Global Water Quality Sensor Market size was valued at USD 6.1 Bn. in 2024, and the total Water Quality Sensor Market revenue is expected to grow by 4% from 2025 to 2032, reaching nearly USD 11.29 Bn.Water Quality Sensor Market Overview:

The Water Quality Sensor market is the area of environmental monitoring technologies that employ sensor systems to monitor specific water variables, such as pH, dissolved oxygen, turbidity, temperature, conductivity, and concentrations of chemicals and pollutants.To know about the Research Methodology :- Request Free Sample Report The sensor systems are fundamental to real-time water quality monitoring in applications for municipal water governance, industrial discharges, scientific and environmental research and aquaculture, as examples. The report defined the Water Quality Sensor Market, as well as market segments into type (Residual Chlorine Sensor, Total organic carbon (TOC), Turbidity Sensor, Conductivity Sensor, pH Sensor, ORP Sensor, Others) and Application (Laboratories, Residential, Industrial, Government, Commercial Spaces, Agriculture). Other identified market trends included the current availability of compact and wireless options (e.g., IoT, auto-calibrating), presenting exciting opportunities for integration and application. Water Quality Sensor Market demand increases from increased concerns regarding contamination, new regulatory requirements and enforcement, and new smart water infrastructure designs and initiatives. From a supply perspective, the market is also impacted by innovations for durability in all-weather uses and development of multi-parameter sensors. Asia Pacific held the Largest market share in 2024, with the China. identified as a major increasing market.

Water Quality Sensor Market Dynamics:

Improving Water Testing Efficiency with Smart Monitoring Systems to Drive Water Quality Sensor Market Growth For green globalization, one of the main concerns is water contamination. The usual testing procedures, which include collecting samples and analyzing them in laboratories using a chemical reaction, are time-consuming for continuous monitoring. For a variety of applications, sensors can show the state of the water's purity. For laboratory research, quality control, compliance, and tracking changes in a water system's quality over time, researchers, operators, and engineers can employ a water quality monitoring system to provide vital data. Water testing therefore requires the use of water quality sensors. Various factors reflect the quality of water, including its varied characteristics. Sensors are able to identify changes in these properties, and these changes may have an effect on the people and businesses that depend on water. Monitoring water quality requires keeping an eye on characteristics like conductivity, dissolved oxygen, pH, salinity, temperature, and turbidity. As a result, sensors that measure the quality of the water are already commonplace in many systems. Digitalization and Regulation to Drive Water Quality Sensor Market Growth The foundation for effective, dependable, and environmentally friendly processes in the water industry is laid by digitalization, automation, and electrification. It has become crucial to quickly and cheaply detect water contamination because of how quickly urbanization and industrial development have caused water quality to deteriorate. In order to deploy water monitoring systems, health and safety laws at industrial facilities as well as environmental regulations have gotten more stringent globally. The market is expected to be driven by the residential and government services; however, industries including mining, oil, gas, and chemical production and agriculture also play a major role.Water Quality Sensor Market Segment Analysis:

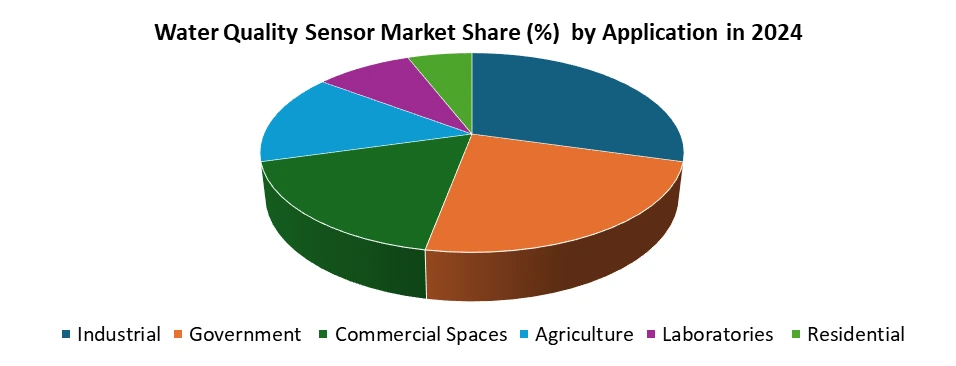

Based on the Type, the market is segmented into Residual Chlorine Sensor, Total organic carbon (TOC), Turbidity Sensor, Conductivity Sensor, pH Sensor, ORP Sensor, and Others. pH Sensor segment is expected to hold the largest market share of xx% by 2032. One of the most significant devices that is frequently used for water measurements is a pH sensor. This kind of sensor can determine how much acidity and alkalinity is present in water and other liquids. When utilised properly, pH sensors can guarantee a product's safety and quality as well as the operations that take place in a manufacturing or wastewater facility. In terms of water treatment and purity, a pH sensor is crucial. A water treatment plant's pH level can become dangerously high or low, which can make the water unsafe. Turbidity Sensor segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. Turbidity sensors are used in laboratory tests, wastewater and effluent measurements, settling pond management equipment, sediment transport research, and river and stream gauging. To measure the turbidity of the water, a turbidity probe projects a light beam into it. Then, any particles that are suspended disperse this light. A light detector measures the amount of light that is reflected to it and is typically positioned at a 90-degree angle to the light source. The amount of suspended particles in water determined using the indicator turbidity. It is possible to determine the amount of suspended particles (in mg/l) in water through laborious mechanical sampling; however, turbidity is increasingly preferred because it is simpler to use and less expensive. As opposed to their absolute mass, suspended solids' diverse effects on aquatic ecosystems are caused by their light scattering characteristics, making it an ecologically significant factor. Conductivity Sensor segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. The ability of a solution to conduct an electrical current is measured using water conductivity sensors in water-quality applications. This kind of analysis evaluates the ion concentration in the solution. The conductivity increases with the number of ions present in the solution. ORP Sensor segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. The ability of a solution to function as an oxidising or reducing agent is measured by the Oxidation-Reduction Potential (ORP) Sensor. Use the ORP Sensor to test the chlorine's ability to oxidise water in swimming pools or to identify whether an oxidation-reduction reaction has reached its equivalence point. Measurements of ORP are crucial for evaluating the quality of water since ORP sensors have the advantage of giving you more information than pH sensors alone can. An ORP sensor will provide you with all the data you need to make an informed decision if you're treating water and want to make sure the chemicals you're employing are having the desired effect. Based on the Application, the market is segmented into Laboratories, Residential, Industrial, Government, Commercial Spaces, and Agriculture. The industrial segment dominated the water quality sensor market, driven by stringent regulatory requirements, the need for real-time monitoring, and the high demand for process optimization in sectors such as manufacturing, chemicals, and power generation. a industries are increasingly adopting advanced sensor technologies to comply with environmental regulations like the Clean Water Act (U.S.) and the EU Water Framework Directive, which mandate strict effluent quality standards. industries leverage IoT-enabled water quality sensors for predictive maintenance and contamination detection, reducing operational risks and downtime. Additionally, industries invest heavily in smart water management systems to enhance efficiency and sustainability, further propelling market growth. While sectors like agriculture and government also contribute significantly, the industrial segment’s scale, regulatory pressures, and technological adoption make it the largest and fastest-growing application area in the water quality sensor market.

Water Quality Sensor Market Regional Analysis:

Asia Pacific region is expected to dominate the Water Quality Sensor Market during the forecast period 2025-2032. It is expected to hold the largest market share of xx% by 2030. Asia Pacific has a large population, and nations like India, Singapore, and China present a huge market opportunity. The region's significant water scarcity along with significant government initiatives like smart cities, river preservation, and smart water management systems are expected to drive the Asia Pacific Water Quality Sensor market. North America region is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. This is due to an increase in the number of homes with swimming pools and an increase in the number of automatic pool cleaners that have sensors to measure water quality in the North America. Water quality sensors have become more popular as a result of consumer electronics products like food processors and purifiers. The Middle East and Africa region is expected to grow rapidly at a CAGR of xx% during the forecast period 2025-2032. This is due to the growing use of the water quality sensors to monitor or check the quality of the water in the Middle East and Africa region. The Moroccan government selected 175 beaches to be included in the 2024 water quality survey. In addition, authorities established a new standard to check the quality of the bathing waters due to the significance of tourism for Morocco. The objective of the report is to present a comprehensive analysis of the Global Water Quality Sensor Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Water Quality Sensor Market dynamic and structure by analyzing the market segments and projecting the Global Water Quality Sensor Market size. Clear representation of competitive analysis of key players by Distribution Channel, price, financial position, product portfolio, growth strategies, and regional presence in the Water Quality Sensor Market make the report investor’s guide.Water Quality Sensor Market Competitive Landscape

The Water Quality Sensor market is highly competitive and moderately fragmented, with many global and regional participants presenting advanced and specialized solutions. The Water Quality market is characterized by technology innovations, strategic alliances, and portfolio diversification to fulfill rapidly increasing environmental regulations and demands for smart water monitoring. The major players, such as Xylem Inc., Thermo Fisher Scientific, HORIBA Ltd., Endress+Hauser, Hach (a Danaher company), dominate the global space in IoT enabled, multi-parameter, and portable water sensors, while they are investing heavily in R&D to improve sensor accuracy, longevity and wireless data transfer capability. Many mid-sized companies and start-ups are ramping up as the rapidly expanding Water Quality market is becoming online based, offering lunar cost, and helps Identify and eliminate issues. Regional players such as Libelium (Spain) and SUTRON Corporation (U.S.) are growing by offering custom applications for local regional needs including agriculture and municipal water. The report cites consolidation activity as M&A transactions, partnerships, and product launches are key strategies selected by players in the industry to increase their position in the market. There are many government incentives aimed at improving water quality, that are pushing technological advancement, new product development and ultimately, more competition. Industrial demand is driving a lot of competition and your innovation across the entire water quality sector. Water Quality Sensor Market Recent Developments 1. July 2024 – England, Europe – Wessex Water/Southern Water Wessex Water and Southern Water installed AI-enabled real-time water quality monitors at popular wild swimming and coastal sites, providing half-hourly bacteria-level alerts through an app—achieving 87% prediction accuracy. 2. April 2024 – China, Asia-Pacific – ZoneWu ZoneWu launched a new LoRaWAN-enabled multi-parameter sensor capable of monitoring pH, dissolved oxygen, turbidity, and ammonia with long-range, low-power data transmission. 3. November 2023 – USA, North America – Siemens Siemens introduced a next-generation water quality sensor with enhanced accuracy for measuring turbidity, pH, and dissolved oxygen, improving industrial and municipal water monitoring. 4. May 2024 – Uganda, Africa – Aqsen Innovations/CENSIS Aqsen Innovations, in partnership with Scotland’s CENSIS, began piloting its low-cost Aquasense IoT sensor system in Lake Victoria and local fish farms, offering affordable real-time water quality monitoring (25–30% price of existing solutions. 5. August 2024 – Brazil (also Nepal & UK), South America – University of York + Phutung Research Institute + Univ. of São Paulo A collaborative research team unveiled realtimeWAS, a portable, lensless, handheld fluorescence sensor meeting WHO standards for rapid detection of bacterial contamination—ready for deployment in low-income regions.Water Quality Sensor Market Key Trend

1. Growing Adoption of Multi-Parameter Sensors • Industries and utilities are increasingly deploying sensors that monitor multiple parameters (pH, turbidity, DO, etc.) simultaneously for cost-effectiveness and real-time analysis. • Example: In 2024, over 60% of new water quality sensors sold globally were multi-parameter units, compared to 42% in 2020. 2. Integration with IoT and Cloud-Based Platforms • Smart water management is driving demand for IoT-enabled water sensors for remote monitoring, data logging, and predictive analytics. • Example: The market for IoT-based water quality sensors is projected to grow at a CAGR of 12.8% from 2024 to 2030, driven by smart city and utility projects. 3. Rising Demand in Agricultural and Aquaculture Applications • Precision farming and aquaculture are using water sensors to optimize irrigation and maintain aquatic health. • Example: Water quality sensor deployment in agriculture and aquaculture grew by 28% in 2023, especially in Asia-Pacific and Sub-Saharan Africa.Water Quality Sensor Market Scope: Inquire before buying

Global Water Quality Sensor Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 6.1 Bn. Forecast Period 2025 to 2032 CAGR: 4% Market Size in 2032: USD 11.29 Bn. Segments Covered: by Type Residual Chlorine Sensor Total organic carbon (TOC) Turbidity Sensor Conductivity Sensor pH Sensor ORP Sensor Others by Application Laboratories Residential Industrial Government Commercial Spaces Agriculture Water Quality Sensor Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Water Quality Sensor Market Manufacturers

North America 1. Thermo Fisher Scientific – USA 2. Xylem Inc. – USA 3. Hach (a Danaher company) – USA 4. Campbell Scientific Inc. – USA 5. In-Situ Inc. – USA Europe 1. Endress+Hauser Group – Switzerland 2. HORIBA Ltd. – France/Germany (European HQ) 3. OTT HydroMet (a Hach company) – Germany 4. YSI Europe – Germany 5. Libelium Comunicaciones Distribuidas S.L. – Spain Asia-Pacific 1. HORIBA Ltd. – Japan 2. Kyoritsu Chemical-Check Lab Corp. – Japan 3. Optiqua Technologies – Singapore 4. Eureka Water Probes (Aquaread Ltd.) – Operating in Australia 5. Shanghai BOQU Instrument Co., Ltd. – China Middle East & Africa 1. Aqsen Innovations – Uganda 2. Arab Water Council Partner Integrators – Egypt 3. Azmec Engineering Ltd. – Nigeria (distributor & integrator) 4. Pure Technologies Ltd. (Xylem subsidiary) – UAE/Saudi Arabia presence Frequently Asked Questions: 1] Which region is expected to hold the highest share in the Water Quality Sensor Market? Ans. Asia Pacific region is expected to hold the highest share in the Water Quality Sensor Market. 2] Who are the top key players in the Water Quality Sensor Market? Ans. ProMinent Fluid Controls, Inc., General Electric Company, Xylem, Inc., Horiba, Ltd, Thermo Fisher Scientific and Oakton Instruments FreeWave Technologies are the top key players in the Water Quality Sensor Market. 3] Which segment is expected to hold the largest market share in the Water Quality Sensor Market by 2032? Ans. pH Sensor segment is expected to hold the largest market share in the Water Quality Sensor Market by 2032. 4] What is the market size of the Water Quality Sensor Market by 2030? Ans. The market size of the Water Quality Sensor Market is expected to reach US$ 11.29 Bn. by 2032. 5] What was the market size of the Water Quality Sensor Market in 2024? Ans. The market size of the Water Quality Sensor Market was worth US$ 6.1 Bn. in 2024.

1. Water Quality Sensor Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Water Quality Sensor Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Water Quality Sensor Market: Dynamics 3.1. Region-wise Trends of Water Quality Sensor Market 3.1.1. North America Water Quality Sensor Market Trends 3.1.2. Europe Water Quality Sensor Market Trends 3.1.3. Asia Pacific Water Quality Sensor Market Trends 3.1.4. Middle East and Africa Water Quality Sensor Market Trends 3.1.5. South America Water Quality Sensor Market Trends 3.2. Water Quality Sensor Market Dynamics 3.2.1. Global Water Quality Sensor Market Drivers 3.2.1.1. Stringent environmental regulations on water pollution control 3.2.1.2. Rising demand for real-time water monitoring in Residential and municipal sectors 3.2.1.3. Growing investments in smart water management and infrastructure 3.2.2. Global Water Quality Sensor Market Restraints 3.2.3. Global Water Quality Sensor Market Opportunities 3.2.4. Rising Demand for Smart Water Management Solutions 3.2.5. Expanding Government Regulations on Water Safety 3.2.6. Emerging Markets Infrastructure Development 3.2.7. Global Water Quality Sensor Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Political – Government regulations on water safety and environmental monitoring 3.4.2. Technological – Integration of IoT and AI in sensor-based water quality monitoring 3.4.3. Environmental – Rising concerns over water pollution and resource conservation 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Water Quality Sensor Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 4.1.1. Residual Chlorine Sensor 4.1.2. Total Organic Carbon 4.1.3. Turbidity Sensor 4.1.4. Conductivity Sensor 4.1.5. pH Sensor 4.1.6. ORP Sensor 4.1.7. Others 4.2. Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 4.2.1. Laboratories 4.2.2. Residential 4.2.3. Industrial 4.2.4. Government 4.2.5. Commercial Spaces 4.2.6. Agriculture 4.3. Water Quality Sensor Market Size and Forecast, by Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Water Quality Sensor Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 5.1.1. Residual Chlorine Sensor 5.1.2. Total Organic Carbon 5.1.3. Turbidity Sensor 5.1.4. Conductivity Sensor 5.1.5. pH Sensor 5.1.6. ORP Sensor 5.1.7. Others 5.2. North America Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 5.2.1. Laboratories 5.2.2. Residential 5.2.3. Industrial 5.2.4. Government 5.2.5. Commercial Spaces 5.2.6. Agriculture 5.2.7. Electrical Discharge Residual Chlorine Sensor 5.3. North America Water Quality Sensor Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 5.3.1.1.1. Residual Chlorine Sensor 5.3.1.1.2. Total Organic Carbon 5.3.1.1.3. Turbidity Sensor 5.3.1.1.4. Conductivity Sensor 5.3.1.1.5. pH Sensor 5.3.1.1.6. ORP Sensor 5.3.1.1.7. Others 5.3.1.2. United States Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 5.3.1.2.1. Laboratories 5.3.1.2.2. Residential 5.3.1.2.3. Industrial 5.3.1.2.4. Government 5.3.1.2.5. Commercial Spaces 5.3.1.2.6. Agriculture 5.3.2. Canada 5.3.2.1. Canada Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 5.3.2.1.1. Residual Chlorine Sensor 5.3.2.1.2. Total Organic Carbon 5.3.2.1.3. Turbidity Sensor 5.3.2.1.4. Conductivity Sensor 5.3.2.1.5. pH Sensor 5.3.2.1.6. ORP Sensor 5.3.2.1.7. Others 5.3.2.2. Canada Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 5.3.2.2.1. Laboratories 5.3.2.2.2. Residential 5.3.2.2.3. Industrial 5.3.2.2.4. Government 5.3.2.2.5. Commercial Spaces 5.3.2.2.6. Agriculture 5.3.3. Maxico 5.3.3.1. Mexico Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 5.3.3.1.1. Residual Chlorine Sensor 5.3.3.1.2. Total Organic Carbon 5.3.3.1.3. Turbidity Sensor 5.3.3.1.4. Conductivity Sensor 5.3.3.1.5. pH Sensor 5.3.3.1.6. ORP Sensor 5.3.3.1.7. Others 5.3.3.2. Mexico Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 5.3.3.2.1. Laboratories 5.3.3.2.2. Residential 5.3.3.2.3. Industrial 5.3.3.2.4. Government 5.3.3.2.5. Commercial Spaces 5.3.3.2.6. Agriculture 6. Europe Water Quality Sensor Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.2. Europe Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 6.3. Europe Water Quality Sensor Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.3.1.2. United Kingdom Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 6.3.2. France 6.3.2.1. France Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.3.2.2. France Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.3.3.2. Germany Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.3.4.2. Italy Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.3.5.2. Spain Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.3.6.2. Sweden Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 6.3.7. Austria 6.3.7.1. Austria Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.3.7.2. Austria Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 6.3.8.2. Rest of Europe Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Water Quality Sensor Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Water Quality Sensor Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.1.2. China Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.2.2. S Korea Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.3.2. Japan Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.4. India 7.3.4.1. India Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.4.2. India Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.5.2. Australia Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.6.2. Indonesia Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.7. Philippines 7.3.7.1. Philippines Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.7.2. Philippines Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.8. Malaysia 7.3.8.1. Malaysia Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.8.2. Malaysia Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.9. Vietnam 7.3.9.1. Vietnam Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.9.2. Vietnam Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.10. Thailand 7.3.10.1. Thailand Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.10.2. Thailand Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 7.3.11.2. Rest of Asia Pacific Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Water Quality Sensor Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Water Quality Sensor Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 8.3.1.2. South Africa Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 8.3.2.2. GCC Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 8.3.3. Nigeria 8.3.3.1. Nigeria Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 8.3.3.2. Nigeria Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 8.3.4.2. Rest of ME&A Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 9. South America Water Quality Sensor Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 9.2. South America Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 9.3. South America Water Quality Sensor Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 9.3.1.2. Brazil Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 9.3.2.2. Argentina Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 9.3.3. Rest of South America 9.3.3.1. Rest of South America Water Quality Sensor Market Size and Forecast, By Type (2024-2032) 9.3.3.2. Rest of South America Water Quality Sensor Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Thermo Fisher Scientific – USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Xylem Inc. – USA 10.3. Hach (a Danaher company) – USA 10.4. Campbell Scientific Inc. – USA 10.5. In-Situ Inc. – USA 10.6. Endress+Hauser Group – Switzerland 10.7. HORIBA Ltd. – France/Germany (European HQ) 10.8. OTT HydroMet (a Hach company) – Germany 10.9. YSI Europe – Germany 10.10. Libelium Comunicaciones Distribuidas S.L. – Spain 10.11. HORIBA Ltd. – Japan 10.12. Kyoritsu Chemical-Check Lab Corp. – Japan 10.13. Optiqua Technologies – Singapore 10.14. Eureka Water Probes (Aquaread Ltd.) – Operating in Australia 10.15. Shanghai BOQU Instrument Co., Ltd. – China 10.16. Aqsen Innovations – Uganda 10.17. Aquamonix – Australia-based but with MEA presence 10.18. Arab Water Council Partner Integrators – Egypt 10.19. Azmec Engineering Ltd. – Nigeria (distributor & integrator) 10.20. Pure Technologies Ltd. (Xylem subsidiary) – UAE/Saudi Arabia presence 10.21. Swan Analytical Instruments Ltd. – Brazil branch 10.22. Analitek Instruments SA de CV – Mexico 10.23. Tecnal Equipamentos Científicos Ltda. – Brazil 10.24. Inoquous S.A.S. – Colombia 10.25. Quimipol S.A. – Argentina 11. Key Findings 12. Analyst Recommendations 13. Water Quality Sensor Market: Research Methodology