Grid-forming Inverter market was valued at USD 687 Mn in 2023 and is expected to reach USD 1186.59 Mn by 2030, at a CAGR of 8.54 % during the forecast period.Grid-forming Inverter Market Overview

The global Grid-forming Inverter market is transforming the energy sector by ensuring grid stability and seamlessly integrating renewable energy sources like solar and wind. Unlike traditional inverters, grid-forming inverters actively control grid parameters, making them essential for managing the intermittency of renewable energy. Countries are moving towards cleaner energy options, which means there's a growing need for grid-forming inverters. This increasing demand is pushing for more innovation in the industry. These inverters play a crucial role in maintaining grid stability, mitigating voltage fluctuations, and preventing power outages. Grid-forming inverters also help energy storage systems join with renewable energy sources, making them more dependable. They're a key part of moving towards cleaner and stronger energy for the future.To know about the Research Methodology :- Request Free Sample Report

Grid-forming Inverter Market Dynamics

Rising demand for decentralized energy evolution and grid stability boosts market for grid-forming inverters. Energy storage becomes increasingly vital in balancing the ups and downs of renewable energy production. Grid-forming inverters play a key role here. They allow energy to flow both to and from the grid, storing excess power when it's plentiful and releasing it when demand is high. This teamwork boosts grid flexibility, helps manage peak energy use, and keeps things running smoothly. The Grid-forming Inverter Market is growing fast, driven by the move toward decentralized energy. More rooftop solar setups, community projects, and microgrids mean less reliance on big power plants. Grid-forming inverters make this possible, letting these smaller energy sources keep running even if the main grid goes down. This shift toward decentralization matches the rising desire for local control over energy, stronger community resilience, and less reliance on far-off power plants. Technology keeps pushing the Grid-forming Inverter Market forward. Manufacturers are working hard to make these inverters better, faster, and smarter. Improved software, precise electronics, and better communication systems mean grid-forming inverters can react quickly to changes in the grid, handling energy ups and downs with ease. As these technologies improve, grid-forming inverters become even more vital in today's energy world. Solar PV surge sparks demand for grid-forming inverters in transition to clean energy The growth in households relying on solar PV, expected to reach over 100 million by 2030, presents a significant opportunity for the Grid-forming Inverter Market. With an expected increase in distributed PV installations, mainly in the residential sector, there will be a growing demand for grid-forming inverters to manage the integration of these renewable energy sources into the electricity grid. As households shift towards electricity for heating, cooling, and electric mobility, the need for local embedded electricity production will rise, further driving the demand for grid-forming inverters. Additionally, the expansion of rooftop PV systems for households, facilitated by innovative business models and decreasing installation costs, will enhance the market for grid-forming inverters, as these devices play a crucial role in ensuring the stability and reliability of distributed energy systems. Overall, the increasing deployment of solar PV in households creates a favorable environment for the growth of the Grid-forming Inverter Market, aligning with the transition towards clean and sustainable energy sources.The global market for Grid-forming Inverters encounters a notable obstacle The intricacy of incorporating these cutting-edge technologies into current energy grids. Despite their manifold advantages, seamless integration of grid-forming inverters necessitates compatibility with a wide array of grid architectures, diverse voltage levels, and varying technical standards. Achieving smooth operation between grid-forming inverters and existing infrastructure requires sophisticated control algorithms and strong communication protocols. This challenge is intensified as grid-forming inverter adoption extends across many counties with unique grid characteristics and regulatory frameworks. Recent Developments: 1. In March 2022, Huawei Technology entered into a strategic cooperation agreement with Meienergy Technology Co. Ltd. to deliver smart PV and energy storage systems for a 1 GW utility PV plant and a 500 MWh energy storage system in Ghana, developed by Meienergy. 2. In February 2022, FIMER partnered with Vega Solar to provide 14 PVS-100 inverters, a three-phase string solution, in Albania. The PVS-100, FIMER’s cloud-connected 3 Phase string inverter solution, offers cost-efficient decentralized photovoltaic systems suitable for both ground-mounted and rooftop applications.

Global Insights: Grid-Forming Functionality in Action

Across various countries, system operators are actively formulating technical criteria to facilitate the deployment of Grid-Forming Multi-Infeed (GFM) functionality:1. In Great Britain, the National Grid Electricity System Operator (NGESO) has conducted studies to assess Grid-Forming Inverters (GFIs) performance, leading to the development of technical standards for GFM capability. These standards are integral to initiatives like the Great Britain Stability Pathfinder Programme, aimed at procuring solutions for dynamic voltage support and inertia enhancement.

2. In Europe, ENTSO-E has coordinated efforts to establish standardized requirements for GFIs, essential for compliance with Connection Network Codes (CNCs) across the European Union. Market mechanisms will facilitate the procurement of GFM functionality, ensuring uniformity in connecting Inverter-Based Resources (IBRs) to the grid.

3. In Australia, GFI-based battery energy storage systems are being deployed in the National Electricity Market, with pilot projects and market mechanisms testing and compensating equipment owners for providing essential system services.

4. In Germany, requirements for Grid-Forming Converter functionality are being developed through the VDE|FNN standard VDE-AR-N-4131 and accompanying guidelines. These standards encompass power imbalance management, frequency response, and voltage control during grid faults.

These global initiatives underscore the widespread interest in leveraging GFI technology to bolster grid stability and accommodate growing renewable energy penetration. Various stakeholders play pivotal roles in advancing Grid-forming Inverter development, deployment, and integration: The involvement of stakeholders plays a very important role in advancing the development, distribution, and integration of Grid-forming Inverters. Power system operators benefit from Grid-forming Inverters as they enhance grid stability, voltage control, and frequency regulation. Energy regulators ensure adherence to standards and grid codes, promoting safe and efficient grid operation. Inverter manufacturers play a pivotal role by designing and supplying efficient Grid-forming Inverters. Renewable energy developers rely on these inverters to seamlessly integrate renewable energy sources into the grid. Research institutions drive innovation and technological progress, while industry associations foster collaboration and advocacy. Through their collective efforts, stakeholders contribute to the effective implementation and widespread adoption of Grid-forming Inverters, fostering a more resilient and sustainable energy system.Grid-forming Inverter Market Segment Analysis

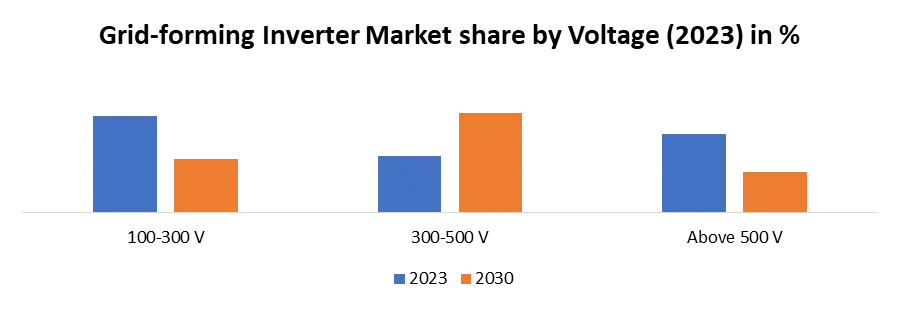

Based on Type, the global grid-forming inverter market in 2023 is largely dominated by the Above 100 kW segment. This segment holds a significant advantage due to its suitability for larger and more complex energy infrastructures. As power grids evolve to accommodate increased renewable energy sources and higher demand, there is a growing need for robust and high-capacity solutions. Grid-forming inverters with an output power rating exceeding 100 kW offer the scalability and versatility required to stabilize and manage grids with substantial energy generation and consumption. In utility-scale solar and wind farms, where power generation is substantial, these inverters play a critical role in synchronizing renewable energy outputs with the grid's stability. Their capacity to handle large power outputs makes them essential for maintaining grid frequency and voltage within acceptable limits, ensuring a seamless integration of clean energy into the existing infrastructure. Based on Voltage, the Central-Inverters segment leads the global Grid-forming Inverter market in 2023. This segment holds a prominent position due to its widespread application across utility-scale renewable energy projects. These inverters are specifically designed to manage and convert the substantial power outputs generated by large solar and wind farms into usable energy for the grid. Their high-power capacity and advanced control capabilities make them essential for maintaining grid stability by synchronizing the variable output of renewable sources with grid requirements. One of the main reasons for the dominance of central inverters is their efficiency in terms of cost, installation, and maintenance. Central inverters offer economies of scale due to their larger capacity, resulting in a lower cost per watt and reduced balance-of-system expenses compared to other types. This cost-effectiveness is particularly advantageous for utility-scale projects that demand high power output, where central inverters offer a competitive solution.

Grid-forming Inverter Market Regional Insight

The Asia-Pacific region leads the global Grid-forming Inverter market during the forecast period. This region is categorized by some of the world's fastest-growing economies and populations, driving a surge in economic activities and urbanization. With this growth comes an increased demand for electricity, prompting countries in the region to seek innovative technologies for efficient power management and distribution, especially with the integration of renewable energy sources. Grid-forming inverters emerge as a crucial solution to address this demand, offering the ability to stabilize grids and incorporate renewable energy. Additionally, the Asia-Pacific region becomes a centre for technological innovation and energy sector investment, with countries like China, Japan, South Korea, and Australia actively developing advanced energy technologies. Grid-forming inverters receive significant attention in terms of research, development, and deployment, giving the region a competitive advantage in the global Grid-forming Inverter market. MMR’s Analyst Opinion: The surge in renewable energy demand, propelled by global environmental consciousness, is driving the rapid adoption of grid-forming inverters worldwide. These inverters efficiently convert DC power to AC power, offering seamless grid connectivity and independent operation, aligning with eco-friendly practices. The escalating number of grid-connected solar power plants, predominantly utilizing on-grid solar inverters, is a key driver for the global inverter market growth. Market growth is further fuelled by the diverse applications of inverters across commercial, industrial, and residential sectors, generating significant demand for reliable and safe power solutions. While developed regions like Europe and North America embrace grid-forming inverters extensively, the Asia-Pacific region is poised to follow suit, indicating a promising market trajectory.Grid-forming Inverter Market Scope: Inquire Before Buying

Global Grid-forming Inverter Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 687 Mn. Forecast Period 2024 to 2030 CAGR: 8.54% Market Size in 2030: US $ 1186.59 Mn. Segments Covered: by Application Solar PV Plants Wind Power Plants Energy Storage System Electric Vehicles by Voltage 100-300 V 300-500 V Above 500 V by Type Micro Inverter String Inverter Central Inverter Grid-forming Inverter Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Grid-forming Inverter Key Players include:

1. Siemens AG - Germany 2. ABB Ltd - Switzerland 3. Schneider Electric SE - France 4. General Electric Company - United States 5. SMA Solar Technology AG - Germany 6. Hitachi ABB Power Grids Ltd - Switzerland 7. Mitsubishi Electric Corporation - Japan 8. Eaton Corporation plc - Ireland 9. Emerson Electric Co. - United States 10. Toshiba Corporation - Japan 11. Huawei Technologies Co., Ltd - China 12. Enphase Energy, Inc. - United States 13. Omron Corporation - Japan 14. KACO new energy GmbH - Germany 15. Power Electronics Espana, S.L.U. - Spain 16. Sungrow Power Supply Co., Ltd - China 17. Ingeteam Power Technology, S.A. - Spain 18. Fronius International GmbH - Austria 19. Delta Electronics, Inc. - Taiwan 20. Solaredge Technologies, Inc. - Israel 21. Riello S.p.A - Italy 22. Schneider Electric India Pvt. Ltd - India 23. GoodWe Power Supply Technology Co., Ltd - China 24. KOSTAL Solar Electric GmbH - Germany 25. Yaskawa Electric Corporation - Japan Frequently asked Questions: 1. Why are big players interested in it? Ans: Market Demand: The global shift towards renewable energy and the push for decarbonization have created a growing demand for Grid-forming Inverters (GFIs), which are essential for efficiently integrating renewable resources. Manufacturers are acknowledging this market's growth potential and are strategically positioning themselves to fulfil the increasing demand for GFIs. 2. How does incorporating Grid-forming Inverters (GFIs) into inverters provide manufacturers with a competitive edge in the market?? Ans: Manufacturers gain a competitive edge by integrating GFIs into their inverters. By focusing on developing and offering GFI technologies that enable the stable and efficient integration of renewable energy into the grid, manufacturers can differentiate themselves from competitors and expand their market share. 3. How do manufacturers foresee the role of Grid-forming Inverter (GFI) technology contributing to long-term growth? Ans: In the realm of long-term growth, the escalating presence of renewable energy and the development of sophisticated grid structures underscore the vital significance of Grid-forming Inverter (GFI) technology. GFIs are poised to become instrumental in upholding grid stability, facilitating the seamless integration of energy storage, and propelling the transition towards smarter grids. Manufacturers acknowledge that grid-forming inverters are not merely a passing fad but rather an indispensable element of forthcoming energy infrastructures.

1. Grid-forming Inverter Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Grid-forming Inverter Market: Dynamics 2.1. Grid-forming Inverter Market Trends by Region 2.1.1. North America Grid-forming Inverter Market Trends 2.1.2. Europe Grid-forming Inverter Market Trends 2.1.3. Asia Pacific Grid-forming Inverter Market Trends 2.1.4. Middle East and Africa Grid-forming Inverter Market Trends 2.1.5. South America Grid-forming Inverter Market Trends 2.2. Grid-forming Inverter Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Grid-forming Inverter Market Drivers 2.2.1.2. North America Grid-forming Inverter Market Restraints 2.2.1.3. North America Grid-forming Inverter Market Opportunities 2.2.1.4. North America Grid-forming Inverter Market Challenges 2.2.2. Europe 2.2.2.1. Europe Grid-forming Inverter Market Drivers 2.2.2.2. Europe Grid-forming Inverter Market Restraints 2.2.2.3. Europe Grid-forming Inverter Market Opportunities 2.2.2.4. Europe Grid-forming Inverter Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Grid-forming Inverter Market Drivers 2.2.3.2. Asia Pacific Grid-forming Inverter Market Restraints 2.2.3.3. Asia Pacific Grid-forming Inverter Market Opportunities 2.2.3.4. Asia Pacific Grid-forming Inverter Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Grid-forming Inverter Market Drivers 2.2.4.2. Middle East and Africa Grid-forming Inverter Market Restraints 2.2.4.3. Middle East and Africa Grid-forming Inverter Market Opportunities 2.2.4.4. Middle East and Africa Grid-forming Inverter Market Challenges 2.2.5. South America 2.2.5.1. South America Grid-forming Inverter Market Drivers 2.2.5.2. South America Grid-forming Inverter Market Restraints 2.2.5.3. South America Grid-forming Inverter Market Opportunities 2.2.5.4. South America Grid-forming Inverter Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Grid-forming Inverter Industry 2.8. Analysis of Government Schemes and Initiatives For Grid-forming Inverter Industry 2.9. Grid-forming Inverter Market Trade Analysis 2.10. The Global Pandemic Impact on Grid-forming Inverter Market 3. Grid-forming Inverter Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 3.1.1. Solar PV Plants 3.1.2. Wind Power Plants 3.1.3. Energy Storage System 3.1.4. Electric Vehicles 3.2. Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 3.2.1. 100-300 V 3.2.2. 300-500 V 3.2.3. Above 500 V 3.3. Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 3.3.1. Micro Inverter 3.3.2. String Inverter 3.3.3. Central Inverter 3.4. Grid-forming Inverter Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Grid-forming Inverter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 4.1.1. Solar PV Plants 4.1.2. Wind Power Plants 4.1.3. Energy Storage System 4.1.4. Electric Vehicles 4.2. North America Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 4.2.1. 100-300 V 4.2.2. 300-500 V 4.2.3. Above 500 V 4.3. North America Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 4.3.1. Micro Inverter 4.3.2. String Inverter 4.3.3. Central Inverter 4.4. North America Grid-forming Inverter Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 4.4.1.1.1. Solar PV Plants 4.4.1.1.2. Wind Power Plants 4.4.1.1.3. Energy Storage System 4.4.1.1.4. Electric Vehicles 4.4.1.2. United States Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 4.4.1.2.1. 100-300 V 4.4.1.2.2. 300-500 V 4.4.1.2.3. Above 500 V 4.4.1.3. United States Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 4.4.1.3.1. Micro Inverter 4.4.1.3.2. String Inverter 4.4.1.3.3. Central Inverter 4.4.2. Canada 4.4.2.1. Canada Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 4.4.2.1.1. Solar PV Plants 4.4.2.1.2. Wind Power Plants 4.4.2.1.3. Energy Storage System 4.4.2.1.4. Electric Vehicles 4.4.2.2. Canada Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 4.4.2.2.1. 100-300 V 4.4.2.2.2. 300-500 V 4.4.2.2.3. Above 500 V 4.4.2.3. Canada Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 4.4.2.3.1. Micro Inverter 4.4.2.3.2. String Inverter 4.4.2.3.3. Central Inverter 4.4.3. Mexico 4.4.3.1. Mexico Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 4.4.3.1.1. Solar PV Plants 4.4.3.1.2. Wind Power Plants 4.4.3.1.3. Energy Storage System 4.4.3.1.4. Electric Vehicles 4.4.3.2. Mexico Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 4.4.3.2.1. 100-300 V 4.4.3.2.2. 300-500 V 4.4.3.2.3. Above 500 V 4.4.3.3. Mexico Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 4.4.3.3.1. Micro Inverter 4.4.3.3.2. String Inverter 4.4.3.3.3. Central Inverter 5. Europe Grid-forming Inverter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.2. Europe Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.3. Europe Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 5.4. Europe Grid-forming Inverter Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.4.1.2. United Kingdom Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.4.1.3. United Kingdom Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 5.4.2. France 5.4.2.1. France Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.4.2.2. France Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.4.2.3. France Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.4.3.2. Germany Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.4.3.3. Germany Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.4.4.2. Italy Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.4.4.3. Italy Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.4.5.2. Spain Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.4.5.3. Spain Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.4.6.2. Sweden Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.4.6.3. Sweden Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.4.7.2. Austria Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.4.7.3. Austria Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 5.4.8.2. Rest of Europe Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 5.4.8.3. Rest of Europe Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6. Asia Pacific Grid-forming Inverter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.3. Asia Pacific Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4. Asia Pacific Grid-forming Inverter Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.1.2. China Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.1.3. China Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.2.2. S Korea Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.2.3. S Korea Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.3.2. Japan Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.3.3. Japan Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.4. India 6.4.4.1. India Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.4.2. India Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.4.3. India Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.5.2. Australia Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.5.3. Australia Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.6.2. Indonesia Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.6.3. Indonesia Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.7.2. Malaysia Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.7.3. Malaysia Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.8.2. Vietnam Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.8.3. Vietnam Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.9.2. Taiwan Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.9.3. Taiwan Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 6.4.10.2. Rest of Asia Pacific Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 6.4.10.3. Rest of Asia Pacific Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 7. Middle East and Africa Grid-forming Inverter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 7.3. Middle East and Africa Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 7.4. Middle East and Africa Grid-forming Inverter Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 7.4.1.2. South Africa Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 7.4.1.3. South Africa Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 7.4.2.2. GCC Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 7.4.2.3. GCC Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 7.4.3.2. Nigeria Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 7.4.3.3. Nigeria Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 7.4.4.2. Rest of ME&A Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 7.4.4.3. Rest of ME&A Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 8. South America Grid-forming Inverter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 8.2. South America Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 8.3. South America Grid-forming Inverter Market Size and Forecast, by Type(2023-2030) 8.4. South America Grid-forming Inverter Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 8.4.1.2. Brazil Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 8.4.1.3. Brazil Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 8.4.2.2. Argentina Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 8.4.2.3. Argentina Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Grid-forming Inverter Market Size and Forecast, by Application (2023-2030) 8.4.3.2. Rest Of South America Grid-forming Inverter Market Size and Forecast, by Voltage (2023-2030) 8.4.3.3. Rest Of South America Grid-forming Inverter Market Size and Forecast, by Type (2023-2030) 9. Global Grid-forming Inverter Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Grid-forming Inverter Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Siemens AG - Germany 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. ABB Ltd - Switzerland 10.3. Schneider Electric SE - France 10.4. General Electric Company - United States 10.5. SMA Solar Technology AG - Germany 10.6. Hitachi ABB Power Grids Ltd - Switzerland 10.7. Mitsubishi Electric Corporation - Japan 10.8. Eaton Corporation plc - Ireland 10.9. Emerson Electric Co. - United States 10.10. Toshiba Corporation - Japan 10.11. Huawei Technologies Co., Ltd - China 10.12. Enphase Energy, Inc. - United States 10.13. Omron Corporation - Japan 10.14. KACO new energy GmbH - Germany 10.15. Power Electronics Espana, S.L.U. - Spain 10.16. Sungrow Power Supply Co., Ltd - China 10.17. Ingeteam Power Technology, S.A. - Spain 10.18. Fronius International GmbH - Austria 10.19. Delta Electronics, Inc. - Taiwan 10.20. Solaredge Technologies, Inc. - Israel 10.21. Riello S.p.A - Italy 10.22. Schneider Electric India Pvt. Ltd - India 10.23. GoodWe Power Supply Technology Co., Ltd - China 10.24. KOSTAL Solar Electric GmbH - Germany 10.25. Yaskawa Electric Corporation - Japan 11. Key Findings 12. Industry Recommendations 13. Grid-forming Inverter Market: Research Methodology 14. Terms and Glossary