The High-Speed Engine Market is expected to grow at a CAGR of 3.9% during the forecast period, from 2022 to 2029, to reach a market size of USD 29.9 billion by 2029, up from USD 23.6 billion in 2022.High-Speed Engine Market Overview:

High-speed engines are robust power units designed to operate at significantly elevated speeds compared to traditional engines, delivering enhanced power output within a compact structure. These engines are characterized by their ability to provide high-performance capabilities, often boasting superior power density and efficiency. The demand for high-speed engines has increased significantly in recent years, thanks to their crucial role in ensuring uninterrupted power supply across various industries. Sectors such as data centers, hospitals, manufacturing facilities, and marine applications highly rely on these engines for consistent and reliable power, contributing to their increased adoption globally. Countries such as China, India, Japan, and South Korea exhibit substantial demand for high-speed engines due to rapid industrialization, urbanization, and frequent power disruptions. The high-speed engine market is witnessing significant growth, fueled by technological advancements that improve engine efficiency, reduce emissions, and broaden their applications across diverse industries. The demand for these engines is prominent in sectors where reliability and continuous power supply are critical, thereby propelling high-speed engine industry growth. Their high demand spans industries where uninterrupted power is imperative for operations, including data centers that require consistent energy for servers, hospitals for continuous medical equipment operation, manufacturing facilities for production processes, and marine applications to power ships and vessels. Additionally, governmental initiatives like "Make in India" foster domestic production and usage of high-speed engines, contributing to the high-speed engine market’s revenue growth. Collaborations between international and regional players drive innovation and product development, further boosting the high-speed engine market size. With industries increasingly prioritizing reliable and uninterrupted power supply, the high-speed engine market is poised for sustained growth, catering to the rising demand across diverse sectors and geographical regions. As these engines continue to evolve, emphasizing efficiency, reduced emissions, and expanded application scope, their role in providing consistent power solutions across industries is expected to grow significantly.To know about the Research Methodology :- Request Free Sample Report

High-Speed Engine Market Dynamics:

Growth In International Marine Freight Transport The increase in international marine freight transport has emerged as a major factor driving the demand for high-speed engines, particularly in marine applications, thus increasing the high-speed engine market revenue in the marine industry. The demand for these advanced and efficient high-speed engines to power a spectrum of marine vessels, including ships and boats has rapidly increased in recent years, thanks to the substantial growth in global trade and commerce, which heavily relies on maritime transport for the movement of goods and commodities across international borders. This heightened demand is further fueled by the expansion of manufacturing industries and trade networks, necessitating efficient and reliable propulsion systems for vessels to ensure timely and cost-effective transportation of goods. The surge in marine freight transport is propelled by the increasing globalization of trade, where countries across the globe participate in the import and export of goods, materials, and resources.Notably, countries with robust manufacturing sectors and those strategically positioned for international trade, such as China, the United States, Germany, and Japan, contribute significantly to this rising demand for marine freight transport services. Furthermore, the demand for high-speed engines in marine applications is intricately linked to the need for enhanced efficiency, reduced fuel consumption, and compliance with stringent environmental regulations governing emissions from marine vessels. As a result, according to the MMR analysis, there's an inclination toward advanced engine technologies capable of delivering higher power output while ensuring greater fuel economy and reduced environmental impact. This burgeoning demand for high-speed engines in the context of international marine freight transport underscores the critical role these engines play in powering vessels for the seamless movement of goods across oceans, facilitating global trade, and meeting the demands of a progressively interconnected global economy. These all factors collectively contribute to the high-speed engine market growth during the forecast period. Rising Demand For Reliable And Uninterrupted Power The rapidly increasing demand for reliable and uninterrupted power from various end-user industries such as data centers, hospitals, manufacturing facilities, etc. is expected to be the major factor driving the high-speed engine market growth. This rapid surge is expected to be driven by several interconnected factors. The exponential growth of data centers, critical hubs for processing and storing vast volumes of digital information, has created an unprecedented need for unwavering power backup systems, thereby supporting the high-speed engine market growth. These centers require robust engines to ensure continual operations and safeguard against costly downtimes. In addition, hospitals, an integral part of any society, rely extensively on seamless power sources to sustain critical medical equipment, life support systems, and overall facility operations. The imperative for reliable power in this sector is heightened due to the life-saving nature of medical procedures and patient care. As a result, increasing demand from the hospital sector is expected to further boost high-speed engine production, thereby supporting the high-speed engine market growth. Moreover, the expanding landscape of manufacturing facilities, driven by industrial growth, emphasizes consistent power supply to maintain production efficiency, further expected to benefit the high-speed engine industry. As industries evolve and automation becomes prevalent, uninterrupted energy sources are pivotal to sustaining operations and meeting production demands. This surge in demand for high-speed engines is thus propelled by the critical need for uninterrupted power across these sectors, ensuring operational continuity, data integrity, and sustained productivity, all of which are foundational to modern societal functions and technological advancements.

High Cost Of Operation And Maintenance Of High-Speed Engine The high operation and maintenance costs associated with high-speed engines are expected to be the major factor restraining the high-speed engine market. While these engines boast substantial functionality and endurance, their upkeep demands meticulous attention and frequent servicing, contributing to elevated operational expenses. Typically, a standby generator can endure around 30,000 operational hours before necessitating a major overhaul. However, achieving this longevity requires rigorous preventive maintenance, including regular servicing and replenishment of essential systems like lubrication, cooling, and fueling, alongside maintenance of starting batteries and fuel filters. High-speed engine’s high reliance on diesel fuel for sustained operation renders their extended-duration functionality more expensive when compared to alternative power sources like gas engines or turbines driving up the operational costs of these engines. Moreover, external elements such as extreme temperatures, adverse weather conditions, or exposure to saltwater can escalate the frequency of necessary maintenance activities, further adding to the operational expenditures. This higher operational cost dynamic significantly impacts the high-speed engine market growth, especially with emerging technologies like battery energy systems offering more cost-effective solutions. Modern alternatives like battery-based backup power systems entail lower maintenance costs and eliminate the need for fuel, presenting an attractive proposition compared to the ongoing expenses associated with high-speed engines. The burgeoning popularity and advancements in such alternative technologies pose a challenge to the high-speed engine market, compelling industry players to address these cost-related restraints to remain competitive in an evolving landscape.

High-Speed Engine Market Segment Analysis:

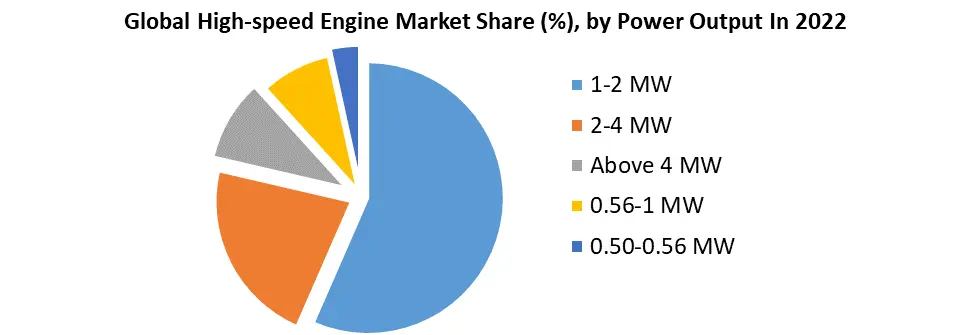

Based on the Power Output segment, the 1-2 MW segment led the global high-speed engine market with the highest market share of more than 40% in 2022. The segment is further expected to grow at a significant CAGR during the forecast period. This segment's significance stems from its extensive utilization across diverse sectors, specifically in maritime applications, commercial enterprises, and industrial settings. The engines falling within this power output range of 1-2 MW demonstrate a versatile capacity to cater to a wide array of demands. Particularly in sectors like marine, commercial establishments, and industrial operations, these engines hold pivotal roles in delivering substantial power to meet the demands of varied applications. Within large-scale facilities such as hospitals, data centers, and commercial entities, multiple units within the 1-2 MW range are commonly installed in parallel configurations. This installation design not only supports sizable loads but also ensures uninterrupted power supply, a critical necessity for operations that rely heavily on continuous and reliable power. The robust demand for engines in this power output segment is primarily driven by the essential need for dependable power sources across these sectors. Their ability to provide consistent and high-capacity power makes them indispensable for sustaining critical operations, ensuring minimal disruptions, and supporting large-scale infrastructure. The expected growth in demand from these sectors is thus expected to significantly contribute to the growth and sustenance of the high-speed engine market, solidifying the pivotal role played by the 1-2 MW segment in propelling overall high-speed engine industry growth.

High-Speed Engine Market Regional Insights:

Asia Pacific dominated the global high-speed engine market with the highest revenue share of 38% in 2022. The region is further expected to maintain its dominance by 2029. Increasing globalization, rapid urbanization, and expanding industrial industries across the APAC countries including China, India, Japan, and South Korea are expected to be the key factors increasing the demand for continuous power supply. This surge in demand is primarily fueled by frequent power outages and blackouts in these developing countries, necessitating robust backup solutions. Thus, increasing demand for continuous power supply across the APAC countries driving the high-speed engine market growth Initiatives such as China's maritime sector development and India's "Make in India" campaign are further expected to boost the high-speed engine industry growth. The expanding industrial and infrastructural landscape in these countries also accentuates the need for reliable power sources, fostering the adoption of high-speed engines. Additionally, strategic collaborations between global players and local manufacturers contribute to technological advancements and the availability of efficient high-speed engines, propelling the APAC high-speed engine market's upward trajectory. China's prominence in the high-speed engine sector is underscored by its burgeoning marine sector. The country's focus on maritime development has stimulated a greater uptake of high-speed engines to power marine vessels, thereby driving China's high-speed engine market growth. In addition, India's "Make in India" campaign has created a favorable environment for the high-speed engine market, fostering local manufacturing and encouraging partnerships to cater to escalating demands. India, China, Japan, and South Korea are expected to be the major countries driving the APAC high-speed engine market.India's emergence as a global manufacturing hub and its focus on domestic production incentivize market growth. Japan and South Korea's developing marine sectors, in addition to their industrial expansions, further contribute to the heightened demand for high-speed engines, supporting the high-speed engine’s maximum production, and boosting the high-speed engine market growth. Besides that, Key global automotive giants like Rolls Royce have consolidated their presence in significant Asian countries such as India, China, and Japan. In November 2020, Rolls Royce inked pivotal agreements for supplying up to 1000 engines and solidified partnerships with six major Chinese firms, indicating the region's rising importance in the high-speed engine domain. This factor further increases the high-speed engine market’s revenue growth.

High-Speed Engine Market Scope: Inquiry Before Buying

High Speed Engine Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2021 Market Size in 2022: US $ 23.6 Bn. Forecast Period 2023 to 2029 CAGR: 3.9% Market Size in 2029: US $ 29.9 Bn. Segments Covered: by speed 1000-1500 rpm 1500-1800 rpm Above 1800 rpm by Power Output 1-2 MW 2-4 MW Above 4 MW 0.56-1 MW 0.50-0.56 MW by End-Users Power Generation Continuous Back-up Marine Propulsion Auxiliary Railways Mining and Oil & Gas Construction Others High Speed Engine Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)High Speed Engine Market Major Competitors

1. Caterpillar 2. Cummins Inc. 3. Rolls-Royce Holdings plc 4. MAN Energy Solutions SE 5. Wärtsilä Corporation 6. Yanmar Co., Ltd. 7. Mitsubishi Heavy Industries, Ltd. 8. MTU Friedrichshafen GmbH 9. Deutz AG 10.Scania AB 11.Volvo Penta 12.General Electric Company 13.Doosan Infracore Co., Ltd. 14.Kohler Co. 15.Isuzu Motors Ltd. 16.Weichai Power Co., Ltd. 17.Detroit Diesel Corporation 18.Kirloskar Oil Engines Limited 19.Liebherr Group 20.GE Transportation 21.JCB Power Systems Ltd. 22.AGCO Power 23.Yanmar Marine International B.V. 24.MAN Truck & Bus SE 25.John Deere Power Systems FAQS: 1. What are the growth drivers for the High-Speed Engine Market? Ans. The growth drivers of the high-speed engine market include increasing demand for power generation, rising maritime trade, and the growing need for energy efficiency and sustainability. 2. What is the major restraint for the market growth? Ans. The high cost of high-speed engines compared to their low-speed counterparts is a major restraint for market growth. 3. Which region is expected to lead the global High Speed Engine Market during the forecast period? Ans. Asia Pacific is expected to lead the global High Speed Engine Market during the forecast period. 4. What is the projected market size & growth rate of the Market? Ans. The High-Speed Engine Market size was valued at USD 23.6 Billion in 2022 and the total revenue is expected to grow at a CAGR of 3.9% from 2023 to 2029, reaching nearly USD 29.9 Billion. 5. What segments are covered in this report? Ans. The segments covered in the High-Speed Engine Market report are Type, Applications, and Region.

1. High-Speed Engine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. High-Speed Engine Market: Dynamics 2.1. High-Speed Engine Market Trends by Region 2.1.1. North America High-Speed Engine Market Trends 2.1.2. Europe High-Speed Engine Market Trends 2.1.3. Asia Pacific High-Speed Engine Market Trends 2.1.4. Middle East and Africa High-Speed Engine Market Trends 2.1.5. South America High-Speed Engine Market Trends 2.2. High-Speed Engine Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America High-Speed Engine Market Drivers 2.2.1.2. North America High-Speed Engine Market Restraints 2.2.1.3. North America High-Speed Engine Market Opportunities 2.2.1.4. North America High-Speed Engine Market Challenges 2.2.2. Europe 2.2.2.1. Europe High-Speed Engine Market Drivers 2.2.2.2. Europe High-Speed Engine Market Restraints 2.2.2.3. Europe High-Speed Engine Market Opportunities 2.2.2.4. Europe High-Speed Engine Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific High-Speed Engine Market Drivers 2.2.3.2. Asia Pacific High-Speed Engine Market Restraints 2.2.3.3. Asia Pacific High-Speed Engine Market Opportunities 2.2.3.4. Asia Pacific High-Speed Engine Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa High-Speed Engine Market Drivers 2.2.4.2. Middle East and Africa High-Speed Engine Market Restraints 2.2.4.3. Middle East and Africa High-Speed Engine Market Opportunities 2.2.4.4. Middle East and Africa High-Speed Engine Market Challenges 2.2.5. South America 2.2.5.1. South America High-Speed Engine Market Drivers 2.2.5.2. South America High-Speed Engine Market Restraints 2.2.5.3. South America High-Speed Engine Market Opportunities 2.2.5.4. South America High-Speed Engine Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For High-Speed Engine Industry 2.8. Analysis of Government Schemes and Initiatives For High-Speed Engine Industry 2.9. High-Speed Engine Market Trade Analysis 2.10. The Global Pandemic Impact on High-Speed Engine Market 3. High-Speed Engine Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 3.1.1. 1000-1500 rpm 3.1.2. 1500-1800 rpm 3.1.3. Above 1800 rpm 3.2. High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 3.2.1. 1-2 MW 3.2.2. 2-4 MW 3.2.3. Above 4 MW 3.2.4. 0.56-1 MW 3.2.5. 0.50-0.56 MW 3.3. High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 3.3.1. Power Generation 3.3.2. Marine 3.3.3. Railways 3.3.4. Mining and Oil & Gas 3.3.5. Construction 3.3.6. Others 3.4. High-Speed Engine Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America High-Speed Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 4.1.1. 1000-1500 rpm 4.1.2. 1500-1800 rpm 4.1.3. Above 1800 rpm 4.2. North America High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 4.2.1. 1-2 MW 4.2.2. 2-4 MW 4.2.3. Above 4 MW 4.2.4. 0.56-1 MW 4.2.5. 0.50-0.56 MW 4.3. North America High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 4.3.1. Power Generation 4.3.2. Marine 4.3.3. Railways 4.3.4. Mining and Oil & Gas 4.3.5. Construction 4.3.6. Others 4.4. North America High-Speed Engine Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 4.4.1.1.1. 1000-1500 rpm 4.4.1.1.2. 1500-1800 rpm 4.4.1.1.3. Above 1800 rpm 4.4.1.2. United States High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 4.4.1.2.1. 1-2 MW 4.4.1.2.2. 2-4 MW 4.4.1.2.3. Above 4 MW 4.4.1.2.4. 0.56-1 MW 4.4.1.2.5. 0.50-0.56 MW 4.4.1.3. United States High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 4.4.1.3.1. Power Generation 4.4.1.3.2. Marine 4.4.1.3.3. Railways 4.4.1.3.4. Mining and Oil & Gas 4.4.1.3.5. Construction 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 4.4.2.1.1. 1000-1500 rpm 4.4.2.1.2. 1500-1800 rpm 4.4.2.1.3. Above 1800 rpm 4.4.2.2. Canada High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 4.4.2.2.1. 1-2 MW 4.4.2.2.2. 2-4 MW 4.4.2.2.3. Above 4 MW 4.4.2.2.4. 0.56-1 MW 4.4.2.2.5. 0.50-0.56 MW 4.4.2.3. Canada High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 4.4.2.3.1. Power Generation 4.4.2.3.2. Marine 4.4.2.3.3. Railways 4.4.2.3.4. Mining and Oil & Gas 4.4.2.3.5. Construction 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 4.4.3.1.1. 1000-1500 rpm 4.4.3.1.2. 1500-1800 rpm 4.4.3.1.3. Above 1800 rpm 4.4.3.2. Mexico High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 4.4.3.2.1. 1-2 MW 4.4.3.2.2. 2-4 MW 4.4.3.2.3. Above 4 MW 4.4.3.2.4. 0.56-1 MW 4.4.3.2.5. 0.50-0.56 MW 4.4.3.3. Mexico High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 4.4.3.3.1. Power Generation 4.4.3.3.2. Marine 4.4.3.3.3. Railways 4.4.3.3.4. Mining and Oil & Gas 4.4.3.3.5. Construction 4.4.3.3.6. Others 5. Europe High-Speed Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.2. Europe High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.3. Europe High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 5.4. Europe High-Speed Engine Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.4.1.2. United Kingdom High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.4.1.3. United Kingdom High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 5.4.2. France 5.4.2.1. France High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.4.2.2. France High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.4.2.3. France High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 5.4.3. Germany 5.4.3.1. Germany High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.4.3.2. Germany High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.4.3.3. Germany High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 5.4.4. Italy 5.4.4.1. Italy High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.4.4.2. Italy High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.4.4.3. Italy High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 5.4.5. Spain 5.4.5.1. Spain High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.4.5.2. Spain High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.4.5.3. Spain High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.4.6.2. Sweden High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.4.6.3. Sweden High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 5.4.7. Austria 5.4.7.1. Austria High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.4.7.2. Austria High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.4.7.3. Austria High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 5.4.8.2. Rest of Europe High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 5.4.8.3. Rest of Europe High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6. Asia Pacific High-Speed Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.2. Asia Pacific High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.3. Asia Pacific High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4. Asia Pacific High-Speed Engine Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.1.2. China High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.1.3. China High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.2.2. S Korea High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.2.3. S Korea High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.3. Japan 6.4.3.1. Japan High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.3.2. Japan High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.3.3. Japan High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.4. India 6.4.4.1. India High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.4.2. India High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.4.3. India High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.5. Australia 6.4.5.1. Australia High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.5.2. Australia High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.5.3. Australia High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.6.2. Indonesia High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.6.3. Indonesia High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.7.2. Malaysia High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.7.3. Malaysia High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.8.2. Vietnam High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.8.3. Vietnam High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.9.2. Taiwan High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.9.3. Taiwan High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 6.4.10.2. Rest of Asia Pacific High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 6.4.10.3. Rest of Asia Pacific High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 7. Middle East and Africa High-Speed Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 7.2. Middle East and Africa High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 7.3. Middle East and Africa High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 7.4. Middle East and Africa High-Speed Engine Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 7.4.1.2. South Africa High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 7.4.1.3. South Africa High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 7.4.2. GCC 7.4.2.1. GCC High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 7.4.2.2. GCC High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 7.4.2.3. GCC High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 7.4.3.2. Nigeria High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 7.4.3.3. Nigeria High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 7.4.4.2. Rest of ME&A High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 7.4.4.3. Rest of ME&A High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 8. South America High-Speed Engine Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 8.2. South America High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 8.3. South America High-Speed Engine Market Size and Forecast, by End-Users(2022-2029) 8.4. South America High-Speed Engine Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 8.4.1.2. Brazil High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 8.4.1.3. Brazil High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 8.4.2.2. Argentina High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 8.4.2.3. Argentina High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America High-Speed Engine Market Size and Forecast, by Speed (2022-2029) 8.4.3.2. Rest Of South America High-Speed Engine Market Size and Forecast, by Power Output (2022-2029) 8.4.3.3. Rest Of South America High-Speed Engine Market Size and Forecast, by End-Users (2022-2029) 9. Global High-Speed Engine Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading High-Speed Engine Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Caterpillar 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cummins Inc. 10.3. Rolls-Royce Holdings plc 10.4. MAN Energy Solutions SE 10.5. Wärtsilä Corporation 10.6. Yanmar Co., Ltd. 10.7. Mitsubishi Heavy Industries, Ltd. 10.8. MTU Friedrichshafen GmbH 10.9. Deutz AG 10.10. Scania AB 10.11. Volvo Penta 10.12. General Electric Company 10.13. Doosan Infracore Co., Ltd. 10.14. Kohler Co. 10.15. Isuzu Motors Ltd. 10.16. Weichai Power Co., Ltd. 10.17. Detroit Diesel Corporation 10.18. Kirloskar Oil Engines Limited 10.19. Liebherr Group 10.20. GE Transportation 10.21. JCB Power Systems Ltd. 10.22. AGCO Power 10.23. Yanmar Marine International B.V. 10.24. MAN Truck & Bus SE 10.25. John Deere Power Systems 11. Key Findings 12. Industry Recommendations 13. High-Speed Engine Market: Research Methodology 14. Terms and Glossary