The Global Wind Turbine Market size was valued at USD 128.72 Bn in 2024, and the total Wind Turbine Market revenue is expected to grow by 8.2% from 2025 to 2032, reaching nearly USD 240.45 Bn.Wind Turbine Market Overview:

Wind turbines are important parts of wind energy systems, delivering a transformation from kinetic wind energy to electricity. Wind turbines have undergone great changes from small onshore turbines to more complex offshore high-capacity turbines with inventions such as variable-speed generators, light-weight composite blades, and condition monitoring systems built. The necessity for clean, renewable energy has increased across the world due to climate change issues, energy security concerns, and decarbonization requirements in nations such as the U.S., China, Germany, India, and the UK. The Manufacturers are developing more efficient turbines with increased capacity factors and digital control systems to improve grid stability and lower operational expenses. The onshore and offshore segments are experiencing breakthroughs with offshore turbines now exceeding 15 MW capacities, particularly in Europe and the Asia-Pacific markets. The wind farms of increasingly feature AI-based predictive, floating platforms, and hybrid energy complementing storage solutions. The report delves into the main growth drivers, such as government renewable energy targets, industrial decarbonization at a faster pace, declining cost per kWh of wind power, and rising investments in offshore wind. The top Key Players in the wind turbine market are Vestas (Denmark), Siemens Gamesa (Spain), GE Renewable Energy (USA), Goldwind (China), and Nordex Group (Germany), innovation leaders and large-scale deployment participants. The report elaborates on how smart grid integration, energy storage alliances, and blade aerodynamic innovation are driving the wind turbine market.To know about the Research Methodology :- Request Free Sample Report

Wind Turbine Market Dynamics:

The Power of Policy, Scale, and Advanced Technologies to Boost the Wind Turbine Market Growth The global wind turbine market is witnessing significant growth, driven by favorable government policies, large-scale installations, and continuous technological advancements. Commitments under the COP28 initiative to triple renewable energy capacity by 2030 have reinforced investor confidence, while supportive measures such as renewable auctions, clean energy mandates, and financing frameworks are strengthening the growth pipeline. In 2024, the Global Wind Energy Council reported a record 117 GW of newly added wind capacity, signaling strong momentum despite policy fluctuations in some geographies. Major turbine manufacturers continue to record robust demand. Nordex reported 2.3 GW of new orders in Q2 2025, largely supported by demand across Europe, the Middle East, and Africa. Vestas has maintained steady order inflows across onshore and offshore projects, while GE Vernova emphasized the growing U.S. repowering market, where older fleets are being modernized to extend operational life and improve capacity factors. In parallel, the UK’s CfD Allocation Round 7 and policy reforms across Europe are streamlining financing and procurement, helping to reduce investment risk and accelerate project development. Technological innovation accelerates growth. High-capacity turbines, such as GE’s Haliade-X certified up to 14.7 MW, are lowering the levelized cost of energy (LCOE) and expanding offshore wind’s economic feasibility. Advanced digital solutions, artificial intelligence, and predictive maintenance platforms are enhancing turbine availability, optimizing energy yield, and improving O&M economics. The global OEMs like Goldwind are expanding international production footprints, such as nacelle manufacturing in Brazil, to align with regional content rules and reduce supply chain risks. Collectively, these drivers highlight how policy support, deployment scale, and innovation are reshaping the wind turbine market.Integration Issues and Infrastructure Gaps Hamper Wind Turbine Market Growth The Wind Turbine market faces structural challenges that limit seamless expansion. Policy and regulatory instability remain a concern. For example, Vestas flagged order delays tied to political uncertainty in the U.S., while offshore leaders like Ørsted are under financial pressure due to rising costs and capital constraints. Auction results in Germany and the UK in mid-2025 fell short of capacity expectations, reflecting persistent cost inflation, rising interest rates, and supply chain bottlenecks that continue to weigh on project viability. Technology quality issues pose risks. Siemens Gamesa’s 4.X and 5.X turbine platforms have suffered design flaws, forcing production pauses and costly remedial measures. Such issues disrupt supply, strain OEM balance sheets, and undermine developer confidence. Additionally, grid interconnection and permitting bottlenecks remain major hurdles, particularly in Europe, where projects face multi-year approval delays despite robust demand. The global targets for renewable energy are ambitious, but progress toward achieving them is uneven. Independent trackers have noted that most countries are not aligned with the 2030 renewable capacity tripling goal, raising concerns about potential procurement slowdowns and policy resets. These challenges policy volatility, cost pressures, technical risks, and infrastructure gaps are collectively slowing the pace of wind energy deployment. Growth in Digital Solutions in the Wind Turbine Industry to Boost the Wind Turbine Market Repowering and modernization are emerging as high-potential segments, particularly in developed markets such as the U.S. and Europe, where aging fleets can be upgraded with more efficient turbines to boost output and extend operational lifespans. Similarly, the rise of offshore and floating wind technologies opens new frontiers, especially in countries with deep-water coastlines such as the UK, Japan, South Korea, and the U.S. East Coast, where traditional fixed-bottom turbines are less feasible. Emerging markets represent a major growth frontier. Rapidly industrializing economies in Latin America, Southeast Asia, and Africa are stepping up investments in renewables to meet energy demand while reducing carbon footprints. Localization strategies, such as regional turbine assembly in Brazil and India, create opportunities for OEMs to capture market share while complying with domestic content requirements. In addition, the integration of digital solutions, AI-driven performance optimization, and predictive maintenance is unlocking new revenue streams for OEMs and service providers, transforming the wind market into a long-term lifecycle services business rather than purely an equipment supply market. The shift toward corporate power purchase agreements (PPAs) and decarbonization pledges from global companies also creates direct demand for wind energy projects, diversifying revenue opportunities beyond government-backed tenders. The repowering, offshore and floating wind expansion, emerging Wind Turbine Market growth, digital O&M services, and corporate PPAs are expected to drive the next phase of wind turbine market growth, even as the sector navigates near-term integration challenges.

Wind Turbine Market Segment Analysis:

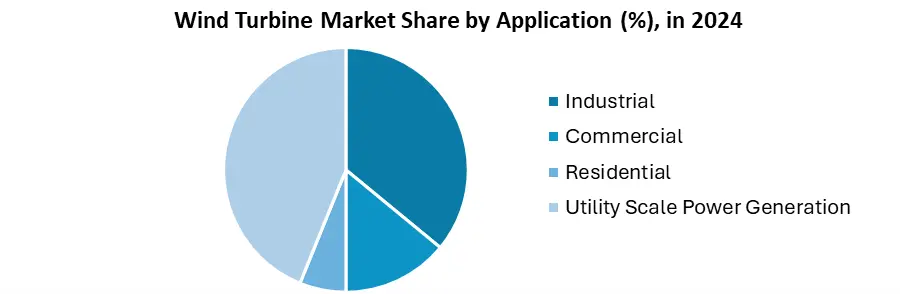

The global Wind Turbine Market is segmented by Installation Type, rating, Components and Application. Based on installation type, the global Wind Turbine market is segmented into Onshore and Offshore. The Onshore segment held the largest market share in 2024, continue to account for the majority of global deployment. In 2024, onshore wind capacity additions were reported at around 109 GW, representing more than 80% of new installations worldwide. This trend is also visible in the United States, all new wind capacity added in the 2025 came from onshore projects, highlighting the segment’s cost advantages and readiness for deployment. Despite onshore’s dominance, the offshore wind segment held highest growth rate in 2024. The global offshore installations are projected to recover in 2025 with nearly 19 GW of new capacity, led by China, which is expected to contribute over 65% of the total. Major developers such as Ørsted remain committed to offshore growth, targeting 8.1 GW of new offshore capacity by 2027, even as financial pressures and policy uncertainties pose challenges. Based on Application, the wind turbine market by application is segmented into industrial, commercial, residential, and utility-scale power generation. The utility-scale power generation being the dominant segment in 2024. The expansion of utility-scale wind is being propelled by supportive government auctions, corporate power purchase agreements (PPAs), and investments in modern grid infrastructure. Although regulatory delays, trade uncertainty, and supply chain pressures remain challenges, industry leaders continue to emphasize the urgency of scaling deployment to meet global climate goals. Vestas, for instance, has highlighted the need for streamlined permitting and grid investment to accelerate progress. Meanwhile, strategic shifts are growing the competitive landscape: Siemens Energy recently divested 90% of its wind turbine business in India to focus on core markets, underscoring the sector’s emphasis on utility-scale opportunities. With over 117 GW of new global wind capacity added in 2024, utility-scale wind power has firmly established itself as the driving force behind industry growth and a cornerstone of decarbonization strategies.

Wind Turbine Market Regional Insights:

Asia Pacific dominated the global Wind Turbine market in 2024 and is expected to maintain its dominance during the forecast period 2025-2032. The rapid industrialization, strong government support, and rising investments in renewable energy projects boost the Wind Turbine Market. The region, led by countries such as China, Japan, and South Korea, has become the hub for wind turbine manufacturing and installation. India stands out as the most promising country in the wind turbine industry, driven by the steady addition of wind energy capacity and the rising flow of investments in both wind power development and onshore wind energy projects. China accounts for a significant share of global wind energy capacity, supported by favorable policies, subsidies, and aggressive renewable energy targets under its carbon neutrality goals. The key factor behind Asia Pacific’s dominance is the availability of vast onshore and offshore wind resources. Coastal nations such as China, Japan, and Vietnam are investing heavily in offshore wind projects, which offer large-scale capacity generation. Moreover, regional players benefit from advanced manufacturing capabilities, cost efficiencies, and economies of scale, enabling them to produce turbines at competitive prices compared to other regions. Governments in the Asia Pacific are implementing supportive policies such as feed-in tariffs, tax incentives, and renewable purchase obligations, which further stimulate the adoption of wind power. In addition, increasing foreign direct investments, partnerships between global energy companies and regional firms, and the rising demand for sustainable energy due to population growth and urbanization are expected to strengthen the Wind Turbine Market.Wind Turbine Market Competitive Landscape

The Wind Turbine Market is very competitive and innovation-driven in terms of turbine efficiency, blade design, and digital control systems. Market leaders like Vestas Wind Systems A/S of Denmark and Siemens Gamesa Renewable Energy S.A. of Spain dominate the supply chains of the world through huge project portfolios and solid R&D capacities. Vestas registered wind turbine sales of about USD 15.1 billion for the year 2024, fuelled by its growing onshore and offshore orders in North America and Europe. Siemens Gamesa reported around USD 10.8 billion worth of revenue in 2024, with strong growth coming from offshore wind, driven by bundled digital turbine control and high-capacity project installations. In Asia, Goldwind (China) reached revenues of close to USD 8.9 billion in 2024 on the strength of China's ambitious renewable targets and huge domestic projects. The companies keep designing bigger, smarter turbines some over 15 MW along with AI-driven predictive maintenance and composite materials to keep pace with demand globally and increase energy output. The market is competitive as competitors compete to provide next-generation turbines in line with worldwide decarbonization objectives and changing energy infrastructure.Wind Turbine Market Trends

Shift Towards Offshore Wind Expansion: Offshore wind farms are picking up pace all over the world because of greater wind stability and available space. Turbines with capacities greater than 15 MW are being used, particularly in Europe, China, and America, as they immensely boost the output of power per unit. Increase in Turbine Size and Capacity: They are emphasizing taller towers, bigger rotor diameters, and greater rated capacities to increase efficiency in terms of energy and minimize the cost per megawatt, especially for utility projects. Integration of Smart Technologies Increased use of AI, IoT, and predictive maintenance systems allows for performance monitoring in real time, minimizing downtime, and maximizing turbine efficiency.Wind Turbine Market Key Development

• On June 18, 2025– UK: Orsted and Siemens Gamesa initiated full-scale deployment of 14 MW turbines at the Hornsea 3 offshore wind farm, pushing forward one of the largest offshore projects in Europe. • On March 2023, Germany: Siemens Gamesa introduced the SG 14-236 DD offshore turbine, aimed at boosting capacity and reducing the Levelized Cost of Energy (LCOE) in European offshore wind projects. • On June 10, 2024, Denmark: Vestas launched its next-generation offshore wind turbine, V236-15.0 MW, marking one of the world’s most powerful turbines, capable of powering over 20,000 homes per unit annually. • On July 24, 2023, China: Goldwind began commercial deployment of its 16 MW offshore wind turbine, tailored for China’s deep-sea offshore wind farms, reinforcing China's position as a global offshore wind leader. The objective of the report is to present a comprehensive analysis of the global Wind Turbine Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports helps in understanding the global Wind Turbine Market dynamic, structure by analyzing the market segments and project the global Wind Turbine Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Wind Turbine Market make the report investor’s guide.Wind Turbine Market Scope: Inquire before buying

Wind Turbine Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 128.72 Bn. Forecast Period 2025 to 2032 CAGR: 8.2% Market Size in 2032: USD 240.45 Bn. Segments Covered: by Installation Type Onshore Offshore by Component Rotator Blade Gearbox Generator Nacelle Others by Rating ≤ 2 MW, >2≤ 5 MW >5≤ 8 MW >8≤10 MW >10≤ 12 MW >12 MW by Application Industrial Commercial Residential Utility Scale Power Generation Wind Turbine Market, by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Wind Turbine Key Players are

North America 1. GE Vernova – United States 2. Invenergy – United States 3. NextEra Energy Resources – United States 4. Pattern Energy Group – United States 5. Brookfield Renewable Partners – Canada Europe 6. Vestas Wind Systems A/S – Denmark 7. Siemens Gamesa Renewable Energy S.A. – Spain 8. Nordex Group – Germany 9. Enercon GmbH – Germany 10. Senvion S.A. – Luxembourg 11. Ørsted A/S – Denmark 12. EDF Renewables – France 13. Statkraft – Norway 14. Acciona Energía – Spain 15. EDP Renewables – Portugal Asia-Pacific 16. Goldwind – China 17. Ming Yang Smart Energy – China 18. Envision Energy – China 19. Suzlon Energy Limited – India 20. CSIC Haizhuang Wind Power – China 21. Shanghai Electric Wind Power – China 22. United Power (China Energy Investment Corp.) – China 23. Doosan Enerbility – South Korea 24. Hitachi Ltd. – Japan 25. MHI Vestas Offshore Wind (JV, Japan/Denmark) Middle East & Africa 26. Lekela Power – South Africa South America 27. Casa dos Ventos – BrazilFrequently Asked Questions:

1] What segments are covered in Wind Turbine Market report? Ans. The segments covered in Wind Turbine Market report are based on Installation Type, Components, Rating, and Application,. 2] Which region is expected to hold the Largest Wind Turbine market share in the global Market? Ans. Asia Pacific is expected to hold the highest Wind Turbine Market share in the global Market. 3] What is the market size of global Wind Turbine Market by 2032? Ans. The market size of global Wind Turbine Market by 2032 is USD 240.45 Bn. 4] Who are the top key players in the global Wind Turbine Market? Ans. Suzlon, Nordex Acciona, Senvion, Goldwind, MHI-Vestas and United Power are the top key players in the global Wind Turbine Market. 5] What was the market size of the global Wind Turbine Market in 2024? Ans. The market size of the global Wind Turbine Market in 2024 was USD 128.72 Bn.

1. Wind Turbine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Wind Turbine Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Wind Turbine Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Wind Turbine Market: Dynamics 3.1. Wind Turbine Market Trends by Region 3.1.1. North America Wind Turbine Market Trends 3.1.2. Europe Wind Turbine Market Trends 3.1.3. Asia Pacific Wind Turbine Market Trends 3.1.4. Middle East and Africa Wind Turbine Market Trends 3.1.5. South America Wind Turbine Market Trends 3.2. Wind Turbine Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Wind Turbine Market Drivers 3.2.1.2. North America Wind Turbine Market Restraints 3.2.1.3. North America Wind Turbine Market Opportunities 3.2.1.4. North America Wind Turbine Market Challenges 3.2.2. Europe 3.2.2.1. Europe Wind Turbine Market Drivers 3.2.2.2. Europe Wind Turbine Market Restraints 3.2.2.3. Europe Wind Turbine Market Opportunities 3.2.2.4. Europe Wind Turbine Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Wind Turbine Market Drivers 3.2.3.2. Asia Pacific Wind Turbine Market Restraints 3.2.3.3. Asia Pacific Wind Turbine Market Opportunities 3.2.3.4. Asia Pacific Wind Turbine Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Wind Turbine Market Drivers 3.2.4.2. Middle East and Africa Wind Turbine Market Restraints 3.2.4.3. Middle East and Africa Wind Turbine Market Opportunities 3.2.4.4. Middle East and Africa Wind Turbine Market Challenges 3.2.5. South America 3.2.5.1. South America Wind Turbine Market Drivers 3.2.5.2. South America Wind Turbine Market Restraints 3.2.5.3. South America Wind Turbine Market Opportunities 3.2.5.4. South America Wind Turbine Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Wind Turbine Industry 3.8. Analysis of Government Schemes and Initiatives For Wind Turbine Industry 3.9. Wind Turbine Market Trade Analysis 3.10. The Global Pandemic Impact on Wind Turbine Market 4. Wind Turbine Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 4.1.1. Onshore 4.1.2. Offshore 4.2. Wind Turbine Market Size and Forecast, by Component (2024-2032) 4.2.1. Rotator Blade 4.2.2. Gearbox 4.2.3. Generator 4.2.4. Nacelle 4.2.5. Others 4.3. Wind Turbine Market Size and Forecast, by Rating (2024-2032) 4.3.1. ≤ 2 MW, 4.3.2. >2≤ 5 MW 4.3.3. >5≤ 8 MW 4.3.4. >8≤10 MW 4.3.5. >10≤ 12 MW 4.3.6. >12 MW 4.4. Wind Turbine Market Size and Forecast, by Application (2024-2032) 4.4.1. Industrial 4.4.2. Commercial 4.4.3. Residential 4.4.4. Utility Scale Power Generation 4.5. Wind Turbine Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Wind Turbine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 5.1.1. Onshore 5.1.2. Offshore 5.2. North America Wind Turbine Market Size and Forecast, by Component (2024-2032) 5.2.1. Rotator Blade 5.2.2. Gearbox 5.2.3. Generator 5.2.4. Nacelle 5.2.5. Others 5.3. North America Wind Turbine Market Size and Forecast, by Rating (2024-2032) 5.3.1. ≤ 2 MW, 5.3.2. >2≤ 5 MW 5.3.3. >5≤ 8 MW 5.3.4. >8≤10 MW 5.3.5. >10≤ 12 MW 5.3.6. >12 MW 5.4. North America Wind Turbine Market Size and Forecast, by Application (2024-2032) 5.4.1. Industrial 5.4.2. Commercial 5.4.3. Residential 5.4.4. Utility Scale Power Generation 5.5. North America Wind Turbine Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 5.5.1.1.1. Onshore 5.5.1.1.2. Offshore 5.5.1.2. United States Wind Turbine Market Size and Forecast, by Component (2024-2032) 5.5.1.2.1. Rotator Blade 5.5.1.2.2. Gearbox 5.5.1.2.3. Generator 5.5.1.2.4. Nacelle 5.5.1.2.5. Others 5.5.1.3. United States Wind Turbine Market Size and Forecast, by Rating (2024-2032) 5.5.1.3.1. ≤ 2 MW, 5.5.1.3.2. >2≤ 5 MW 5.5.1.3.3. >5≤ 8 MW 5.5.1.3.4. >8≤10 MW 5.5.1.3.5. >10≤ 12 MW 5.5.1.3.6. >12 MW 5.5.1.4. United States Wind Turbine Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Industrial 5.5.1.4.2. Commercial 5.5.1.4.3. Residential 5.5.1.4.4. Utility Scale Power Generation 5.5.2. Canada 5.5.2.1. Canada Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 5.5.2.1.1. Onshore 5.5.2.1.2. Offshore 5.5.2.2. Canada Wind Turbine Market Size and Forecast, by Component (2024-2032) 5.5.2.2.1. Rotator Blade 5.5.2.2.2. Gearbox 5.5.2.2.3. Generator 5.5.2.2.4. Nacelle 5.5.2.2.5. Others 5.5.2.3. Canada Wind Turbine Market Size and Forecast, by Rating (2024-2032) 5.5.2.3.1. ≤ 2 MW, 5.5.2.3.2. >2≤ 5 MW 5.5.2.3.3. >5≤ 8 MW 5.5.2.3.4. >8≤10 MW 5.5.2.3.5. >10≤ 12 MW 5.5.2.3.6. >12 MW 5.5.2.4. Canada Wind Turbine Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Industrial 5.5.2.4.2. Commercial 5.5.2.4.3. Residential 5.5.2.4.4. Utility Scale Power Generation 5.5.3. Mexico 5.5.3.1. Mexico Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 5.5.3.1.1. Onshore 5.5.3.1.2. Offshore 5.5.3.2. Mexico Wind Turbine Market Size and Forecast, by Component (2024-2032) 5.5.3.2.1. Rotator Blade 5.5.3.2.2. Gearbox 5.5.3.2.3. Generator 5.5.3.2.4. Nacelle 5.5.3.2.5. Others 5.5.3.3. Mexico Wind Turbine Market Size and Forecast, by Rating (2024-2032) 5.5.3.3.1. ≤ 2 MW, 5.5.3.3.2. >2≤ 5 MW 5.5.3.3.3. >5≤ 8 MW 5.5.3.3.4. >8≤10 MW 5.5.3.3.5. >10≤ 12 MW 5.5.3.3.6. >12 MW 5.5.3.4. Mexico Wind Turbine Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Industrial 5.5.3.4.2. Commercial 5.5.3.4.3. Residential 5.5.3.4.4. Utility Scale Power Generation 6. Europe Wind Turbine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.2. Europe Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.3. Europe Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.4. Europe Wind Turbine Market Size and Forecast, by Application (2024-2032) 6.5. Europe Wind Turbine Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.5.1.2. United Kingdom Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.5.1.3. United Kingdom Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.5.1.4. United Kingdom Wind Turbine Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.5.2.2. France Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.5.2.3. France Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.5.2.4. France Wind Turbine Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.5.3.2. Germany Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.5.3.3. Germany Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.5.3.4. Germany Wind Turbine Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.5.4.2. Italy Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.5.4.3. Italy Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.5.4.4. Italy Wind Turbine Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.5.5.2. Spain Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.5.5.3. Spain Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.5.5.4. Spain Wind Turbine Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.5.6.2. Sweden Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.5.6.3. Sweden Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.5.6.4. Sweden Wind Turbine Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.5.7.2. Austria Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.5.7.3. Austria Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.5.7.4. Austria Wind Turbine Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 6.5.8.2. Rest of Europe Wind Turbine Market Size and Forecast, by Component (2024-2032) 6.5.8.3. Rest of Europe Wind Turbine Market Size and Forecast, by Rating (2024-2032) 6.5.8.4. Rest of Europe Wind Turbine Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Wind Turbine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.2. Asia Pacific Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.3. Asia Pacific Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.4. Asia Pacific Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Wind Turbine Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.1.2. China Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.1.3. China Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.1.4. China Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.2.2. S Korea Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.2.3. S Korea Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.2.4. S Korea Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.3.2. Japan Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.3.3. Japan Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.3.4. Japan Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.4.2. India Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.4.3. India Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.4.4. India Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.5.2. Australia Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.5.3. Australia Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.5.4. Australia Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.6.2. Indonesia Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.6.3. Indonesia Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.6.4. Indonesia Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.7.2. Malaysia Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.7.3. Malaysia Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.7.4. Malaysia Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.8.2. Vietnam Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.8.3. Vietnam Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.8.4. Vietnam Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.9.2. Taiwan Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.9.3. Taiwan Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.9.4. Taiwan Wind Turbine Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Wind Turbine Market Size and Forecast, by Component (2024-2032) 7.5.10.3. Rest of Asia Pacific Wind Turbine Market Size and Forecast, by Rating (2024-2032) 7.5.10.4. Rest of Asia Pacific Wind Turbine Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Wind Turbine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 8.2. Middle East and Africa Wind Turbine Market Size and Forecast, by Component (2024-2032) 8.3. Middle East and Africa Wind Turbine Market Size and Forecast, by Rating (2024-2032) 8.4. Middle East and Africa Wind Turbine Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Wind Turbine Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 8.5.1.2. South Africa Wind Turbine Market Size and Forecast, by Component (2024-2032) 8.5.1.3. South Africa Wind Turbine Market Size and Forecast, by Rating (2024-2032) 8.5.1.4. South Africa Wind Turbine Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 8.5.2.2. GCC Wind Turbine Market Size and Forecast, by Component (2024-2032) 8.5.2.3. GCC Wind Turbine Market Size and Forecast, by Rating (2024-2032) 8.5.2.4. GCC Wind Turbine Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 8.5.3.2. Nigeria Wind Turbine Market Size and Forecast, by Component (2024-2032) 8.5.3.3. Nigeria Wind Turbine Market Size and Forecast, by Rating (2024-2032) 8.5.3.4. Nigeria Wind Turbine Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 8.5.4.2. Rest of ME&A Wind Turbine Market Size and Forecast, by Component (2024-2032) 8.5.4.3. Rest of ME&A Wind Turbine Market Size and Forecast, by Rating (2024-2032) 8.5.4.4. Rest of ME&A Wind Turbine Market Size and Forecast, by Application (2024-2032) 9. South America Wind Turbine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 9.2. South America Wind Turbine Market Size and Forecast, by Component (2024-2032) 9.3. South America Wind Turbine Market Size and Forecast, by Rating(2024-2032) 9.4. South America Wind Turbine Market Size and Forecast, by Application (2024-2032) 9.5. South America Wind Turbine Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 9.5.1.2. Brazil Wind Turbine Market Size and Forecast, by Component (2024-2032) 9.5.1.3. Brazil Wind Turbine Market Size and Forecast, by Rating (2024-2032) 9.5.1.4. Brazil Wind Turbine Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 9.5.2.2. Argentina Wind Turbine Market Size and Forecast, by Component (2024-2032) 9.5.2.3. Argentina Wind Turbine Market Size and Forecast, by Rating (2024-2032) 9.5.2.4. Argentina Wind Turbine Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Wind Turbine Market Size and Forecast, by Installation Type (2024-2032) 9.5.3.2. Rest Of South America Wind Turbine Market Size and Forecast, by Component (2024-2032) 9.5.3.3. Rest Of South America Wind Turbine Market Size and Forecast, by Rating (2024-2032) 9.5.3.4. Rest Of South America Wind Turbine Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. GE Vernova – United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Invenergy – United States 10.3. NextEra Energy Resources – United States 10.4. Pattern Energy Group – United States 10.5. Brookfield Renewable Partners – Canada 10.6. Vestas Wind Systems A/S – Denmark 10.7. Siemens Gamesa Renewable Energy S.A. – Spain 10.8. Nordex Group – Germany 10.9. Enercon GmbH – Germany 10.10. Senvion S.A. – Luxembourg 10.11. Ørsted A/S – Denmark 10.12. EDF Renewables – France 10.13. Statkraft – Norway 10.14. Acciona Energía – Spain 10.15. EDP Renewables – Portugal 10.16. Goldwind – China 10.17. Ming Yang Smart Energy – China 10.18. Envision Energy – China 10.19. Suzlon Energy Limited – India 10.20. CSIC Haizhuang Wind Power – China 10.21. Shanghai Electric Wind Power – China 10.22. United Power (China Energy Investment Corp.) – China 10.23. Doosan Enerbility – South Korea 10.24. Hitachi Ltd. – Japan 10.25. MHI Vestas Offshore Wind (JV, Japan/Denmark) 10.26. Lekela Power – South Africa 10.27. Casa dos Ventos – Brazil 11. Key Findings 12. Industry Recommendations 13. Wind Turbine Market: Research Methodology 14. Terms and Glossary