India Automotive Aftermarket size was valued at USD 10.3 billion in 2023 and the total India Automotive Aftermarket revenue is expected to grow at a CAGR of 7.2% from 2024 to 2030, reaching nearly USD 16.76 Billion.India Automotive Aftermarket Overview

The India automotive aftermarket is currently experiencing strong growth, thanks to the country's vehicle parc reaching 340 million, and expected to grow steadily at a compound annual growth rate of over 8% in the next five years, the market presents substantial opportunities. The Two-Wheelers and Passenger Vehicles segments are expected to witness significant growth, with projections indicating an increase from 257 to 365 million units and from around 47 to over 72 million units respectively over the next five years.To know about the Research Methodology:-Request Free Sample Report The growing pre-owned car sales market is playing an important role in driving substantial growth of India Automotive Aftermarket, projected to achieve a compound annual growth rate of approximately 17.5% by the financial year 2030, driven by organized businesses and online platforms. On the international front, the Indian aftermarket industry is eyeing significant export opportunities, particularly in 10 major export markets. These markets, including matured ones like Indonesia, LATAM, Poland, Brazil, Columbia, and Bangladesh, as well as rapidly developing ones such as North Africa, South Africa, East Africa, West Africa, and the UAE, hold identified export potentials. Trends Transformative Trends in India's Automotive Aftermarket: Shifting Business Models and Revenue Sources The India automotive aftermarket is experiencing an outstanding shift in its business models and revenue sources. Traditionally, aftermarket businesses followed a sequential selling approach, but now there's a transition towards direct distribution through e-commerce platforms, facilitated by partnerships between Original Equipment Manufacturers (OEMs) and online retail giants like Amazon and eBay. For instance, Robert Bosch's collaboration with TMall yielded a substantial Gross Merchandise Volume (GMV) of $290 million in 2015-16. In terms of revenue sources, while wear-and-tear parts have historically dominated, their demand is anticipated to slow down due to improved part quality. Similarly, the prevalence of crash-relevant parts is expected to decrease with advancements in vehicle safety features. Consequently, growth in the aftermarket sector is projected to be driven by new offerings in diagnostics and services, particularly those leveraging digitization and car data. Connected vehicles and IoT sensors, for example, generate predictive data to forecast potential issues, enabling proactive maintenance alerts before part failure. Driver Increasing Vehicle Sales Growth boost, the India Automotive Aftermarket The India Automotive Aftermarket is set to experience a substantial boost with the recent surge in vehicle sales growth. According to MMR Study Report in January 2024, overall vehicle sales soared by 15%, escalating from 18.49 lakh units in January 2023 to 21.27 lakh units in January 2024. This surge in sales is particularly prominent in key segments, with two-wheelers leading the charge with a robust 15% growth, followed closely by three-wheelers at an impressive 37% increase and passenger vehicles at a commendable 13% rise. Specifically, two-wheeler sales surged to 14,58,849 units in January 2024, marking a 15% increase compared to the same period last year. This surge is driven by steady demand, particularly in rural areas, buoyed by favorable agricultural conditions and government support initiatives. Three-wheelers also experienced a remarkable upswing, witnessing a staggering 37% increase in sales, reaching 97,675 units compared to 71,325 units in January 2023. The passenger vehicle segment achieved record-breaking sales figures, reaching an all-time high of 3,93,250 vehicles in January 2024, surpassing the previous record set in November 2023. However, challenges persist in the form of high inventory levels, which linger in the 50-55-day range, posing significant challenges for auto dealers. Also, tractors witnessed a notable 21% increase in sales, reaching 88,671 units in January 2024. Nonetheless, the commercial vehicle segment experienced modest growth, with sales remaining relatively flat at 89,208 units. In India Automotive Aftermarket remains promising, with various factors contributing to this positive sentiment. These include ongoing marriage seasons, anticipated agricultural income, successful new model launches, and supportive post-Union Budget policies. However, challenges such as market uncertainty due to upcoming elections, persistent supply bottlenecks, and fluctuating market liquidity may temper the growth trajectory. The significant surge in vehicle sales growth presents lucrative opportunities for the India Automotive Aftermarket, provided industry stakeholders effectively navigate the accompanying challenges.

Restrain Strict Regulatory Environment Limits the India Automotive Aftermarket Growth The strict regulatory environment governing the Indian automotive aftermarket poses significant limitations on its growth potential. These regulations, which encompass safety and emission norms, certification requirements, manufacturing standards, and compliance with Automotive Industry Standards (AIS) and Bureau of Indian Standards (BIS) certifications, create several challenges for aftermarket businesses.

The strict regulatory environment in India imposes various limitations on the automotive aftermarket's growth potential. While regulations are necessary to ensure safety, environmental protection, and ethical conduct within the industry, striking a balance between regulatory compliance and fostering innovation and market competition is essential to support the sustainable growth of the India automotive aftermarket. Opportunity Technological Advancements in the automotive sector create multiple growth opportunities for the India Automotive Aftermarket Technological advancements in the automotive sector are driving significant growth opportunities for the India Automotive Aftermarket. With innovations such as connected vehicles, electric vehicles (EVs), and advanced driver assistance systems (ADAS), aftermarket businesses can develop and offer compatible products and services, including diagnostics, software updates, and specialized components. The increasing adoption of connected vehicle technology enables aftermarket players to offer solutions for remote diagnostics, predictive maintenance, and fleet management, enhancing efficiency and reducing downtime for vehicle owners. Furthermore, the transition towards EVs presents opportunities for aftermarket businesses to provide charging infrastructure, battery management systems, and retrofitting services for conventional vehicles. The integration of ADAS features such as lane departure warning systems, adaptive cruise control, and collision avoidance systems opens up avenues for aftermarket installation and calibration services, catering to both OEMs and vehicle owners seeking to upgrade their vehicles' safety features. Also, technological advancements in materials, manufacturing processes, and 3D printing enable aftermarket businesses to develop custom components, accessories, and performance upgrades tailored to individual preferences and vehicle specifications. By embracing these technological advancements, the India Automotive Aftermarket can drive innovation, enhance competitiveness, and capitalize on the evolving needs of vehicle owners in the rapidly transforming automotive landscape.

Challenges Description Compliance Costs Significant investments in research, development, testing, and certification processes. Complexity and Red Tape Navigating through complex, frequently updated regulations, and ensuring ongoing compliance can be time-consuming and resource-intensive. Barriers to Entry Strict regulatory requirements deter new players, limiting competition and innovation. Impact on Product Innovation Stringent standards may hinder innovation as businesses prioritize compliance over R&D. Market Fragmentation Favoring larger, compliant players contribute to a less competitive aftermarket landscape. Consumer Perception Compliance influences consumer perception, affecting sales and brand reputation. International Trade Barriers Compliance with Indian standards hinder international trade and market. India Automotive Aftermarket Segment Analysis

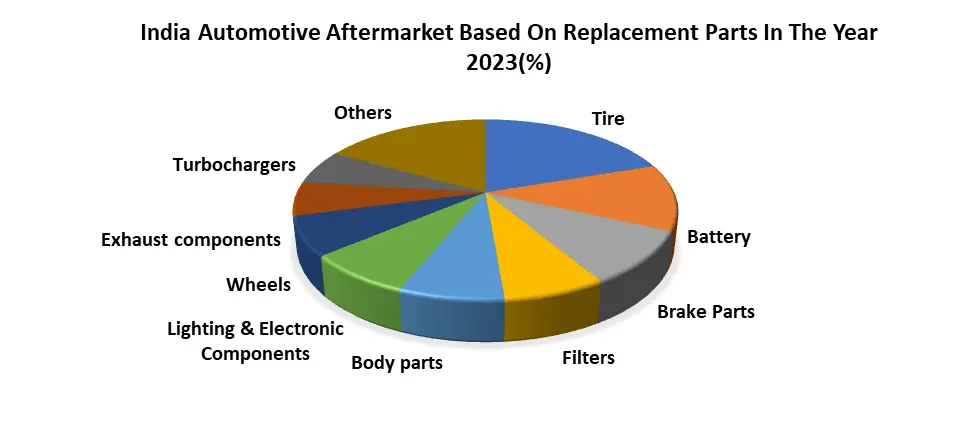

Based On Replacement Parts, the tire segment dominated the India Automotive Aftermarket in the year 2023. Tires are essential components of vehicles, experiencing regular wear and tear, leading to frequent replacements. With India's large and diverse vehicle parc, ranging from passenger cars to commercial vehicles and two-wheelers, there's a substantial and consistent demand for tires across various segments. Also, the Indian automotive aftermarket has witnessed significant growth in recent years, driven by factors such as increasing vehicle ownership, rising disposable incomes, and urbanization. This growth has translated into higher demand for aftermarket products and services, with the tire segment benefiting immensely from this trend. The tire market in India is characterized by intense competition, leading to innovations in tire technology, product offerings, and distribution channels. Companies in the tire segment have focused on expanding their product portfolios, enhancing manufacturing capabilities, and optimizing supply chains to meet the diverse needs of customers across different vehicle categories and usage patterns.

Regional Analysis of India Automotive Aftermarket

The Northern region dominated the India Automotive Aftermarket in the year 2023. The northern region, including states like Delhi, Uttar Pradesh, Punjab, and Haryana, constitutes a significant portion of the aftermarket demand. This is driven by high vehicle density in urban centers such as Delhi-NCR, as well as agricultural activities in rural areas. Demand in this region is diverse, ranging from passenger vehicles to commercial vehicles and agricultural machinery. States such as Maharashtra, Gujarat, and Rajasthan are key contributors to the automotive aftermarket. The presence of major cities like Mumbai and Pune fosters demand for aftermarket products and services, particularly in the passenger car and commercial vehicle segments. The industrial hubs in Gujarat drive demand for commercial vehicle parts and components. The presence of automotive manufacturing clusters boosts demand for aftermarket products and services. The growing urbanization and higher disposable incomes in cities contribute to increased aftermarket spending. The aftermarket in this region is still evolving compared to other parts of the country, presenting opportunities for market growth and penetration. The diverse nature of the Indian automotive aftermarket, with each region presenting unique opportunities and challenges for aftermarket businesses. Understanding regional dynamics is crucial for targeted marketing strategies and efficient distribution network optimization.Scope of the India automotive aftermarket: Inquire before buying

India automotive aftermarket Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 10.3 Bn. Forecast Period 2024 to 2030 CAGR: 7.2% Market Size in 2030: US $ 16.76 Bn. Segments Covered: by Replacement Parts Tire Battery Brake Parts Filters Body parts Lighting & Electronic Components Wheels Exhaust components Turbochargers Others by Certification Genuine Parts Certified Parts Uncertified Parts by Service Channel DIY (Do it Yourself) DIFM (Do it for Me) OE (Delegating to OEM’s) by Distribution Channel OEMs Repair Shops Wholesalers & Distributors India Automotive Aftermarket Key Players:

1. Bosch India 2. TVS Group 3. Mahindra & Mahindra 4. Exide Industries 5. Tata Motors 6. Minda Industries 7. Amara Raja Batteries 8. Ashok Leyland 9. Hero MotoCorp 10. Maruti Suzuki 11. Motherson Sumi Systems 12. JK Tyre & Industries 13. Lumax Industries 14. Sundram Fasteners 15. WABCO India 16. Gabriel India 17. Ceat Ltd. 18. SKF India 19. MRF Limited 20. Apollo Tyres FAQs: 1. What are the growth drivers for the India Automotive Aftermarket? Ans. A growing middle class and rising disposable incomes, there's an increasing demand for vehicles across various segments, and this is expected to be the major driver for the India Automotive Aftermarket. 2. What is the major opportunity for India's Automotive Aftermarket growth? Ans. Rising Demand for Parts and Accessories Revolutionizing the India Automotive Aftermarket Industry. 3. What is the India Automotive Aftermarket size in 2023? Ans. India Automotive Aftermarket size was valued at USD 10.3 billion in 2023. 4. What segments are covered in the India Automotive Aftermarket report? Ans. The segments covered in the India Automotive Aftermarket report are by Replacement Parts, Certification, Service Channel, Distribution Channel, and Region.

1. India Automotive Aftermarket Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global India Automotive Aftermarket : Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Growth Rate (Y-O-Y %) 2.4.5. Revenue (2023) 2.4.6. Profit Margin 2.4.7. Market Share 2.5. Mergers and Acquisitions Details 2.6. Emerging Startups and Innovators 2.7. Market Size Estimation Methodology 2.7.1. Bottom-Up Approach 2.7.2. Top-Down Approach 3. India Automotive Aftermarket : Dynamics 3.1. India Automotive Aftermarket Trends 3.2. India Automotive Aftermarket Dynamics 3.2.1.1. Drivers 3.2.1.2. Restraints 3.2.1.3. Opportunities 3.2.1.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.3.1. Customer Bargaining Power 3.3.2. Supplier Bargaining Power 3.3.3. Threat of New Entrants 3.3.4. Rivalry of Competitors 3.3.5. Threat of Substitute Products 3.4. PESTLE Analysis 3.5. Technological Advancements 3.5.1. Role of AI, IoT, and Automation in the Aftermarket 3.5.2. Electric Vehicles and Aftermarket Adaptation 3.5.3. Digital Platforms for Spare Parts Distribution 3.6. Consumer Behavior and Preferences 3.6.1. Factors Influencing Aftermarket Purchase Decisions 3.6.2. Shift Toward E-commerce and Online Platforms 4. India Automotive Aftermarket : Market Size and Forecast By Segmentation (By Volume in INR Bn) (2023-2030) 4.1. India Automotive Aftermarket Size and Forecast, By Replacement Parts (2023-2030) 4.1.1. Tire 4.1.2. Battery 4.1.3. Brake Parts 4.1.4. Filters 4.1.5. Body parts 4.1.6. Lighting & Electronic Components 4.1.7. Wheels 4.1.8. Exhaust components 4.1.9. Turbochargers 4.1.10. Others 4.2. India Automotive Aftermarket Size and Forecast, By Certification (2023-2030) 4.2.1. Genuine Parts 4.2.2. Certified Parts 4.2.3. Uncertified Parts 4.3. India Automotive Aftermarket Size and Forecast, By Service Channel (2023-2030) 4.3.1. DIY (Do it Yourself) 4.3.2. DIFM (Do it for Me) 4.3.3. OE (Delegating to OEM’s) 4.4. India Automotive Aftermarket Size and Forecast, By Distribution Channel (2023-2030) 4.4.1. OEMs 4.4.2. Repair Shops 4.4.3. Wholesalers & Distributors 5. Company Profile: Key Players 5.1. Bosch Limited 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview (Total Revenue, Segment Revenue, and Regional Revenue) 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Recent Developments 5.2. TVS Group 5.3. Mahindra & Mahindra 5.4. Exide Industries 5.5. Tata Motors 5.6. Uno Minda 5.7. Amara Raja Energy & Mobility Limited. 5.8. Hero MotoCorp 5.9. Maruti Suzuki 5.10. JK Tyre & Industries 5.11. Lumax Auto Technologies Limited 5.12. Gabriel India 5.13. CEAT Ltd. 5.14. SKF India 5.15. MRF Limited 5.16. Apollo Tyres 5.17. Hyundai Motors India 5.18. Honda Cars India 5.19. Motherson Sumi Systems 5.20. Mico 5.21. Michelin India 5.22. Castrol India 5.23. Bridgestone India 6. Key Findings 7. Analyst Recommendations