Global Water Heater Market size was valued at USD 29.88 Bn in 2023 and is expected to reach USD 41.54 Bn by 2030, at a CAGR of 4.82 %.Water Heater Market Overview

A water heater is a device used to heat water for various domestic, commercial, and industrial purposes. Its primary function is to provide hot water for activities such as bathing, cooking, cleaning, and space heating. Water heaters come in different types and sizes, each designed to suit specific applications and user preferences. The water heater industry encompasses various types, including storage tanks, tankless, heat pumps, solar, and hybrid systems, catering to diverse energy sources and consumer needs. Key trends include a focus on energy efficiency, smart technology integration, and hybrid system advancements. Governments enforce regulations for energy efficiency and safety standards. Major players such as Rheem, AO Smith, and Rinnai compete fiercely, emphasizing factors such as price, quality, and technology. Consumer considerations span upfront and operating costs, energy efficiency, reliability, and available space. The global Water Heater Market outlook remains positive, driven by population growth, urbanization, and increasing environmental awareness, development innovation and sustainability in water heating solutions.To know about the Research Methodology :- Request Free Sample Report

Water Heater Market Dynamics

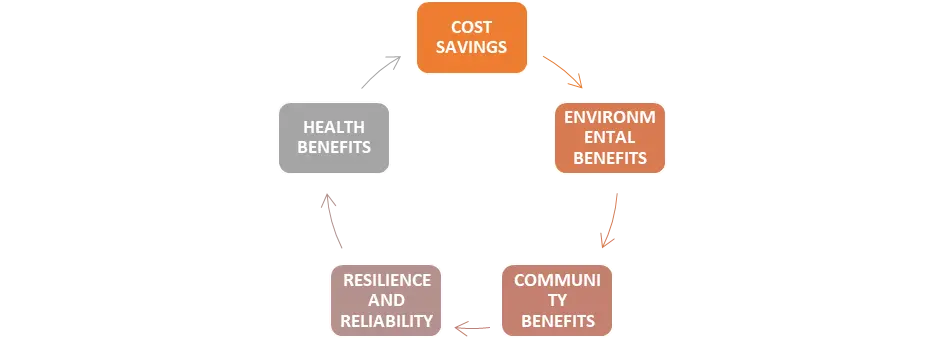

Energy Efficiency Revolutionizing Driving the Water Heater Market Growth Energy efficiency stands as a paramount driver propelling the water heater market's growth. With a global push towards sustainability and reducing carbon footprints, consumers are increasingly opting for energy-efficient water heating solutions. Technological advancements have led to the development of highly efficient heat pump water heaters, solar water heaters, and tankless water heaters. These innovations not only save energy but also significantly lower utility bills over time, making them attractive options for both residential and commercial applications. Governments and regulatory bodies worldwide are also incentivizing the adoption of energy-efficient water heaters through rebates and subsidies, which is expected to drive market growth. The Energy Department, per the Energy Policy and Conservation Act, proposes updated energy conservation standards for consumer water heaters. A public meeting is scheduled for comments on the proposed standards and related analyses. The proposed rule aims to assess the feasibility and economic viability of stricter standards, potentially leading to significant energy savings.A nation’s economy and general standard of living are significantly impacted by the development of efficient power generation technologies and sources. The ability of industries and enterprises to operate and thrive makes access to affordable and reliable energy essential for economic progress. Additionally, the efficient use of energy resources also helps to conserve the environment and attenuate the effects of climate change. Modern society has come to rely heavily on electricity it is hard to imagine life without it. Both renewable and non-renewable energy sources are used to generate power. The water heater market encompasses various types of heaters designed to provide hot water for residential and commercial use. This includes tankless water heaters, traditional tank water heaters, heat pump water heaters, solar water heaters, and hybrid water heaters. Consumer demand for energy-efficient and eco-friendly water heating solutions has driven innovation in the market, leading to the development of smart water heaters and systems with improved energy efficiency ratings. Factors such as government regulations, technological advancements, and shifting consumer preferences influence the dynamics of the water heater industry, shaping product offerings and market trends. Energy Efficiency Benefits

Smart Technology Transforming Water Heating Landscape

The integration of smart technology into water heating systems is revolutionizing the market. Smart water heaters equipped with Wi-Fi connectivity, mobile apps, and sensors offer users unprecedented control and convenience. These devices allow users to monitor and adjust water temperature, schedule heating times, and receive maintenance alerts remotely, enhancing user experience and efficiency. Additionally, smart water heaters optimize energy usage by learning usage patterns and adjusting heating schedules accordingly, further contributing to energy savings. As smart home ecosystems continue to expand, the demand for interconnected and intelligent water heating solutions is expected to soar, driving significant growth in the water heater market. Smart water heaters reduce energy consumption by up to 50%, compared to traditional water heaters, according to the US Department of Energy. The convergence of water heaters with Internet of Things (IoT) technology presents a transformative opportunity in the market. Smart water heaters equipped with IoT capabilities offer unprecedented levels of convenience, efficiency, and control to consumers and businesses. Through smartphone apps and home automation platforms, users remotely monitor and adjust water heater settings, optimize energy usage, and receive real-time alerts for maintenance or issues. As IoT adoption continues to proliferate across various industries, the water heater market stands to benefit from the demand for connected devices and intelligent solutions. Manufacturers investing in IoT integration and data analytics capabilities gain a competitive edge by offering innovative, future-ready products that cater to evolving consumer preferences and sustainability goals. Embracing smart technology not only drives market growth but also fosters a paradigm shift towards smarter, more efficient water heating solutions. For instance, new technologies, including the Internet of Things (IoT), enable every product, including appliances, lighting, and HVAC systems, to be computer-controlled smart devices. In essence, any product that performs some level of control become a smart device. That concept is also true for the ubiquitous water heater. As a result, the market for electric water heaters is growing at an attractive rate with a CAGR of 7.4%. Governments are spurring growth by incentivizing consumers to convert their gas-based water heating systems to electric systems to achieve the Net-Zero Emissions Initiative. In addition, new building codes in some regions will not permit a natural gas hook-up, further accelerating the growth of all-electric products such as water heaters. This integration not only enhances user experience but also enables predictive maintenance, reducing downtime and repair costs. IoT-enabled water heaters contribute to the development of smart homes and buildings, promoting energy conservation and sustainability. Also, data analytics and machine learning algorithms analyze usage patterns to optimize energy consumption further and suggest personalized recommendations for efficiency improvements and boost the Water Heater Market growth. Bradford White Water Heaters launches Bradford White Connect, enabling users to monitor and manage the AeroTherm Heat Pump Water Heater via a mobile app. The platform allows adjustments, alerts, and performance analysis for contractors. The Connect adapter aligns with demand response standards, offering energy-efficient solutions. This innovation reflects the company's commitment to convenience and performance in IoT-connected appliances. Sustainable Innovations As environmental concerns escalate, the water heater industry witnesses a pivotal opportunity in sustainable innovations. Energy-efficient water heaters are gaining traction due to their dual benefits of reducing carbon footprint and lowering utility bills. Advanced technologies such as heat pumps, solar water heaters, and condensing systems are revolutionizing the industry by maximizing energy conservation without compromising performance. These innovations align with global initiatives for carbon neutrality and sustainable development goals. Governments worldwide are incentivizing the adoption of eco-friendly appliances through rebates and subsidies, further propelling the Water Heater market growth. Additionally, rising consumer awareness regarding environmental impact and long-term cost savings enhances the demand for energy-efficient water heaters. With the world’s population growing and the demand for energy rising, the need for sustainable and efficient water heating solutions is more crucial than ever. This has prompted manufacturers to re-evaluate and improve their designs to meet the rising demand for efficiency and sustainability. Manufacturers investing in research and development to enhance product efficiency and durability stand to capitalize on this opportunity. Collaborations with renewable energy providers and smart home integration further differentiate offerings and capture a larger market share. As sustainability becomes a primary concern for consumers and businesses alike, the water heater market's shift towards eco-conscious solutions represents a lucrative opportunity for forward-thinking companies. Compact and Space-Efficient Designs Efficiency stands atop water heater design priorities; meeting sustainability demands and energy concerns. Manufacturers innovate for greater energy efficiency and eco-friendliness, addressing carbon emissions and consumption worries. Smart systems integrate remote monitoring and high-efficiency transitions, driven by building management systems and policies favoring heat pump water heaters. Heat pump technology gains ground, transferring heat from the atmosphere to water with 70% greater efficiency than conventional heaters. This innovation reduces greenhouse gas emissions and dependence on non-renewables, yet upfront costs and maintenance remain commercial limitations. With urbanization on the rise and living spaces becoming increasingly compact, there is a growing need for water heaters that are not only efficient but also space-saving. Compact designs, such as tankless water heaters and wall-mounted units, are gaining popularity as they are installed in smaller spaces without compromising performance. This trend presents a lucrative opportunity for Water Heater manufacturers to cater to the needs of urban dwellers seeking appliances that offer functionality without occupying valuable floor space. Moreover, advancements in compact water heater technology, such as improved heating elements and integrated storage solutions, further enhance usability and convenience for consumers living in apartments, condos, or tiny homes. For instance, Tankless or on-demand water heaters are gaining popularity due to their space-saving design, energy efficiency, and continuous hot water supply. There is an opportunity for manufacturers to expand their offerings in this segment and educate consumers about the benefits of tankless water heaters compared to traditional tank-based models. Fluctuating Raw Material Prices to Restrain the Water Heater Market Fluctuating raw material prices present a significant challenge for the water heater market. The production of water heaters requires various materials, including steel, copper, and plastics, whose prices are subject to market volatility and geopolitical factors. When raw material prices surge, manufacturers face increased production costs, which are passed on to consumers through higher product prices. Additionally, fluctuations in raw material prices disrupt supply chains, leading to production delays and inventory shortages. Water heater manufacturers struggle to maintain profitability amidst unpredictable material costs, impacting investment in research and development and hindering innovation in the water heater industry. Moreover, heightened price volatility creates uncertainty for consumers, affecting their purchasing decisions and slowing market growth. To mitigate these challenges, stakeholders must adopt strategic sourcing practices and explore alternative materials to ensure the stability and sustainability of the water heater market. Safety is a paramount concern for consumers when it comes to water heaters, driving the demand for products equipped with advanced safety features. Manufacturers are investing in technologies such as leak detection systems, automatic shut-off valves, and pressure relief mechanisms to mitigate the risk of accidents such as leaks, overheating, or explosions. Compliance with stringent regulatory standards and certifications further underscores the importance of incorporating robust safety measures into water heater designs. This presents an opportunity for companies to differentiate their products by prioritizing safety and reliability, thereby building trust and loyalty among consumers. Additionally, proactive communication and education about safety features help raise awareness and instill confidence in the brand, leading to increased sales and market share. By continuously innovating and enhancing safety features, manufacturers ensure their products meet the evolving needs and expectations of consumers while maintaining compliance with industry regulations.Water Heater Market Segment Analysis

By Technology: In 2023, the storage tank segment emerged as the dominant force in the Water Heater Market and is poised for lucrative growth from 2024 to 2030. This surge is attributed to the product's high-energy conversion potential and minimal maintenance requirements. The escalating installations in commercial and industrial settings, especially in colder regions worldwide, are fueling the demand for storage tank water heaters. On the other hand, tankless water heaters offer distinct advantages like precise temperature control, enhanced energy efficiency, and environmental sustainability, fostering their adoption across various sectors. The hybrid segment is anticipated to witness substantial growth, driven by its multifaceted capabilities, such as providing both cooling and heating functions from a single unit. Leveraging electricity to transfer heat rather than directly generating power, hybrid water heaters boast superior energy efficiency compared to their electric counterparts, further boosting their appeal. Based on capacity, the 30 - 100 liters capacity segment dominated the Water Heater Market share in 2023. This growth is driven by its versatility across residential and commercial establishments, including banks, healthcare facilities, hotels, government institutions, and shopping complexes. The increasing urbanization and migration to cities are expected to propel demand for the 100-250-liter segment. With water heaters available in various capacities, they cater to diverse client needs, spanning kitchen, swimming pool, and bathroom applications, thereby driving market expansion. The escalating adoption of low-capacity heating systems, particularly in residential setups, is anticipated to drive demand for water heaters below 30 liters. The growing prevalence of storage tank systems will likely augment the installation of water heaters with capacities below 30 liters in the foreseeable future. The water heaters with capacities exceeding 400 liters, capable of integrating heat pumps with thermal solar systems, are expected to experience heightened demand, further boosting segment growth.Water Heater Market Regional Insight

North America held the largest water heater market share in 2023. The United States spearheads this growth, closely trailed by Canada, together propelling market expansion. A mounting preference for energy-efficient and eco-friendly hot water solutions, fueling the surge in demand. Instantaneous water heaters, prized for their energy efficiency and compact design, are garnering increased traction in the region. In Canada, the water heater market is primarily fueled by the escalating demand for hot water across various industries, bolstered by the country's well-established industrial infrastructure. Notably, the introduction of NRCan (Natural Resources Canada) Amendment 15 to the Energy Efficiency requirements, catalyzed the market, particularly for condensing tankless units. This Amendment mandated the use of condensing technology for all home tankless water heaters with an input of less than 200 MBH, leading to a notable uptick in demand. The new regulations stipulated minimum efficiency limits based on the maximum flow rate of the product, with 0.86 UEF required for less than 6.4 L/min and 0.87 UEF for more than 6.4 L/min. This move has spurred the adoption of gas-fired condensing technology, applicable to both storage tanks and tankless water heaters, driving positive growth momentum in the Water Heater Industry. In Europe, the water heater sector ranks as the second largest, steered by a growing appetite for hot water in domestic and commercial spheres. Leading the charge are powerhouse economies like Germany, England, and France. Europe's market maturity is underscored by a pronounced shift towards energy-efficient technologies. Notably, there's a concerted effort towards curbing carbon emissions and ramping up renewable energy adoption, driving up the popularity of heat pump water heaters and solar water heaters. Asia Pacific region is experiencing robust growth in the water heater market, fueled by rapid urbanization, burgeoning population, and rising disposable incomes. China, India, Japan, South Korea, and Southeast Asian nations emerge as pivotal players in driving market expansion. Electric storage water heaters currently dominate the landscape, yet there's a burgeoning demand for solar water heaters and heat pump water heaters, indicative of a shifting preference towards more sustainable solutions.Water Heater Market Scope: Inquiry Before Buying

Water Heater Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 29.88 Bn. Forecast Period 2024 to 2030 CAGR: 4.82% Market Size in 2030: US $ 41.54 Bn. Segments Covered: by Product Gas Storage Solar by Capacity Below 30 Liters 30 - 100 Liters 100 - 250 Liters 250 - 400 Liters Above 400 Liters by Technology Tankless Storage Hybrid by Application Commercial Residential Industrial Water Heater Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Water Heater Key Players are:

North America 1. Heat Transfer Products Inc. (USA) 2. Bradford White Corp. (USA) 3. Rheem Manufacturing Co. (USA) 4. A. O. Smith Corp. (USA) 5. GE Co. (USA) 6. Alternate Energy Technologies (USA) Asia Pacific 7. Noritz Corp. (Japan) 8. Rinnai Corp (Japan) 9. Crompton Greaves Ltd. (India) 10. Haier Water Heater Co. Ltd. (China) 11. Bajaj Electricals Ltd. (India) 12. Linuo Ritter (China) 13. Racold (India) 14. V Guard Industries (India) 15. Himin Solar Energy (China) Europe 16. Ariston Thermo SPA. (Italy) 17. Siemens AG (Germany) 18. Viessmann (Germany) 19. Wagner Solar (Germany) 20. Bosch (Germany) 21. Chromagen (Israel) 22. Sun Tank (Turkey)Frequently Asked Questions:

1] What is the growth rate of the Global Water Heater Market? Ans. The Global Water Heater Market is growing at a significant rate of 4.82 % during the forecast period. 2] Which region is expected to dominate the Global Water Heater Market? Ans. North America is expected to dominate the Water Heater Market during the forecast period. 3] What is the expected Global Water Heater Market size by 2030? Ans. The Water Heater Market size is expected to reach USD 41.54 Bn by 2030. 4] Which are the top players in the Global Water Heater Market? Ans. The major top players in the Global Water Heater Market are Heat Transfer Products Inc., Bradford White Corp. and others. 5] What are the factors driving the Global Water Heater Market growth? Ans. The consumer trend toward energy efficiency products due to sustainability concerns is the primary driver of the Water Heater Market growth. 6] Which country held the largest Global Water Heater Market share in 2023? Ans. The United States held the largest Water Heater Market share in 2023.

1. Water Heater Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Water Heater Market: Dynamics 2.1. Water Heater Market Trends by Region 2.1.1. North America Water Heater Market Trends 2.1.2. Europe Water Heater Market Trends 2.1.3. Asia Pacific Water Heater Market Trends 2.1.4. Middle East and Africa Water Heater Market Trends 2.1.5. South America Water Heater Market Trends 2.2. Water Heater Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Water Heater Market Drivers 2.2.1.2. North America Water Heater Market Restraints 2.2.1.3. North America Water Heater Market Opportunities 2.2.1.4. North America Water Heater Market Challenges 2.2.2. Europe 2.2.2.1. Europe Water Heater Market Drivers 2.2.2.2. Europe Water Heater Market Restraints 2.2.2.3. Europe Water Heater Market Opportunities 2.2.2.4. Europe Water Heater Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Water Heater Market Drivers 2.2.3.2. Asia Pacific Water Heater Market Restraints 2.2.3.3. Asia Pacific Water Heater Market Opportunities 2.2.3.4. Asia Pacific Water Heater Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Water Heater Market Drivers 2.2.4.2. Middle East and Africa Water Heater Market Restraints 2.2.4.3. Middle East and Africa Water Heater Market Opportunities 2.2.4.4. Middle East and Africa Water Heater Market Challenges 2.2.5. South America 2.2.5.1. South America Water Heater Market Drivers 2.2.5.2. South America Water Heater Market Restraints 2.2.5.3. South America Water Heater Market Opportunities 2.2.5.4. South America Water Heater Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Analysis of Government Schemes and Initiatives For the Water Heater Industry 2.8. The Covid-19 Pandemic's Impact on the Water Heater Market 3. Water Heater Market: Global Market Size and Forecast by Segmentation (by Value USD Mn and Volume Units) (2023-2030) 3.1. Water Heater Market Size and Forecast, by Product (2023-2030) 3.1.1. Gas 3.1.2. Storage 3.1.3. Solar 3.2. Water Heater Market Size and Forecast, by Capacity (2023-2030) 3.2.1. Below 30 Liters 3.2.2. 30 - 100 Liters 3.2.3. 100 - 250 Liters 3.2.4. 250 - 400 Liters 3.2.5. Above 400 Liters 3.3. Water Heater Market Size and Forecast, by Technology (2023-2030) 3.3.1. Tankless 3.3.2. Storage 3.3.3. Hybrid 3.4. Water Heater Market Size and Forecast, by Application (2023-2030) 3.4.1. Commercial 3.4.2. Residential 3.4.3. Industrial 3.5. Water Heater Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Water Heater Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 4.1. North America Water Heater Market Size and Forecast, by Product (2023-2030) 4.1.1. Gas 4.1.2. Storage 4.1.3. Solar 4.2. North America Water Heater Market Size and Forecast, by Capacity (2023-2030) 4.2.1. Below 30 Liters 4.2.2. 30 - 100 Liters 4.2.3. 100 - 250 Liters 4.2.4. 250 - 400 Liters 4.2.5. Above 400 Liters 4.3. North America Water Heater Market Size and Forecast, by Technology (2023-2030) 4.3.1. Tankless 4.3.2. Storage 4.3.3. Hybrid 4.4. North America Water Heater Market Size and Forecast, by Application (2023-2030) 4.4.1. Commercial 4.4.2. Residential 4.4.3. Industrial 4.5. North America Water Heater Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Water Heater Market Size and Forecast, by Product (2023-2030) 4.5.1.1.1. Gas 4.5.1.1.2. Storage 4.5.1.1.3. Solar 4.5.1.2. United States Water Heater Market Size and Forecast, by Capacity (2023-2030) 4.5.1.2.1. Below 30 Liters 4.5.1.2.2. 30 - 100 Liters 4.5.1.2.3. 100 - 250 Liters 4.5.1.2.4. 250 - 400 Liters 4.5.1.2.5. Above 400 Liters 4.5.1.3. United States Water Heater Market Size and Forecast, by Technology (2023-2030) 4.5.1.3.1. Tankless 4.5.1.3.2. Storage 4.5.1.3.3. Hybrid 4.5.1.4. United States Water Heater Market Size and Forecast, by Application (2023-2030) 4.5.1.4.1. Commercial 4.5.1.4.2. Residential 4.5.1.4.3. Industrial 4.5.2. Canada 4.5.2.1. Canada Water Heater Market Size and Forecast, by Product (2023-2030) 4.5.2.1.1. Gas 4.5.2.1.2. Storage 4.5.2.1.3. Solar 4.5.2.2. Canada Water Heater Market Size and Forecast, by Capacity (2023-2030) 4.5.2.2.1. Below 30 Liters 4.5.2.2.2. 30 - 100 Liters 4.5.2.2.3. 100 - 250 Liters 4.5.2.2.4. 250 - 400 Liters 4.5.2.2.5. Above 400 Liters 4.5.2.3. Canada Water Heater Market Size and Forecast, by Technology (2023-2030) 4.5.2.3.1. Tankless 4.5.2.3.2. Storage 4.5.2.3.3. Hybrid 4.5.2.4. Canada Water Heater Market Size and Forecast, by Application (2023-2030) 4.5.2.4.1. Commercial 4.5.2.4.2. Residential 4.5.2.4.3. Industrial 4.5.3. Mexico 4.5.3.1. Mexico Water Heater Market Size and Forecast, by Product (2023-2030) 4.5.3.1.1. Gas 4.5.3.1.2. Storage 4.5.3.1.3. Solar 4.5.3.2. Mexico Water Heater Market Size and Forecast, by Capacity (2023-2030) 4.5.3.2.1. Below 30 Liters 4.5.3.2.2. 30 - 100 Liters 4.5.3.2.3. 100 - 250 Liters 4.5.3.2.4. 250 - 400 Liters 4.5.3.2.5. Above 400 Liters 4.5.3.3. Mexico Water Heater Market Size and Forecast, by Technology (2023-2030) 4.5.3.3.1. Tankless 4.5.3.3.2. Storage 4.5.3.3.3. Hybrid 4.5.3.4. Mexico Water Heater Market Size and Forecast, by Application (2023-2030) 4.5.3.4.1. Commercial 4.5.3.4.2. Residential 4.5.3.4.3. Industrial 5. Europe Water Heater Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 5.1. Europe Water Heater Market Size and Forecast, by Product (2023-2030) 5.2. Europe Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.3. Europe Water Heater Market Size and Forecast, by Technology (2023-2030) 5.4. Europe Water Heater Market Size and Forecast, by Application (2023-2030) 5.5. Europe Water Heater Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Water Heater Market Size and Forecast, by Product (2023-2030) 5.5.1.2. United Kingdom Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.5.1.3. United Kingdom Water Heater Market Size and Forecast, by Technology (2023-2030) 5.5.1.4. United Kingdom Water Heater Market Size and Forecast, by Application (2023-2030) 5.5.2. France 5.5.2.1. France Water Heater Market Size and Forecast, by Product (2023-2030) 5.5.2.2. France Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.5.2.3. France Water Heater Market Size and Forecast, by Technology (2023-2030) 5.5.2.4. France Water Heater Market Size and Forecast, by Application (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Water Heater Market Size and Forecast, by Product (2023-2030) 5.5.3.2. Germany Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.5.3.3. Germany Water Heater Market Size and Forecast, by Technology (2023-2030) 5.5.3.4. Germany Water Heater Market Size and Forecast, by Application (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Water Heater Market Size and Forecast, by Product (2023-2030) 5.5.4.2. Italy Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.5.4.3. Italy Water Heater Market Size and Forecast, by Technology (2023-2030) 5.5.4.4. Italy Water Heater Market Size and Forecast, by Application (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Water Heater Market Size and Forecast, by Product (2023-2030) 5.5.5.2. Spain Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.5.5.3. Spain Water Heater Market Size and Forecast, by Technology (2023-2030) 5.5.5.4. Spain Water Heater Market Size and Forecast, by Application (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Water Heater Market Size and Forecast, by Product (2023-2030) 5.5.6.2. Sweden Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.5.6.3. Sweden Water Heater Market Size and Forecast, by Technology (2023-2030) 5.5.6.4. Sweden Water Heater Market Size and Forecast, by Application (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Water Heater Market Size and Forecast, by Product (2023-2030) 5.5.7.2. Austria Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.5.7.3. Austria Water Heater Market Size and Forecast, by Technology (2023-2030) 5.5.7.4. Austria Water Heater Market Size and Forecast, by Application (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Water Heater Market Size and Forecast, by Product (2023-2030) 5.5.8.2. Rest of Europe Water Heater Market Size and Forecast, by Capacity (2023-2030) 5.5.8.3. Rest of Europe Water Heater Market Size and Forecast, by Technology (2023-2030) 5.5.8.4. Rest of Europe Water Heater Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Water Heater Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 6.1. Asia Pacific Water Heater Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.3. Asia Pacific Water Heater Market Size and Forecast, by Technology (2023-2030) 6.4. Asia Pacific Water Heater Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific Water Heater Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.1.2. China Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.1.3. China Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.1.4. China Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.2.2. S Korea Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.2.3. S Korea Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.2.4. S Korea Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.3.2. Japan Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.3.3. Japan Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.3.4. Japan Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.4. India 6.5.4.1. India Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.4.2. India Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.4.3. India Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.4.4. India Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.5.2. Australia Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.5.3. Australia Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.5.4. Australia Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.6.2. Indonesia Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.6.3. Indonesia Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.6.4. Indonesia Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.7.2. Malaysia Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.7.3. Malaysia Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.7.4. Malaysia Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.8.2. Vietnam Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.8.3. Vietnam Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.8.4. Vietnam Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.9.2. Taiwan Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.9.3. Taiwan Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.9.4. Taiwan Water Heater Market Size and Forecast, by Application (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Water Heater Market Size and Forecast, by Product (2023-2030) 6.5.10.2. Rest of Asia Pacific Water Heater Market Size and Forecast, by Capacity (2023-2030) 6.5.10.3. Rest of Asia Pacific Water Heater Market Size and Forecast, by Technology (2023-2030) 6.5.10.4. Rest of Asia Pacific Water Heater Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Water Heater Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 7.1. Middle East and Africa Water Heater Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Water Heater Market Size and Forecast, by Capacity (2023-2030) 7.3. Middle East and Africa Water Heater Market Size and Forecast, by Technology (2023-2030) 7.4. Middle East and Africa Water Heater Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa Water Heater Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Water Heater Market Size and Forecast, by Product (2023-2030) 7.5.1.2. South Africa Water Heater Market Size and Forecast, by Capacity (2023-2030) 7.5.1.3. South Africa Water Heater Market Size and Forecast, by Technology (2023-2030) 7.5.1.4. South Africa Water Heater Market Size and Forecast, by Application (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Water Heater Market Size and Forecast, by Product (2023-2030) 7.5.2.2. GCC Water Heater Market Size and Forecast, by Capacity (2023-2030) 7.5.2.3. GCC Water Heater Market Size and Forecast, by Technology (2023-2030) 7.5.2.4. GCC Water Heater Market Size and Forecast, by Application (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Water Heater Market Size and Forecast, by Product (2023-2030) 7.5.3.2. Nigeria Water Heater Market Size and Forecast, by Capacity (2023-2030) 7.5.3.3. Nigeria Water Heater Market Size and Forecast, by Technology (2023-2030) 7.5.3.4. Nigeria Water Heater Market Size and Forecast, by Application (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Water Heater Market Size and Forecast, by Product (2023-2030) 7.5.4.2. Rest of ME&A Water Heater Market Size and Forecast, by Capacity (2023-2030) 7.5.4.3. Rest of ME&A Water Heater Market Size and Forecast, by Technology (2023-2030) 7.5.4.4. Rest of ME&A Water Heater Market Size and Forecast, by Application (2023-2030) 8. South America Water Heater Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030) 8.1. South America Water Heater Market Size and Forecast, by Product (2023-2030) 8.2. South America Water Heater Market Size and Forecast, by Capacity (2023-2030) 8.3. South America Water Heater Market Size and Forecast, by Technology (2023-2030) 8.4. South America Water Heater Market Size and Forecast, by Application (2023-2030) 8.5. South America Water Heater Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Water Heater Market Size and Forecast, by Product (2023-2030) 8.5.1.2. Brazil Water Heater Market Size and Forecast, by Capacity (2023-2030) 8.5.1.3. Brazil Water Heater Market Size and Forecast, by Technology (2023-2030) 8.5.1.4. Brazil Water Heater Market Size and Forecast, by Application (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Water Heater Market Size and Forecast, by Product (2023-2030) 8.5.2.2. Argentina Water Heater Market Size and Forecast, by Capacity (2023-2030) 8.5.2.3. Argentina Water Heater Market Size and Forecast, by Technology (2023-2030) 8.5.2.4. Argentina Water Heater Market Size and Forecast, by Application (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Water Heater Market Size and Forecast, by Product (2023-2030) 8.5.3.2. Rest Of South America Water Heater Market Size and Forecast, by Capacity (2023-2030) 8.5.3.3. Rest Of South America Water Heater Market Size and Forecast, by Technology (2023-2030) 8.5.3.4. Rest Of South America Water Heater Market Size and Forecast, by Application (2023-2030) 9. Global Water Heater Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.4. Market Structure 9.4.1. Market Leaders 9.4.2. Market Followers 9.4.3. Emerging Players 9.5. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Rinnai Corp 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Heat Transfer Products Inc. 10.3. Bradford White Corp. 10.4. Noritz Corp. 10.5. Crompton Greaves Ltd. 10.6. Haier Water Heater Co. Ltd. 10.7. Ariston Thermo SPA. 10.8. Rheem Manufacturing Co. 10.9. Siemens AG 10.10. O. Smith Corp. 10.11. GE Co. 10.12. Bajaj Electricals Ltd. 10.13. Viessmann 10.14. Rheem manufacturing 10.15. Bradford White 10.16. Wagner Solar 10.17. Linuo Ritter 10.18. Bosch 10.19. Racold 10.20. V Guard Industries 10.21. Himin Solar Energy 10.22. Chromagen 10.23. Sun Tank 10.24. Alternate Energy Technologies 11. Key Findings and Analyst Recommendations 12. Water Heater Market: Research Methodology