Global Household Product Market size was valued at USD 319.30 Billion in 2023 and the total Global Household Product revenue is expected to grow at 3.6 % from 2024 to 2030, reaching nearly USD 408.99 Billion in 2030. Household products are goods and products used within households. Household products have a wide range of substances used in households, including cleaning products, kitchen equipment, textile washing products, general-purpose cleaners, tissue and hygiene products, and others, they are tangible and movable personal property placed in the rooms of a house, such as a bed or a refrigerator.To know about the Research Methodology :- Request Free Sample Report The key driving factors for the Household products market such as such as rising disposable income, increasing living standards, increased focus on health and hygiene, consumer tastes and preferences, distribution channels, and the desire for comfort. Consumers’ spending on home improvement products is also contributing to the growth of the Household products market. The trend of smart and connected appliances and technological advancements is growing in the household Product market. People are increasingly opting for automatic products that reduce manual labor and save time. The growing opportunities in the Household products market like In 2020, the COVID-19 pandemic had a huge impact on the market. The second wave of the pandemic increased the demand for household products in 2021. Which is still ongoing continue during the forecast period. The analysis conducted by Maximize market research for the Household products market over the past 5 years and by using the data, concluded that Asia Pacific has grown at a CAGR of 4.75%, and is expected to continue during the forecast period in the global Household products market. Followed by North America, Asia Pacific is expected largest share of the Household products market. The market is dominated by key players such as Henkel AG & Co. KGaA, Colgate-Palmolive Company, Unilever PLC, Haier Group, and Reckitt Benckiser Group plc. Etc. These key players are operating in various segments of the household products market, such as cleaning products, kitchen equipment, and textile washing products, general-purpose cleaners, tissue & hygiene products, and others.

Household products Market Dynamics:

Increasing Urbanization is the driver of Household Product Market Increasing Household Product demand is enhancing the consumption of Household Products and the market is expected to exhibit the highest growth rate during the forecast period. The rise in consumer disposable income, high living standards, and the need for comfort encourage consumers to upgrade their existing appliances to smarter versions, which is further expected to coerce the market demand. Consumers widely purchase home appliances as they offer ease, diminish efforts, and save time. People are moving to urban areas, and the demand for smaller, more convenient products increases also consumers are more likely to purchase products that help them to save space, such as multi-functional furniture. As well as the Income of consumers rising, they are willing to spend more on higher-end household products. Lack of customer retention and product differentiation is the restraint to the household product market Psychographic, demographic, and behavioral characteristics and product preferences may differ from person to person. Consumer behavior is primarily influenced by lifestyle and awareness standards. Consumer loyalty and product distinctiveness are difficult to maintain in the household cleaning products market. New and creative products are frequently attractive to consumers. As a result, sticking to a single product or brand is difficult. Small and medium-sized manufacturers are finding it increasingly difficult to keep up with changing consumer behaviors. There are five factors affecting client retention client satisfaction, client delight, client switching costs, client relationships, and client service standards. As per MMR report 82% of people have stopped doing business with a company because of bad customer service. 53% of customers have switched companies because they felt unappreciated. As a result, these factors decrease the growth rate of the Household Product Market. The incorporation of technologies such as artificial intelligence, AR/VR, the Internet of Things, and robotics boost the growth of the market The gradual adoption of advanced technologies like AI and AR/VR, the Internet of Things, and robotics reduce working time and energy. Product innovation, new product development, product differentiation, and integration of numerous value-added features are further expected to propel the market demand over the next few years. Adobe Smart Security Kit, Abode is a reliable DIY home security system with limitless smart home features. It can be used with Alexa, Google Assistant, and Home Kit, and it can also be used as a hub for Z-Wave and Zigbee devices, which are a couple of wireless home automation protocols that greatly expand the sorts of gadgets. Arlo Video Doorbell is another smart home device. It helps to detect visitors and activities in the doorway using a camera, speaker, microphone, motion sensor, and an internet connection. AI technology improves lighting and has progressed from candles to gas to electricity. The smart home is rapidly expanding. Markets are investing in AI research and development for robots. In February 2017, Dyson invested USD 587 million in developing an R&D tech center in Singapore focused on connected tech and intelligent machines. These innovations boost the market during the forecast period.Household Product Market Segment Analysis:

Household Product Market by Product Type, Personal care products dominated the household product market. Based on the product type household product market is classified into Cleaning products, Personal care products, Kitchenware and appliances, Home décor, and furnishings. The personal care products market generated market revenue of 625.38 billion in 2023 with a growing rate at a CAGR of 3.33%. The household cleaner market is growing during the forecast period. Rising awareness among people regarding keeping the household clean has become one of the primary driving factors for the household cleaner market growth. Additionally, the easy availability of household cleaners coupled with several variations including different fragrances is also likely to boost the market advancement.Household Product Market by Consumer Demographic, Age and Income dominated the household market and are expected to grow during the forecast period. Based on consumer Demographics market is classified into age income and lifestyle. Age and income affect the household product market by influencing what products customers can afford and what products they need. Older consumers may be more likely to purchase products that help them with mobility and accessibility. Consumers with higher incomes they likely to purchase luxury products, thus they boost the household product market during the forecast period.

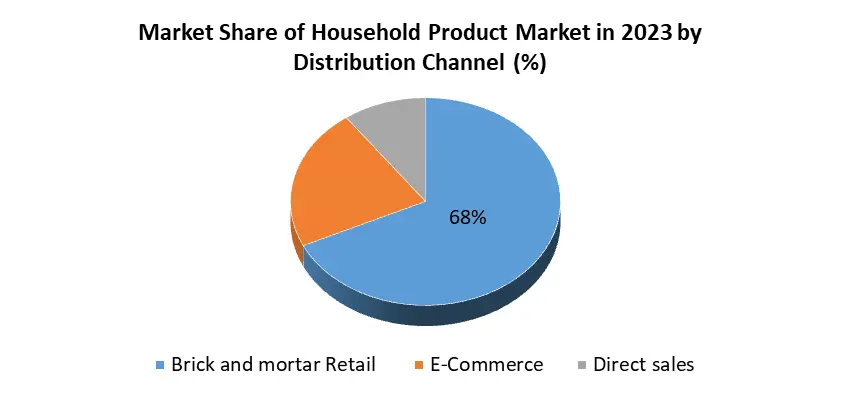

Household Product Market by Distribution Channel, Brick and mortar Retail segment contributed to the highest share of over 68% in the global market revenue in 2023. Based on the distribution channel household product market is classified into Brick-and-mortar retail, E-Commerce, and Direct sales. Brick and mortar sales continued to rise throughout 2023 and 46 % of consumers still say they prefer to shop in person rather than online. Amazon.com Inc. has opened brick-and-mortar stores to help market and its products and strengthen customer relations. Brick-and-mortar stores have an average return rate of 8.9%, compared to around 30% for online stores. Some brick-and-mortar grocery stores, such as Safeway, allow customers to shop for groceries online and have them delivered to their doorstep in as little as a few hours. Brick-and-mortar stores offer the advantage of an in-person shopping experience, which may be important when the product must be inspected by the shopper. The rising organized retail sector in emerging economies such as Malaysia, India, and China is anticipated to boost the demand for household products in the coming years. Thus, all these factors are likely to propel the growth of this segment during the forecast period.

Household Product Market Regional Insights:

North America Holds a Significant Revenue Share in the Household Product Market The North American Household Product Market has the highest market share in 2023, with a market share of about 42%. The United States is the largest market in North America, with a market share of about 19%. The average user in the United States spent upwards of USD 765 per year on household products. The most popular major household appliances in the US such as Refrigerators and freezers, Kitchen furniture and countertops, Dishwashing machines, etc. Asia Pacific is expected to dominate the global Household Product Market during the forecast period in terms of sales and revenue. Emerging economies like India, China, and Japan are making significant investments with key players like Henkel AG & Co. KGaA, Colgate-Palmolive Company, Reckitt Benckiser Group PLC, The Procter & Gamble Company, Unilever PLC, Kao Corporation, S.C. Johnson & Son Inc., and Church & Dwight Co. Inc. These companies are major players in the global household product market and are involved in the production and distribution of different household products, including personal care products, cleaning products, and home appliances. So, these key players play a significant role in the household product market in Asia.Household Product Market Competitive Landscapes: 13 innovations by Johnson & Johnson that inspired us in 2023 Johnson & Johnson is a leading healthcare company that made innovations to improve people's health. In 2023, the Johnson & Johnson Company announced 13 healthcare innovations that are changing cancer treatments and surgical tools for a global impact. The innovation efforts are focused on solving health challenges and driving scientific innovations that improve health. Johnson & Johnson has been recognized for its innovative spirit and approach to advancing healthcare. The innovation centers aim to foster new and creative ideas that lead to ground-breaking healthcare developments. Johnson & Johnson's innovation reflects its partnerships with other companies, such as Nanobiotix, to advance healthcare solutions. Overall, Johnson & Johnson is a key player in the healthcare industry, driving innovation and advancing healthcare solutions to improve health and good fortune. Circular Action Alliance (CAA) Announces the Addition of Six New Founding Member Companies Circular Action Alliance, a non-profit organization, has recently earned the distinction of being the first-ever Producer Responsibility Organization (PRO) sanctioned to manage the Extended Producer Responsibility (EPR) program for paper and packaging in the U.S. The Colorado Department of Public Health & Environment has entrusted CAA with the pivotal role of executing Colorado's Producer Responsibility Program per the State-wide Recycling Act. Circular Action Alliance (CAA) has announced the addition of six Founding Member companies representing the retail, consumer goods, and food and beverage industries, including The Clorox Company, Colgate-Palmolive, SC Johnson, Target, The Kraft Heinz Company, and Walmart. Six new companies are joining Circular Action Alliance's existing 17 Founding Members, forming a collective of diverse brands operating under Extended Producer Responsibility (EPR) laws and covering a wide range of packaging materials.

Household Product Market Scope: Inquire before buying

Household Product Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 319.30 Bn. Forecast Period 2024 to 2030 CAGR: 3.6 % Market Size in 2030: US $ US$ 408.99 Bn. Segments Covered: by Product Type Cleaning products Personal care product Kitchenware and appliances Home appliances Home décor and furnishings by consumer demographic Age and lifestyle Income levels by Distribution channel Brick and mortar Retail E-commerce Direct sales Household Product Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Household Product Market Key Players:

1. Procter & Gamble (United States) 2. Amway (United States) 3. Prestige Brands(United States) 4. The Clorox Company (United States) 5. Luxury Brand Partners (United States) 6. Estée Lauder (United States) 7. Colgate-Palmolive (United States) 8. SC Johnson (United States) 9. Bath & Body Works (United States) 10. Ecolab (United States) 11. Church & Dwight (United States) 12. Johnson & Johnson(United States) 13. Diversey (South Carolina) 14. Young Living (United States) 15. Kao Corporation (Japan) 16. Henkel (Germany) 17. Reckitt Benckiser(England) 18. Unilever(London) 19. Godrej Consumer Products Ltd. (India) 20. Revlon (New York) FAQs: 1. What are the growth drivers for the Household Product market? Ans. Increasing Urbanization, increasing living standards, and increased focus on health and hygiene are expected to be the major drivers for the Household Product market. 2. Which region is expected to lead the global Household Product Market during the forecast period? Ans. Asia Pacific is expected to lead the global Household Product Market during the forecast period. 3. What is the projected market size and growth rate of the Household Product Market? Ans. The Household Product Market size was valued at USD 319.30 Billion in 2023 and the total Household Product revenue is expected to grow at a CAGR of 3.6% from 2024 to 2030, reaching nearly USD 408.99 Billion in 2030. 4. What segments are covered in the Household Product Market report? Ans. The segments covered in the Household Product Market report are Product Type, Consumer Demographic, Distribution Channel, and Region. 5. What is the study period of the Household Product Market? Ans: The Global Household Product Market is studied from 2023 to 2030.

1. Household Product Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Household Product Market: Dynamics 2.1. Household Product Market Trends by Region 2.1.1. North America Household Product Market Trends 2.1.2. Europe Household Product Market Trends 2.1.3. Asia Pacific Household Product Market Trends 2.1.4. Middle East and Africa Household Product Market Trends 2.1.5. South America Household Product Market Trends 2.2. Household Product Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Household Product Market Drivers 2.2.1.2. North America Household Product Market Restraints 2.2.1.3. North America Household Product Market Opportunities 2.2.1.4. North America Household Product Market Challenges 2.2.2. Europe 2.2.2.1. Europe Household Product Market Drivers 2.2.2.2. Europe Household Product Market Restraints 2.2.2.3. Europe Household Product Market Opportunities 2.2.2.4. Europe Household Product Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Household Product Market Drivers 2.2.3.2. Asia Pacific Household Product Market Restraints 2.2.3.3. Asia Pacific Household Product Market Opportunities 2.2.3.4. Asia Pacific Household Product Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Household Product Market Drivers 2.2.4.2. Middle East and Africa Household Product Market Restraints 2.2.4.3. Middle East and Africa Household Product Market Opportunities 2.2.4.4. Middle East and Africa Household Product Market Challenges 2.2.5. South America 2.2.5.1. South America Household Product Market Drivers 2.2.5.2. South America Household Product Market Restraints 2.2.5.3. South America Household Product Market Opportunities 2.2.5.4. South America Household Product Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Household Product Industry 2.8. Analysis of Government Schemes and Initiatives For Household Product Industry 2.9. Household Product Market Trade Analysis 2.10. The Global Pandemic Impact on Household Product Market 3. Household Product Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Household Product Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Cleaning products 3.1.2. Personal care product 3.1.3. Kitchenware and appliances 3.1.4. Home appliances 3.1.5. Home décor and furnishings 3.2. Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 3.2.1. Age and lifestyle 3.2.2. Income levels 3.3. Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Brick and mortar Retail 3.3.2. E-commerce 3.3.3. Direct sales 3.4. Household Product Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Household Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Household Product Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Cleaning products 4.1.2. Personal care product 4.1.3. Kitchenware and appliances 4.1.4. Home appliances 4.1.5. Home décor and furnishings 4.2. North America Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 4.2.1. Age and lifestyle 4.2.2. Income levels 4.3. North America Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Brick and mortar Retail 4.3.2. E-commerce 4.3.3. Direct sales 4.4. North America Household Product Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Household Product Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Cleaning products 4.4.1.1.2. Personal care product 4.4.1.1.3. Kitchenware and appliances 4.4.1.1.4. Home appliances 4.4.1.1.5. Home décor and furnishings 4.4.1.2. United States Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 4.4.1.2.1. Age and lifestyle 4.4.1.2.2. Income levels 4.4.1.3. United States Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Brick and mortar Retail 4.4.1.3.2. E-commerce 4.4.1.3.3. Direct sales 4.4.2. Canada 4.4.2.1. Canada Household Product Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Cleaning products 4.4.2.1.2. Personal care product 4.4.2.1.3. Kitchenware and appliances 4.4.2.1.4. Home appliances 4.4.2.1.5. Home décor and furnishings 4.4.2.2. Canada Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 4.4.2.2.1. Age and lifestyle 4.4.2.2.2. Income levels 4.4.2.3. Canada Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Brick and mortar Retail 4.4.2.3.2. E-commerce 4.4.2.3.3. Direct sales 4.4.3. Mexico 4.4.3.1. Mexico Household Product Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Cleaning products 4.4.3.1.2. Personal care product 4.4.3.1.3. Kitchenware and appliances 4.4.3.1.4. Home appliances 4.4.3.1.5. Home décor and furnishings 4.4.3.2. Mexico Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 4.4.3.2.1. Age and lifestyle 4.4.3.2.2. Income levels 4.4.3.3. Mexico Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Brick and mortar Retail 4.4.3.3.2. E-commerce 4.4.3.3.3. Direct sales 5. Europe Household Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Household Product Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.3. Europe Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Household Product Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Household Product Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.4.1.3. United Kingdom Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Household Product Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.4.2.3. France Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Household Product Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.4.3.3. Germany Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Household Product Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.4.4.3. Italy Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Household Product Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.4.5.3. Spain Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Household Product Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.4.6.3. Sweden Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Household Product Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.4.7.3. Austria Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Household Product Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 5.4.8.3. Rest of Europe Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Household Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Household Product Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.3. Asia Pacific Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Household Product Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.1.3. China Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.2.3. S Korea Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.3.3. Japan Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.4.3. India Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.5.3. Australia Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.6.3. Indonesia Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.7.3. Malaysia Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.8.3. Vietnam Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.9.3. Taiwan Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Household Product Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 6.4.10.3. Rest of Asia Pacific Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Household Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Household Product Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 7.3. Middle East and Africa Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Household Product Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Household Product Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 7.4.1.3. South Africa Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Household Product Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. GCC Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 7.4.2.3. GCC Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Household Product Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Nigeria Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 7.4.3.3. Nigeria Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Household Product Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. Rest of ME&A Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 7.4.4.3. Rest of ME&A Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Household Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Household Product Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 8.3. South America Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Household Product Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Household Product Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 8.4.1.3. Brazil Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Household Product Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 8.4.2.3. Argentina Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Household Product Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest Of South America Household Product Market Size and Forecast, by Consumer Demographic (2023-2030) 8.4.3.3. Rest Of South America Household Product Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Household Product Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Household Product Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Procter & Gamble (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Amway (United States) 10.3. Prestige Brands(United States) 10.4. The Clorox Company (United States) 10.5. Luxury Brand Partners (United States) 10.6. Estée Lauder (United States) 10.7. Colgate-Palmolive (United States) 10.8. SC Johnson (United States) 10.9. Bath & Body Works (United States) 10.10. Ecolab (United States) 10.11. Church & Dwight (United States) 10.12. Johnson & Johnson(United States) 10.13. Diversey (South Carolina) 10.14. Young Living (United States) 10.15. Kao Corporation (Japan) 10.16. Henkel (Germany) 10.17. Reckitt Benckiser(England) 10.18. Unilever(London) 10.19. Godrej Consumer Products Ltd. (India) 10.20. Revlon (New York) 11. Key Findings 12. Industry Recommendations 13. Household Product Market: Research Methodology 14. Terms and Glossary