The Liquid Chlorine demand in India stood at 1119.4 Kilo Tons in the year 2020 & is expected to reach 1789 Kilo Tons by 2027, at a CAGR of 6.93% during the forecast period.India Liquid Chlorine Market Overview:

The Rising demand for Chlorine derivatives, like PVC which is extensively used in construction, automobile, packaging, electronic & healthcare uses will push the Liquid Chlorine demand during the forecast period. Chlorine & Ethylene are countered to produce Ethylene Dichloride which is used to make Vinyl Chloride Monomer. Vinyl Chloride Monomer is further managed to make PVC. Polyvinyl Chloride is a highly durable construction material, used in different applications like rigid or flexible, white, black or multi-colored applications.To know about the Research Methodology :- Request Free Sample Report There has been extensive growth in demand for PVC resins from pipes & fittings which replaces to decrease water losses from the ageing infrastructure. Heavy investments made by the government of India in the region’s infrastructure developments backed by the growing focus on irrigational land are the key drivers for the Polyvinyl Chloride demand development further rising the demand for Liquid Chlorine during the forecast period. In adding, Chlorinated Paraffin Wax that are used to impart flame retardant properties to the Polyvinyl Chloride products like PVC cables & flooring will further rise the Liquid Chlorine demand during the forecast period. However, an unexpected outbreak of the Corona Virus which led to extended nation-wide lockdown in India strictly affected the Chlor-Alkali industry which continued hard hit as construction actions endured stalled for most of Q4 FY20. Battered by the demand slump, numerous Chlor-Alkali producers such as GACL, Grasim & Meghmani had to close their manufacturing units while others declared operational cuts up to 40 percent to deal with expansion inventories. Chlorine values are intensely driven by the local demand-supply aspects, hence domestic players reported contracted margins through the fourth quarter. However, firming consumption of Liquid Chlorine for water treatment purposes owing to the government’s active measures to keep safe hygiene practices throughout the pandemic supported the stable value trend. Moreover, with ease in lockdown restraints & resumption of downstream activities, demand for Liquid Chlorine & its derivatives is anticipated to increase to appreciable levels.

Key players working in India’s Liquid Chlorine market are Aditya Birla Chemicals India, Tata Chemicals Limited, DCW Limited, Gujarat Alkalies, and Chemicals Limited, Grasim Industries Limited, DCM Shriram Consolidated Limited, Meghmani Organics Limited, Nirma Limited, Chemplast Sanmar Limited, Chemicals Limited, Others. In the year 2019, DCM Shriram Ltd. commissioned a 60 TPD Aluminium Chloride plant in Gujarat (Bharuch) with an investment of about INR 31 Cr in order to rise the portfolio of its Chlorine downstream products. Also, some Indian firms are planning to expand capacity uses during the forecast period with steady improvement in the local Liquid Chlorine market with adding of downstream businesses. As Liquid Chlorine is a bulk product, its demand has been powerfully driven by the local demand-supply situation.

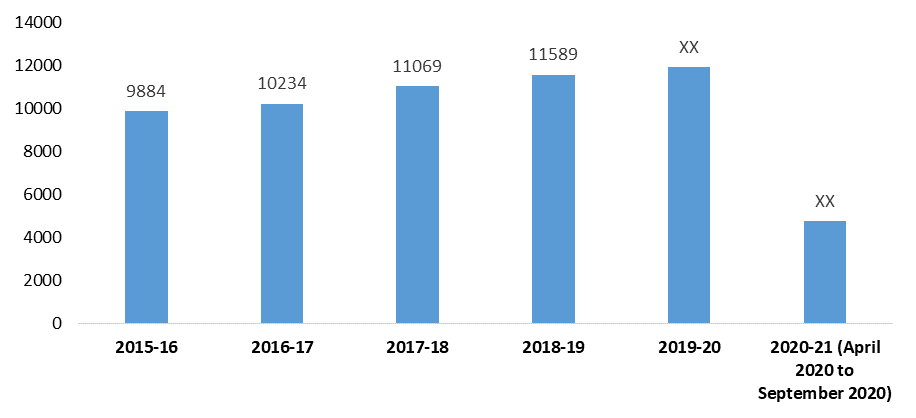

Production of selected Major Chemicals & Petrochemicals:

An enormous drop in India’s GDP owing to economic slowdown caused due to the Corona Virus pandemic crisis is revealing of lesser downstream demand in the next few quarters. However, as the Indian construction industry is anticipated to reach $738.5 Billion by the year 2022, the Liquid Chlorine demand estimate for manufacturing PVC resin looks highly optimistic. However, challenges related to the storage & transportation of Liquid Chlorine makes the local Chlor-Alkali manufacturers run their plants based on the domestic Chlorine demand. Hence, if Chlorine demand increases, they would concurrently have to increase the volumes of Caustic Soda which is its co-product. The vinyl industry is the only largest customer of Chlorine produced in India & hence growing downstream investments can offer valuable options & be the main drivers for the Liquid Chlorine market during the forecast period. Moreover, since most of the Chlorine making is “localized”, boosting local industrialists to discover possibilities like investment in Chlorine Derivate products such as Chlorinated Paraffin Wax (CPW) will further increase the local Liquid Chlorine industry. Since severe volatility in its values is one of the main concerns of local Liquid Chlorine producers, it is important to understand the market dynamics & the related threats that may hamper the productivity of the Chlor-Alkali firms.

Chemical Segment- Trends in Production of Major Chemicals:

The objective of the report is to present a comprehensive analysis of the India Liquid Chlorine Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the India Liquid Chlorine Market dynamics, structure by analyzing the market segments and project the India Liquid Chlorine Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the India Liquid Chlorine Market make the report investor’s guide.India Liquid Chlorine Market Scope: Inquire before buying

• North India • South India • East India • West India

India Liquid Chlorine Market Report Coverage Details Base Year: 2020 Forecast Period: 2021-2027 Historical Data: 2016 to 2020 Market Size in 2020: 1119 Kilo Tons Forecast Period 2021 to 2027 CAGR: 6.93% Market Size in 2027: 1789 Kilo Tons Segments Covered: by Application • Ethylene Dichloride (EDC) • Chloromethanes • Chlorinated Paraffin Wax (CPW) • Others by End Use • Polyvinyl Chloride Resin (PVC) • Water Treatment, Pharmaceuticals, • Pulp and Paper • Others by Sales Channel • Direct/Institutional Sales • Retail Sales • Other Channel Sales India Liquid Chlorine Market Key Players

• Aditya Birla Chemicals India • DCW Limited • Gujarat Alkalies and Chemicals Limited • Grasim Industries Limited • DCM Shriram Consolidated Limited • Meghmani Organics Limited • Tata Chemicals Limited • Nirma Limited • Chemplast Sanmar Limited • Sree Rayalaseema Alkalies • Chemicals Limited • Others Frequently Asked Questions: 1. What is the forecast period for the India Liquid Chlorine Market? Ans. The forecast period for the India Liquid Chlorine Market is 2021-2027. 2. Which key factors are hindering the growth of the India Liquid Chlorine Market? Ans. The stringent rules & protocols imposed on the use of high VOC content industrial cleaning chemicals are the main factor anticipated to hinder the growth of the India Liquid Chlorine Market during the forecast period. 3. What is the compound annual growth rate (CAGR) of the India Liquid Chlorine Market for the next 6 years? Ans. The India Liquid Chlorine Market is expected to grow at a CAGR of 7.2% during the forecast period (2021-2027). 4. What are the key factors driving the growth of the India Liquid Chlorine Market? Ans. The increasing demand for polyvinyl chloride is expected to boost the demand for chlorine. This, in turn, shall benefit the market for chlorine during the forecast period. 5. Which are the major key players of the India Liquid Chlorine Market worldwide? Ans. Aditya Birla Chemicals India, DCW Limited, Gujarat Alkalies and Chemicals Limited, Grasim Industries Limited, DCM Shriram Consolidated Limited, Meghmani Organics Limited, Tata Chemicals Limited, Nirma Limited, Chemplast Sanmar Limited, Sree Rayalaseema Alkalies, Chemicals Limited, and Others.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: India Liquid Chlorine Market Size, by Market Value 3.1. India Market Segmentation 3.2. India Market Segmentation Share Analysis, 2020 3.3. Geographical Snapshot of the India Liquid Chlorine Market 3.4. Geographical Snapshot of the India Liquid Chlorine Market, By Manufacturer share 4. India Liquid Chlorine Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the India Liquid Chlorine Market 5. Supply Side and Demand Side Indicators 6. India Liquid Chlorine Market Analysis and Forecast, 2020-2027 6.1. India Liquid Chlorine Market Size & Y-o-Y Growth Analysis. 7. India Liquid Chlorine Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Application, 2020-2027 7.1.1. Ethylene Dichloride (EDC) 7.1.2. Chloromethanes 7.1.3. Chlorinated Paraffin Wax (CPW) 7.1.4. Others 7.2. Market Size (Value) Estimates & Forecast By End Use, 2020-2027 7.2.1. Polyvinyl Chloride Resin (PVC) 7.2.2. Water Treatment, Pharmaceuticals, 7.2.3. Pulp and Paper 7.2.4. Others 7.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2020-2027 7.3.1. Direct/Institutional Sales 7.3.2. Retail Sales 7.3.3. Other Channel Sales 8. India Liquid Chlorine Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2020-2027 8.1.1. North India 8.1.2. North India 8.1.3. North India 8.1.4. North India 9. Competitive Landscape 9.1. Geographic Footprint of Major Players in the India Liquid Chlorine Market 9.2. Competition Matrix 9.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 9.2.2. New Product Launches and Product Enhancements 9.2.3. Market Consolidation 9.2.3.1. M&A by Regions, Investment and Verticals 9.2.3.2. M&A, Forward Integration and Backward Integration 9.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 9.3. Company Profile : Key Players 9.3.1. Aditya Birla Chemicals India 9.3.1.1. Company Overview 9.3.1.2. Financial Overview 9.3.1.3. Geographic Footprint 9.3.1.4. Product Portfolio 9.3.1.5. Business Strategy 9.3.1.6. Recent Developments 9.3.2. DCW Limited 9.3.3. Gujarat Alkalies and Chemicals Limited 9.3.4. Grasim Industries Limited 9.3.5. DCM Shriram Consolidated Limited 9.3.6. Meghmani Organics Limited 9.3.7. Tata Chemicals Limited 9.3.8. Nirma Limited 9.3.9. Chemplast Sanmar Limited 9.3.10. Sree Rayalaseema Alkalies 9.3.11. Chemicals Limited 9.3.12. Others 10. Primary Key Insights