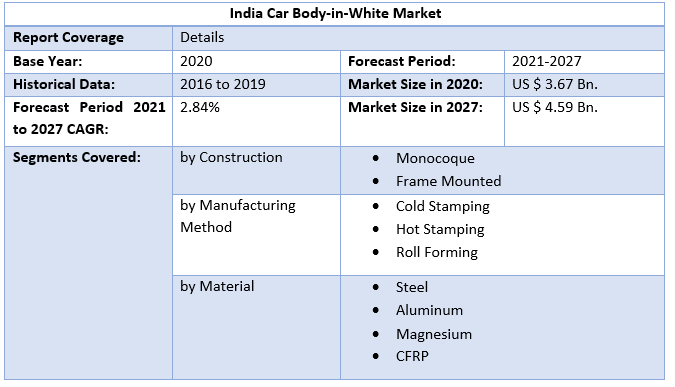

India Car Body-in-White Market was worth US$ 3.67 Bn. in 2020 and total revenue is expected to grow at a rate of 2.84 % CAGR from 2021 to 2027, reaching almost US $ 4.59 Bn. in 2027.India Car Body-in-White Market Overview:

Most businesses across the globe have been harmfully impacted over the past two years. This can be credited to major disruptions faced by their own manufacturing & supply-chain processes as an outcome of different safety lockdowns, & other limitations which were imposed by governing professionals throughout the globe. The similar relates to the car Body-in-White Market. Also, customer demand has also consequently reduced as people are now more keen on removing non-essential costs from their particular budgets as the overall economic status of most people has been severely affected by this outburst.To know about the Research Methodology :- Request Free Sample Report As a means of increasing overall fame, businesses included in the Car Body-in-White Market sector are now more involved with starting approaches like directed marketing, CSR events, etc. A visible trend that is being witnessed through the board is that these firms now target to achieve a given business-related movement in a nation that offers favorable rules. Specialists in developing countries like India, China, etc., are passing rules to appeal to foreign investors to the individual manufacturing segments by dropping trade tariffs & responsibilities in order to produce more jobs. Also, many major market players of the Car Body-in-White market segment are now more concentrated on setting-up operative JVs, M&A in order to increase their particular customer bases., key companies stand to increase their given objective bases by being able to provide to them on both a worldwide & local level.

Passenger Vehicles to Lead Car Body-in-White over forecast period:

Driven by growing automobile sales globally, the India Car Body-in-White market size is expected to record growth at a 2.84 % CAGR during the forecast period. Despite growing production in particular pockets, uninspiring car sales in the Indian market & disturbances observed amidst COVID-19 have harmfully affected the market Car Body-in-White market. But, MMR expects a stable recovery in sales & manufacturing as pandemic made limitations are gradually elevated. According to the MMR report study, the market is estimated to register 3.1 percent YOY in the year 2021. In addition, the application of BS-VI rules & rising demand for cars for private travel post-pandemic will endure driving the India Car Body-in-White market during the forecast period. With the rising worries about ecological pollution & CO2 emissions, government establishments have forced severe rules in India. This has controlled the growing demand for maintainable & cleaner production processes & products. According to the MMR report study, the necessity for maintainable practices & products in the automotive segment inspires builders to join cultured technologies which will help to control CO2. As an outcome, this progress is estimated to increase market growth during the forecast period. Car Body-in-White is less popular than ADAS, but its importance for the management, safety & coziness of a vehicle should not be underrated. BIW is raised as the core of the vehicle, BIW design will become gradually significant as the old-style model of cars evolves to imitate the new realism of autonomous driving. Similarly, the growth of EVS will call for invention around the packaging of batteries, & new requests for crash testing. Key companies will need to project new ‘top hats’ which can offer crossover for other models. The hunt for trivial materials & composites like aluminum, which can match all features of steel also unlocks the door to good advantage.Vehicle Manufacturing Costs:

With the rise in the severity of security standards in vehicles, the challenge of decreasing car Manufacturing costs & time has become more problematic. Hence, firms in the car body-in-white market are growing Research and Development in a range of custom facilities with respect to passenger car body-in-white based precisely on their new necessities for emerging lightweight projects. Automotive firms are estimated to collaborate with engineers to make 3D CAD data for a Car Body-in-White over automotive 3D scanning and reverse engineering, which is very useful in crashworthiness examination of a Car Body-in-White.Increase in Number of Digital Workshops

The car BIW market is expected to establish from a revenue of USD 3.67 Bn in 2020 & surpass USD 4.59 Bn by the end of 2027. Timely reply to the demands of consumers, & partners are serving makers to increase their reliability credentials. ThyssenKrupp’s Automotive Expertise - a worldwide supplier & manufacturing partner to the global auto industry, is archiving credit for its digital workshop, which comprises top-shelf software resolutions right from digital procedure planning to the plan of whole systems. Firms in the car body-in-white market are offering single-model resolutions & multi-flexible lines for the maximum variety of vehicle models.Challenges

The supply chain of automotive manufacturing companies is more composite as compared to other businesses. Automotive manufacturers have circulated their processes in different locations. This globalization trend accepted by automotive manufacturers adds various exclusive difficulties to their supply chains. This makes differences in dimensions, values, & other characteristics of the automotive mechanisms with body-in-white goods. Therefore, car BIW manufacturing & assembly engineers face many challenges in identifying the mistakes & making corrective movements for errors in assemblies. Thus, scattered supply chains of automotive manufacturing companies hamper the Indian car body-in-white market during the forecast period. The coronavirus pandemic has opened many challenges for the automotive fields. The U.S., India, France, the U.K., Italy, & Germany, which are measured to be capitals in terms of automobile & related module manufacturing, import, & export, had been harshly hit by the outbreak. However, as the coronavirus pandemic is coming under control, trade actions are being re-established to regular, which is projected to have an optimistic impact on the car BIW during the forecast period.MMR Viewpoint:

Key companies in the car BIW market are anticipated to become innovative, supple, & advanced with offerings in EVs during the post-COVID 19 pandemic. The market is expected to grow at a rate of 2.84 % CAGR over the forecast period. This is evident since automotive manufacturers are challenged to decrease vehicle manufacturing costs. Hence, automotive manufacturers should join services with engineers & researchers to make 3D and 2D CAD data, which grips potential plans to decrease vehicle manufacturing costs. Since the manufacturing of side panels is very composite, makers should comprise large components, composite component geometrics, & material combination with high strength for crash safety. The objective of the report is to present a comprehensive analysis of the India Car Body-in-White Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the India Car Body-in-White Market dynamics, structure by analyzing the market segments and project the India Car Body-in-White Market size. Clear representation of competitive analysis of key players by Construction, price, financial position, Construction portfolio, growth strategies, and regional presence in the India Car Body-in-White Market make the report investor’s guide.India Car Body-in-White Market Scope: Inquire before buying

India Car Body-in-White Market key player

• 3M • Gestamp Automoción • Voestalpine Group • Magna • Benteler International • CIE Automotive • Tower International • Martinrea International • Aisin Seiki • KIRCHHOFF Automotive • Dura Automotive • Thyssenkrupp • JBM Auto.Frequently Asked Questions:

1) What was the market size of India Car Body-in-White Market markets in 2020? Ans - India Car Body-in-White Market was worth US $ 3.67Bn in 2020. 2) What is the market segment of India Car Body-in-White Market markets? Ans -The market segments are based on Construction and Manufacturing Method. 3) What is forecast period consider for India Car Body-in-White Market? Ans -The forecast period for India Car Body-in-White Market is 2021 to 2027. 4) Which are the worldwide major key players covered for India Car Body-in-White Market report? Ans – 3M,Gestamp Automoción , Voestalpine Group, Magna , Benteler International, CIE Automotive, Tower International, Martinrea International, Aisin Seiki, KIRCHHOFF Automotive, Dura Automotive, Thyssenkrupp , JBM Auto 5) What was the market size of India Car Body-in-White Market markets in 2027? Ans – North India Car Body-in-White Market was worth US $ 4.59 Bn in 2027.

1. India Car Body-in-White Market: Research Methodology 2. India Car Body-in-White Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to India Car Body-in-White Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. India Car Body-in-White Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1. M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.8.1. PORTERS Five Forces Analysis 3.8.2. PESTLE 3.8.3. Regulatory Landscape by region 3.8.3.1. North India 3.8.3.2. South India 3.8.3.3. West India 3.8.3.4. East India 3.8.4. COVID-19 Impact 4. India Car Body-in-White Market (Value) by region: 4.1. India Car Body-in-White Market, by Construction 4.1.1.1. Monocoque 4.1.1.2. Frame Mounted 4.1.1.2.1. North India 4.1.1.2.2. South India 4.1.1.2.3. East India 4.1.1.2.4. West India 4.2. India Car Body-in-White Market, by Manufacturing Method 4.2.1.1. Cold Stamping 4.2.1.2. Hot Stamping 4.2.1.3. Roll Forming 4.2.1.3.1. North India 4.2.1.3.2. South India 4.2.1.3.3. East India 4.2.1.3.4. West India 4.3. India Car Body-in-White Market, by Material 4.3.1.1. Steel 4.3.1.2. Aluminum 4.3.1.3. Magnesium 4.3.1.4. CFRP 4.3.1.4.1. North India 4.3.1.4.2. South India 4.3.1.4.3. East India 4.3.1.4.4. West India 4.4. Company Profile: Key Players 4.4.1. 3M. 4.4.1.1. Company Overview 4.4.1.2. Financial Overview 4.4.1.3. India Presence 4.4.1.4. Construction Portfolio 4.4.1.5. Business Strategy 4.4.1.6. Recent Developments 4.4.2. Gestamp Automoción 4.4.3. Voestalpine Group 4.4.4. Magna 4.4.5. Benteler International 4.4.6. CIE Automotive 4.4.7. Tower International 4.4.8. Martinrea International 4.4.9. Aisin Seiki 4.4.10. KIRCHHOFF Automotive 4.4.11. Dura Automotive 4.4.12. Thyssenkrupp 4.4.13. JBM Auto 5. Primary Key Insights