The India Dishwashers Market size was valued at USD 55.98 Million in 2022 and the total India Dishwashers Market revenue is expected to grow at a CAGR of 10.8 % from 2023 to 2029, reaching nearly USD 114.76 Million.India Dishwashers Market Overview:

Dishwashers are a great addition to the Indian kitchen. They have the ability to clean dishes at a high temperature, which is important for removing tough stains and bacteria. The dishwasher rarely appeared on an Indian kitchen’s appliances list. But over the past decade, dishwashers gained popularity with the implementation of modern interior design. The majority of urban homes now benefit from a reliable water supply, making it a feasible option to consider acquiring a dishwasher. When comparing the costs of hand washing to using dishwashers, it becomes seeming that hand washing is slightly cheaper. The amount of time and effort a dishwasher saves is of intrinsic value this factor significantly drives the growth of India Dishwashers Market. Furthermore, many Indian consumers are not convinced that dishwashers are capable of removing tough stains from cookware, crockery, and cutlery effectively. This is a particularly important issue in India, where cooking methods involve spices, oil, tadka, and paste capable of leaving utensils greasy and oily these factors are expected to hamper the growth of the Dishwashers Market in India. Also, technological innovation and increasing adoption of the modern kitchen create lucrative growth opportunities for the India Dishwasher Market.To know about the Research Methodology :- Request Free Sample Report India Dishwashers Industry Trends: Traditional methods of dish cleaning require tedious effort and time. The next generation population does not have sufficient time to invest in these activities and may easily avail of these alternatives. This has been the primary growth factor contributing to the India Dishwashers Market. Growth is also being supported by players expanding the market by introducing new innovative products. The demand is generated by the adoption of modern kitchen aids and cooking is a big part of the Indian culture. Dishwashers are one of the fastest-growing Industries in India and experienced healthy growth in the 2022-2029 period. The significant trends in the Dishwashers industry include, companies entering this segment and existing companies expanding their product portfolio to include products. The growing demand is due to rising consumer income, easy availability of credit, and increased products helping to accelerate the market growth during the forecast Period.

Top 10 Dishwashers in India

Necessity of Dishwasher for Indian Homes: 1. Dishwashers have ample capacity, perfect for larger Indian families, allowing them to load all dishes in one go. 2. 90% of dishwashers in India are highly energy efficient, significantly savings electricity and water bills. 3. Modern dishwashers offer up to 12 wash types, ensuring efficient and thorough cleaning, leaving you with no concerns about stubborn food stains. 4. Dishwashers are easy to maintain as well as use. 5. Dishwashers prove a perfect addition to any busy family, whether it's a joint or nuclear household. With this appliance taking care of the dishwashing, multitasking becomes a breeze, allowing manage other chores and responsibilities while your dishes are efficiently being cleaned. 6. Dishwashers demand a small amount of manual involvement.

India Dishwashers Market Dynamics

Surging Trend of Modular Kitchen to Drive the Growth of Dishwashers Market in India The Indian Dishwashers Market witnessed a significant transformation, with the advent of modular kitchen concepts gaining immense popularity among consumers. One of the major driving factors of the growth of dishwashers in India is the increasing adoption of modular kitchens. In traditional Indian kitchens, manual dishwashing is the norm, with a reliance on a large labor force for household tasks. However, the use of modern kitchen appliances like dishwashers. These machines not only save time and effort but also offer better hygiene, as they ensure thorough cleaning and sterilization of utensils. Dishwashers offer a convenient and time-saving solution for cookware in a modern kitchen setting. Due to the efficient use of space, the Look of the design, and the functionality of the fittings, Ergonomics, a science of comfort more people switch to modular kitchens. Therefore, the demand for dishwashers is likely to rise, as they complement the aesthetics and functionality of such kitchen setups. Growth in young urban consumers and nuclear families boosts the Dishwashers Industry growth in India As lifestyles evolve and urbanization continues to accelerate, the demand for convenient and time-saving kitchen solutions has grown exponentially. In response to this shift in consumer preferences, the dishwasher market in India has experienced remarkable growth. India observing rapid urbanization. A significant portion of the population moving to cities for better opportunities and improved living standards. In urban areas, people have busy lifestyles, which helps to a higher demand for time-saving appliances such as dishwashers. The convenience of dishwashers attracts young consumers who value efficiency and are willing to invest in modern household appliances. Traditional joint families were prevalent in India, where several generations lived together. However, in recent years, the trend has shifted towards nuclear families with fewer members. Smaller households find dishwashers more appealing as they do not have the same support system for sharing household tasks as larger families once did. Therefore the growing urbanization and leading numbers of nuclear families drive the growth of India Dishwashers Market.India: Degree of Urbanization from 2018 to 2022

According to MMR Study Report In 2021, about one-third of India's population lived in cities. There is a 4 % increase in urbanization. People move from rural areas to cities in search of work and better opportunities. Therefore, Increase in Demand for Smart dishwashers in India. Lack of Awareness and consumer Perception hampers the India Dishwashers Market Growth in India Awareness and perception are interrelated and influence consumer behavior as well as buying decisions. In India, many consumers are not knowing about dishwashers. More than 40 % of people are unaware of what dishwashers are. Also, how to use, how dishwasher works these type of all questions faced by people. This lack of awareness makes people hesitant to buy a dishwasher, even if they have the means to afford one In such cases, companies need to highlight the pain points and demonstrate how their offering provides a solution. The perception of dishwashers as luxury items remains prevalent in India due to deeply ingrained cultural biases toward hand-washing dishes. Hand washing is commonly believed more hygienic practice, and many individuals view dishwashers as unnecessary and wasteful of water. The traditional method of hand-washing dishes is deeply rooted in Indian households. It is perceived as a means of ensuring cleanliness, as individuals feel they have control over the washing process. This belief is supported by the notion that hand-washing allows for a more thorough examination of each dish. Another major factor hindering the widespread adoption of dishwashers in India is the concern over water consumption. In a country where water scarcity is a pressing issue in many regions, the idea of using a dishwasher that requires a seemingly substantial amount of water is met with uncertainty.

Total dishwasher Users in India (%) in the year 2022

Growing Traction for Smart Appliances Creates Lucrative Growth Opportunities for Market The increasing demand for connected and smart devices creates tremendous growth opportunities for the dishwasher market. Consumers are increasingly searching for ways to connect devices to the internet. The smart Dishwashers offer a convenient way to do this. Many smart dishwashers are designed as energy-efficient, offering benefits such as reduced electricity consumption and lower utility bills. The increasing adoption of IoT technology and the growing number of connected devices have paved the way for Dishwashers. As the IoT market expands, so does the potential for smart Dishwasher growth. The entry of new players in the Dishwashers market is also driving its growth. These new players are bringing innovative products to the market, which is attracting consumers. Which will create lucrative growth opportunities for the India Dishwashers Market growth.

India Dishwashers Market Competitive Analysis:

The Dishwashers industry is highly competitive, with various opportunities for new market entrants to a continuous shift in consumer preference towards a modern lifestyle. Application of Dishwashers in households and industries presents a lucrative opportunity for Dishwasher Manufacturers in India. The market size, competition intensity, capacity, and local infrastructure influence the value chain of the product. Dishwasher companies are directly involved in retail activity and are investing in e-commerce to gain benefits from the market. India Dishwashers’ key players are Bosch, IFB, LG, Siemens, Whirlpool, Samsung, Elica, Faber, KAFF, Voltas Beko. The number of Dishwashers’ key players is huge and is growing with the increasing opportunity to generate significant revenue due to the growing demand for Dishwashers from various parts of the country. The key players in the market are implementing growth strategies for marketing and online discount schemes to gain a competitive advantage in the market. The strategies adopted by the major player, such as expansion of product portfolio, mergers & acquisitions, geographical expansion, and collaborations, to enhance the Dishwashers market penetration. Bosch, the company Dishwashers Specially Designed for Indian Kitchens. They are made from high-quality materials, intelligent and energy-efficient components, and use less water. Dishwashers are a perfect match for the Indian utensils range. Such as Bosch 14 Place Settings 60 cm Dishwasher, Bosch 13 Place Settings free-standing Dishwasher, and Bosch Built-in Dishwasher.India Dishwashers Market Segment Analysis:

Based on Product Type, the Free-Standing Dishwashers segment dominated the product type segment of the India Dishwashers Market in the year 2022. Freestanding dishwashers are standalone units that are placed anywhere in the kitchen without the need for installation within cabinetry. Freestanding dishwashers have gained immense popularity among households due to the flexibility and convenience they offer. It is a preferred choice for many consumers, these appliances help to those seeking the ease of a dishwasher without the commitment of permanent installation. The appeal of freestanding dishwashers extends to a wide range of users who desire versatile options. One of the main advantages that set freestanding dishwashers apart is their straightforward installation process. Unlike built-in models that require complex integration, users simply connect the appliance to the water supply and drain, making it ready for immediate use. The flexibility of freestanding dishwashers also contributes to their popularity. Users easily move and place the appliance wherever it suits their needs best, offering the flexibility to adapt to changing kitchen layouts. Therefore, the demand for Free-Standing Dishwashers is rapidly increasing during Forecast Period 2023-2029.India Dishwashers Market By Product Type (%) in the year 2022

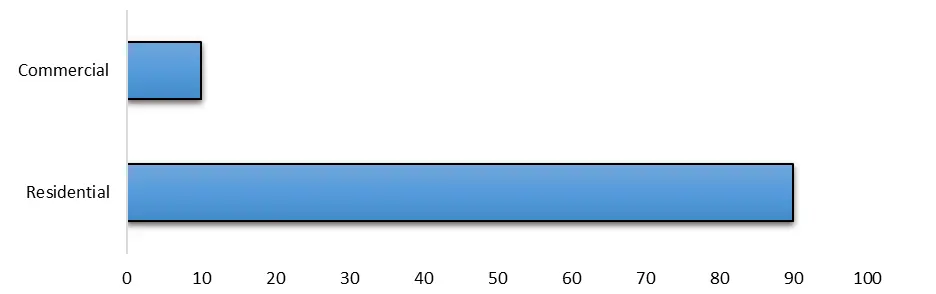

Based on the End User, The residential sector dominated the End Use segment of the India Dishwashers Market in the year 2022. The evolving consumer preferences, changing lifestyles, and increasing disposable incomes accelerate the demand for dishwashers in the residential sector. The efficiency, water-saving features, and hygiene advantages of dishwashers, driving greater adoption. Rising disposable incomes and aspirations for a more comfortable lifestyle have prompted Indian consumers to invest in modern appliances that enhance their daily living experience. Dishwashers have become a symbol of convenience and efficiency, aligning with the lifestyle aspirations of many households. In urban kitchens, space optimization is essential. Freestanding dishwashers provide a convenient solution as they can be placed anywhere in the kitchen without the need for permanent installation, making them suitable for smaller urban kitchens.

India Dishwashers Market By End User (%) in the Year 2022

Regional Insight of India Dishwashers Market:

The south region of India dominated the India Dishwasher Market in the year 2022. The south region of India is the largest market for dishwashers. Urban areas are the major markets for dishwashers in India because the demand for dishwashers is higher in urban areas. Middle-class and upper-class households are the major buyers of dishwashers in India. The low availability of domestic servants in metro cities is a major concern for consumers, especially among women professionals. Urban households are readily adopting dishwashers owing to convenience, time-saving, and growing automation requirements. With the emerging trend of nuclear families, manufacturers such as Electrolux, and Siemens, have also introduced compact dishwashers with a capacity of 8-place settings in the country targeting metro cities. This all factors help to boost the India Dishwashers Market.India Dishwashers Market Scope: Inquire Before Buying

India Dishwashers Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2023: US $ 55.98 Mn. Forecast Period 2023 to 2029 CAGR: 10.8% Market Size in 2029: US $ 114.76 Mn. Segments Covered: by Product Type Free-Standing Dishwashers Built-In Dishwashers by End User Commercial Residential by Distribution Channel Online Hypermarket/Supermarket Multi Branded Stores Exclusive Stores Others India Dishwashers Key Players:

1. Bosch 2. IFB 3. LG 4. Siemens 5. Whirlpool 6. Samsung 7. Elica 8. Faber 9. KAFF 10. Voltas Beko 11. Electrolux 12. Chirag Group of Company 13. Miele India Pvt. Ltd. 14. Dine & Design Trading CompanyFAQs:

1] What segments are covered in the India Dishwashers Market report? Ans. The segments covered in the India Dishwashers Market report are based on Product Type, End-User, and Distribution Channel. 2] Which region is expected to hold the highest share of the India Dishwashers Market? Ans. The southern region of India is expected to hold the largest share of the India Dishwashers Market. 3] What was the market size of the India Dishwashers Market by 2022? Ans. The market size of the India Dishwashers Market by 2022 is US$ 55.98 Mn. 4] What is the forecast period for the India Dishwashers Market? Ans. The forecast period for the India Dishwashers Market is 2023-2029. 5] What is the market size of the India Dishwashers Market in 2029? Ans. The market size of the India Dishwashers Market in 2029 is valued at US$ 114.76 Mn.

1. India Dishwashers Market: Research Methodology 2. India Dishwashers Market: Executive Summary 3. India Dishwashers Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. India Dishwashers Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. India Dishwashers Market: Segmentation (by Value USD and Volume Units) 5.1. India Dishwashers Market, by Product Type(2022-2029) 5.1.1. Free-Standing Dishwashers 5.1.2. Built-In Dishwashers 5.2. India Dishwashers Market, by End User(2022-2029) 5.2.1. Residential 5.2.2. Commercial 5.3. India Dishwashers Market, by Distribution Channel(2022-2029) 5.3.1. Online 5.3.2. Hypermarket/Supermarket 5.3.3. Multi Branded Stores 5.3.4. Exclusive Stores 5.3.5. Others 5.4. India Dishwashers Market, by Region (2022-2029) 5.4.1. Southern India 5.4.2. Northern India 5.4.3. West India 5.4.4. East & Northeast 5.4.5. Central India 6. Company Profile: Key players 6.1. Bosch 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. IFB 6.3. LG 6.4. Siemens 6.5. Whirlpool 6.6. Samsung 6.7. Elica 6.8. Faber 6.9. KAFF 6.10. Voltas Beko 6.11. Electrolux 6.12. Chirag Group of Company 6.13. Miele India Pvt. Ltd. 6.14. Dine & Design Trading Company 7. Key Findings 8. Industry Recommendation