M-Commerce Payment Market size is expected to reach nearly US $ 52.41 Bn by 2029 with the CAGR of 16.5% during the forecast period.M-Commerce Payment Market Definition:

M-commerce (Mobile Commerce) is another name for an E-commerce transaction, which includes the use of wireless devices like smartphones, tablets, laptops, with the help of internet under the supply medium of wireless or wired. Mobile payments of many types are utilized for diverse operations, including ordering takeaway food, movie tickets, and smartphone game upgrade across various end-user industries.To know about the Research Methodology :- Request Free Sample Report The report study has analyzed revenue impact of COVID -19 pandemic on the sales revenue of market leaders, market followers and market disrupters in the report and same is reflected in our analysis.

Global M-Commerce Payment Market Dynamics:

The world of M-Commerce or mobile payments is always evolving with rapidly growing consumer needs. The importance of mobile commerce is further reinforced by the fact that over 35% of the visitors to popular E-commerce sites prefer using an app rather than the web version. Along with M-Commerce, the mobile payment sector is also one of the most dynamic and fastest-growing sectors of the international economy and supports different types of technologies and business models aiming in various global markets. Renewed interest in near field communication is anticipated to offer lucrative opportunities for the market in future. Such as, ICICI Bank launches NFC-based contactless mobile pay solution on March 2017. So, the scope of the report includes a detailed study of global and regional markets for M-Commerce Payment with the reasons given for variations in the growth of the industry in certain regions.Barriers to M-commerce payment adoption:

A lack of infrastructure and large unbanked populations has held back M-Commerce payment adoption in some developing markets. In developed economies, including the UK, Australia & Finland the extensive use of contactless payment cards has been a barrier to adoption. Also, security breaches and privacy of the user data are major concerns for the M-commerce payment market and might hamper the market growth.Global M-Commerce Payment Market Ongoing Trend:

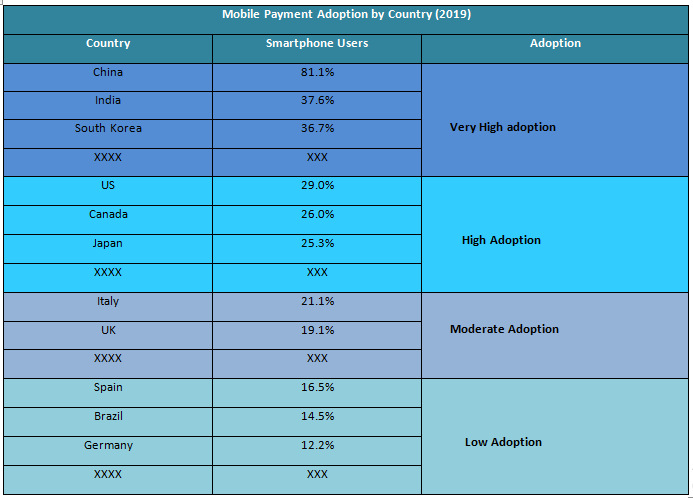

The report covers all the trends and technologies playing a major role in the growth of the M-Commerce payment market over 2022-2029. Growing demand and high penetration of smartphones across the world have led the users to focus more on mobile-based payments and transactions using mobile wallets that are anticipated to have a positive impact on market growth. According to the research, approximately 66% of the World Population has adopted smartphones as of 2021.Global M-Commerce Payment Market Segment Analysis:

By payment modes, the near field communication (NFC) segment was valued at USD xx Mn. in 2021 and is expected to reach USD xx Mn. by 2029 at a CAGR of xx% during the forecast period. Digital wallets using near field communication (NFC) for contactless card machines comprise Samsung Pay, Apple Pay, and Google Pay and this is consequently set fuel the mobile commerce market. NFC phones can communicate with NFC-enabled card machines using close-proximity radio regularity identification. The mobile phones are not desired to touch the point of sale to transfer cash, but they have to be within a few inches of the terminal. Likewise, the MMR report covers all segments in the M-Commerce payment market such as transactions, payment modes, and end-user.Mobile Payment Usage is Highest in Global Economies:

Global M-Commerce Payment Market Regional Analysis:

The report offers a brief analysis of the major regions in the M-Commerce payment market, such as Asia-Pacific, Europe, North America, South America, and the Middle East & Africa. The Asia Pacific M-Commerce payment market was valued at US$ xx million in 2021 and is expected to reach a value of US$ xx million by 2029, with a CAGR of xx% during the forecast period. The APAC is increasingly becoming popular for the adoption of its M-Commerce payment models. Major economies, like China, Japan, India, and Australia, are providing a stable ecosystem for the growth of the M-Commerce payment market. In India, the recent demonetization act has brought widespread awareness about other modes of payment other than cash. According to the Visa Company, the company has crossed more than US$ 20.0 Mn. contactless cards in 2021 in India. The Visa Company also reveals that the contact less payment method and QR transactions make more than ~25% of the transactions processed by Visa in India.Global M-Commerce Payment Market Key Development:

The MMR research study includes the profiles of leading companies operating in the global M-Commerce payment market. In Feb 2021, Visa and Planeta announced the launch of new technology that allows public transit operators global to implement contactless payments faster and at ease than ever, and for a much lower cost. The objective of the report is to present a comprehensive analysis of the Global M-Commerce Payment Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global M-Commerce Payment Market dynamics, structure by analyzing the market segments and projects the Global M-Commerce Payment Market size. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global M-Commerce Payment Market make the report investor’s guide.Global M-Commerce Payment Market Scope: Inquire before buying

Global M-Commerce Payment Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 15.44 Bn. Forecast Period 2022 to 2029 CAGR: 16.5% Market Size in 2029: US $ 52.41 Bn. Segments Covered: by Transactions • M-Retailing • M-ticketing/booking • M-billing • Other M-Commerce Services by Payment Modes • Near Field Communication (NFC) • Premium SMS • Wireless application protocol (WAP) • Direct Carrier Billing by End User • Smart device users • Feature phone users Global M-Commerce Payment Market, by Region

• Asia Pacific • North America • Europe • South America • Middle East AfricaGlobal M-Commerce Payment Market, Key players

• Ericsson • Gemalto • Jack Henry & Associates Inc • Google Inc. • IBM Corp. • Mastercard Inc. • Mopay AG • ACI Wrldwide, Inc. • Oxygen8 • Fiserv, Inc. • Paypal • SAP AG • Visa Inc. • Samsung Electronics Company Limited • Square, Inc • Fidelity National Information Services, Inc. • Apple Inc • Alphabet Inc • DH Corporation • Fiserv, Inc. • Jack Henry & Associates Inc. Frequently Asked Questions: 1. Which region has the largest share in Global M-Commerce Payment Market? Ans: Asia Pacific region holds the highest share in 2021. 2. What is the growth rate of Global M-Commerce Payment Market? Ans: The Global M-Commerce Payment Market is growing at a CAGR of 16.5% during forecasting period 2022-2029. 3. What is scope of the Global M-Commerce Payment market report? Ans: Global M-Commerce Payment Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global M-Commerce Payment market? Ans: The important key players in the Global M-Commerce Payment Market are – Ericsson, Gemalto, Jack Henry & Associates Inc, Google Inc., IBM Corp., Mastercard Inc., Mopay AG, ACI Wrldwide, Inc., Oxygen8, Fiserv, Inc., Paypal, SAP AG, Visa Inc., Samsung Electronics Company Limited, Square, Inc, Fidelity National Information Services, Inc., Apple Inc, Alphabet Inc, DH Corporation, Fiserv, Inc., and Jack Henry & Associates Inc. 5. What is the study period of this market? Ans: The Global M-Commerce Payment Market is studied from 2021 to 2029.

Global M-Commerce Payment Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global M-Commerce Payment Market Size, by Market Value (US$ Bn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Global M-Commerce Payment Market Analysis and Forecast 6.1. M-Commerce Payment Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Global M-Commerce Payment Market Analysis and Forecast, By End User 7.1. Introduction and Definition 7.2. Key Findings 7.3. M-Commerce Payment Market Value Share Analysis, By End User 7.4. M-Commerce Payment Market Size (US$ Bn) Forecast, By End User 7.5. M-Commerce Payment Market Analysis, By End User 7.6. M-Commerce Payment Market Attractiveness Analysis, By End User 8. Global M-Commerce Payment Market Analysis and Forecast, By Transactions 8.1. Introduction and Definition 8.2. Key Findings 8.3. M-Commerce Payment Market Value Share Analysis, By Transactions 8.4. M-Commerce Payment Market Size (US$ Bn) Forecast, By Transactions 8.5. M-Commerce Payment Market Analysis, By Transactions 8.6. M-Commerce Payment Market Attractiveness Analysis, By Transactions 9. Global M-Commerce Payment Market Analysis and Forecast, By Payment Modes 9.1. Introduction and Definition 9.2. Key Findings 9.3. M-Commerce Payment Market Value Share Analysis, By Payment Modes 9.4. M-Commerce Payment Market Size (US$ Bn) Forecast, By Payment Modes 9.5. M-Commerce Payment Market Analysis, By Payment Modes 9.6. M-Commerce Payment Market Attractiveness Analysis, By Payment Modes 10. Global M-Commerce Payment Market Analysis, by Region 10.1. M-Commerce Payment Market Value Share Analysis, by Region 10.2. M-Commerce Payment Market Size (US$ Bn) Forecast, by Region 10.3. M-Commerce Payment Market Attractiveness Analysis, by Region 11. North America M-Commerce Payment Market Analysis 11.1. Key Findings 11.2. North America M-Commerce Payment Market Overview 11.3. North America M-Commerce Payment Market Value Share Analysis, By End User 11.4. North America M-Commerce Payment Market Forecast, By End User 11.4.1. Smart device users 11.4.2. Feature phone users 11.5. North America M-Commerce Payment Market Value Share Analysis, By Transactions 11.6. North America M-Commerce Payment Market Forecast, By Transactions 11.6.1.1. M-Retailing 11.6.1.2. M-ticketing/booking 11.6.1.3. M-billing 11.6.1.4. Other M-Commerce Services 11.7. North America M-Commerce Payment Market Value Share Analysis, By Payment Modes 11.8. North America M-Commerce Payment Market Forecast, By Payment Modes 11.8.1. Near Field Communication (NFC) 11.8.2. Premium SMS 11.8.3. Wireless application protocol (WAP) 11.8.4. Direct Carrier Billing 11.9. North America M-Commerce Payment Market Value Share Analysis, by Country 11.10. North America M-Commerce Payment Market Forecast, by Country 11.10.1. U.S. 11.10.2. Canada 11.11. North America M-Commerce Payment Market Analysis, by Country 11.12. U.S. M-Commerce Payment Market Forecast, By End User 11.12.1. Smart device users 11.12.2. Feature phone users 11.13. U.S. M-Commerce Payment Market Forecast, By Transactions 11.13.1. M-Retailing 11.13.2. M-ticketing/booking 11.13.3. M-billing 11.13.4. Other M-Commerce Services 11.14. U.S. M-Commerce Payment Market Forecast, By Payment Modes 11.14.1. Near Field Communication (NFC) 11.14.2. Premium SMS 11.14.3. Wireless application protocol (WAP) 11.14.4. Direct Carrier Billing 11.15. Canada M-Commerce Payment Market Forecast, By End User 11.15.1. Smart device users 11.15.2. Feature phone users 11.16. Canada M-Commerce Payment Market Forecast, By Transactions 11.16.1. M-Retailing 11.16.2. M-ticketing/booking 11.16.3. M-billing 11.16.4. Other M-Commerce Services 11.17. Canada M-Commerce Payment Market Forecast, By Payment Modes 11.17.1. Near Field Communication (NFC) 11.17.2. Premium SMS 11.17.3. Wireless application protocol (WAP) 11.17.4. Direct Carrier Billing 11.18. North America M-Commerce Payment Market Attractiveness Analysis 11.18.1. By End User 11.18.2. By Transactions 11.18.3. By Payment Modes 11.19. PEST Analysis 11.20. Key Trends 11.21. Key Developments 12. Europe M-Commerce Payment Market Analysis 12.1. Key Findings 12.2. Europe M-Commerce Payment Market Overview 12.3. Europe M-Commerce Payment Market Value Share Analysis, By End User 12.4. Europe M-Commerce Payment Market Forecast, By End User 12.4.1. Smart device users 12.4.2. Feature phone users 12.5. Europe M-Commerce Payment Market Value Share Analysis, By Transactions 12.6. Europe M-Commerce Payment Market Forecast, By Transactions 12.6.1.1. M-Retailing 12.6.1.2. M-ticketing/booking 12.6.1.3. M-billing 12.6.1.4. Other M-Commerce Services 12.7. Europe M-Commerce Payment Market Value Share Analysis, By Payment Modes 12.8. Europe M-Commerce Payment Market Forecast, By Payment Modes 12.8.1. Near Field Communication (NFC) 12.8.2. Premium SMS 12.8.3. Wireless application protocol (WAP) 12.8.4. Direct Carrier Billing 12.9. Europe M-Commerce Payment Market Value Share Analysis, by Country 12.10. Europe M-Commerce Payment Market Forecast, by Country 12.10.1. Germany 12.10.2. U.K. 12.10.3. France 12.10.4. Italy 12.10.5. Spain 12.10.6. Rest of Europe 12.11. Europe M-Commerce Payment Market Analysis, by Country 12.12. Germany M-Commerce Payment Market Forecast, By End User 12.12.1. Smart device users 12.12.2. Feature phone users 12.13. Germany M-Commerce Payment Market Forecast, By Transactions 12.13.1. M-Retailing 12.13.2. M-ticketing/booking 12.13.3. M-billing 12.13.4. Other M-Commerce Services 12.14. Germany M-Commerce Payment Market Forecast, By Payment Modes 12.14.1. Near Field Communication (NFC) 12.14.2. Premium SMS 12.14.3. Wireless application protocol (WAP) 12.14.4. Direct Carrier Billing 12.15. U.K. M-Commerce Payment Market Forecast, By End User 12.15.1. Smart device users 12.15.2. Feature phone users 12.16. U.K. M-Commerce Payment Market Forecast, By Transactions 12.16.1. M-Retailing 12.16.2. M-ticketing/booking 12.16.3. M-billing 12.16.4. Other M-Commerce Services 12.17. U.K. M-Commerce Payment Market Forecast, By Payment Modes 12.17.1. Near Field Communication (NFC) 12.17.2. Premium SMS 12.17.3. Wireless application protocol (WAP) 12.17.4. Direct Carrier Billing 12.18. France M-Commerce Payment Market Forecast, By End User 12.18.1. Smart device users 12.18.2. Feature phone users 12.19. France M-Commerce Payment Market Forecast, By Transactions 12.19.1. M-Retailing 12.19.2. M-ticketing/booking 12.19.3. M-billing 12.19.4. Other M-Commerce Services 12.20. France M-Commerce Payment Market Forecast, By Payment Modes 12.20.1. Near Field Communication (NFC) 12.20.2. Premium SMS 12.20.3. Wireless application protocol (WAP) 12.20.4. Direct Carrier Billing 12.21. Italy M-Commerce Payment Market Forecast, By End User 12.21.1. Smart device users 12.21.2. Feature phone users 12.22. Italy M-Commerce Payment Market Forecast, By Transactions 12.22.1. M-Retailing 12.22.2. M-ticketing/booking 12.22.3. M-billing 12.22.4. Other M-Commerce Services 12.23. Italy M-Commerce Payment Market Forecast, By Payment Modes 12.23.1. Near Field Communication (NFC) 12.23.2. Premium SMS 12.23.3. Wireless application protocol (WAP) 12.23.4. Direct Carrier Billing 12.24. Spain M-Commerce Payment Market Forecast, By End User 12.24.1. Smart device users 12.24.2. Feature phone users 12.25. Spain M-Commerce Payment Market Forecast, By Transactions 12.25.1. M-Retailing 12.25.2. M-ticketing/booking 12.25.3. M-billing 12.25.4. Other M-Commerce Services 12.26. Spain M-Commerce Payment Market Forecast, By Payment Modes 12.26.1. Near Field Communication (NFC) 12.26.2. Premium SMS 12.26.3. Wireless application protocol (WAP) 12.26.4. Direct Carrier Billing 12.27. Rest of Europe M-Commerce Payment Market Forecast, By End User 12.27.1. Smart device users 12.27.2. Feature phone users 12.28. Rest of Europe M-Commerce Payment Market Forecast, By Transactions 12.28.1. M-Retailing 12.28.2. M-ticketing/booking 12.28.3. M-billing 12.28.4. Other M-Commerce Services 12.29. Rest Of Europe M-Commerce Payment Market Forecast, By Payment Modes 12.29.1. Near Field Communication (NFC) 12.29.2. Premium SMS 12.29.3. Wireless application protocol (WAP) 12.29.4. Direct Carrier Billing 12.30. Europe M-Commerce Payment Market Attractiveness Analysis 12.30.1. By End User 12.30.2. By Transactions 12.30.3. By Payment Modes 12.31. PEST Analysis 12.32. Key Trends 12.33. Key Developments 13. Asia Pacific M-Commerce Payment Market Analysis 13.1. Key Findings 13.2. Asia Pacific M-Commerce Payment Market Overview 13.3. Asia Pacific M-Commerce Payment Market Value Share Analysis, By End User 13.4. Asia Pacific M-Commerce Payment Market Forecast, By End User 13.4.1. Smart device users 13.4.2. Feature phone users 13.5. Asia Pacific M-Commerce Payment Market Value Share Analysis, By Transactions 13.6. Asia Pacific M-Commerce Payment Market Forecast, By Transactions 13.6.1.1. M-Retailing 13.6.1.2. M-ticketing/booking 13.6.1.3. M-billing 13.6.1.4. Other M-Commerce Services 13.7. Asia Pacific M-Commerce Payment Market Value Share Analysis, By Payment Modes 13.8. Asia Pacific M-Commerce Payment Market Forecast, By Payment Modes 13.8.1. Near Field Communication (NFC) 13.8.2. Premium SMS 13.8.3. Wireless application protocol (WAP) 13.8.4. Direct Carrier Billing 13.9. Asia Pacific M-Commerce Payment Market Value Share Analysis, by Country 13.10. Asia Pacific M-Commerce Payment Market Forecast, by Country 13.10.1. China 13.10.2. India 13.10.3. Japan 13.10.4. ASEAN 13.10.5. Rest of Asia Pacific 13.11. Asia Pacific M-Commerce Payment Market Analysis, by Country 13.12. China M-Commerce Payment Market Forecast, By End User 13.12.1. Smart device users 13.12.2. Feature phone users 13.13. China M-Commerce Payment Market Forecast, By Transactions 13.13.1. M-Retailing 13.13.2. M-ticketing/booking 13.13.3. M-billing 13.13.4. Other M-Commerce Services 13.14. China M-Commerce Payment Market Forecast, By Payment Modes 13.14.1. Near Field Communication (NFC) 13.14.2. Premium SMS 13.14.3. Wireless application protocol (WAP) 13.14.4. Direct Carrier Billing 13.15. India M-Commerce Payment Market Forecast, By End User 13.15.1. Smart device users 13.15.2. Feature phone users 13.16. India M-Commerce Payment Market Forecast, By Transactions 13.16.1. M-Retailing 13.16.2. M-ticketing/booking 13.16.3. M-billing 13.16.4. Other M-Commerce Services 13.17. India M-Commerce Payment Market Forecast, By Payment Modes 13.17.1. Near Field Communication (NFC) 13.17.2. Premium SMS 13.17.3. Wireless application protocol (WAP) 13.17.4. Direct Carrier Billing 13.18. Japan M-Commerce Payment Market Forecast, By End User 13.18.1. Smart device users 13.18.2. Feature phone users 13.19. Japan M-Commerce Payment Market Forecast, By Transactions 13.19.1. M-Retailing 13.19.2. M-ticketing/booking 13.19.3. M-billing 13.19.4. Other M-Commerce Services 13.20. Japan M-Commerce Payment Market Forecast, By Payment Modes 13.20.1. Near Field Communication (NFC) 13.20.2. Premium SMS 13.20.3. Wireless application protocol (WAP) 13.20.4. Direct Carrier Billing 13.21. ASEAN M-Commerce Payment Market Forecast, By End User 13.21.1. Smart device users 13.21.2. Feature phone users 13.22. ASEAN M-Commerce Payment Market Forecast, By Transactions 13.22.1. M-Retailing 13.22.2. M-ticketing/booking 13.22.3. M-billing 13.22.4. Other M-Commerce Services 13.23. ASEAN M-Commerce Payment Market Forecast, By Payment Modes 13.23.1. Near Field Communication (NFC) 13.23.2. Premium SMS 13.23.3. Wireless application protocol (WAP) 13.23.4. Direct Carrier Billing 13.24. Rest of Asia Pacific M-Commerce Payment Market Forecast, By End User 13.24.1. Smart device users 13.24.2. Feature phone users 13.25. Rest of Asia Pacific M-Commerce Payment Market Forecast, By Transactions 13.25.1. M-Retailing 13.25.2. M-ticketing/booking 13.25.3. M-billing 13.25.4. Other M-Commerce Services 13.26. Rest of Asia Pacific M-Commerce Payment Market Forecast, By Payment Modes 13.26.1. Near Field Communication (NFC) 13.26.2. Premium SMS 13.26.3. Wireless application protocol (WAP) 13.26.4. Direct Carrier Billing 13.27. Asia Pacific M-Commerce Payment Market Attractiveness Analysis 13.27.1. By End User 13.27.2. By Transactions 13.27.3. By Payment Modes 13.28. PEST Analysis 13.29. Key Trends 13.30. Key Developments 14. Middle East & Africa M-Commerce Payment Market Analysis 14.1. Key Findings 14.2. Middle East & Africa M-Commerce Payment Market Overview 14.3. Middle East & Africa M-Commerce Payment Market Value Share Analysis, By End User 14.4. Middle East & Africa M-Commerce Payment Market Forecast, By End User 14.4.1. Smart device users 14.4.2. Feature phone users 14.5. Middle East & Africa M-Commerce Payment Market Value Share Analysis, By Transactions 14.6. Middle East & Africa M-Commerce Payment Market Forecast, By Transactions 14.6.1.1. M-Retailing 14.6.1.2. M-ticketing/booking 14.6.1.3. M-billing 14.6.1.4. Other M-Commerce Services 14.7. Middle East & Africa M-Commerce Payment Market Value Share Analysis, By Payment Modes 14.8. Middle East & Africa M-Commerce Payment Market Forecast, By Payment Modes 14.8.1. Near Field Communication (NFC) 14.8.2. Premium SMS 14.8.3. Wireless application protocol (WAP) 14.8.4. Direct Carrier Billing 14.9. Middle East & Africa M-Commerce Payment Market Value Share Analysis, by Country 14.10. Middle East & Africa M-Commerce Payment Market Forecast, by Country 14.10.1. GCC 14.10.2. South Africa 14.10.3. Rest of Middle East & Africa 14.11. Middle East & Africa M-Commerce Payment Market Analysis, by Country 14.12. GCC M-Commerce Payment Market Forecast, By End User 14.12.1. Smart device users 14.12.2. Feature phone users 14.13. GCC M-Commerce Payment Market Forecast, By Transactions 14.13.1. M-Retailing 14.13.2. M-ticketing/booking 14.13.3. M-billing 14.13.4. Other M-Commerce Services 14.14. GCC M-Commerce Payment Market Forecast, By Payment Modes 14.14.1. Near Field Communication (NFC) 14.14.2. Premium SMS 14.14.3. Wireless application protocol (WAP) 14.14.4. Direct Carrier Billing 14.15. South Africa M-Commerce Payment Market Forecast, By End User 14.15.1. Smart device users 14.15.2. Feature phone users 14.16. South Africa M-Commerce Payment Market Forecast, By Transactions 14.16.1. M-Retailing 14.16.2. M-ticketing/booking 14.16.3. M-billing 14.16.4. Other M-Commerce Services 14.17. South Africa M-Commerce Payment Market Forecast, By Payment Modes 14.17.1. Near Field Communication (NFC) 14.17.2. Premium SMS 14.17.3. Wireless application protocol (WAP) 14.17.4. Direct Carrier Billing 14.18. Rest of Middle East & Africa M-Commerce Payment Market Forecast, By End User 14.18.1. Smart device users 14.18.2. Feature phone users 14.19. Rest of Middle East & Africa M-Commerce Payment Market Forecast, By Transactions 14.19.1. M-Retailing 14.19.2. M-ticketing/booking 14.19.3. M-billing 14.19.4. Other M-Commerce Services 14.20. Middle East & Africa M-Commerce Payment Market Forecast, By Payment Modes 14.20.1. Near Field Communication (NFC) 14.20.2. Premium SMS 14.20.3. Wireless application protocol (WAP) 14.20.4. Direct Carrier Billing 14.21. Middle East & Africa M-Commerce Payment Market Attractiveness Analysis 14.21.1. By End User 14.21.2. By Transactions 14.21.3. By Payment Modes 14.22. PEST Analysis 14.23. Key Trends 14.24. Key Developments 15. South America M-Commerce Payment Market Analysis 15.1. Key Findings 15.2. South America M-Commerce Payment Market Overview 15.3. South America M-Commerce Payment Market Value Share Analysis, By End User 15.4. South America M-Commerce Payment Market Forecast, By End User 15.4.1. Smart device users 15.4.2. Feature phone users 15.5. South America M-Commerce Payment Market Value Share Analysis, By Transactions 15.6. South America M-Commerce Payment Market Forecast, By Transactions 15.6.1.1. M-Retailing 15.6.1.2. M-ticketing/booking 15.6.1.3. M-billing 15.6.1.4. Other M-Commerce Services 15.7. South America M-Commerce Payment Market Value Share Analysis, By Payment Modes 15.8. South America M-Commerce Payment Market Forecast, By Payment Modes 15.8.1. Near Field Communication (NFC) 15.8.2. Premium SMS 15.8.3. Wireless application protocol (WAP) 15.8.4. Direct Carrier Billing 15.9. South America M-Commerce Payment Market Value Share Analysis, by Country 15.10. South America M-Commerce Payment Market Forecast, by Country 15.10.1. Brazil 15.10.2. Mexico 15.10.3. Rest of South America 15.11. South America M-Commerce Payment Market Analysis, by Country 15.12. Brazil M-Commerce Payment Market Forecast, By End User 15.12.1. Smart device users 15.12.2. Feature phone users 15.13. Brazil M-Commerce Payment Market Forecast, By Transactions 15.13.1. M-Retailing 15.13.2. M-ticketing/booking 15.13.3. M-billing 15.13.4. Other M-Commerce Services 15.14. Brazil M-Commerce Payment Market Forecast, By Payment Modes 15.14.1. Near Field Communication (NFC) 15.14.2. Premium SMS 15.14.3. Wireless application protocol (WAP) 15.14.4. Direct Carrier Billing 15.15. Mexico M-Commerce Payment Market Forecast, By End User 15.15.1. Smart device users 15.15.2. Feature phone users 15.16. Mexico M-Commerce Payment Market Forecast, By Transactions 15.16.1. M-Retailing 15.16.2. M-ticketing/booking 15.16.3. M-billing 15.16.4. Other M-Commerce Services 15.17. Mexico M-Commerce Payment Market Forecast, By Payment Modes 15.17.1. Near Field Communication (NFC) 15.17.2. Premium SMS 15.17.3. Wireless application protocol (WAP) 15.17.4. Direct Carrier Billing 15.18. Rest of South America M-Commerce Payment Market Forecast, By End User 15.18.1. Smart device users 15.18.2. Feature phone users 15.19. Rest of South America M-Commerce Payment Market Forecast, By Transactions 15.19.1. M-Retailing 15.19.2. M-ticketing/booking 15.19.3. M-billing 15.19.4. Other M-Commerce Services 15.20. Rest of South America M-Commerce Payment Market Forecast, By Payment Modes 15.20.1. Near Field Communication (NFC) 15.20.2. Premium SMS 15.20.3. Wireless application protocol (WAP) 15.20.4. Direct Carrier Billing 15.21. South America M-Commerce Payment Market Attractiveness Analysis 15.21.1. By End User 15.21.2. By Transactions 15.21.3. By Payment Modes 15.22. PEST Analysis 15.23. Key Trends 15.24. Key Developments 16. Company Profiles 16.1. Market Share Analysis, by Company 16.2. Competition Matrix 16.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 16.2.2. New Product Launches and Product Enhancements 16.2.3. Market Consolidation 16.2.3.1. M&A by Regions, Investment and Applications 16.2.3.2. M&A Key Players, Forward Integration and Backward 16.2.3.3. Integration 16.3. Company Profiles: Key Players 16.3.1. Ericsson 16.3.1.1. Company Overview 16.3.1.2. Financial Overview 16.3.1.3. Product Portfolio 16.3.1.4. Business Strategy 16.3.1.5. Recent Developments 16.3.1.6. Development Footprint 16.3.2. Gemalto 16.3.3. Jack Henry & Associates Inc 16.3.4. Google Inc. 16.3.5. IBM Corp. 16.3.6. Mastercard Inc. 16.3.7. Mopay AG 16.3.8. ACI Wrldwide, Inc. 16.3.9. Oxygen8 16.3.10. Fiserv, Inc. 16.3.11. Paypal 16.3.12. SAP AG 16.3.13. Visa Inc. 16.3.14. Samsung Electronics Company Limited 16.3.15. Square, Inc 16.3.16. Fidelity National Information Services, Inc. 16.3.17. Apple Inc 16.3.18. Alphabet Inc 16.3.19. DH Corporation 16.3.20. Fiserv, Inc. 16.3.21. Jack Henry & Associates Inc. 17. Primary Key Insights