Hepatitis B Market size was valued at USD 5.1 Billion in 2023 and the total Hepatitis B Revenue is expected to grow at a CAGR of 4.2 % from 2024 to 2030, reaching nearly USD 6.80 Billion in 2030.Hepatitis B Market Overview:

HBV is a small, double-stranded DNA virus in the family Hepadnaviridae. Serologic markers for HBV infection include HBsAg, antibodies to HBsAg (anti-HBs), immunoglobulin class M (IgM) antibodies to hepatitis B core antigen (IgM anti-HBc), and immunoglobulin class G (IgG) anti-HBc (IgG anti-HBc).To know about the Research Methodology :- Request Free Sample Report Across the selected countries, the mechanisms for procuring antiretroviral (ARV) drugs for HIV programs depend on the funding mechanism. Commodities funded by government budget funds are procured by national procurement. Commodities funded by nongovernment entities are done outside the national procurement system. The GFATM procurements are done through its online procurement system (Wambo.org), and the U.S. President’s Emergency Plan for AIDS Relief (PEPFAR) procurements through PEPFAR’s procurement service agent that delivers to the in-county central warehouses. Three out of six countries, namely India, Rwanda, and Uganda, fall under the bucket of publicly coordinated HBV programs. The countries have centralized financing with services being delivered free of charge to patients. Commodities in the countries are centrally procured and distributed to facilities, which has resulted in low prices of TDF between US$2.60 – 4.60 per pack. The Rwanda Medical Supply (RMS) Ltd is responsible for procuring diagnostic and treatment commodities in the country and an annual quantification exercise is conducted to inform national procurement. RMS pools the drug requirement at the program level and procures via an open tender which is awarded for one year with the possibility of renewal twice.

Hepatitis B market Dynamics:

Driving Factors and Opportunities in the Global Hepatitis B Vaccine Market The rise in HBV diagnosis incidence increased the number of tests performed as well as improved disease awareness and the continuation of strong screening initiatives. The increasing number of hepatitis B cases globally is the primary driver of hepatitis B vaccine market growth. Governments are taking initiatives to raise awareness among residents about the benefits of the hepatitis B vaccine. In addition, continued awareness of hepatitis treatment owing to collaborations and associations in major organizations and the presentation of fewer approaches to hepatitis treatment are other factors driving the market growth. Limited access to hepatitis B treatment and diagnosis in many resource-constrained settings, as well as the rising prevalence of hepatitis B infections, are expected to drive the global hepatitis B market through the forecast period. Rising awareness and affordability are two key factors that increase the rate of diagnosis before a person has advanced liver disease. Rising awareness and the development of new types of medications with higher efficacy are expected to provide a good opportunity for the global hepatitis B vaccines market.Government Initiatives and Novel Therapies Propel Growth in Hepatitis B Vaccination Market Rising government initiatives, policies, and awareness programs have played a significant role in promoting hepatitis b vaccination. An increased number of hepatitis B infections and deaths has significantly highlighted the importance of preventing hepatitis B infection and its associated health burdens. Various Governments have implemented numerous strategies to increase vaccine coverage including mandating hepatitis B vaccination for infants, children, and high-risk populations. Integrating the vaccine into routine immunization schedules and providing financial support for vaccination programs is expected to boost the market share. Food and Drug Administration (FDA) has approved the supplemental new drug application (sNDA) for Vemlidy (tenofovir alafenamide) 25 mg tablets as a once-daily treatment for chronic hepatitis B virus (HBV) infection in pediatric patients 12 years of age and older with compensated liver disease. The launch of novel hepatitis medication therapies is expected to drive market expansion through the forecast period. Regulatory Hurdles and Time Constraints In the Hepatitis B Market Vaccines under FDA regulation undergo various rigorous review procedures by laboratories to ensure the product’s efficacy, safety, purity, and potency. Producing a vaccine around 15 years to establish its safety and efficacy. The factors contributed to such a long process arise with complexities at the time of the development process, the clinical trial process, and different regularity requirements in other regions. Processes with high time consumption contribute to additional time utilization owing to stringent regulatory policies by various administration organizations for approval, factors are expected to limit the introduction of new products by advanced technologies restraining market growth.

Hepatitis B Market Segmentation:

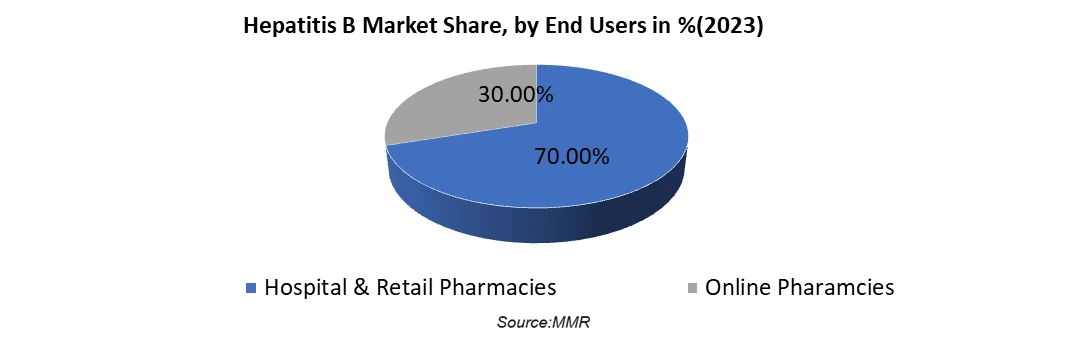

By End Users, the Hospitals & Retail Pharmacies sub-segment had dominated the market with a share of 70 % in 2023. The prevalence of viral hepatitis in the United States is a significant health problem, and pharmacists help. Pharmacists are uniquely positioned to raise patients' awareness of, prevent, and access treatment for severe diseases by administering vaccinations and counseling on prevention, testing, and treatment. The increasing number of private clinics in the Asia-Pacific and Latin America regions is projected to contribute to positive segment growth. Some referral hospitals provide hepatitis B surface antigen (HBsAg) testing refer eligible patients to a private lab for diagnostics, and write a drug prescription. TDF is available to patients from private hospitals/ pharmacies at US$30 per pack. Hospitals offer accessibility and convenience for individuals seeking hepatitis B vaccination through their regular visits for healthcare needs. Developed infrastructure and well-established storage facilities contribute to streamlined operations and reduce the risk of vaccine shortage and wastage in hospitals.

Hepatitis B Market Regional Insight:

North America's hepatitis B vaccine market accounted for over 38 % share in 2023 and is expected to grow at a considerable growth rate through the forecast period. The increased prevalence of hepatitis B infections coupled with the increased population at risk, including newborns, and healthcare workers among others is expected to fuel the market growth in the region. Canada considers hepatitis B, a huge concern as many people is suffering from Chronic Hepatitis B. Canada has invested in their research and drugs to manage the effluence of Hepatitis B. In Mexico, several pharmaceutical companies such as Laboratories Liomont S.A. are involved in the development and marketing of hepatitis B drugs and vaccines. But the market share for Mexico is lesser than that of its counterparts. Growth prospects in the region are bolstered by several factors, including a high illness burden, increasing access to medicines, improved healthcare and sanitation, and more awareness about hepatitis immunization. Countries like India, China, Indonesia, and others in the South Asian economic region are constantly growing their healthcare expenditure and reimbursement coverage to ensure more people have access to high-quality medical treatment. In addition, the Asia-Pacific area is expected to benefit from the rising demand for generic pharmaceuticals. The African region accounted for 26% of the global burden for Hepatitis B and 125,000 associated deaths. The Middle East and Africa, on the other hand, have the lowest market share for hepatitis B treatments because of strict government regulations, the presence of underdeveloped economies, a lack of awareness, and low healthcare spending in the area. Ethiopia has an estimated 11 million people living with HBV (prevalence of 9.4 percent). Ethiopia is committed to halting transmission by providing access to safe, affordable, and effective care to those living with HBV. The Ethiopian government has scaled up its HBV program by increasing the number of health facilities providing treatment services from 13 to 90. The Ethiopian National Viral Hepatitis Treatment Guidelines recommend TDF and ETV therapies for chronic HBV, with TDF being the most widely used. A revolving drug fund (RDF) is used to aggregate demand and procure centrally to leverage volume-based pricing. The Ethiopian Pharmaceutical Supply Service (EPSS) is the procurement agency tasked with procuring healthcare commodities in the country and its purchase. Rwanda has an estimated HBV burden of 399,000 (HBV prevalence of 0.82 percent) infections. The country’s Viral Hepatitis program sits within the wider HIV program at Rwanda Biomedical Centre (RBC). The program is in a scaling stage, and HBV diagnosis and treatment services are available at all health facilities across the country, entirely free to the patients. HBV screening is mandatory for pregnant women through antenatal care. Free screening services are available for the general population. India has an estimated 33 million people living with HBV (HBV prevalence at around 0.95 percent). The Indian government has established the National Viral Hepatitis Control Program (NVHCP) which offers free diagnostics for the management of patients with hepatitis B or C. The viral hepatitis program is scaling, with 868 facilities nationwide (across most district hospitals and some sub-district hospitals) providing hepatitis treatment. It is 100 percent domestically funded by the Government of India, and all services are offered free of cost to patients.Hepatitis B Market Competitive Landscape: On 19 Feb. 2023- AstraZeneca announced the successful completion of the acquisition of Icesave, Inc., a US-based clinical-stage biopharmaceutical company focused on developing differentiated, high-potential vaccines using an innovative, protein virus-like particle (VLP) platform. As a result of the acquisition, Icesave has become a subsidiary of AstraZeneca, with operations in Seattle, US. Oct. 10, 2023 – The Hepatitis B Foundation, a global nonprofit headquartered in the U.S., coordinated the highly successful 2023 International HBV Meeting, held Sept. 19-23 in Kobe, Japan. China – June 26, 2023 – Brii Biosciences Limited (“Brii Bio,” “we,” or the “Company”, stock code: 2137. HK), a biotechnology company developing therapies to improve patient health and choice across diseases with high unmet needs, announced that it entered into definitive agreements with Qpex Biopharma (“Qpex”) and third parties in connection with the acquisition of Qpex by Shionogi.

Hepatitis B Market Scope: Inquiry Before Buying

Global Hepatitis B Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.1 Bn. Forecast Period 2024 to 2030 CAGR: 4.2% Market Size in 2030: US $ 6.80 Bn. Segments Covered: by Therapy Chemo Therapy Immunosuppressant Therapy Nucleoside Analogue by Product Type Hepatitis B Vaccine Anti-viral Drugs Tenofovir Entecavir by End User Hospital Pharmacies Retail Pharmacies Online Pharmacies Hepatitis B Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hepatitis B Market Key Players:

1. Gilead Sciences - USA - Antiviral medications 2. Bristol-Myers Squibb - USA - Antiviral medications 3. AbbVie - USA - Antiviral medications 4. Abbott Laboratories - USA - Diagnostic tests 5. Thermo Fisher Scientific - USA - Diagnostic tests 6. Becton, Dickinson and Company - USA - Diagnostic tests 7. Johnson & Johnson - USA - Diagnostic tests 8. Dynavax Technologies Corporation - USA - Vaccines 9. MedImmune - USA – Vaccines 10. GlaxoSmithKline - UK - Vaccines 11. Merck & Co. Inc. - USA – Vaccines 12. Pfizer Inc. - USA - Vaccines 13. Novartis AG - Switzerland - Antiviral medications 14. Siemens Healthineers - Germany - Diagnostic tests 15. Roche - Switzerland - Diagnostic tests 16. Sanofi Pasteur - France - Vaccines 17. Qiagen N.V. - Netherlands - Diagnostic tests 18. F. Hoffmann-La Roche AG - Switzerland - Antiviral medications 19. Astellas Pharma - Japan - Antiviral medications 20. GeneOne Life Science Inc. - South Korea - Vaccines 21. Hualan Biological Engineering Inc. - China - Vaccines 22. Mitsubishi Tanabe Pharma - Japan - Antiviral medications 23. Serum Institute of India - India - Vaccines 24. Zydus Cadila - India - Vaccines 25. Beijing Tiantan Biological Products Co., Ltd. - China – Vaccines 26. Bio-Manguinhos – Brazil – Vaccines 27. Saudi Biological Industries – Saudi Arabia - Vaccines Frequently Asked Questions: 1] What segments are covered in the Hepatitis B Market report? Ans. The segments covered in the Hepatitis B Market report are based on Therapy, Product Type, and End Users. 2] Which region is expected to hold the highest share in the Hepatitis B Market? Ans. The North American region is expected to hold the highest share of the Hepatitis B Market. 3] What is the market size of the Hepatitis B Market by 2030? Ans. The market size of the Hepatitis B Market by 2030 will be $ 6.80 Billion. 4] What is the forecast period for the Hepatitis B Market? Ans. The Forecast period for the Hepatitis B Market is 2024- 2030.

1. Hepatitis B Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Hepatitis B Market: Dynamics 2.1. Hepatitis B Market Trends by Region 2.1.1. North America Hepatitis B Market Trends 2.1.2. Europe Hepatitis B Market Trends 2.1.3. Asia Pacific Hepatitis B Market Trends 2.1.4. Middle East and Africa Hepatitis B Market Trends 2.1.5. South America Hepatitis B Market Trends 2.2. Hepatitis B Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Hepatitis B Market Drivers 2.2.1.2. North America Hepatitis B Market Restraints 2.2.1.3. North America Hepatitis B Market Opportunities 2.2.1.4. North America Hepatitis B Market Challenges 2.2.2. Europe 2.2.2.1. Europe Hepatitis B Market Drivers 2.2.2.2. Europe Hepatitis B Market Restraints 2.2.2.3. Europe Hepatitis B Market Opportunities 2.2.2.4. Europe Hepatitis B Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Hepatitis B Market Drivers 2.2.3.2. Asia Pacific Hepatitis B Market Restraints 2.2.3.3. Asia Pacific Hepatitis B Market Opportunities 2.2.3.4. Asia Pacific Hepatitis B Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Hepatitis B Market Drivers 2.2.4.2. Middle East and Africa Hepatitis B Market Restraints 2.2.4.3. Middle East and Africa Hepatitis B Market Opportunities 2.2.4.4. Middle East and Africa Hepatitis B Market Challenges 2.2.5. South America 2.2.5.1. South America Hepatitis B Market Drivers 2.2.5.2. South America Hepatitis B Market Restraints 2.2.5.3. South America Hepatitis B Market Opportunities 2.2.5.4. South America Hepatitis B Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Hepatitis B Industry 2.8. Analysis of Government Schemes and Initiatives For Hepatitis B Industry 2.9. Hepatitis B Market Trade Analysis 2.10. The Global Pandemic Impact on Hepatitis B Market 3. Hepatitis B Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 3.1.1. Chemo Therapy 3.1.2. Immunosuppressant Therapy 3.1.3. Nucleoside Analogue 3.2. Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 3.2.1. Hepatitis B Vaccine 3.2.2. Anti-viral Drugs 3.2.3. Tenofovir 3.2.4. Entecavir 3.3. Hepatitis B Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospital Pharmacies 3.3.2. Retail Pharmacies 3.3.3. Online Pharmacies 3.4. Hepatitis B Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Hepatitis B Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 4.1.1. Chemo Therapy 4.1.2. Immunosuppressant Therapy 4.1.3. Nucleoside Analogue 4.2. North America Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 4.2.1. Hepatitis B Vaccine 4.2.2. Anti-viral Drugs 4.2.3. Tenofovir 4.2.4. Entecavir 4.3. North America Hepatitis B Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospital Pharmacies 4.3.2. Retail Pharmacies 4.3.3. Online Pharmacies 4.4. North America Hepatitis B Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 4.4.1.1.1. Chemo Therapy 4.4.1.1.2. Immunosuppressant Therapy 4.4.1.1.3. Nucleoside Analogue 4.4.1.2. United States Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 4.4.1.2.1. Hepatitis B Vaccine 4.4.1.2.2. Anti-viral Drugs 4.4.1.2.3. Tenofovir 4.4.1.2.4. Entecavir 4.4.1.3. United States Hepatitis B Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Hospital Pharmacies 4.4.1.3.2. Retail Pharmacies 4.4.1.3.3. Online Pharmacies 4.4.2. Canada 4.4.2.1. Canada Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 4.4.2.1.1. Chemo Therapy 4.4.2.1.2. Immunosuppressant Therapy 4.4.2.1.3. Nucleoside Analogue 4.4.2.2. Canada Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 4.4.2.2.1. Hepatitis B Vaccine 4.4.2.2.2. Anti-viral Drugs 4.4.2.2.3. Tenofovir 4.4.2.2.4. Entecavir 4.4.2.3. Canada Hepatitis B Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Hospital Pharmacies 4.4.2.3.2. Retail Pharmacies 4.4.2.3.3. Online Pharmacies 4.4.3. Mexico 4.4.3.1. Mexico Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 4.4.3.1.1. Chemo Therapy 4.4.3.1.2. Immunosuppressant Therapy 4.4.3.1.3. Nucleoside Analogue 4.4.3.2. Mexico Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 4.4.3.2.1. Hepatitis B Vaccine 4.4.3.2.2. Anti-viral Drugs 4.4.3.2.3. Tenofovir 4.4.3.2.4. Entecavir 4.4.3.3. Mexico Hepatitis B Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Hospital Pharmacies 4.4.3.3.2. Retail Pharmacies 4.4.3.3.3. Online Pharmacies 5. Europe Hepatitis B Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.2. Europe Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.3. Europe Hepatitis B Market Size and Forecast, by End User (2023-2030) 5.4. Europe Hepatitis B Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.4.1.2. United Kingdom Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.4.1.3. United Kingdom Hepatitis B Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.4.2.2. France Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.4.2.3. France Hepatitis B Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.4.3.2. Germany Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.4.3.3. Germany Hepatitis B Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.4.4.2. Italy Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.4.4.3. Italy Hepatitis B Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.4.5.2. Spain Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.4.5.3. Spain Hepatitis B Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.4.6.2. Sweden Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.4.6.3. Sweden Hepatitis B Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.4.7.2. Austria Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.4.7.3. Austria Hepatitis B Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 5.4.8.2. Rest of Europe Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 5.4.8.3. Rest of Europe Hepatitis B Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Hepatitis B Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.2. Asia Pacific Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.3. Asia Pacific Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Hepatitis B Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.1.2. China Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.1.3. China Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.2.2. S Korea Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.2.3. S Korea Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.3.2. Japan Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.3.3. Japan Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.4.2. India Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.4.3. India Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.5.2. Australia Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.5.3. Australia Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.6.2. Indonesia Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.6.3. Indonesia Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.7.2. Malaysia Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.7.3. Malaysia Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.8.2. Vietnam Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.8.3. Vietnam Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.9.2. Taiwan Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.9.3. Taiwan Hepatitis B Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 6.4.10.2. Rest of Asia Pacific Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Hepatitis B Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Hepatitis B Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 7.2. Middle East and Africa Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 7.3. Middle East and Africa Hepatitis B Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Hepatitis B Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 7.4.1.2. South Africa Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 7.4.1.3. South Africa Hepatitis B Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 7.4.2.2. GCC Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 7.4.2.3. GCC Hepatitis B Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 7.4.3.2. Nigeria Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 7.4.3.3. Nigeria Hepatitis B Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 7.4.4.2. Rest of ME&A Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 7.4.4.3. Rest of ME&A Hepatitis B Market Size and Forecast, by End User (2023-2030) 8. South America Hepatitis B Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 8.2. South America Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 8.3. South America Hepatitis B Market Size and Forecast, by End User(2023-2030) 8.4. South America Hepatitis B Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 8.4.1.2. Brazil Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 8.4.1.3. Brazil Hepatitis B Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 8.4.2.2. Argentina Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 8.4.2.3. Argentina Hepatitis B Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Hepatitis B Market Size and Forecast, by Therapy (2023-2030) 8.4.3.2. Rest Of South America Hepatitis B Market Size and Forecast, by Product Type (2023-2030) 8.4.3.3. Rest Of South America Hepatitis B Market Size and Forecast, by End User (2023-2030) 9. Global Hepatitis B Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Hepatitis B Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Gilead Sciences - USA - Antiviral medications 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bristol-Myers Squibb - USA - Antiviral medications 10.3. AbbVie - USA - Antiviral medications 10.4. Abbott Laboratories - USA - Diagnostic tests 10.5. Thermo Fisher Scientific - USA - Diagnostic tests 10.6. Becton, Dickinson and Company - USA - Diagnostic tests 10.7. Johnson & Johnson - USA - Diagnostic tests 10.8. Dynavax Technologies Corporation - USA - Vaccines 10.9. MedImmune - USA – Vaccines 10.10. GlaxoSmithKline - UK - Vaccines 10.11. Merck & Co. Inc. - USA – Vaccines 10.12. Pfizer Inc. - USA - Vaccines 10.13. Novartis AG - Switzerland - Antiviral medications 10.14. Siemens Healthineers - Germany - Diagnostic tests 10.15. Roche - Switzerland - Diagnostic tests 10.16. Sanofi Pasteur - France - Vaccines 10.17. Qiagen N.V. - Netherlands - Diagnostic tests 10.18. F. Hoffmann-La Roche AG - Switzerland - Antiviral medications 10.19. Astellas Pharma - Japan - Antiviral medications 10.20. GeneOne Life Science Inc. - South Korea - Vaccines 10.21. Hualan Biological Engineering Inc. - China - Vaccines 10.22. Mitsubishi Tanabe Pharma - Japan - Antiviral medications 10.23. Serum Institute of India - India - Vaccines 10.24. Zydus Cadila - India - Vaccines 10.25. Beijing Tiantan Biological Products Co., Ltd. - China – Vaccines 10.26. Bio-Manguinhos – Brazil – Vaccines 10.27. Saudi Biological Industries – Saudi Arabia - Vaccines 11. Key Findings 12. Industry Recommendations 13. Hepatitis B Market: Research Methodology 14. Terms and Glossary