Global Incentive Travel Market size was valued at USD 12.4 Bn in 2022 and Incentive Travel Market revenue is expected to reach USD 18.89 Bn by 2029, at a CAGR of 6.2 % over the forecast period (2023-2029).Incentive Travel Market Overview

In the corporate landscape, incentive travel has emerged as a favored strategy for rewarding employees and elevating their motivation and loyalty. According to an MMR report, nearly half of European companies opt for incentive trip. Incentive travel serves as a powerful motivator for staff recognition, rewarding achievements like long service or outstanding performance. Unlike cash bonuses, it offers a lasting impact felt before, during, and after the trip, fostering sustained motivation and dedication. Research emphasizes its appeal as a top desired reward, as memorable experiences resonate more than material possessions. This type of reward not only boosts morale but also focuses employees on achieving goals, fostering a positive work environment and driving improved performance within the company.To know about the Research Methodology :- Request Free Sample Report

Incentive Travel Market Dynamics

The Transformative Power of Incentive Travel Programs in Driving Employee Engagement and Profitability Before the pandemic, the U.S. witnessed an average annual spend of $4,260 per employee on incentive travel, typically evaluated by companies through profitability to gauge program success. Despite some business owners' skepticism about investing in intangible perks, incentive travel programs have demonstrated marked benefits, driving heightened employee engagement, satisfaction, and increased profitability. These impacts, measurable through departmental metrics or employee surveys, present a more substantial value proposition than commonly perceived by executives. Highlighting its driving force in the incentive travel market, significant correlation between incentives, employee longevity and top performance ratings among 55% of incentive travel earners. This indicates that incentive travel programs not only offer enjoyable experiences but also wield considerable influence at a higher operational level, cementing their position as a pivotal driver in the incentive travel market. The landscape of the incentive merchandise and travel marketplace has experienced consistent growth, as evidenced by a study conducted by the Incentive Federation at the end of 2000, which engaged 8,000 executives from sales, marketing, and human resources across various American businesses. Despite this growth, the study indicated ample potential for further expansion in this industry. However, comprehensive statistics on incentive travel remain scarce for most countries, with the United States being the only nation to have extensively tabulated data on this sector. In the United States, according to MMR the total volume for the Incentive Travel industry reached $3.41 billion, with prominent destinations including Florida, California, Hawaii, Nevada, Arizona, the Caribbean, Mexico, Bahamas, France, and Italy. Another organization, the Incentive Federation, conducted a comprehensive study involving 6,500 executives from sales, human resources, and marketing departments across American businesses. This study revealed that 38% of firms utilized individual travel and 29% utilized group travel as primary incentives for motivation within their organizations. Corporations globally have embraced incentive travel as a powerful motivational tool for their employees. This paradigm shift is not limited to multinational corporations; even small businesses have adopted this strategy. The incorporation of incentive travel has emerged as a key driver propelling the growth of the incentive travel market across various business sectors worldwide. Transformative Impact: Incentive Travel Redefining Corporate Motivation and Growth Strategies Utilizing meticulously planned incentive programs that include all-expenses-paid travel experiences goes beyond conventional rewards, fostering a powerful amalgamation of motivation and loyalty within companies. Beyond monetary gains, these journeys forge enduring connections among employees, fostering enhanced team dynamics and bolstering organizational cohesiveness. They also serve as a linchpin for building employee trust, loyalty, and brand advocacy, amplifying retention rates, and consolidating market position, solidifying the multi-dimensional impact of incentive travel within the corporate arena. These initiatives, guided by strategic event management partnerships and a focus on attendee-centric customization, not only amplify employee satisfaction and well-being but also serve as pivotal tools in driving revenue, retention, and market expansion strategies. In the contemporary corporate sphere, incentive travel stands as a key catalyst driving organizational growth and fortification. As per MMR report, incentive travel market with almost half of U.S. businesses dedicating a staggering $22.5 billion annually to incentive trips, underscoring a fundamental transformation in how companies motivate and retain their workforce. Limiting Factors Impacting Incentive Travel Programs In the incentive travel market, several challenges impede its seamless operation and effectiveness. Cost constraints present a significant hurdle, straining budgets as these programs encompass various expenses, from travel to accommodations, impacting financial allocations amid economic fluctuations. Geopolitical uncertainties, including global events and safety concerns, dictate destination choices, demanding adaptable solutions to ensure program continuity amidst unpredictable shifts. Data security risks escalate with remote work and blended travel experiences, necessitating stringent cybersecurity measures to protect sensitive traveler information. Measuring the true return on investment proves intricate, requiring comprehensive metrics beyond immediate satisfaction scores. Additionally Growing emphasis on environmental and social responsibility prompts concerns regarding the ecological impact of travel. Incentive travel providers must embrace sustainable tourism initiatives, offering eco-friendly experiences that align with travelers' and corporations' prioritization of responsible practices. The incentive travel market thrives on strategic planning and meticulous execution, where incentive travel planning plays a pivotal role. Leveraging incentive travel software, planners curate unique experiences, selecting from an array of enticing incentive travel destinations and activities, tailored to align with the set budget. The success of these programs hinges on comprehensive measurement tools, gauging the ROI and effectiveness of incentive travel initiatives. By intricately weaving together planning, execution, software utilization, destination selection, activities, budget management, and measurement techniques, companies elevate their ability to motivate, reward, and retain top talent through unforgettable incentive travel experiences.Incentive Travel Market Segment Analysis Based on Industry, In the incentive travel market, the finance industry asserts its dominance within the incentive travel market, commanding approximately 30% of the global share. This stronghold emanates from ingrained practices that prioritize employee recognition and retention, aligning perfectly with the high-performance culture prevalent in finance. Bolstered by robust financial capabilities, these firms invest significantly in impactful incentive travel experiences, leveraging them as a potent tool to motivate their competitive workforce. In contrast, while the technology sector holds a respectable 25% share, its prominence stems from distinct factors. The technology sector stands out as the dominant force. With a relentless pursuit of innovation and an emphasis on talent retention, technology companies have embraced incentive travel as a cornerstone of their employee engagement strategy. The competitive nature of the industry drives these firms to offer compelling and cutting-edge travel experiences, leveraging technology-focused destinations and activities that resonate with their workforce. Moreover, technology companies often possess robust budgets, allowing for more extravagant and enticing incentive travel programs. Their agility in adopting incentive travel software for seamless planning and measurement further solidifies their position as leaders in this space, consistently pushing boundaries to create unforgettable experiences that reinforce company culture and drive performance. Based on Travel, Domestic incentive travel dominates the global market, capturing 59.32% of total spending, fueled by its cost-effectiveness, ease of planning, flexibility, accessibility, and simplified logistics. Domestic trips offer reduced transportation costs, shorter travel times, and fewer logistical complexities compared to international travel. This simplicity streamlines planning, aligns programs with business goals, and ensures a wider array of destinations, catering to diverse employee preferences. With fewer visa requirements and minimized cultural barriers, domestic travel proves more manageable and appealing for organizations aiming to optimize ROI and provide tailored, engaging experiences. While international travel remains significant for its unique cross-cultural engagements, the practical advantages firmly establish domestic incentive travel as the dominant choice, likely to persist in the market.

Incentive Travel Market Regional Growth Analysis

Europe held the largest Incentive Travel Market Revenue share in 2022. Europe boasts a rich tapestry of diverse cultures, historical sites, and picturesque landscapes, offering a plethora of options for incentive travel planners. Countries like France, Italy, Spain, and the UK hold iconic landmarks and cities that attract businesses aiming to create unique and memorable experiences for their employees. Europe's well-developed transportation infrastructure, including efficient rail networks and well-connected airports, simplifies travel within the continent, enhancing the feasibility and attractiveness of incentive programs. The proximity of various countries allows for multi-destination trips, providing participants with a rich and varied experience within a relatively short timeframe. Europe's ascent as a powerhouse in the incentive travel market stems from multiple factors shaping its appeal. The region's robust post-pandemic economic recovery fuels increased corporate spending, driving investments in incentive travel to reward and retain employees. European destinations pivot toward experiential travel, meeting the rising demand for transformative experiences beyond conventional sightseeing. Emphasizing sustainability and wellness, European organizations foster demand for eco-friendly accommodations and activities, aligning with evolving preferences. Enhanced accessibility via well-connected transportation networks streamlines logistics, reducing costs for multi-destination trips. Europe's rich cultural diversity, spanning historical sites to vibrant landscapes, caters to varied interests, solidifying its allure. This unique blend of economic vitality, experiential offerings, sustainability focus, and cultural richness positions Europe as a frontrunner poised for continued dominance in the incentive travel market. North America's standing as the second-largest region in the incentive travel market is fueled by several key factors. Its robust economy and thriving corporate landscape fuel significant investments in incentive travel programs. Both the United States and Canada boast a diverse array of appealing destinations, blending cosmopolitan cities, natural wonders, and cultural hubs, catering to a broad spectrum of participant interests. North America's inclination towards innovation and cutting-edge technology aligns seamlessly with the evolving preferences for unique and tech-driven incentive travel experiences. The region's dedication to service excellence, luxurious accommodations, and top-tier experiences further enhances its attractiveness among businesses striving to offer premium incentive trips. North America's emphasis on employee engagement and recognition acts as a catalyst, bolstering the demand for incentive travel as companies prioritize motivating and rewarding their workforce. The continent's well-established transportation infrastructure and connectivity streamline travel logistics, facilitating the organization of multi-destination incentive trips with efficiency. Overall, North America's economic prowess, diverse destinations, technological innovation, commitment to service excellence, and focus on employee engagement collectively secure its position as a robust and influential player in the global incentive travel market.Incentive Travel Market Competitive Analysis

The incentive travel market stands as a highly competitive arena. From industry giants like Maritz and Carlson Wagonlit Travel to specialized players in leisure blends and sustainable travel, a diverse array of contenders vies for prominence. This landscape witness’s intense competition marked by a strategic pursuit of differentiation to align with evolving traveller preferences. From established leaders delivering customizable, data-driven programs to tech-savvy disruptors leveraging AI-driven platforms, destination experts curating immersive experiences, sustainability champions promoting eco-conscious initiatives, and innovators blending business with leisure, the industry's future hinges on personalization, AI, and data analytics. As the boundaries blur between work and leisure and sustainability gains prominence, the incentive travel domain anticipates significant transformative shifts, leaving the ultimate champion of this dynamic space a compelling tale yet to unfold. The objective of the report is to present a comprehensive analysis of the Incentive Travel Market including all the stakeholders of the Technology. The past and current status of the Technology with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Technology with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Technology to the decision-makers.The report also helps in understanding the Incentive Travel Market dynamics, and structure by analyzing the market segments and projecting the Incentive Travel Market size. Clear representation of competitive analysis of key players by type, price, financial position, Type portfolio, growth strategies, and regional presence in the Incentive Travel Market makes the report an investor’s guide.

Incentive Travel Market Scope: Inquiry Before Buying

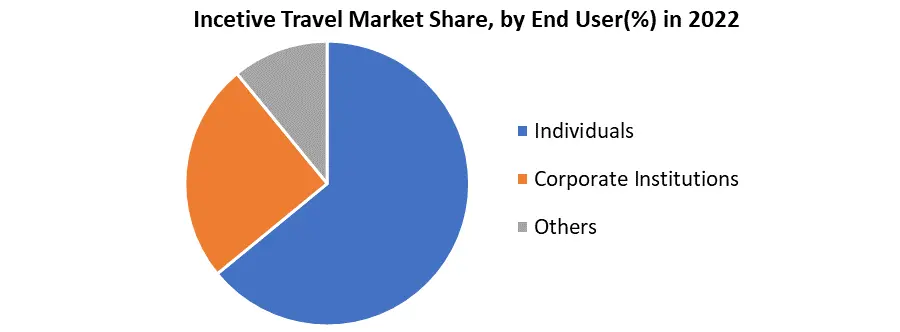

Incentive Travel Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 12.4 Bn. Forecast Period 2023 to 2029 CAGR: 6.2% Market Size in 2029: US $ 18.89 Bn. Segments Covered: by Industry Finance Technology Healthcare Others by Travel Domestic International by End-User Individuals Corporate Institutions Other Incentive Travel Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Incentive Travel Market Key players

1. Maritz Global Events (USA) 2. ITA Group (USA) 3. Creative Group (USA) 4. BI WORLDWIDE (USA) 5. Aimia Inc. (Canada) 6. One10 (USA) 7. Brightspot Incentives & Events (USA) 8. Ovation Global DMC (Ireland) 9. Meetings and Incentives Worldwide (USA) 10. Frosch (USA) 11. Omega World Travel (Virginia, USA) 12. Adelman Travel (USA) 13. The Performance Group (Florida, USA) 14. Gavel International (California, USA) 15. Carlson Wagonlit (Minnesota, USA) 16. Next Level Performance (New Jersey, USA)Frequently Asked Questions:

1] What is the growth rate of the Global Incentive Travel Market? Ans. The Global Incentive Travel Market is growing at a significant rate of 6.2% over the forecast period. 2] Which region is expected to dominate the Global Incentive Travel Market? Ans. Europe region is expected to dominate the Incentive Travel Market over the forecast period. 3] What is the expected Global Incentive Travel Market size by 2029? Ans. The market size of the Incentive Travel Market is expected to reach USD 18.89 Bn by 2029. 4] Who are the top players in the Global Incentive Travel Industry? Ans. The major key players in the Global Incentive Travel Market Maritz Global Events (USA), ITA Group (USA), Creative Group (USA), BI WORLDWIDE (USA), Aimia Inc. (Canada) 5] What is the estimated value of the Global Incentive Travel Market in 2022? Ans. The Global market was estimated to be valued at USD 12.4 Million in 2022.

1. Incentive Travel Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Incentive Travel Market: Dynamics, 2.1 Incentive Travel Market Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 Incentive Travel Market Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 Incentive Travel Market Restraints 2.4 Incentive Travel Market Opportunities 2.5 Incentive Travel Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power of Suppliers 2.6.2 Bargaining Power of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives for Incentive Travel Industry 2.11 The Global Pandemic and Redefining of The Incentive Travel Industry Landscape 2.12 Price Trend Analysis 2.13 Technological Road Map 3. Incentive Travel Market: Global Market Size and Forecast by Segmentation (Value and Volume) 3.1 Global Incentive Travel Market, by Industry (2022-2029) 3.1.1 Finance 3.1.2 Technology 3.1.3 Healthcare 3.1.4 Others 3.2 Global Incentive Travel Market, by Travel (2022-2029) 3.2.1 Domestic 3.2.2 International 3.3 Global Incentive Travel Market, by End User (2022-2029) 3.3.1 Individuals 3.3.2 Corporate Institutions 3.3.3 Other 3.4 Global Incentive Travel Market, by Region (2022-2029) 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Middle East and Africa 3.4.5 South America 4. North American Incentive Travel Market Size and Forecast by Segmentation (Value and Volume) 4.1 North America Incentive Travel Market, by Industry (2022-2029) 4.1.1 Finance 4.1.2 Technology 4.1.3 Healthcare 4.1.4 Others 4.2 North America Incentive Travel Market, by Travel (2022-2029) 4.2.1 Domestic 4.2.2 International 4.3 Incentive Travel Market, by End User (2022-2029) 4.3.1 Individuals 4.3.2 Corporate Institutions 4.3.3 Other 4.4 North America Incentive Travel Market, by Country (2022-2029) 4.4.1 United States 4.4.1.1 United States Incentive Travel Market, by Industry (2022-2029) 4.4.1.1.1 Finance 4.4.1.1.2 Technology 4.4.1.1.3 Healthcare 4.4.1.1.4 Others 4.4.1.2 United States Incentive Travel Market, by Travel (2022-2029) 4.4.1.2.1 Domestic 4.4.1.2.2 International 4.4.1.3 United States Incentive Travel Market, by End User (2022-2029) 4.4.1.3.1 Individuals 4.4.1.3.2 Corporate Institutions 4.4.1.3.3 Other 4.4.2 Canada 4.4.2.1 Canada Incentive Travel Market, by Industry (2022-2029) 4.4.2.1.1 Finance 4.4.2.1.2 Technology 4.4.2.1.3 Healthcare 4.4.2.1.4 Others 4.4.2.2 Canada Incentive Travel Market, by Travel (2022-2029) 4.4.2.2.1 Domestic 4.4.2.2.2 International 4.4.2.3 Incentive Travel Market, by End User (2022-2029) 4.4.2.3.1 Individuals 4.4.2.3.2 Corporate Institutions 4.4.2.3.3 Other 4.4.3 Mexico 4.4.3.1 Mexico Incentive Travel Market, by Industry (2022-2029) 4.4.3.1.1 Finance 4.4.3.1.2 Technology 4.4.3.1.3 Healthcare 4.4.3.1.4 Others 4.4.3.2 Mexico Incentive Travel Market, by Travel (2022-2029) 4.4.3.2.1 Domestic 4.4.3.2.2 International 4.4.3.3 Incentive Travel Market, by End User (2022-2029) 4.4.3.3.1 Individuals 4.4.3.3.2 Corporate Institutions 4.4.3.3.3 Other 5. Europe Incentive Travel Market Size and Forecast by Segmentation by (Value and Volume) 5.1 Europe Incentive Travel Market, by Industry (2022-2029) 5.2 Europe Incentive Travel Market, by Travel (2022-2029) 5.3 Europe Incentive Travel Market, by End User (2022-2029) 5.4 Europe Incentive Travel Market, by Country (2022-2029) 5.4.1 United Kingdom 5.4.1.1 United Kingdom Incentive Travel Market, by Industry (2022-2029) 5.4.1.2 United Kingdom Incentive Travel Market, by Travel (2022-2029) 5.4.1.3 United Kingdom Incentive Travel Market, by End User (2022-2029) 5.4.2 France 5.4.2.1 France Incentive Travel Market, by Industry (2022-2029) 5.4.2.2 France Incentive Travel Market, by Travel (2022-2029) 5.4.2.3 France Incentive Travel Market, by End User (2022-2029) 5.4.3 Germany 5.4.3.1 Germany Incentive Travel Market, by Industry (2022-2029) 5.4.3.2 Germany Incentive Travel Market, by Travel (2022-2029) 5.4.3.3 Germany Incentive Travel Market, by End User (2022-2029) 5.4.4 Italy 5.4.4.1 Italy Incentive Travel Market, by Industry (2022-2029) 5.4.4.2 Italy Incentive Travel Market, by Travel (2022-2029) 5.4.4.3 Italy Incentive Travel Market, by End User (2022-2029) 5.4.5 Spain 5.4.5.1 Spain Incentive Travel Market, by Industry (2022-2029) 5.4.5.2 Spain Incentive Travel Market, by Travel (2022-2029) 5.4.5.3 Spain Incentive Travel Market, by End User (2022-2029) 5.4.6 Sweden 5.4.6.1 Sweden Incentive Travel Market, by Industry (2022-2029) 5.4.6.2 Sweden Incentive Travel Market, by Travel (2022-2029) 5.4.6.3 Sweden Incentive Travel Market, by End User (2022-2029) 5.4.7 Austria 5.4.7.1 Austria Incentive Travel Market, by Industry (2022-2029) 5.4.7.2 Austria Incentive Travel Market, by Travel (2022-2029) 5.4.7.3 Austria Incentive Travel Market, by End User (2022-2029) 5.4.8 Rest of Europe 5.4.8.1 Rest of Europe Incentive Travel Market, by Industry (2022-2029) 5.4.8.2 Rest of Europe Incentive Travel Market, by Travel (2022-2029). 5.4.8.3 Rest of Europe Incentive Travel Market, by End User (2022-2029) 6. Asia Pacific Incentive Travel Market Size and Forecast by Segmentation by (Value and Volume) 6.1 Asia Pacific Incentive Travel Market, by Industry (2022-2029) 6.2 Asia Pacific Incentive Travel Market, by Travel (2022-2029) 6.3 Asia Pacific Incentive Travel Market, by End User (2022-2029) 6.4 Asia Pacific Incentive Travel Market, by Country (2022-2029) 6.4.1 China 6.4.1.1 China Incentive Travel Market, by Industry (2022-2029) 6.4.1.2 China Incentive Travel Market, by Travel (2022-2029) 6.4.1.3 China Incentive Travel Market, by End User (2022-2029) 6.4.2 South Korea 6.4.2.1 S Korea Incentive Travel Market, by Industry (2022-2029) 6.4.2.2 S Korea Incentive Travel Market, by Travel (2022-2029) 6.4.2.3 S Korea Incentive Travel Market, by End User (2022-2029) 6.4.3 Japan 6.4.3.1 Japan Incentive Travel Market, by Industry (2022-2029) 6.4.3.2 Japan Incentive Travel Market, by Travel (2022-2029) 6.4.3.3 Japan Incentive Travel Market, by End User (2022-2029) 6.4.4 India 6.4.4.1 India Incentive Travel Market, by Industry (2022-2029) 6.4.4.2 India Incentive Travel Market, by Travel (2022-2029) 6.4.4.3 India Incentive Travel Market, by End User (2022-2029) 6.4.5 Australia 6.4.5.1 Australia Incentive Travel Market, by Industry (2022-2029) 6.4.5.2 Australia Incentive Travel Market, by Travel (2022-2029) 6.4.5.3 Australia Incentive Travel Market, by End User (2022-2029) 6.4.6 Indonesia 6.4.6.1 Indonesia Incentive Travel Market, by Industry (2022-2029) 6.4.6.2 Indonesia Incentive Travel Market, by Travel (2022-2029) 6.4.6.3 Indonesia Incentive Travel Market, by Travel (2022-2029) 6.4.7 Malaysia 6.4.7.1 Malaysia Incentive Travel Market, by Industry (2022-2029) 6.4.7.2 Malaysia Incentive Travel Market, by Travel (2022-2029) 6.4.7.3 Malaysia Incentive Travel Market, by End User (2022-2029) 6.4.8 Vietnam 6.4.8.1 Vietnam Incentive Travel Market, by Industry (2022-2029) 6.4.8.2 Vietnam Incentive Travel Market, by Travel (2022-2029) 6.4.8.3 Vietnam Incentive Travel Market, by End User (2022-2029) 6.4.9 Taiwan 6.4.9.1 Taiwan Incentive Travel Market, by Industry (2022-2029) 6.4.9.2 Taiwan Incentive Travel Market, by Travel (2022-2029) 6.4.9.3 Taiwan Incentive Travel Market, by End User (2022-2029) 6.4.10 Bangladesh 6.4.10.1 Bangladesh Incentive Travel Market, by Industry (2022-2029) 6.4.10.2 Bangladesh Incentive Travel Market, by Travel (2022-2029) 6.4.10.3 Bangladesh Incentive Travel Market, by End User (2022-2029) 6.4.11 Pakistan 6.4.11.1 Pakistan Incentive Travel Market, by Industry (2022-2029) 6.4.11.2 Pakistan Incentive Travel Market, by Travel (2022-2029) 6.4.11.3 Pakistan Incentive Travel Market, by End User (2022-2029) 6.4.12 Rest of Asia Pacific 6.4.12.1 Rest of Asia Pacific Incentive Travel Market, by Industry (2022-2029) 6.4.12.2 Rest of Asia Pacific Incentive Travel Market, by Travel (2022-2029) 6.4.12.3 Rest of Asia Pacific Incentive Travel Market, by End User (2022-2029) 7. Middle East and Africa Incentive Travel Market Size and Forecast by Segmentation (Value and Volume) 7.1 Middle East and Africa Incentive Travel Market, by Industry (2022-2029) 7.2 Middle East and Africa Incentive Travel Market, by Travel (2022-2029) 7.3 Middle East and Africa Incentive Travel Market, by End User (2022-2029) 7.4 Middle East and Africa Incentive Travel Market, by Country (2022-2029) 7.4.1 South Africa 7.4.1.1 South Africa Incentive Travel Market, by Industry (2022-2029) 7.4.1.2 South Africa Incentive Travel Market, by Travel (2022-2029) 7.4.1.3 South Africa Incentive Travel Market, by End User (2022-2029) 7.4.2 GCC 7.4.2.1 GCC Incentive Travel Market, by Industry (2022-2029) 7.4.2.2 GCC Incentive Travel Market, by Travel (2022-2029) 7.4.2.3 GCC Incentive Travel Market, by End User (2022-2029) 7.4.3 Egypt 7.4.3.1 Egypt Incentive Travel Market, by Industry (2022-2029) 7.4.3.2 Egypt Incentive Travel Market, by Travel (2022-2029) 7.4.3.3 Egypt Incentive Travel Market, by End User (2022-2029) 7.4.4 Nigeria 7.4.4.1 Nigeria Incentive Travel Market, by Industry (2022-2029) 7.4.4.2 Nigeria Incentive Travel Market, by Travel (2022-2029) 7.4.4.3 Nigeria Incentive Travel Market, by End User (2022-2029) 7.4.5 Rest of ME&A 7.4.5.1 Rest of ME&A Incentive Travel Market, by Industry (2022-2029) 7.4.5.2 Rest of ME&A Incentive Travel Market, by Travel (2022-2029) 7.4.5.3 Rest of ME&A Incentive Travel Market, by End User (2022-2029) 8. South America Incentive Travel Market Size and Forecast by Segmentation by (Value and Volume) 8.1 South America Incentive Travel Market, by Industry (2022-2029) 8.2 South America Incentive Travel Market, by Travel (2022-2029) 8.3 South America Incentive Travel Market, by End User (2022-2029) 8.4 South America Incentive Travel Market, by Country (2022-2029) 8.4.1 Brazil 8.4.1.1 Brazil Incentive Travel Market, by Industry (2022-2029) 8.4.1.2 Brazil Incentive Travel Market, by Travel (2022-2029) 8.4.1.3 Brazil Incentive Travel Market, by End User (2022-2029) 8.4.2 Argentina 8.4.2.1 Argentina Incentive Travel Market, by Industry (2022-2029) 8.4.2.2 Argentina Incentive Travel Market, by Travel (2022-2029) 8.4.2.3 Argentina Incentive Travel Market, by End User (2022-2029) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America Incentive Travel Market, by Industry (2022-2029) 8.4.3.2 Rest Of South America Incentive Travel Market, by Travel (2022-2029) 8.4.3.3 Rest Of South America Incentive Travel Market, by End User (2022-2029) 9. Global Incentive Travel Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Manufacturing Locations 9.3.6 Production Capacity 9.3.7 Production for 2022 9.4 Leading Incentive Travel Global Companies, by market capitalization 9.5 Market Structure 9.5.1 Market Leaders 9.5.2 Market Followers 9.5.3 Emerging Players 9.6 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 Maritz Global Events (USA) 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Details on Partnership 10.1.7 Regulatory Accreditations and Certifications Received by Them 10.1.8 Awards Received by the Firm 10.1.9 Recent Developments 10.2 ITA Group (USA) 10.3 Creative Group (USA) 10.4 BI WORLDWIDE (USA) 10.5 Aimia Inc. (Canada) 10.6 One10 (USA) 10.7 Brightspot Incentives & Events (USA) 10.8 Ovation Global DMC (Ireland) 10.9 Meetings and Incentives Worldwide (USA) 10.10 Frosch (USA) 10.11 Omega World Travel (Virginia, USA) 10.12 Adelman Travel (USA) 10.13 The Performance Group (Florida, USA) 10.14 Gavel International (California, USA) 10.15 Carlson Wagonlit (Minnesota, USA) 10.16 Next Level Performance (New Jersey, USA) 11. Key Findings 12. Industry Recommendations 13. Incentive Travel Market: Research Methodology 14. Terms and Glossary