The Global Hyperloop Market size was valued at USD 1.69 Bn. In 2022 the total Hyperloop Market revenue is growing by 40.5 % from 2023 to 2029, reaching nearly USD 18.27 Bn.Hyperloop Market Overview:

Hyperloop is the third revolution in traveling technologies after road, and air. Hyperloop technology is expected to disrupt traveling technologies and expected to bring the world closer by saving fuel costs, reducing carbon emissions, and mass traveling at near speed of air travel. The Hyperloop market is rapidly evolving, thanks to the potential for high-speed, sustainable transportation significantly drives the Hyperloop Market Growth. With growing investments, technological advancements, and increased public interest, it offers promising opportunities for innovation and market growth. This advanced mode of transportation promises rapid, energy-efficient travel, bolstered. The utilization of renewable energy sources, such as solar and wind power, for propulsion. It helps to a substantial reduction in immediate emissions, signifying a significant leap in the battle against both air pollution and climate change. The Hyperloop market stands as an exciting frontier for sustainable, high-speed transportation innovation and market growth.To know about the Research Methodology :- Request Free Sample Report

Competitive Landscape

The Hyperloop Market competitive landscape is characterized by dynamic competition among key players, each vying for market share through product innovation, quality, and customer satisfaction. Hyperloop Market is rapidly growing Hundreds of millions of dollars are being spent on hyperloop technology by companies and countries across the globe. Key objectives of hyperloop companies currently are reducing the cost of technology and making it affordable for mass travel. Though most of the ongoing projects across the globe are for domestic travel, very soon hyperloop is expected to be implemented for international and inter-continent travel. Investment across the globe by governments, companies, and PE firms is making the hyperloop market next-generation travel technology and has been creating opportunities for companies across the globe. The companies focused on continued development despite the initial hype fading, companies are still working on developing Hyperloop technology. For example, TUM Hyperloop, a company affiliated with the Technical University of Munich, is actively building up the technology and expects it to be ready by the end of the decadeFuture Scope and Trend of Hyperloop Market:

The future of the Hyperloop market holds significant potential for revolutionizing transportation. In an era characterized by pollution, traffic congestion, and chaotic travel experiences, the Hyperloop emerges as a promising solution to address these challenges. It presents two versions, including Passenger-Only and Passenger-Plus-Vehicle Hyperloop, offering efficient, eco-friendly, and cost-effective mass transit. To unlock its full potential, several avenues for improvement are evident. Firstly, designing stylish, user-friendly stations for seamless passenger boarding and alighting is crucial. Secondly, enhancing safety features and propulsion systems to accommodate sharp turns and varying altitudes is imperative. The current capsule design, accommodating only 28 passengers, also be optimized for increased capacity. While Hyperloop technology is still in its infancy, its promising triple-crown trajectory suggests room for future advancements. However, realizing this vision necessitates linear routes spanning hundreds of miles and substantial funding, presenting feasibility challenges. Yet, in an industry marked by stagnation, Hyperloop represents a beacon of innovation and a promising step toward modernizing transportation, even if its widespread adoption remains uncertain.

Hyperloop Market Dynamics

Rising Environmental Concerns Drive the Market Growth Environmental concern is a key driver in the push for the Hyperloop Market. Traditional transportation methods, particularly road and air travel, contribute significantly to carbon emissions and pollution. The sustainability potential of Hyperloop transportation lies in its capacity for energy efficiency and lower emissions per passenger mile. Unlike conventional vehicles relying on fossil fuels, Hyperloop systems harness renewable energy sources like solar and wind power to generate the necessary electricity for propulsion. Eliminating direct emissions from Hyperloop pods, significantly mitigates air pollution, rendering it an appealing choice in the global effort to combat climate change. Reducing the carbon footprint of transportation aligns with global efforts to mitigate environmental impacts. Governments and institutions are placing growing emphasis on sustainable transportation solutions, and the environmentally friendly aspects of Hyperloop are essential in gaining backing and financial support for its advancement. Consequently, Hyperloop technology emerges as a hopeful avenue for tackling environmental issues within the transportation industry. Reduced Infrastructure Costs Boost the Market Growth The development of Hyperloop technology is strongly motivated by its potential to drastically lower infrastructure expenses when compared to conventional transportation systems. This promise of significantly reduced infrastructure costs makes Hyperloop technology an immensely attractive prospect. One of its primary cost-saving features is the above-ground nature of the infrastructure. Hyperloop operates on elevated pylons or within low-pressure tubes, eliminating the need for extensive and expensive land acquisition or tunneling, which burdens conventional rail or subway projects. The modular construction approach used in Hyperloop development simplifies construction processes, lowers labor costs, and minimizes the likelihood of project delays, in stark contrast to the custom-designed, on-site construction common in traditional infrastructure projects. Hyperloop leverages existing transportation corridors, such as highway medians or rail rights-of-way, reducing the necessity for acquiring new land and further curbing expenses. The energy-efficient design of Hyperloop systems decreases operational costs over time and aligns with sustainability goals, making it an economically and environmentally prudent choice. Reduced maintenance needs, thanks to its minimal friction and wear design, translate into long-term cost savings. The involvement of private sector investment in certain Hyperloop projects redistributes financial responsibilities, alleviating the burden on governments and taxpayers. This factor significantly boosts the Hyperloop Market growth. For Example, The estimated cost of building a Hyperloop system varies depending on the location, project scope, and other factors. 1. The Great Lakes Hyperloop, as estimated by a study conducted by the Northeast Ohio Area-wide Coordinating Agency (NOACA), is projected to cost between $25 billion and $30 billion, or $60 million per mile, and take six years to construct. This estimate includes the cost of land, permits, and other factors. 2. In 2016, leaked documents estimated the cost of a Hyperloop line at $121 million per mile, while Elon Musk had initially pledged $11.5 million per mile in 2013. This disparity in cost estimates is not fully explained, but factors such as land costs and project scope may contribute to the variation 3. Hyperloop One, another company working on Hyperloop technology, estimated the cost of a potential 107-mile Bay Area project to be between $9 billion and $13 billion, or $84 million to $121 million per mile. This estimate is in line with the leaked documents from 2016. 4. The route between Abu Dhabi and Dubai, announced by Hyperloop One, was estimated to cost $4.8 billion, or $52 million per mile. Again, the variation in cost estimates can be attributed to different project factors and locations. 5. A 2020 model by Virgin Hyperloop One estimated a per-mile cost of $84 to $121 million for a cut-down 107-mile Bay Area project. This cost is compared to a projected cost of $178 million per mile for the full Californian high-speed rail project Regulatory Hurdles Limit the Market Growth Regulatory hurdles pose a substantial challenge to the successful deployment of Hyperloop technology. These challenges encompass a wide array of complexities, ranging from safety certification to international coordination. First and foremost, ensuring the safety of passengers and cargo within the high-speed, low-pressure environment of Hyperloop systems demands the development of rigorous safety standards and certification processes, a task that lacks established precedents. Additionally, Hyperloop projects often span multiple jurisdictions and countries, requiring the harmonization of regulations on a global scale. This international dimension adds layers of complexity to the regulatory landscape. Moreover, defining legal liability in the event of accidents or incidents involving Hyperloop systems becomes a delicate issue necessitating careful consideration. The approval processes for Hyperloop infrastructure, involving land use, environmental impact, and property rights, further contribute to regulatory intricacies. To navigate these hurdles successfully, stakeholders must collaborate to develop comprehensive, forward-thinking regulatory frameworks that prioritize safety, environmental sustainability, and public acceptance while accommodating the unique attributes of Hyperloop technology. Such frameworks will be pivotal in ensuring the safe and efficient integration of Hyperloop systems into the global transportation network. Innovation and technological advancement create lucrative growth opportunities for the Market Growth Innovation and technological advancement are the lifeblood of the Hyperloop Market, offering a multitude of lucrative growth opportunities Hyperloop technology undergoes ongoing evolution, it unveils ground-breaking achievements in propulsion, materials, safety systems, and energy efficiency. These strides in innovation hold the potential to offer swifter, safer, and more economically efficient transportation solutions, rendering Hyperloop an increasingly appealing choice for governments, investors, and commuters. This continual pursuit of progress fosters fierce competition among companies competing to create superior Hyperloop systems that could transform the transportation landscape. The economic ramifications of such technological advancements are substantial, as they generate high-tech employment opportunities, stimulate research and development endeavors, and drive investments in related sectors, renewable energy. Safety concerns are addressed through innovation, and public trust in the technology grows, further boosting Market growth. The Hyperloop ecosystem, comprised of start-ups, research institutions, and established players, thrives in this environment, collectively driving the advancement and proliferation of this ground-breaking transportation mode.Hyperloop Market Challenges:

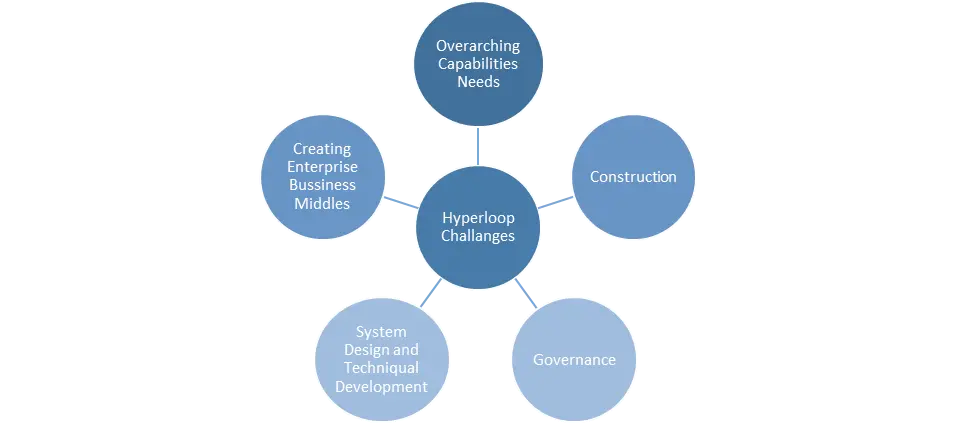

1. Overarching Capability Needs Overarching capability needs refers to capabilities that are fundamental to delivering most aspects of the hyperloop system. This includes management of risks to project delivery. Risks will not only relate to technology readiness levels but also to manufacturing readiness levels and supply chain readiness levels. During conversations about the project, the team was encouraging the Hyperloop developers to outline what they considered to be the biggest risks to delivery. 2. Creating Enterprising Business Models This capability area is focused on securing finance, which could come from a variety of private and public sources. Without financing, infrastructure projects simply cannot happen. Related to financing is the building of the business case, which forms the basis of investment.Hyperloop Market Segment Analysis:

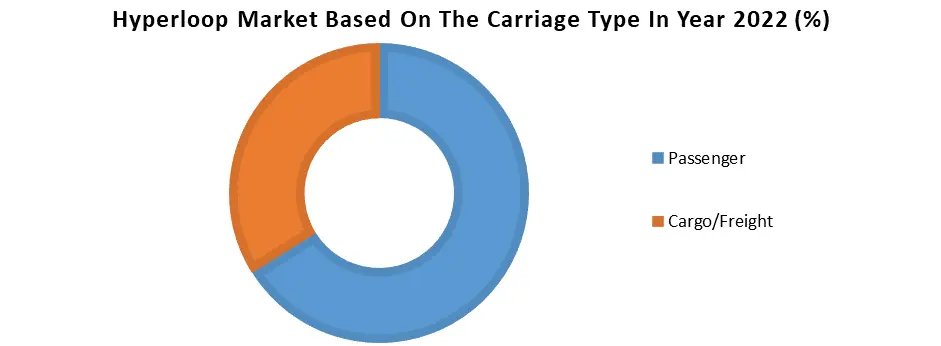

Based on the Transportation System, The Capsule transportation segment dominated the Hyperloop Market in the year 2022. The capsule transportation segment emerged as the dominant force in the Hyperloop Market. Capsule technology advanced significantly, resulting in faster, safer, and more efficient travel within low-pressure hyperloop tubes. These capsules incorporated cutting-edge materials and propulsion systems, enabling them to achieve near-supersonic speeds while maintaining passenger comfort. Additionally, high-profile partnerships and investments boosted the capsule transportation sector's growth. Major corporations and governments worldwide recognized the potential of Hyperloop technology to revolutionize transportation, leading to substantial funding and regulatory support. Capsule-based Hyperloop systems demonstrated their viability through successful test runs and pilot projects in various regions. Public confidence in this transportation mode grew, attracting both passengers and investors. The capsule transportation segment's dominance in the 2022 Market is a significant step forward in realizing the vision of ultra-fast, sustainable, and efficient transportation.Based on the Carriage Type, the passenger segment dominate the Hyperloop Market in the year 2022. Passenger transportation is a significant market with high demand. People need to commute to work, travel for leisure, and move between cities, making the passenger segment a crucial aspect of the transportation industry. If Hyperloop technology provides a fast, efficient, and comfortable passenger experience, it is likely to attract more customers. Hyperloop’s high-speed capabilities significantly reduce travel times between cities. This is particularly attractive for passenger transportation, people are more likely to opt for faster modes of travel when they want to reach their destinations quickly. Therefore the passenger segment significantly dominates the passenger sub-segment.

Hyperloop Market Regional Insight

The Asia Pacific Region dominated the Hyperloop Market in the year 2022 with the highest market share of around 42%. The Asia-Pacific region is positioned to become the frontrunner in the global Hyperloop Market, with both Hyperloop Technologies and Hyperloop Transportation Technologies expressing their ambitions to pioneer the first Hyperloop system outside of the USA. They are considering potential sites in the United Kingdom, Singapore-Kuala Lumpur, and the Middle East, attracted by supportive government initiatives and streamlined regulatory processes. China, in particular, is aggressively expanding its transportation infrastructure while aiming to reduce the high costs associated with freight transportation. Currently spending around 16 % of its GDP on logistics, China seeks to improve efficiency and competitiveness compared to Western countries, where logistics expenditure averages around 10%-12% of GDP. Hyperloop technology offers the promise of significantly faster and more efficient goods transportation compared to traditional road and rail methods, making it an appealing solution for addressing China's logistics challenges and fostering economic growth in the region. Hyperloop in India1. Hyperloop Transportation Technologies is in the process of signing a Letter of Intent with the Indian Government for a proposed route between Chennai and Bengaluru. If things go as planned, the distance of 345 km could be covered in 30 minutes. 2. HTT also signed an agreement with the Andhra Pradesh government to build India’s first Hyperloop project connecting Amravati to Vijayawada in a 6-minute ride. 3. On February 22, 2018, Hyperloop One entered into a MOU (Memorandum of Understanding) with the Government of Maharashtra to build a Hyperloop transportation system between Mumbai and Pune that would cut the travel time from the current 180 minutes to just 20 minutes.

Hyperloop Market Scope: Inquiry Before Buying

Hyperloop Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.69 Bn. Forecast Period 2023 to 2029 CAGR: 40.5% Market Size in 2029: US $ 18.27 Bn. Segments Covered: by Transportation System Capsule Guideway Propulsion System Route by Carriage Type Passenger Cargo/Freight by Speed More than 700 kmph less than 700 kmph Hyperloop Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hyperloop Market Key Players

1. Hyperloop Transportation Technologies 2. Virgin Group 3. SpaceX 4. Tesla 5. AECOM Inc. 6. Dinclix GroundWorks 7. Zeleros Hyperloop 8. Arrivo Corporation 9. Nevomo 10. Hardt 11. HyperloopTT 12. Avishkar Hyperloop 13. TUM Hyperloop 14. The Boring Company 15. TranspodFAQ

1] What segments are covered in the Global Hyperloop Market report? Ans. The segments covered in the Hyperloop Market report are based on Transportation System, Carriage Type, Speed, and Regions. 2] Which region is expected to hold the highest share in the Global Hyperloop Market by 2029? Ans. The Asia Pacific region is expected to hold the highest share of the Hyperloop Market by 2029. 3] What is the market size of the Global Hyperloop Market by 2029? Ans. The market size of the Hyperloop Market by 2029 is expected to reach US$ 18.27 Bn. 4] What is the forecast period for the Global Hyperloop Market? Ans. The forecast period for the Hyperloop Market is 2023-2029. 5] What was the market size of the Global Hyperloop Market in 2022? Ans. The market size of the Hyperloop Market in 2022 was valued at US$ 1.69 Bn.

1. Hyperloop Market: Research Methodology 2. Hyperloop Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Hyperloop Market: Dynamics 3.1. Hyperloop Market Trends by Region 3.1.1. North America Hyperloop Market Trends 3.1.2. Europe Hyperloop Market Trends 3.1.3. Asia Pacific Hyperloop Market Trends 3.1.4. Middle East and Africa Hyperloop Market Trends 3.1.5. South America Hyperloop Market Trends 3.2. Hyperloop Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Hyperloop Market Drivers 3.2.1.2. North America Hyperloop Market Restraints 3.2.1.3. North America Hyperloop Market Opportunities 3.2.1.4. North America Hyperloop Market Challenges 3.2.2. Europe 3.2.2.1. Europe Hyperloop Market Drivers 3.2.2.2. Europe Hyperloop Market Restraints 3.2.2.3. Europe Hyperloop Market Opportunities 3.2.2.4. Europe Hyperloop Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Hyperloop Market Drivers 3.2.3.2. Asia Pacific Hyperloop Market Restraints 3.2.3.3. Asia Pacific Hyperloop Market Opportunities 3.2.3.4. Asia Pacific Hyperloop Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Hyperloop Market Drivers 3.2.4.2. Middle East and Africa Hyperloop Market Restraints 3.2.4.3. Middle East and Africa Hyperloop Market Opportunities 3.2.4.4. Middle East and Africa Hyperloop Market Challenges 3.2.5. South America 3.2.5.1. South America Hyperloop Market Drivers 3.2.5.2. South America Hyperloop Market Restraints 3.2.5.3. South America Hyperloop Market Opportunities 3.2.5.4. South America Hyperloop Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Carriage Type Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For the Hyperloop Industry 3.8. Analysis of Government Schemes and Initiatives For Hyperloop Industry 3.9. The Global Pandemic's Impact on the Hyperloop Market 4. Hyperloop Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 4.1.1. Capsule 4.1.2. Guideway 4.1.3. Propulsion System 4.1.4. Route 4.2. Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 4.2.1. Passenger 4.2.2. Cargo/Freight 4.3. Hyperloop Market Size and Forecast, by Speed (2022-2029) 4.3.1. More than 700 kmph 4.3.2. Less than 700 kmph 4.4. Hyperloop Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Hyperloop Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. North America Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 5.1.1. Capsule 5.1.2. Guideway 5.1.3. Propulsion System 5.2. North America Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 5.2.1. Passenger 5.2.2. Cargo/Freight 5.3. North America Hyperloop Market Size and Forecast, by Speed (2022-2029) 5.3.1. More than 700 kmph 5.3.2. Less than 700 kmph 5.4. North America Hyperloop Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 5.4.1.1.1. Capsule 5.4.1.1.2. Guideway 5.4.1.1.3. Propulsion System 5.4.1.1.4. Route 5.4.1.2. United States Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 5.4.1.2.1. Passenger 5.4.1.2.2. Cargo/Freight 5.4.1.3. United States Hyperloop Market Size and Forecast, by Speed(2022-2029) 5.4.1.3.1. More than 700 kmph 5.4.1.3.2. Less than 700 kmph 5.4.2. Canada 5.4.2.1. Canada Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 5.4.2.1.1. Capsule 5.4.2.1.2. Guideway 5.4.2.1.3. Propulsion System 5.4.2.1.4. Route 5.4.2.2. Canada Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 5.4.2.2.1. Passenger 5.4.2.2.2. Cargo/Freight 5.4.2.3. Canada Hyperloop Market Size and Forecast, by Speed(2022-2029) 5.4.2.3.1. More than 700 kmph 5.4.2.3.2. Less than 700 kmph 5.4.3. Mexico 5.4.3.1. Mexico Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 5.4.3.1.1. Capsule 5.4.3.1.2. Guideway 5.4.3.1.3. Propulsion System 5.4.3.1.4. Route 5.4.3.2. Mexico Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 5.4.3.2.1. Passenger 5.4.3.2.2. Cargo/Freight 5.4.3.3. Mexico Hyperloop Market Size and Forecast, by Speed(2022-2029) 5.4.3.3.1. More than 700 kmph 5.4.3.3.2. Less than 700 kmph 6. Europe Hyperloop Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Europe Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.2. Europe Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.3. Europe Hyperloop Market Size and Forecast, by End User(2022-2029) 6.4. Europe Hyperloop Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.4.1.2. United Kingdom Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.4.1.3. United Kingdom Hyperloop Market Size and Forecast, by End User(2022-2029) 6.4.2. France 6.4.2.1. France Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.4.2.2. France Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.4.2.3. France Hyperloop Market Size and Forecast, by End User(2022-2029) 6.4.3. Germany 6.4.3.1. Germany Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.4.3.2. Germany Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.4.3.3. Germany Hyperloop Market Size and Forecast, by End User(2022-2029) 6.4.4. Italy 6.4.4.1. Italy Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.4.4.2. Italy Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.4.4.3. Italy Hyperloop Market Size and Forecast, by End User(2022-2029) 6.4.5. Spain 6.4.5.1. Spain Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.4.5.2. Spain Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.4.5.3. Spain Hyperloop Market Size and Forecast, by End User(2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.4.6.2. Sweden Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.4.6.3. Sweden Hyperloop Market Size and Forecast, by End User(2022-2029) 6.4.7. Austria 6.4.7.1. Austria Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.4.7.2. Austria Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.4.7.3. Austria Hyperloop Market Size and Forecast, by End User(2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 6.4.8.2. Rest of Europe Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 6.4.8.3. Rest of Europe Hyperloop Market Size and Forecast, by End User(2022-2029) 7. Asia Pacific Hyperloop Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.2. Asia Pacific Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.3. Asia Pacific Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4. Asia Pacific Hyperloop Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.1.2. China Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.1.3. China Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.2.2. S Korea Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.2.3. S Korea Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.3. Japan 7.4.3.1. Japan Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.3.2. Japan Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.3.3. Japan Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.4. India 7.4.4.1. India Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.4.2. India Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.4.3. India Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.5. Australia 7.4.5.1. Australia Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.5.2. Australia Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.5.3. Australia Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.6.2. Indonesia Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.6.3. Indonesia Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.7.2. Malaysia Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.7.3. Malaysia Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.8.2. Vietnam Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.8.3. Vietnam Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.9.2. Taiwan Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.9.3. Taiwan Hyperloop Market Size and Forecast, by End User(2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 7.4.10.2. Rest of Asia Pacific Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 7.4.10.3. Rest of Asia Pacific Hyperloop Market Size and Forecast, by End User(2022-2029) 8. Middle East and Africa Hyperloop Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 8.2. Middle East and Africa Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 8.3. Middle East and Africa Hyperloop Market Size and Forecast, by End User(2022-2029) 8.4. Middle East and Africa Hyperloop Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 8.4.1.2. South Africa Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 8.4.1.3. South Africa Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 8.4.1.4. South Africa Hyperloop Market Size and Forecast, by End User(2022-2029) 8.4.2. GCC 8.4.2.1. GCC Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 8.4.2.2. GCC Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 8.4.2.3. GCC Hyperloop Market Size and Forecast, by End User(2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 8.4.3.2. Nigeria Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 8.4.3.3. Nigeria Hyperloop Market Size and Forecast, by End User(2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 8.4.4.2. Rest of ME&A Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 8.4.4.3. Rest of ME&A Hyperloop Market Size and Forecast, by End User(2022-2029) 9. South America Hyperloop Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 9.1. South America Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 9.2. South America Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 9.3. South America Hyperloop Market Size and Forecast, by End User(2022-2029) 9.4. South America Hyperloop Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 9.4.1.2. Brazil Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 9.4.1.3. Brazil Hyperloop Market Size and Forecast, by End User(2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 9.4.2.2. Argentina Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 9.4.2.3. Argentina Hyperloop Market Size and Forecast, by End User(2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Hyperloop Market Size and Forecast, by Transportation System (2022-2029) 9.4.3.2. Rest Of South America Hyperloop Market Size and Forecast, by Carriage Type (2022-2029) 9.4.3.3. Rest Of South America Hyperloop Market Size and Forecast, by End User(2022-2029) 10. Global Hyperloop Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Hyperloop Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Hyperloop Transportation Technologies 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Virgin Group 11.3. SpaceX 11.4. Tesla 11.5. AECOM Inc. 11.6. Dinclix GroundWorks 11.7. Zeleros Hyperloop 11.8. Arrivo Corporation 11.9. Nevomo 11.10. Hardt 11.11. HyperloopTT 11.12. Avishkar Hyperloop 11.13. TUM Hyperloop 11.14. The Boring Company 11.15. Transpod 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary