The Immersion Cooling Fluids Market size was valued at USD 2.11 Billion in 2025 and the total Immersion Cooling Fluids revenue is expected to grow at a CAGR of 8.1% from 2026 to 2032, reaching nearly USD 3.65 Billion by 2032. Immersion cooling is a thermal management approach, commonly used in IT cooling, in which electronic equipment and IT components, including entire servers and storage devices, are immersed in a thermally conductive but electrically insulating dielectric liquid or coolant. Heat is removed from the system by bringing relatively cold liquid into direct contact with hot components, then passing the now-heated liquid through cool heat exchangers. Immersion cooling, particularly for bitcoin mining, has been a popular way of generating useable heat in recent years. A single ASIC miner in a cold environment can generate super high efficiency electric heat conversion sufficient to heat an entire home. Immersion cooling market is likely to be driven by increasing server rack density and chip density, new use cases such as hazardous edge computing settings, and demand to minimise energy usage during data centre cooling. Several global as well as regional competitors are present in the industry. In the industry, there are several unique immersion cooling systems available, and several manufacturers retrofit off-the-shelf Information Technology Equipment (ITE) to make it compatible with their technology. Furthermore, manufacturers provide customised solutions to their clients based on their needs. The growing demand for IoT capabilities and cloud computing infrastructure will fuel demand for data centres, particularly hyper-scale data centres. Hyperscale data centres allow digital platforms to efficiently store and move data. When compared to current data centres, hyper-scale facilities can manage high-volume traffic as well as large computational workloads.To know about the Research Methodology :- Request Free Sample Report

Immersion Cooling Fluids Market Dynamics

Increasing Need for Sustainable Cooling Solutions Almost every major sector in the world is undergoing dramatic transformations, and many old business strategies are becoming obsolete as most companies shift their focus from commercial and revenue expansions to sustainable development and the circular economy. As future initiatives are planned within the Environmental, Social, and Governance (ESG) framework, this has had an influence on numerous company models. This is visible in many ESG developments throughout the world. Sustainable data centres have begun to update their facilities in order to drastically cut water use, including data centre cooling advances. New battery improvements enable them to use fewer and longer-lasting batteries. They are also collaborating closely with local power companies to find strategies to increase the use of green energy. This is expected to boost the Immersion Cooling Fluids Market growth.Increasing Government Initiatives for Carbon Neutral and Energy-Efficient Data Centers The development of carbon-neutral data centres is expected to be fueled by various government programmes and environmental laws, notably those aimed at lowering carbon emissions. For example, the International Climate Agreement, often known as the Paris Agreement, in which nations discuss activities they will take to reduce greenhouse gas emissions in order to achieve the goal of zero carbon emissions. Government initiatives, as well as data centre and organisation actions and responsibilities, are critical for advancing practical data centre cooling improvements. Governments and data centre operators can collaborate to determine how sustainable investments and activities can best benefit the whole framework while also assisting in fulfilling national energy and environmental standards. High Investment with Greater Capital Expenditure The expense of replacing failing servers more often than normal may be less expensive over time for a big organisation than the cost of maintaining a hyperscale facility at lower temperatures. However, with the increasing integration of GPUs in data centres driven by the need for more computational power, major organisations must shift to an effective cooling system. When comparing the two-phase immersion cooling system to the single-phase immersion, the upfront expenses of the two-phase immersion are much higher owing to the advanced engineering. Because immersion technology is newer than water or air cooling, and cooling technology is continually evolving, the cost is higher than for established methods. Furthermore, the expense of fluorocarbon-based coolants is significant since they must be refilled on a regular basis. These coolants cost hundreds of dollars per gallon, which raises overall running costs and offsets any little increases in power efficiency, not to mention the total cost of ownership (TCO). Lack of Standardization & Alternative Technologies Existing in the Market The lack of immersion cooling guidelines and industry standards is a key impediment to the spread of immersion cooling innovation. Standard SOPs and guidelines are chosen for non-homogeneous process settings because goods controlled by standards and regulations are more compatible, consistent, and of higher quality. Because incompatible, non-standardized systems represent a market barrier, it is critical to develop standards and principles to enable worldwide adoption of immersion cooling for data centres, cryptocurrency mining farms, and blockchain applications. Cooling infrastructure is classified into two types: air-based and water-based. To maintain temperature, air is fed into data centres using air-based cooling. Water-based cooling is further subdivided into immersion cooling and water-cooled racks, where fluid coolants flow across heated parts to maintain temperature. According to research, data centres contribute for 2% to 5% of worldwide greenhouse gas (GHG) emissions. Cooling systems account for over 40% of electricity usage in a data centre. Companies are attempting to address this issue by establishing "green" data centres that use free air-cooling devices rather than traditional air conditioners. The growing trend of establishing green data centres for managing, storing, and exchanging data has assisted many software companies in lowering energy use and total energy costs. This is expected to hamper the Immersion Cooling Fluids Market growth.

Immersion Cooling Fluids Market Segment Analysis

Based on Cooling Fluid, mineral oil dominated the segment in 2025 and is expected to dominate the Immersion Cooling market during the forecast period. Mineral oil is a by-product of the refining of crude oil to produce gasoline and other petroleum products. These mineral oil kinds are mostly constituted of alkanes and cycloalkanes and are often provided by oil refineries with no further processing, qualifications, or quality control. When compared to traditional air conditioning systems, mineral oil is more efficient, which simplifies facility design and results in cost savings. Mineral oil is used as a single-phase dielectric because of its high boiling point and because it is transparent and oily. Over the forecast period, demand for fluorocarbon-based fluids is expected to increase at the quickest rate, with the highest CAGR. The most often used fluorocarbon molecules in immersion cooling solutions are perfluorocarbons (PFCs), hydrofluoroethers (HFEs), perfluoropolyethers (PFPEs), and fluorketones (FKs). Strong chemical and thermal stability, high dielectric strength, and relatively high vapour pressure all contribute to the ease of use of such cooling solutions for maintaining IT equipment temperatures. Based on Product, single-phase immersion cooling type is expected to witness the fastest growth at the highest CAGR and dominate the Immersion Cooling market during the forecast period. Servers or other information technology (IT) components are installed vertically in a coolant bath of a hydrocarbon-based dielectric fluid with qualities comparable to mineral oil in single-phase immersion cooling system technology. Because the coolants do not evaporate when heated, they deteriorate after ten to fifteen years. As a result, the single-phase immersion cooling system is both cost-effective and extremely dependable, and it is expected to grow at a quicker rate in the future. Single-phase immersion cooling will continue to grow in popularity since it is less expensive to install and uses less energy. Demand for single immersion cooling will increase as customers become more aware of the tradeoffs between single-phase and two-phase immersion. To prevent fluid loss owing to evaporation, the two-phase immersion cooling system is sealed with liquid. As a result, the two-phase immersion cooling system is more complicated and less practical than the single-phase immersion cooling system. Based on Application, the high-performance computing application is dominating the global immersion cooling market as it requires relatively intensive computing resources such as artificial intelligence (AI) and machine learning (ML). Investment in high-density data centres and high-performance computing applications is expanding. Furthermore, as technology advances, faster microprocessors will become accessible each year, and low-cost HPC systems with a few processors will deliver capability hitherto reserved for pricey vector computers or MPP systems. As a result, high-performance computers are no longer restricted to specific architectures, but instead contribute to the high end of a continuum of fast desktop systems and servers.Due to the groundbreaking notion of transactional compliance, start-ups, big and small and medium-sized organisations (SMEs), and many other entrepreneurs are adopting cryptocurrencies. This has led in bitcoin solution suppliers investing, partnerships, and collaborations, which will improve end-to-end solutions. This industry is very competitive because to the tremendous potential for development in nations such as the United States, Japan, India, and Germany. Microsoft has been exploring immersion cooling technology from bitcoin mining for its cloud servers since March 2021. As the most promising technology for future high-density data centres, the business has been focused on immersion cooling technology utilised in bitcoin mining.

Regional Insights

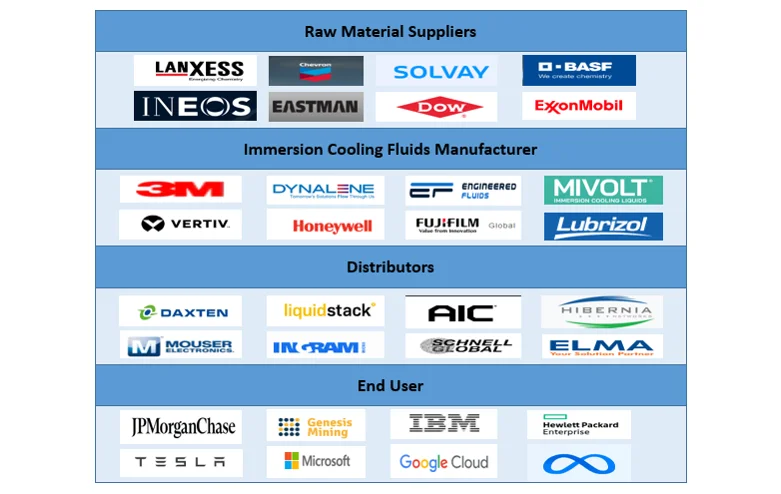

North America is a leader in the adoption of emerging technology and is expected to dominate the Immersion Cooling market during the forecast period. The region's linked device penetration has increased dramatically. Investors in data centres are increasingly interested in liquid immersion and direct-to-chip cooling methods. The introduction of 5G networks throughout the world has helped the relevance of edge data centres, and the United States is among the early users of the technology. Many US operators, including EdgePresence, EdgeMicro, and American Towers, have begun to invest in these centres. Citizens and Companies in the United States are increasingly using the internet. The country is the largest market for data centre operations, and it is continue to grow as end-user data demand increases. The rising popularity of the Internet of Things (IoT) is a crucial driver for the US hyper-scale data centre industry, resulting in the construction of new facilities capable of handling exabytes of data generated by both commercial and consumer users. Furthermore, due to rising need for efficient data centres, initiatives for ecological data centre solutions, and significant expansion in power density across the area, Canada is constantly developing and supplying more data centre infrastructure options. The data centre business in the Asia Pacific area is expanding rapidly and concentrating more on efficiency and uptime. Larger organisations are aiming to scale out their data centres to assure stability and dependability of data services, as the use of 5G, wearable devices, the internet of things, and artificial intelligence fuels a booming demand for processing capacity. Accelerator processors are finding their way into company data centres as artificial intelligence and comparable loads become regular practise across numerous industrial verticals in China. Technologies that operate at zero latency process information at astronomical rates with the assistance of accelerating systems, meeting the needs of all latency-sensitive services. Several Taiwanese firms are engaged in considerable development operations in the immersion cooling landscape. With over 150 data centres, the Japanese industry has developed to become one of Asia's major data centre marketplaces. With over 150 data centres, the Japanese industry has developed to become one of Asia's major data centre marketplaces.Immersion Cooling Fluids Industry Ecosystem:

Immersion Cooling Fluids Market Scope: Inquire before buying

Immersion Cooling Fluids Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 2.11 Bn. Forecast Period 2026 to 2032 CAGR: 8.1% Market Size in 2032: USD 3.65 Bn. Segments Covered: by Cooling Fluid Mineral Oil Synthetic Fluids Fluorocarbon-based Fluids Others by Product Single-phase Two-phase by Application High-performance Computing Edge Computing Cryptocurrency Mining Artificial Intelligence Others Immersion Cooling Fluids Market,by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Immersion Cooling Fluids Market, Key Players are

1. Alfa Laval AB(Sweden) 2. Liquid Stack Inc. (United States) 3. Asetek AS (United States) 4. Asperitas Company(Netherlands) 5. Chilldyne Inc. (Canada) 6. CoolIT Systems Inc. (Canada) 7. Fujitsu Limited (Japan) 8. Mikros Technologies (United States) 9. Kaori Heat Treatment Co. Ltd (Taiwan) 10.Lenovo group Limited (Hong Kong) 11.Liquid Cool Solutions (United States) 12.Midas Green Technologies (United States) 13.Iceotope Technologies Ltd (United Kingdom) 14.USystems Ltd (United Kingdom) 15.Rittal GmbH & Co. KG(Germany) 16.Schneider Electric (France) 17.Submer Technologies (Spain) 18.Vertiv Co. (United States) 19.Wakefield-Vette Inc. (United States) 20.Wiwynn Corporation (Taiwan) Frequently Asked Questions: 1] What segments are covered in the Global Immersion Cooling Fluids Market report? Ans. The segments covered in the Immersion Cooling Fluids Market report are based on Cooling Fluid, Product, Industry, Application. 2] Which region is expected to hold the highest share in the Global Immersion Cooling Fluids Market? Ans. The North America region is expected to hold the highest share in the Immersion Cooling Fluids Market. 3] What is the market size of the Global Immersion Cooling Fluids Market by 2032? Ans. The market size of the Immersion Cooling Fluids Market by 2032 is expected to reach USD 3.65 Bn. 4] What is the forecast period for the Global Immersion Cooling Fluids Market? Ans. The forecast period for the Immersion Cooling Fluids Market is 2026-2032. 5] What was the Global Immersion Cooling Fluids Market size in 2025? Ans: The Global Immersion Cooling Fluids Market size was USD 2.11 Billion in 2025.

1. Immersion Cooling Fluids Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Immersion Cooling Fluids Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Cooling Fluid Segment 2.5.3. Product Segment 2.5.4. Application Segment 2.5.5. Revenue (2025) 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Consolidation of the Market 2.7.1. Strategic Initiatives and Developments 2.7.2. Mergers and Acquisitions 2.7.3. Collaborations and Partnerships 2.7.4. Product Launches and Innovations 3. Patent Analysis: 3.1.1. Top 10 Patent Holders 3.1.2. Top 10 Companies with Highest Number of Patents 3.1.3. Patent Registration Analysis 3.1.4. Number of Patents Granted Still 2024 4. Global Immersion Cooling Fluids Market: Dynamics 4.1. Immersion Cooling Fluids Market Trends 4.2. Immersion Cooling Fluids Market Dynamics 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 5. Value and Supply Chain Analysis 6. Pricing Analysis 6.1. Average price of Immersion Cooling Fluids, by Region 6.2. Average price of Immersion Cooling Fluids, by Function 7. Regulatory Landscape 7.1. Regulation by Region 7.2. Tariff and Taxes 7.3. Regulatory Bodies, Government agencies, and other organization by Region 8. Trade Data Analysis: 8.1. Import/ Export of Immersion Cooling Fluids 8.1.1. Import Data on Immersion Cooling Fluids 8.1.2. Export Data on Immersion Cooling Fluids 8.2. Evolution of Emmerson Cooling for Data Centers 9. Global Immersion Cooling Fluids Market Size and Forecast by Segments (by Value USD Billion) 9.1. Global Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 9.1.1. Mineral Oil 9.1.2. Synthetic Fluids 9.1.3. Fluorocarbon-based Fluids 9.1.4. Others 9.2. Global Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 9.2.1. Single-phase 9.2.2. Two-phase 9.3. Global Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 9.3.1. High-performance Computing 9.3.2. Edge Computing 9.3.3. Cryptocurrency Mining 9.3.4. Artificial Intelligence 9.3.5. Others 9.4. Global Immersion Cooling Fluids Market Size and Forecast, by Region (2025-2032) 9.4.1. North America 9.4.2. Europe 9.4.3. Asia Pacific 9.4.4. Middle East and Africa 9.4.5. South America 10. North America Global Immersion Cooling Fluids Market Size and Forecast (by Value USD Billion) 10.1. North America Global Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 10.1.1. Mineral Oil 10.1.2. Synthetic Fluids 10.1.3. Fluorocarbon-based Fluids 10.1.4. Others 10.2. North America Global Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 10.2.1. Single-phase 10.2.2. Two-phase 10.3. North America Global Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 10.3.1. High-performance Computing 10.3.2. Edge Computing 10.3.3. Cryptocurrency Mining 10.3.4. Artificial Intelligence 10.3.5. Others 10.4. North America Global Immersion Cooling Fluids Market Size and Forecast, by Country (2025-2032) 10.4.1. United States 10.4.1.1. United States Global Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 10.4.1.1.1. Mineral Oil 10.4.1.1.2. Synthetic Fluids 10.4.1.1.3. Fluorocarbon-based Fluids 10.4.1.1.4. Others 10.4.1.2. United States Global Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 10.4.1.2.1. Single-phase 10.4.1.2.2. Two-phase 10.4.1.3. United States Global Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 10.4.1.3.1. High-performance Computing 10.4.1.3.2. Edge Computing 10.4.1.3.3. Cryptocurrency Mining 10.4.1.3.4. Artificial Intelligence 10.4.1.3.5. Others 10.4.2. Canada 10.4.2.1. Canada Global Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 10.4.2.1.1. Mineral Oil 10.4.2.1.2. Synthetic Fluids 10.4.2.1.3. Fluorocarbon-based Fluids 10.4.2.1.4. Others 10.4.2.2. Canada Global Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 10.4.2.2.1. Single-phase 10.4.2.2.2. Two-phase 10.4.2.3. Canada Global Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 10.4.2.3.1. High-performance Computing 10.4.2.3.2. Edge Computing 10.4.2.3.3. Cryptocurrency Mining 10.4.2.3.4. Artificial Intelligence 10.4.2.3.5. Others 10.4.3. Mexico 10.4.3.1. Mexico Global Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 10.4.3.1.1. Mineral Oil 10.4.3.1.2. Synthetic Fluids 10.4.3.1.3. Fluorocarbon-based Fluids 10.4.3.1.4. Others 10.4.3.2. Mexico Global Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 10.4.3.2.1. Single-phase 10.4.3.2.2. Two-phase 10.4.3.3. Mexico Global Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 10.4.3.3.1. High-performance Computing 10.4.3.3.2. Edge Computing 10.4.3.3.3. Cryptocurrency Mining 10.4.3.3.4. Artificial Intelligence 10.4.3.3.5. Others 11. Europe Immersion Cooling Fluids Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 11.1. Europe Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.2. Europe Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.3. Europe Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 11.4. Europe Immersion Cooling Fluids Market Size and Forecast, by Country (2025-2032) 11.4.1. United Kingdom 11.4.1.1. United Kingdom Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.4.1.2. United Kingdom Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.4.1.3. United Kingdom Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 11.4.2. France 11.4.2.1. France Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.4.2.2. France Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.4.2.3. France Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 11.4.3. Germany 11.4.3.1. Germany Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.4.3.2. Germany Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.4.3.3. Germany Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 11.4.4. Italy 11.4.4.1. Italy Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.4.4.2. Italy Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.4.4.3. Italy Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 11.4.5. Spain 11.4.5.1. Spain Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.4.5.2. Spain Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.4.5.3. Spain Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 11.4.6. Sweden 11.4.6.1. Sweden Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.4.6.2. Sweden Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.4.6.3. Sweden Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 11.4.7. Austria 11.4.7.1. Austria Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.4.7.2. Austria Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.4.7.3. Austria Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 11.4.8. Rest of Europe 11.4.8.1. Rest of Europe Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 11.4.8.2. Rest of Europe Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 11.4.8.3. Rest of Europe Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12. Asia Pacific Immersion Cooling Fluids Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 12.1. Asia Pacific Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.2. Asia Pacific Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.3. Asia Pacific Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4. Asia Pacific Immersion Cooling Fluids Market Size and Forecast, by Country (2025-2032) 12.4.1. China 12.4.1.1. China Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.1.2. China Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.1.3. China Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.2. S Korea 12.4.2.1. S Korea Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.2.2. S Korea Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.2.3. S Korea Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.3. Japan 12.4.3.1. Japan Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.3.2. Japan Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.3.3. Japan Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.4. India 12.4.4.1. India Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.4.2. India Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.4.3. India Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.5. Australia 12.4.5.1. Australia Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.5.2. Australia Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.5.3. Australia Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.6. Indonesia 12.4.6.1. Indonesia Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.6.2. Indonesia Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.6.3. Indonesia Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.7. Malaysia 12.4.7.1. Malaysia Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.7.2. Malaysia Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.7.3. Malaysia Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.8. Vietnam 12.4.8.1. Vietnam Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.8.2. Vietnam Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.8.3. Vietnam Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.9. Taiwan 12.4.9.1. Taiwan Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.9.2. Taiwan Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.9.3. Taiwan Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 12.4.10. Rest of Asia Pacific 12.4.10.1. Rest of Asia Pacific Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 12.4.10.2. Rest of Asia Pacific Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 12.4.10.3. Rest of Asia Pacific Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 13. South America Immersion Cooling Fluids Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 13.1. South America Immersion Cooling Fluids Market Size and Forecast, by Cooling (2025-2032) 13.2. South America Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 13.3. South America Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 13.4. South America Immersion Cooling Fluids Market Size and Forecast, by Country (2025-2032) 13.4.1. Brazil 13.4.1.1. Brazil Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 13.4.1.2. Brazil Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 13.4.1.3. Brazil Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 13.4.2. Argentina 13.4.2.1. Argentina Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 13.4.2.2. Argentina Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 13.4.2.3. Argentina Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 13.4.3. Rest Of South America 13.4.3.1. Rest of South America Immersion Cooling Fluids Market Size and Forecast, by Cooling Fluid (2025-2032) 13.4.3.2. Rest of South America Immersion Cooling Fluids Market Size and Forecast, by Product (2025-2032) 13.4.3.3. Rest of South America Immersion Cooling Fluids Market Size and Forecast, by Application (2025-2032) 14. Company Profile: Key players 14.1. Liquid Cool Solutions (United States) 14.1.1. Financial Overview 14.1.2. Business Portfolio 14.1.3. SWOT Analysis 14.1.4. Business Strategy 14.1.5. Recent Developments 14.2. Alfa Laval AB(Sweden) 14.3. Liquid Stack Inc. (United States) 14.4. Asetek AS (United States) 14.5. Asperitas Company(Netherlands) 14.6. Chilldyne Inc. (Canada) 14.7. CoolIT Systems Inc. (Canada) 14.8. Fujitsu Limited (Japan) 14.9. Mikros Technologies (United States) 14.10. Kaori Heat Treatment Co. Ltd (Taiwan) 14.11. Lenovo group Limited (Hong Kong) 14.12. Liquid Cool Solutions (United States) 14.13. Midas Green Technologies (United States) 14.14. Iceotope Technologies Ltd (United Kingdom) 14.15. USystems Ltd (United Kingdom) 14.16. Rittal GmbH & Co. KG(Germany) 14.17. Schneider Electric (France) 14.18. Submer Technologies (Spain) 14.19. Vertiv Co. (United States) 14.20. Wakefield-Vette Inc. (United States) 14.21. Wiwynn Corporation (Taiwan) 14.22. Others 15. Key Findings 16. Industry Recommendations 16.1. Attractive opportunities of key players in the global market 17. Global Immersion Cooling Fluids Market: Research Methodology