, in numerous products, & chemicals in the pharmaceutical business. The machineries make sure the safety & care of the placed items in the vessels which estimated to increase the demand for the Packaging Machinery Market in the country over the forecast period. Moreover, the Packaging Machinery Market is anticipated to face many challenges owing to more expenditure on human capitals & fast changes in technology. The market for packaging machinery in India is expected to gain drive during the forecast period supported by the increasing potential development of the logistic industry reinforced by improved e-commerce stages progressively where packaging is vigorous to keep items safe during transport with respects to the breaking of item & is projected to leave an optimistic impact over the market & would shoot the development of packaging machinery in India. Additional, the increasing pharmaceutical segment needs packaging to define useful medical Info about drug, as an outcome, is projected to boost the explosive development of India's packaging machinery market during the forecast period.Automation in the packaging equipment:

Packaging machinery market is consumer oriented & focused by the improved demand for a variety of items in dissimilar types & sizes of packages. Companies in the application industries are accepting modular packaging machines which proposal flexibility & quickly adjust to the varying packaging formats, along with whole packaging outlines which join multiple roles, like filling, labeling, & closing from a particular source. Sustainability & increasing environmental worries have improved the demand for lightweight & thin walled packaging to decrease the quantity of material used for packaging. Therefore, to facilitate these supplies, equipment manufacturing companies are focusing on the progress of machines with better-quality functionality to maximize making speeds while accommodating more delicate & thinner packaging materials. Automation in the packaging equipment proposals numerous benefits, like improved operability & flexibility of the equipment, together with an advanced output rate. In link with the automation tendency, the usage of robotics proposals many welfares, counting a high output rate, better accuracy, constancy, & negligible waste. Thus, the combination of automation has improved over the last decade & is increasing in many end-of-line procedures, like wrapping & palletizing.Key Firms and Market Share Overview:

The market is extremely competitive due to the occurrence of MNC & regional market companies & is reliant on technical progressions & product advances. Main market members have widely capitalized in R&D operations in last few years, which has controlled to the development of numerous advanced products which can be used through the market. Market member’s proposal their consumers separate machines & the design, development, manufacturing, & installation of modified packaging lines. Market companies are also concentrating on technical concepts, like the IIoT, automation, & robotics, to improve the working efficiency of their invention offerings. The objective of the report is to present a comprehensive analysis of the India Packaging Machinery Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the India Packaging Machinery Market dynamics, structure by analyzing the market segments and project the India Packaging Machinery Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the India Packaging Machinery Market make the report investor’s guide.India Packaging Machinery Market Scope: Inquire before buying

India Packaging Machinery Market, by Region

• North India • South India • East India • West IndiaIndia Packaging Machinery Market key player

• Alfa Laval • GEA Group • Buhler • Clextral • Marel • JBT Corporation • TNA Australia Solutions • Bucher industries • Equipamientos Carnicos • S.L • Praj Industries • KHS GmbH • Welbil Inc • Electrolux • Tetra Laval • IMA Group.Frequently Asked Questions:

1) What was the market size of India Packaging Machinery Market markets in 2020? Ans - India Packaging Machinery Market was worth US$ 4162 Mn in 2020. 2) What is the market segment of India Packaging Machinery Market markets? Ans -The market segments are based on Type, Technology & Region. 3) What is forecast period consider for India Packaging Machinery Market? Ans -The forecast period for India Packaging Machinery Market is 2021 to 2027. 4) Which are the worldwide major key players covered for India Packaging Machinery Market report? Ans – Alfa Laval, GEA Group, Buhler, Clextral, Marel, JBT Corporation, TNA Australia Solutions, Bucher industries, Equipamientos Carnicos, S.L, Praj Industries, KHS GmbH, Welbil Inc, Electrolux, Tetra Laval, IMA Group. 5) Which region is dominated in India Packaging Machinery Market? Ans -In 2020, South region dominated the India Packaging Machinery Market.

1. India Packaging Machinery Market: Research Methodology 2. India Packaging Machinery Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to India Packaging Machinery Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. India Packaging Machinery Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1. M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.8.1. PORTERS Five Forces Analysis 3.8.2. PESTLE 3.8.3. Regulatory Landscape by region 3.8.3.1. North India 3.8.3.2. South India 3.8.3.3. East India 3.8.3.4. West India 3.8.4. COVID-19 Impact 4. India Packaging Machinery Market (Value) by region: 4.1. India Packaging Machinery Market, by Type 4.1.1. Form Fill Seal (FFS) 4.1.2. Wrapping and Bundling 4.1.3. Labelling and Coding 4.1.4. Package Closing and Sealing. 4.1.4.1.1. North India 4.1.4.1.2. South India 4.1.4.1.3. East India 4.1.4.1.4. West India 4.2. India Packaging Machinery Market, by End Use Industry 4.2.1. Food & Beverages 4.2.2. Pharmaceutical 4.2.3. Personal Care & Cosmetics 4.2.4. Others. 4.2.4.1.1. North India 4.2.4.1.2. South India 4.2.4.1.3. East India 4.2.4.1.4. West India 4.3. India Packaging Machinery Market, by Technology 4.3.1. MAP Technology 4.3.2. Vacuum Packaging Technology. 4.3.2.1.1. North India 4.3.2.1.2. South India 4.3.2.1.3. East India 4.3.2.1.4. West India 5 Company Profile: Key Players 5.1.1 Alfa Laval 5.1.1.1 Company Overview 5.1.1.2 Financial Overview 5.1.1.3 India Presence 5.1.1.4 Type Portfolio 5.1.1.5 Business Strategy 5.1.1.6 Recent Developments 5.1.2 GEA Group 5.1.3 Buhler 5.1.4 Clextral 5.1.5 Marel 5.1.6 JBT Corporation 5.1.7 TNA Australia Solutions 5.1.8 Bucher industries 5.1.9 Equipamientos Carnicos 5.1.10 S.L 5.1.11 Praj Industries 5.1.12 KHS GmbH 5.1.13 Welbil Inc 5.1.14 Electrolux 5.1.15 Tetra Laval 5.1.16 IMA Group