The Government and Education Logistics Market size was valued at USD 438.28 Billion in 2023 and the total Government and Education Logistics Market is expected to grow at a CAGR of 8.6% from 2024 to 2030, reaching nearly USD 780.84 Billion. Government and Education Logistics Market Overview Government and Education Logistics refers to the specialized logistics services provided to government agencies and educational institutions. It involves the planning, coordination, and execution of various logistics activities to support the specific needs of the government and education sectors. In the context of government logistics, it encompasses the transportation, warehousing, and supply chain management required for government agencies to fulfil their operational requirements. This can include the movement of goods, equipment, and resources needed for public services, emergency response, defense, healthcare, infrastructure projects, and other governmental activities.To know about the Research Methodology :- Request Free Sample Report For the education sector, logistics services cater to the unique needs of schools, colleges, universities, and other educational institutions. It includes the management of logistics operations related to educational materials, textbooks, school supplies, equipment, and resources required for teaching, research, and administrative purposes. These logistics services ensure that educational institutions have the necessary resources available at the right time and place. Government and Education Logistics may involve various activities such as procurement, inventory management, transportation planning, fleet management, warehouse operations, and distribution. The goal is to optimize the flow of goods and resources, ensure timely delivery, and enhance efficiency within the government and education sectors. As per the study, the global Government and Education Logistics market is expected to grow rapidly during the forecast period. Many governments were investing in infrastructure development, leading to increased logistics requirements for construction materials, equipment, and project management Many governments around the world have been actively investing in infrastructure development to drive economic growth, enhance connectivity, and improve the overall quality of public services. Infrastructure projects can include the construction or improvement of transportation systems (roads, railways, airports, ports), energy facilities (power plants, renewable energy projects), water and sanitation systems, communication networks, and social infrastructure like schools and hospitals. China has been known for its massive infrastructure investments through initiatives like the Belt and Road Initiative (BRI). The country has undertaken various infrastructure projects domestically, including high-speed rail networks, airports, and urban development projects. The United States has recognized the need for significant investments in its infrastructure to address aging infrastructure, improve transportation networks, and support economic growth. Infrastructure spending has been a topic of discussion and action at both federal and state levels. In recent years, there have been discussions and proposals for infrastructure spending bills aimed at upgrading roads, bridges, airports, and other critical infrastructure elements. In 2021, the United States Congress passed the Infrastructure Investment and Jobs Act, a landmark infrastructure bill that allocates substantial funding for various infrastructure sectors. By investing in infrastructure, the United States aims to improve transportation networks, enhance connectivity, and promote sustainable and resilient infrastructure systems. In recent years, the infrastructure sector in India has experienced a notable influx of investments. The Indian government has implemented several initiatives, including Make in India, Smart Cities, and Infrastructure Development Finance Corporation (IDFC), to encourage investments in this sector. As a result, there has been a significant rise in investments across various infrastructure segments such as roads, railways, energy, water, and sanitation. The significance of infrastructure development lies in its ability to deliver numerous economic, social, and environmental benefits. It plays a pivotal role in driving GDP growth, generating employment opportunities, facilitating trade and investments, enhancing connectivity and accessibility, improving healthcare facilities, and mitigating pollution levels.

The growth of the education sector, including schools, colleges, and universities, directly impacts the logistics industry. The growth of the education sector, including schools, colleges, and universities, has a direct impact on the logistics industry as it creates a heightened demand for transportation, delivery, and storage services. For instance, as the number of educational institutions expands, there is a need for efficient transportation of students, such as managing bus routes and schedules. This is contributing to the growth of the Government and Education Logistics Market. Additionally, the procurement and delivery of educational supplies like textbooks, laboratory equipment, and furniture become essential, necessitating robust logistics networks to ensure timely and accurate distribution. Furthermore, the logistics industry plays a vital role in supporting the globalization of education by facilitating the movement of international students and managing the logistics of exams and assessments. Overall, the growth of the education sector drives the logistics industry to provide tailored solutions and services that support the smooth functioning of educational institutions. Below are a few examples to illustrate this relationship. Transportation of Students: As the education sector expands, there is a need to transport students to and from educational institutions. This includes providing transportation for daily commuting, field trips, and extracurricular activities. The logistics industry plays a vital role in ensuring safe and efficient transportation services for students, including managing bus routes, scheduling, and maintaining a fleet of vehicles. Delivery of Educational Supplies: Educational institutions require a steady supply of various materials, such as textbooks, stationery, laboratory equipment, and furniture. The logistics industry facilitates the delivery of these supplies from manufacturers or suppliers to schools, colleges, and universities. This involves managing inventory, warehousing, and distribution to ensure that educational institutions have the necessary resources to function effectively. Online Learning Materials: With the increasing adoption of online learning platforms, educational materials, including digital content, e-books, and multimedia resources, need to be efficiently delivered to students and educators. The logistics industry plays a significant role in managing the distribution of these digital resources, ensuring their availability and accessibility to learners across various locations. Government and Education Logistics Market Competitive Landscapes: The competitive landscape of the Government and Education Logistics market is characterized by a diverse range of companies that provide logistics services tailored to the unique requirements of government bodies and educational institutions. These companies compete in various aspects of logistics, including transportation, supply chain management, warehousing, and distribution. Key players in this industry often possess extensive experience and expertise in serving the specific needs of government and educational clients. They offer specialized solutions to ensure the efficient and reliable movement of goods, resources, and services within the public sector. These solutions may include transportation of students, procurement and delivery of educational supplies, management of exam logistics, and support for government initiatives. Competitive factors in this industry include service quality, reliability, efficiency, cost-effectiveness, technology integration, and compliance with regulations and security standards. Companies strive to differentiate themselves by offering value-added services, innovative solutions, and customized logistics strategies to meet the unique demands of government and educational clients. Moreover, competition in the Government and Education Logistics market is influenced by factors such as geographical coverage, network capabilities, industry partnerships, and customer relationships. Companies that can establish strong relationships with government agencies, educational institutions, and key stakeholders have a competitive advantage in securing contracts and long-term partnerships. The competitive landscape of the Government and Education Logistics industry is shaped by the ability of companies to meet the specific logistical requirements of the public sector, deliver reliable services, and provide innovative solutions that drive efficiency and effectiveness in the logistics operations of government and educational entities.

Projects Details Narmada Valley Development Project The ambitious Narmada Valley Development (NVD) Project, with a staggering investment of USD 30 billion, aims to effectively manage water resources in the Narmada Valley River. This project entails the construction of an extensive network of canals and over 3,000 dams within the river basin. Its objectives are to generate energy, enhance the drinking water supply, and improve irrigation for agriculture. Notably, the centerpiece of the NVD project is the Sardar Sarovar Dam, a hydroelectric project dam with a capacity of 1,450 MW. Delhi-Mumbai Industrial Corridor (DMIC) The objective of the initiative is to foster economic growth and industrialization along the Delhi-Mumbai freight corridor by setting up logistics hubs, industrial zones, educational institutions, healthcare facilities, as well as key infrastructure such as ports, airports, highways, and power plants.Spanning a distance of 1,483 kilometers and backed by a substantial budget of USD 90 billion, the DMIC project traverses through Haryana, Rajasthan, Gujarat, and Maharashtra, connecting Delhi to Mumbai. The project aims to not only create employment opportunities but also make a significant contribution to the nation's GDP. Mumbai Trans Harbour Link The Mumbai Trans Harbour Link (MTHL) is a ground-breaking project with a substantial budget of USD 2.2 billion. Its primary objective is to connect the eastern terminus of the Mumbai-Pune Expressway with the western terminus of the Coastal Road, which is currently undergoing development. Spanning an impressive 21.8 kilometers, the MTHL is a sea link motorway bridge road equipped with six lanes. It has the capacity to accommodate an estimated 70,000-80,000 vehicles annually. Government and Education Logistics Market Dynamics:

Supply Chain Management and Efficiency The focus on supply chain management and efficiency in the Government and Education Logistics market is showed by the demand for optimized inventory management, cost reduction, timely delivery, and improved operational efficiency. For example, a logistics provider that specializes in serving educational institutions implements a streamlined supply chain solution that integrates advanced inventory management systems. By leveraging real-time tracking technology, they ensure that educational resources, such as textbooks and learning materials, are efficiently managed and replenished. This minimizes the risk of stockouts and reduces inventory carrying costs. Additionally, the logistics provider optimizes delivery routes and employs route optimization software to ensure timely and cost-effective delivery of resources to different educational institutions. By offering value-added services like inventory visibility, analytics, and supply chain consulting, the logistics provider enhances the overall operational efficiency of educational institutions, allowing them to focus on core educational activities while reducing logistics-related complexities and costs. This competitive advantage enables the logistics provider to attract and retain government and educational clients seeking efficient supply chain management solutions. Security and Safety Concerns Government bodies and educational institutions prioritize security and safety in their logistics operations. This includes ensuring the secure transportation of sensitive documents, protection of personal information, and adherence to safety protocols for the transportation of students and educational resources. Logistics providers need to address these concerns and implement robust security measures to safeguard the integrity and confidentiality of the logistics processes. Addressing security and safety concerns is vital in the Government and Education Logistics market to protect sensitive data, ensure the well-being of students, safeguard valuable educational resources, comply with regulations, and respond to emergencies. Logistics providers that prioritize security and safety measures gain the trust and confidence of government bodies and educational institutions, leading to long-term partnerships and business growth.Government and Education Logistics Market Segment Analysis:

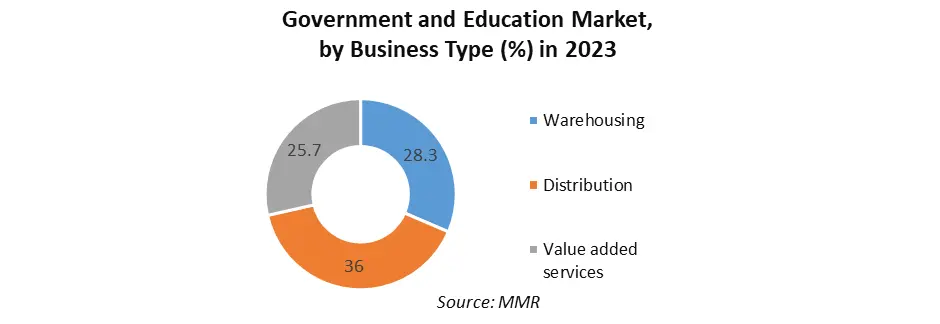

Based on Mode of Operation, the Government and Education Logistics Market is segmented into Storage, Roadways Distribution, Seaways Distribution and Others. The Roadways Distribution segment held the largest market share in terms of revenue in 2023. As Road transportation offers a higher level of accessibility compared to other modes such as seaways or airways. It allows logistics providers to reach even the most remote areas, including rural regions where educational institutions and government offices are located. This accessibility factor enables efficient transportation of goods and resources, making roadways distribution a preferred choice. Based on Business Type, the Government and Education Logistics Market is segmented by Warehousing, Distribution, Value added services. The Distribution Business Type segment held the largest share of the global revenue in 2023, and is expected to maintain its dominance in the forecast period. The increasing demand for timely deliveries in the Government and Education Logistics Market reflects the growing importance of efficient logistics services. Logistics providers that excel in distribution services by delivering goods and resources on time gain a competitive edge in the market. Meeting strict deadlines contributes to customer satisfaction, enhances operational efficiency, and enables government bodies and educational institutions to focus on their core activities without disruptions caused by delayed deliveries.

Government and Education Logistics Market Regional Insights:

The Asia-Pacific region emerged as the dominant player in the global government and education logistics market, primarily due to its active and highly integrated supply chain network. This network connects producers and consumers seamlessly through various transportation modes, including air and express delivery services, rail, maritime transport, and truck transport. Governments across the Asia-Pacific region have made substantial investments in strengthening logistics and transportation infrastructure while introducing trade and transportation initiatives. These initiatives have significantly contributed to the market's growth in the region. Additionally, there is a growing demand for military logistics services in the Asia-Pacific region, particularly for transporting military equipment and structural materials. This increased demand further drives the growth of the government and education logistics market. Factors such as advancements in logistics and supply chains, the rapid modernization of warehouse facilities, expansion of transportation facilities, and consumer demand for public utilities also play a crucial role in fueling market growth. Moreover, the establishment of military logistic platforms by emerging nations' governments serves as an important catalyst for the market's expansion in the region. In the North America region, the government and education logistics market is experiencing growth driven by initiatives taken by the U.S. General Services Administration (GSA) to provide comprehensive solutions for fleet management and transportation needs of the federal government. GSA Fleet offers thorough fleet management services, including options for purchasing, leasing, and renting vehicles, supported by internet tools for easy acquisitions. The market is further boosted by the increasing use of logistics services to supply land, air, and sea transportation for the Department of Defense (DoD), along with the government's efforts to strengthen logistics and supply chains across the country.An example of the government's commitment to infrastructure investments is the announcement made by the Biden-Harris Administration in January 2022, stating an investment of over $14 billion in the fiscal year 2022 for more than 500 projects across 52 states and territories. This includes expanding capacity at major ports, reflecting the government's focus on enhancing logistics capabilities.Government and Education Logistics Market Scope: Inquire before buying

Government and Education Logistics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $438.28 Bn. Forecast Period 2024 to 2030 CAGR: 8.6 % Market Size in 2030: US $ 780.84 Bn. Segments Covered: by Mode Of Operation Storage Roadways Distribution Seaways Distribution Others by Business Type Warehousing Distribution Value added services by End Use Aid and Relief Public Utilities Military and Defense Education Government and Education Logistics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Government and Education Logistics Key Players

1. DHL 2. FedEx Corporation 3. UPS 4. XPO Logistics 5. Kuehne + Nagel 6. DB Schenker 7. C.H. Robinson 8. Maersk 9. Expeditors International 10. DSV Panalpina 11. Penske Logistics 12. Agility 13. Yusen Logistics 14. Nippon Express 15. Hellmann Worldwide Logistics FAQs: 1] What segments are covered in the Global Government and Education Logistics Market report? Ans. The segments covered in the Government and Education Logistics report are based on Mode of Operation, Business Type, End Use and Region. 2] Which region is expected to hold the highest share in the Global Government and Education Logistics Market during the forecast period? Ans. The North America region is expected to hold the highest share of the Government and Education Logistics market during the forecast period. 3] What is the market size of the Global Government and Education Logistics by 2030? Ans. The market size of the Government and Education Logistics by 2030 is expected to reach US$ 780.84 Bn. 4] What is the forecast period for the Global Government and Education Logistics Market? Ans. The forecast period for the Government and Education Logistics market is 2024-2030. 5] What was the market size of the Global Government and Education Logistics in 2023? Ans. The market size of the Government and Education Logistics in 2023 was valued at US$ 438.28 Bn.

1. Government and Education Logistics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Government and Education Logistics Market: Dynamics 2.1. Government and Education Logistics Market Trends by Region 2.1.1. North America Government and Education Logistics Market Trends 2.1.2. Europe Government and Education Logistics Market Trends 2.1.3. Asia Pacific Government and Education Logistics Market Trends 2.1.4. Middle East and Africa Government and Education Logistics Market Trends 2.1.5. South America Government and Education Logistics Market Trends 2.2. Government and Education Logistics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Government and Education Logistics Market Drivers 2.2.1.2. North America Government and Education Logistics Market Restraints 2.2.1.3. North America Government and Education Logistics Market Opportunities 2.2.1.4. North America Government and Education Logistics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Government and Education Logistics Market Drivers 2.2.2.2. Europe Government and Education Logistics Market Restraints 2.2.2.3. Europe Government and Education Logistics Market Opportunities 2.2.2.4. Europe Government and Education Logistics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Government and Education Logistics Market Drivers 2.2.3.2. Asia Pacific Government and Education Logistics Market Restraints 2.2.3.3. Asia Pacific Government and Education Logistics Market Opportunities 2.2.3.4. Asia Pacific Government and Education Logistics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Government and Education Logistics Market Drivers 2.2.4.2. Middle East and Africa Government and Education Logistics Market Restraints 2.2.4.3. Middle East and Africa Government and Education Logistics Market Opportunities 2.2.4.4. Middle East and Africa Government and Education Logistics Market Challenges 2.2.5. South America 2.2.5.1. South America Government and Education Logistics Market Drivers 2.2.5.2. South America Government and Education Logistics Market Restraints 2.2.5.3. South America Government and Education Logistics Market Opportunities 2.2.5.4. South America Government and Education Logistics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Government and Education Logistics Industry 2.8. Analysis of Government Schemes and Initiatives For Government and Education Logistics Industry 2.9. Government and Education Logistics Market Trade Analysis 2.10. The Global Pandemic Impact on Government and Education Logistics Market 3. Government and Education Logistics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 3.1.1. Storage 3.1.2. Roadways Distribution 3.1.3. Seaways Distribution 3.1.4. Others 3.2. Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 3.2.1. Warehousing 3.2.2. Distribution 3.2.3. Value added services 3.3. Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 3.3.1. Aid and Relief 3.3.2. Public Utilities 3.3.3. Military and Defense 3.3.4. Education 3.4. Government and Education Logistics Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Government and Education Logistics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 4.1.1. Storage 4.1.2. Roadways Distribution 4.1.3. Seaways Distribution 4.1.4. Others 4.2. North America Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 4.2.1. Warehousing 4.2.2. Distribution 4.2.3. Value added services 4.3. North America Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 4.3.1. Aid and Relief 4.3.2. Public Utilities 4.3.3. Military and Defense 4.3.4. Education 4.4. North America Government and Education Logistics Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 4.4.1.1.1. Storage 4.4.1.1.2. Roadways Distribution 4.4.1.1.3. Seaways Distribution 4.4.1.1.4. Others 4.4.1.2. United States Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 4.4.1.2.1. Warehousing 4.4.1.2.2. Distribution 4.4.1.2.3. Value added services 4.4.1.3. United States Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Aid and Relief 4.4.1.3.2. Public Utilities 4.4.1.3.3. Military and Defense 4.4.1.3.4. Education 4.4.2. Canada 4.4.2.1. Canada Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 4.4.2.1.1. Storage 4.4.2.1.2. Roadways Distribution 4.4.2.1.3. Seaways Distribution 4.4.2.1.4. Others 4.4.2.2. Canada Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 4.4.2.2.1. Warehousing 4.4.2.2.2. Distribution 4.4.2.2.3. Value added services 4.4.2.3. Canada Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Aid and Relief 4.4.2.3.2. Public Utilities 4.4.2.3.3. Military and Defense 4.4.2.3.4. Education 4.4.3. Mexico 4.4.3.1. Mexico Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 4.4.3.1.1. Storage 4.4.3.1.2. Roadways Distribution 4.4.3.1.3. Seaways Distribution 4.4.3.1.4. Others 4.4.3.2. Mexico Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 4.4.3.2.1. Warehousing 4.4.3.2.2. Distribution 4.4.3.2.3. Value added services 4.4.3.3. Mexico Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Aid and Relief 4.4.3.3.2. Public Utilities 4.4.3.3.3. Military and Defense 4.4.3.3.4. Education 5. Europe Government and Education Logistics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.2. Europe Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.3. Europe Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 5.4. Europe Government and Education Logistics Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.4.1.2. United Kingdom Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.4.1.3. United Kingdom Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.4.2.2. France Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.4.2.3. France Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.4.3.2. Germany Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.4.3.3. Germany Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.4.4.2. Italy Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.4.4.3. Italy Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.4.5.2. Spain Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.4.5.3. Spain Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.4.6.2. Sweden Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.4.6.3. Sweden Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.4.7.2. Austria Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.4.7.3. Austria Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 5.4.8.2. Rest of Europe Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 5.4.8.3. Rest of Europe Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Government and Education Logistics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.2. Asia Pacific Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.3. Asia Pacific Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Government and Education Logistics Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.1.2. China Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.1.3. China Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.2.2. S Korea Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.2.3. S Korea Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.3.2. Japan Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.3.3. Japan Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.4.2. India Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.4.3. India Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.5.2. Australia Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.5.3. Australia Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.6.2. Indonesia Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.6.3. Indonesia Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.7.2. Malaysia Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.7.3. Malaysia Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.8.2. Vietnam Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.8.3. Vietnam Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.9.2. Taiwan Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.9.3. Taiwan Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 6.4.10.2. Rest of Asia Pacific Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Government and Education Logistics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 7.2. Middle East and Africa Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 7.3. Middle East and Africa Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Government and Education Logistics Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 7.4.1.2. South Africa Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 7.4.1.3. South Africa Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 7.4.2.2. GCC Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 7.4.2.3. GCC Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 7.4.3.2. Nigeria Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 7.4.3.3. Nigeria Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 7.4.4.2. Rest of ME&A Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 7.4.4.3. Rest of ME&A Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 8. South America Government and Education Logistics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 8.2. South America Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 8.3. South America Government and Education Logistics Market Size and Forecast, by End User(2023-2030) 8.4. South America Government and Education Logistics Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 8.4.1.2. Brazil Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 8.4.1.3. Brazil Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 8.4.2.2. Argentina Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 8.4.2.3. Argentina Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Government and Education Logistics Market Size and Forecast, by Mode of Operation (2023-2030) 8.4.3.2. Rest Of South America Government and Education Logistics Market Size and Forecast, by Business Type (2023-2030) 8.4.3.3. Rest Of South America Government and Education Logistics Market Size and Forecast, by End User (2023-2030) 9. Global Government and Education Logistics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Government and Education Logistics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. DHL 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. FedEx Corporation 10.3. UPS 10.4. XPO Logistics 10.5. Kuehne + Nagel 10.6. DB Schenker 10.7. C.H. Robinson 10.8. Maersk 10.9. Expeditors International 10.10. DSV Panalpina 10.11. Penske Logistics 10.12. Agility 10.13. Yusen Logistics 10.14. Nippon Express 10.15. Hellmann Worldwide Logistics 11. Key Findings 12. Industry Recommendations 13. Government and Education Logistics Market: Research Methodology 14. Terms and Glossary