The Grid Connected PV Systems Market size was valued at USD 943.13 GW in 2024 and the total Grid Connected PV Systems revenue is expected to grow at a CAGR of 12.91% from 2025 to 2032, reaching nearly USD 2491.34 GW.Grid Connected PV Systems Market Overview:

A grid-connected PV (photovoltaic power) system is an electric power system connected to the utility grid, which generates electricity by using solar power. It consists of solar panels, grid connection devices, and power controlling units along with DC-DC converter and inverters. The system arrangement ranges from commercial and industrial rooftop systems to small residential units to large utility-scale solar power energy stations. A grid-connected PV system installed at residential are connected to home appliances, meters, and the grid PV system has large potential to provide energy with minimal impact on the environment, as it is clean and pollution free. Grid connected PV systems across the globe account for about 99% of the installed capacity when compared to stand-alone systems that use batteries.To know about the Research Methodology :- Request Free Sample Report

Grid Connected PV Systems Market Dynamics:

A grid connected PV systems market is showing continuous northward direction growth across the globe, thanks to the growing adoption of systems as it has a low operating cost, low electricity bills, and simple design. Removal of luxurious backup batteries from new and innovative grid designs has lowered the electricity bills. Growing demand for solar-powered energy storage solutions, solar power installations, along with government’s schemes for encouraging renewable energy production is driving the grid connected PV system market growth across the globe. According to the International Renewable Energy Agency, global grid-connected PV system capacity reached 580.1 GW in 2019, including 3.4 GW of off grid PV. Solar installations, which include photovoltaic (PV) and concentrated solar power (CSP), continue to trail wind, which has 622.7 GW and Grid-connected PV accounted for 580.1 GW, while CSP accounted for 6.27 GW. A grid connected PV system provides easy installation, excellent efficiency, increased flexibility, and reliability, which in turn as a result of inherent benefits, is expected to boost the demand for the system during the forecast period. The system with various storage technologies, such as direct load control and battery energy, is more cost-effective and reliable when it comes to generating energy from solar electricity. Over 100 MW of new solar PV capacity is planned to be installed during the forecast period in over 40 nations across the globe, which in turn is expected to fuel the grid connected PV system market growth across the globe. Governments across the globe are encouraging the development of solar photovoltaic power plants by providing incentives and subsidies are expected to fuel the grid connected PV system market growth. First Solar Japan, a subsidiary of First Solar (US), and Toshiba Energy Systems & Solutions Corporation signed a contract to build two mega solar projects, such as Yatsubo Solar Power Plant and Ikeda Solar Power Plant, in Tochigi Prefecture, Japan, to supply electricity to the country's electricity grid. The Indian government has set a goal of having 175 GW of grid-connected solar power installed capacity in the country and India has installed 96.95 GW of cumulative grid-interactive renewable energy capacity. These factors are expected to fuel the growth of the grid-connected PV systems market during the forecast period. According to statistics of the International Renewable Energy Agency (IRENA), the world added more than 260 gigawatts (GW) of renewable energy capacity last year, nearly double the amount added in 2019. Last year, renewable energy accounted for more than 80% of all new power capacity added, with solar and wind accounting for 91% of new renewables.Grid Connected PV Systems Market Segment Analysis:

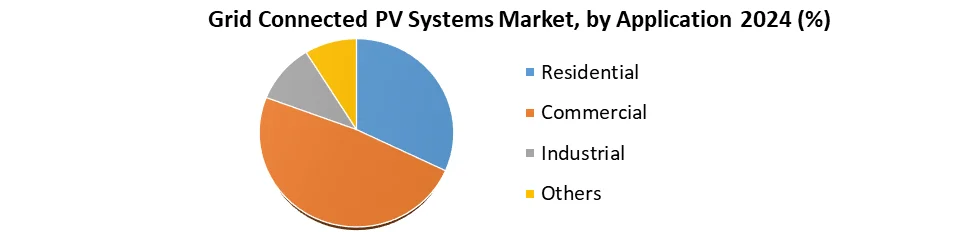

Based on the Technology, the Grid Connected PV Systems Market is segmented into Grid Connected, Off Grid. The Grid Connected segment held the largest market share, accounting for 53.1% in 2024. The segment growth is attributed to a wide range of inherent benefits, such as low energy bills and substantial cost savings by organizations along with residential households. Grid-connected systems can be used in a variety of settings, including residential. Commercial and large-scale grid-connected solar power systems differ from off-grid solar power systems. In most cases, a grid-connected system does not require a battery. As the system generates more energy than the load, it will immediately switch to backup mode. The Off Grid segment is expected to witness a significant growth rate at a CAGR of 12.1% during the forecast period. Off-grid systems, also known as standalone systems or small grids, are generated and run electricity on their own. Off-grid solutions are appropriate for electrifying small communities. As the diverse living and scattered people in the huge area, off-grid electrification systems are practical for distant locations in nations where they have little or no access to electricity. Across the globe, the Off-grid capacity grew by 365 MW , which was 2% growth as compared to 2019, and reached at 10.6 GW. Among these Solar expanded by 250 MW to reach 4.3 GW. The growing adoption of the segment in several end-users, such as residential and commercial are boosting the product demand for this segment. Based on the Application, the Grid Connected PV Systems Market is segmented into Residential, Commercial, Industrial, and Others. The Industrial segment held the largest market share, accounting for 31.2% in 2024 The technological advancements to promote power generation from renewable sources are expected to fuel the grid-connected PV system market growth for this segment. The cost-effectiveness along with ease of maintenance is expected to increase the adoption and installation of grid connected PV systems during the forecast period.

Regional Insights:

Asia Pacific region held the largest market share accounted for 38.6% in 2024. The region’s growth is attributed to the increased expenditures in solar projects and demand for solar energy sources in the region. The growing number of PV installations in China and India demonstrates the market's huge potential. With 330.1 GW of cumulative installed PV capacity, Asia is the region of the globe with the most PV capacity. China has the most cumulative installations in the area, with 205.7 GW, followed by Japan (61.8 GW), India (34.8 GW), and South Korea (10.5 GW). North America region is expected to witness significant growth at a CAGR of XX% during the forecast period. The segment growth is attributed to growing energy-saving programs and the elimination of taxes in business electricity rates in the region. With the growth of solar farms and the passage of legislation to implement renewable energy plans, the United States is set to be the region's largest revenue provider. The market is expected to benefit from the deployment of GPV connected systems and regulatory changes. The United States has installed 29 GW of renewables last year, nearly 80% more than in 2019, including 15 GW of solar, which is expected to uplift the grid-connected PV systems market during the forecast period. The objective of the report is to present a comprehensive analysis of the global Grid Connected PV Systems Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the market dynamic, structure by analyzing the market segments and projecting the market size. Clear representation of competitive analysis of key players by Technology, price, financial position, product portfolio, growth strategies, and regional presence in the market make the report investor’s guide.Grid Connected PV Systems Market Scope: Inquire before buying

Grid Connected PV Systems Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 943.13 GW. Forecast Period 2025 to 2032 CAGR: 12.91% Market Size in 2032: USD 2491.34 GW. Segments Covered: by Grid Type Thin Film Crystalline Silicon Others by Technology Grid Connected Off-Grid by Application Residential Commercial Industrial Others Grid Connected PV Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Grid Connected PV Systems Market Key Players are:

1. Suntech Power 2. Sun Power Corporation 3. First Solar Inc. 4. Yingli Green Energy Holding Co. Ltd. 5. Canadian Solar Inc. 6. Schott Solar Ag. 7. Sharp Corporation 8. Solar world Ag 9. Jinko Solar Holding Company Ltd. 10.Trina solar limited 11.Kaneka Corporation 12.Kayocera Corporation 13.Renesola Co.,Ltd 14.BP Solar International 15.Bloo Solar Inc. 16.1366 Technologies Inc. 17.3G Solar Photovoltaic’s Ltd. 18.Zytech Solar 19.Ravano Green Powers 20.Huawei Technologies 21.Sharp Corporation 22.TRIENERGY Schweiz AG Frequently Asked Questions: 1. Which region has the largest share in Global Grid Connected PV Systems Market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of Global Grid Connected PV Systems Market? Ans: The Global market is growing at a CAGR of 12.91% during forecasting period 2025-2032. 3. What is scope of the Global Grid Connected PV Systems Market report? Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Grid Connected PV Systems Market? Ans: The important key players in the Global market are – Suntech Power, Sun Power Corporation, First Solar Inc., Yingli Green Energy Holding Co. Ltd., Canadian Solar Inc., Schott Solar Ag., Sharp Corporation, Solar world Ag, Jinko Solar Holding Company Ltd., Trina solar limited, Kaneka Corporation, Kayocera Corporation, Renesola Co.,Ltd, BP Solar International, Bloo Solar Inc., 1366 Technologies Inc., 3G Solar Photovoltaic’s Ltd., Zytech Solar, Ravano Green Powers, Huawei Technologies, Sharp Corporation, and TRIENERGY Schweiz AG 5. What was the Global Grid Connected PV Systems Market size in 2024? Ans: The Global Grid Connected PV Systems Market size was USD 943.13 GW in 2024.

1. Grid Connected PV Systems Market Size: Research Methodology 2. Grid Connected PV Systems Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Grid Connected PV Systems Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Grid Connected PV Systems Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region 3.12. COVID-19 Impact 4. Grid Connected PV Systems Market Size Segmentation 4.1. Grid Connected PV Systems Market Size, by Grid type (2024-2032) 4.2. Grid Connected PV Systems Market Size, by Technology (2024-2032) 4.3. Grid Connected PV Systems Market Size, by Application (2024-2032) 5. North America Grid Connected PV Systems Market (2024-2032) 5.1. Grid Connected PV Systems Market Size, by Grid type (2024-2032) 5.2. Grid Connected PV Systems Market Size, by Technology (2024-2032) 5.3. Grid Connected PV Systems Market Size, by Application (2024-2032) 5.4. North America Grid Connected PV Systems Market, by Country (2024-2032) 6. European Grid Connected PV Systems Market (2024-2032) 6.1. European Grid Connected PV Systems Market, by Grid type (2024-2032) 6.2. European Grid Connected PV Systems Market, by Technology (2024-2032) 6.3. European Grid Connected PV Systems Market, by Application (2024-2032) 6.4. European Grid Connected PV Systems Market, by Country (2024-2032) 7. Asia Pacific Grid Connected PV Systems Market (2024-2032) 7.1. Asia Pacific Grid Connected PV Systems Market, by Grid type (2024-2032) 7.2. Asia Pacific Grid Connected PV Systems Market, by Technology (2024-2032) 7.3. Asia Pacific Grid Connected PV Systems Market, by Application (2024-2032) 7.4. Asia Pacific Grid Connected PV Systems Market, by Country (2024-2032) 8. The Middle East and Africa Grid Connected PV Systems Market (2024-2032) 8.1. The Middle East and Africa Grid Connected PV Systems Market, by Grid type (2024-2032) 8.2. The Middle East and Africa Grid Connected PV Systems Market, by Technology (2024-2032) 8.3. The Middle East and Africa Grid Connected PV Systems Market, by Application (2024-2032) 8.4. The Middle East and Africa Grid Connected PV Systems Market, by Country (2024-2032) 9. Latin America Grid Connected PV Systems Market (2024-2032) 9.1. Latin America Grid Connected PV Systems Market, by Grid type (2024-2032) 9.2. Latin America Grid Connected PV Systems Market, by Technology (2024-2032) 9.3. Latin America Grid Connected PV Systems Market, by Application (2024-2032) 9.4. Latin America Grid Connected PV Systems Market, by Country (2024-2032) 10. Company Profile: Key players 10.1. Suntech Power Holding Co. Ltd. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Sun Power Corporation 10.3. First Solar Inc. 10.4. Yingli Green Energy Holding Co. Ltd. 10.5. Canadian Solar Inc. 10.6. Schott Solar Ag. 10.7. Sharp Corporation 10.8. Solar world Ag 10.9. Jinko Solar Holding Company Ltd. 10.10. Trina solar limited 10.11. Kaneka Corporation 10.12. Kayocera Corporation 10.13. Renesola Co.,Ltd 10.14. BP Solar International 10.15. Bloo Solar Inc. 10.16. 1366 Technologies Inc. 10.17. 3G Solar Photovoltaic’s Ltd. 10.18. Zytech Solar 10.19. Ravano Green Powers 10.20. Huawei Technologies 10.21. Sharp Corporation 10.22. TRIENERGY Schweiz AG