India M-Commerce Payment Market size is expected to reach nearly US $ 36.5 Bn by 2027 with the CAGR of 22.3% during the forecast period.To know about the Research Methodology :- Request Free Sample Report The report study has analyzed revenue impact of COVID -19 pandemic on the sales revenue of market leaders, market followers and market disrupters in the report and same is reflected in our analysis.

India M-Commerce Payment Market Definition:

M-commerce (mobile commerce or mobile payment) is any payment transaction involving the purchase of goods or services that is completed with a wireless device, like a cellular phone, personal computer (wireless), or personal digital assistant. Mobile payment is a new developing way of paying by using a mobile terminal to start transaction over a mobile network.India M-Commerce Payment Market Dynamics:

The report covers all the trends and technologies playing a major role in the growth of the India M-Commerce Payment Market over the forecast period. It highlights the drivers, restraints, and opportunities expected to influence market growth during 2020-2027. Rapid growth is on the horizon for India’s market for electronic commerce. There is significant room for development from basic access to the internet to innovation in its online payment methods but both the state and e-commerce companies are ramping up investment in the industry’s underlying infrastructure. E-Wallets are also gaining popularity in-store, growing at a rate of 39% each year. Already familiar with using smartphones for social networking, Indian customers are using their trusted mobile devices to pay for goods both offline and online.Digital Wallets in India:

Major fast-growing payment method in India is digital wallets, which are currently used for a quarter of all E-commerce payments. Digital wallet use is expected to grow at a compound annual growth rate of nearly 80% to 2021, at which point it will be the primary online payment method, taking a 34.8% share of sales. There are a plethora of digital wallet options available in India already, with the most popular with Airtel Money and PayPal. Increased M-commerce sales will be supported by good smartphone penetration, which, at 75%, places it on a par with Singapore. This, however, means that a quarter of India’s population does not own a smartphone, proposing further opportunities for growth.

India M-Commerce Payment Market Segmentation:

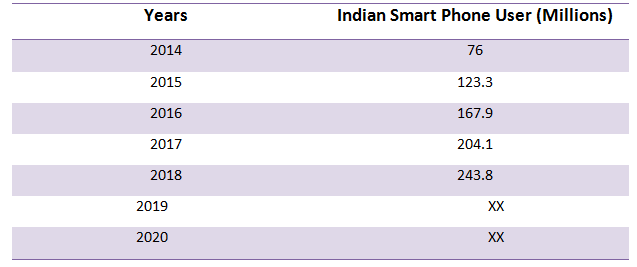

The report covers the segments in the m-commerce payment market such as transactions, payment modes, and end-user. By payment mode, Near Field Communication (NFC) is expected to account for the largest XX% market share by 2027. Renewed interest in NFC is anticipated to provide lucrative opportunities for the Indian market in upcoming years. Such as, ICICI Bank launches NFC-based contactless mobile pay solution in March 2016. Digital wallets using near field communication (NFC) for contactless card machines comprise Samsung Pay, Apple Pay, and Google Pay and this is consequently set fuel the M-commerce market in India.Smartphone User in India:

India A World Leader in App-Based Payment Methods

M-commerce is set to become the primary payment method for online shopping in India. It is already used for 46% of transactions. The high growth potential of the Indian e-commerce market is based on existing smartphone penetration, which is low, with only 22 % of the population owning such a device. The objective of the report is to present a comprehensive analysis of the India M-Commerce Payment Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding India M-Commerce Payment Market dynamics, structure by analyzing the market segments and projects the India M-Commerce Payment Market size. Clear representation of competitive analysis of key players by application, price, financial position, Product portfolio, growth strategies, and country presence in the India M-Commerce Payment Market make the report investor’s guide.Scope of the India M-Commerce Payment Market: Inquire before buying

India M-Commerce Payment Market, by Transactions

• M-Retailing • M-ticketing/booking • M-billing • Other M-Commerce ServicesIndia M-Commerce Payment Market, by Payment Modes

• Near Field Communication (NFC) • Premium SMS • Wireless application protocol (WAP) • Direct Carrier BillingIndia M-Commerce Payment Market, by End User

• Smart device users • Feature phone usersKey players operating in India M-Commerce Payment Market

• PayTM • PayUMoney • Freecharge • MobiKwik • BHIM UPI • Google Tez • PayPal Holdings • Samsung • Orange S.A. • Vodacom Group Limited • MasterCard Incorporated • Bharti Airtel Limited • MTN Group Limited • Safaricom Limited, Inc. • Econet Wireless Zimbabwe Limited • PayPal India • CCAvenue • Razorpay • Instamojo • Cashfree • FrstPay • FonePaisa • DirecPay

India M-Commerce Payment Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: India M-Commerce Payment Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. India M-Commerce Payment Market Analysis and Forecast, By Transactions 6.1. Introduction and Definition 6.2. Key Findings 6.3. India M-Commerce Payment Market Value Share Analysis, By Transactions 6.4. India M-Commerce Payment Market Size (US$ Mn) Forecast, By Transactions 6.5. India M-Commerce Payment Market Analysis, By Transactions 6.6. India M-Commerce Payment Market Attractiveness Analysis, By Transactions 7. India M-Commerce Payment Market Analysis and Forecast, By Payment Modes 7.1. Introduction and Definition 7.2. Key Findings 7.3. India M-Commerce Payment Market Value Share Analysis, By Payment Modes 7.4. India M-Commerce Payment Market Size (US$ Mn) Forecast, By Payment Modes 7.5. India M-Commerce Payment Market Analysis, By Payment Modes 7.6. India M-Commerce Payment Market Attractiveness Analysis, By Payment Modes 8. India M-Commerce Payment Market Analysis and Forecast, By End User 8.1. Introduction and Definition 8.2. Key Findings 8.3. India M-Commerce Payment Market Value Share Analysis, By End User 8.4. India M-Commerce Payment Market Size (US$ Mn) Forecast, By End User 8.5. India M-Commerce Payment Market Analysis, By End User 8.6. India M-Commerce Payment Market Attractiveness Analysis, By End User 9. India M-Commerce Payment Market Analysis 9.1. Key Findings 9.2. India M-Commerce Payment Market Overview 9.3. India M-Commerce Payment Market Value Share Analysis, By Transactions 9.4. India M-Commerce Payment Market Forecast, By Transactions 9.4.1. M-Retailing 9.4.2. M-ticketing/booking 9.4.3. M-billing 9.4.4. Other M-Commerce Services 9.5. India M-Commerce Payment Market Value Share Analysis, By Payment Modes 9.6. India M-Commerce Payment Market Forecast, By Payment Modes 9.6.1. Near Field Communication (NFC) 9.6.2. Premium SMS 9.6.3. Wireless application protocol (WAP) 9.6.4. Direct Carrier Billing 9.7. India M-Commerce Payment Market Value Share Analysis, By End User 9.8. India M-Commerce Payment Market Forecast, By End User 9.8.1. Smart device users 9.8.2. Feature phone users 9.9. PEST Analysis 9.10. Key Trends 9.11. Key Developments 10. Company Profiles 10.1. Market Share Analysis, by Company 10.2. Competition Matrix 10.2.1. Competitive Benchmarking of key players by price, presence, market share, Solutions and R&D investment 10.2.2. New Product Launches and Product Enhancements 10.2.3. Market Consolidation 10.2.3.1. M&A by Country, Investment and Solutions 10.2.3.2. M&A Key Players, Forward Integration and Backward 10.2.3.3. Integration 10.3. Company Profiles: Key Players 10.3.1. PayTM 10.3.1.1. Company Overview 10.3.1.2. Financial Overview 10.3.1.3. Product Portfolio 10.3.1.4. Business Strategy 10.3.1.5. Recent Developments 10.3.1.6. Company Footprint 10.3.2. PayUMoney 10.3.3. Freecharge 10.3.4. MobiKwik 10.3.5. BHIM UPI 10.3.6. Google Tez 10.3.7. PayPal Holdings 10.3.8. Samsung 10.3.9. Orange S.A. 10.3.10. Vodacom Group Limited 10.3.11. MasterCard Incorporated 10.3.12. Bharti Airtel Limited 10.3.13. MTN Group Limited 10.3.14. Safaricom Limited, Inc. 10.3.15. Econet Wireless Zimbabwe Limited 10.3.16. PayPal India 10.3.17. CCAvenue 10.3.18. Razorpay 10.3.19. Instamojo 10.3.20. Cashfree 10.3.21. FrstPay 10.3.22. FonePaisa 10.3.23. DirecPay 11. Primary Key Insights