The Healthcare Information System Market size was valued at 520.62 Bn in 2024. The Market is growing at a CAGR of 8.25%, from 2025 to 2032, reaching nearly USD 981.62 Bn by 2032.Healthcare Information System Market Overview

Healthcare Information Systems (HIS) are integrated IT solutions designed to manage, analyze, and share patient-specific and healthcare-related data. Core components include Electronic Health Records (EHR), Hospital Information Systems, Pharmacy Information Systems, Laboratory Information Systems, and Clinical Decision Support Systems. EHRs store medical history, diagnoses, medications, treatment plans, and other vital health information, enabling seamless sharing across healthcare providers for accurate, coordinated patient care. For example, over 90% of U.S. physicians use certified EHR technology to streamline hospital workflows and improve patient outcomes. The rise of cloud-based platforms, mobile health applications, and AI-powered clinical decision support systems continues to transform healthcare delivery. Hospitals, clinics, and pharmaceutical organizations are increasingly adopting HIS to improve operational efficiency, patient engagement, and personalized care, creating a globally connected, smarter healthcare ecosystem.To know about the Research Methodology :- Request Free Sample Report North America dominates Healthcare Information System adoption, driven by advanced digital infrastructure, high EHR penetration, and government initiatives such as the ONC Public Health Information and Technology Workforce Program. Epic Systems Corporation and NextGen Healthcare are major market influencers, leveraging generative AI to support clinical decision-making, optimize revenue cycles, enhance patient experiences, and improve clinician workflows. Asia Pacific is emerging as the fastest-growing region, with countries such as China, India, Japan, and South Korea investing heavily in healthcare IT infrastructure this factor significantly drives the Healthcare Information System Market.

Healthcare Information System Market Dynamics

Increasing Adoption of Electronic Health Records (EHRs) to Drive the growth of Healthcare Information System Market The growing adoption of Electronic Health Records (EHRs) is a major driver boosting the growth of the Healthcare Information System Market. Healthcare providers worldwide are shifting from paper-based systems to digital platforms to enhance efficiency, reduce errors, and improve patient outcomes. EHRs streamline patient data management by integrating medical history, prescriptions, diagnostic results, and treatment plans in a unified digital system. For instance, the U.S. Centers for Medicare & Medicaid Services (CMS) has actively promoted the adoption of EHRs under its Meaningful Use Program, incentivizing hospitals and clinics to digitize healthcare processes. Similarly, in countries such as India, the National Digital Health Mission (NDHM) is boosting EHR implementation to ensure seamless health data accessibility across providers. The demand for EHRs is also rising due to telemedicine growth, as physicians require secure and real-time access to patient records during remote consultations. This transformation improves clinical decision-making and reduces operational costs for hospitals by minimizing duplicate tests and medication errors. With global healthcare spending expected to rise significantly, the adoption of EHRs continue to accelerate, driving strong demand for healthcare information systems. Thus, the digital shift in patient data management is creating a sustainable pathway for market growth, positioning EHRs as the cornerstone of modern healthcare information technology. Data Security and Privacy Concerns limits the growth of the growth of Healthcare Information System Market Rapid digitization, data security and privacy concerns remain a critical restraint hampering the growth of the Healthcare Information System Market. With the rising use of EHRs, telehealth, and cloud-based platforms, healthcare organizations face heightened risks of cyberattacks, data breaches, and unauthorized access to sensitive patient information. For example, in 2023, the U.S. healthcare sector reported over 133 million breached health records, according to the Department of Health and Human Services (HHS). These breaches compromise patient confidentiality and lead to significant financial losses, regulatory penalties, and erosion of trust in healthcare systems. Compliance with data protection regulations such as HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR (General Data Protection Regulation) in Europe adds also pressure on healthcare providers to invest heavily in cybersecurity solutions. Smaller hospitals and clinics often face challenges in allocating sufficient resources for advanced data protection, limiting the adoption of healthcare information systems. Additionally, ransomware attacks targeting hospital databases have disrupted operations, delayed treatments, and put patient safety at risk. For Instance, the WannaCry cyberattack on the UK’s National Health Service (NHS) in 2017, which forced hospitals to cancel appointments and emergency services. These persistent risks highlight that unless robust cybersecurity frameworks and AI-driven threat detection solutions are integrated, data privacy concerns will remain a significant barrier restraining Healthcare Information System Market growth. Growth in AI-Driven Clinical Decision Support Creates Lucrative Growth Opportunities to the of Healthcare Information System Market The integration of artificial intelligence (AI) in clinical decision support (CDS) systems presents a lucrative opportunity for the Healthcare Information System Market. AI-driven CDS tools help healthcare providers analyze vast amounts of patient data, identify patterns, and generate actionable insights to enhance diagnosis, treatment planning, and disease prevention. For example, IBM Watson Health has been used to support oncologists in recommending personalized cancer treatments by analyzing clinical research and patient records. Similarly, AI-powered CDS platforms are increasingly applied in radiology to detect anomalies in medical imaging faster and with higher accuracy than traditional methods. The rising demand for precision medicine, coupled with the global burden of chronic diseases such as diabetes and cardiovascular disorders, is accelerating the need for AI-integrated healthcare information systems. Moreover, AI helps reduce clinician burnout by automating administrative tasks and providing evidence-based recommendations, allowing physicians to focus more on patient care. Real-time predictive analytics enabled by AI also assist in identifying patients at risk of adverse health events, enabling proactive interventions. Governments and healthcare providers are actively investing in AI solutions to improve efficiency and lower healthcare costs. For instance, the European Commission’s AI strategy supports innovations in digital health technologies. Thus, the growing reliance on AI-powered CDS systems is creating immense opportunities for market players to expand their offerings and revolutionize modern healthcare delivery.Healthcare Information System Market Segment Analysis

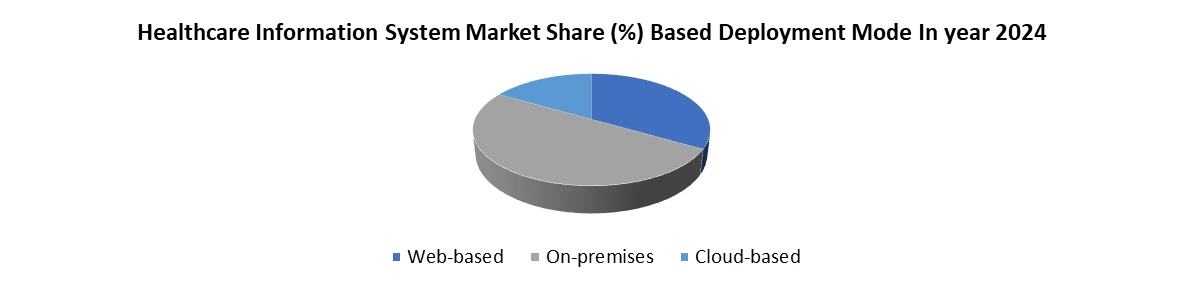

Based Deployment mode, Healthcare Information System Market is segmented into Web-based, On-premises, and Cloud-based. The On-premises segment dominated the Deployment mode segment in year 2024.Due to its strong reliability, control, and data security advantages. Healthcare providers, particularly large hospitals and research institutions, preferred on-premises solutions because they allow complete ownership of IT infrastructure, ensuring sensitive patient health records remain within the organization’s secure environment. With rising concerns over cyberattacks and data breaches in cloud systems, many healthcare institutions chose on-premises deployment to comply with stringent data privacy regulations such as HIPAA in the U.S. and GDPR in Europe. Also, on-premises systems offer greater customization and integration flexibility with legacy hospital systems, which is critical for large-scale organizations handling high patient volumes. Although cloud adoption is increasing due to cost-effectiveness, the upfront investment in on-premises solutions is often justified by long-term stability, robust performance, and minimal downtime. This strong emphasis on security and operational control significantly contributed to the dominance of the on-premises segment in 2024.

Healthcare Information System Market Regional Analysis:

North America Dominated the Healthcare Information System Market in year 2024.Strong digital infrastructure, high EHR adoption rates, and government-backed healthcare IT efforts are expected to boost the North American healthcare information systems industry. With about 90% of doctors using EHR systems, the United States leads the region. Due to its advanced healthcare infrastructure, high adoption of digital health solutions, and strong government initiatives promoting electronic health records (EHRs) and interoperability. The region’s well-established healthcare IT ecosystem, backed by substantial investments from both private and public sectors, created a conducive environment for rapid HIS deployment. Hospitals and clinics increasingly adopted on-premises and cloud-based HIS solutions to enhance operational efficiency, patient care, and regulatory compliance. According to the Office of the National Coordinator for Health Information Technology (ONC), over 90% of hospitals in the U.S. had adopted certified EHR technology by 2024. This trend encouraged healthcare providers to integrate advanced HIS platforms capable of data analytics, telemedicine support, and AI-driven clinical decision tools. For instance, include Mayo Clinic and Cleveland Clinic, which leveraged HIS platforms to streamline patient management, reduce medical errors, and improve care coordination across multiple facilities. Additionally, government programs like the U.S. Health Information Technology for Economic and Clinical Health (HITECH) Act offered financial incentives for HIS adoption, further boosting market growth. North America’s leadership in HIS adoption stems from its technological readiness, supportive regulatory framework, and the healthcare sector’s focus on improving patient outcomes, operational efficiency, and data-driven decision-making, setting a benchmark for other regions.Healthcare Information Systems Market Competitive Analysis:

The global Healthcare Information System Market is highly competitive, with leading players leveraging advanced technology, strategic partnerships, and regional customization to strengthen their market presence. Companies operate within a complex regulatory environment, balancing stringent data privacy laws in North America and Europe with cost-sensitive healthcare systems in emerging regions. Players are increasingly focusing on AI-driven analytics, cloud-based platforms, and interoperable solutions to improve clinical efficiency, patient outcomes, and compliance. Key market leaders include Cerner Corporation, Epic Systems, Allscripts, MEDITECH, and McKesson. Cerner excels with integrated EHR solutions and population health management tools, while Epic Systems is known for its scalable, cloud-enabled EHR platforms supporting large hospital networks. Allscripts focuses on predictive analytics and care coordination solutions, and MEDITECH offers cost-effective, customizable HIS solutions for mid-sized hospitals. McKesson drives innovation with pharmacy management integration and supply chain optimization. These companies emphasize R&D, digital transformation, and localized offerings to cater to diverse healthcare settings worldwide.Healthcare Information System Market Key Trends:

Big Data and Analytics Healthcare data continues to expand, analytical tools are developing to extract valuable insights from this data. Effective resource allocation, treatment plan personalization, and at-risk patient identification are all possible with predictive analytics. Use of Artificial Intelligence (AI) and Automation AI and Automation is presently being used for automating administrative tasks, as well as reviewing patient data for diagnosis, treatment decisions and personalizing care. Generative AI is emerging to assist with taking notes, summarizing visits, and developing discharge instructions, which could help reduce clinician's time writing things down. AI is also being used in cyber-security for prevention and detection of breaches which could save organizations millions of dollars.Healthcare Information System Market Key development

On January 15, 2025, Sutter Health and GE HealthCare have launched a seven-year partnership, Care Alliance, to advance diagnostic imaging across California. The collaboration focuses on AI-powered imaging technologies, improving patient care and clinician efficiency. It aims to expand access to advanced imaging, ensure faster diagnostics, streamline operations, and deliver consistent, high-quality experiences across Sutter Health’s network. On December 12, 2024, Philips has expanded its strategic partnership with Sim&Cure to advance neurovascular therapy innovation. The collaboration integrates Sim&Size software into Philips’ next-generation Azurion Image-Guided Therapy platform, enabling physicians to simulate device placement, optimize selection, and guide deployment for complex brain aneurysms. This unified solution reduces procedural complexity, enhances precision, streamlines workflows, and supports safer, more efficient interventions, while driving ongoing innovation in cathlabs and improving patient outcomes globally. On January 31, 2025, GE HealthCare is investing $138 million to expand its Carrigtohill, Cork contrast media manufacturing facility, adding capacity for 25 million more patient doses annually by 2027. The new 3,000 m² facility will enhance production flexibility, automation, and supply security to meet rising global demand for CT and X-ray contrast media, supporting efficient diagnostics and strengthening GE HealthCare’s pharmaceutical presence in Ireland. On September 10, 2024, AvaSure is partnering with Oracle Cloud Infrastructure (OCI) and NVIDIA to develop an AI-powered virtual concierge for hospitals, integrating AvaSure’s Intelligent Virtual Care Platform with OCI AI services and NVIDIA NIM microservices. Designed to streamline clinical workflows, support staff, and enhance patient communication, the solution enables smart, voice-activated hospital rooms. It is expected to launch next year, improving efficiency and personalized care delivery.Healthcare Information System Market Scope: Inquire Before Buying

Global Healthcare Information System Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 520.62 Bn. Forecast Period 2025 to 2032 CAGR: 8.25% Market Size in 2032: USD 981.62 Bn. Segments Covered: by Component Software Hardware Services by Deployment Mode Web-based On-premises Cloud-based by Application Hospital Information System Electronic Health Record Electronic Medical Record Real-time Healthcare Patient Engagement Solution Population Health Management Pharmacy Automation Systems Medication Dispensing System Packaging & Labeling System Storage & Retrieval System Automated Medication Compounding System Tabletop Tablet Counters Laboratory Informatics Revenue Cycle Management Medical Imaging Information System Radiology Information Systems Monitoring Analysis Software Picture Archiving and Communication Systems Patient Administration System by End-User Hospitals & Ambulatory Diagnostic Centers Laboratory Academic & Research Institutes Healthcare Information System Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Healthcare Information System Market,Key Players are

North America 1. Epic Systems Corporation (U.S.) 2. Oracle Health (formerly Cerner) 3. Allscripts / Veradigm (North America) 4. McKesson Corporation (North America) 5. Athenahealth (North America) 6. NextGen Healthcare (North America) 7. eClinicalWorks (North America) 8. Meditech (U.S.) Europe 9. Siemens Healthineers (Europe) 10. Philips Healthcare (Europe) 11. CompuGroup Medical (CGM) (Europe) 12. Agfa HealthCare (Europe) 13. Orion Health (Europe / Global) 14. InterSystems Corporation (Europe) Asia Pacific 15. Neusoft Corporation (Asia Pacific – China) 16. Infosys (Asia Pacific – India) 17. Wipro (Asia Pacific – India) 18. Fujitsu (Asia Pacific – Japan) 19. NTT Data Corporation (Asia Pacific – Japan) Middle East & Africa 20. Orion Health (Middle East – especially Gulf countries) 21. eHealth Nigeria (Africa – Nigeria)Healthcare Information System Market Frequently Asked Questions

1] What segments are covered in the Global Healthcare Information System Market report? Ans. The segments covered in the Healthcare Information System Market report are based on Component, Deployment Mode, Application, End User and Regions. 2] Which region is expected to hold the highest share in the Global Healthcare Information System Market? Ans. The North America region is expected to hold the largest share of the Healthcare Information Systems Market. 3] What is the market size of the Global Healthcare Information System Market by 2032? Ans. The market size of the Healthcare Information System Market by 2032 is expected to reach US$ 981.62 Bn. 4] What is the forecast period for the Global Healthcare Information System Market? Ans. The forecast period for the Healthcare Information System Market is 2024-2032. 5] What was the market size of the Global Healthcare Information System Market in 2024? Ans. The market size of the Healthcare Information System Market in 2024 was valued at US$ 520.62 Bn.

1. Healthcare Information System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Healthcare Information System Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Healthcare Information System Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Healthcare Information System Market: Dynamics 3.1. Healthcare Information System Market Trends by Region 3.1.1. North America Healthcare Information System Market Trends 3.1.2. Europe Healthcare Information System Market Trends 3.1.3. Asia Pacific Healthcare Information System Market Trends 3.1.4. Middle East and Africa Healthcare Information System Market Trends 3.1.5. South America Healthcare Information System Market Trends 3.2. Healthcare Information System Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Healthcare Information System Market Drivers 3.2.1.2. North America Healthcare Information System Market Restraints 3.2.1.3. North America Healthcare Information System Market Opportunities 3.2.1.4. North America Healthcare Information System Market Challenges 3.2.2. Europe 3.2.2.1. Europe Healthcare Information System Market Drivers 3.2.2.2. Europe Healthcare Information System Market Restraints 3.2.2.3. Europe Healthcare Information System Market Opportunities 3.2.2.4. Europe Healthcare Information System Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Healthcare Information System Market Drivers 3.2.3.2. Asia Pacific Healthcare Information System Market Restraints 3.2.3.3. Asia Pacific Healthcare Information System Market Opportunities 3.2.3.4. Asia Pacific Healthcare Information System Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Healthcare Information System Market Drivers 3.2.4.2. Middle East and Africa Healthcare Information System Market Restraints 3.2.4.3. Middle East and Africa Healthcare Information System Market Opportunities 3.2.4.4. Middle East and Africa Healthcare Information System Market Challenges 3.2.5. South America 3.2.5.1. South America Healthcare Information System Market Drivers 3.2.5.2. South America Healthcare Information System Market Restraints 3.2.5.3. South America Healthcare Information System Market Opportunities 3.2.5.4. South America Healthcare Information System Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Healthcare Information System Industry 3.8. Analysis of Government Schemes and Initiatives For Healthcare Information System Industry 3.9. Healthcare Information System Market Trade Analysis 3.10. The Global Pandemic Impact on Healthcare Information System Market 4. Healthcare Information System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Healthcare Information System Market Size and Forecast, by Component (2024-2032) 4.1.1. Software 4.1.2. Hardware 4.1.3. Services 4.2. Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 4.2.1. Web-based 4.2.2. On-premises 4.2.3. Cloud-based 4.3. Healthcare Information System Market Size and Forecast, by Application (2024-2032) 4.3.1. Hospital Information System 4.3.2. Pharmacy Automation Systems 4.3.3. Laboratory Informatics 4.3.4. Revenue Cycle Management 4.3.5. Medical Imaging Information System 4.3.6. Patient Administration System 4.4. Healthcare Information System Market Size and Forecast, by End User (2024-2032) 4.4.1. Hospitals & Ambulatory 4.4.2. Diagnostic Centers 4.4.3. Laboratory 4.4.4. Academic & Research Institutes 4.5. Healthcare Information System Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Healthcare Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Healthcare Information System Market Size and Forecast, by Component (2024-2032) 5.1.1. Software 5.1.2. Hardware 5.1.3. Services 5.2. North America Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 5.2.1. Web-based 5.2.2. On-premises 5.2.3. Cloud-based 5.3. North America Healthcare Information System Market Size and Forecast, by Application (2024-2032) 5.3.1. Hospital Information System 5.3.2. Pharmacy Automation Systems 5.3.3. Laboratory Informatics 5.3.4. Revenue Cycle Management 5.3.5. Medical Imaging Information System 5.3.6. Patient Administration System 5.4. North America Healthcare Information System Market Size and Forecast, by End User (2024-2032) 5.4.1. Hospitals & Ambulatory 5.4.2. Diagnostic Centers 5.4.3. Laboratory 5.4.4. Academic & Research Institutes 5.5. North America Healthcare Information System Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Healthcare Information System Market Size and Forecast, by Component (2024-2032) 5.5.1.1.1. Software 5.5.1.1.2. Hardware 5.5.1.1.3. Services 5.5.1.2. United States Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 5.5.1.2.1. Web-based 5.5.1.2.2. On-premises 5.5.1.2.3. Cloud-based 5.5.1.3. United States Healthcare Information System Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Hospital Information System 5.5.1.3.2. Pharmacy Automation Systems 5.5.1.3.3. Laboratory Informatics 5.5.1.3.4. Revenue Cycle Management 5.5.1.3.5. Medical Imaging Information System 5.5.1.3.6. Patient Administration System 5.5.1.4. United States Healthcare Information System Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Hospitals & Ambulatory 5.5.1.4.2. Diagnostic Centers 5.5.1.4.3. Laboratory 5.5.1.4.4. Academic & Research Institutes 5.5.2. Canada 5.5.2.1. Canada Healthcare Information System Market Size and Forecast, by Component (2024-2032) 5.5.2.1.1. Software 5.5.2.1.2. Hardware 5.5.2.1.3. Services 5.5.2.2. Canada Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 5.5.2.2.1. Web-based 5.5.2.2.2. On-premises 5.5.2.2.3. Cloud-based 5.5.2.3. Canada Healthcare Information System Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Hospital Information System 5.5.2.3.2. Pharmacy Automation Systems 5.5.2.3.3. Laboratory Informatics 5.5.2.3.4. Revenue Cycle Management 5.5.2.3.5. Medical Imaging Information System 5.5.2.3.6. Patient Administration System 5.5.2.4. Canada Healthcare Information System Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Hospitals & Ambulatory 5.5.2.4.2. Diagnostic Centers 5.5.2.4.3. Laboratory 5.5.2.4.4. Academic & Research Institutes 5.5.3. Mexico 5.5.3.1. Mexico Healthcare Information System Market Size and Forecast, by Component (2024-2032) 5.5.3.1.1. Software 5.5.3.1.2. Hardware 5.5.3.1.3. Services 5.5.3.2. Mexico Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 5.5.3.2.1. Web-based 5.5.3.2.2. On-premises 5.5.3.2.3. Cloud-based 5.5.3.3. Mexico Healthcare Information System Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Hospital Information System 5.5.3.3.2. Pharmacy Automation Systems 5.5.3.3.3. Laboratory Informatics 5.5.3.3.4. Revenue Cycle Management 5.5.3.3.5. Medical Imaging Information System 5.5.3.3.6. Patient Administration System 5.5.3.4. Mexico Healthcare Information System Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Hospitals & Ambulatory 5.5.3.4.2. Diagnostic Centers 5.5.3.4.3. Laboratory 5.5.3.4.4. Academic & Research Institutes 6. Europe Healthcare Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.2. Europe Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.3. Europe Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.4. Europe Healthcare Information System Market Size and Forecast, by End User (2024-2032) 6.5. Europe Healthcare Information System Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.5.1.2. United Kingdom Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.1.3. United Kingdom Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Healthcare Information System Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.5.2.2. France Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.2.3. France Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Healthcare Information System Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.5.3.2. Germany Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.3.3. Germany Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Healthcare Information System Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.5.4.2. Italy Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.4.3. Italy Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Healthcare Information System Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.5.5.2. Spain Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.5.3. Spain Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Healthcare Information System Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.5.6.2. Sweden Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.6.3. Sweden Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Healthcare Information System Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.5.7.2. Austria Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.7.3. Austria Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Healthcare Information System Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Healthcare Information System Market Size and Forecast, by Component (2024-2032) 6.5.8.2. Rest of Europe Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.8.3. Rest of Europe Healthcare Information System Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Healthcare Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.2. Asia Pacific Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.3. Asia Pacific Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Healthcare Information System Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.1.2. China Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.1.3. China Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.2.2. S Korea Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.2.3. S Korea Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.3.2. Japan Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.3.3. Japan Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.4.2. India Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.4.3. India Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.5.2. Australia Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.5.3. Australia Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.6.2. Indonesia Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.6.3. Indonesia Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.7.2. Malaysia Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.7.3. Malaysia Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.8.2. Vietnam Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.8.3. Vietnam Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.9.2. Taiwan Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.9.3. Taiwan Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Healthcare Information System Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Healthcare Information System Market Size and Forecast, by Component (2024-2032) 7.5.10.2. Rest of Asia Pacific Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.10.3. Rest of Asia Pacific Healthcare Information System Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Healthcare Information System Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Healthcare Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Healthcare Information System Market Size and Forecast, by Component (2024-2032) 8.2. Middle East and Africa Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 8.3. Middle East and Africa Healthcare Information System Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Healthcare Information System Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Healthcare Information System Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Healthcare Information System Market Size and Forecast, by Component (2024-2032) 8.5.1.2. South Africa Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 8.5.1.3. South Africa Healthcare Information System Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Healthcare Information System Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Healthcare Information System Market Size and Forecast, by Component (2024-2032) 8.5.2.2. GCC Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 8.5.2.3. GCC Healthcare Information System Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Healthcare Information System Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Healthcare Information System Market Size and Forecast, by Component (2024-2032) 8.5.3.2. Nigeria Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 8.5.3.3. Nigeria Healthcare Information System Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Healthcare Information System Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Healthcare Information System Market Size and Forecast, by Component (2024-2032) 8.5.4.2. Rest of ME&A Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 8.5.4.3. Rest of ME&A Healthcare Information System Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Healthcare Information System Market Size and Forecast, by End User (2024-2032) 9. South America Healthcare Information System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Healthcare Information System Market Size and Forecast, by Component (2024-2032) 9.2. South America Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 9.3. South America Healthcare Information System Market Size and Forecast, by Application(2024-2032) 9.4. South America Healthcare Information System Market Size and Forecast, by End User (2024-2032) 9.5. South America Healthcare Information System Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Healthcare Information System Market Size and Forecast, by Component (2024-2032) 9.5.1.2. Brazil Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 9.5.1.3. Brazil Healthcare Information System Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Healthcare Information System Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Healthcare Information System Market Size and Forecast, by Component (2024-2032) 9.5.2.2. Argentina Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 9.5.2.3. Argentina Healthcare Information System Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Healthcare Information System Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Healthcare Information System Market Size and Forecast, by Component (2024-2032) 9.5.3.2. Rest Of South America Healthcare Information System Market Size and Forecast, by Deployment Mode (2024-2032) 9.5.3.3. Rest Of South America Healthcare Information System Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Healthcare Information System Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Epic Systems Corporation (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Oracle Health (formerly Cerner) 10.3. Allscripts / Veradigm (North America) 10.4. McKesson Corporation (North America) 10.5. Athenahealth (North America) 10.6. NextGen Healthcare (North America) 10.7. eClinicalWorks (North America) 10.8. Meditech (U.S.) 10.9. Siemens Healthineers (Europe) 10.10. Philips Healthcare (Europe) 10.11. CompuGroup Medical (CGM) (Europe) 10.12. Agfa HealthCare (Europe) 10.13. Orion Health (Europe / Global) 10.14. InterSystems Corporation (Europe) 10.15. Neusoft Corporation (Asia Pacific – China) 10.16. Infosys (Asia Pacific – India) 10.17. Wipro (Asia Pacific – India) 10.18. Fujitsu (Asia Pacific – Japan) 10.19. NTT Data Corporation (Asia Pacific – Japan) 10.20. Orion Health (Middle East – especially Gulf countries) 10.21. eHealth Nigeria (Africa – Nigeria) 11. Key Findings 12. Industry Recommendations 13. Healthcare Information System Market: Research Methodology 14. Terms and Glossary