India Footwear Market size was estimated at USD 17.89 Bn. in 2024. It is expected to reach at a CAGR of 12.39 % from 2025 to 2032.India Footwear Market Overview

The India footwear market has been witnessing robust growth, driven by rising urban demand and the increasing middle class. India is the second-largest producer and consumer of footwear globally, with a projected production of nearly 3 billion units by 2024. Brands like Bata and Liberty lead the way in eco-friendly innovations and increasing product offerings. Footwear consumption per capita has increased from 1.7 pairs in 2016 to 2.3 pairs in 2021, reflecting growing demand. India's major production hubs, including Tamil Nadu, Uttar Pradesh, and Maharashtra, ensure a steady supply to meet the demand. MSMEs make up over 95% of production units, contributing significantly to employment. With a workforce of approximately 1.10 million people in the footwear manufacturing industry, India is well-positioned as a global leader. The country’s footwear exports, including casual shoes, sandals, boots, and moccasins, constitute a large share of global trade, with major markets in the USA, Germany, and the UAE. The Indian government has played a crucial role in stimulating market growth through policies like de-licensing and de-reservation, which have allowed for modern production capabilities. Additionally, initiatives such as 100% Foreign Direct Investment (FDI) in the footwear sector and the establishment of Footwear Complexes and Component Parks have bolstered competitiveness, attracting external investments and enhancing the country’s cost advantage.To know about the Research Methodology :- Request Free Sample Report India's Footwear Revolution: From Production Powerhouse to Export Giant India is a key player in the global leather and footwear industry, ranking as the second-largest producer and consumer of footwear and the fourth-largest exporter of leather goods. The country contributes approximately 13% of global leather production, with 3 billion square feet produced annually. India’s leather sector benefits from access to 21% of the world’s cattle and buffalo, providing a steady supply of raw materials. Employment in the industry is significant, with over 4 million workers, including a large percentage of women in leather product manufacturing. India's footwear production is expected to reach nearly 3 billion units by 2024, growing at an 8% CAGR. Non-leather footwear is expanding, contributing 90% to the India footwear market. The India Footwear industry is dominated by MSMEs, with key production hubs in Tamil Nadu, Andhra Pradesh, and West Bengal. In 2023-24, India’s leather and footwear exports totaled USD 4.68 billion, with footwear accounting for 47% of this share. Major export markets include the USA, Germany, and the UAE, reflecting India’s increasing footprint in the global market. In January 2023, footwear production decreased by 2.6% compared to January 2022, with 17.43 million pairs produced. February 2023 also saw a 5% decline in production year-over-year, with 17.17 million pairs produced. Cumulatively, from April to February 2023, total footwear production decreased by 10.5%, amounting to 178.22 million pairs. The production trend over the past five financial years shows consistent declines, reflecting broader challenges in the industry. Key market factors contributing to this reduction may include supply chain disruptions and shifts in consumer demand in the India footwear market.

Cumulative Change in Production of Footwear (April-February) 2018-19 1.53% 2019-20 -2.38% 2020-21 -12.1% 2021-22 -6.8% 2022-23 -10.52% The Rise of India’s Footwear Industry: Investment Insights and Market Trends

The India footwear sector is witnessing significant growth, fuelled by reforms such as de-licensing and de-reservation, which have enabled expansion through modern production facilities and advanced machinery. The Indian government has permitted 100% Foreign Direct Investment (FDI) in the footwear sector, attracting global players. For instance, Taiwan’s Pou Chen Group has pledged an investment of ₹2,302 crores to establish a manufacturing facility in Tamil Nadu, creating 20,000 job opportunities over the next 12 years. Additionally, the Hong Fu Group has invested ₹10 billion in the region. These foreign investments reflect the sector’s robust growth, with an increasing number of ongoing projects between 2018 and 2023, Signaling a positive outlook for the India footwear industry and the Indian economy. This trend positions India as a growing global leader in footwear production and export.Investment Trends in Indian Footwear Industry in the last 5 years

Year Projects under implementation Projects outstanding Cost ₹ Million Project Count Cost ₹ Million Project Count 2018-19 250 1 852.8 3 2019-20 1,213.20 2 1,463.20 3 2020-21 1,813.20 2 5,313.20 3 2021-22 313.2 1 24,113.20 9 2022-23 20,313.20 4 80,402.50 16 India Footwear Market Dynamics

The Dynamic Forces Driving Growth in India's Footwear Market The India footwear market is driven by various key factors. Increasing disposable incomes are aiding consumers to spend more on higher quality and branded footwear, while rapid development and changing lifestyles are growing the demand for fashionable and diverse footwear options. Increasing awareness of health & fitness is also boosting the India footwear market for athletic and sports footwear. The growth of E-commerce has made footwear more nearby, notably in remote areas, driving sales further. Furthermore, experience to worldwide fashion trends and a large, youthful population are driving demand for stylish and trendy footwear. Government initiatives like 'Make in India' are supporting domestic production, and the raise of organized retail, along with the opening of exclusive brand outlets, is boosting consumer access to a expansive range of footwear choices. These factors combined are driving the growth of the India footwear market.Challenges and Growth Barriers in India's Footwear Industry The Indian footwear markets on the brink of major growth, but several challenges may hinder its potential. One key challenge is the stagnation in production capacity, presently at around 2.2 billion pairs annually. This stagnation is mostly due to policies that prioritize SME businesses, combined with a heavy tax burden on the organized industry, which has suppressed the industry's growth. This issue poses a possible threat to the exchequer, as India's existing production capacity is insufficient to meet future demand. As demand for footwear increases, India could become heavily reliant on imports, mainly from China, which benefits from a well-organized industry, ample production capacity, and low production costs. If India's per capita demand for footwear scopes the current average of developed markets by 2032, domestic production at present levels would only be able to meet 25 per cent of the demand, possibly resulting in an annual forex loss of around USD 55 billion due to imports. Rising Trends and Opportunities in the Indian Footwear Market Footwear market in India has been experiencing dynamic growth focused by various emerging trends and opportunities. One major trend is the rise in demand for athleisure and sports footwear, as consumers progressively prioritize health, comfort, and style. This shift is inducing brands to expand their product helps and innovate with technology-driven features, like fitness tracking. Another significant trend is the rising prominence on sustainability, with consumers obtaining eco-friendly and properly produced footwear. This shift presents opportunities for brands to adopt environmental practices, use recyclable materials, and accelerate transparency in their supply chains. Additionally, growing digital platforms is transforming how consumers shop for footwear, indicating to increased online sales and the need for a strong digital presence. As disposable incomes rise and growth go faster, there is also a growing India Footwear market for premium and fashion-forward footwear. Brands that can essentially capitalize on these trends by focusing on sustainability, innovation, and digital engagement are well-positioned to follow in the increasing Indian footwear market.

India Footwear Market Segment Analysis

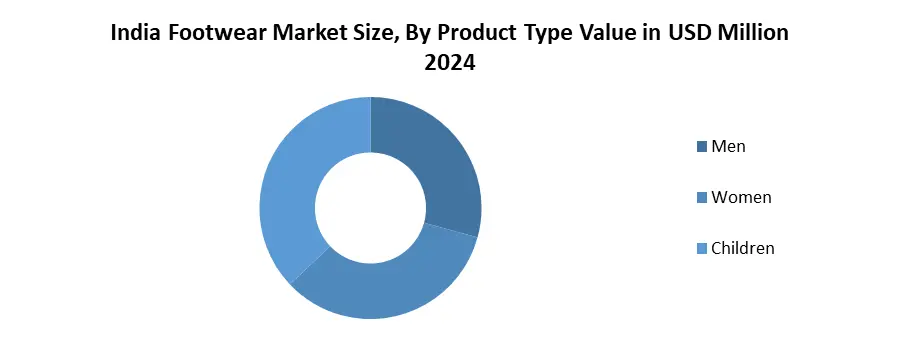

By End User, the women segment held the highest market share of about xxx% in 2024 and is expected to dominate the India footwear market through the forecast period. The Indian women's footwear market is highly various, offering various styles and designs to meet the involved needs of women. Flats, heels, sandals, boots, and sneakers are among the most popular classifications. Fashion trends and aesthetics are critical in driving consumer favourites. Children footwear segment is expected to grow at an increasing CAGR over 2025-2032. The children's foot care sector focuses on presenting comfortable, durable, and age-suitable footwear. Athletic shoes and sneakers are popular for girls and boys, selecting support and functionality. Sandals, School shoes, and boots are also important categories proposed to meet the specific needs of distinctive age groups and activities. Parents are enhancing more aware of the significance of proper foot support and development, leading them to take shoe brands that order comfort features, like arch support, cushioning, and breathable materials. For example, in April 2023, Aretto, an Indian footwear startup, stated the launch of shoes that expand as the child grows. These shoes are aimed to be flexible and comfortable and offer the right fit for growth feet.

India Footwear Market Regional Analysis:

In 2024, South India is expected to account for a dominant share of the India footwear market. The presence of strategic footwear production capacities in this region is what permits it to hold a dominant outlook in the Indian footwear market. Growing awareness involving fitness and modifying consumer preferences of people in this region are also contributing to the developing sales of footwear. Tamil Nadu is the prominent producer of footwear in this region with Chennai and Ambur presence the top footwear-producing cities in this South Indian state. North India is projected to emerge as the fastest-growing region in the Indian footwear market over the coming years. Growing population density and growth disposable income of people in this region are key factors driving Indian footwear market growth. Delhi is expected to be the most profitable city in this region for Indian footwear providers. Presence of a good, followed retail infrastructure is what allows Delhi to be a prominent North India footwear market.India Footwear Market Competitive Analysis

The India footwear industry is dominated by key players like Bata India, Relaxo Footwears, Metro Brands, Campus Activewear, and Liberty Shoes, each with unique market strategies. Bata India is a market leader, leveraging its extensive retail network with over 1,500 stores nationwide. Its focus on modernizing stores and enhancing its digital presence has strengthened its brand appeal among urban consumers. In comparison, Relaxo Footwears targets the mass market with affordable and durable products, particularly excelling in the flip-flops and casual footwear segments. Metro Brands, known for its premium offerings, has grown its market share through acquisitions and partnerships, like its recent stake in Cravatex Brands, to diversify its product line. Campus Activewear has carved a niche in the athleisure segment, focusing on youth-oriented and sports footwear, capitalizing on the growing demand for stylish and affordable sports shoes. Liberty Shoes continues to hold a significant share in the mid-segment India footwear market, leveraging its strong distribution network. The competitive landscape is shaped by factors like brand loyalty, product diversification, and pricing strategies, with each company adapting to the evolving consumer preferences and the rising trend of online shopping to maintain its market position.India Footwear Market Scope: Inquire before buying

India Footwear Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 17.89 Bn. Forecast Period 2025 to 2032 CAGR: 12.39% Market Size in 2032: USD 45.54 Bn. Segments Covered: by Product Type Casual Footwear Mass Footwear Active/Sport Footwear Leather Footwear Non-Leather Footwear by Material Leather Rubber Synthetic Others by Distribution Channel Online Retail Department Stores Specialty Stores Supermarkets Brand Outlets Others by End-User Men Women Children Key Players in India Footwear Market

International Key Players: 1. Nike India 2. Adidas India 3. Crocs India 4. Puma Sports India 5. Reebok India Domestic Key Players 6. Relaxo 7. Bata India Ltd. 8. Liberty 9. Ajanta Shoes 10. Khadims 11. Campus Activewear 12. Paragon 13. ACTION EVA FLOTTER 14. Sreeleathers 15. Catwalk 16. Mochi 17. Lallan Shoes 18. DSK Leather Works 19. Condor Footwear 20. Dayz FootwearFrequently Asked Questions:

1] Which region is expected to hold the largest market share in the India Footwear Market? Ans. The South India region is expected to hold the largest market share in the Footwear Market during the forecast period. 2] Which End User segment is expected to dominate the India Footwear Market during the forecast period? Ans. Women segment is expected to dominate the India Footwear Market during the forecast period. 3] Which Mode of Sale segment is expected to hold the largest market share in the India Footwear Market? Ans. Online segment is expected to dominate the India Footwear Market during the forecast period. 4] What is the forecast period for the India Footwear Market? Ans. The forecast period for the Footwear Market is 2025-2032.

1. India Footwear Market: Executive Summary 1. Executive Summary 1.1.1. Study Assumptions and Definitions 1.1.2. Scope of the Study 1.1.3. Top Footwear Consumers in 2019-2024 (in Millions of Pairs) 2. India Footwear Market: Competitive Landscape 2.1 MMR Competition Matrix 2.2 India Footwear Market : Competitive Positioning 2.3 Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Headquarter 2.3.6. SKU Details 2.3.7. Production Capacity 2.3.8. Production for 2024 2.3.9. No. of Stores 2.3.10. Distribution Model 2.3.11. Market Share (%) 2.4. Market Analysis by Organized Players vs. Unorganized Players 2.4.1. Organized Players 2.4.1.1. Brands sourced from India 2.4.1.2. MNC brands are sold in India 2.4.1.3. Indian brands sold in India 2.4.2. Unorganized Players 2.5. Brand Share Analysis Organized Players vs. Unorganized Players 2.6. Leading Footwear Companies in India, by market capitalization 2.7. Foreign Trade Operations of Luxury Footwear in India 2.8. Market Structure 2.8.1. Market Leaders 2.8.2. Market Followers 2.8.3. Emerging Players 2.9. Mergers and Acquisitions Details 3. Retail Value of the Footwear in India by Segments 2019-2024 4. Footwear Industry Analysis- India 4.1 Footwear Cluster in India 4.1.1 Agra leather footwear cluster 4.1.2 Chennai leather footwear cluster 4.1.3 Other Major Footwear Clusters 4.2 Major Trends in India Footwear Market 4.3 Growth Factors of the Footwear Market in India 4.4 Opportunities in Indian Footwear Industry 4.5 Challenges in Indian Footwear Industry 4.6 Growth Potential Of The E-commerce Footwear Industry 4.7 PORTER’s Five Forces Analysis 4.8 PESTLE Analysis 4.9 Policy and Regulatory Environment 4.9.1 Standards and Certification Framework 4.9.2 Labor Laws and Compliance Mandates 4.9.3 Environmental and Sustainability Regulations 4.9.4 Taxation and Trade Policies 4.9.5 Government Incentives and Development Programs 4.10 Analysis of Government Schemes and Initiatives For Footwear Industry 4.11 Growth Potential Of The E-commerce Footwear Industry 4.12 The Global Pandemic and Redefining of The Footwear Landscape 5 Indian Footwear Trade Analysis (2019-2024) 5.1 Global Import of Footwear 5.2 Global Export of Footwear For Different categories 5.2.1 Casual Footwear 5.2.2 Mass Footwear 5.2.3 Active/Sport Footwear 5.2.4 Leather Footwear 5.2.5 Non-Leather Footwear 6 Consumer Insights and Buying Behavior (2024) 6.1 Demographic Profiling of Footwear Consumers 6.1.1 Age-Wise Segmentation 6.1.2 Gender-Based Preferences 6.1.3 Income Level and Purchasing Power 6.2 Psychographic and Behavioral Segmentation 6.2.1 Lifestyle & Attitudinal Factors 6.2.2 Brand Loyalty and Switching Behavior 6.3 Urban vs. Rural Buying Patterns 6.4 Influence of Fashion and Utility Considerations 6.5 Consumer Preferences by Footwear Material and Design 6.5.1 Leather vs. Non-Leather Preferences 6.5.2 Growing Inclination Towards Eco-Friendly Footwear 6.6 Drivers of Purchase Decisions 6.6.1 Price vs. Quality Trade-Off 6.6.2 Availability of Size and Fit Options 6.6.3 After-Sales Service and Return Policies 7 Pricing Analysis 7.1 Price Trends by Product Category (2019-2024) 7.2 Price Positioning and Competitive Benchmarking 7.2.1 Brand-wise Price Comparison (Domestic vs. International) 7.2.2 Pricing Strategy by Tier (Economy, Mid, Premium, Luxury) 7.2.3 Discounts, Promotions, and Bundling Offers 7.3 Online vs. Offline Channel Pricing Comparison 8 Supply Chain Analysis 8.1 Overview of Footwear Supply Chain Structure in India 8.2 Domestic vs. Imported Inputs 8.3 Manufacturing Landscape and Cluster Analysis 8.3.1 Key Production Hubs (Agra, Kanpur, Ambur, Chennai, etc.) 8.3.2 Role of MSMEs and Unorganized Sector 8.4 Logistics, Warehousing, and Distribution Channels 8.5 Impact of Raw Material Price Volatility 8.6 Analysis of Supply Chain for Key MNCs - By Cities 8.6.1 Delhi 8.6.2 Bangalore 8.6.3 Kolkata 8.6.4 Mumbai 8.6.5 Others 8.7 Supply Chain By Major Companies 8.7.1 Nike India 8.7.2 Adidas India 8.7.3 Crocs India 8.7.4 Puma Sports India 8.7.5 Reebok India 9 India Footwear Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 9.1 India Footwear Market Size and Forecast, By Product Type 9.1.1 Casual Footwear 9.1.2 Mass Footwear 9.1.3 Active/Sport Footwear 9.1.4 Leather Footwear 9.1.5 Non-Leather Footwear 9.2 India Footwear Market Size and Forecast, By Material 9.2.1 Leather 9.2.2 Rubber 9.2.3 Synthetic 9.2.4 Others 9.3 India Footwear Market Size and Forecast, By Distribution Channel 9.3.1 Online Retail 9.3.2 Department Stores 9.3.3 Specialty Stores 9.3.4 Supermarkets 9.3.5 Brand Outlets 9.3.6 Others 9.4 India Footwear Market Size and Forecast, By End Users 9.4.1 Men 9.4.2 Women 9.4.3 Children 10 Company Profile: Key Players 10.1 Nike India 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Number of Manufacturing Facilities 10.1.8 Details on Partnerships 10.1.9 Recent Developments 10.2 Adidas India 10.3 Crocs India 10.4 Puma Sports India 10.5 Reebok India 10.6 Relaxo 10.7 Bata India Ltd. 10.8 Liberty 10.9 Ajanta Shoes 10.10 Khadims 10.11 Campus Activewear 10.12 Paragon 10.13 ACTION EVA FLOTTER 10.14 Sreeleathers 10.15 Catwalk 10.16 Mochi 10.17 Lallan Shoes 10.18 DSK Leather Works 10.19 Condor Footwear 10.20 Dayz Footwear 10.21 Others Key players 11 Key Findings 12 Strategic Recommendations 12.1 Market Entry and Expansion Strategy 12.2 Brand Differentiation and Consumer Engagement 12.3 Channel Optimization and Omni-channel Strategy 12.4 Innovation and Product Development 13 Research Methodology